January 2025

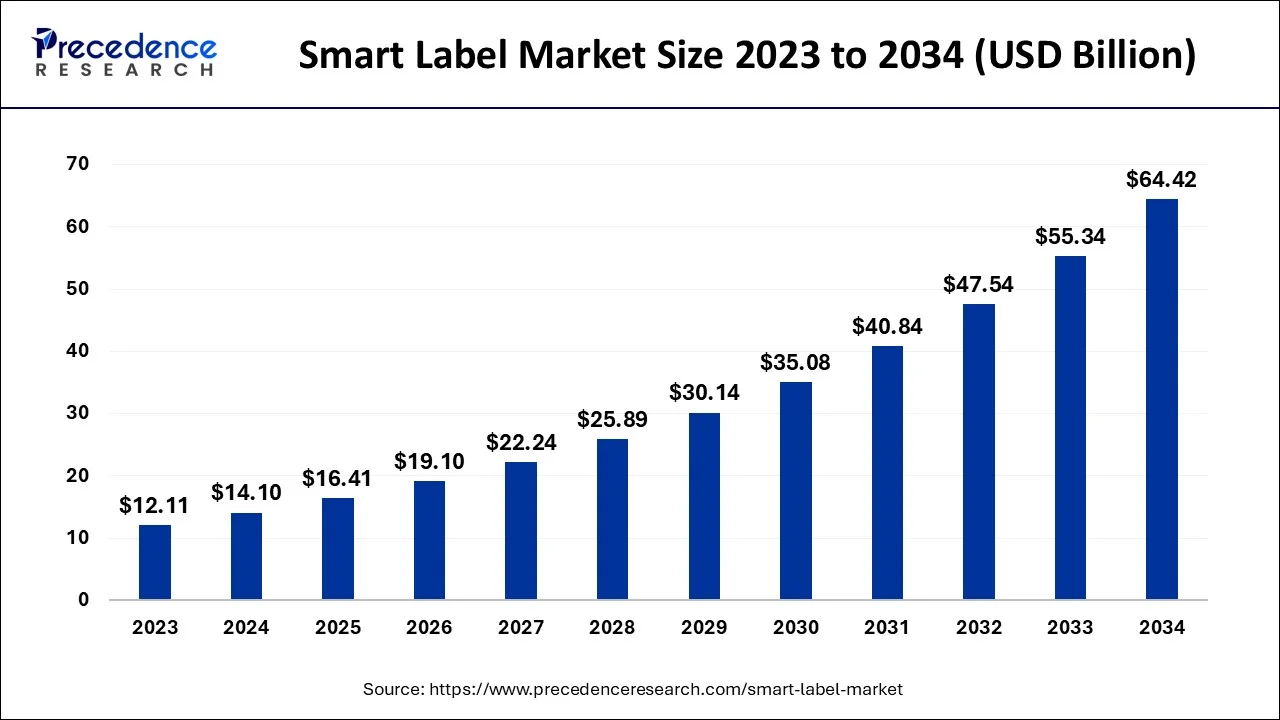

The global smart label market size is accounted for USD 14.10 billion in 2024, grew to USD 16.41 billion in 2025 and is projected to reach around USD 64.42 billion by 2034. The market is expanding at a double-digit CAGR of 16.41% between 2024 and 2034. The North America smart label market size was valued at USD 5.22 billion in 2024 and is growing at a healthy CAGR of 16.55% from 2024 to 2034.

The global smart label market size is calculated at USD 14.10 billion in 2024 and is projected to surpass around USD 64.42 billion by 2034, expanding at a healthy CAGR of 16.41% from 2024 to 2034. The rising demand for sustainable packaging is expected to offer lucrative growth opportunities to the global smart label market.

