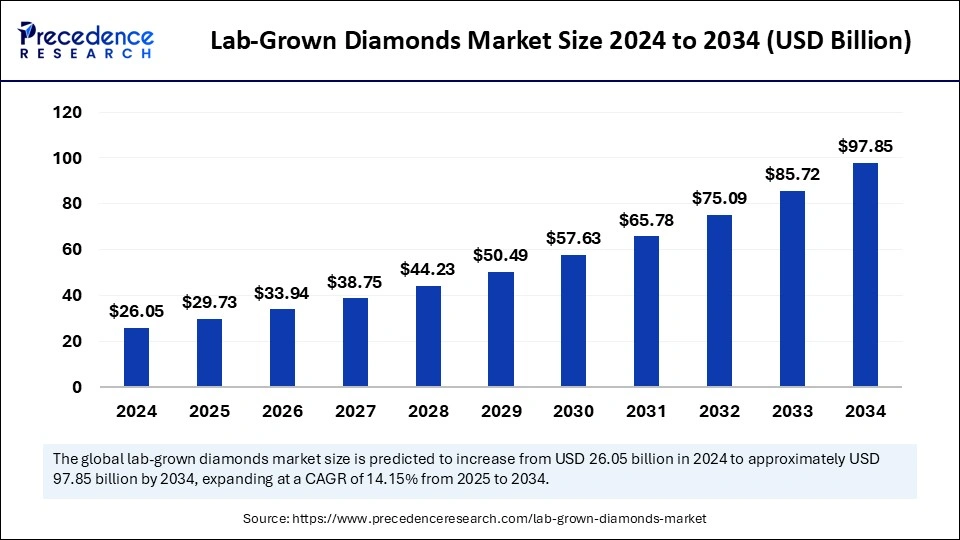

The global lab-grown diamonds market size is recorded at USD 29.73 billion in 2025 and is forecasted to reach around USD 97.85 billion by 2034, accelerating at a CAGR of 14.15% from 2025 to 2034. The Asia Pacific market size surpassed USD 8.86 billion in 2024 and is expanding at a CAGR of 14.31% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lab-grown diamonds market size was estimated at USD 26.05 billion in 2024 and is predicted to increase from USD 29.73 billion in 2025 to approximately USD 97.85 billion by 2034, expanding at a CAGR of 14.15% from 2025 to 2034. The market is driven by the rising preference for sustainable, affordable options, and consumers, particularly millennials and Gen Z, are increasingly choosing eco-friendly alternatives to natural diamonds.

Developing sophisticated Artificial Intelligence algorithms to assess and enhance the production process of lab-grown diamonds increases the precision, uniformity, and efficiency of quality evaluation, especially in detecting subtle traits and grading in the lab-grown diamonds market, while reducing human error. AI technology works to enhance both manufacturing techniques and diamond value analysis for cultured diamonds, thus making them clearer and more honest to the end market. The AI-based diamond quality assessments within the lab-produced diamond market enable improved rapid assessment of diamond characteristics, including cut, clarity, color, and weight.

