July 2024

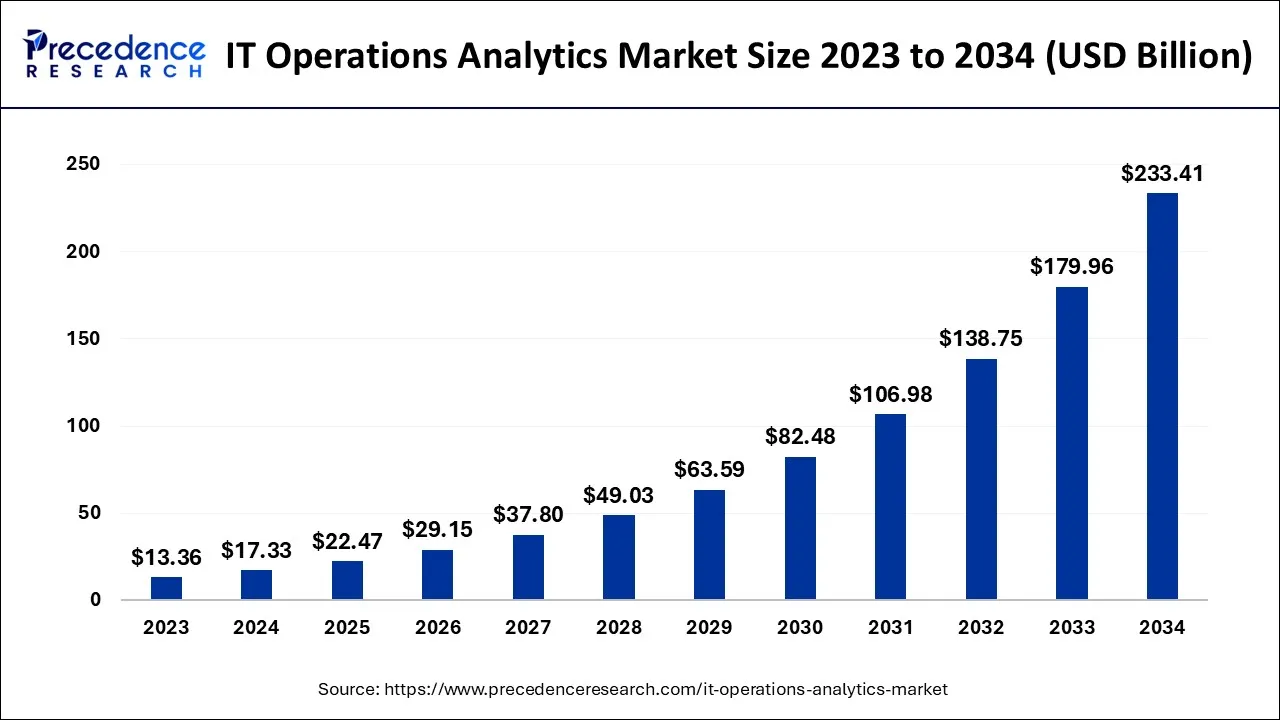

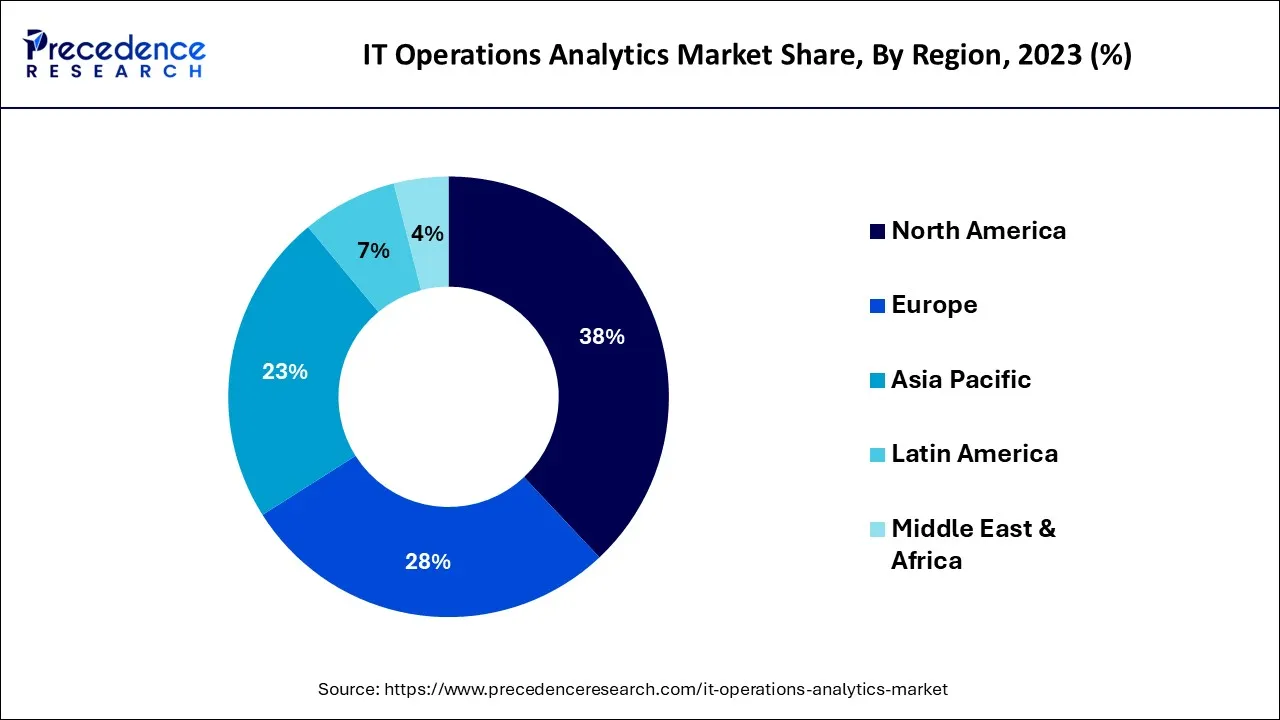

The global IT operations analytics market size is calculated at USD 17.33 billion in 2024, grew to USD 22.47 billion in 2025, and is predicted to hit around USD 233.41 billion by 2034, poised to grow at a CAGR of 29.7% between 2024 and 2034. The North America IT operations analytics market size accounted for USD 6.59 billion in 2024 and is anticipated to grow at the fastest CAGR of 29.87% during the forecast year.

The global IT operations analytics market is expected to be valued at USD 17.33 billion in 2024 and is anticipated to reach around USD 233.41 billion by 2034, expanding at a CAGR of 29.7% over the forecast period from 2024 to 2034.

