January 2025

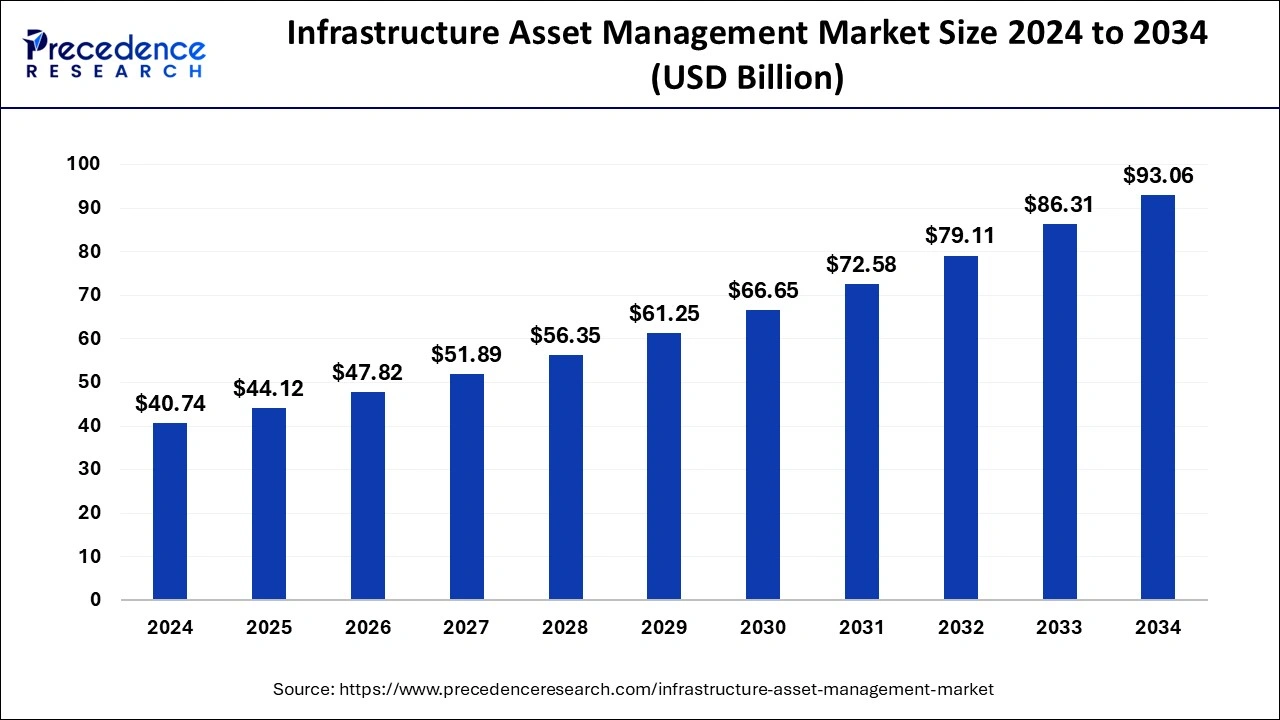

The global infrastructure asset management market size is accounted at USD 44.12 billion in 2025 and is forecasted to hit around USD 93.06 billion by 2034, representing a CAGR of 8.61% from 2025 to 2034. The North America market size was estimated at USD 13.44 billion in 2024 and is expanding at a CAGR of 8.64% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global infrastructure asset management market size was calculated at USD 40.74 billion in 2024 and is predicted to increase from USD 44.12 billion in 2025 to approximately USD 93.06 billion by 2034, expanding at a CAGR of 8.61% from 2025 to 2034.

The U.S. infrastructure asset management market size was evaluated at USD 9.41 billion in 2024 and is projected to be worth around USD 21.50 billion by 2034, growing at a CAGR of 8.61% from 2025 to 2034.

