August 2024

The global integrated facility management market size is calculated at USD 175.84 billion in 2025 and is forecasted to reach around USD 345.70 billion by 2034, accelerating at a CAGR of 7.10% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global integrated facility management market size was estimated at USD 163.12 billion in 2024 and is predicted to increase from USD 175.84 billion in 2025 to approximately USD 345.70 billion by 2034, expanding at a CAGR of 7.10% from 2025 to 2034. The demand for integrated facility management is driven by cost-effectiveness, which helps companies manage their expenditures.

The emergence of technologies like artificial intelligence and machine learning (ML) plays an influential role in enhancing the services within organizations. The use of AI is being widely adopted to optimize energy consumption where the monitors adjust the requirement and manage the power usage. Additionally, the rising changes in the infrastructure use AI tools for designing the workspace efficiently.

The rising demand for predictive maintenance to avoid any last-moment failures is anticipated to boost the growth of the integrated facility management market. The rise of AI-powered chatbots is also increasing, where they help in handling multiple tasks like maintenance tickets, resource bookings, and many others.

Integrated facility management (IFM) refers to a centralized approach that manages all the services, systems, and processes within a single provider. The main motive behind IFM is to adopt quality services that can manage all the tasks and eliminate redundancies. The integrated facility management market is growing rapidly as companies are rapidly adopting technologies that can manage the workflow efficiently. Some of the IFM services include security, maintenance, cleaning, waste management, and other workplace management. Multiple industries are using facility management, which is making it more popular among various businesses.

| Report Coverage | Details |

| Market Size by 2034 | USD 345.70 Billion |

| Market Size in 2025 | USD 175.84 Billion |

| Market Size in 2024 | USD 163.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of Commercial Infrastructure

Rapid urbanization has been playing a key role, which is leading to an increasing number of office spaces, shopping malls, hospitals, restaurants, and many more. These settings usually require management facilities where they can handle multiple functions and tasks easily.

The integrated facility management market is playing a key role in providing these services which helps the companies and businesses to provide high-end facilities to consumers. Additionally, the growing tourism industry in the developing regions is anticipated to create more advancements, which would help in catering to the demand for SMEs. The rising number of professional parks for IT, business, and entertainment will boost the demand for IFMs further.

Growth of outsourcing trend

Large-scale businesses are majorly focusing on managing the core operations where they adopt companies who offer facility management services which helps them to focus on their tasks efficiently. The integrated facility management market is witnessing significant growth where these providers are offering multiple services and reducing the expenses of the other companies. Additionally, the growth of companies in the developing regions is creating several business opportunities for the IFM companies. Additionally, these companies have access to the technologies and skilled professionals which helps them in managing the tasks easily. The growth in the healthcare industry is attracting the majority of the demand for FMs.

Higher initial investments

Rapid digitalization has led to the use of advanced technologies in various industries to manage their non-core operations. The higher capital requirement makes it financially unaffordable for the companies, which can restrain the growth of the integrated facility management market in small-scale companies. Additionally, many old companies still rely on manual processes, which also stand as a barrier that can restrict growth. For many companies, the ROI can be longer due to constant investments like employee training, which could act as a financial barrier for them.

Investments in smart city initiatives

Governments are increasing their focus on building smart cities that enable automated public facilities, smart grids, and many more. For instance, the Indian government announced a budget of 2400 crore rupees for smart city missions in 2024-25. These initiatives are grabbing significant investments for urban development, which would also create business opportunities for other private companies. The integrated facility management market is growing rapidly, and the IFM providers are being given preference for urban security, which will mark more growth in the upcoming years. The rising investments are anticipated to create more opportunities for technological adoption in the future.

Growth of sustainable and green buildings

The rising trend towards sustainable adoption has been leading to significant changes across multiple industries. Governments and organizations like WHO are promoting sustainability which is leading towards the adoption of green buildings which adopt solutions that help in reducing carbon footprints. The rising adoption of green certifications like LEED and BREEAM are also promoting the growth of the integrated facility management market where these providers are helping the business to adopt these certifications.