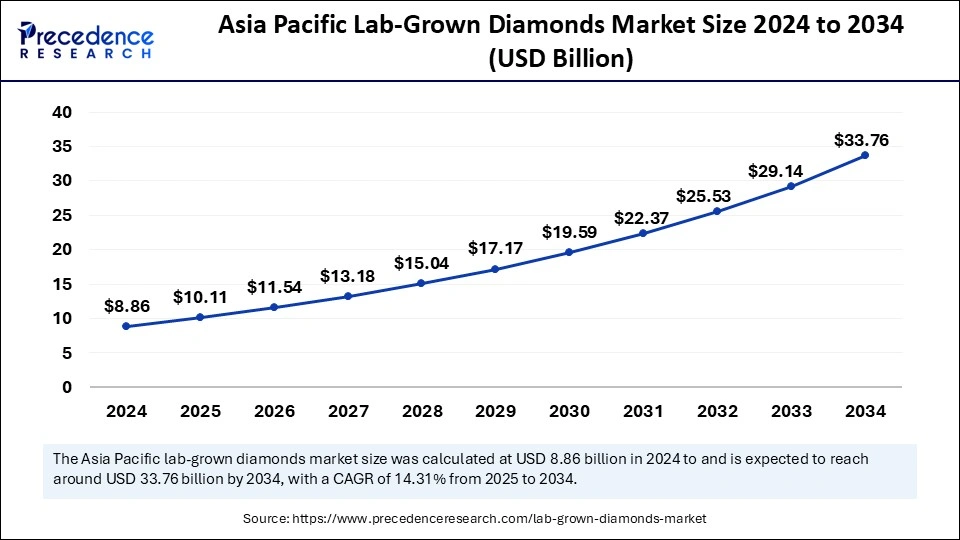

The Asia Pacific lab-grown diamonds market size was evaluated at USD 8.86 billion in 2024 and is projected to be worth around USD 33.76 billion by 2034, growing at a CAGR of 14.31% from 2025 to 2034.

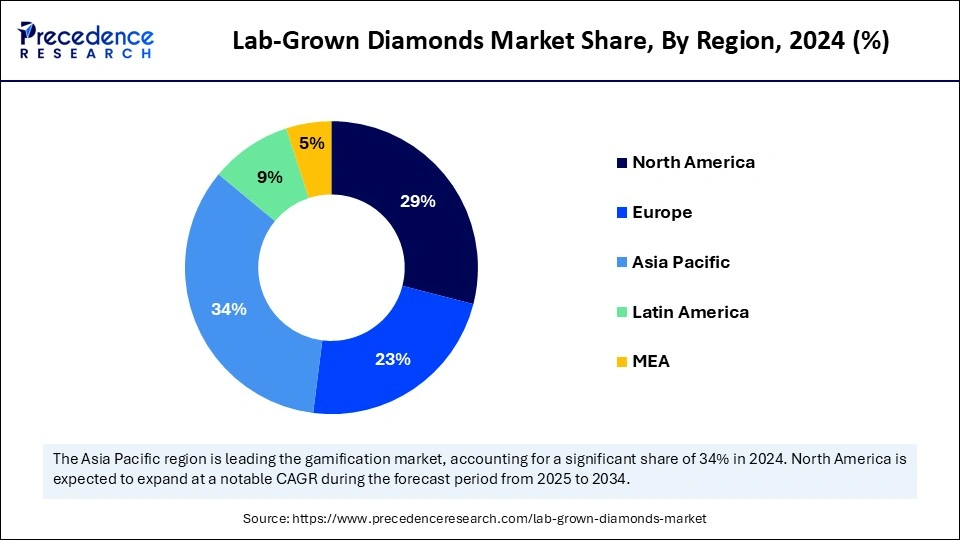

Asia Pacific accounted for the largest share of the lab-grown diamonds market in 2024. India holds great potential to become a major international hub for producing manufactured diamonds, and China currently leads in producing and exporting these stones. The high manufacturing output of quality laboratory-grown diamonds in different carat sizes and forms occurs throughout China and India. Public programs aimed at developing new products help drive market expansion, while the rapid growth of middle-class populations creates rising demand for affordable luxury items, including man-made diamonds. Consumers prefer lab-grown diamonds because these stones reflect ethical values and sustainability, with the growing social and environmental awareness.

North America will witness the fastest growth in the lab-grown diamonds market during the forecasted years. The commercial sectors of automotive and electronics show rapid development in North America, while consumer demand for eco-friendly jewelry and greater awareness about laboratory-made diamonds push forward demand. The rising disposable income of U.S. and Canadian consumers allows for better purchasing ability, which drives the acceptance of lab-grown diamonds as investments.

The market receives support through expanding online sales channels and existing retail networks, enabling consumers to access lab-grown diamonds easily. The market attractiveness in North America rises from positive marketing initiatives and partnerships established between luxury brands. Market expansion in the region will receive additional momentum through advancements in diamond production methods and increasing retail collaboration.

