December 2024

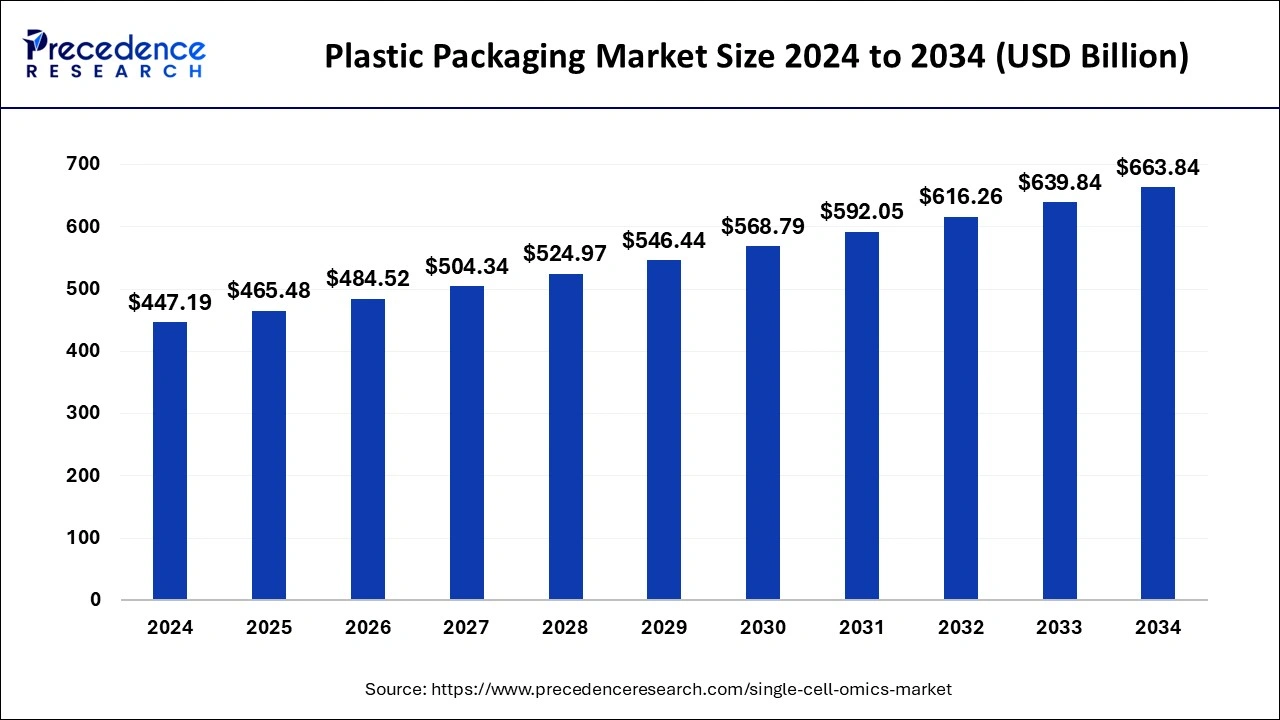

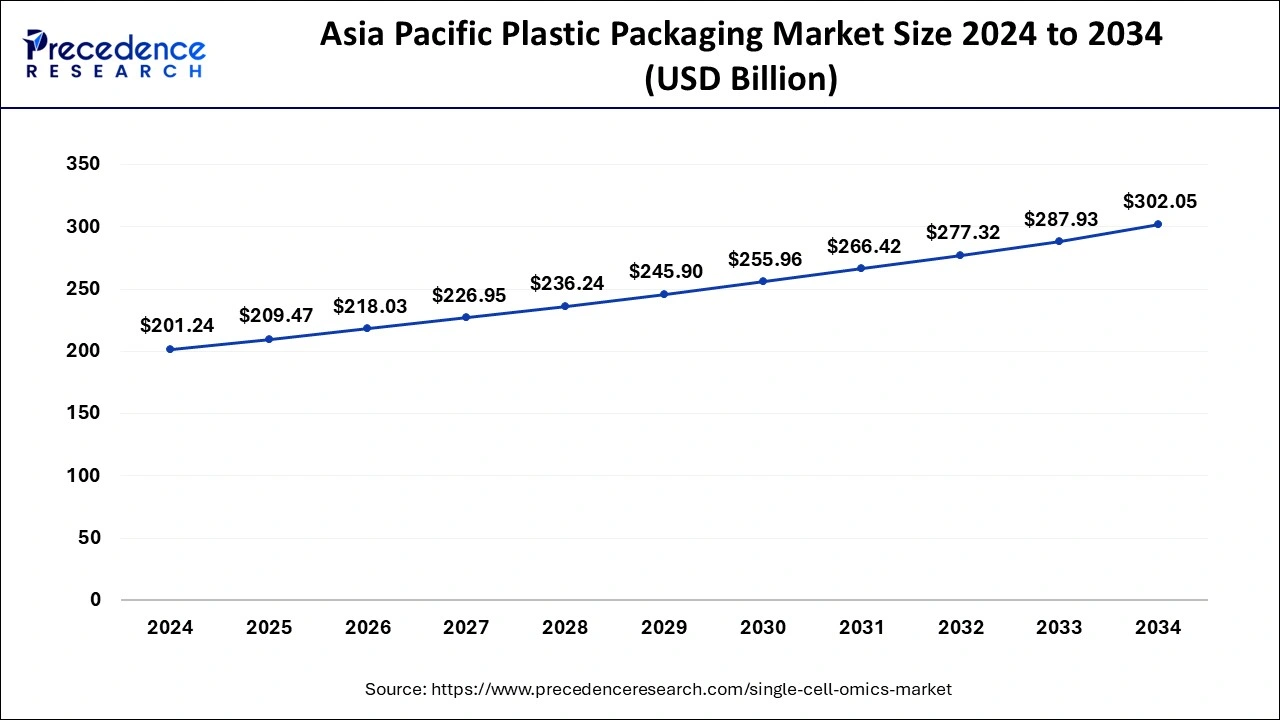

The global plastic packaging market size is calculated at USD 465.48 billion in 2025 and is forecasted to reach around USD 663.84 billion by 2034, accelerating at a CAGR of 4.03% from 2025 to 2034. The Asia Pacific plastic packaging market size surpassed USD 209.47 billion in 2025 and is expanding at a CAGR of 4.14% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global plastic packaging market size reached USD 447.19 billion in 2024 and is projected to hit around USD 663.84 billion by 2034, growing at a CAGR of 4.03% from 2025 to 2034.

The Asia Pacific plastic packaging market size was estimated at USD 201.24 billion in 2024 and is projected to surpass around USD 302.05 billion by 2034 at a CAGR of 4.14% from 2025 to 2034.