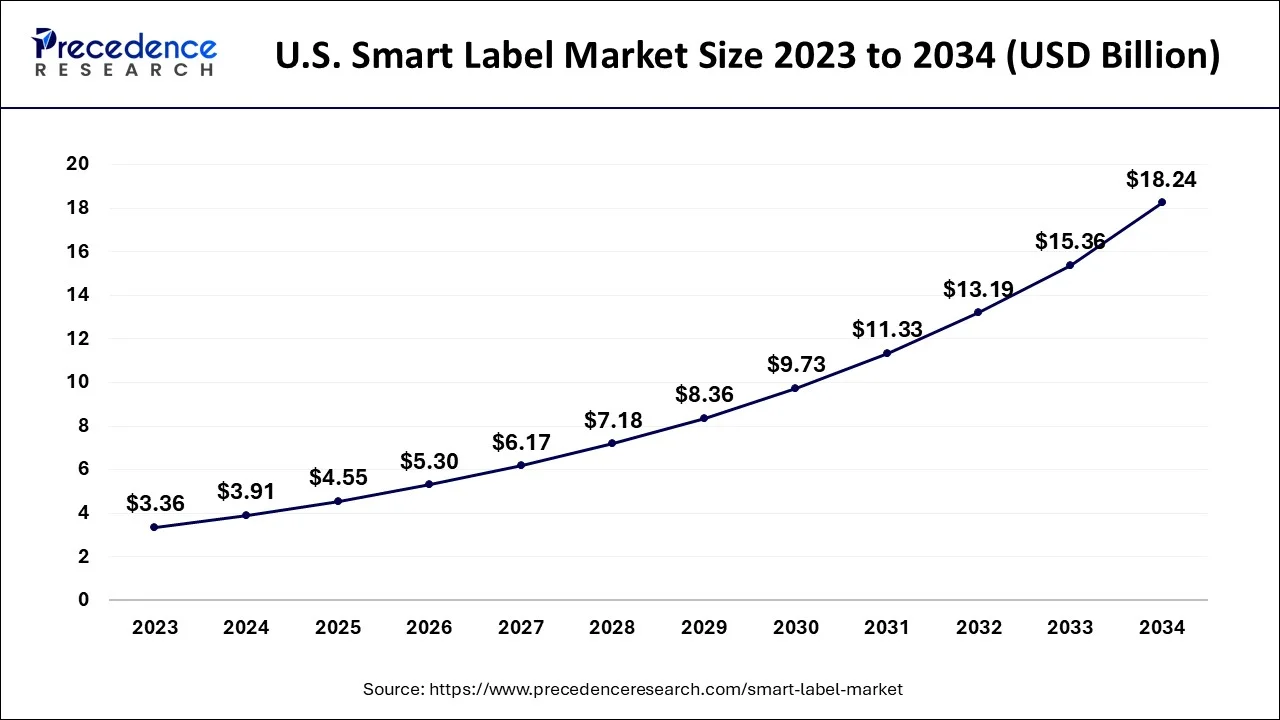

The U.S. smart label market size is evaluated at USD 3.91 billion in 2024 and is projected to be worth around USD 18.24 billion by 2034, representing a double-digit CAGR of 16.62% from 2024 to 2034.

