January 2025

The global IVD contract manufacturing market size was USD 17.19 billion in 2023, calculated at USD 19.17 billion in 2024 and is projected to surpass around USD 56.94 billion by 2034, expanding at a CAGR of 11.5% from 2024 to 2034.

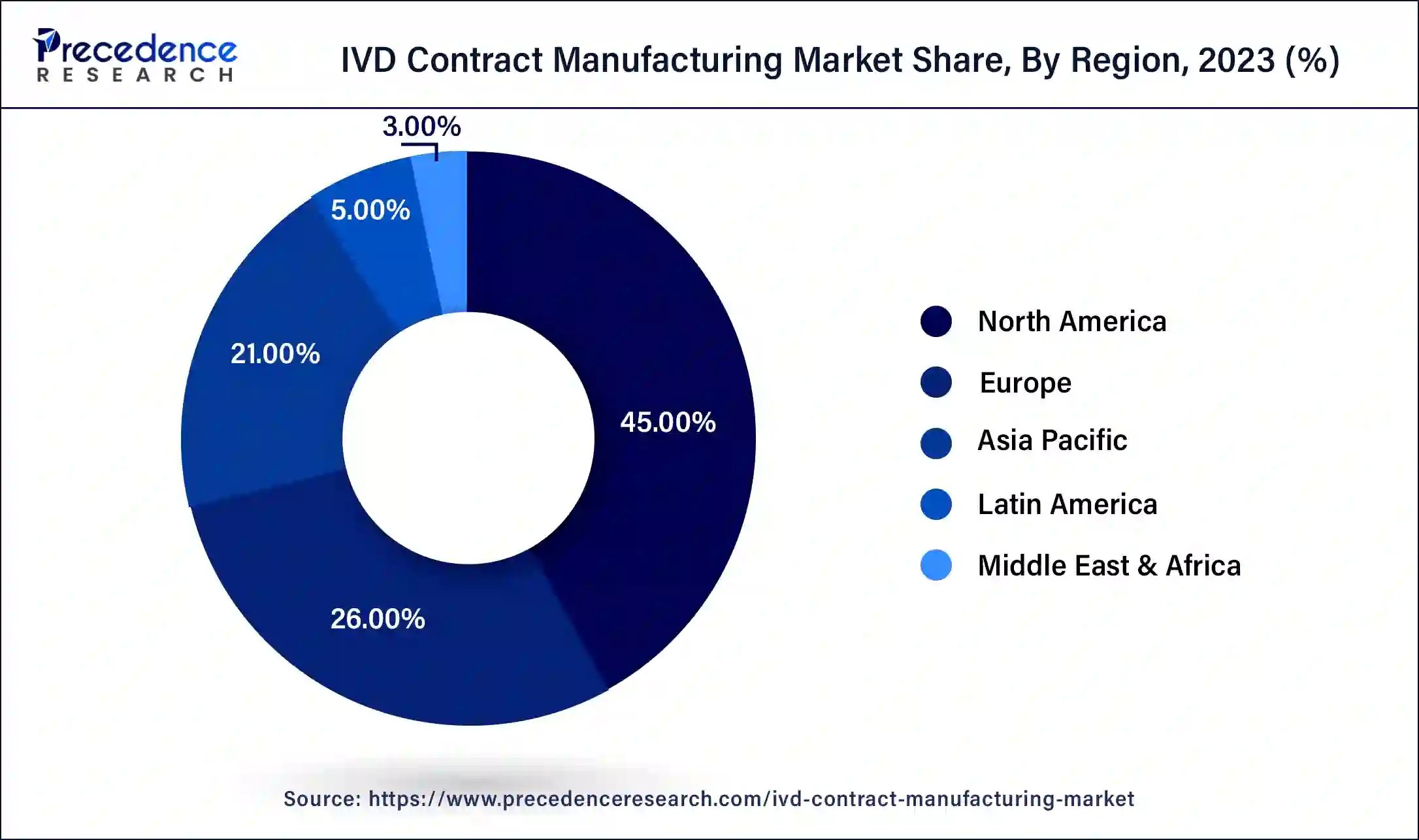

The global IVD contract manufacturing market size accounted for USD 19.17 billion in 2024 and is expected to be worth around USD 56.94 billion by 2034, at a CAGR of 11.5% from 2024 to 2034. The North America IVD contract manufacturing market size reached USD 7.74 billion in 2023.