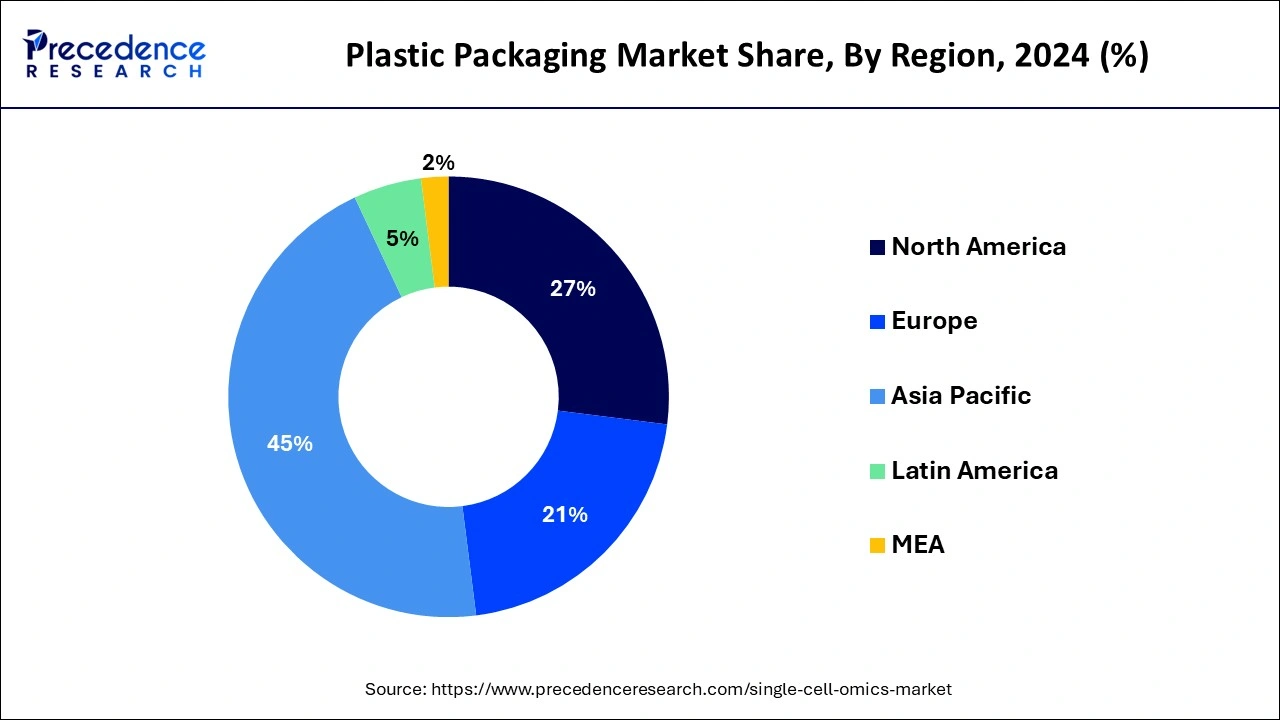

Geographically, Asia Pacific is anticipated to contribute a significant portion of the world market for plastic packaging. This region now leads the global market due to high packaged food consumption and rising consumerism. The rising expansion of end-users including personal care, consumer electronics and pharmaceuticals is observed to boost the market’s growth in Asia Pacific during the forecast period. Asia Pacific accounts for the most significant percentage of sales in the target market, followed by Europe, North America, the Middle East, Latin America, and Africa.

On the other hand, Europe is expected to be the most attractive marketplace for plastic packaging solutions. The rising demand for sustainable plastic packaging solutions for the pharmaceutical industry is observed to be the major driver for the market’s growth in the region. Additionally, the presence of advanced technologies for packaging solutions is intended to supplement the market’s growth.

Plastic packaging has become a crucial component of many businesses due to its innovative design, which helps in offering creative packaging solutions. Protective packaging made of plastic is used for delicate goods that are difficult to transport, and plastic products are renowned0 for being affordable and high-quality. Plastic packaging is used to protect goods during distribution, transit, and storage. Additionally, it increases shelf life by protecting products from damage, deterioration, and contamination. It serves as a way to handle brand identity and variation and inform customers about the product.

Plastic packaging is widely accepted and permitted for use in the packaging of consumer goods, including everything from food items and electronics to large business machinery and equipment. Many businesses use it as an affordable and reliable method of packaging. The plastic packaging industry has matured with the development of technology and increased environmental awareness. The market for plastic packaging is expanding globally, with mature markets offering a modest rate of growth while the newest emerging markets are creating the most recent opportunities for potential expansion rates.

Plastics are organic materials with a noticeable molecular weight composed of various synthetic organic elements and malleable enough to take on a variety of shapes. Products made of plastic often include altered versions of materials like glass, paper, metal, and wood. Packaging is a technique to enclose and safeguard various goods for use, sale, distribution, and storage. Plastic offers good performance and is typically more affordable. Plastic is a recyclable material that benefits the environment by reducing waste and utilizing less energy.

The plastic packaging market is driven by the growth in manufacturing procedures across various industries, such as food and beverage, pharmaceuticals, chemicals, and construction, among others. The expansion of end-users for packaging solutions, for example, the demand for plastic packaging in the pet-care industry, is supplementing the market’s growth. There is a growing demand for sustainable packaging solutions that are eco-friendly, recyclable, and reusable. This has led to the development of new materials and packaging solutions that meet these requirements; the rising requirements for sustainable solutions in the packaging market have forced the market players to focus on the development of sustainable packaging solutions.

In addition, the growth of the plastic packaging market is attributed to the rising focus on developing recycled plastic packaging in several industries, along with strengthening government regulations for maximizing the production and utilization of recycled plastic material. To fulfill the rising consumer demand for recycled plastic, multiple market players are focused on the development of recycled plastic packaging solutions to reduce carbon emissions.

For instance, in February 2023, Ecolab and TotalEnergies announced a strategic partnership in order to develop and launch recyclable plastic packaging material for heavy-use purposes. The strategic partnership aims to produce post-consumer recycled (PCR) plastic for concentrated cleaning products in primary packaging. Under the strategic partnership, both companies have focused on offering sustainable packaging solutions.

