January 2025

The global infection control surveillance solutions market size is calculated at USD 950.78 billion in 2025 and is forecasted to reach around USD 3,046.65 billion by 2034, accelerating at a CAGR of 15.40% from 2025 to 2034. The North America infection control surveillance solutions market size surpassed USD 369.77 billion in 2024 and is expanding at a CAGR of 15% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global infection control surveillance solutions market size was USD 839.98 million in 2024, estimated at USD 950.78 million in 2025 and is anticipated to reach around USD 3,046.65 billion by 2034, expanding at a CAGR of 15.40% from 2025 to 2034. The increasing number of hospitals acquired infections is observed to drive the growth of the infection control surveillance solutions market

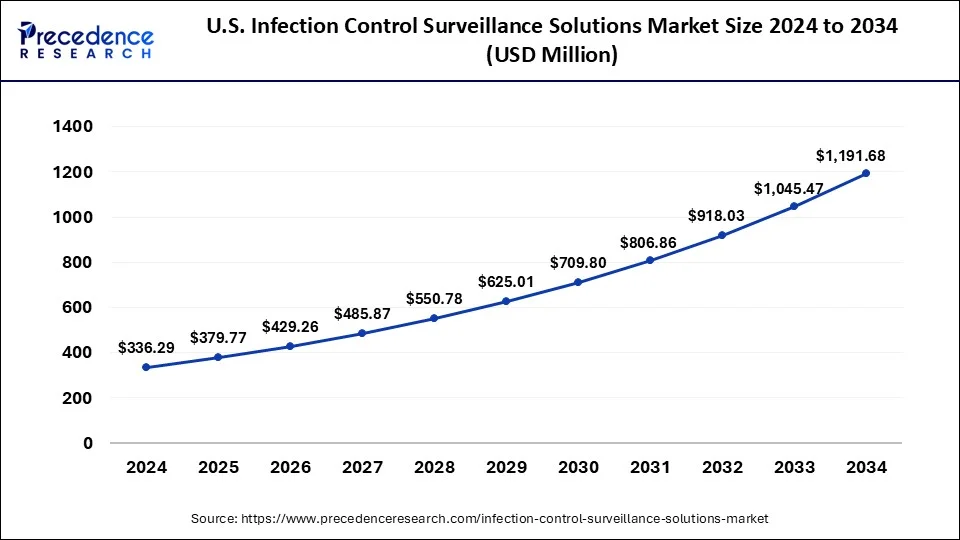

The U.S. infection control surveillance solutions market size was valued at USD 336.29 million in 2024 and is expected to be worth around USD 1,191.68 million by 2034 with a CAGR of 15.10% from 2025 to 2034.

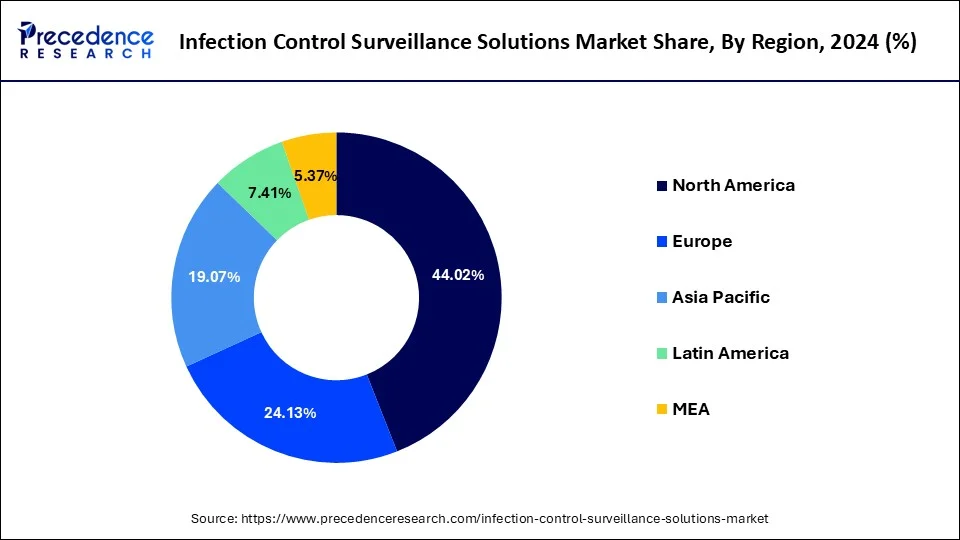

North America dominated the infection control surveillance solutions market with the largest share in 2024. The growth of the segment is attributed to the rising healthcare infrastructure in countries like the United States and Canada that fuel the demand for infection control surveillance solutions. The rising expenditure on healthcare due to the disposable income in the population and the rising prevalence of chronic disorders are accelerating the growth of the market. The increasing prevalence of the hospital acquired infection in the United States are boosting the demand for the infection control surveillance solutions.

