August 2024

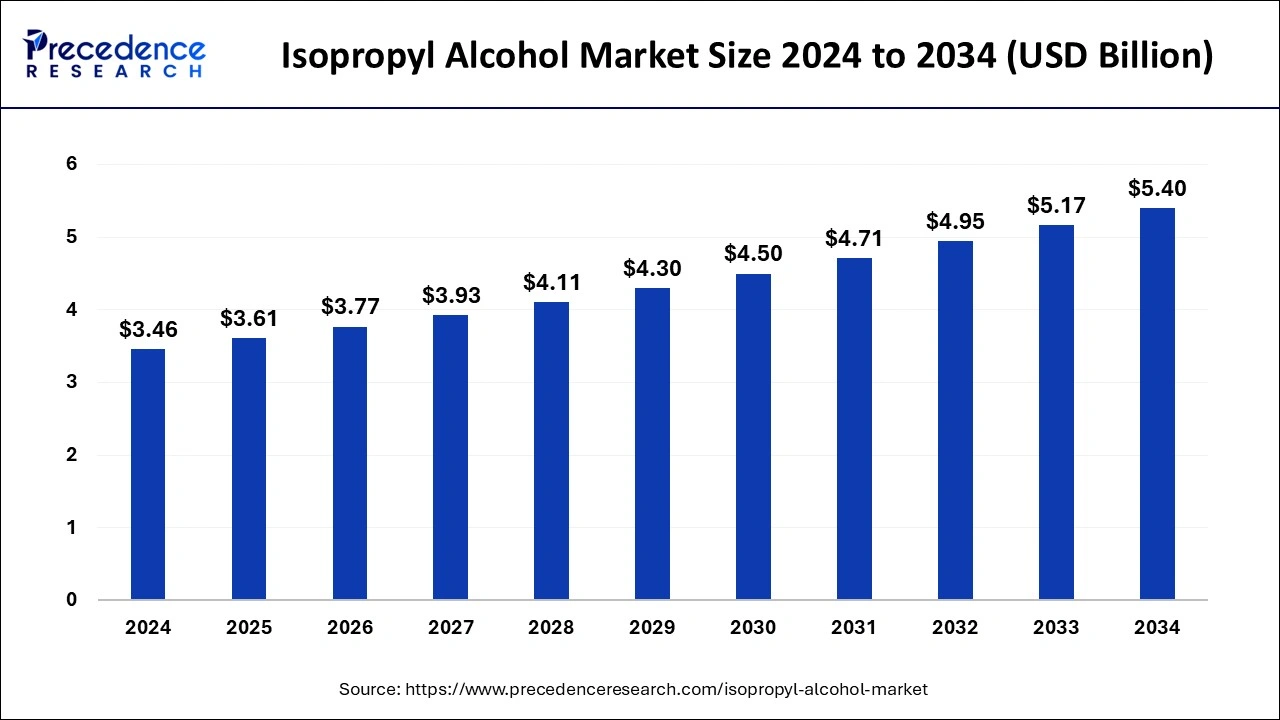

The global isopropyl alcohol market size is accounted at USD 3.61 billion in 2025 and is forecasted to hit around USD 5.40 billion by 2034, representing a CAGR of 4.55% from 2025 to 2034. The Asia Pacific market size was estimated at USD 1.38 billion in 2024 and is expanding at a CAGR of 4.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global isopropyl alcohol market size was calculated at USD 3.46 billion in 2024 and is predicted to increase from USD 3.61 billion in 2025 to approximately USD 5.40 billion by 2034, expanding at a CAGR of 4.55% from 2025 to 2034.

The global isopropyl alcohol (IPA) market is a dynamic and expansive realm, defined by the production and dissemination of isopropyl alcohol, a versatile chemical compound. IPA serves as a pivotal solvent, disinfectant, and intermediary component across multifarious industries. Its intrinsic value is manifest in pharmaceuticals, cosmetics, electronics, and cleaning agents. The marketplace experiences catalytic surges in response to unique catalysts, such as the heightened demand for sanitizing solutions during the COVID-19 pandemic. Within this sphere, leading entities comprise chemical manufacturers and distributors are tirelessly striving to cater to the diverse exigencies of both industrial and consumer segments.