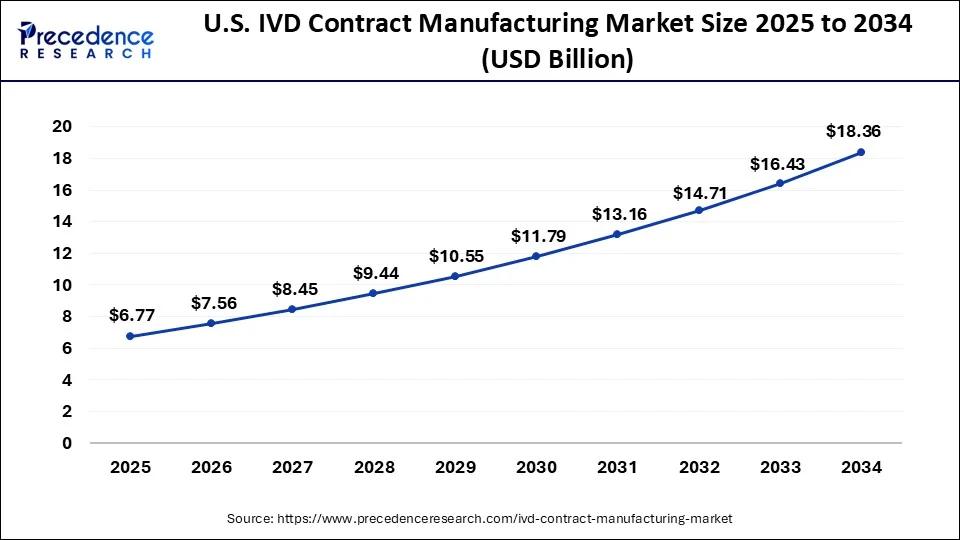

The U.S. IVD contract manufacturing market size was estimated at USD 5.43 billion in 2023 and is predicted to be worth around USD 18.36 billion by 2034, at a CAGR of 11.7% from 2024 to 2034.

North America has held the largest revenue share of 45% in 2023. North America dominates the in vitro diagnostics (IVD) contract manufacturing market owing to its strong healthcare infrastructure, high incidence of chronic diseases, and significant investments in research and development. The region's favorable regulatory environment, the presence of major industry players, and a focus on technological advancements also contribute to its leading position. With an increasing demand for personalized medicine and innovative diagnostics, North America stands out as a key player in driving growth and advancements in the IVD contract manufacturing.

| Parameter | 2023 Data (North America) |

| Chronic Disease Prevalence | 60% of adults have one or more chronic diseases |

| R&D Investment in Diagnostics | $2.5 billion invested in diagnostics research |

| Personalized Medicine Adoption | 35% of diagnostics involve personalized medicine |

| FDA IVD Product Approvals | 120+ new IVD products approved in 2023 |

| Leading Chronic Diseases | Diagnosed Cardiovascular diseases, diabetes, and cancer |

| Technological Advancements in IVD | Significant advancements in AI-driven diagnostic tools |

| Key IVD Manufacturers in the Region | Thermo Fisher Scientific, Roche Diagnostics, Abbott |

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the in vitro diagnostics (IVD) contract manufacturing market due to several factors. The region's thriving healthcare industry, increasing demand for diagnostic solutions, and a rapidly growing population contribute to market dominance. Moreover, Asia-Pacific offers cost-effective manufacturing capabilities, attracting global IVD companies seeking efficient production. The presence of skilled labor, technological advancements, and supportive government initiatives further enhance the region's prominence in the IVD contract manufacturing sector, solidifying its position as a key hub for manufacturing and innovation in the diagnostic industry.

