May 2024

Inflammatory Bowel Disease Treatment Market (By Type: Crohns Disease, Ulcerative Colitis; By Drug Class: Aminosalicylates, Corticosteroids, TNF Inhibitors, IL Inhibitors, Anti-Integrin, JAK Inhibitors, Others; By Route of Administration : Oral, Injectable; By Distribution Channel: Hospital Pharmacy, Retail Pharmacy, Online Pharmacy) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

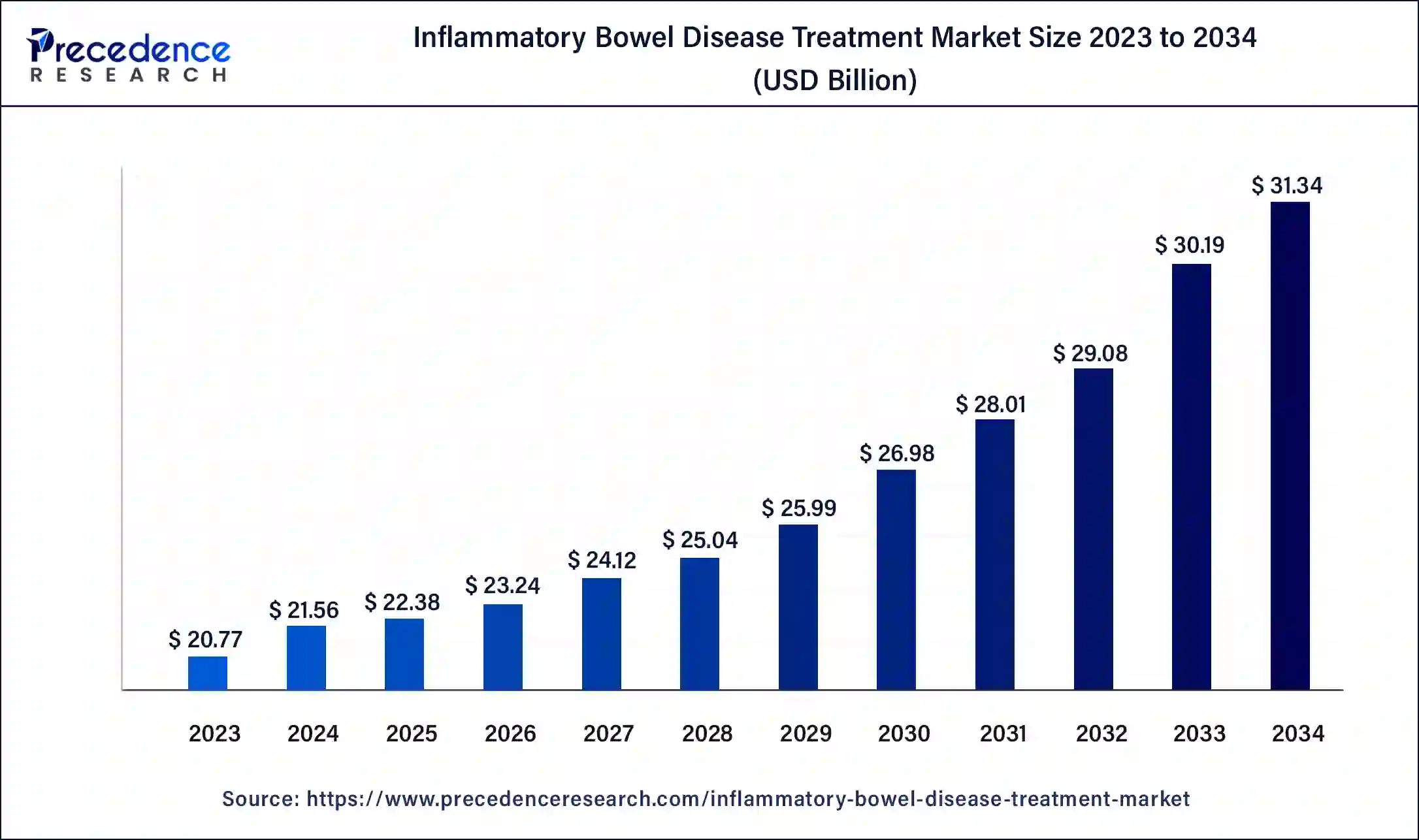

The global inflammatory bowel disease treatment market size was USD 20.77 billion in 2023, calculated at USD 31.34 billion in 2024 and is expected to reach around USD 31.34 billion by 2034, expanding at a CAGR of 3.81% from 2024 to 2034. The North America inflammatory bowel disease treatment market size was valued at USD 12.25 billion in 2023. The rising prevalence of ulcerative colitis and Crohn's disease across the globe and increasing approval of novel therapeutics are anticipated to drive the inflammatory bowel disease treatment market.

