List of Contents

Stainless Steel Market Size and Forecast 2025 to 2034

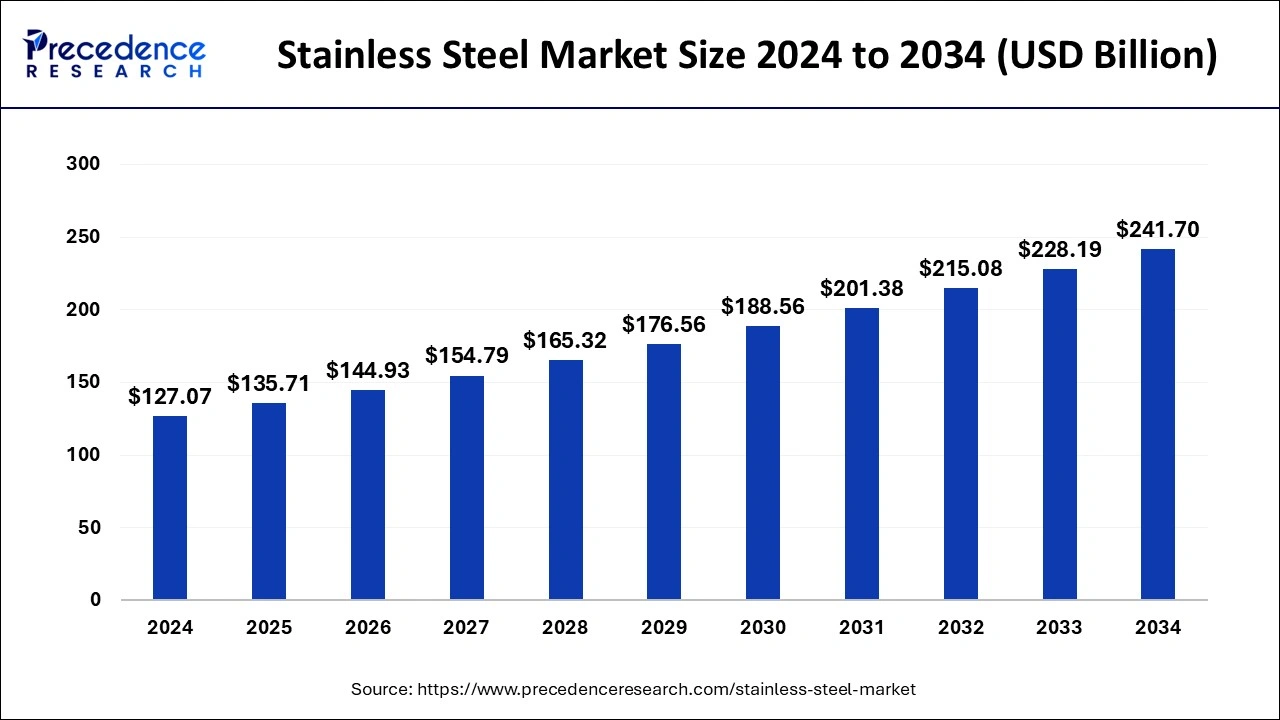

The global stainless steel market size was USD 127.07 billion in 2024, calculated at USD 135.71 billion in 2025 and is expected to reach around USD 241.70 billion by 2034. The market is expanding at a solid CAGR of 6.64% over the forecast period 2025 to 2034. The market is experiencing rapid growth due to the increasing demand for stainless steel from various end-use industries, such as construction, automotive, and consumer goods.

