July 2024

Influenza Diagnostic Market (By Test Type: RIDT, RT-PCR, Cell Culture, Others; By End-use: Hospitals, POCT, Laboratories) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

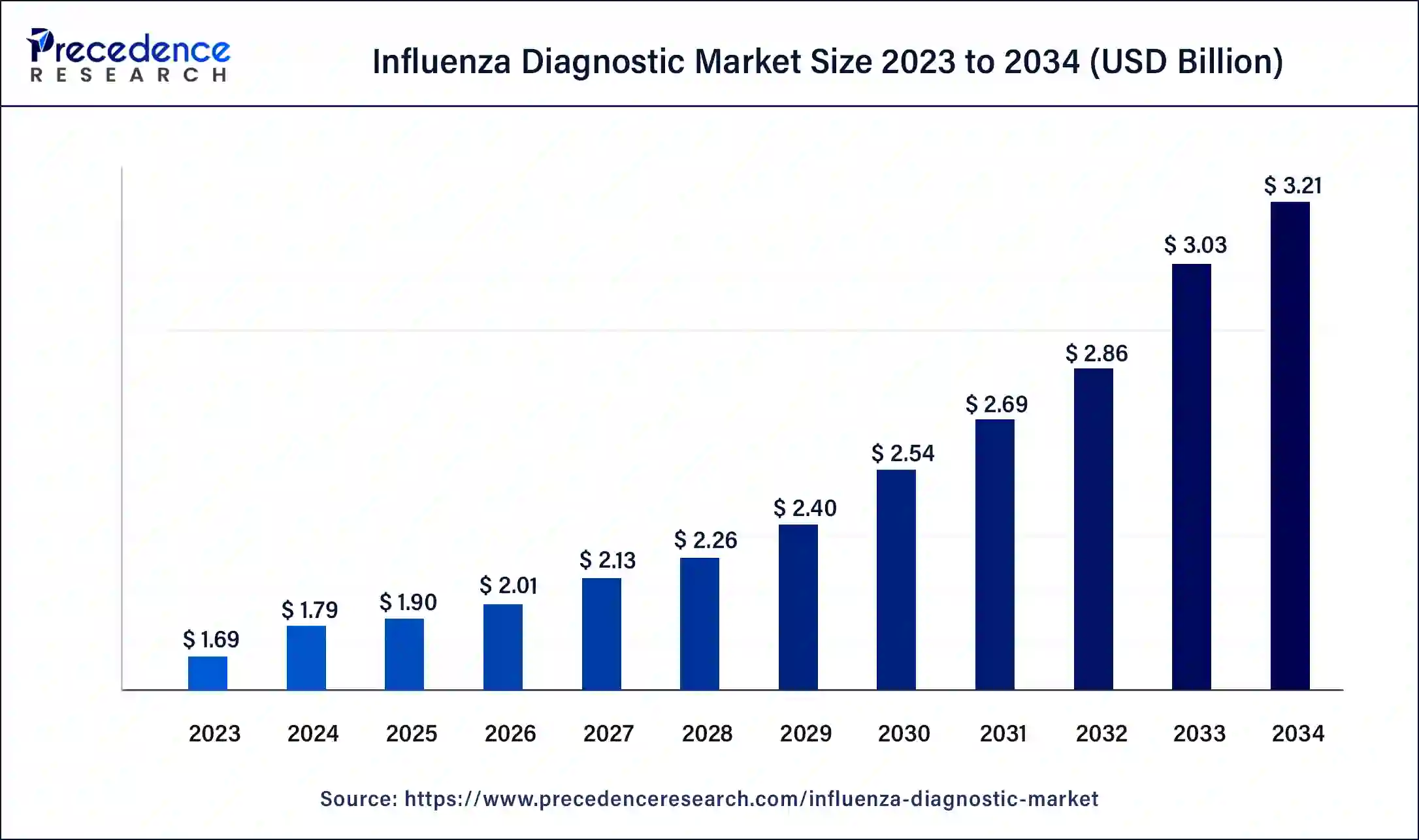

The global influenza diagnostic market size was USD 1.69 billion in 2023, accounted for USD 1.79 billion in 2024, and is expected to reach around USD 3.21 billion by 2034, expanding at a CAGR of 6% from 2024 to 2034. The North America influenza diagnostic market size reached USD 570 million in 2023. The influenza diagnostic market is driven by an increasing focus on early identification to effectively manage influenza.

