September 2024

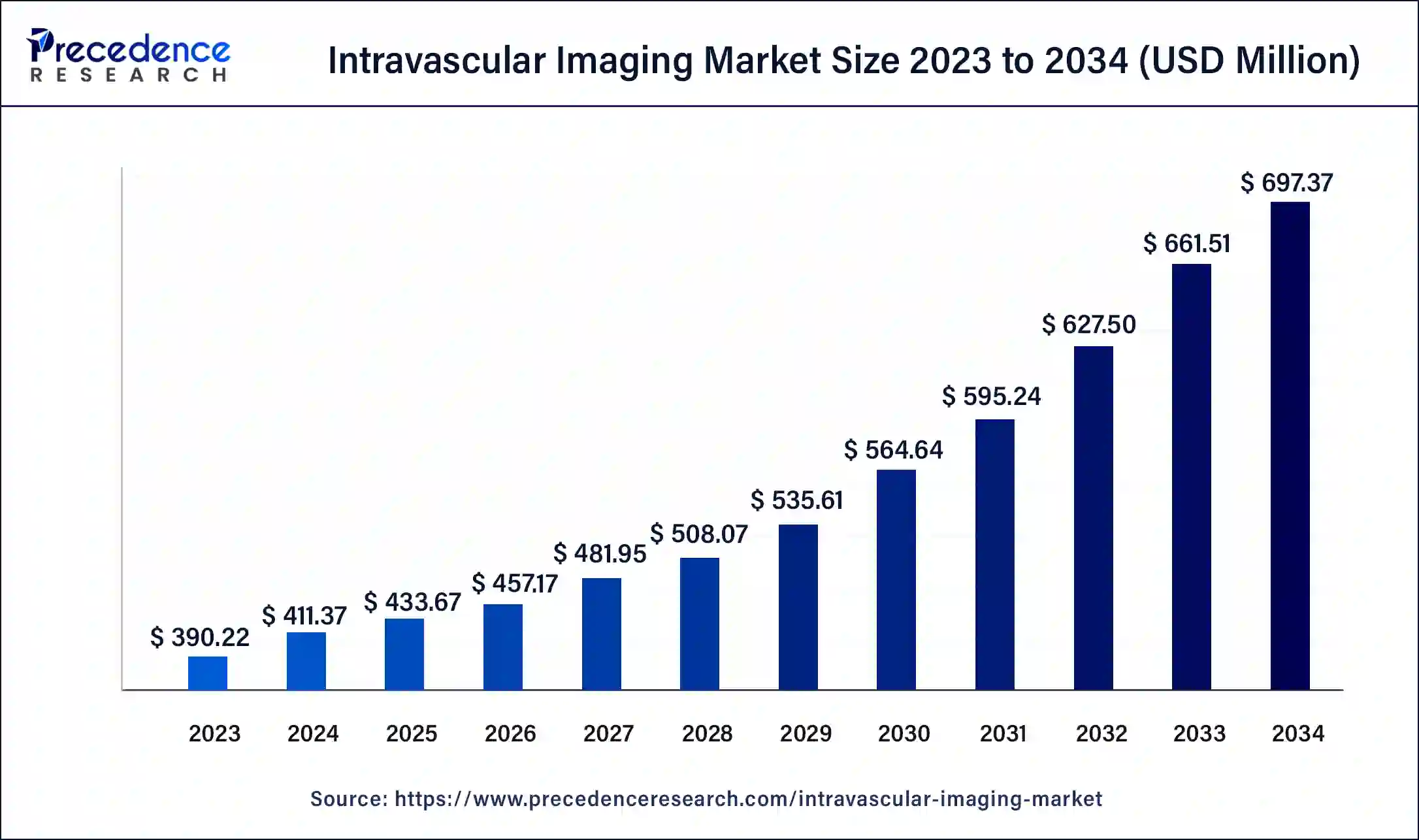

The global intravascular imaging market size surpassed USD 390.22 million in 2023 and is estimated to increase from USD 411.37 million in 2024 to approximately USD 697.37 million by 2034. It is projected to grow at a CAGR of 5.42% from 2024 to 2034.

The global intravascular imaging market size is worth around USD 411.37 million in 2024 and is anticipated to reach around USD 697.37 million by 2034, growing at a CAGR of 5.42% over the forecast period 2024 to 2034. Increased usage of intravascular imaging modalities is expected to boost intravascular imaging market growth.

The intravascular imaging market includes cutting-edge medical imaging technologies designed for visualizing and assessing coronary arteries and blood vessels. Techniques such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT) are integral to diagnosing cardiovascular conditions and directing interventional treatments like angioplasty and stent placement. This innovative field of intravascular imaging transforms cardiovascular diagnostics and interventions by utilizing specialized methods to visualize the inner structures of arteries and veins directly within the blood vessels.