Stainless Steel Market Key Takeaways

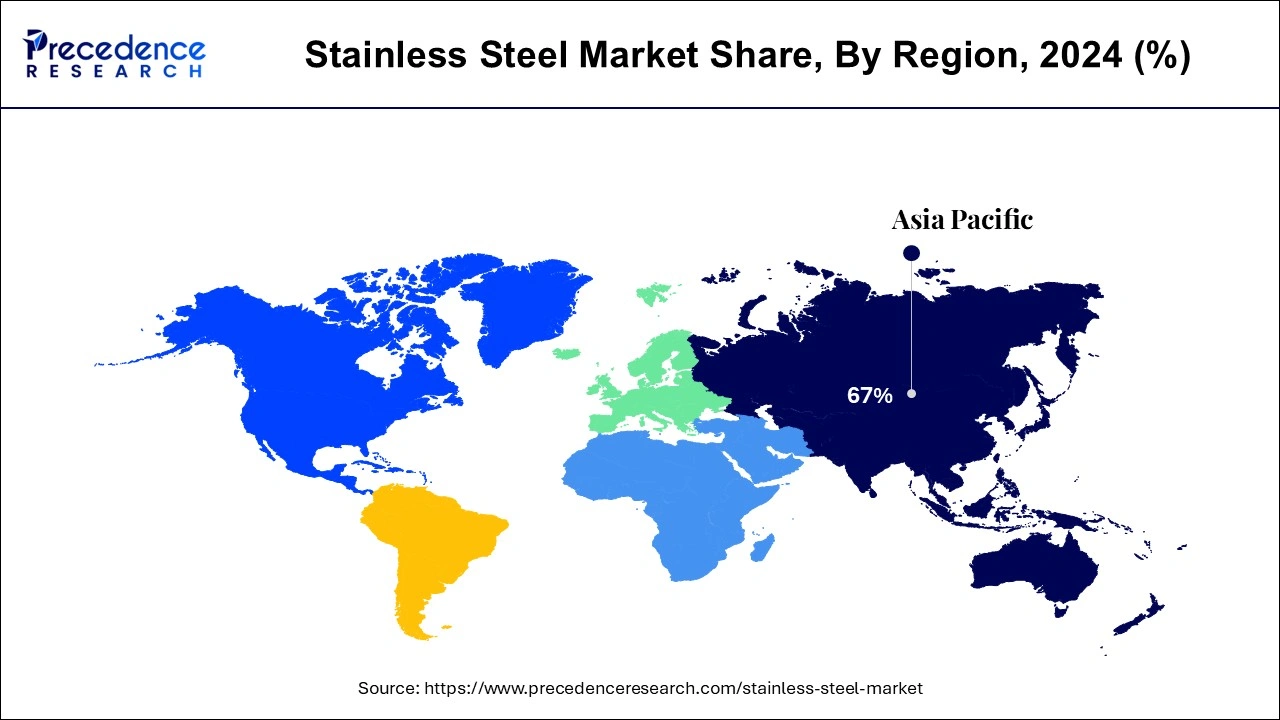

- Asia Pacific led the market with the biggest market share of 67% in 2024.

- By Product, the flat segment registered the maximum market share of 31% in 2024.

- By Product, the long segment is expected to grow at a notable CAGR of 6.8% during the forecast period.

- By Application, the automotive & transportation segment is anticipated to grow at the fastest rate during the forecast period.

Impact of Artificial Intelligence (AI) on the Stainless Steel Market

Artificial intelligence is revolutionizing the steel industry by creating many opportunities for business optimization and increased efficiency. Steel manufacturing companies can use AI technologies to improve product quality, reduce costs, reduce energy consumption, and increase customer satisfaction. Integrating AI technologies into the steel manufacturing processes enhances production efficiency by automating various tasks and reducing human errors. AI can help manage the operation and performance of metallurgical equipment such as blast furnaces, mills, and crushers. It helps predict problems and optimize maintenance schedules, reducing costs and downtime. Moreover, AI helps steel manufacturers optimize supply chains by predicting future demands and managing inventory levels.

