February 2025

The global iron and steel market size accounted for USD 1.71 trillion in 2024, grew to USD 1.79 trillion in 2025 and is projected to surpass around USD 2.7 trillion by 2034, representing a healthy CAGR of 4.70% between 2024 and 2034.

The global iron and steel market size is estimated at USD 1.71 trillion in 2024 and is anticipated to reach around USD 2.7 trillion by 2034, expanding at a CAGR of 4.70% between 2024 and 2034.

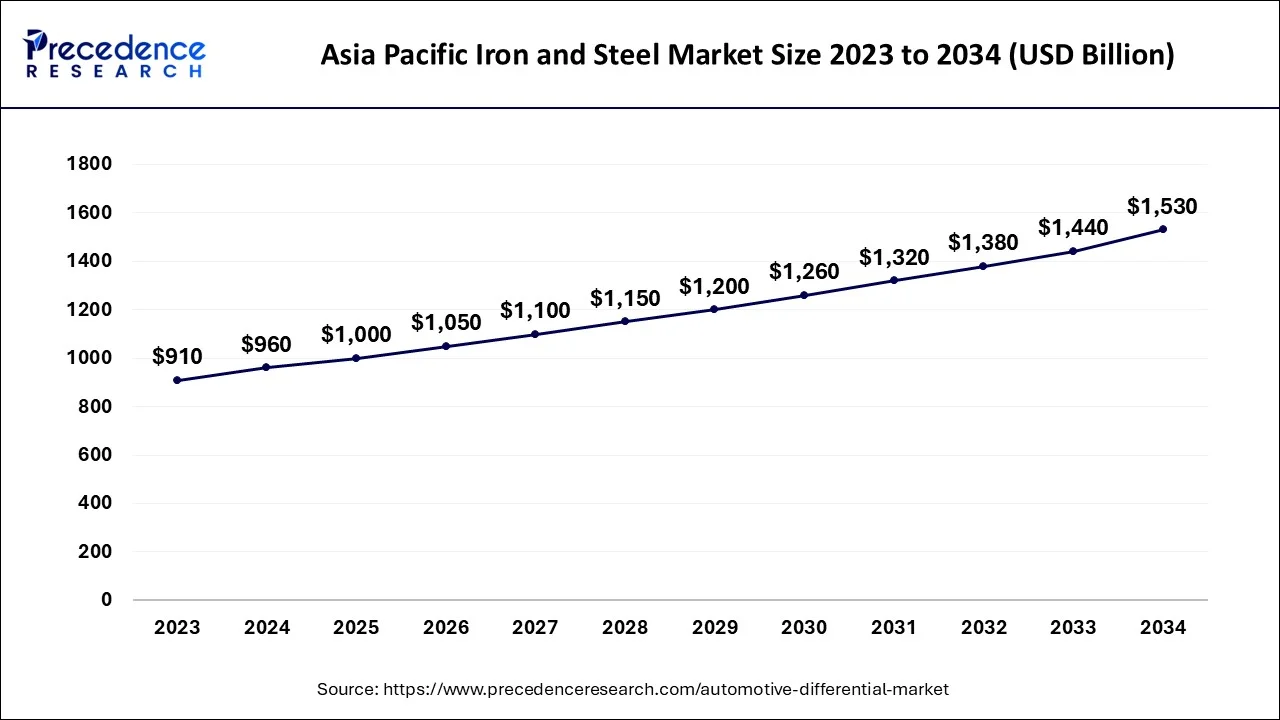

The Asia Pacific iron and steel market size is valued at USD 960 billion in 2024 and is predicted to be worth around USD 1530 billion by 2034, growing at a CAGR of 4.83% between 2024 and 2034.