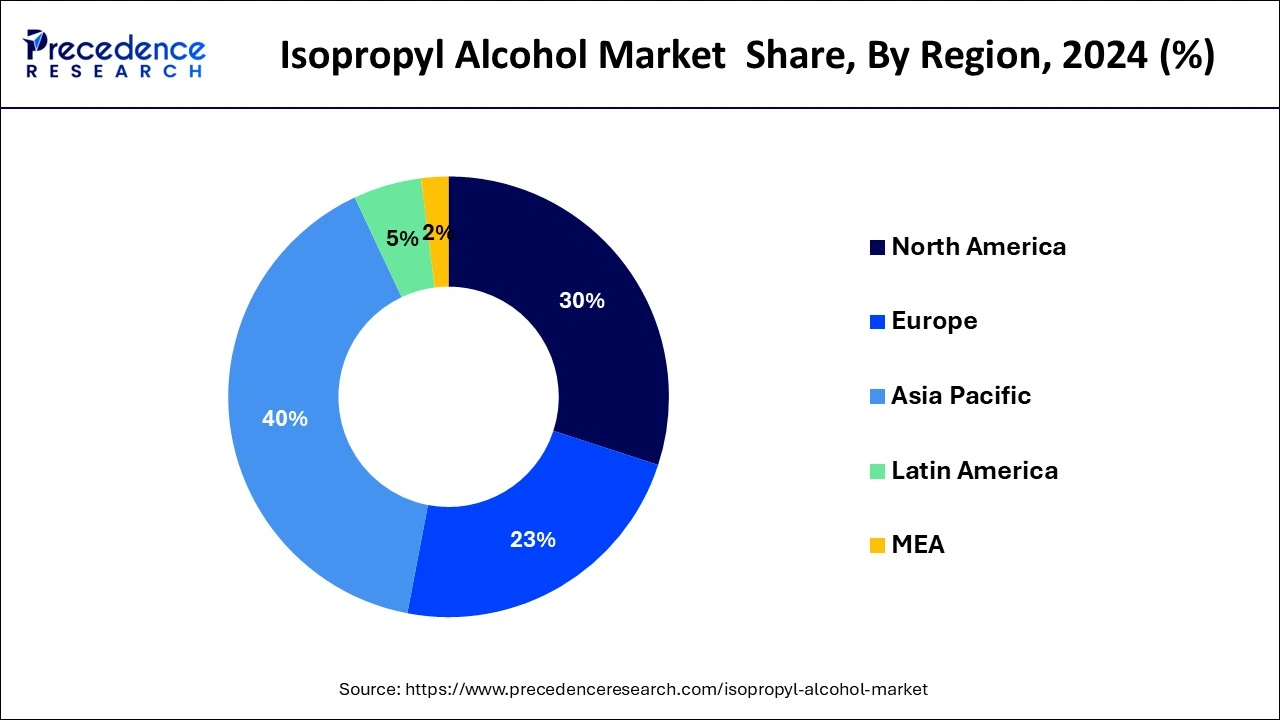

The Asia Pacific isopropyl alcohol market size was evaluated at USD 1.38 billion in 2024 and is projected to be worth around USD 2.19 billion by 2034, growing at a CAGR of 4.73% from 2025 to 2034.

Asia Pacific held the largest revenue share 40% in 2024. Asia-Pacific dominates the isopropyl alcohol (IPA) market due to a combination of factors. The region's robust industrialization, increasing population, and rapid urbanization have driven demand for IPA across various sectors, including electronics, pharmaceuticals, cosmetics, and cleaning products. Additionally, favorable government policies, lower production costs, and the presence of key IPA manufacturers have made Asia-Pacific a major IPA production hub. As a result, the region not only caters to its domestic demand but also exports IPA to other global markets, solidifying its prominent share in the IPA market.

North America is estimated to observe the fastest expansion. North America's dominance in the isopropyl alcohol (IPA) market can be attributed to several factors. The region boasts a robust pharmaceutical and healthcare industry that relies on IPA for various applications. Additionally, the electronics and semiconductor sectors in North America contribute significantly to IPA demand. The awareness of hygiene and sanitization, especially during the COVID-19 pandemic, led to increased IPA consumption in the region. Moreover, a well-established manufacturing base and stringent quality standards have made North America a key IPA producer. This combination of diverse industrial demand and a strong manufacturing base consolidates North America's position as a major player in the global IPA market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.55% |

| Market Size in 2025 | USD 3.61 Billion |

| Market Size by 2034 | USD 5.40 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application and End-user Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Health and hygiene awareness

Elevated health and hygiene consciousness stands as a potent catalyst propelling the expansion of the isopropyl alcohol (IPA) market. The seismic impact of the COVID-19 pandemic has left an indelible imprint on our collective understanding of cleanliness and sanitation. Consequently, the demand for IPA-derived products, notably hand sanitizers and disinfectants, has experienced an extraordinary upsurge. People are now not only more vigilant but also more discerning in recognizing the pivotal role of IPA in upholding hygiene and curtailing the transmission of contagions. This heightened awareness has not merely ignited a momentary spike in IPA demand; it has ignited a sustained fervor.

Even as the pandemic subsides, consumers and businesses have internalized the indispensability of IPA in maintaining pristine environments and stemming the contagion tide. Moreover, IPA has been seamlessly woven into our daily routines, both in private sanctuaries and public arenas, imprinting itself as a societal staple.