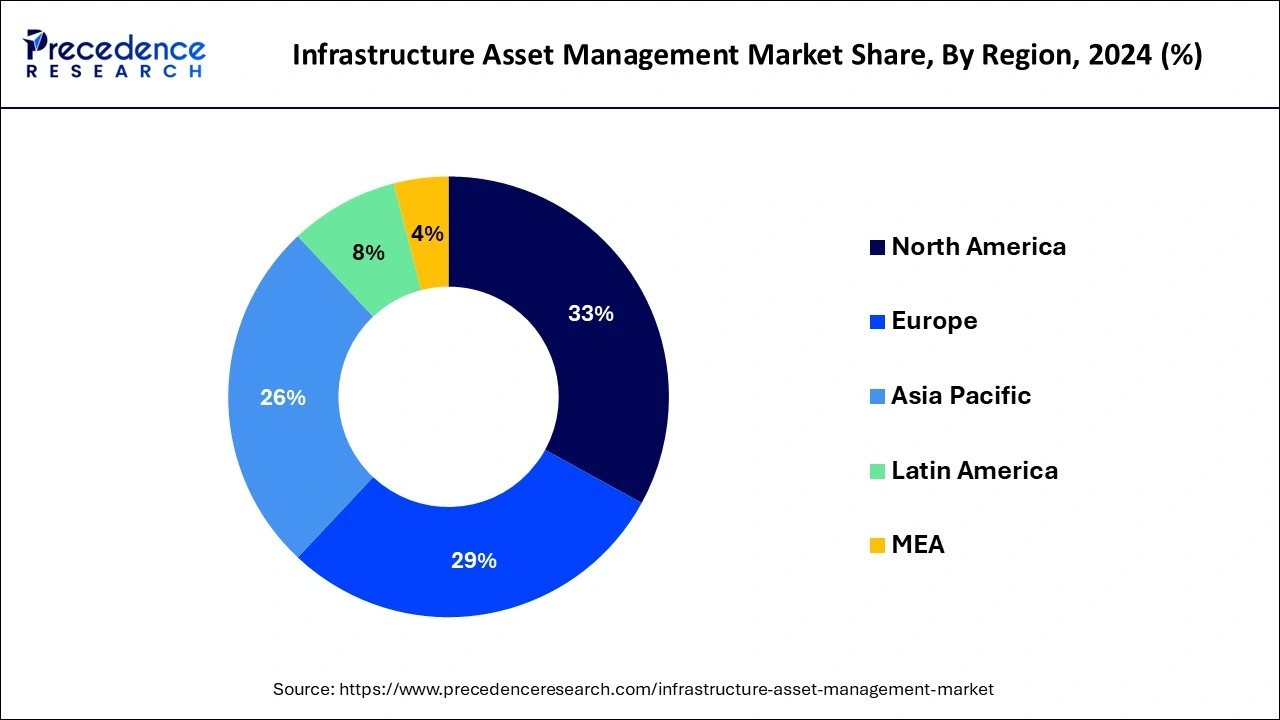

In 2024, North America held a share of 33% in the infrastructure asset management market due to robust investments in modernizing aging infrastructure, particularly in the United States and Canada. The region's emphasis on smart city initiatives, stringent regulatory compliance, and a focus on technological advancements contribute to the dominance. Additionally, the presence of key market players, a high level of awareness regarding the benefits of asset management, and a proactive approach to addressing infrastructure challenges further solidify North America's leadership in the infrastructure asset management market.

Asia-Pacific is set for rapid growth in the infrastructure asset management market due to surging investments in large-scale development projects. Governments across the region are heavily focusing on upgrading and expanding their infrastructure networks, creating a substantial demand for effective asset management solutions. The increasing adoption of advanced technologies, along with the need for sustainable infrastructure, further propels this growth. As the region modernizes its infrastructure, there is a significant opportunity for asset management providers to play a pivotal role in optimizing performance and ensuring long-term sustainability.

Meanwhile, Europe is experiencing notable growth in the infrastructure asset management market due to increased government investments in modernizing and maintaining aging infrastructure. The region's commitment to sustainable development, smart city initiatives, and stringent regulatory compliance has spurred the adoption of advanced asset management solutions. Moreover, the push for digital transformation, coupled with a rising awareness of the benefits of technology integration, has led to a surge in demand for innovative infrastructure asset management practices, contributing to the market's significant expansion in Europe.

Infrastructure asset management involves the systematic planning, monitoring, and maintenance of physical assets like roads, bridges, and utilities to ensure their optimal performance and longevity. It encompasses a strategic approach to managing assets throughout their lifecycle, from acquisition to disposal. This process helps organizations make informed decisions about resource allocation, prioritize maintenance activities, and extend the lifespan of infrastructure, ultimately maximizing return on investment. By employing infrastructure asset management practices, authorities can enhance the reliability and efficiency of public services, reduce operational costs, and minimize the risks associated with asset failure. This proactive approach enables better decision-making, improved infrastructure performance, and the sustainable use of resources, contributing to the overall well-being and functionality of communities.

Infrastructure Asset Management Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.61% |

| Market Size in 2025 | USD 44.12 Billion |

| Market Size by 2034 | USD 93.06 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Service, and Component |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Government initiatives

Government initiatives play a pivotal role in boosting the demand for infrastructure asset management solutions. When governments prioritize investments in infrastructure development and maintenance, it creates a surge in market demand. For instance, substantial budget allocations for projects like road construction, energy facilities, and water management enhance the need for effective asset management to ensure optimal performance and longevity.

Moreover, the successful implementation of government initiatives often sets a standard for best practices in infrastructure asset management. As projects demonstrate improved efficiency, cost-effectiveness, and sustainability, other regions and industries take note, further fueling market demand. When governments lead by example in adopting advanced technologies and proactive maintenance strategies, it instills confidence in the private sector to invest in similar solutions, fostering a positive cycle of growth for the infrastructure asset management market.

