February 2025

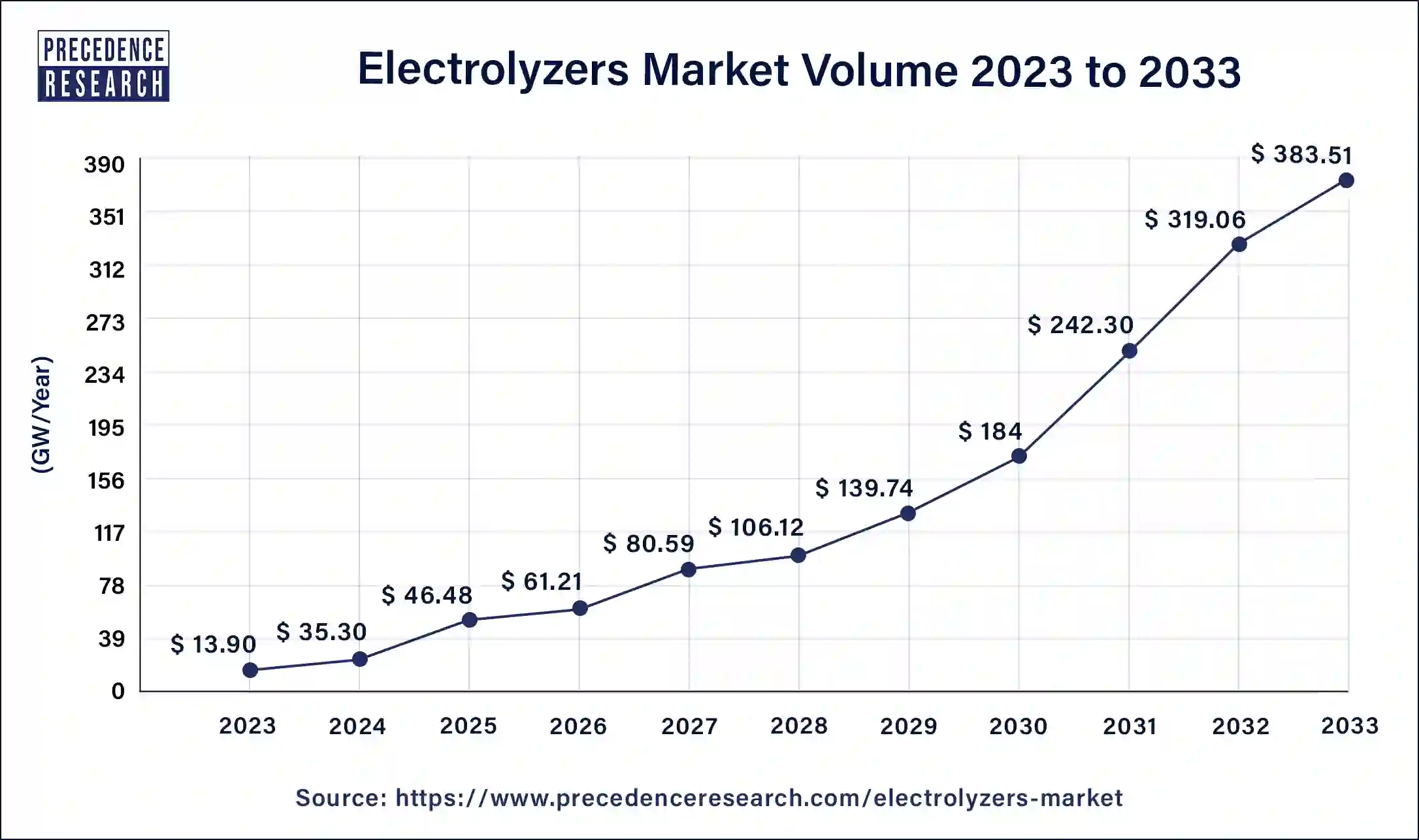

The global electrolyzer market size was accounted for USD 12.81 billion in 2023 and is expanding around USD 278.82 billion by 2033, growing at a compound annual growth rate (CAGR) of 36% from 2024 to 2033.