The rise of food delivery services, increasing demand for packaged food products, and booming e-commerce businesses across the world are a few other factors to support the growth of the global plastic packaging market. Moreover, technological advancements have led to the development of new packaging materials, such as biodegradable and compostable materials, which are environmentally friendly and have better properties than traditional packaging materials. Technological innovations are observed to supplement the growth of the plastic packaging market.

| Report Coverage | Details |

| Market Size in 2025 | USD 465.48 Billion |

| Market Size by 2034 | USD 663.84 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.03% |

| Largest Market | Asia Pacific |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Benefits of plastic packaging

Busy lifestyles have increased the high demand for practical products, which has increased the need for flexible packaging. Flexible plastic packaging is more affordable than other types of packaging due to it requires less energy and resources than rigid plastic packaging. Flexible packages are also less expensive and require 35% less shelf space on retail shelves. In addition to increasing shelf life, plastic packaging lessens product waste. Bananas, for instance, develop more gradually when wrapped in flexible plastic packaging, extending shelf life. Utilizing the least amount of packaging possible, this type of packing may improve or preserve product protection while lessening the expenses of warehousing and transportation.

Additionally, the market for plastic packaging will experience increased growth due to factors like plastic's affordable price and excellent printability. Other factors anticipated to contribute to the market's expansion include the high consumer income and the acceleration of e-commerce activities, particularly in developing nations.

Availability of sustainable packaging alternatives in the market

The availability of sustainable packaging alternatives such as metal, glass, bioplastics, and paper are observed to restrain the growth of the plastic packaging market. The mentioned alternatives are becoming more widely available with the rising consumer preferences for sustainable packaging options. The packaging industry is witnessing a growing market preference for sustainable materials; this restrains the growth of the plastic packaging market. Additionally, multiple businesses and industries are recognizing the importance of sustainability in their branding and marketing efforts to boost their brand reputation; this is observed to hamper the growth of the plastic packaging market. However, adapting to changing market requirements by market players involved in the plastic packaging market is intended to overcome this restraint.

Development of innovative plastic packaging solutions

Due to the industry's dynamic changes, including the implementation of novel regulatory initiatives, companies have been compelled to develop new packaging solutions. In response to increasing environmental issues regarding the utilization of biodegradable polymers for flexible packaging, manufacturers have developed secure and safe, sustainable packaging options. To relieve cost pressure while sustaining product packaging integrity, companies are looking toward environmentally friendly solutions that consume less energy and resources during production, cost less to transport, and give products a longer shelf life.

Due to strict regulations from the government, shifting consumer preferences, and environmental pressures, companies are reorienting their business practices toward circularity and using novel plastic technologies to create sustainable and recyclable products that have specific properties like oxygen, light, moisture, puncture, and chemical resistance, along with easy-tear propagation. While the creation of replacement bioplastics like bio polybutylene and polypropylene succinate and their cost and disposal, which must be researched to ensure effective use, are essential focus areas for manufacturers.

Due to their high aesthetic appeal and durability, the rigid segment, which comprised most of the plastic packaging market, held the highest revenue share at over 61.0%. In addition, rigid packaging's high barrier to oxygen, light, moisture, and other factors played a role in the segment's higher share. The reusability of rigid packaging products like pallets, intermediate bulk containers, and other industrial packaging products favors the increasing popularity of rigid plastic products.

The rigid plastic segment is divided into various types of bottles and jars, trays and containers, cans, closures, etc. Due to their low cost, convenience, and superior performance, plastic bottles are globally used in the packaging of beverages. Because of their lighter weight and aesthetics, containers and trays are used in the packaged food and food service industries. Wraps, bags, pouches, films, and others comprise the fourth sub-segment of the flexible packaging type. Pouches are becoming increasingly popular because they require less plastic to manufacture than rigid products like jars and bottles.

Extrusion technology accounted for the largest revenue share, accounting for over 38.0%. It produces the most flexible packaging products, such as pouches, bags, and films. In the upcoming years, the requirement for the extrusion segment is anticipated to expand due to the increasing popularity of flexible packaging products due to their higher sustainability and lower cost than their rigid counterparts.