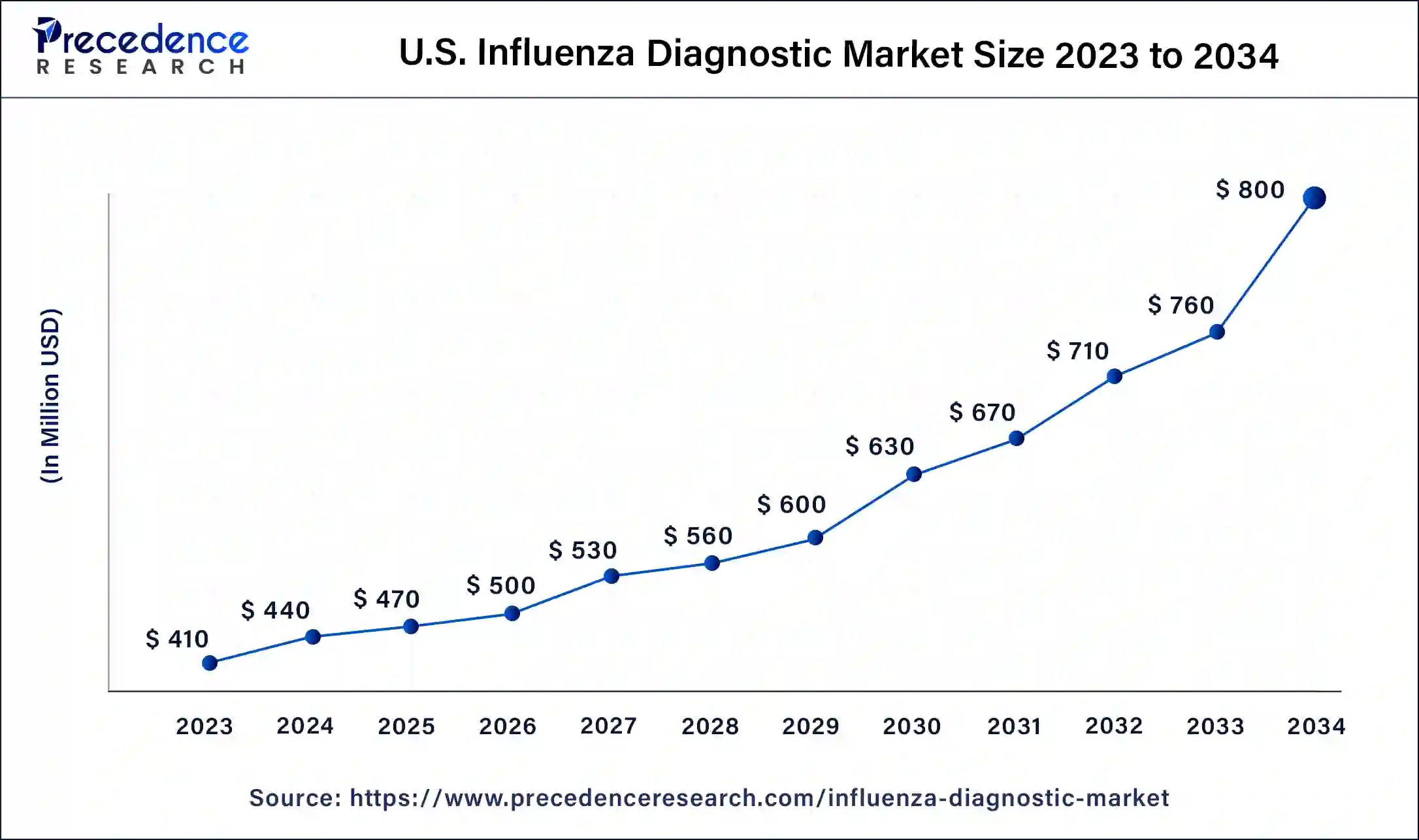

The U.S. influenza diagnostic market size was estimated at USD 410.00 million in 2023 and is predicted to be worth around USD 800.00 million by 2034, at a CAGR of 6.2% from 2024 to 2034.

