February 2025

The global interdental cleaning products market size is accounted at USD 1.38 billion in 2025 and is forecasted to hit around USD 2.41 billion by 2034, representing a CAGR of 6.38% from 2025 to 2034. The North America market size was estimated at USD 442.00 million in 2024 and is expanding at a CAGR of 6.49% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global interdental cleaning products market size accounted for USD 1.30 billion in 2024 and is predicted to increase from USD 1.38 billion in 2025 to approximately USD 2.41 billion by 2034, expanding at a CAGR of 6.38% from 2025 to 2034. market is growing due to rising oral hygiene awareness. Key products include floss, interdental brushes, and water flossers. Innovations and eco-friendly options drive market expansion globally.

The introduction of Artificial Intelligence (AI) in oral care is changing interdental cleaning from an activity that we manually perform to a healthcare practice that is driven by precision. Smart toothbrushes and interdental devices are equipped with sensors that can measure pressure during brushing or flossing, deliver real-time feedback, and provide analytical tools via app integration to apply a gamified experience to brushing time and technique. Providing technologies for oral health are especially beneficial for children, the elderly, and persons with disabilities or limited manual dexterity.

These technologies not only assist patients in tracking time and technique but can also identify missed areas between the teeth to remove plaque. Other products are micro-robots that can be targeted to autonomously kill biofilm. For patients with poor compliance or oral hygiene, dental providers are increasingly recommending devices that integrate AI mechanisms to improve compliance with changing behavior for the sake of disease reduction. Both the individual patient and the provider can rely on the data provided by the smart brush to improve individualized treatment plans. As AI improves performance, precision, and engagement, the future of interdental cleaning is going to be smarter and more preventative.

The U.S. interdental cleaning products market size was exhibited at USD 331.5 billion in 2024 and is projected to be worth around USD 623.59 billion by 2034, growing at a CAGR of 6.52% from 2025 to 2034.

North America Leads the Charge in Interdental Cleaning Innovation and Sustainability

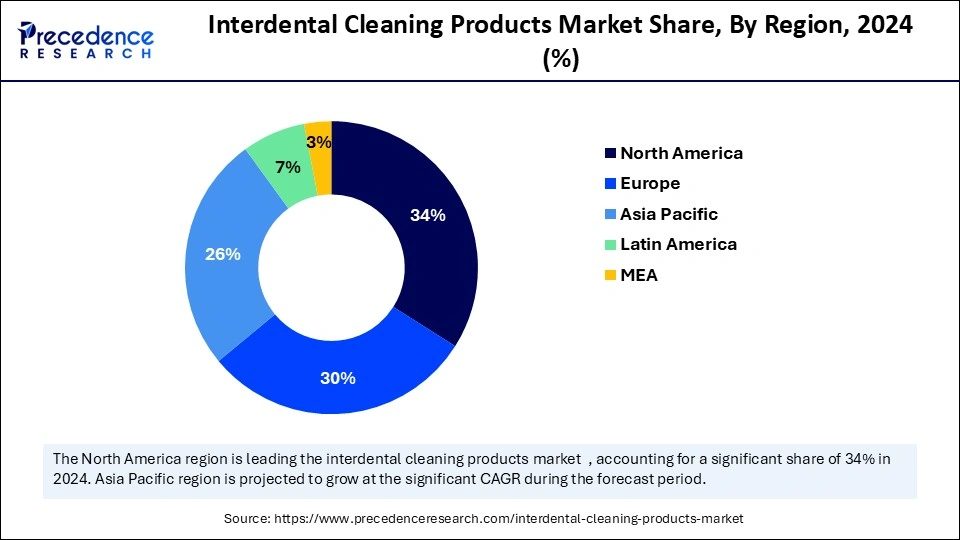

North America is the leading region for the interdental cleaning products market due to factors such as high consumer awareness levels, well-developed dental care infrastructure, and an emphasis on preventive care. According to the Centers for Disease Control and Prevention (CDC), only 30% of individuals in the U.S. floss on a daily basis, suggesting the opportunity for alternative interdental cleaning devices. Additionally, due to the expansion of online retailing in the region, interdental brush sales from online channels account for more than 40% of total sales in the region, increasing accessibility to these products. The market is also seeing a transition to sustainability, driven by the introduction of biodegradable interdental brushes made of bamboo and cornstarch. These factors—along with the continued rise in periodontal disease prevalence—are driving growth in the market.

The United States holds the frontline in the interdental cleaning products market fueled by increased awareness of oral care and advancements in dental innovations. The American Dental Association states that 91% of U.S. adults aged 20–64 have experienced caries, and more than 47% of adults over 30 years have a form of periodontal disease, demonstrating the need for efficient interdental cleaning. The market is diversifying with AI-supported interdental brushes, Bluetooth connectivity, and real-time feedback from Philips and Oral-B. The movement toward eco-friendly products continues to grow, along with a consumer preference for biodegradable brushes manufactured with sustainable resources.

