January 2025

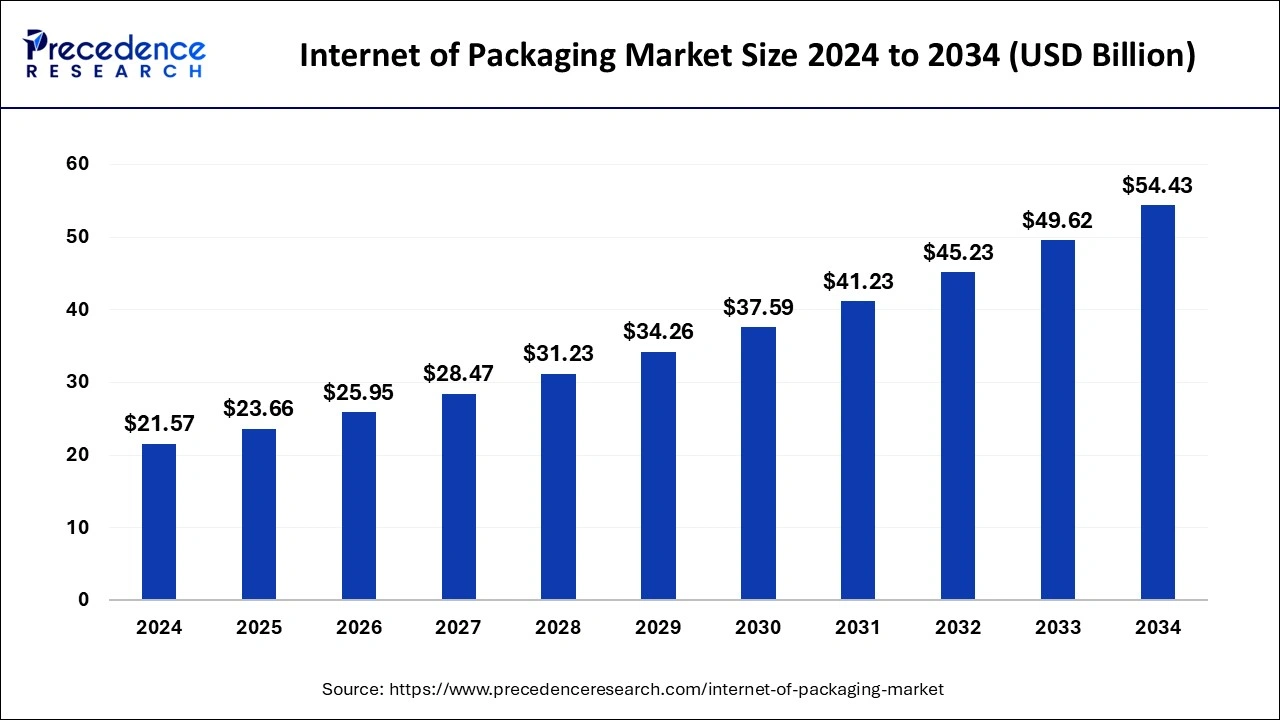

The global internet of packaging market size is accounted for USD 23.66 billion in 2025 and is predicted to surpass around USD 54.43 billion by 2034, representing a healthy CAGR of 9.70% between 2025 and 2034. The North America internet of packaging market size is calculated at USD 8.63 billion in 2024 and is expected to grow at a fastest CAGR of 9.83% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global internet of packaging market size is estimated at USD 21.57 billion in 2024 and is anticipated to reach around USD 54.43 billion by 2034, expanding at a CAGR of 9.70% from 2025 to 2034.