Its efficacy in eradicating pathogens has etched it as the quintessential tool for personal and communal hygiene. Thus, the uptick in health and hygiene cognizance has not solely energized market expansion; it has fundamentally reshaped consumer behavior and industry conventions, cementing IPA's status as an enduring necessity in our progressively health-attuned world. The IPA market's horizon continues to gleam with promise as it unwaveringly serves an indispensable role in global health and sanitation.

Supply chain disruptions

Supply chain disruptions present a significant restraint to the isopropyl alcohol (IPA) market's growth. The IPA market is intricately interconnected across global supply chains, and any disruption can have cascading effects. Natural disasters, geopolitical tensions, and transportation issues can disrupt the sourcing of raw materials, production, and distribution of IPA. These disruptions can lead to supply shortages, causing price volatility and instability in the market. Manufacturers may struggle to secure consistent and affordable sources of feedstock, impacting their cost structures and profitability.

Moreover, supply chain interruptions can result in delayed deliveries, affecting customers' production schedules and leading to dissatisfaction and potential shifts to alternative products or suppliers. In a market highly dependent on the timely availability of materials and finished products, such disruptions can hinder growth prospects and lead to uncertainty, making it imperative for industry players to invest in robust supply chain management strategies and contingency plans to mitigate these challenges.

Electronic and semiconductor advancements

Electronic and semiconductor advancements are fostering significant opportunities in the isopropyl alcohol (IPA) market. As technology continues to advance, electronic components are becoming increasingly miniaturized and intricate, demanding a higher level of purity and precision in cleaning processes. IPA, renowned for its effectiveness in removing contaminants from sensitive electronic surfaces, remains a critical solution in these industries.

The demand for high-purity IPA is thus on the rise, driven by the need for flawless manufacturing, reliable circuitry, and impeccable semiconductor production. IPA suppliers have the opportunity to cater to these evolving needs by offering specialized, ultra-high purity IPA formulations and innovative cleaning solutions. Moreover, as emerging technologies like 5G, Internet of Things (IoT), and electric vehicles become more prevalent, the demand for IPA in electronic and semiconductor applications is expected to further expand, presenting a fertile ground for market growth and development.

Impacts of COVID-19

According to the application, the process and preparation solvent segment held a 31% revenue share in 2024. The zirconia segment's substantial market presence can be credited to its prevalence in various structural configurations and its extensive utility across multiple industries. Zirconia manifests in three primary crystal phases – monoclinic, tetragonal, and cubic – each endowed with distinctive attributes suited for a diverse array of industrial domains, encompassing ceramics, electronics, and healthcare.

Its malleability and versatility render it an appealing choice for applications spanning advanced ceramics, dental prosthetics, fuel cells, and electronic components. Given its ability to cater to the diverse requirements of different sectors, zirconia emerges as the favored option, securing a significant portion of the isopropyl alcohol market.

The other segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. The segment commands a significant growth in the isopropyl alcohol market due to the diversity of sources from which isopropyl alcohol is extracted. While zircon, an isopropyl alcohol silicate mineral, represents a substantial portion, other minerals, such as baddeleyite and various industrial by-products, also contribute. This diverse range of sources ensures a stable and robust supply, reducing the market's vulnerability to disruptions from a single source. It provides a degree of flexibility and resilience, making it a pivotal component in meeting the varied and growing demand for isopropyl alcohol across multiple industries and applications.

Based on the end-user industry, cosmetics and personal care segment held the largest market share of 30% in 2024. The cosmetics and personal care sector exert a noteworthy influence on the isopropyl alcohol (IPA) market, primarily attributable to IPA's indispensable utility in these realms. IPA plays a multifaceted role as a versatile constituent in cosmetics and personal care merchandise, functioning as a reliable solvent for fragrances and aiding in formulation intricacies.

It contributes to product stability, improving the overall sensory experience and texture of a diverse array of cosmetic products. Furthermore, IPA's antimicrobial attributes are instrumental in upholding product integrity and ensuring hygiene. In light of the continual advancements within the beauty and personal care industry, the demand for IPA remains steadfast, cementing its prominence as a substantial segment within the broader IPA market landscape.

On the other hand, the other segment is projected to grow at the fastest rate over the projected period. The segment commands a substantial share in the isopropyl alcohol (IPA) market due to its diverse applications across various sectors. IPA's versatility makes it a valuable component in industries not specifically categorized, including printing, agriculture, adhesives, and specialty chemicals. Its use as a solvent, cleaner, and intermediate product serves a broad range of manufacturing and processing needs. This adaptability allows IPA to penetrate markets beyond well-defined sectors, contributing significantly to its overall market share, where specific end-use segments may not individually dominate but collectively establish its strong presence.

By Application

By End-user Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

August 2024