January 2025

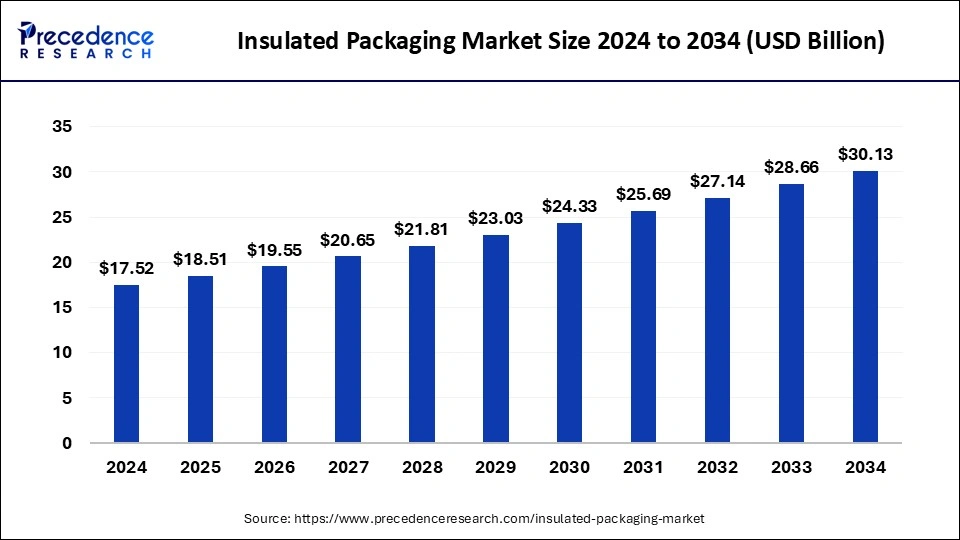

The global insulated packaging market size is evaluated at USD 18.51 billion in 2025 and is forecasted to hit around USD 30.13 billion by 2034, growing at a CAGR of 5.57% from 2025 to 2034. The Asia Pacific market size was accounted at USD 6.31 billion in 2024 and is expanding at a CAGR of 5.75% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global insulated packaging market size accounted for USD 17.52 billion in 2024 and is predicted to increase from USD 18.51 billion in 2025 to approximately USD 30.13 billion by 2034, expanding at a CAGR of 5.57% from 2025 to 2034. The rising adoption of insulated packaging can boost the insulated packaging market.

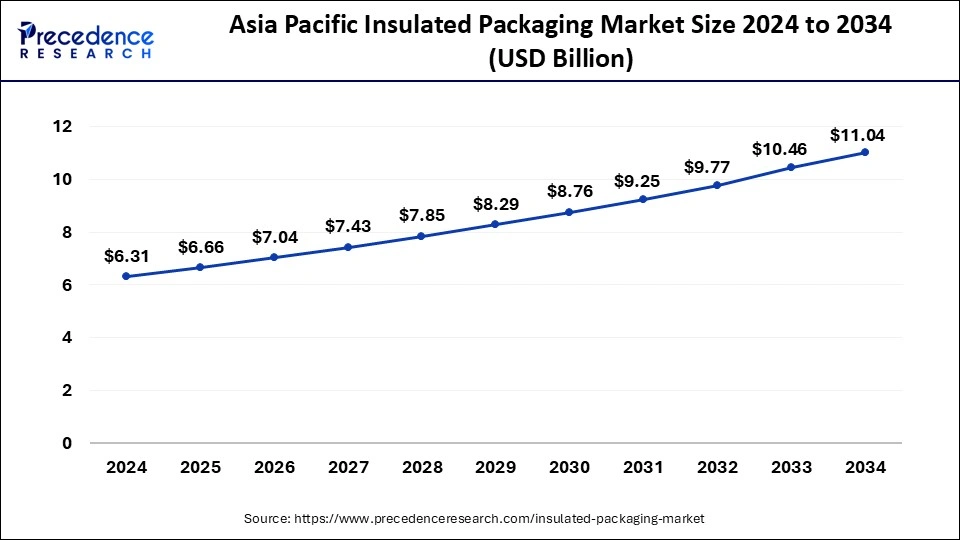

The Asia Pacific insulated packaging market size was exhibited at USD 6.31 billion in 2024 and is projected to be worth around USD 11.04 billion by 2034, growing at a CAGR of 5.75% from 2025 to 2034.