The electrolyzer, an instrument that utilizes electricity to separate the oxygen and hydrogen molecules through electrolysis, are crucial in producing low-emission hydrogen from nuclear or renewable energy sources. The concurrently generated oxygen is expelled into the environment. In some circumstances, it can be stored for later utilization as a gas for industrial or medical purposes. Hydrogen is either compressed and stored as a gas or liquefied for use in hydrogen fuel cells which can power ships, aircraft, as well as trains. In addition, it is utilized in various industries.

Multiple industries employ electrolysis, and it is also used for metal extraction and purification. One of the commercial techniques to create hydrogen gas utilizes electrolysis procedures. To meet the Hydrogen Energy Earthshot target of reducing the cost of clean hydrogen by 80% to USD 1/kg in a decade, electrolysis is a primary hydrogen production alternative. Hydrogen electrolysis can cause no greenhouse gas emissions depending on the electricity source used.

| Electrolyzers Market | 2021 | 2022 | 2023 |

| Electrolyzers Market Volume (GW/year) | 8.80 | 11.00 | 13.90 |

| Electrolyzers Market Revenue ($Billion) | 8.30 | 10.34 | 12.81 |

| Electrolyzers Market Price ($/KW) | 943.48 | 940.45 | 921.80 |

Electrolyzer Variants:

In electrolysis, there are various processes for producing hydrogen. These differ mainly by the following aspects such as:

Reduction in the cost of electrolyzers for the production of hydrogen at competitive rates

Among the main fuels for the clean energy transition, green hydrogen is created by electrolyzing water with clean electricity from renewable sources, such as wind and solar.

Since electricity and electrolyzers account for the main portion of manufacturing costs, creating more effective electrolyzers has a significant positive impact on the production of green hydrogen. In addition to these expenses, the additional costs included are operating expenses, transmission and distribution costs, power wheeling charges, and local taxes. For instance, according to the NITI Aayog report, the cost of producing hydrogen through electrolysis is currently ranging from USD 4.10 to USD 7 per kilogram, depending on the technology employed and other associated costs.

Moreover, the average amount of electricity used by electrolyzers to produce per kilogram of hydrogen is 50–55 kilowatt hours. electrolyzers can be as small as a few kilowatts or as large as several megawatts.

The two commercial technologies that are most frequently employed are alkaline and polymer electrolyte membrane (PEM) electrolyzers. In the former, sodium or potassium hydroxide is utilized as a liquid alkaline electrolyte. A solid polymer membrane serves as a partition between the cathode and anode compartments in PEM.

However, solid oxide or ceramic is used as the electrolyte in solid oxide electrolyzers in order to create hydrogen and oxygen. Modern technologies, like electrochemistry, use time cycles to split hydrogen and oxygen that are produced.

Rising government aspirations for deploying electrolysis capacity

Governments are setting goals for deploying the production capacity of low-emission hydrogen to communicate with private partners regarding long-term plans for hydrogen technology. Industrial capacity is gaining some pace as a result, and the goals for implementing hydrogen-generating technologies are expanding rapidly. More than double the 74 GW of 2021, the total national targets for deploying electrolysis capacity now stand around 145-190 GW.

Adoption of new mechanisms by the authority to mitigate investment risks and support project developers

Many projects in development are pioneers and are exposed to different hazards, including a lack of infrastructure, unclear legal frameworks, limited operating expertise, and unreliable demand. Governments can assist project developers by enacting regulations that enable them to reduce risk and capitalize on private capital. Several governments are already implementing such regulations through subsidies, loans, tax incentives, and carbon contracts for difference (CCfDs). Over the past year, there has been an incredibly high volume of activity, leading to several noteworthy announcements:

Investment in the deployment of electrolyzers reached USD 1.5 billion in 2021

In 2021, electrolyzer capacity went online more than ever before. Additionally, in 2022, it was planned to operate electrolyzers with a capacity of almost 900 MW. It is estimated that more than USD 1.5 billion was spent on projects at advanced stages in 2021, that is, those with a final investment decision and under construction, the majority of which projects aim for establishing in 2022 and the upcoming future. The quantity of capital invested in projects increases along with their size and frequency and is only marginally countered by falling prices. Compared to the same spending in 2020, there has been a threefold rise.