Asia Pacific Stainless Steel Market Size and Growth 2025 to 2034

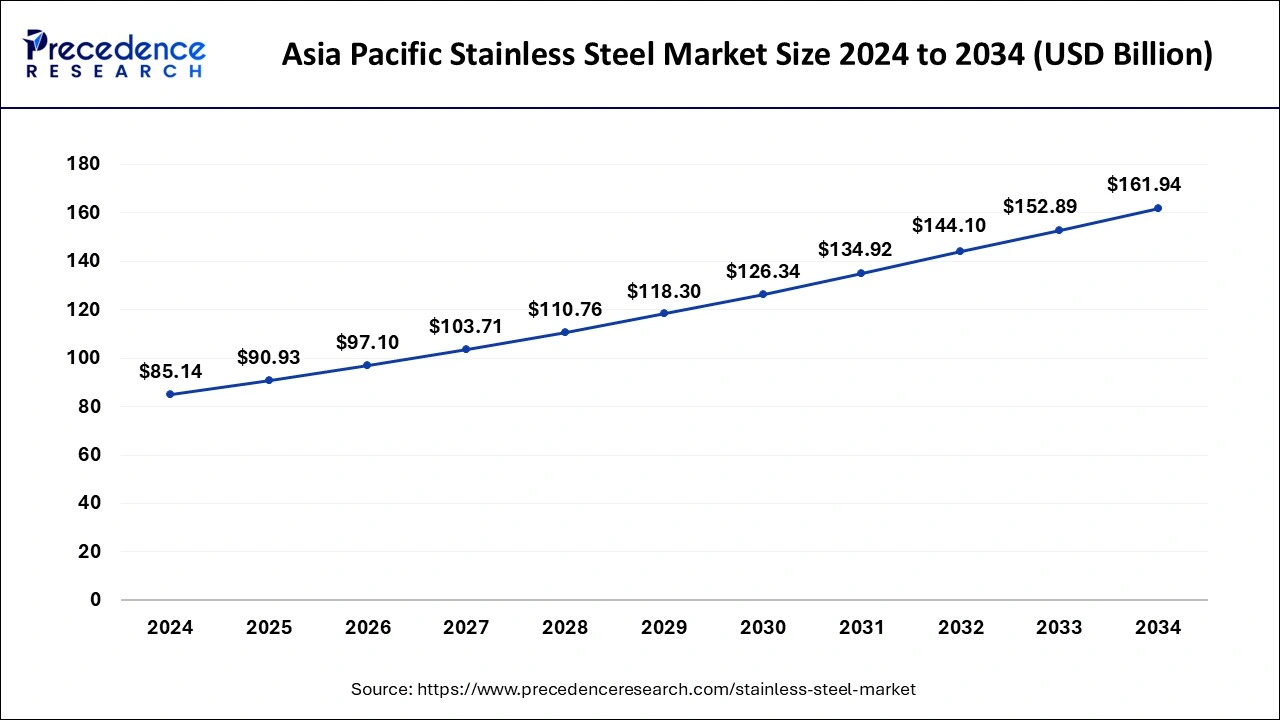

The Asia Pacific stainless steel market size was estimated at USD 85.14 billion in 2024 and is predicted to be worth around USD 161.94 billion by 2034, at a CAGR of 6.67% from 2025 to 2034.

Asia Pacific held the largest share of the market in 2024. The increasing manufacturing activities in the region contributed to the regional market growth. Stainless steel is increasingly used in industrial applications due to its high strength, durability, and corrosion resistance properties. The rising industrialization and increasing construction activities in countries such as India and China augmented the market in the region.

As per the United Nations Conference on Trade & Development, the inward Foreign Direct Investment (FDI) rate for the Asia Pacific region was around 9.1% in 2017, the highest compared to other regions. An increase in FDI helps the region to develop various industries in the country as well as generate more employment that in turn anticipated to boosts the demand for stainless steel in the region over the coming years.

Asia Pacific Stainless Steel Market Trends

According to the data released by the Stainless-Steel Council of China Iron and Steel Association (CSSC) on April 25, China's crude stainless-steel output reached 9.62 million tonnes in the first quarter of 2025, rising by 599,300 tonnes or 6.6% from the same period last year.

Additionally, stainless steel manufacturers are widely supported by governments initiatives is expected to propel the market's revenue during the forecast period. For instance, in July 2023, Govt. of India's Union Ministry of Steel has announced a newstainless steel policy with an aim to increase the country's domestic capacity to 30 million tons per year from the current levels of 6.6 million tons.

Market Overview

The application of stainless steel spans across aerospace, medical, construction, automotive, and consumer goods industries due to its aesthetic appeal, durability, and resistance to rust. The market can fluctuate due to global trade policies, availability of alternative materials, and volatility in raw material prices. The rising advancements in production technologies are expected to drive the market growth over the forecast period.

Stainless steel is a superior material with excellent strength, durability, and corrosion resistance, making it the best choice for many applications. Its low maintenance cost, versatile use, and economical cost make it an ideal material for use in heavy equipment, machinery, and medical equipment. It is a versatile material that can be cast, forged, and welded into various shapes and sizes. It can be processed in many ways, such as brushed, polished, or matted.

- Nearly 345 million tonnes of food will be produced annually in India by 2030 to feed the growing population, which requires modernized facilities for processing. Stainless steel plays an important role in significantly contributing to hygiene and cleanliness while handling food.

