November 2024

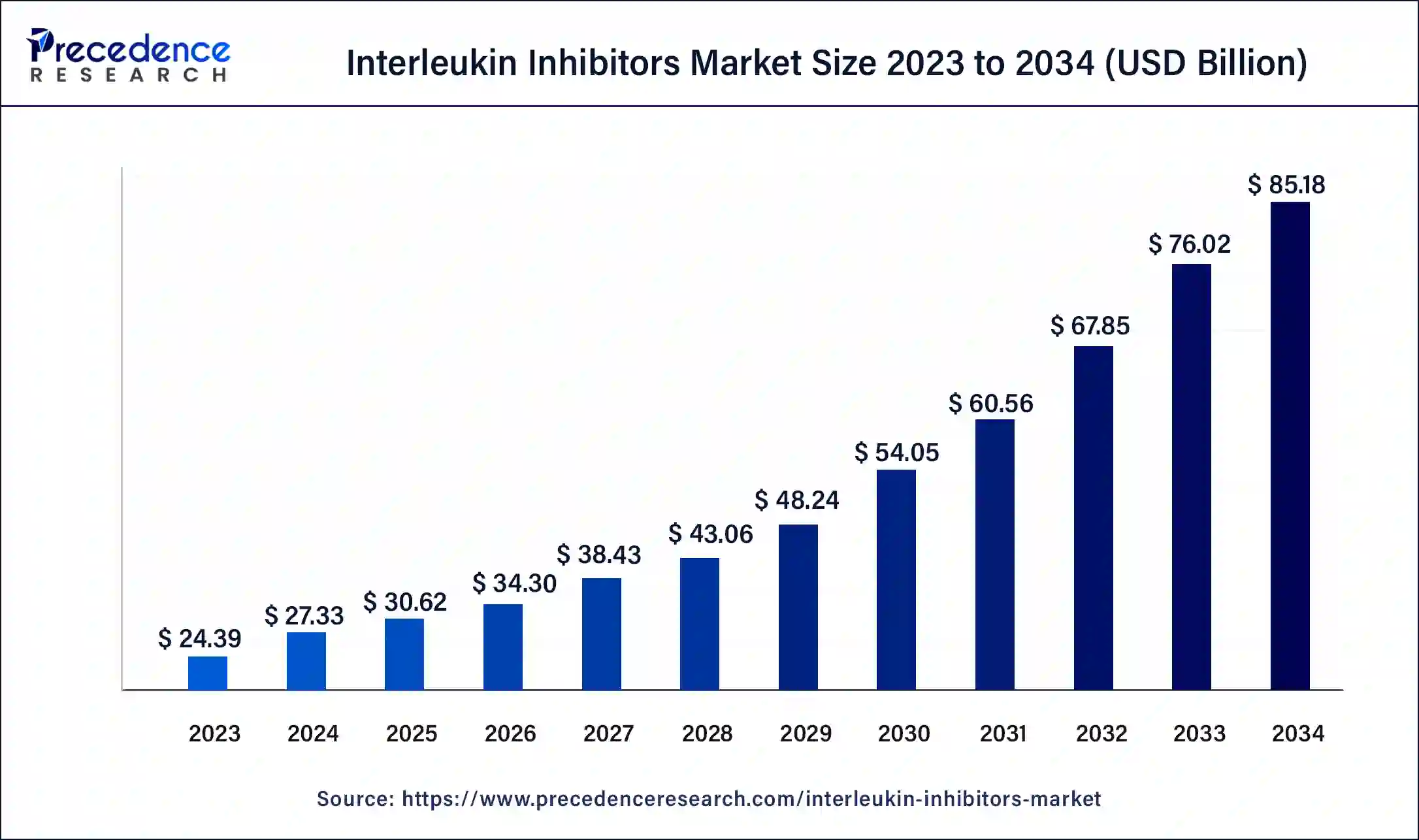

The global interleukin inhibitors market size was USD 24.39 billion in 2023, calculated at USD 27.33 billion in 2024 and is expected to be worth around USD 85.18 billion by 2034. The market is slated to expand at 12.04% CAGR between 2024 and 2034.