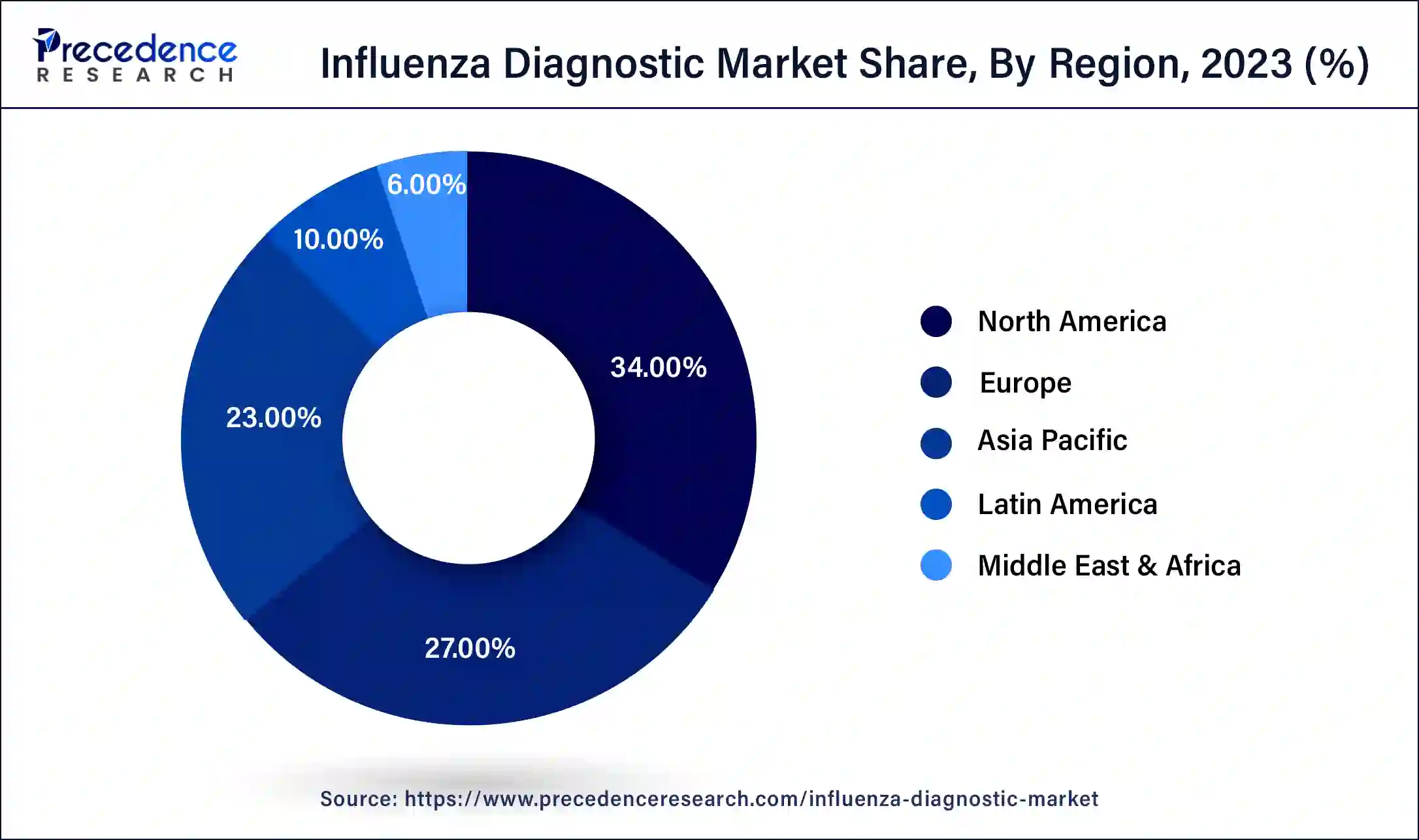

North America carried the largest market share of 34% in 2023. There is a high level of awareness about influenza among healthcare professionals and the general population in North America. This awareness encourages individuals to seek medical attention promptly when experiencing symptoms suggestive of influenza, leading to higher diagnostic rates. Additionally, healthcare providers in the region are proactive in testing patients for influenza, especially during flu seasons, further boosting the demand for influenza diagnostic tests. North America's governments and healthcare regulatory agencies implement policies and initiatives to control the spread of infectious diseases like influenza.