In vitro diagnostics (IVD) contract manufacturing is a strategic business arrangement where companies in the healthcare sector outsource the production of diagnostic testing materials and equipment to specialized third-party manufacturers. This collaboration allows IVD companies to streamline their operations, minimize production costs, and leverage the expertise of external manufacturing partners. Contract manufacturers in the IVD space are equipped with the necessary facilities and knowledge to produce a diverse range of diagnostic products, including reagents, assay kits, and diagnostic instruments.

The IVD contract manufacturing model enables companies to focus on core aspects like research, development, and market strategies, while leaving the intricacies of manufacturing to proficient partners. This approach not only enhances efficiency but also accelerates the delivery of innovative diagnostic technologies to the market. In a rapidly evolving healthcare landscape, IVD contract manufacturing plays a pivotal role in ensuring the availability of high-quality and timely diagnostic solutions, contributing significantly to disease detection, monitoring, and effective patient care.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 11.5% |

| Market Size in 2023 | USD 17.19 Billion |

| Market Size in 2024 | USD 19.17 Billion |

| Market Size by 2034 | USD 56.94 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Device Type, By Technology, and By Service Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Outsourcing efficiency and technological convergence

Outsourcing efficiency and technological convergence are pivotal factors propelling the demand for in vitro diagnostics (IVD) contract manufacturing services. In an era of rapid technological advancements, IVD companies increasingly outsource manufacturing processes to specialized partners, aiming to optimize operational efficiency and reduce costs. Contract manufacturers bring expertise and streamlined production capabilities, allowing IVD firms to focus on innovation and market strategies. This collaborative outsourcing model not only ensures cost-effectiveness but also accelerates the development and delivery of cutting-edge diagnostic technologies to the market.

Technological convergence, where various technologies integrate seamlessly, plays a crucial role in driving demand for IVD contract manufacturing. As diagnostics and technologies like artificial intelligence converge, specialized manufacturing expertise becomes essential. Contract manufacturers adept at navigating this convergence can efficiently produce advanced diagnostic tools, meeting the evolving demands of the healthcare industry for accurate, efficient, and technologically integrated in vitro diagnostic solutions.

Intellectual property concerns and customization complexities

Intellectual property concerns and customization complexities pose significant restraints on the in vitro diagnostics (IVD) contract manufacturing market. The collaboration between IVD companies and contract manufacturers involves the exchange of proprietary information and technologies, raising challenges in protecting intellectual property. Concerns over data security and the potential for unauthorized use of innovative diagnostic solutions may hinder open collaboration, impacting the willingness of IVD companies to engage in outsourcing partnerships.

Moreover, customization complexities present a dual challenge for IVD contract manufacturers. While there is a growing demand for personalized diagnostic solutions, the intricacies of customization can lead to increased production times and costs. Striking the right balance between standardized and tailored products is essential, as excessive customization can impede manufacturing efficiency and make it challenging for contract manufacturers to meet diverse market demands. These dual challenges of intellectual property protection and customization intricacies contribute to the complexities faced by IVD contract manufacturers, influencing market demand and shaping the landscape of collaborative relationships in the industry.

Expansion of Point-of-Care testing and partnerships for research

The expansion of point-of-care testing (POCT) and partnerships for research are instrumental in creating lucrative opportunities in the in vitro diagnostics (IVD) contract manufacturing market. The increasing adoption of POCT, driven by the demand for rapid and decentralized diagnostic solutions, opens avenues for contract manufacturers to specialize in the production of portable and efficient testing devices. Contract manufacturers can leverage their expertise to support IVD companies in developing and manufacturing POCT devices, meeting the growing need for accessible and real-time diagnostics in various healthcare settings.

Additionally, strategic partnerships for research with institutions and universities empower IVD contract manufacturers to stay at the forefront of scientific advancements. By collaborating on research projects, contract manufacturers can contribute to the development of novel diagnostic products, gaining access to cutting-edge technologies and expanding their portfolio. These partnerships not only enhance innovation but also position contract manufacturers as key players in driving advancements that address evolving healthcare challenges and market demands.