Fragmented data and systems

Fragmented data and systems pose a significant restraint on the infrastructure asset management market. In many cases, different departments and entities within organizations manage various infrastructure assets using separate systems and data sources. This fragmentation leads to challenges in consolidating and harmonizing information, hindering the seamless implementation of comprehensive asset management strategies. The lack of integration between disparate systems makes it difficult to obtain a holistic view of an organization's infrastructure assets. This can result in inefficiencies, data discrepancies, and delays in decision-making processes.

To address this restraint, there is a growing need for standardized data formats and interoperable systems that can facilitate the smooth exchange of information across different platforms. Overcoming the hurdle of fragmented data and systems is essential for unlocking the full potential of infrastructure asset management solutions, ensuring better-informed decisions and optimized performance of critical assets.

Global connectivity and cross-border projects

Global connectivity and cross-border projects are creating significant opportunities in the infrastructure asset management market. As countries increasingly collaborate on large-scale infrastructure initiatives that span across borders, there is a growing demand for standardized and interoperable asset management solutions. This presents an opportunity for technology providers to offer systems that facilitate seamless coordination, data exchange, and information sharing among different stakeholders involved in cross-border projects.

Infrastructure asset management becomes crucial in ensuring the efficient operation and maintenance of shared assets, such as transportation networks and energy grids. The need for unified asset management practices across borders opens avenues for innovation and the adoption of advanced technologies. Companies that can provide solutions to address the unique challenges of cross-border projects, including data harmonization and collaborative decision-making, are well-positioned to thrive in this dynamic market, contributing to the overall success and sustainability of global infrastructure endeavors.

The transportation segment held the highest market share of 32% in 2023. The transportation segment in the infrastructure asset management market focuses on managing assets related to transportation networks, including roads, bridges, railways, and airports. Trends in this segment involve the increasing use of technology for real-time monitoring, predictive maintenance, and optimization of transportation infrastructure. Emphasis is placed on improving safety, reducing downtime, and enhancing overall efficiency. By leveraging advanced asset management solutions, transportation authorities can address the challenges of aging infrastructure, ensuring reliable and sustainable transportation systems for the growing global population.

The energy infrastructure segment is anticipated to witness rapid growth at a significant CAGR of 11.4% during the projected period. In the infrastructure asset management market, the energy infrastructure segment involves managing assets related to energy production, distribution, and storage. This includes power plants, renewable energy facilities, electrical grids, and associated infrastructure. A notable trend in this segment is the increasing integration of smart technologies, such as sensors and data analytics, to optimize energy asset performance. This enables proactive maintenance, efficient operations, and enhanced decision-making, contributing to the overall reliability and sustainability of energy infrastructure.

The operational asset management segment has held a 40% market share in 2024. Operational asset management in the infrastructure asset management market refers to the services focused on day-to-day activities to ensure the optimal performance and functionality of physical assets. This segment includes routine maintenance, monitoring, and operational enhancements to extend asset life. Trends in operational asset management involve an increasing shift toward predictive maintenance using data analytics, IoT integration for real-time monitoring, and the adoption of cloud-based solutions. These trends enhance operational efficiency, reduce downtime, and contribute to the overall effectiveness of managing and maintaining critical infrastructure assets.

The strategic asset management segment is anticipated to witness rapid growth over the projected period. Strategic asset management, in the context of infrastructure asset management services, involves developing and implementing long-term plans to optimize the performance and value of assets. This includes strategic planning, risk management, and investment decision-making. In the infrastructure asset management market, a trend is emerging towards greater integration of data-driven strategies, leveraging technologies like AI and IoT for predictive maintenance. Organizations are increasingly adopting strategic asset management services to enhance resilience, reduce operational costs, and maximize the lifespan of critical infrastructure assets.

The services segment has held a 66% market share in 2024. In the infrastructure asset management market, the services segment refers to the range of professional offerings provided by service providers to support the implementation and ongoing operation of asset management systems. These services include consulting, training, maintenance, and support. A key trend in this segment involves a shift towards comprehensive service packages that not only assist in the initial setup of asset management solutions but also offer continuous support, training, and updates. Service providers are increasingly emphasizing long-term partnerships to ensure clients derive maximum value from their infrastructure asset management investments.

The solution segment is anticipated to witness rapid growth over the projected period. The solution segment in the infrastructure asset management market refers to comprehensive software and technology offerings that facilitate the management, monitoring, and optimization of infrastructure assets. These solutions typically include tools for asset tracking, data analytics, predictive maintenance, and performance optimization. A prominent trend in this segment involves the integration of advanced technologies such as Internet of Things (IoT), artificial intelligence (AI), and cloud computing to enhance real-time monitoring, decision-making, and overall efficiency in managing diverse infrastructure assets. This trend reflects the industry's shift towards more proactive and data-driven approaches to asset management.

By Application

By Service

By Component

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

January 2025

October 2024