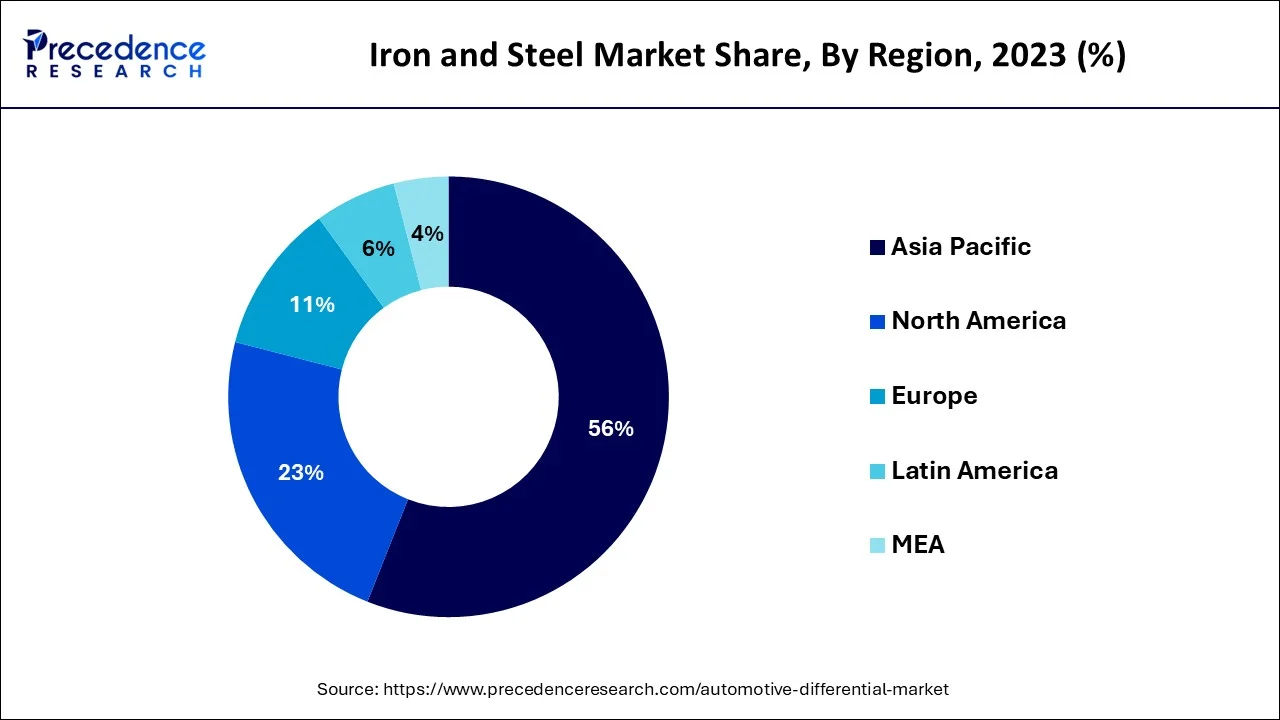

The Asia-Pacific region is the dominant market for iron and steel, with a substantial share of the global market. This can be attributed to the high demand for iron and steel products in countries like India and China, which are major producers and consumers of these products. Furthermore, the demand for iron and steel products is being fueled by the growing construction and infrastructure activities in the region.

North America and Europe are well-established and consolidated markets for iron and steel, with established players. The infrastructure and construction industries are well-developed in these regions, which is driving the demand for iron and steel products. However, the growth of the market in these regions is expected to be moderate due to saturation in several end-use industries.

Latin America and the Middle East & Africa regions are considered emerging markets for iron and steel, with substantial growth potential. The demand for iron and steel products is being driven by the increasing population, urbanization, and rising construction activities in these regions. However, market growth in these regions is hindered by challenges such as political instability and lack of infrastructure.

The industry growth is anticipated to be fueled by a moderate rise in construction spending and increasing investments in smart cities, which are expected to raise the demand for iron and steel products.

The global iron and steel market encompasses the production and trade of iron and steel goods that are utilized across various industries such as construction, automotive, aerospace, and energy. Iron and steel are essential materials for infrastructure development, transportation, and manufacturing, making the industry crucial for the global economy and providing employment opportunities for millions of people worldwide.

In this highly competitive market, numerous companies operate, with ArcelorMittal, POSCO, Baosteel Group, Nippon Steel & Sumitomo Metal Corporation, and Tata Steel being some of the prominent players. The demand and supply of iron and steel products can fluctuate based on a range of factors, including economic conditions, technological advancements, government policies, and environmental regulations. The industry is also facing challenges related to sustainability and environmental impact as steel production is a significant contributor to greenhouse gas emissions.

The bulk of the iron found in ores is used to make steel, and it is a common metal that is generally found in the form of oxide. The development of effective and innovative technologies, a surge in demand from developing building sectors, a booming automotive industry, and lucrative steel and construction are the main factors driving the expansion of the global steel market. In addition, steel is increasingly being used in new industrial areas, and expanding economies like China and India present new market potential for steel worldwide. The availability of raw materials, the cost of substitute chemicals, the depletion of iron ore mines, and the diminishing grade of ore are all important obstacles for the global steel business.

Iron and steel market is being driven by several factors, which include:

| Report Coverage | Details |

| Market Size in 2024 | USD 1.71 Trillion |

| Market Size by 2034 | USD 2.7 Trillion |

| Growth Rate from 2024 to 2034 | CAGR of 4.7% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Flat products were the largest market share of both iron and steel markets, followed by long products, tube products as well as rolling products during the period 2022 onwards. Flat products are manufactured by rolling and shaping molten steel, which is turned into flat sheets. Flat products are commonly used in the construction of buildings, automobiles, and other industrial applications.

The flat product segment can be further classified into hot-rolled, cold-rolled, and coated products. Long Products are manufactured by shaping molten steel into various forms such as bars, rods, and wires. Long products are commonly used in the construction of buildings, bridges, and other infrastructure. The long product segment can be further classified into reinforcing bars, structural sections, wire rods, and other products.Tubular products, such as pipes and tubes, are used in the construction of buildings, infrastructure, and transportation systems, as well as in the energy industry for the transportation of oil, gas, and other fluids.

In 2023, building and the construction category had the biggest revenue share at 46%, and it is anticipated that this pattern would hold throughout the projection period. Because of increased investments in building activities, the demand for steel is anticipated to rise. For instance, in April 2022, renowned real estate developer Alliance Group declared its intention to invest USD 1,125.8 million in building projects in Chennai, Hyderabad, and Bengaluru.

A typical car comprises around 53% steel, according to the American Iron and Steel Association. Many vehicle components, including chassis, frames, door panels and support beams, are made from this metal. Steel is still preferred in the production of automobile parts due to its durability, strength, and capacity for ongoing recycling, despite the fact that aluminum is often used as a substitute for steel due to its less weight.

Steel is extensively used in heavy industries such as shipbuilding, defense product manufacturing, and oil and gas. The increasing investments in these industries are expected to drive market growth over the forecast period.

As a highly versatile material, steel finds extensive usage across various heavy industries, such as shipbuilding, defense product manufacturing, and oil and gas. It is anticipated that the burgeoning investments in these sectors will drive the growth of the steel market during the projected period. For instance, in February 2022, the German government announced a plan to invest USD 112.0 billion in military equipment manufacturing, with the objective of dedicating over 2% of the country's economic output to the defense sector every year.

Segments Covered in the Report:

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

September 2024

January 2024

January 2025