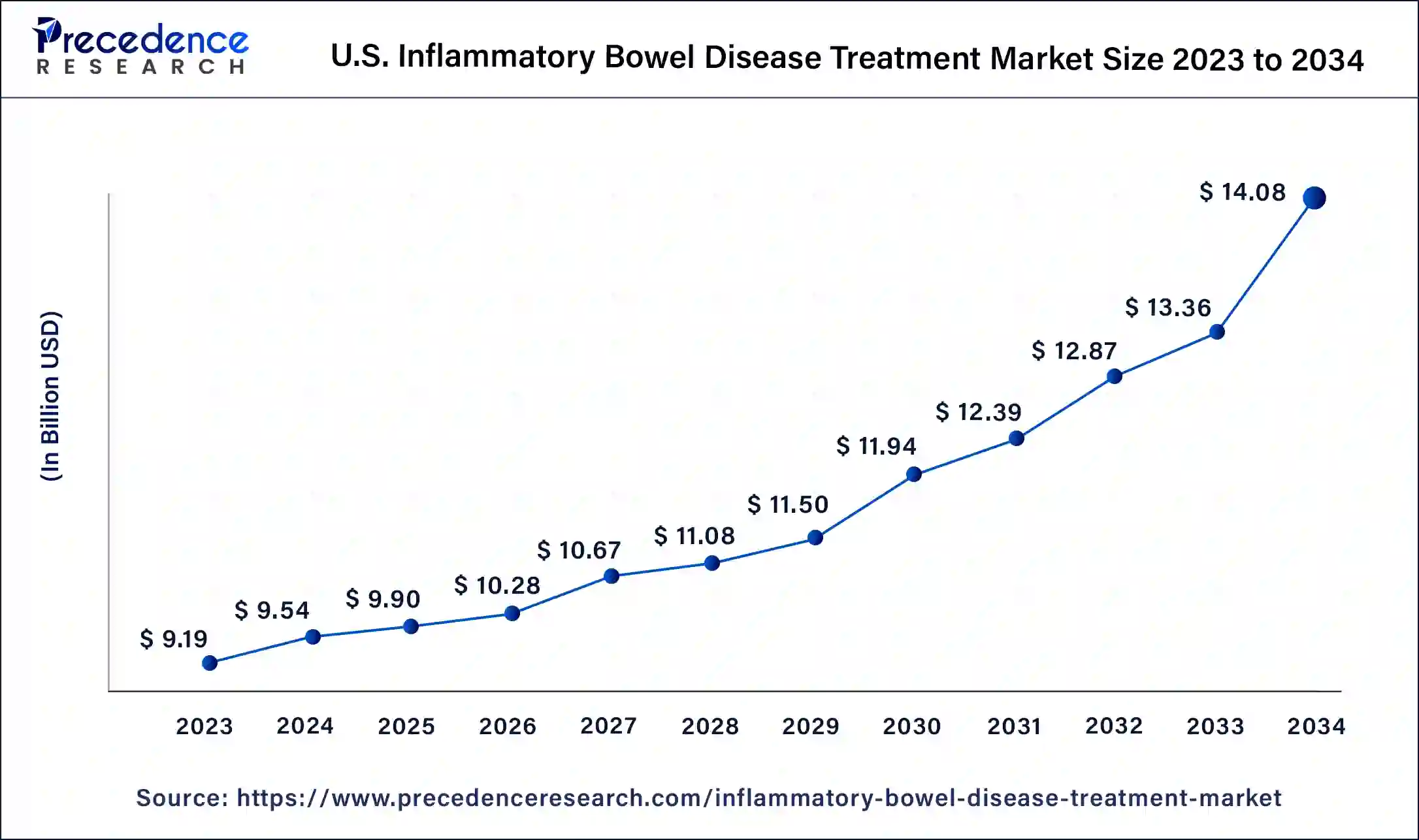

The U.S. inflammatory bowel disease treatment market size was exhibited at USD 9.19 billion in 2023 and is projected to be worth around USD 14.08 billion by 2034, poised to grow at a CAGR of 3.95% from 2024 to 2034.