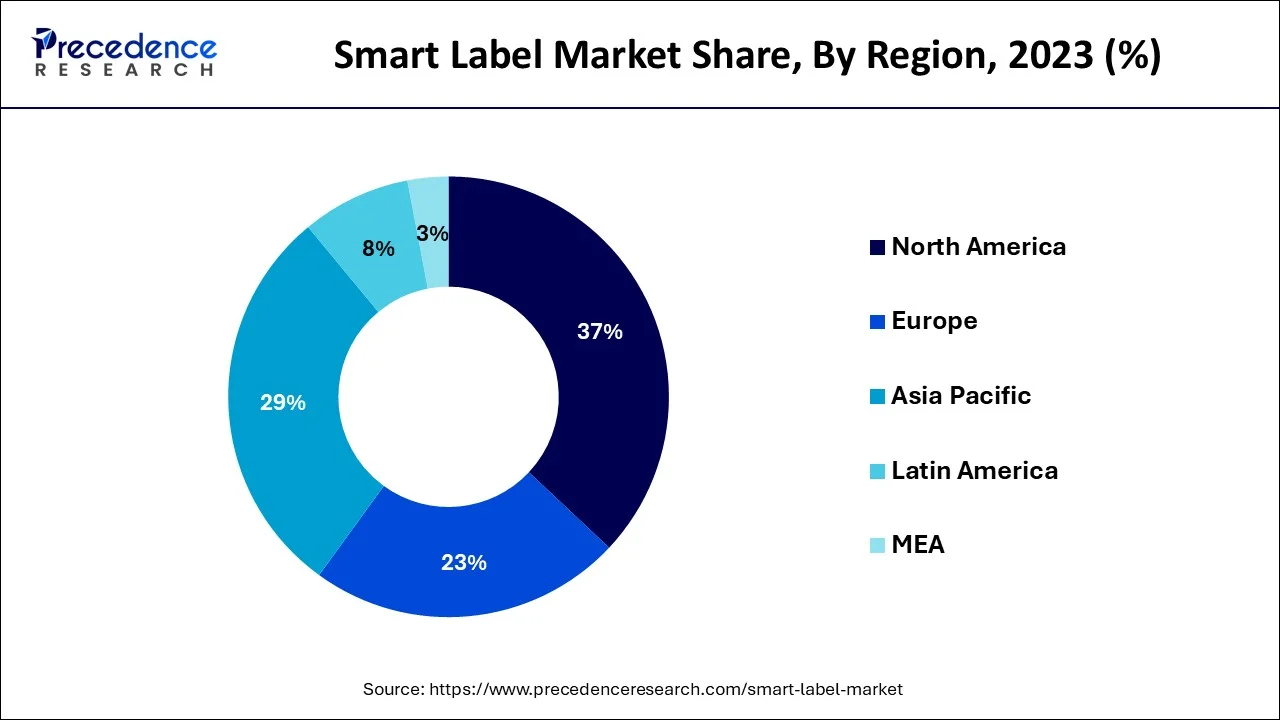

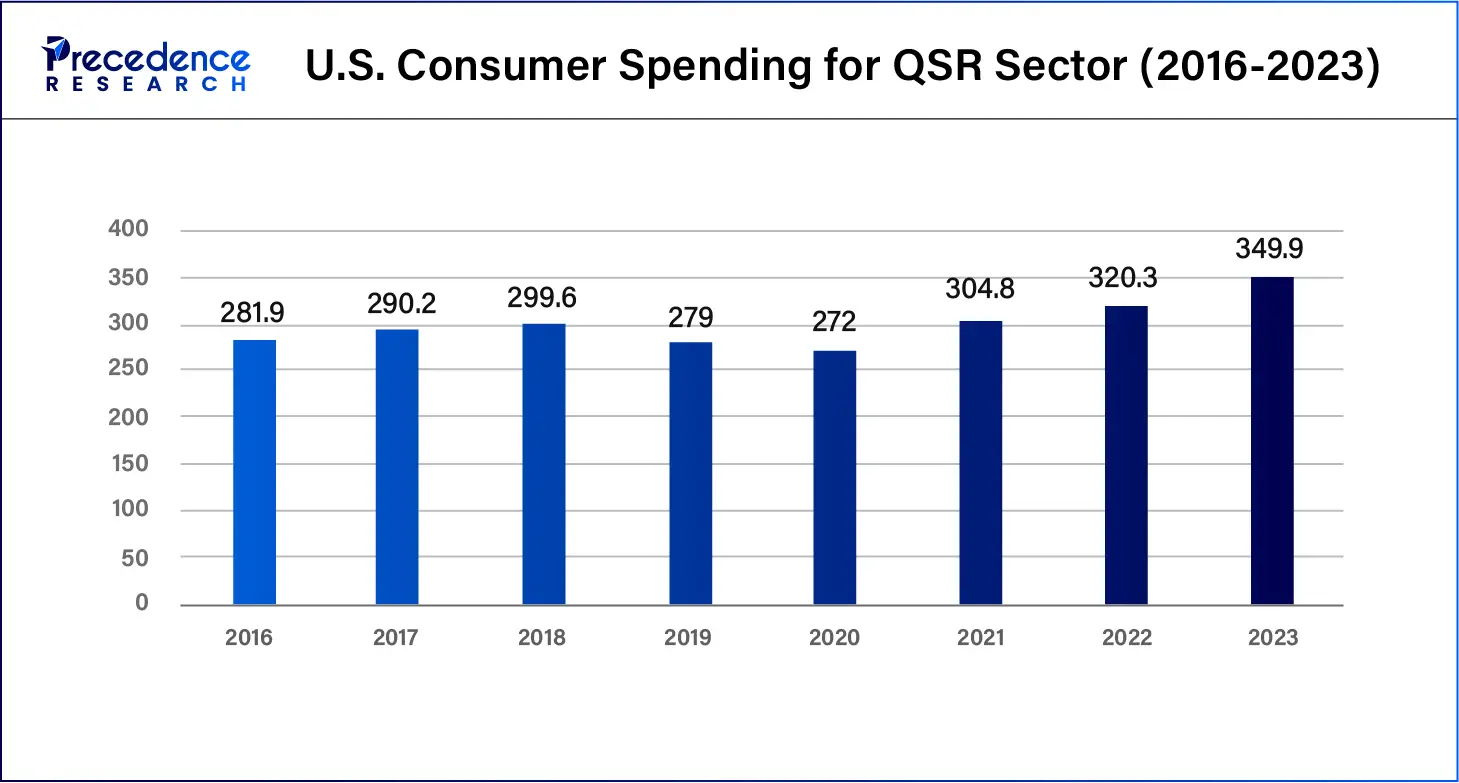

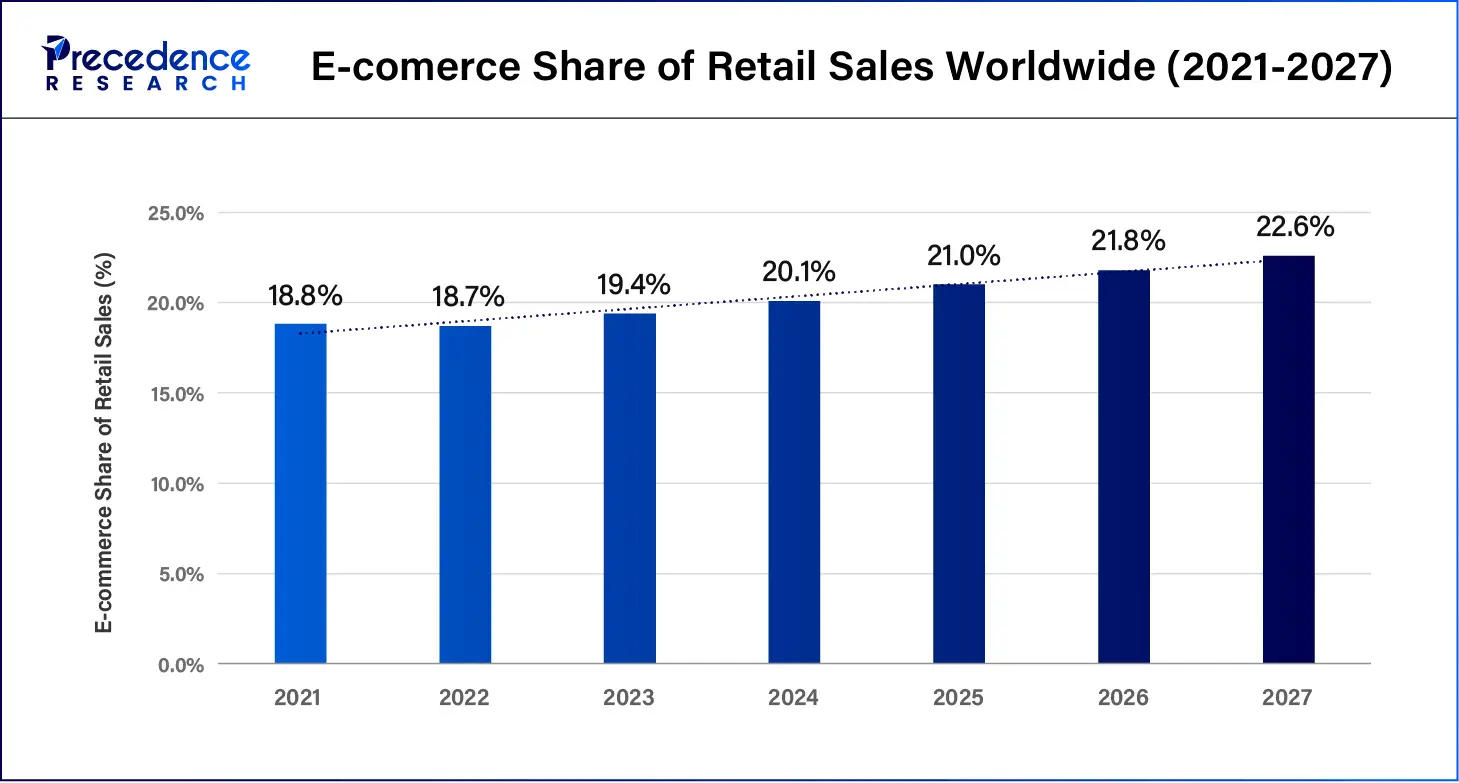

North America held the dominant share of the smart label market in 2023. The growth of the region is characterized by the presence of sophisticated digital infrastructure, increasing use of QR Code menus in restaurants, increasing demand for security and tracking solutions, expansion of the e-commerce sector, widespread adoption of smartphones, strong penetration of the internet, rising need for inventory management, and seamless supply chain management. Furthermore, the widespread adoption of smart labels assists companies in addressing issues like counterfeiting, theft, and shoplifting.

The increasing applications of smart labels across various industries, such as pharmaceuticals, manufacturing, retail, logistics, consumer electronics, financial institutions, food & beverages, and others, are expected to contribute to the significant growth potential of the market in North America. In addition, there is rising adoption of advanced technologies, including the Internet of Things (IoT) and cloud computing. This robust digital infrastructure supports the rapid implementation and integration of smart label technology.

Europe is observed to expand at a rapid pace in the smart label market during the forecast period. The growth of the region is driven by rising economic growth, increasing popularity of interactive labels, growing concerns over counterfeit products, rising demand for QR code menus for restaurants, increasing consumer spending, rising need to optimize the supply chain, and increasing emphasis on enhanced quality and safety validation.