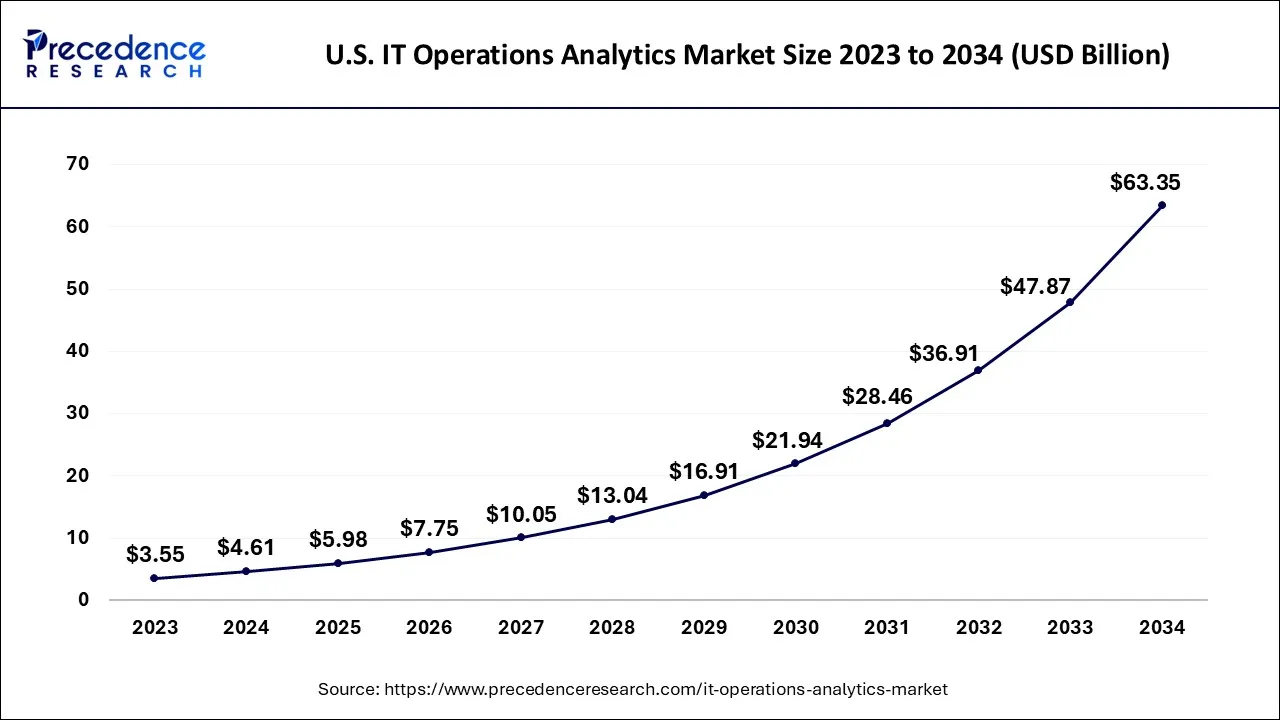

The U.S. IT operations analytics market size is accounted for USD 4.61 billion in 2024 and is projected to be worth around USD 63.35 billion by 2034, poised to grow at a CAGR of 29.96% from 2024 to 2034.

North America dominated the global IT operations analytics market in 2023, the region is observed to sustain its position throughout the forecast period. Companies situated in the United States such as Splunk, Oracle, Microsoft, SAP are the most effective and sophisticated in terms of implementing operational analytics systems. These companies continuously produce massive volumes of data that can be utilized to improve their IT operations. Companies in the region are often early adopters of new technologies. The willingness to take calculated risks and embrace novel solutions gives them an advantage in terms of experience and expertise in implementing and optimizing ITOA solutions. These factors are likely to support the growth of the market in the region.

Asia Pacific is expected to grow at the fastest rate during the forecast period. Countries like China, India, and Japan are witnessing rapid digital change across various industries. As a result, the generation of IT data in diverse organizations has increased dramatically.

The region is also witnessing significant growth in the construction of data centers to meet the increased demand for digital services and cloud-based applications. Data centers are vital hubs for data management and processing, making them excellent applications for ITOA solutions. Businesses in this area are striving to establish and maintain modern IT infrastructures in response to the increased acceptance of digital technologies and the rise in internet penetration. This involves bringing their networks, server systems, and cloud environments up to date.

IT operations analytics market refers to the industry that manages the processing of data, analyzing it and interpreting the same which is generated by an organization’s IT infrastructure and applications. The market encompasses various software solutions, tools and technologies designed to monitor and optimize IT systems and services. These tools help businesses detect issues, predict potential problems and make informed decisions to ensure smooth IT operations and better overall performance. The market has been growing since organizations seek multiple ways to enhance their IT management processes.

The IT operations analytics (ITOA) market has grown significantly as a result of many major factors, including increasing business use of ITOA solutions and services to decrease operating costs and improve infrastructure. Organizations are looking for effective solutions to monitor and manage their operations as contemporary IT systems become more sophisticated. ITOA solutions give useful insights into system performance, detect possible obstacles, and fix issues proactively, resulting in better operational efficiency and cost savings.

IT operations analytics solution enables organizations to make data-driven choices, optimize resource utilization, and minimize downtime by employing sophisticated analytics and machine learning, resulting in improved overall infrastructure performance. Also, artificial intelligence (AI) and machine learning (ML) technologies have revolutionized the analytics environment. AI and ML algorithms are used in IT Operations analytics to automate anomaly detection, predictive maintenance, and other vital operations. This capacity improves operational efficiency, lowers downtime, and enables proactive problem-solving, propelling IT Operations analytics' long-term market development.

| Report Coverage | Details |

| Market Size in 2024 | USD 17.33 Billion |

| Market Size by 2034 | USD 233.41 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 29.7% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Deployment, By End-use, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The massive expansion of IT operations

Due to the industry's fast change and the complexity of IT infrastructures, a tremendous amount of operational data is produced every day. This data contains insightful information that businesses can use to improve performance, streamline processes, and optimize their IT systems. Finding the underlying causes of IT system performance issues promptly is one of the main benefits of IT operations analytics (ITOA) solutions.

Traditional methods of troubleshooting and issue-solving required a lot of physical labor and were frequently time-consuming. Organizations analyze operational data more flexibly and affordably with ITOA solutions, which enables them to see problems early and take timely action. The user experience is improved, system downtime is reduced, and overall system performance is increased due to this proactive approach to problem-solving. Additionally, ITOA solutions give businesses the ability to analyze substantial volumes of operational data gleaned from various applications and IT infrastructure parts.