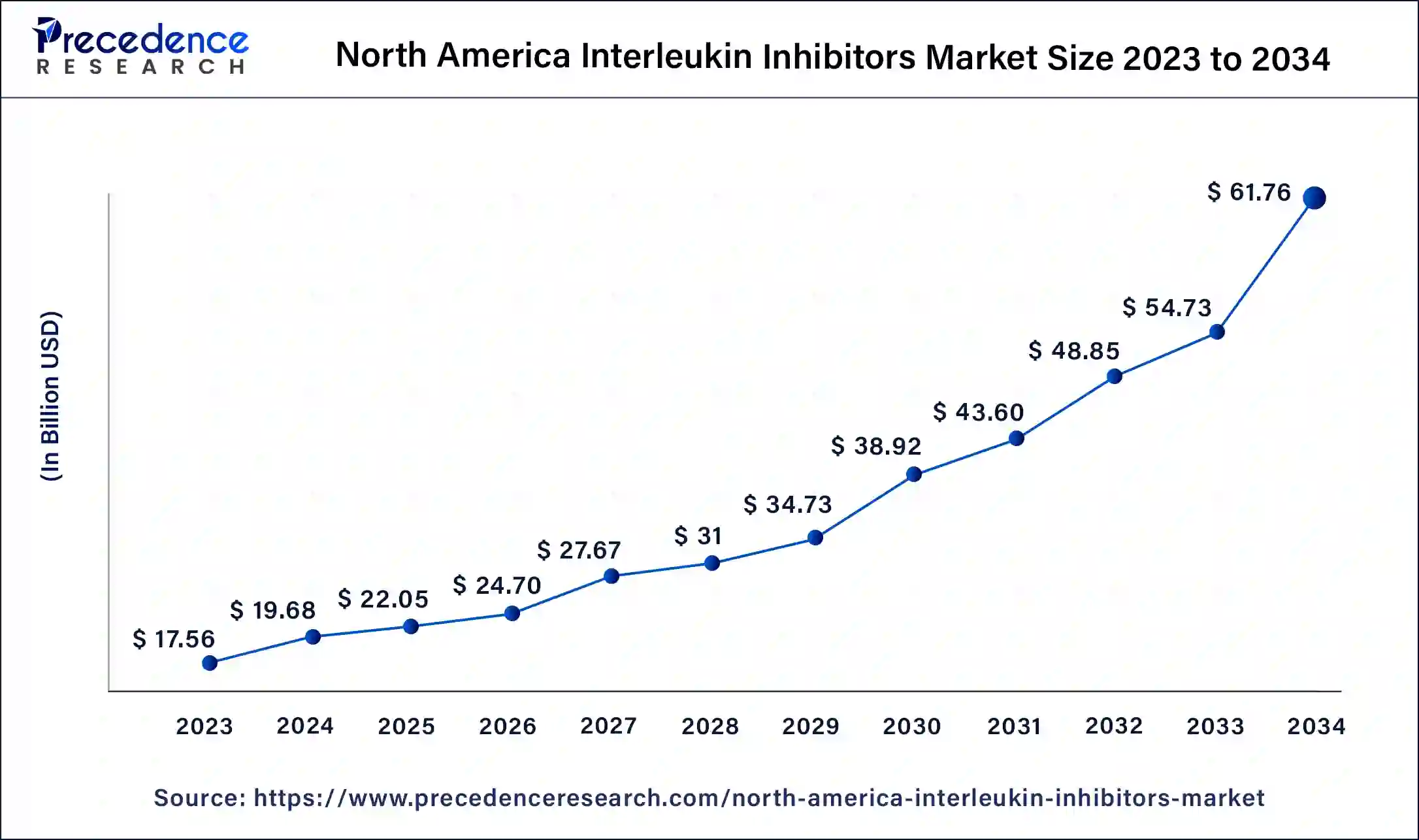

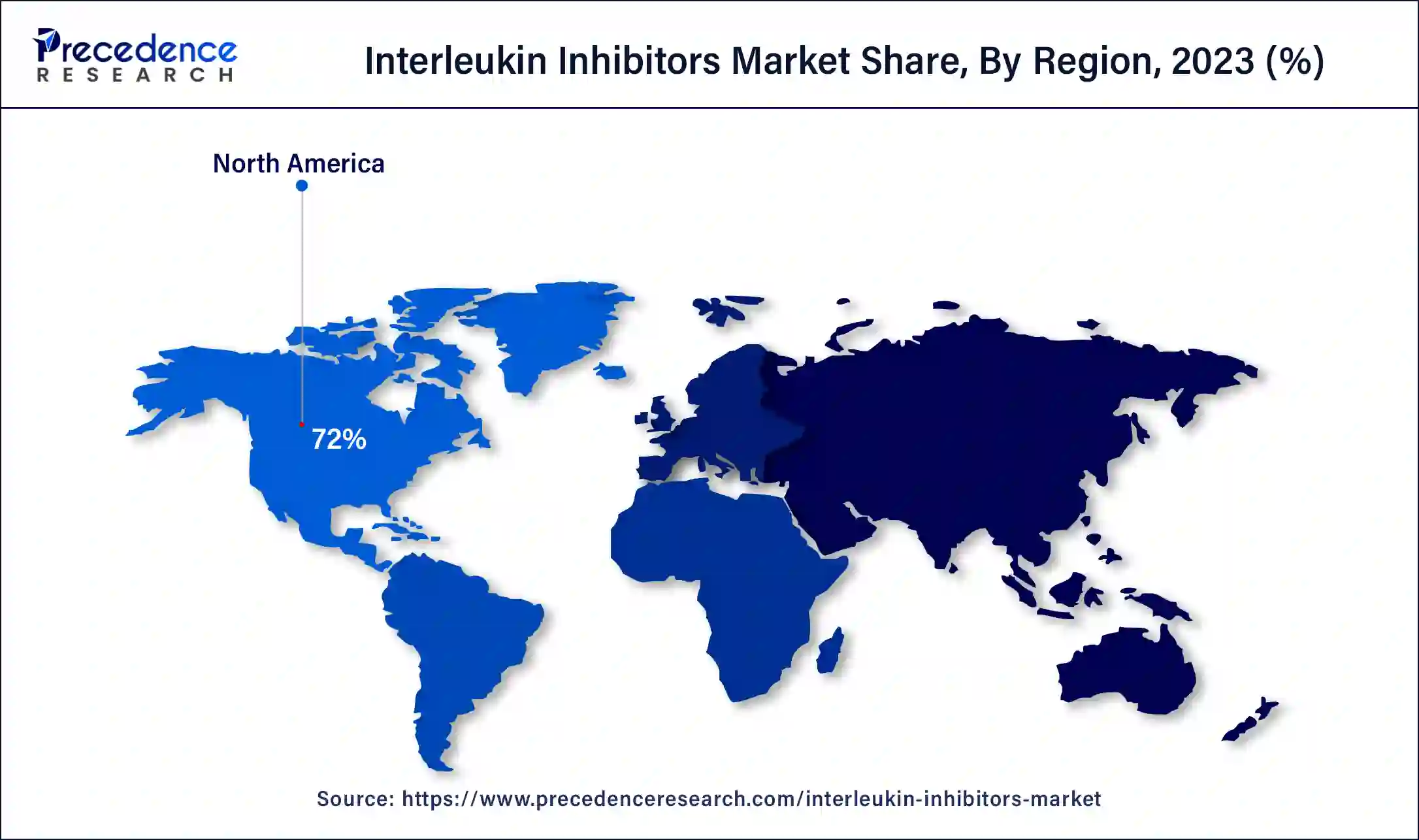

The global interleukin inhibitors market size is projected to reach around USD 85.18 billion by 2034 from USD 27.33 billion in 2024, at a CAGR of 12.04% between 2024 and 2034. The North America interleukin inhibitors market size reached USD 17.56 billion in 2023. The growing cases of hypereosinophilic syndrome across the world are driving the growth of the interleukin inhibitors market.