These initiatives often include public health campaigns promoting influenza vaccination and encouraging early detection through diagnostic testing. Moreover, the region's reimbursement policies and insurance coverage for influenza diagnostic tests facilitate access to testing services.

Asia-Pacific is the fastest growing in the influenza diagnostic market during the forecast period. There has been a noticeable movement in the Asia-Pacific area toward point-of-care testing (POCT) options due to the growing need for quick and precise diagnostic results. POCT devices are especially useful in resource-constrained environments and remote locations with limited access to centralized laboratories because of their mobility, convenience, and quick turnaround times. Fast developments in diagnostic technologies have improved the speed, accessibility, and accuracy of influenza diagnosis in the Asia-Pacific area.

These technologies include molecular diagnostics, immunoassays, and point-of-care testing. Healthcare providers can promptly identify influenza strains thanks to these cutting-edge diagnostic tools, which make treatment and containment strategies easier to implement on time.

Producing, developing and distributing developing and disseminating instruments, tests, and technologies to identify and diagnose influenza virus infections is the main objective of the influenza diagnostic market. These diagnostic instruments are intended for use in various environments, such as point-of-care facilities, clinics, hospitals, and labs. At the local, national, and international levels, influenza diagnostics aid in the surveillance and monitoring of influenza activity. Public health officials may effectively allocate resources and adopt targeted control measures to lessen the impact of seasonal influenza outbreaks and pandemics by monitoring influenza virus circulation and detecting new strains.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6% |

| Global Market Size in 2023 | USD 1.69 Billion |

| Global Market Size in 2024 | USD 1.79 Billion |

| Global Market Size by 2034 | USD 3.21Billion |

| U.S. Market Size in 2023 | USD 410 Million |

| U.S. Market Size by 2034 | USD 800 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Test Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of influenza

Apart from seasonal influenza, new strains of the virus can potentially produce influenza pandemics worldwide. For example, the H1N1 pandemic in 2009 and the Spanish flu pandemic in 1918 demonstrated how quickly influenza can spread over the world and cause massive disease and fatalities.

The possibility of fresh pandemics is a persistent worry as new influenza strains develop. Early diagnosis and containment are crucial in stopping the spread of new influenza viruses and lessening their adverse effects on public health, and this requires the deployment of effective diagnostic technologies. Thereby, the rising prevalence of influenza is observed to act as a major driver for the influenza diagnostic market. Governments and public health organizations acknowledge the significance of implementing readiness measures to lessen the impact of influenza epidemics. Developing a strong diagnostic infrastructure is essential to pandemic preparedness plans.

Rising demand for faster diagnostic test for influenza

Influenza outbreaks can present serious problems for public health, especially when they coincide with pandemics or seasonal highs. Quick diagnostic tests make illness surveillance, outbreak containment, and epidemiological monitoring more effective for public health authorities. These diagnostics reduce the amount of influenza that spreads throughout communities and healthcare facilities by promptly detecting and separating cases. Diagnostic delays may occur from the sample collection, transit to a central laboratory, and subsequent processing involved in traditional laboratory-based procedures for influenza. The benefit of rapid diagnostic testing is that answers can be obtained in minutes, significantly minimizing patient wait periods. Thereby, considering the demand for diagnostic test for influenza acts as a major driver for the influenza diagnostic market.

Variabilities in test sensitivity and specificity

Influenza is a highly transmissible respiratory disease that can cause serious complications, particularly in susceptible groups like the elderly, small children, and people with underlying medical disorders. Therefore, prompt treatment and management depend heavily on precise and trustworthy diagnostic testing. Variations in sensitivity and specificity can potentially provide erroneous results, including missed diagnoses or false positives or negatives. The precision of influenza diagnostic tests is essential to manage outbreaks and monitor public health.