But over the forecast period, the segment's growth will likely be constrained by the longer lead times and higher tooling costs associated with injection molding technology. Popular plastic molding technique known as blow molding produces hollow objects like drums, liquid containers, bottles, and storage tanks. The three main categories of blow molding technology are injection, extrusion, and injection stretch. Extrusion blow molding is the most popular method and is mainly used to produce complex product shapes like bottles or containers.

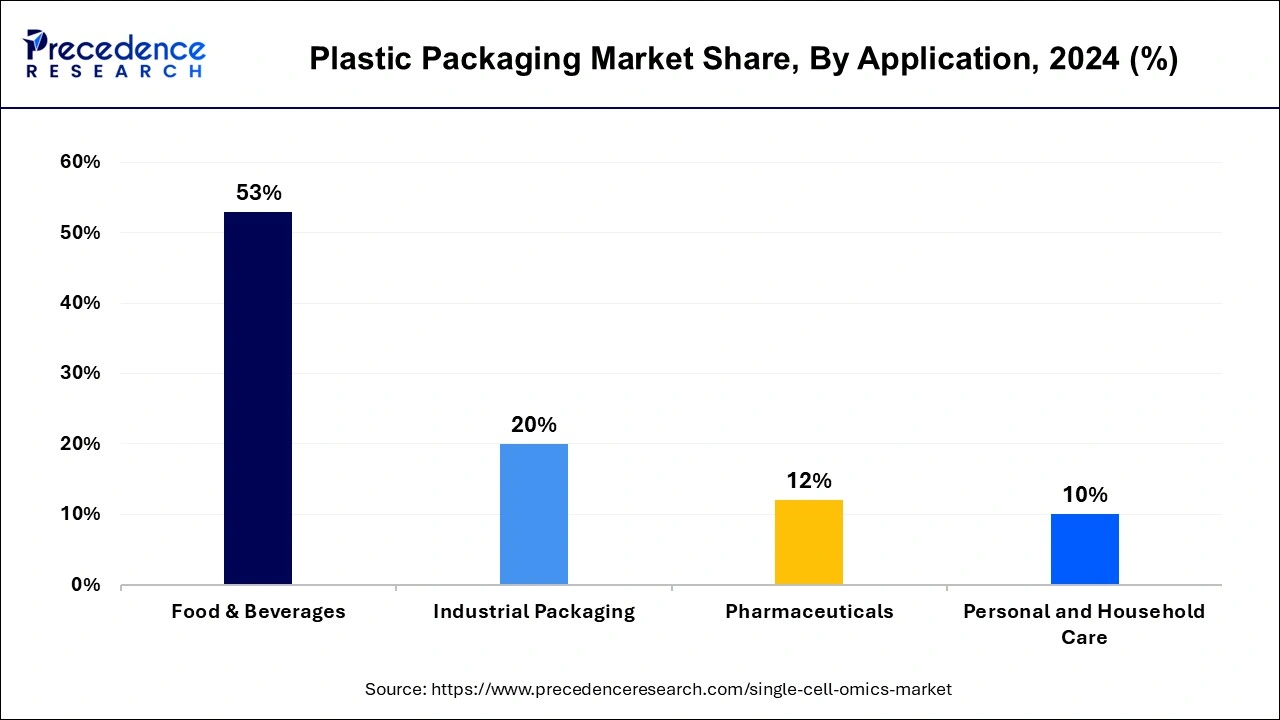

The food and beverage application segment held most of the market's revenue of 53%. Throughout the forecast period, the segment is anticipated to experience significant growth. The packaging and processed food manufacturing industries have expanded due to shifting consumer lifestyles and food preferences, which is likely to increase the popularity of plastic packaging. Additionally, rising non-alcoholic and alcoholic beverage consumption, particularly among young people, is anticipated to support industry expansion.

Due to its benefits, single-serve consumer packaging has expanded significantly over the last few years. Rising consumer focus on health and well-being, increased knowledge of waterborne diseases, and increasing purchasing power have fueled the demand for packaged drinking water worldwide, which is anticipated to benefit them.

The aging population in Europe and North America and favorable demographic trends are predicted to increase demand for pharmaceutical products, which is predicted to be advantageous for the market. Additionally, increasing generic drug production is anticipated to boost plastic packaging demand in the pharmaceutical application sector.

By Product

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

May 2025

March 2025

January 2025