The rising adoption of smartphones and internet penetration are the major factors contributing to the region's growth. The region has a presence of robust retail, healthcare, manufacturing, logistics, and FMCG industries, e-commerce, and other sectors have led to an increasing demand for smart labels. Key market players in European countries, such as the U.K., Spain, Germany, Italy, the Netherlands, and others, are actively engaged in launching technologically advanced smart labels aimed at reducing waste and promoting product efficiency.

Moreover, the rapid adoption of advanced technology and supportive government regulations and legislation require products to be labeled. For instance, European regulations such as the Falsified Medicines Directive (FMD) promote the usage of smart labels for product authentication, traceability, and other safety features.

Over the years, the rapid rate of technological innovation has made the technology more attractive. The benefits offered by smart labeling are endless. The smart label market serves as an innovative tool to validate the authenticity of a product, offering real-time data tracking, enhanced security, and interactive consumer engagement. Smart labels are extensively used to provide instantaneous details about the products used by multiple industries, including healthcare, food & beverages, automotive, logistics, pharmaceuticals, and others.

Smart labels facilitate secure and seamless interactions between products, consumers, and businesses. They provide track-and-trace capabilities, deliver consumer engagement, drive brand awareness, and have the potential to address issues like counterfeiting. Smart labels facilitate faster tracking and identification opportunities that reduce errors and save time. The smart label market has witnessed a substantial rise in popularity in smart packaging and smart logistics operations.

How Technological Advancement is Impacting the Growth of the Smart Label Market

In the evolving technology landscape, artificial intelligence (AI) and machine learning (ML) have emerged as transformative technologies with the potential to revolutionize the smart label market in various aspects. Predictive analytics can be leveraged to anticipate supply chain disruptions, optimize inventory levels, and enhance overall efficiency. Artificial intelligence algorithms can easily analyze data collected from smart labels to identify patterns and anomalies, which enables more proactive and efficient anti-counterfeiting measures.

Smart labeling uses machine learning models like LLMs to automatically generate labels or categories for unstructured data, which can be helpful in several scenarios, including classified documents and contracts as per the regulatory and compliance criteria, as well as customer inquiries. Therefore, technology advancements hold substantial promise in enhancing smart labels' capabilities.

| Report Coverage | Details |

| Market Size by 2034 | USD 64.42 Billion |

| Market Size in 2024 | USD 14.10 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.41% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, End-user Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for robust security measures and efficient tracking systems

The increasing need for robust security measures and efficient tracking systems is anticipated to boost the growth of the smart label market during the forecast period. A smart label is an intelligent and powerful tool in product authentication and the prevention of counterfeiting. In an era of increasingly interconnected, counterfeit products have become a rising concern for consumers and businesses alike.