Test sensitivity and specificity variations can impact the validity of surveillance data, making it difficult for public health officials to precisely monitor the virus's spread, implement the necessary controls, and deploy resources during influenza seasons or pandemics. Thereby, such concerns related to sensitivity and specificity act as a major restraint for the influenza diagnostic market.

Variability in test accuracy may damage the public's confidence in influenza diagnostic tests and healthcare systems. Test results may cause patients and healthcare professionals to lose faith in them, which could result in a decline in the uptake of advised preventative measures like immunization and infection control procedures.

Stringent regulatory guidelines

Regulatory standards require strict quality control procedures to guarantee the accuracy and consistency of influenza diagnostic tests. Manufacturers must implement comprehensive quality management systems to oversee and regulate all facets of the production process, from acquiring raw materials to distributing finished products. To reduce the possibility of contamination, quality variations, or product faults, adherence to Good Manufacturing Practices (GMP) is crucial. The company's reputation and financial health may suffer in the event of regulatory penalties, product recalls, or market withdrawal resulting from noncompliance with these criteria.

Increasing number of patients acquiring infections

The rising number of patients acquiring infections is observed to open a lucrative opportunity for the influenza diagnostic market. There is a growing need for precise and effective diagnostic tests as the number of patients getting infections rises. Being a highly contagious respiratory disease, influenza must be diagnosed as soon as possible to start treatment and stop the sickness from spreading. The market for influenza diagnostics is set up for success by this spike in demand.

The infrastructure for providing healthcare, which includes clinics, hospitals, and laboratories, has been steadily growing in many areas. Patients with influenza-like symptoms now have easier access to diagnostic services thanks to the expansion of healthcare facilities. Furthermore, point-of-care testing equipment promotes decentralized testing, facilitating prompt diagnosis and treatment in various healthcare settings and supporting market expansion.

Advancements in genomic and proteomic technologies

Detailed characterization of influenza virus strains, including genetic diversity, antigenic characteristics, and treatment resistance profiles, is made possible by proteomic and genome technologies. This data is crucial for tracking the transmission of viruses across various geographic locations, keeping an eye out for the appearance of novel influenza strains, and helping to choose vaccine variants. These technological advancements aid in creating more potent diagnostic tools and vaccinations by offering comprehensive insights into the genomic and proteomic composition of influenza viruses. Thereby, technological advancements are observed to act as an opportunity for the influenza diagnostic market.

The RIDT segment dominated and sustained to be the fastest growing in the influenza diagnostic market. The Rapid Influenza Diagnostic Test (RIDT) is efficient for patients and healthcare providers since it provides fast findings, usually in 15 to 30 minutes. This quick response time is essential for controlling influenza epidemics because it enables prompt identification and proper treatment or containment measures. Technology has advanced to the point that influenza viruses may now be accurately detected thanks to RIDTs' increased sensitivity and specificity. They may not be as sensitive as molecular tests conducted in laboratories, such as Polymerase Chain Reaction (PCR), but they provide a fast enough screening and diagnosis.