Asia Pacific is the fastest-growing market for interdental cleaning products due to growing awareness of oral hygiene and preventive care. The demand for interdental brushes, dental floss, and toothpicks is on the rise as consumers are looking for more innovative and effective interdental cleaning products. Eco-friendly and sustainable products are also gaining ground as the world becomes more environmentally conscious. Furthermore, online retail outlets are playing a key role in expediting market growth by making these products more accessible. Lastly, countries like Japan, India, and Australia have enacted awareness initiatives, typically led by government and dental associations, which have negatively influenced the adoption of interdental cleaning products.

The interdental cleaning products market in China is expanding due to a growing awareness of oral care, as well as rising demand for premium products such as smart toothbrushes and electric flossers. The preference for natural and herbal products that consumers are increasingly adopting aligns with a health-consciousness trend among consumers. The expansion of online retailers has made oral products even more accessible. In addition, the Healthy China 2030 Plan focuses on raising awareness of oral health and aims to reduce the incidence of dental caries in children to 25% per city by 2030, increasing the demand for interdental products. Additionally, government initiatives and consumer discretionary income will contribute to market expansion, solidifying the importance of China as a competitive player in the oral category.

Rising Consumer Awareness Fuels Europe's Interdental Cleaning Products Market

Europe holds a crucial position in the global market due to increasing consumer awareness around oral hygiene and preventive dental care overall. This focus on dental health has increased interest in products like interdental brushes, dental floss, and dental tapes. The 41-65 age demographic is particularly relevant to this market, highlighting the role of preventive dental care in middle age. The availability of products for sale online has also increased, serving the growing demand for convenience in shopping.

Germany is the leading European country in the interdental cleaning products market, where consumers obviously prefer to buy high-quality and innovative tools. The presence of the country's well-developed health care system and attention to preventive oral hygiene has led to the introduction of some innovative products, such as interdental brushes with an antibacterial bristle and ergonomic design. Other campaigns, initiated as a partnership between dental associations and educational institutions, have raised awareness and educated the public about needed dental hygiene even more, adding to market growth and preceding consumer trust in preventative oral care. These campaigns have likely created a greater overall consumer willingness to use interdental cleaning products in Germany, becoming standard in everyday hygiene and dental routines.

Interdental cleaning products are unique oral care products made to get rid of debris and plaque between teeth that regular toothbrushes often miss. This product category includes dental floss, interdental brushes, soft picks, and water flossers, designed to address the needs of different consumers in terms of dexterity, gum sensitivities, and dental anatomy. The market for interdental cleaning products is becoming more sophisticated as it shifts away from floss as the typical option and toward ergonomic, efficient, and tech-enabled cleaning options.

The competitive landscape of cleaning between teeth products and devices is shifting from traditional price competition toward differentiation based on design and innovation, sustainability of composition material, and clinical efficacy. While consumer education still presents as a barrier to entry, word-of-mouth from dental professionals is the most credible endorsement for consumers. Market participants are also utilizing direct-to-consumer (DTC) models and subscription services to build brand loyalty and recurring revenue. With overall oral heath being considered a part of overall health, the interdental cleaning products market is poised for moderate growth overall, and stronger growth in the premium and specialty market keeps adult consumers inclined to try something new or different.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.41 Billion |

| Market Size by 2025 | USD 1.38 Billion |

| Market Size by 2024 | USD 1.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.38% |

| Dominated Region | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising dental disorders

The growing focus on oral hygiene is a major driver of the interdental cleaning products market. Consumer awareness of the importance of dental health, supported by educational campaigns, increasing exposure to digital media, and government initiatives, has increased the number of consumers using interdental brushes, floss, and other adjuncts daily. Influencing this behavior globally is the work of organizations such as the World Health Organization (WHO) and the American Dental Association (ADA), which consistently advocate for preventive care of the oral cavity.

In addition, to educate the population on good dental hygiene, several governments have introduced awareness programs. For instance, India has launched its National Oral Health Programme (NOHP) and, in the UK, "Smile4Life". Additionally, the increase in the incidence of dental disorders leads to further demand for products. According to the WHO, approximately 3.5 billion people have oral disorders, with 2.3 billion suffering from decayed teeth in their permanent dentition. With increasing awareness, increases in orthodontic treatment, and novel product development anticipated, the interdental cleaning product market will continue to grow.

Low awareness and adoption

One of the main factors limiting the growth of the interdental cleaning products market is low consumer awareness and variation in adoption. Even with rising awareness for oral health, many people still believe that brushing alone is enough and do not value interdental cleaning as part of their oral cleaning routine, leading to slow adoption of floss, interdental brushes, and water flossers. This is compounded by a perception of discomfort and inconvenience, as well as price, when it comes to dedicated oral cleaning products. Premium advanced pricing of products has been a market challenge for price-sensitive environments, limiting accessibility to those with purchasing power.

Furthermore, gum bleeding and discomfort may be an initial consideration for many but are also barriers to continued regular use of interdental cleaning products. Whilst dental professionals continue to encourage and advocate for daily interdental cleaning, there remains a gap between evidence-based recommendation and varying consumer adoption. Closing these gaps with education, affordability, and user-friendly innovation will be pivotal in driving continued market growth.