Europe

The lab-grown diamond market in Europe accounted for a significant share in 2024, owing to the consumer’s inclination towards ethical and sustainable choices for jewelry. In the past decades, lab-grown diamonds have witnessed immense popularity due to their structure, which is similar to natural diamonds at a lower cost. In the region, the European Union has approved a grant of USD 84 million. The aim behind investing such a whopping amount is to support a diamond foundry’s establishment facility in Spain.

Lab-grown diamonds, also known as artificial diamonds, are produced in a lab. They achieve high quality in just a few months, whereas natural diamonds take many years to form. The increasing use of these diamonds in jewelry, research, cutting tools, and machinery parts drives significant growth. Additionally, lab-grown diamonds are more affordable than natural ones since they eliminate the need for mining, and their greater availability boosts their acceptance worldwide.

The lab-grown diamonds market consists of diamond production and manufacturing in laboratory settings. The market supports customer areas, which include jewelry, fashion, and industrial operations. The industry develops at a fast pace due to rising sustainable products, ethical standards, lower costs, and better diamond synthesis technologies. Lab-grown diamonds will experience sustained market growth because the number of environmentally conscious and socially responsible customers is increasing. With their affordability, ethical appeal, and potential for innovative design, lab-grown diamonds are poised to reshape the future of fashion.

| Report Coverage | Details |

| Market Size by 2034 | USD 97.85 Billion |

| Market Size in 2025 | USD 29.73 Billion |

| Market Size in 2024 | USD 26.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Manufacturing Method, Nature, Size, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising industrial applications

The market expands because various industries utilize laboratory-diamond products for cutting tools, machinery elements, semiconductor devices, and abrasives because of their special features. The essential characteristics of hardness and strength enable the product to serve as an adopted material for polishing, drilling, cutting, and grinding operations across multiple industries, including automotive. The thermal conductivity capability of man-made diamonds facilitates their addition to electronic devices such as diode lamps and computers because of their effectiveness as heat spreaders. The worldwide growth of the lab-grown diamonds market increases as more industries expand, including electronics, automotive, and semiconductors.

Rising demand globally

The worldwide demand for the lab-grown diamonds market has been steadily rising, thus boosting sales numbers. The range of jewelry products includes rings, earrings, bracelets, and necklaces, and these diamonds are used to meet the requirements of customers. Middle-income shoppers should consider this affordable product to enhance their jewelry selections, as its cost is less than that of natural and mined diamond jewelry alternatives. Furthermore, the rising need for reasonably priced and high-quality jewelry, particularly among women, will aid in the global market expansion in the coming years.

Alternative products and quality concerns

The lab-grown diamonds market encounters significant challenges from competing products, such as natural diamonds and easily sourced gemstones like emeralds, sapphires, garnets, amethysts, and peridots. Consumer interest in these alternatives is increasing, as they offer many attractive features, including remarkable beauty and superior quality with lasting durability. Sales of lab-grown diamonds have declined due to consumer concerns about their color and durability. These perceived quality issues lead potential buyers to view lab-grown diamonds as inferior to alternatives, making them hesitant to buy. Additionally, the market's growth is hindered by a lack of awareness surrounding artificial diamonds.

Sustainability trends

The worldwide sustainability movement forces more people to choose the lab-grown diamonds market. Lab-grown diamonds bypass the need for mining operations because their production does not damage forests and neither produces air contamination nor creates greenhouse gases. The increasing awareness of sustainability practices among millennial and Gen Z generations drives the market demand toward sustainably sourced ethical diamonds. The combination of environmental concerns and ethical problems related to conflict diamonds with ethical issues spurs consumers to choose laboratory-grown diamonds instead of traditional ones.

