January 2025

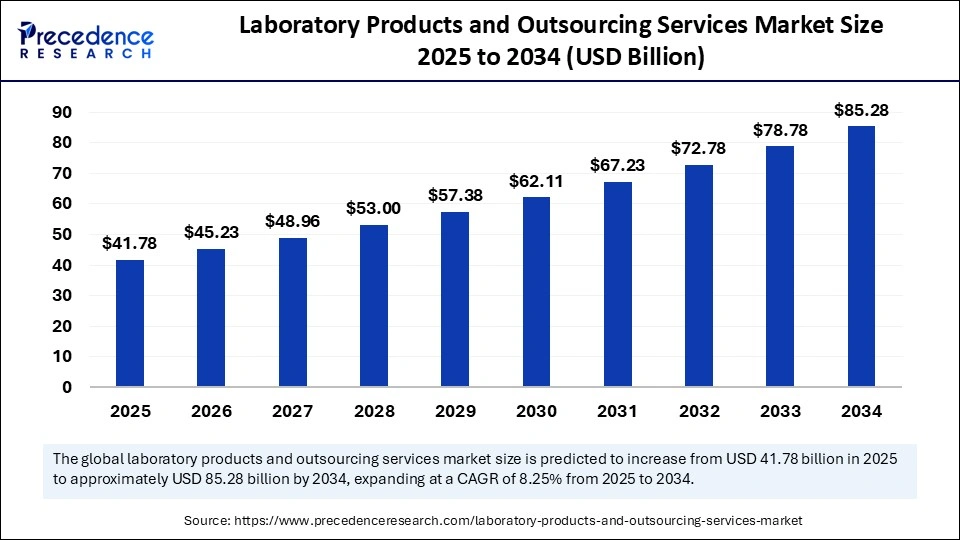

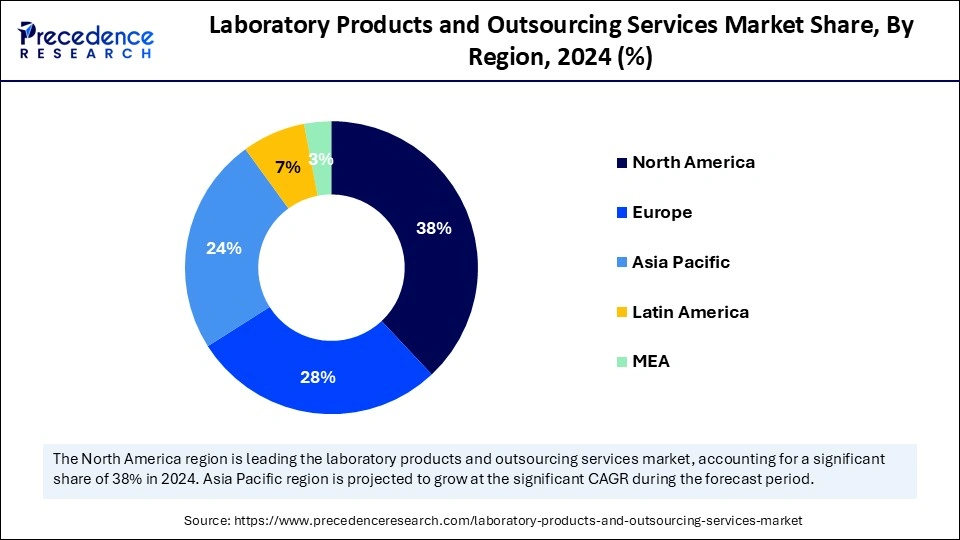

The global laboratory products and outsourcing services market size is calculated at USD 41.78 billion in 2025 and is forecasted to reach around USD 85.28 billion by 2034, accelerating at a CAGR of 8.25% from 2025 to 2034. The North America market size surpassed USD 14.67 billion in 2024 and is expanding at a CAGR of 8.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global laboratory products and outsourcing services market size accounted for USD 38.6 billion in 2024 and is predicted to increase from USD 41.78 billion in 2025 to approximately USD 85.28 billion by 2034, expanding at a CAGR of 8.25% from 2025 to 2034. The rising occurrence of intricate diseases and the need for improved diagnostics are fueling expansion in the market. The increasing use of personalized medicine, non-invasive technologies, and outsourcing for cost-effectiveness and regulatory adherence also drives market growth.

Artificial intelligence is transforming the laboratory products and outsourcing services market by improving efficiency and precision via automation and data evaluation. It enhances the handling of extensive datasets, increases reproducibility, and reduces human mistakes. Important uses involve automated data evaluation, forecasting models, and robotics integration, which enhance workflows such as sample management and assay processing. AI enhances the analysis of experimental results, shortens turnaround times, and optimizes resource use, especially in drug discovery and clinical trials, thereby boosting overall productivity.