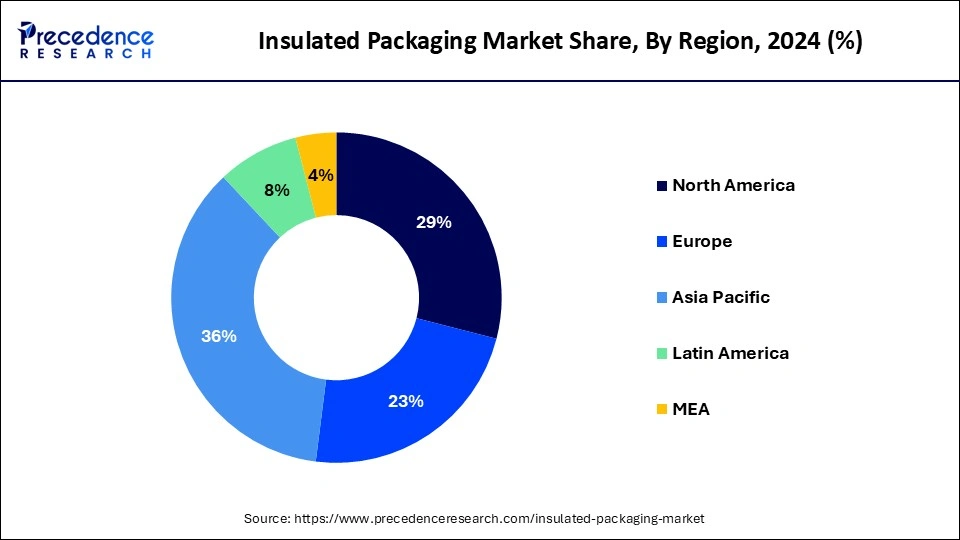

Asia Pacific dominated the insulated packaging market in 2024. The demand for premium food, drinks, and medications is being driven by rising disposable incomes and the expansion of the middle class in nations like China, India, and Southeast Asia. Consumer lives are changing as a result of rapid urbanization, and insulated packaging is becoming more and more necessary for convenience foods, ready-to-eat meals, and home delivery services.

In order to guarantee the safe and timely delivery of perishable items, there is an increasing need for insulated packaging in the area due to the growth of e-commerce and online meal delivery services. The insulated packaging market is becoming more and more necessary as the demand for temperature-controlled convenience foods and ready-to-eat meals rises. China and India are important hubs for the production and export of pharmaceuticals.

North America is expected to grow at the highest CAGR in the insulated packaging market during the forecast period. Insulated packaging is now more important than ever to enable the safe transportation of perishable items in North America due to the increasing growth of e-commerce and online grocery shopping. Reliable, insulated packaging is in high demand to preserve food freshness and safety during transportation due to the growing popularity of food delivery services, which include meal kits and ready-to-eat meals.

The biotechnology and pharmaceutical industries have their main center in North America, primarily in the United States. The requirement to transport biologics, vaccines, and temperature-sensitive pharmaceuticals is what drives the region's strong need for insulated packaging. To preserve the integrity of experimental medications and samples, insulated packaging is required due to the large number of clinical trials and research activities conducted in North America.

The insulated packaging market refers to the industry that helps to preserve a certain temperature range. Insulated packaging shields items from temperature changes during storage and transportation. The food, medicine, and chemical industries, which depend on maintaining consistent temperatures for their goods to maintain quality and safety, are among those that frequently employ it.