Additionally, the rising investment in research and development activities for the development of healthcare facilities and government initiatives for the prevention of diseases is accelerating the growth of the infection control surveillance solutions market across the region. Advances in infection control technologies, such as automated surveillance systems and real-time monitoring tools, have made it easier and more effective for specialty surgical centers to implement and manage infection control measures. These technologies offer actionable insights and early warnings, facilitating timely interventions.

Asia Pacific is expected to witness significant growth in the infection control surveillance solutions market during the forecast period. The growth of the market in the region is expected to increase due to the rise in population and the higher demand for the healthcare industry that enhances the demand for infection control surveillance solutions and software for the prevention of infectious diseases and creates a healthy environment and safety for the staff, and patients which boost the growth of the market in the region. Consequently, the rising expenses on healthcare and the investment by the major firms for the development of healthcare infrastructure are further propelling the growth of the infection control surveillance solutions market across the region.

The infection control surveillance solutions market has played an important role in healthcare institutions in maintaining the standard of care while safeguarding their employees, clients, and guests. Implementing these technologies also has several advantages, including better patient outcomes, reduced expenses, and rising staff safety. These solutions are essential for maintaining patient safety, reducing the incidence of healthcare-associated infections (HAIs), and ensuring compliance with regulatory standards. A rise in hospital stays is a result of the global increase in surgical procedures which directly impacts positively on the market’s growth. The need for infection surveillance systems is predicted to increase along with rising healthcare costs.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.05% |

| Market Size in 2024 | USD 766.82 Million |

| Market Size in 2025 | USD 866.89 Million |

| Market Size by 2034 | USD 2,614.56 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancements in hospital safety

The increasing advancements for hospital safety are accelerating the demand for infection control surveillance solutions. The increasing demand from hospitals for improved technologies for infection prevention with enhanced surveillance solutions. The rising investments by the hospitals to gain or capture more insightful data efficiently and accurately. The rising investments in technologies to predict and detect infections use the evidence protocol for the implementation of best practices and tract results over the period.

The infection control surveillance solution powered by artificial intelligence, data analytics, machine learning, and predictive modeling allows hospitals to find an accurate and efficient solution for mitigating infectious risks. Thus, the rising demand for safety in hospitals is enhancing the growth of the infection control surveillance solutions market.

Lack of awareness about solutions

Many healthcare providers may not fully understand the advantages of infection control surveillance solutions, such as improved patient safety, reduced healthcare-associated infections (HAIs), and better compliance with regulatory standards. Without proper training and education, healthcare staff may not be equipped to use these advanced surveillance systems effectively, diminishing their potential impact. There might be a perception that infection control surveillance systems are too complex or difficult to implement, discouraging adoption among healthcare facilities. Thereby, the lack of awareness about these solutions can create a restraint for infection control surveillance solutions market.

Government support

The favorable government initiatives all around the world with the introduction of the latest policies and regulations with the focus on the development of long-lasting prevention programs and creating awareness in healthcare providers for maintaining the best infection prevention control. The increasing investments in the healthcare centers and organizations by the government for integrating advanced software for infection surveillance. Government support allows healthcare organizations to utilize the tools more effectively and accurately. Thus, favorable government initiatives are driving the growth of the infection control surveillance solutions market.

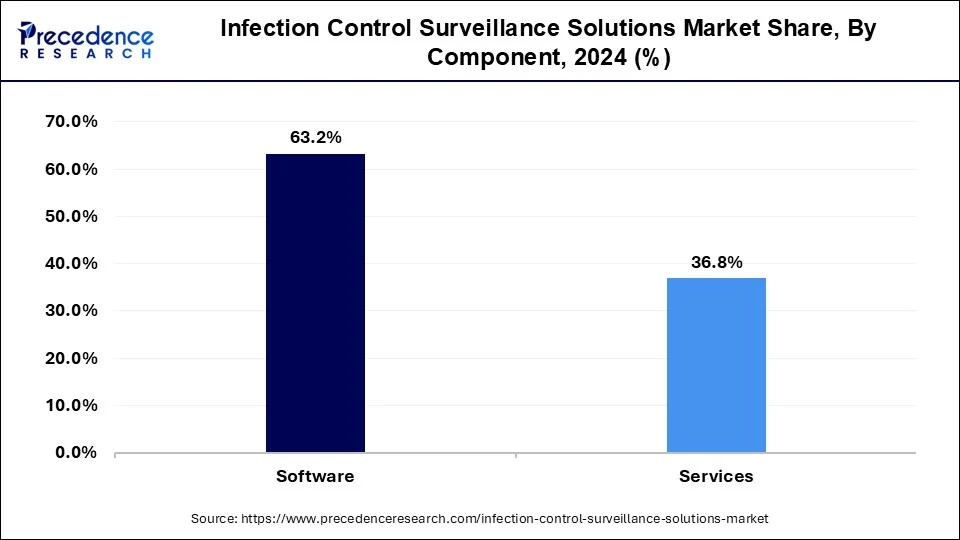

The software segment dominated the market in the infection control surveillance solutions market in 2024. The software segment is further divided into on-premise and web-based software. The growth of the segment is attributed to the on-premises software benefits including availability in many configurations, quick payback period, and real-time analysis. Software packages, and healthcare IT businesses provide innovative approaches to data management, analytics, and infrastructure that facilitate the collection of data on electronic health records (EHR), infections, and epidemic trends. The software segment analyzes the real-time data and offers feedback which helps healthcare professionals control infections more accurately and enhances the growth of the segment.

The services segment is observed to grow at a notable rate in the infection control surveillance solutions market during the forecast period. Services include the customization and implementation of infection control surveillance systems tailored to the specific needs of different healthcare facilities. This ensures that the systems are optimally integrated with existing healthcare IT infrastructure. Services include comprehensive training programs for healthcare staff to ensure they are proficient in using the surveillance systems. Effective training enhances the accuracy and efficiency of infection data monitoring and reporting.

Infection Control Surveillance Solutions Market Revenue, By Component 2022-2024 (USD Million)

| Component | 2022 | 2023 | 2024 |

| Software | 417 | 470.1 | 530.5 |

| Services | 240 | 272.7 | 309.5 |

The hospitals egment led the infection control surveillance solutions market in 2024. The growth of the segment is attributed to the increasing chronic illness and rising burden of infection and the frequent adaptation of the hospitals for the treatment of infections are driving the growth of the segment. The rise in the hospital stays by people for the treatment of infection and other disorders is driving the demand for infection control surveillance in hospital facilities for the prevention of infection, improving the growth of the market.

Additionally, the increasing healthcare infrastructure in developing and developed countries and the rising investment in the development of technologies in hospital facilities, devices, software, and equipment for providing better safety and treatment also contributed to the growth of the infection control surveillance solutions market.

The specialty surgical centers segment is observed to grow at a significant rate during the forecast period in the infection control surveillance solutions market. Specialty surgical centers are performing an increasing number of surgeries, often including complex and high-risk procedures. This rise in surgical volume heightens the need for robust infection control measures to prevent surgical site infections (SSIs), which are a common and serious complication of surgery. There are stringent regulatory and accreditation requirements for infection control in surgical settings. Specialty surgical centers must comply with guidelines from organizations such as the Centers for Disease Control and Prevention (CDC) and the Joint Commission, which drives the adoption of advanced surveillance solutions.

Infection Control Surveillance Solutions Market Revenue, By End-user, 2022-2024 (USD Million)

| End-user | 2022 | 2023 | 2024 |

| Hospitals | 445.2 | 503.4 | 569.7 |

| Clinics | 90.8 | 102.5 | 115.9 |

| Ambulatory surgical centers | 67.0 | 75.6 | 85.5 |

| Specialty centers | 25.1 | 28.4 | 32.0 |

| Others | 29.5 | 32.9 | 36.8 |

By Component

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

February 2025

February 2025