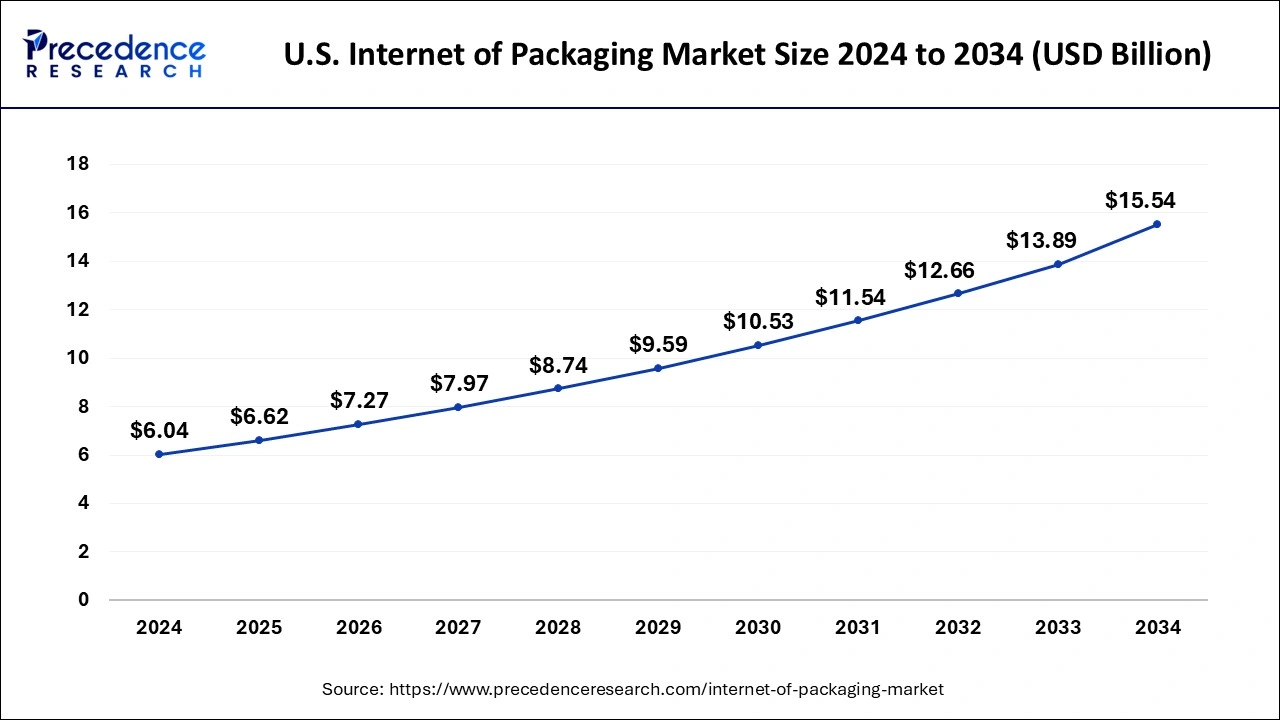

The U.S. internet of packaging market size is evaluated at USD 6.04 billion in 2024 and is predicted to be worth around USD 15.54 billion by 2034, rising at a CAGR of 9.90% from 2025 to 2034.

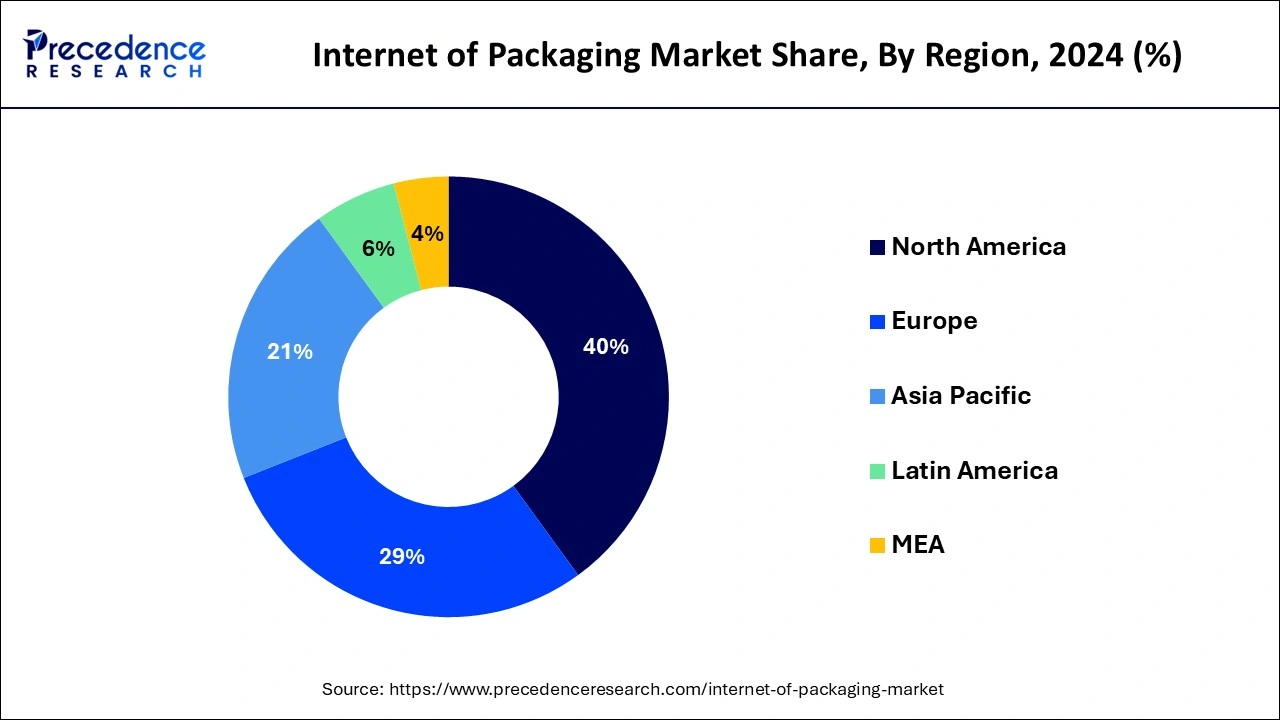

With the highest market share, North America emerged as the biggest regional market for the Internet of Packaging in 2024. The region's growing preference for Internet of Packaging over conventional packaging and the accessibility of widespread Internet connectivity are primarily responsible for the development in revenue in the North American market. Additionally, thanks to the Internet of Packaging, better safety assurance, transparency, and dependability. Due to the presence of top industry players in the area, such as Unipac Corporation, Scanbuy, Inc., Identiv, Inc., and Tapwow, the Internet of packaging market in North America is anticipated to have strong revenue growth throughout the course of the projection year.