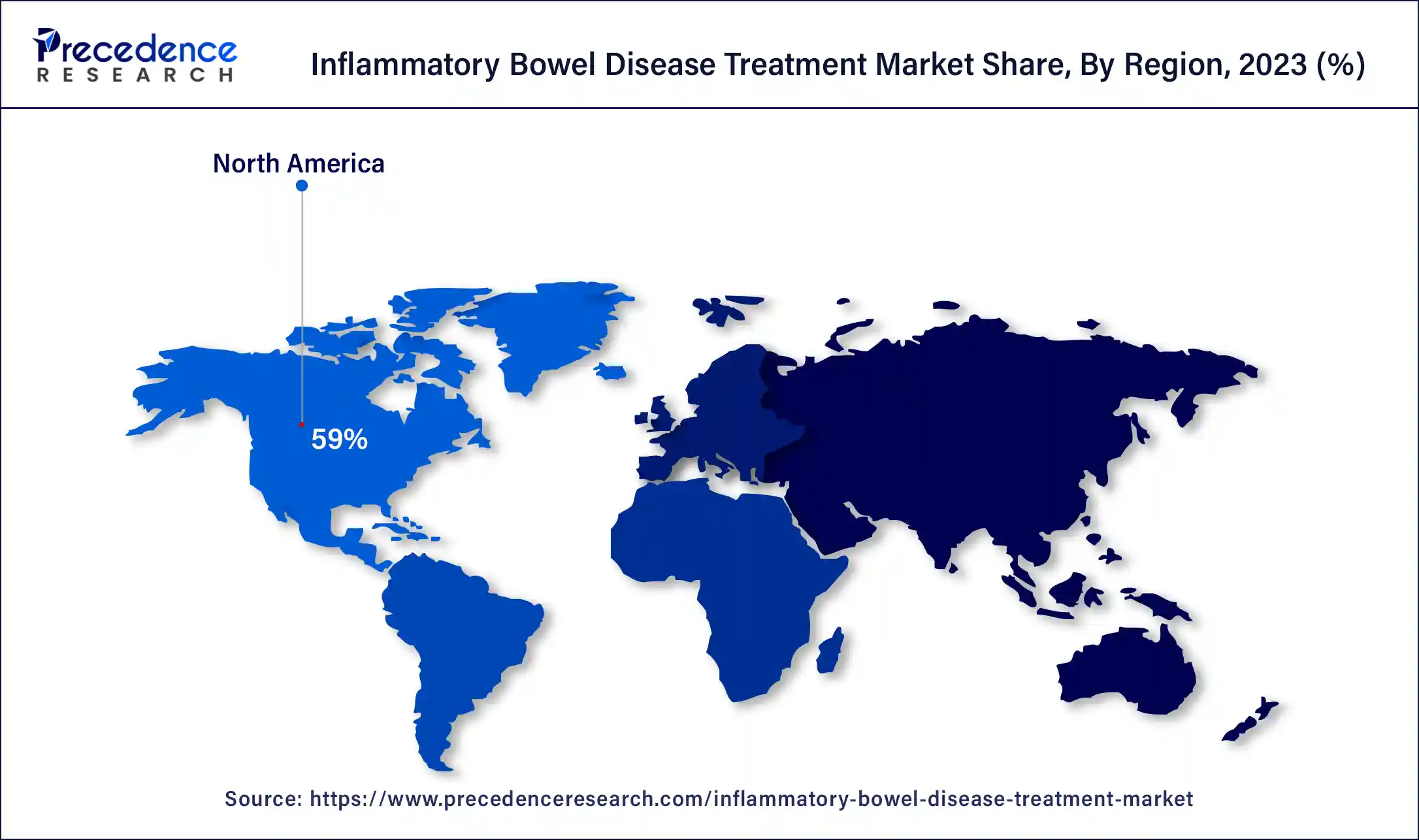

North America led the inflammatory bowel disease treatment market in 2023. The market in North America is experiencing growth due to the rising incidence and prevalence of chronic gastrointestinal diseases and increased healthcare spending. In the U.S., the biologic Stekinumab, which inhibits the cytokines IL-12 and IL-23, has been approved for treating Crohn's disease. Two anti-integrin biologics, Natalizumab and Vedolizumab, have been approved for the treatment of IBD, along with biosimilars for anti-TNF medications.

Asia Pacific is expected to show the fastest growth in the inflammatory bowel disease treatment market over the forecast period. Several factors will drive market expansion in the coming years, including an aging population, a high likelihood of developing inflammatory illnesses, an increase in the incidence of inflammatory bowel disorders, and improved healthcare policies in the region. China held the largest market share for inflammatory bowel disease treatment, while India was the fastest-growing market in this sector.