According to the data published by the World Steel Association in April 2025

- World crude steel production for the 69 countries reporting to the World Steel Association (worldsteel) was 166.1 million tonnes (Mt) in

- March 2025, a 2.9% increase compared to March 2024.

- Africa produced 1.9 Mt in March 2025, up 0.6% on March 2024. Asia and Oceania produced 123.6 Mt, up 3.9%. The EU (27) produced 11.7 Mt, up 0.2%.

- The top 10 steel producing countries in the world includes China, India, Japan, United States, Russia, South Korea, Türkiye, Germany, Brazil, and Iran.

- China produced 92.8 Mt in March 2025, up 4.6% on March 2024. India produced 13.8 Mt, up 7.0%. Japan produced 7.2 Mt, up 0.2%.

Stainless Steel Market Growth Factors

- The rising infrastructure development in emerging countries and the increasing construction activities boost the growth of the stainless steel market. The construction industry uses stainless steel in building structures due to its corrosion and heat resistance, high strength, and aesthetic appeal.

- Despite the initial cost of stainless steel being higher than other materials, its low maintenance and durability make it an affordable option in the long run, contributing to market expansion.

- The rising demand for durable materials in various industries contributes to market growth. Stainless steel has incredible durability due to its unique composition of iron, chromium, and other alloys. This combination makes stainless steel five times stronger than ordinary steel, making it ideal for applications where durability is at utmost priority.

- The growing industrial applications fuel the market growth. Stainless steel is often used in aircraft engines and power plants because it maintains strength even at high temperatures. This superior strength makes stainless steel resistant to heavy loads and pressure, making it an ideal material for heavy equipment and machinery.

- The growing focus on sustainability supports the growth of the market. Stainless steel is a recyclable material, contributing to a circular economy.

- The increasing production of vehicles boosts the growth of the market.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 127.07 Billion |

| Market Size by 2034 | USD 241.70 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.6% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, End User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising usage of stainless steel in the automotive industry

Stainless steel is heavily used in the automotive industry for manufacturing automotive parts due to its high robustness and resistance to corrosion. The rising automobile production in regions such as Asia Pacific, Latin America, and the Middle East boosts the demand for stainless steel in these regions. The rising need for personal transportation significantly boosts the demand for stainless steel, thereby driving the market. Moreover, the rising adoption of stainless steel in the aerospace industry is likely to propel the market.

- In November 2023, Landspace revealed its plans to develop a reusable stainless steel rocket. The company is set to use stainless propellant tanks in its Zhuque-3 (Vermillion Bird 3) rocket.

Restraint

Economic downturns can impede the market growth

Despite increased production of automobiles, shifting market trend toward implementation of lighter material, such as carbon fiber, to enhance the fuel efficiency is a significant factor that expected to hamper the demand of stainless steel in the near future. Governments of various regions have issued stringent emission regulations that propel the demand for high fuel efficiency. Furthermore, carbon fiber also aids high strength and load-bearing capacities that triggers its implementation over stainless steel in the automotive sector.

Opportunity

Hydrogen-based Steelmaking

Integrating hydrogen injection technology into steelmaking processes can increase efficiency and reduce carbon emissions, bringing significant opportunities to the stainless steel market. Using hydrogen as a reducing agent in blast furnaces or reduction reactors can reduce CO2 emissions while maintaining the desired quality and characteristics of stainless steel. However, this change requires strategic planning and engineering expertise to modify existing equipment, such as converters and ladles, to ensure the safety of hydrogen. Furthermore, hydrogen steel production can be fully achieved by combining renewable energy sources such as solar, wind, or hydropower to increase hydrogen production and reduce dependence on fossil fuels. By embracing the new clean energy revolution, stainless steel manufacturers can respond to and meet the consumer and industry demand for green steel.

Grade Insights

The 300 series segment dominated the market in 2023. The growth of the segment is attributed to the good anti-corrosion resistance properties of the 300 series grade steel. The 300 series grade steel is used in applications where low magnetic permeability is required. This is particularly suited for all types of dairy equipment, including sterilizers, milking machines, and containers.

The duplex series segment is expected to grow at the fastest rate over the forecast period. Duplex series grade stainless steel has superior properties like low weight, high strength, and high corrosion resistance, especially for stress corrosion cracking. The rising demand for robust materials in the automotive industry is projected to boost the segment.