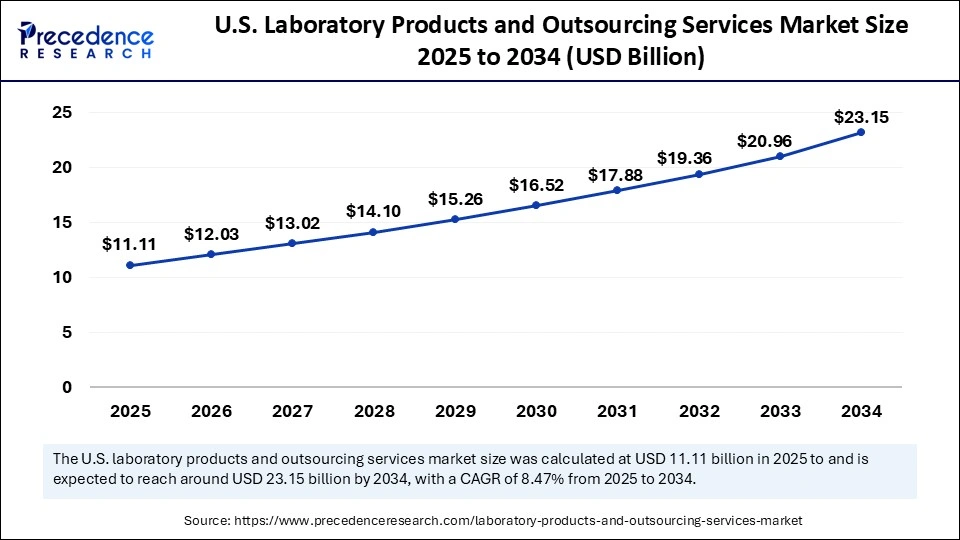

The U.S. Laboratory Products and Outsourcing Services market size was exhibited at USD 10.27 billion in 2024 and is projected to be worth around USD 23.15 billion by 2034, growing at a CAGR of 8.47% from 2025 to 2034.

How North America Stays Ahead in the Market

North America dominated the laboratory products and outsourcing services market in 2024, because of its strong healthcare infrastructure, substantial investment in Research and Development, and prominent presence of top pharmaceutical and biotechnology firms. The sophisticated technological environment, strict regulatory standards, and superior quality benchmarks of the area enhance its market leadership. The U.S. represents a significant share of this market, bolstered by its established pharmaceutical sector and favorable regulatory landscape. The sophisticated healthcare system, substantial number of clinical trials, and stringent regulatory standards of the region guarantee high-quality and dependable laboratory operations, motivating companies to outsource services to fulfill compliance obligations.

The U.S. Laboratory Products and Outsourcing Services Market Trends

The laboratory products and outsourcing services market is led by the U.S., due to its sophisticated healthcare system, substantial clinical trial activity, robust biotech and pharmaceutical sectors, considerable government backing, and favorable regulatory conditions. The U.S. boasts advanced healthcare facilities and research institutions, fostering innovation and increasing the demand for laboratory products and services. Key companies such as Pfizer, Merck, and Moderna significantly invest in research and development, frequently outsourcing their laboratory operations. The FDA implements strict quality and safety regulations, requiring companies to partner with specialized service providers.

Cost-Effectiveness and Talent Propel Growth in Asia Pacific

The Asia Pacific region is anticipated to grow at the fastest rate in the market during the forecast period. The region has experienced considerable progress in the pharmaceutical and biotechnology industries, driven by heightened R&D funding, an increasing array of clinical trials, and a surge in the need for specialized laboratory services.

The reduced operational and labor expenses in nations such as China and India render it appealing for outsourcing laboratory services, enabling firms to minimize costs while maintaining quality. Government programs and a talented workforce in the science and technology sectors also enhance the strengths of the region in biotechnology and pharmaceutical research.

Japan: Enhancing Precision Medicine through Innovative Advancements

Japan is becoming a crucial participant in the laboratory products and outsourcing services market due to its sophisticated healthcare infrastructure, robust governmental backing for research and development, and an emphasis on precision medicine. Due to a significant occurrence of chronic illnesses and an elderly demographic, there has been a rise in the need for creative treatments and diagnostic technologies. Regulatory framework and governmental efforts of Japan, such as the Society 5.0 initiative, enhance its market standing.

Government Funding Drives Pharmaceutical Growth in China

China is witnessing swift expansion in the market due to its expanding pharmaceutical and biotechnology industries, governmental funding in healthcare and research, along with projects such as the Made in China 2025 initiative. The affordable workforce and regulatory changes of the nation, including the National Medical Products Administration, position it as a favored location for clinical trials and laboratory outsourcing. The rising emphasis on personalized medicine and an expanding middle-class demographic pursuing improved healthcare additionally bolsters its market leadership.

Regulatory Excellence Positions Europe as the Market Champion

Europe plays an important role in the laboratory products and outsourcing services market because of its robust healthcare infrastructure, adherence to regulations, and emphasis on research. The cooperative atmosphere among stakeholders, such as government agencies, educational organizations, and private enterprises of the region, promotes progress in laboratory technologies and services. The market is anticipated to expand because of rising healthcare investments and a greater need for diagnostic services. The European Medicines Agency upholds rigorous quality standards, fostering a need for sophisticated laboratory services. