August 2024

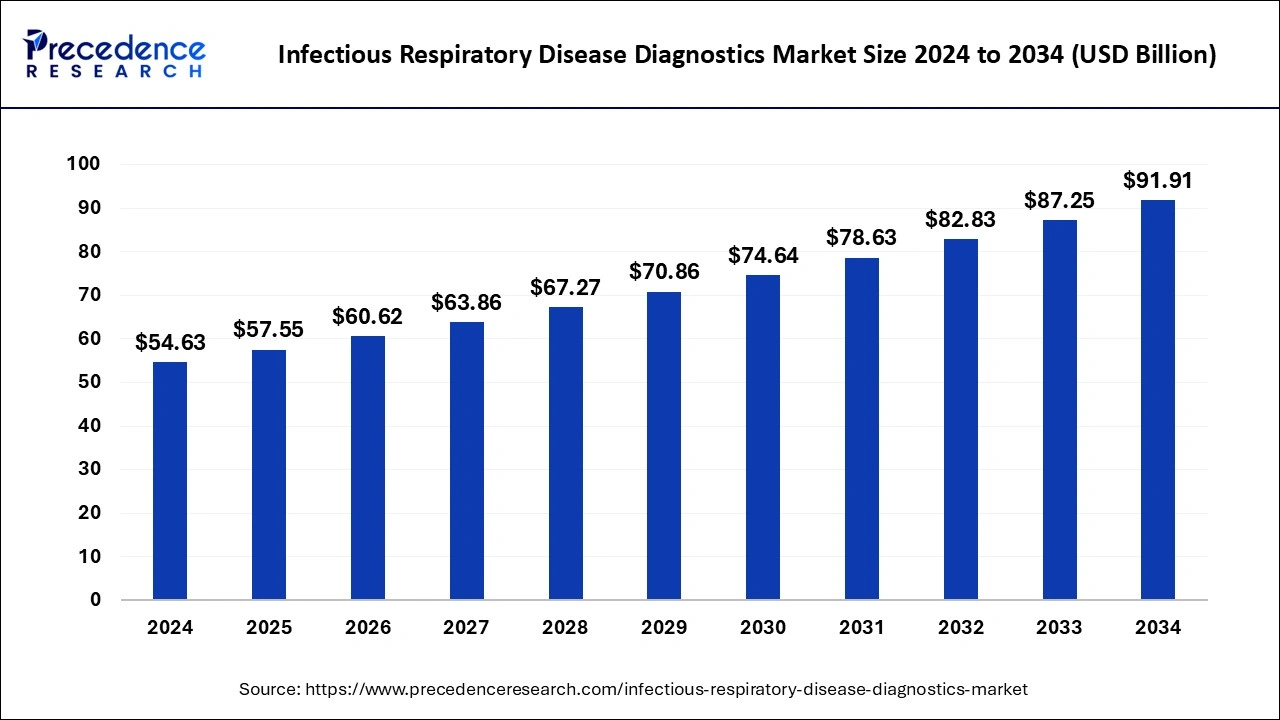

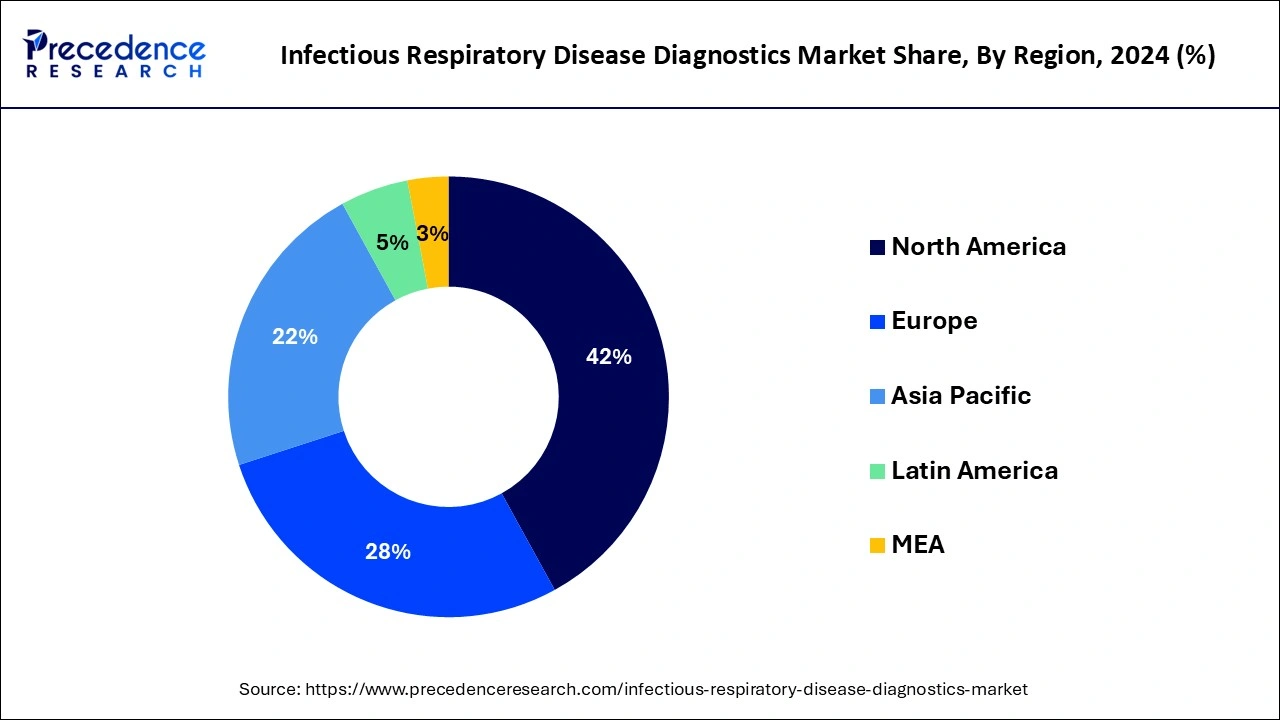

The global infectious respiratory disease diagnostics market size is calculated at USD 57.55 billion in 2025 and is forecasted to reach around USD 91.91 billion by 2034, accelerating at a CAGR of 5.34% from 2025 to 2034. The North America infectious respiratory disease diagnostics market size surpassed USD 22.94 billion in 2024 and is expanding at a CAGR of 5.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global infectious respiratory disease diagnostics market size was estimated at USD 54.63 billion in 2024 and is anticipated to reach around USD 91.91 billion by 2034, expanding at a CAGR of 5.34% from 2025 to 2034. The increased adoption of point-of-care testing is the key factor driving growth of the global infectious respiratory disease diagnostics market. The rising government initiatives and funding for infectious disease diagnostics are expected to fuel the market growth in the forecast period.

The leverage of cutting-edge technologies like AI, ML, and IoT in the healthcare sector is working to dramatically transform the expenditure. The ability of AI to analyze broad amounts of data & provide early detection of infectious respiratory diseases has generated its popularity in diagnostic applications & devices. Additionally, the requirement of personalized medicines has been a success shot thanks to the AI. The real-time surveillance and outbreak detection ability of AI has been a major reason for its leverage in infectious respiratory disease diagnostics.

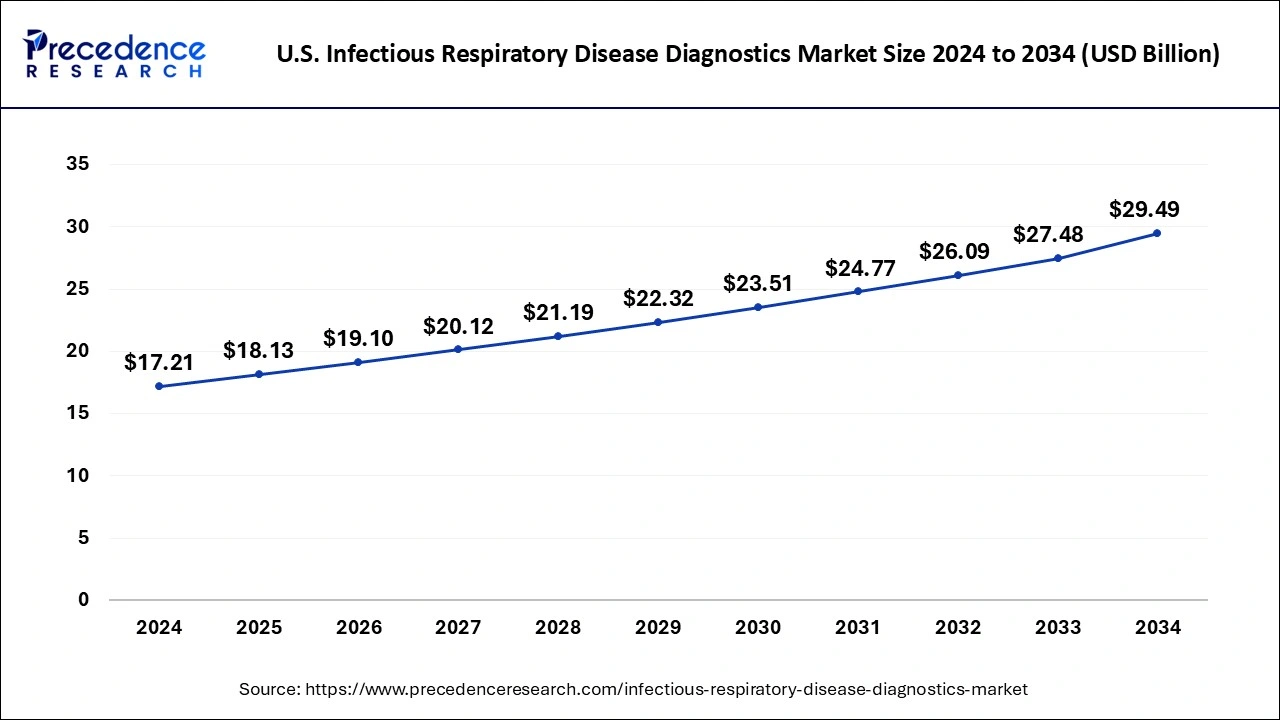

The U.S. infectious respiratory disease diagnostics market size was evaluated at USD 17.21 billion in 2024 and is predicted to be worth around USD 29.49 billion by 2034, rising at a CAGR of 5.53% from 2025 to 2034.

North America led the global infectious respiratory disease diagnostics market with the largest market share of 42% in 2024. The growing preference for multiplex diagnostic tests that can detect multiple pathogens simultaneously is becoming more common in North America. These tests save time, reduce costs, and are more efficient in diagnosing co-infections that can occur with respiratory illnesses like COVID-19, flu, and pneumonia. The growth of personalized medicine is a significant trend in the respiratory disease diagnostics market. Precision medicine involves tailoring healthcare treatments based on individual genetic profiles, and diagnostics play a crucial role in identifying the appropriate treatments. This trend is expected to gain momentum in North America as technologies evolve.

The infectious respiratory disease diagnostics market operates within the healthcare sector, primarily focusing on the diagnosis and treatment of respiratory infections. This market includes a diverse array of diagnostic techniques, including molecular assays, immunoassays, and imaging methods, all aimed at identifying the causative pathogens behind respiratory ailments, encompassing both viral and bacterial infections.

It plays a pivotal role in early disease detection, guiding effective treatment strategies, and monitoring the prevalence of respiratory diseases, with particular relevance during outbreaks like influenza and the COVID-19 pandemic. The market is characterized by continual technological advancements and a constant emphasis on delivering rapid, accurate, and accessible diagnostic solutions.

It plays a crucial role in early disease detection, guiding treatment decisions, and monitoring disease trends, particularly relevant during outbreaks like influenza and COVID-19. The market's nature involves continuous technological advancements and a focus on rapid, accurate, and accessible diagnostic solutions.

| Report Coverage | Details |

| Market Size in 2025 | USD 57.55 Billion |

| Market Size by 2034 | USD 91.91 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.34% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product Type, By Sample Type, By Application, and By Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of respiratory infections and timely outbreak response

The surging prevalence of respiratory infections, including viral and bacterial diseases, significantly surges the demand for diagnostic solutions within the infectious respiratory disease diagnostics market. As the global population faces a heightened risk of respiratory ailments, healthcare providers and individuals increasingly rely on precise and rapid diagnostic tools to identify these infections swiftly. This escalating demand underscores the critical role of diagnostics in timely disease detection, allowing for prompt treatment and containment measures, particularly during outbreaks like influenza and the COVID-19 pandemic.

Moreover, timely outbreak response is a compelling catalyst for surging market demand in the infectious respiratory disease diagnostics market. During infectious disease outbreaks, rapid and accurate diagnostics are paramount to effectively identify and manage cases, contain the spread of pathogens, and safeguard public health. The urgency of outbreak situations underscores the essential role of advanced respiratory diagnostics in providing swift results, guiding treatment decisions, and enabling proactive measures, leading to an increased demand for these diagnostic tools and technologies.

Regulatory challenges and resource constraints

Regulatory challenges serve as a significant restraint on the market demand for infectious respiratory disease diagnostics. Stringent regulatory approval processes and compliance requirements can prolong the time it takes to develop and introduce new diagnostic tests and technologies. This delay can impede timely responses to outbreaks and limit the availability of innovative solutions. Moreover, the complexity of navigating regulatory hurdles can deter smaller companies from entering the market, reducing competition and potentially limiting the range of available diagnostic options.

Moreover, resource constraints significantly hinder market demand in the infectious respiratory disease diagnostics market. In resource-limited settings, access to advanced diagnostic technologies and skilled healthcare professionals is limited. This scarcity of resources impedes the widespread adoption of respiratory diagnostics, creating disparities in healthcare delivery. Patients in underserved regions may face delays in diagnosis and treatment, leading to adverse health outcomes and increased disease transmission. Bridging this resource gap is crucial to ensure equitable access to respiratory diagnostics and address the challenges posed by infectious respiratory diseases effectively.

Point-of-care testing and continuous innovation

Point-of-care testing is a pivotal driver of market demand in the infectious respiratory disease diagnostics market. These rapid and on-site diagnostic tests offer the advantage of providing quick and accurate results at the patient's bedside, reducing the time to diagnosis and enabling immediate treatment decisions. This is especially critical during infectious disease outbreaks and in remote or resource-limited settings where access to centralized laboratories is limited.

The convenience and speed of point-of-care testing enhance the adoption of respiratory diagnostics, contributing significantly to market growth. Moreover, continuous innovation serves as a compelling driver for surging market demand within the infectious respiratory disease diagnostics market. Ongoing research and development efforts aimed at enhancing diagnostic technologies, improving sensitivity and specificity, and introducing novel testing methodologies create a climate of constant improvement.

This not only bolsters the accuracy and efficiency of respiratory diagnostics but also fuels healthcare providers' confidence in adopting advanced solutions. As a result, the market experiences a heightened demand for cutting-edge respiratory diagnostic tools, driving growth and improving patient care.

The nasopharyngeal swabs segment contributed the highest market share of 35% in 2024. Nasopharyngeal swabs, a commonly used sample type in the infectious respiratory disease diagnostics market, involve collecting secretions from the upper part of the throat and nasal passages. Trends indicate a growing preference for this sample type due to its reliability in detecting respiratory pathogens like COVID-19. Additionally, innovations in swab designs and transport media have improved the quality of sample collection and preservation, enhancing diagnostic accuracy. Nasopharyngeal swabs are expected to remain a key sample type in respiratory disease diagnostics, especially during infectious disease outbreaks.

The saliva segment is anticipated to grow at a solid CAGR of 6.22% during the projected period. Saliva samples in the infectious respiratory disease diagnostics market refer to the use of saliva as a non-invasive specimen for detecting respiratory infections. A significant trend is the growing interest in saliva-based tests, especially during the COVID-19 pandemic. Saliva sampling offers advantages like ease of collection, reduced exposure risk for healthcare workers, and suitability for mass testing. Emerging research and diagnostic developments are focusing on optimizing saliva-based assays for respiratory infections, making it a promising and convenient sample type for disease detection.

The molecular diagnostics segment accounted for the biggest market share of 67% in 2024. Molecular diagnostics, a key technology in the infectious respiratory disease diagnostics market, involves the detection of respiratory pathogens through the analysis of genetic material. This method has witnessed a growing trend towards rapid and highly sensitive Polymerase Chain Reaction (PCR)-based tests, allowing for the swift identification of viral and bacterial infections.

Moreover, advancements in multiplex assays enable the simultaneous detection of multiple pathogens, enhancing diagnostic efficiency. The integration of molecular diagnostics with artificial intelligence for data analysis further refines accuracy, making it a pivotal technology in respiratory disease diagnostics.

The immunoassays segment is projected to grow at the fastest CAGR over the projected period. Immunoassays, a prominent technology in the infectious respiratory disease diagnostics market, are biochemical tests that detect the presence of specific antibodies or antigens in a patient's sample. Recent trends indicate a growing preference for multiplex immunoassays, allowing the simultaneous detection of multiple respiratory pathogens in a single test, improving diagnostic efficiency. Moreover, advancements in assay design, such as lateral flow assays and chemiluminescent immunoassays, enhance sensitivity and reduce turnaround times, aligning with the market's demand for rapid and accurate respiratory disease diagnostics.

The application of COVID-19 diagnostics within the infectious respiratory disease diagnostics market has been transformative. The pandemic led to an unprecedented demand for respiratory diagnostics specifically tailored to detect the SARS-CoV-2 virus. This prompted the development of rapid antigen tests, PCR assays, and serological tests, setting new trends in diagnostic speed and accuracy. The COVID-19 application also drove innovations in remote testing and home-based collection kits, reflecting the market's adaptability to emerging needs during a global health crisis. These trends are reshaping the landscape of infectious respiratory disease diagnostics.

The Influenza segment is anticipated to expand at the fastest rate over the projected period. Influenza, a highly contagious respiratory infection caused by influenza viruses, is a pivotal application area in the infectious respiratory disease diagnostics market. Trends in influenza diagnostics include the development of rapid molecular assays for early detection, a shift towards point-of-care testing to enable quick intervention, and continuous surveillance to monitor influenza strains and predict outbreaks. The market's focus on timely and accurate influenza diagnosis aligns with the broader goal of enhancing public health preparedness in the face of respiratory infectious diseases.

By Product Type

By Sample Type

By Application

By Technology

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024

October 2024

January 2025