Organizations get a comprehensive understanding of their IT operations, spot trends, spot abnormalities, and make data-driven choices by integrating data from diverse sources. This thorough study aids in capacity planning, infrastructure management, and resource allocation optimization. The benefit of using ITOA solutions is further increased by real-time analytical capabilities. Organizations quickly spot potential problems, analyze operational data in real-time, and obtain rapid insights into system performance. Thereby, the massive expansion of IT operations across the industry is observed to act as a driver for the market.

Complex nature of IT infrastructure

The complexity of IT infrastructure poses a restraint for the IT operations analytics market because it makes data collection, integration and analysis more challenging. The intricate network of hardware, software and various components creates difficulties in identifying relevant data sources and establishing consistent data flows. Complexity can lead to incomplete or inaccurate insights, making it harder for detecting issues, optimizing performance and making informed decisions. Organizations mat hesitate to invest in analytics solutions that struggle to effectively handle the intricacies of their IT environments.

Growing demand from businesses for comprehensive 360-degree visibility

The growing demand for comprehensive 360-degree visibility from multiple businesses presents a significant opportunity for the market to grow. Traditional domain-centric monitoring systems offer insightful information in a limited number of areas, but they frequently fall short of delivering a connected end-to-end picture across IT domains.

Due to this restriction, there is a gap in monitoring and resolving infrastructure problems that affect many domains, which might cause inefficiencies and disruptions. IT operations analytics solutions provide a significant chance to close the gap and give organizations all-encompassing visibility and analytical capabilities. Such solutions give organizations a comprehensive perspective of their IT environment by combining data from many sources and domains, revealing correlations and relationships that conventional tools can overlook.

Additionally, ITOA solutions make it easier for various teams and domains to collaborate and synchronize their operations. The collaborative nature of ITOA enables IT teams to collaborate easily and use their combined knowledge and experience to effectively tackle challenging problems. Another big possibility provided by ITOA solutions is real-time analysis. Organizations can spot abnormalities and possible problems as they arise by monitoring operational data in real time, enabling proactive response. By lowering the mean time to resolution (MTTR), reducing downtime, and improving operational efficiency, this feature helps. Organizations might maintain a high degree of service availability and responsiveness by having the capacity to detect and fix issues in real time.

On the basis of types, the root cause analytics segment held the largest share in 2023, the segment is expected to remain attractive throughout the forecast period. The root cause analytics targets smooth operations, making it an important component of IT management. By identifying the root cause of problems, organizations can efficiently address issues and reduce downtime. The segment allocates resources effectively while addressing operational issues.

On the other hand, the predictive analytics segment is expected to witness significant growth during the forecast period. By analyzing historical data and patterns, predictive analytics can forecast system failures, network downtime and performance bottlenecks. This proactive approach reduces downtime, enhances operational efficiency and minimizes costs, making it a crucial tool for maintaining IT infrastructure and delivering seamless services.

On the basis of deployment, the cloud segment held the largest share in 2023 and is expected to continue this trend throughout the forecast period. Cloud solutions offer easy and effective access to resources, enabling businesses to quickly scale their operational levels.

Moreover, cloud-based deployment is attractive to organizations looking to analyze and manage IT operations efficiently while staying agile in the rapidly changing technological landscape. In addition, the scalability and flexibility offered by cloud-based deployment supplement the segment’s growth.

On the basis of end-use, the BFSI segment dominated the market in 2023, the segment is observed to sustain its position during the forecast period. The industry heavily relies on technology for seamless operations, data security and fraud detection. Whereas IT operations analytics services help banking, financial services and insurance institutions to monitor and analyze complex IT infrastructure in real-time, ensuring efficient operations.

In addition, the sector of BFSI has a complex or critical nature while considering transactions and data management. The continuous demand for managing such complexities in the sector can be fulfilled by IT operations, analytics services and solutions. As banks and other financial institutions focus on mitigating the risks in operations, the integration of IT operations analytics services is observed to grow.

On the basis of applications, the asset performance management segment held the largest revenue share in 2023. Due to the rising need for digital solutions to monitor asset performance and decrease operating expenditures in organizations, the application of analytics in asset performance management has seen substantial expansion in numerous industries. The asset performance management application enhances operational efficiency, reduces downtime and lowers maintenance costs.

The segment’s dominance is driven by industries including energy and utilities where maintaining the data about assets and their performance is crucial. Asset performance management has the capability to prevent failures and optimize asset lifecycle aligns well with the goals of IT operations analytics. Thereby, the segment is observed to continue to grow throughout the forecast period.

Segments Covered in the Report

By Type

By Deployment

By End-use

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

November 2024

November 2024

November 2024