In 2023, the IVD consumables segment held the highest market share of 68% based on the device type. In the in vitro diagnostics (IVD) contract manufacturing market, the IVD consumables segment encompasses a range of disposable products crucial for diagnostic testing, including reagents, assay kits, and disposable laboratory tools. Trends in this segment involve a growing demand for customized consumables tailored to specific diagnostic applications, as well as an increased focus on eco-friendly and sustainable manufacturing practices. Contract manufacturers are adapting to these trends by offering flexible and sustainable solutions to IVD companies, meeting the evolving needs of the diagnostic industry.

The IVD equipment segment is anticipated to expand at a significant CAGR of 13.5% during the projected period. In the in vitro diagnostics (IVD) contract manufacturing market, the IVD equipment segment encompasses a range of diagnostic devices, including analyzers, readers, and laboratory instruments used in clinical testing. A notable trend in this segment is the increasing demand for compact, portable, and connected diagnostic equipment. Contract manufacturers are focusing on developing and producing technologically advanced IVD equipment, aligning with the industry's move towards point-of-care testing and digital integration. This trend addresses the need for rapid, efficient, and interconnected diagnostic solutions in healthcare settings worldwide.

According to the technology, the immunoassay segment has held a 35% revenue share in 2023. In the in vitro diagnostics (IVD) contract manufacturing market, the Immunoassay segment focuses on the detection and measurement of specific molecules using immune system components. This includes tests for proteins, hormones, and antibodies, offering crucial insights into various medical conditions. A trend in IVD contract manufacturing for Immunoassays involves heightened demand for multiplexed assays, allowing simultaneous analysis of multiple analytes.

The molecular diagnostics segment is anticipated to expand fastest over the projected period. As reported by the National Cancer Institute in 2023, the molecular diagnostics market is projected to reach $19.5 billion by 2026, driven by advancements in personalized medicine. Molecular diagnostics in the In Vitro Diagnostics (IVD) contract manufacturing market involves the detection of specific nucleic acids, proteins, or other molecular markers to diagnose diseases. In this segment, trends include a growing emphasis on personalized medicine, with increased demand for custom assay development.

A study conducted by the Personalized Medicine Coalition in 2022 found that 75% of surveyed healthcare providers support the integration of molecular diagnostics into clinical practice, highlighting its critical role in modern healthcare. Advancements in nucleic acid-based technologies, such as PCR and next-generation sequencing, drive innovation. IVD contract manufacturers are capitalizing on these trends by offering specialized expertise in molecular diagnostic assay production, meeting the demand for precise and tailored diagnostic solutions in healthcare.

According to the service type, the assay development segment held a 45% revenue share in 2023.

The National Institutes of Health (NIH) reported a 20% increase in funding for custom assay development projects in 2022, reflecting the growing emphasis on precision medicine and biomarker discovery. A survey conducted by the Association for Molecular Pathology in 2023 indicated that 78% of laboratories are now seeking custom assay solutions to enhance diagnostic accuracy. IVD contract manufacturers are leveraging their expertise to meet this demand, offering specialized assay development services to enhance diagnostic accuracy and precision.

The manufacturing services segment is anticipated to expand fastest over the projected period. According to the U.S. Food and Drug Administration (FDA), the adoption of automated manufacturing processes in the IVD sector increased by 25% in 2023, driven by the need for efficiency and scalability. In the in vitro diagnostics (IVD) contract manufacturing market, the manufacturing services development segment involves the creation and optimization of production processes for diagnostic products. This includes enhancing manufacturing efficiency, ensuring regulatory compliance, and integrating advanced technologies. Current trends in this segment focus on the adoption of automation, rapid prototyping, and flexible manufacturing approaches to meet the demand for customized and innovative IVD solutions. The U.S. Department of Health and Human Services (HHS) projects that investments in flexible manufacturing technologies grow by 30% by 2024, further supporting the shift towards tailored IVD solutions. As IVD companies seek streamlined and cost-effective manufacturing, service providers in this segment play a vital role in driving efficiency and product quality in the IVD contract manufacturing landscape.

Segments Covered in the Report

By Device Type

By Technology

By Service Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024

August 2024