The insulated packaging market is fragmented with multiple small-scale and large-scale players, such as Deutsche Post DHL, Sofrigam, Winpak, E.I. Du Pont De Nemours, and Co., Amcor Limited, Sonoco Products Company, Huhtamaki OYJ, Constantia Flexibles, Greiner Group, Innovia Films, DHL, Exeltainer, American Aerogel Corporation, Thermal Packaging Solutions, TemperPack, Insulated Products Corp., Davis Core & Pad Co., Cryopak, DS Smith PLC, Innovative Energy Inc.

| Report Coverage | Details |

| Market Size by 2034 | USD 30.13 Billion |

| Market Size in 2025 | USD 18.51 Billion |

| Market Size in 2024 | USD 17.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.57% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising consumer demand for ready-to-eat packaging food

The rising consumer demand for ready-to-packaging food significantly raises the insulated packaging market. Convenient meal alternatives with less preparation are in greater demand as more customers lead busy lives. The ready-to-eat and ready-to-pack meals are quite popular since they provide a simple and quick solution. The demand for these items is further driven by the increasing concentration of customers who want easy meal alternatives in urban regions. The perishable components, including dairy, meats, and vegetables, are frequently used in ready-to-eat meals. These foods must be properly cooled to retain their freshness and avoid spoiling.

Volatility in the cost of insulated packaging

The volatility in the cost of insulated packaging can slow down the insulated packaging market. The slower rate of market expansion and acceptance may result from the cost of insulated packaging fluctuating, which can pose serious difficulties for producers, retailers, and customers. For the purpose of encouraging innovation, keeping prices competitive, and guaranteeing the continuous usage and advancement of insulated packaging solutions, cost stability is essential.

Smart Packaging

Smart packaging can be an opportunity to boost the insulated packaging market. The dependability and aesthetic appeal of insulated packaging may be enhanced by integrating sensors and Internet of Things technologies to monitor and regulate temperature throughout transit.

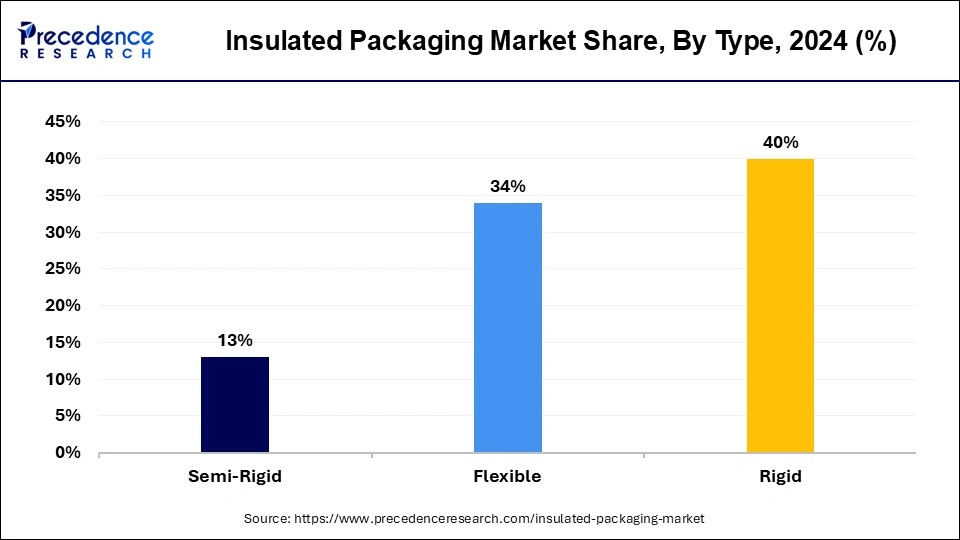

The rigid segment dominated the insulated packaging market in 2024. The expanded polystyrene (EPS) and polyurethane foam containers are examples of rigid insulated packaging that provide excellent protection against physical damage during shipment. Its robustness guarantees that goods stay safe and undamaged. For prolonged periods of time, stable temperatures may be sustained thanks to the outstanding thermal insulation qualities of rigid materials.

For goods that are sensitive to temperature, this is essential. Rigid insulated packaging is a major tool used by the pharmaceutical industry to transport biologics, vaccines, and other temperature-sensitive drugs. The inflexible part guarantees adherence to strict legal specifications in order to preserve product effectiveness. Fresh vegetables, seafood, dairy goods, and meat products are among the many perishable food items that are shipped in rigid, insulated packaging. From the place of origin to the customer, it aids in preserving the freshness and safety of the food.