The North America interleukin inhibitors market size was exhibited at USD 17.56 billion in 2023 and is projected to be worth around USD 61.76 billion by 2034, poised to grow at a CAGR of 12.11% from 2024 to 2034.

North America held the largest share of the interleukin inhibitors market in 2023. The growth of the market in this region is mainly driven by the rising advancements in the healthcare sector along with growing investment by the government in countries such as the U.S. and Canada for developing the pharmaceutical industry. The cases of various types of cancers, such as breast cancer, bladder cancer, kidney cancer, prostate cancer, lymphoma, and some others, have increased across the North American region, increasing the demand for IL-6 inhibitors that in turn increases the demand for interleukin inhibitors, thereby driving the market growth.

The rising prevalence of neurological disorders such as epilepsy, autism, ADD, learning disabilities, neuromuscular disorders, brain tumors, cerebral palsy, and some others has increased in the North American region, which increases the demand for IL-6 inhibitors for treatment, which in turn drives the market growth to some extent. Moreover, several local market players of interleukin inhibitors, such as Johnson and Johnson, Abbvie, Eli Lily, and some others, are constantly engaged in developing interleukin inhibitors and adopting strategies such as partnerships, acquisitions, launches, and business expansions, which in turn drives the growth of the interleukin inhibitors market in this region.

Asia Pacific is expected to be the fastest-growing region during the forecast period. Rising investments in the healthcare system and growing advancements in the biopharmaceutical sector in countries such as Japan, China, India, South Korea, Israel, and others are expected to drive market growth to some extent. Moreover, the increasing prevalence of cardiovascular diseases increases the demand for interleukin inhibitor-based therapies for effective treatment, thereby driving market growth. For instance, in September 2023, the WHO (World Health Organisation) announced that around 3.9 million people in the Southeast Asia region die due to cardiovascular disease every year.

Furthermore, various local companies producing interleukin inhibitors, such as Teva, Sun Pharma, Sunshine Guojian, Chugai Pharmaceutical Co., Ltd., and some others, are developing advanced interleukin inhibitors across the Asia-Pacific region, which is expected to drive the growth of the interleukin inhibitors market in this region.

The government of India’s Department of Health and Family Welfare announced that in FY 2024-25, the government is likely to invest around Rs 87,656.90 crores in developing the healthcare sector in India, an increase of around 12.93% from the revised investment of Rs 77,624.79 crores in FY 2023-2024.

The interleukin inhibitors market is one of the most important industries in the biopharmaceutical sector. This industry deals in manufacturing and distributing superior-grade interleukin inhibitors across the world. The interleukin inhibitors market is mainly driven by the rise in the number of government approvals for using various therapeutics, along with increasing research activities for developing interleukin inhibitors.

This industry comprises various types of interleukin inhibitors such as IL-17, IL-23, IL-1, IL-5, IL-6, and others. Interleukin inhibitors mainly find applications in the treatment of psoriasis, psoriatic arthritis, rheumatoid arthritis, asthma, inflammatory bowel disease (IBD), and some others. This industry is expected to grow significantly with the developments in the pharmaceutical and healthcare industries.

How Can AI Improve the Interleukin Inhibitors Industry?

AI plays an important role in the development of the interleukin inhibitors industry. Nowadays, most of the pharmaceutical companies have started integrating AI in drug discovery and development. Also, the applications of AI in determining the efficacy of medicines, along with identifying the side effects, have helped the pharmaceutical industry to a large extent.