AI Impact on the Intravascular Image Market

Algorithms have the potential to significantly improve intravascular imaging by automating numerous tasks or calculations, uncovering new patterns or phenotypes in data, and offering alternative diagnostic insights. Moreover, In the realm of interventional cardiology, artificial intelligence (AI) can contribute to procedural guidance, enhance intravascular imaging, and provide supplementary information to operators. As AI progressively extends into interventional cardiology, it can fundamentally transform the intravascular imaging market.

| Report Coverage | Details |

| Market Size by 2034 | USD 697.37 Million |

| Market Size in 2023 | USD 390.22 Million |

| Market Size in 2024 | USD 411.37 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Modality, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Expanded applications in peripheral vascular and structural heart procedures

The intravascular imaging market is growing beyond its traditional focus on coronary interventions, now embracing a wider range of applications in peripheral vascular and structural heart procedures. This broadening scope creates new opportunities for growth and market penetration. The potential for expansion extends into peripheral vascular and structural heart procedures, moving beyond conventional coronary interventions.

Concerns regarding radiation exposure

Some intravascular imaging methods, like fluoroscopy, involve exposure to ionizing radiation, raising concerns about the potential health risks. These concerns might affect the adoption of these technologies and shape preferences among patients and healthcare providers. Additionally, the absence of standardization in both procedures and interpretations of intravascular imaging presents challenges that can hinder the intravascular imaging market growth.

Integration of ultrasound imaging

A notable trend in the intravascular imaging market is the integration of intravascular ultrasound with other imaging techniques, such as angiography and optical coherence tomography (OCT). This combination enhances diagnostic and imaging capabilities by providing a more comprehensive view. Healthcare providers aim to improve patient outcomes and reduce costs, which supports the continuation of this trend in the coming years. Furthermore, advancements are being made with more refined IVUS catheters, which feature smaller diameters and make the imaging of narrower blood vessels. Hence, IVUS technology is anticipated to become more prevalent across various healthcare settings due to the increasing demand for minimally invasive diagnostic and therapeutic solutions.

The instrument segment dominated the intravascular imaging market in 2023. In the Intravascular Imaging market, the instrument segment encompasses the medical devices and equipment utilized for imaging procedures within blood vessels. Additionally, these instruments are essential for diagnosing and managing cardiovascular diseases, as they offer high-resolution visuals of arteries and blood vessels. Detailed images assist cardiologists and healthcare professionals in evaluating vascular conditions, detecting blockages, and directing therapeutic interventions.

The software segment is expected to grow at the fastest rate in the intravascular imaging market over the forecast period. This is because Software is important in improving data analysis and interpretation and provides advanced processing and visualization features that complement imaging instruments. This aspect is expected to drive continued growth in the segment throughout the forecast period.

The trolley mounted segment led the intravascular imaging market in 2023. This segment provides versatility and facilitates convenient transportation and positioning during cardiovascular procedures. Trolley stands, and Cassette holders need to be tailored to suit individual patients. A variety of trolley stands and cassette holders are available to meet these needs. The transition from traditional analog X-ray technology to computer-aided radiography improves image communication and offers environmental benefits for you to take full advantage of the improved technology.

The handheld segment is anticipated to witness the fastest growth in the intravascular imaging market during the projected period. Handheld intravascular imaging devices address the need for point-of-care accessibility and greater procedural flexibility. They enable healthcare providers to perform imaging procedures at the bedside, in outpatient settings, or in scenarios where trolley-mounted systems might not be as suitable.

The hospital segment dominated the global intravascular imaging market in 2023. Medical imaging technology is typically found in mid-sized to large hospitals due to its potential to generate substantial outpatient revenue. This segment commands the largest market share, driven by its high utilization rates and extensive patient base.

The ambulatory surgical centers segment is projected to show the fastest growth in the intravascular imaging market over the forecast period. This trend highlights a move towards outpatient cardiovascular interventions. Ambulatory surgical centers (ASCs) provide a more accessible and cost-efficient option, especially for intravascular imaging procedures that involve minimally invasive techniques.

North America held a significant share of the global intravascular imaging market. This growth is supported by the region's strategic embrace of advanced medical technologies and a strong healthcare infrastructure. In the United States, the market for intravascular imaging technologies is expanding steadily, fueled by the rising prevalence of cardiovascular diseases and the demand for sophisticated diagnostic and interventional tools.

The U.S.’s dedication to healthcare research and development promotes innovation, facilitating the smooth integration of innovative intravascular imaging solutions. The advancements in image quality and device portability have significantly enhanced diagnostic precision and patient outcomes.

Asia Pacific is expected to grow at the fastest rate in the intravascular imaging market throughout the studied period. The upward trajectory of China’s intravascular imaging market is largely driven by a rise in cardiovascular diseases and enhanced healthcare investments. The growing incidence of conditions like coronary artery disease has spurred a demand for advanced diagnostic tools, including intravascular imaging. Additionally, the government’s emphasis on improving healthcare infrastructure and extending services to rural regions has further supported market expansion.

Segments Covered in the Report

By Product Type

By Modality

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025