The CVD segment contributed the largest share of the lab-grown diamonds market in 2024. CVD has become the manufacturers' preferred option for producing lab-grown diamonds since it consumes less energy while performing operations at a faster pace than HPHT technology. The CVD method represents a modern production technique for creating lab diamonds that results in high-quality products with minimal flaws. This manufacturing technique grants the producer’s enhanced ability to supervise the growth process execution. The chemical vapor deposition segment leads and grows fastest in the global lab-grown diamond market due to its low production expenses and rising market interest for manmade diamonds, small equipment designs, and enhanced CVD techniques for precise diamond chemical composition management.

The HPHT segment is expected to show considerable growth over the forecast period. The diamond production system under HPHT better matches natural/mined diamond manufacturing techniques with enhanced quality features for clarity grading and color quality. Laboratory-made HPHT diamonds provide consumers with better affordability than natural diamond prices. HPHT technology serves as a process to modify diamond colors. The industrial sector takes advantage of High-Pressure, high-temperature (HPHT) diamonds since these stones serve essential applications that require maximum hardness and durability.

The colorless segment dominated the global lab-grown diamonds market in 2024. The demand for colorless diamonds from lab production continues to rise because they contain high quality and receive better grading assessments. Various uses of these diamonds across cutting tools, electronics, and jewelry production drive their increasing market demand. The market shows an increasing preference for diamonds that deliver aesthetic characteristics identical to natural stones with the ethical qualities of man-made diamonds. There exists widespread demand for colorless lab-made diamonds to design wedding and engagement rings. Jewellery manufacturers employ this diamond type to produce nose pins, bracelets, necklaces, and pendants. Among diamond varieties, colorless forms represent the most premium category when they are created in a laboratory.

The colored segment is anticipated to witness significant growth in the studied period. The preference for lab-grown colored diamonds in jewelry applications grows due to their attractive appearance. The relatively lower prices of colored lab diamonds will boost product sales throughout the upcoming years. These are preferred diamonds for fashion and manufacturing needs because they offer production controls to achieve multiple colors. The colorless and colored diamond properties make them useful in industries for identification coding and technical applications, which depend on their specific color characteristics.

The below 2-carat segment contributed the largest lab-grown diamonds market share in 2024. This growth was driven by a rising consumer preference for eco-friendly alternatives to natural diamonds. Furthermore, the growing trend of below 2-carat diamonds in engagement rings, earrings, and everyday jewelry has elevated demand. With affordability, ethical sourcing, and sustainability becoming essential purchasing considerations, lab-grown diamonds have gained considerable popularity, particularly among millennials and Gen Z. This trend is projected to persist, reinforcing the segment’s dominance in the market.

The above 4-carat segment is expected to show considerable growth over the forecast period. Using advanced technology in a lab setting produces the man-made diamonds known as Lab-grown diamonds. They share identical characteristics where both optical properties, chemical structure, and physical makeup compare exactly to natural diamonds. Consumer disposable income growth across nations with an expanding market for premium jewelry products helps this segment expand because of rising demand.

The fashion segment led the global lab-grown diamonds market in 2024. The fashion industry embraces laboratory-made diamonds, which are genuine diamonds produced through laboratory cultivation. The rising demand for sustainable fashion will lead to the incorporation of lab-grown diamonds into different fashion accessories, which will drive widespread adoption and expand market growth. The jewelry industry uses small lab diamonds to create jewelry items, and the fashion world embeds them in high-end watches, handbags, eyeglasses, and sunglasses frames. Many luxury brands and retailers offer lab-grown diamond collections, which contributes to rising market demand, particularly for distinctive high-quality jewelry products. Lab-grown diamonds will experience growing market potential since consumers keep choosing sustainable fashion items.

The industry segment is anticipated to witness significant growth over the studied period. The outstanding performance characteristics make lab-grown diamonds suitable for industrial applications such as electronics, optics, and cutting tools. The market for semiconductor production and medical device applications uses lab-grown diamonds more frequently. Manufacturers and suppliers can access an expanding market opportunity because technological innovation maintains its momentum in industrial applications of lab-grown diamonds.

By Manufacturing Method

By Nature

By Size

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client