Smart labels play an indispensable role in assisting companies to mitigate the commonly facing challenges such as shoplifting, theft, and counterfeiting. This utilization of advanced labeling technologies offers real-time tracking options, improving security measures and authentication features, making them effective tools for addressing these issues. Therefore, the smart label market has witnessed the rising adoption of smart labels as it aligns with the need for robust security measures and efficient tracking systems to ensure the products' authenticity.

High cost

The high cost is projected to hamper the growth of the global smart label market. High capital is required to install, purchase, and maintain RFID. Smart label technologies can be expensive for small-scale manufacturers. In addition, safety concerns and the inability to withstand harsh climatic conditions are likely to limit the market.

Expansion of the food and beverages industry

The rapid expansion of the food and beverages industry is projected to offer lucrative growth opportunities to the smart label market. Consumer are becoming more cautious about their purchases and like to be well-informed about the food and beverages they are willing to consume. They want information like the presence of genetically modified ingredients, nutrients, manufacturing location, and others. Smart labels assist in making a purchase decision. The smart label serves as a product identification slip that is equipped with more advanced technologies than traditional bar code data.

The smart label market provide handy alternatives that enables companies to easily attach printed sensors to any type of package to provide real-time information about location, movement, temperature, moisture, and others. Moreover, several companies rely on smart labels to provide consumers with traceability of food products. For instance, leading food manufacturing brands like The J.M. Smucker Company, Hershey, Nestle, and Kellogg have started using smart labels.

The retail segment led the global smart label market in 2023. RFID is widely used in retail industries to prevent theft by sounding an alarm when an item with an active tag passes through exit doors. It assists retailers in reducing waiting times for customers, which improves overall customer satisfaction. Smart labels assist retailers in keeping track of their inventory levels on a real-time basis, enabling them to know where the items are located, how much stock they have, and when they need to reorder. Smart labels hold potential promise for retail companies to achieve growth and profitability. They are widely used to improve inventory accuracy while reducing time-consuming tasks and increasing business productivity. Operations managers can make all necessary informed decisions based on accurate inventory data, reducing the cost of overproduction and allowing better stock allocation.

The healthcare & pharmaceutical segment is expected to grow significantly in the smart label market during the forecast period. With smart labels in packaging, the pharmaceutical and healthcare industry has witnessed a significant transformation. As technology continues to evolve, smart labels are crucial tools for pharmaceutical manufacturers, ensuring the delivery of authentic and safe medications to patients around the world. Smart labels are equipped with advanced technologies that allow them to store and transmit data, offering several benefits for pharmaceutical consumers and companies.

The utilization of smart labels assists pharmaceutical companies in various ways, such as improving traceability throughout the pharmaceutical supply chain, ensuring product authenticity of a product, real-time monitoring of temperature, enhancing medication adherence and engagement, streamlining regulatory compliance, reducing waste, and improving sustainability. Therefore, the increasing use of smart labeling in pharmaceutical packaging has the potential to revolutionize how medications are monitored, tracked, and consumed.

The RFID segment accounted for the dominating share of the smart label market in 2023 and is projected to continue its dominance over the forecast period. Radiofrequency identification technology is significantly transforming asset management and inventory management in healthcare, retail, manufacturing, logistics, and others. Radiofrequency identification tags can store information ranging from serial numbers and short product descriptions to entire pages of data.

With Radio frequency identification RFID labels, assets are given unique and digital identities to identify and locate them all at once from a distance in real-time, without needing a line of sight. The accuracy, speed, and adaptability of RFID have led to its rapid adoption in several industries. Earlier, inventory management and logistics have been quite complex, time-consuming, and laborious. RFID technology assists companies in reducing losses and errors, improving compliance and safety, and boosting overall business productivity.

The electronic shelf label segment will witness considerable growth in the smart label market over the forecast period. Electronic shelf labels (ESL) wireless technology is used to communicate with a central hub, forming a dynamic pricing automation network. The major benefits offered by the ESL include automated pricing, more efficient operations, and improved shopper satisfaction.

Segments Covered in the Report

By Technology

By End-user Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

April 2024

August 2024