Product Insights

In 2023, flat products dominated the global stainless steel market because of increasing use of cold-rolled products. Superior properties of flat steel that includes concentricity, straightness, and tolerance make them suitable for various end-use industries such as home appliances, energy, and construction. Further, the growth in these end-use industries is likely to impel the market growth for stainless steel over the analysis period.

On the other hand, long products segment projected to register an escalating growth of around 6.8% in terms of value over the forecast timeframe due to the increasing infrastructure spending in various Asia Pacific regions. In addition, the increasing implementation of stainless steel long products in heavy industries anticipated to augment the market growth over the coming years.

Application Insights

Based on application the stainless steel market is bifurcated into automotive & transportation, building & construction, heavy industry, consumer goods, and others. Heavy industry constitute significant value share on a global scale. Heavy industries include heating cooling & ventilation, chemical industry, pulp and paper, oil & gas, water treatment, food processing, energy industry, and many others. Rising trend of renewable generation in the energy sector to manufacture parts and components of generating station or plant anticipated to boost the growth of stainless steel in the near future. Furthermore, rising industrial revolution along with increasing number of manufacturing plants in the Asia Pacific region because of several unexplored opportunities in the region likely to spurs the demand for stainless steel especially in the engineering & machinery sector of industries.

On the other hand, automotive & transportation is an important application segment that contributes significantly to the overall market revenue. As per the statistics published by the World Steel Association in 2021, the automotive sector accounts for around 12% of global steel consumption. Stainless steel is mainly used in manufacturing various automotive parts & components that include basic vehicle frame for hoods, mufflers, doors, and fuel tanks. Stainless steel together with iron contributes nearly 70% of the total vehicle weight. Consequently, the above mentioned factors expected to propel the market growth over the analysis period.

Stainless Steel Market Companies

- POSCO

- Acerinox S.A.

- Baosteel Group

- Jindal Stainless

- Aperam Stainless

- Nippon Steel Corporation

- Yieh United Steel Corp. (YUSCO)

- ThyssenKrupp Stainless GmbH

- Outokumpu

- ArcelorMittal

Recent Developments

- In February 2025, Bolivia unveiled its plan to launch a Chinese-funded steel mill. The plant is expected to initially produce 200 thousand tons of steel per year. The $546 million Mutun plant was largely financed by the Export-Import Bank of China. In its first year of operation, the plant will be managed by China's Sinosteel Engineering and Technology.

- In May 2024, Bansal Wire Industries (BWIL) has announced its plan to invest a Rs 6 billion in a greenfield project in Gujarat, which will feature a 1.8 lakh-tonne induction-based steel plant and a 60,000-tonne facility for low-carbon and stainless-steel wires. The company has acquired 42 acres at Sanand, near Tata Nagar, for â¹80-90 crore and expects to complete the project by September 2027.

- In December 2024, Sambhv Steel Tubes Limited, a leading manufacturer of electric resistance welded ("ERW") steel pipes and structural tubes in India, announced the expansion of its product range with the launch of a range of stainless steel coils.

- In November 2024, Acerinox, a leading global manufacturer and supplier of stainless steel and high-performance materials, completed the acquisition of Haynes International ("Haynes") through its U.S. subsidiary, North American Stainless.

- In October 2024, Jindal Stainless Steel partnered with CJ Darcl Logistics Limited (CJ Darcl) to develop lightweight, sustainable stainless steel containers. Manufactured from high-strength JT-grade stainless steel, these containers are designed to transport various goods such as polymers, batteries, and rubber. These containers offer significant benefits in weight reduction, improved fuel efficiency, and reduced operating costs.

- In January 2023, US-based 3DEO, an award-winning design, engineering, and manufacturing company recognized as the world's leading 3D printing company, announced the launch of 316L austenitic stainless steel. This new product suits a wide range of sectors, especially the medical, industrial, marine, and food sectors.

Segments Covered in the Report

By Product

- Long

- Flat

By Grade

- Duplex Series

- 400 Series

- 300 Series

- 200 Series

- Others

By Application

- Automotive & Transportation

- Building & Construction

- Heavy Industry

- Consumer Goods

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis â take the 1st step to become a Precedence Research client