The flexible segment is expected to grow at the highest CAGR in the insulated packaging market during the forecast period. Due to its superior protection and insulation qualities, extensive use in important industries, the rise of e-commerce and food delivery services, rising consumer expectations for quality & safety, technological advancements, regulatory compliance, and sustainability initiatives, the rigid segment has a significant presence in the market. All of these elements work together to guarantee that rigid insulated packaging will always be the recommended and dependable method of preserving the integrity of temperature-sensitive goods while they are being transported and stored.

The corrugated cardboard segment dominated the market in 2024. Due to its affordability, superior insulating and protective qualities, sustainability, adaptability, alignment with the growth of e-commerce and food delivery, consumer preferences, regulatory compliance, and technological advancements, corrugated cardboard will continue to dominate the insulated packaging market in 2023. All of these elements work together to guarantee that corrugated cardboard will always be a dependable and favored option for a variety of packaging requirements.

The need for dependable and effective packing solutions has grown as e-commerce and food delivery services have grown in popularity. These requirements are satisfied by corrugated cardboard, which provides insulation and protection for a range of goods. In order to preserve product freshness and safety during transit, insulated corrugated cardboard packaging has become increasingly popular due to the success of meal kits and online grocery delivery services. Customers enjoy and find corrugated cardboard packaging to be user-friendly since it is frequently simple to handle, open, and discard. It gives businesses plenty of room for labeling and branding, boosting their appeal to customers and brand visibility.

The plastic segment is expected to grow at the highest CAGR in the market during the forecast period. The plastic segment of the insulated packaging market is expected to grow at a high rate due to its many uses, superior insulating qualities, durability, compatibility with the expanding e-commerce and food delivery industries, technological advancements, affordability, sustainability initiatives, regulatory compliance, and consumer preferences.

Due to these advantages, plastic insulated packaging is becoming a more sensible, dependable, and well-liked option for a variety of uses, which will fuel its explosive market expansion throughout the course of the projection period. Due to their relatively low production costs, plastic packaging materials are a desirable choice for companies trying to control their package costs. Plastic packaging may be produced on a big scale, which lowers prices and allows for broad use.

In response to environmental concerns and in line with sustainability trends, recyclable and biodegradable plastic materials are being developed, drawing in eco-aware customers and enterprises. Plastic-insulated packaging is becoming less harmful to the environment because of advances in waste management and plastic recycling.

The food & beverages segment dominated the insulated packaging market in 2024. Fresh, perishable foods, including dairy, meat, seafood, fruits, and vegetables, are becoming more and more popular among consumers. From the point of manufacturing to the point of consumption, insulated packaging is crucial for preserving the freshness and quality of these items. Effective insulated packaging is becoming more and more necessary due to the increased demand for convenience and ready-to-eat meals, which frequently need to be kept at a precise temperature to ensure both safety and flavor. In order to guarantee that food products stay safe and fresh throughout transit, insulated packaging is essential, given the explosive rise of meal kit subscription services and online food delivery services. The insulated packaging is crucial for e-commerce companies that specialize in food delivery, particularly for perishable and frozen products, as it preserves product integrity during last-mile delivery.

The pharmaceutical segment is expected to grow at the highest CAGR in the insulated packaging market during the forecast period. Because biologics and biosimilars are extremely sensitive to temperature changes, their increasing use calls for dependable insulated packaging in order to preserve both their safety and effectiveness. Insulated packaging is in high demand due to the distribution of vaccines and specialized medications, particularly those that need to be shipped via cold chain logistics.

The international distribution of COVID-19 vaccines has brought attention to the urgent need for efficient insulated packaging options, as many of these vaccines need tight cold chain conditions. The significant need for insulated packaging is sustained by ongoing vaccination campaigns, which include booster doses and the development of new vaccines. Pharmaceuticals have to abide by strict regulations in order to guarantee the efficacy and safety of their products. To achieve these criteria, insulated packaging is crucial, especially for items that need to be transported and stored within certain temperature ranges.

By Type

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025