Inflammatory bowel disease (IBD) encompasses two conditions, ulcerative colitis and Crohn's disease, characterized by prolonged inflammation of the gastrointestinal (GI) tract. This chronic inflammation leads to damage within the GI tract. The primary goal of IBD treatment is to reduce the inflammation causing the symptoms and signs. Ideally, this can result in not only symptom relief but also long-term remission and a reduced risk of complications. Treatment for IBD often involves drug therapy or surgery. Anti-inflammatory medications are commonly the first line of defense against inflammatory bowel disease.

| Report Coverage | Details |

| Market Size by 2034 | USD 31.34 Billion |

| Market Size in 2023 | USD 20.77 Billion |

| Market Size in 2024 | USD 21.56 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.81% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Drug Class, Route of Administration, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising disease prevalence and a strong focus on R&D

In the inflammatory bowel disease treatment market, healthcare practitioners are leveraging technological advancements such as single-cell RNA sequencing for treatment. Intestinal tissues from patients with Crohn's disease or ulcerative colitis are analyzed using high-dimensional technologies, including single-cell RNA sequencing and mass cytometry. These technologies also offer several benefits, such as developing innovative therapeutic strategies, optimizing specific medications, and preventing disease. Single-cell RNA sequencing helps understand the molecular basis of IBD, facilitating these advancements.

Side effects

The adverse effects associated with drugs used to treat IBD pose a significant challenge in the inflammatory bowel disease treatment market. Corticosteroids are among the most prescribed medications for Crohn's disease and ulcerative colitis. Although they are effective in reducing inflammation in the digestive tract, long-term use of corticosteroids is not advisable. Steroids can disrupt the formation of the protective mucous layer inside the stomach.

New launches of IBD therapeutics

A key trend in the inflammatory bowel disease treatment market is the introduction of new IBD therapeutics. Companies are concentrating on developing novel treatments, including small molecules and biologics, for various inflammatory bowel diseases. The advancement of cutting-edge treatments for IBD is being driven by increased research and development expenditures from pharmaceutical and biopharma companies, along with the launch of new products.

HUMIRA stands out as the first subcutaneous biologic therapeutic option for patients aged five and above with moderately to severely active ulcerative colitis.

The TNF inhibitors segment dominated the inflammatory bowel disease treatment market in 2023. The substantial share of the TNF inhibitor category in IBD treatment can be attributed to the high prescription rates and increasing consumer awareness of these inhibitors. Key TNF inhibitors used to treat inflammatory conditions include Simponi, Humira, and other biosimilars. However, the upcoming loss of patent protection for TNF inhibitors might hinder market growth. Companies are also focusing on expanding the labels of existing products to broaden their market reach.

The JAK inhibitors segment is expected to grow at the fastest rate in the inflammatory bowel disease treatment market during the forecast period. The growth of this segment can be credited to the rising approvals of innovative JAK inhibitors and a robust pipeline of drugs anticipated to be commercialized in the upcoming years. Last year, the U.S. FDA expanded the use of Rinvoq for treating moderate to severe Crohn's disease in adults. Such initiatives are expected to drive the segment's expansion over the forecast period.

The Crohn's disease segment led the inflammatory bowel disease treatment market in 2023. This can be attributed to the high prevalence of the disease, the significant costs associated with Crohn's disease treatment, and the increasing prescription rates of biologics. Moreover, recent approvals of innovative therapies and the presence of a robust pipeline of candidates are expected to drive the segment's growth.

The ulcerative colitis segment is likely to grow at the fastest rate in the inflammatory bowel disease treatment market over the forecast period. Ulcerative colitis manifests as an inflammatory reaction to an atypical TH2 response. This condition affects the large intestine and is characterized by periods of remission and flare-ups. Initially localized in the colon-rectum area, it can progress proximally to involve the entire large intestine and the ileum. Factors contributing to its onset include an improper immune response, dietary factors such as processed foods, and increased stress levels, all of which aggravate inflammation and worsen the severity of colitis.

The injectable segment accounted for the largest share of inflammatory bowel disease treatment market in 2023. The significant share of this segment is due to the high adoption rate of biologics and biosimilar preparations, along with their higher prices, rapid onset of action, and greater bioavailability of injectable drugs. The frequent prescription of injectable formulations such as Humira and others contributes to the large market share of these drugs.

The oral route of administration of drugs segment is expected to grow at the fastest rate in the inflammatory bowel disease treatment market during the projected period. This is because the oral route is the most convenient, generally safest, and least costly method of drug administration, which makes it the most utilized. Oral administration provides several benefits, such as targeted delivery to the gastrointestinal tract, a large absorption area for effective systemic distribution, ease of administration, precise dosing with tablets and boluses, and cost-effectiveness compared to alternative delivery methods.