Recently, researchers discovered two new IL inhibitors named ‘Celecoxib’ and ‘Dexamethasone’ that use AI to help in the treatment of various autoimmune diseases. Thus, AI can help in developing new varieties of interleukin inhibitors, thereby improving the landscape of the interleukin inhibitors industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 85.18 Billion |

| Market Size in 2023 | USD 24.39 Billion |

| Market Size in 2024 | USD 27.33 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.04% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing cases of autoimmune disorders across the world

The cases of autoimmune diseases such as systemic lupus erythematosus, inflammatory bowel disease, multiple sclerosis, Guillain-barre syndrome, asthma, graves' disease, and some others have increased rapidly across the world. With the rise in number of patients suffering from autoimmune diseases, the demand for effective therapies has also increased for treatment. These diseases can be treated using IL inhibitor-based therapies that, in turn, drive the growth of the interleukin inhibitors market during the forecast period.

According to a report published by the global landscape of autoimmune disease in February 2024, autoimmune diseases cumulatively affect around 5 to 10% of the population in industrially developed countries, and the prevalence of autoimmune disease in developing countries is much lower than in developed countries around the world.

Side effects and high treatment cost

The interleukin inhibitor industry has gained prominent attention due to its capability to treat severe diseases. Although there are several applications of interleukin inhibitors in healthcare sectors, certain problems exist in this industry. Firstly, the overuse of interleukin inhibitors can cause several health issues such as headache, rash, joint pain, nausea, fatigue, gastritis, and some others that retards the use of this therapy in some patients. Secondly, the cost of using interleukin inhibitors is increasing day by day, which prevents poor consumers from using them. Thus, numerous side effects associated with the overuse of interleukin inhibitors, along with the increasing cost of interleukin inhibitors, are expected to restrain the growth of the interleukin inhibitors market during the forecast period.

Advancements in IL-6 and IL-1 inhibitors

Various developments have been taking place in the interleukin inhibitors industry in recent times. The researchers have started developing several varieties of IL inhibitors to treat numerous autoimmune diseases. Recently, IL inhibitor companies have increased their emphasis on developing IL-6 and IL-1 inhibitors. IL-1 inhibitors can be used in the treatment of rheumatoid arthritis, and IL-6 inhibitors are found to be effective against cancer and some inflammatory diseases. Thus, the ongoing advancements associated with IL-6 and IL-1 inhibitors are expected to create ample growth opportunities for the market players in the upcoming days.

The psoriasis segment dominated the market in 2023. The rising cases of plaque psoriasis and inverse psoriasis among the people across the world has driven the market growth. Also, the growing emphasis on developing biologics for managing psoriasis is likely to boost market growth. Moreover, the increasing application of interleukin inhibitors for the treatment of guttate psoriasis and erythrodermic psoriasis is expected to drive the growth of the interleukin inhibitors market during the forecast period.

The psoriatic arthritis segment is expected to grow with the highest CAGR during the forecast period. The increasing cases of psoriatic arthritis among the people of the world have boosted the market growth. Also, the growing adoption of interleukin inhibitors for the treatment of psoriatic arthritis among patients is likely to drive the market growth to some extent. Moreover, the ongoing research and developmental activities associated with IL-23 for the treatment of psoriatic arthritis are expected to propel the growth of the interleukin inhibitors market during the forecast period.

The IL-23 segment dominated the interleukin inhibitors market in 2023. The growing demand for IL-23 inhibitors for treating moderate to severe psoriasis among patients has driven the market growth. Also, the rising application of IL-23 inhibitors for the treatment of Crohn's disease and ulcerative colitis is likely to propel the market growth to some extent. Moreover, the increasing use of IL-23 inhibitors for blocking downstream signaling pathways and inhibiting inflammatory responses is expected to boost the growth of the interleukin inhibitor market during the forecast period.

The IL-17 segment is expected to grow with the highest CAGR during the forecast period. The increasing application of IL-17 inhibitors for blocking the inflammatory pathway of cytokine has driven the market growth. Also, the rising demand for IL-17 inhibitors to improve psoriasis symptoms and help reduce inflammation by autoimmune diseases is likely to boost market growth. Moreover, the growing demand for IL-17 inhibitors for the treatment of plaque psoriasis and psoriatic arthritis is expected to propel the growth of the interleukin inhibitors market during the forecast period.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

June 2023

January 2025

July 2024