By the end of 2022, the global electrolysis capacity exceeded 1GW

The technique of electrolyzers is widely utilized in the chlorine-alkaline sector for producing sodium hydroxide and chlorine. The capacity of installed electrolysis in this industry has surpassed 20 GW. However, until the last decade, when operations started to increase, the deployment of electrolyzers for the specific production of hydrogen was slow. With more than 200 MW of electrolysis operational capacity, there was a threefold growth over the year 2020, and total installation capacity reaching more than 500 MW, a approximately 70% increase over the previous year's record, 2021 saw substantial growth in the additions of yearly capacity and became the year with the considerable deployment in the recorded series.

Furthermore, according to the pipeline of projects in development, the total capacity of electrolysis worldwide was predicted to nearly triple from 2021 to the end of 2022, or 1.4 GW. If projects are completed on schedule, they might increase by 10 times in 2023. If all pipeline projects are completed by 2030, the worldwide electrolysis capacity might reach between 134 to 240 GW.

How future demand for electrolyzers will expand the production capacity?

Compared to 2020, the yearly production capacity of electrolyzers increased to about 8 GW in 2021. More than 80% of the world’s manufacturing capacity is in Europe and China. Due to the current market expansion, anticipated future demand growth, and the fact that investing in large manufacturing facilities is a long-term choice, thus manufacturers have begun to increase their production capacity. According to the company’s statement, the capacity for manufacturing electrolyzers globally could exceed 65 GW annually by 2030. Almost two-thirds of the technological capacity is used to produce alkaline electrolyzers, and the remaining 5% is used to produce proton exchange membrane (PEM) electrolyzers.

Impact of the Russia-Ukraine Crisis on the Electrolyzers Market

For European and German authorities, expanding the hydrogen market is becoming more critical than ever because of the gas crisis in Europe and the Russian invasion of Ukraine. But the European Union and its fledgling hydrogen economy face a significant barrier to achieving ambitious goals for green hydrogen. Aside from the need for electricity, the production of electrolyzers is severely lacking. The planned expansion of electrolyzer manufacturing is nearly hard to carry out, interferes with efforts to promote imports, and creates new reliance on suppliers of essential raw materials and vital parts. Although decoupling from Russia's raw material supply is typically feasible, the EU cannot meet its objectives without China.

In addition to relaxed rules and aggressive raw material supply management, Europe may reconsider its unbalanced preference for green hydrogen. Also, Europe must increase its electrolysis capacity while simultaneously securing its market share in the production of electrolyzers.

Electrolyzers Market: Patent Insights for Hydrogen Production

According to the analysis by the EPO and the International Renewable Energy Agency, patent applications for methods of producing hydrogen using water electrolysis have increased on average by 18% annually over the last two decades.

These technological advances are essential for addressing climate change. Hydrogen generated through water electrolysis is anticipated to be at the center of the shift to more environmentally friendly energy production because it is a low-carbon process.

Recent and Future Innovations in the Global Electrolyzers Market

There are several upcoming developments and innovations in the electrolyzers industry that are being developed by the key players such as Cummins Inc., Green Hydrogen Systems, Enapter S.r.l., Sunfire GmbH., Siemens Energy, Plug Power Inc., Nel ASA, ITM Power PLC, HydrogenPro ASA, and Ohmium International, Inc. in the market. For instance,

View Full Insight@ https://www.precedenceresearch.com/electrolyzer-market

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

February 2025

November 2024

November 2024

October 2024