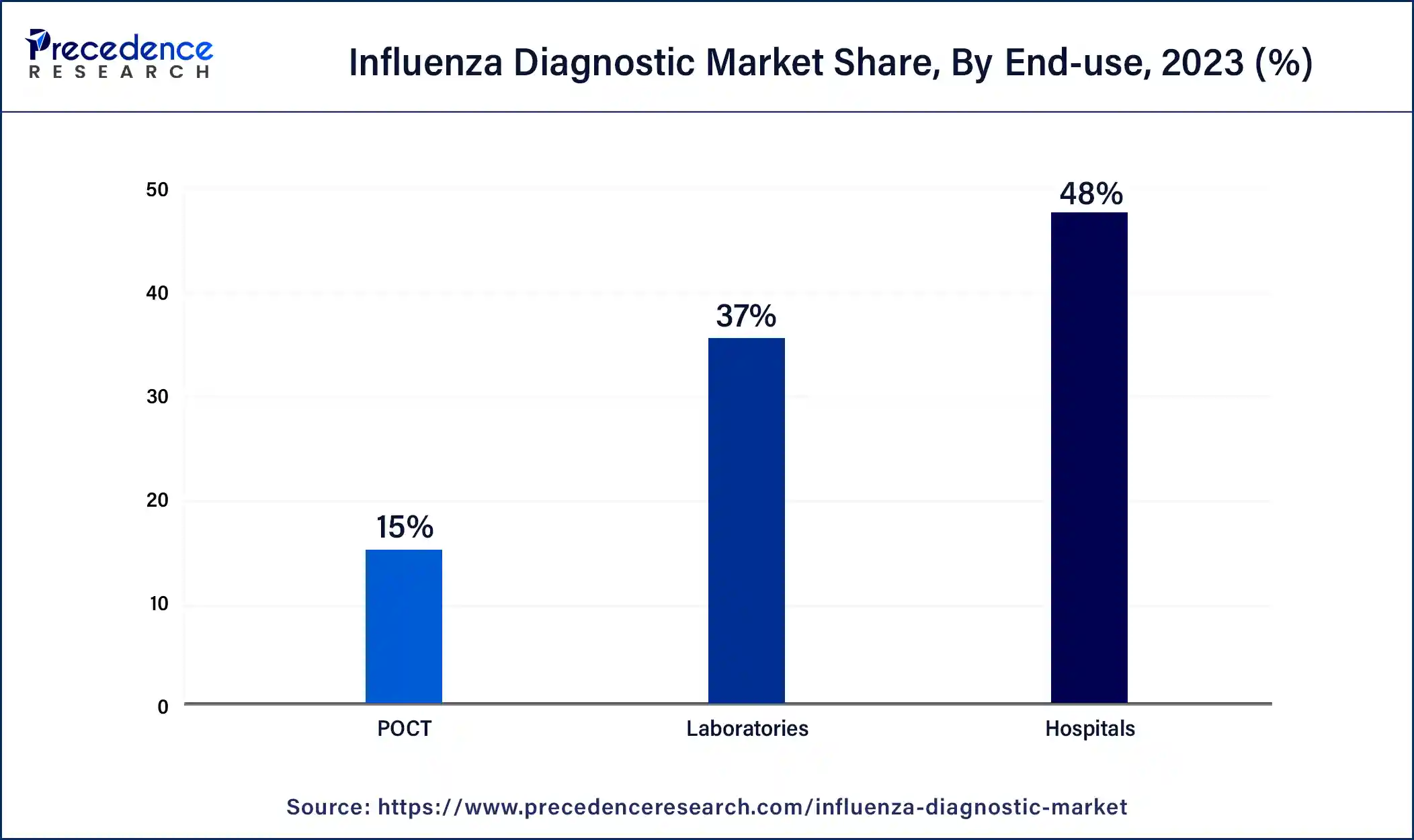

The hospitals segment dominated the influenza diagnostic market share at 48% in 2023. Emergency departments and urgent care clinics are in hospitals and serve patients who need to be seen immediately, including those with severe influenza symptoms or complications. Hospitals play a crucial role in diagnosing and treating influenza cases, and these facilities carry out quick diagnostic tests and offer prompt therapies. It uses a broad group of medical specialists with specific training and experience in detecting infectious disorders such as influenza, including pathologists, physicians, laboratory technicians, and microbiologists. These experts play a critical role in correctly recognizing and diagnosing influenza cases and ensuring the right course of action is taken.

The POCT segment is the fastest-growing in the influenza diagnostic market during the forecast period. Point-of-care testing (POCT) provides patients, healthcare professionals, and laboratories with accessibility and convenience. POCT devices allow for real-time, on-site testing, unlike conventional laboratory-based testing procedures that call for samples to be sent off-site for processing. This shortens turnaround times, avoids substantial sample transportation requirements, and enables timely patient management decision-making. Comparing POCT to conventional laboratory-based testing procedures reveals significant cost savings.

POCT devices facilitate healthcare processes and maximize resource utilization by removing the need for sample transportation, lowering personnel costs related to sample processing, and decreasing the usage of pricey laboratory equipment. Because of its affordability, POCT is a desirable choice for medical professionals and organizations looking for reliable and accurate diagnostics at a reasonable cost.

Segments Covered in the Report

By Test Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

February 2025

August 2024

January 2025