Over the projected period, the Asia Pacific Internet of Packaging market is anticipated to develop at the quickest CAGR. The main drivers of market expansion in APAC are changing lifestyles, growing need for technological packaging solutions, and improved product traceability. The expansion of the APAC market is also aided by the rising clientele and rising e-commerce shipments that make Internet of Packaging possible in the region's emerging nations, notably in China and India.

Traditional packaging is disrupted by the Internet of packaging, which also improves customer-company communication. Smart packaging makes use of Near Field Communication (NFC) chips, smart labels, RFID, and QR codes. By enabling protection, authentication, and connection, these cutting-edge solutions provide value by converting product packaging into a data carrier and digital tool. This enables information about specific packages to be registered and updated in the cloud during the course of the product's lifespan.

Additionally, manufacturers may add diagnostic and indication functions into their packaging thanks to Internet of Things sensors and devices. Customers may now view the product's progress in real-time thanks to this. Significant options for customer marketing and brand interaction, image management, tracking, optimization, and other areas are provided by the Internet of Packaging. As a consequence of the Internet of Packaging, there is now a value network rather than a value chain. Information no longer moves in a single direction. Technology development and the use of Internet of Things (IoT) in packaging solutions across a variety of industrial verticals are major drivers fueling market revenue growth.

In addition, demand for Internet of Packaging is anticipated to be fueled by digitization, improved tracking, increased operational efficiency, and greater customer involvement. IoT is being used by packaging businesses to increase the effectiveness of their operations. When paired with AI, connected sensors provide real-time asset monitoring and the ability to anticipate errors before they happen. The Industrial Internet is being used by packaging makers to help them meet their ESG (environmental, social, and governance) goals. Thus, businesses are using the Industrial Internet to monitor a variety of environmental factors, such as energy and water consumption.

Online Packaging Throughout the projection period, market growth is anticipated to increase significantly. Extremely recent and innovative technology developments, such as smartphone marketing codes, quick feedback, and electronics in the packaging industry, may be the cause of the increase in demand. Sector companies create affordable and effective wrapping services to remain competitive in the commercial market. Due to the rising need for multi-specialty wrapping with the goal of maintaining nutritional and health value and freshness quality in the products at cheap competitive costs, the global Internet of packaging market trend and market size are predicted to increase.

The complexity of goods, advancements in packaging techniques, and expenditures in R & D are some of the major market share drivers. The need for Internet of Packaging Market Services is being driven by the rising customer desire for comfort food, which will accelerate the expansion of the Internet of Packaging Market throughout the forecast period. The e-commerce sector's growing demand for smart packaging with enhanced capabilities like simple tracking and detection utilizing rapid response (QR) codes is boosting sales of clever packaging and A key factor driving the need for active packaging, such as oxygen scavengers and ethylene absorbers, is the implementation of strict laws surrounding the storage and transportation of different food, beverage, and healthcare items in order to maintain product safety.

| Report Coverage | Details |

| Market Size in 2025 | USD 23.66 Billion |

| Market Size by 2034 | USD 54.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.70% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Deployed Type, Industry Verticals and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The near field communication segment is anticipated to account for the greatest revenue share during the projection period based on the kind of technology implemented. NFC tags, which may be integrated into packaging, offer an exciting possibility to enhance the intelligence and interactivity of commonplace items. These NFC tags have distinctive identifiers for every item, not simply the kind of goods, enabling customized, location-specific, and dynamic content. Since NFC technology's unique ID prevents product fraud and enables identification, it is also less likely to be copied. These are two major elements influencing this market's expansion.

The food and beverage category is anticipated to outperform the other categories in terms of revenue share throughout the projected period, according to industry verticals. By making it possible to promptly correct food safety breaches and provide customers with product-related information, internet of packaging technologies prevent food fraud. Since the Internet of Packaging minimizes the amount of time needed to identify an event, tracing the origin of food safety incidents saves lives and money. This suggests more focused recalls, fewer confusion, and higher levels of consumer confidence in food safety. The market is expanding as a result of research into various F&B uses for nanotechnology, the desire from retailers and manufacturers for shelf-stable and sustainable packaging options, and rising packaged food product consumption.

By Technology Deployed Type

By Industry Verticals

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025