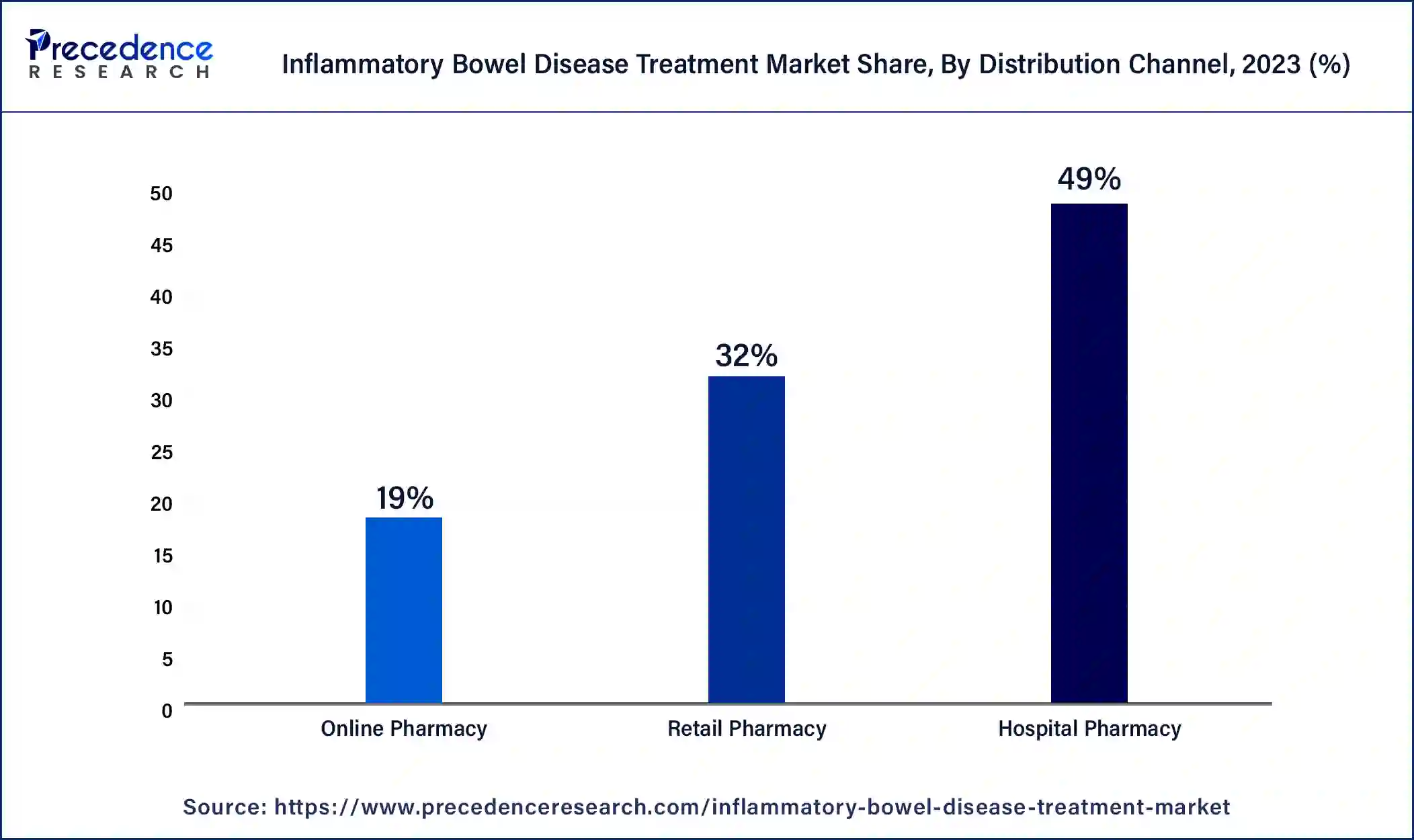

The hospital pharmacy segment dominated the inflammatory bowel disease treatment market by distribution channel in 2023. The segment's growth is anticipated to be driven by improved reimbursement policies in developed and developing countries, which cover high-cost IBD therapeutic products and are expected to expand the segment further. Furthermore, factors such as high hospitalization rates due to the increasing severity of IBD, widespread adoption of injectable drugs, and a growing elderly population.

The online pharmacies segment is projected to experience the most rapid growth in the inflammatory bowel disease treatment market during the forecast period. This is due to the increasing prevalence of online pharmacies, greater internet accessibility, and the availability of various discounts. The rise of telemedicine, the availability of self-administered prefilled syringes and pens for IBD, and the approval of oral medications are encouraging more people to turn to online pharmacies.

Segments Covered in the Report

By Type

By Drug Class

By Route of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2024

January 2025

February 2025

November 2024