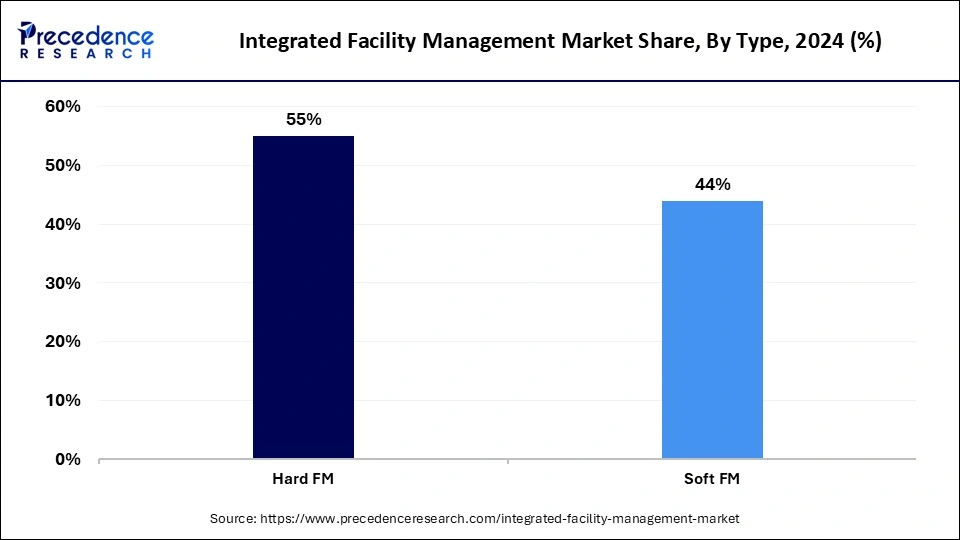

The hard FM segment generated the highest market share in 2024. The segment deals with physical and asset-based services of the buildings which are mandatory for the maintenance and safety of the buildings. The reason behind the dominance of the segment is the rising safety requirement of the buildings, which require alarm systems, fire and electrical safety, and many more. Power consumption is a basic need within the organizations which makes it demanding for its safety in the organization, boosting the growth of integrated facility management. Large-scale companies are making huge investments which helps them in managing their operations efficiently. The rapid growth of healthcare and IT companies is anticipated to boost the demand for IFM providers in the coming years.

The soft FM segment is anticipated to grow rapidly during the forecast period of 2025 to 2034. The segment deals with non-tech services like sanitation, catering, waste management, and others. The integrated facility management market is anticipated to rise efficiently when the safety standards are being adopted which ensure the safety of employees. Additionally, the rising infectious disease prevalence is anticipated to grab more investments where the offices and hospitals maintain their workplace environments. The tech companies are also investing in these services which helps in enhancing the workplace environment as well as enhance their brand image.

The commercial segment stood the dominant as it generated the largest market share in 2024. The segment deals with the management services for offices, hospitals, hotels, and educational institutions. The dominance of the segment is attributed to the higher security demand in these settings, which leads to the adoption of these services. The corporate sector is witnessing significant investments to improve their energy management through these services. The rise of technology is helping these companies manage their operations cost-effectively. The rapid expansion of educational institutions, hotels, and shopping malls is anticipated to create more business opportunities in developing economies like India, UAE, and others.

The industrial segment is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. The segment manages the services for manufacturing plants, logistic centers, energy facilities, and warehouses. The integrated facility management market is anticipated to grow more rapidly in the coming years due to the rising automation in industries, which can improve operational efficiency. Safety is being given priority due to the sensitive environments like oil and gas refineries. Additionally, the rise of the e-commerce industry is anticipated to play a crucial role in the coming years as it is anticipated to attract significant investments in logistic centers and warehouses.

North America dominated the global integrated facility management market by generating the largest revenue share in 2024. The growth of the region is attributed to the massive demand for services in countries like Canada and the U.S. The majority of real estate and healthcare companies are investing heavily in these services, which has boosted the demand for IFM providers. These governments are also initiating safety through regulations in the corporate sector, which is anticipated to boost the market demand in the coming years, too. The dominance of technological infrastructure in the United States will boost the adoption of technologies like AI in these services.

Asia Pacific is anticipated to grow at the highest CAGR during the forecast period of 2025 to 2034. The growth of the region is attributed to the rapid industrialization in countries like India and China which are leading towards the expansion of IFM services in these settings. Additionally, rapid urbanization also stands out to be a crucial factor that will create demand for IFM services like smart cities, e-commerce, and corporate offices. The integrated facility management market is anticipated to grow more rapidly, and countries like Japan, China, and India are adopting outsourcing in their healthcare and IT sectors. These countries are also investing in green building through the adoption of technologies like AI and ML.

By Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

December 2024

March 2025