Innovation in handheld oral healthcare devices

The interdental cleaning products market is poised for considerable growth opportunities through the increasing use of handheld oral healthcare devices, particularly in the case of electric flossers. Handheld devices offer improved efficiency in plaque removal and gum health compared to traditional flossing. Innovations, including customization based on AI, pressure sensors, and app connections, are changing oral care by providing individualized cleaning experiences.

The growing consumer trend toward convenience and effective oral hygiene is resulting in an uptick in demand for electric flossers. Along with a growing understanding of the need for interdental cleaning and technological advancements, there is more growth potential in the sector. Manufacturers focused on producing innovative, user-friendly, and clever interdental cleaning solutions have an opportunity to take advantage of this trend, resulting in market penetration and extended growth.

The toothpicks segment held the largest interdental cleaning products market share in 2024 due to their availability, low price point, and singular mechanism of use. Toothpicks are very popular among a variety of demographic groups as a quick and convenient way to remove food from teeth. Dental evidence demonstrates that toothpicks do an adequate job removing food particles, but they are typically not as effective in plaque removal compared to higher-end interdental cleaning products and tools. Despite this, toothpicks continue to be a preferred product for millions of consumers. Biodegradable and eco-friendly toothpicks are gaining some attention and further cementing their top spot in the market. Consumer dependence on this simple but effective product continues to solidify the position of the toothpick as a valuable interdental cleaning solution.

The interdental brushes segment is anticipated to grow at a remarkable CAGR between 2025 and 2034, primarily attributable to awareness around gum health and the need to remove plaque effectively. Dentists highly endorse brushes, especially for patients with braces, dental implants, and gum disease. The demand for them had grown significantly, given the prevalence of periodontal disease and a shift toward more effective oral care products. Additionally, innovation in brush design, including comfortable ergonomic handles and antibacterial bristles, has added to the usability and further increased demand. As more patients prioritize preventive dental care in their oral hygiene regimen, the market for interdental brushes is likely to continue growing.

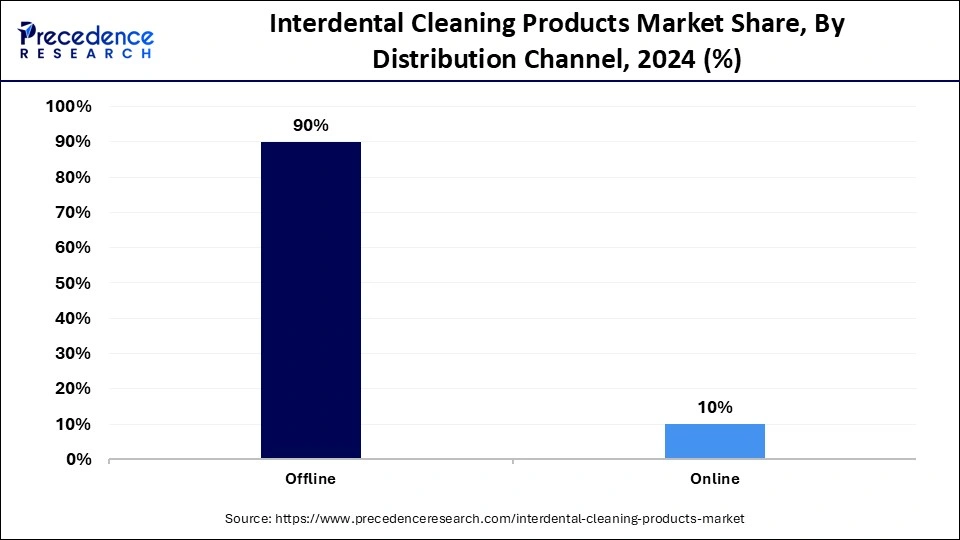

The offline segment captured the biggest interdental cleaning products market share in 2024 with over 70% of oral care product purchases being made through physical stores. Pharmacies, supermarkets, and dental clinics play an important role in consumer buying behavior, with professional recommendations and in-store offers significantly driving sales. Research suggests that approximately 65% of consumers prefer purchasing oral care products in physical retail environments due to factors such as trust in the store to provide quality products, products being available for purchase immediately, and the ability to compare products in the store. The continued presence of dental professionals, coupled with in-store discussions, also help stores remain the primary purchase channel despite the advancements in digital.

The online segment is expected to expand at a notable CAGR over the projected period, supported by internet penetration and changing consumer purchasing habits. Online sales of oral care products have grown over 40% in the past five years, led by e-commerce companies like Amazon, Walgreens, and specialized websites focused on oral care. Subscription models for interdental brushes and flossers are also on the rise, thanks to convenience and cost savings. Moreover, digital marketing and endorsements from online personalities have increased online sales along with consumer habits, which data suggests that over 60% of consumers research oral care products online prior to purchase. The growth of direct-to-consumer (DTC) brands and same-day deliveries is supporting this growth such that online retail is expected to be the most significant growth driver of future consumer health market expansion.

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

September 2024

January 2025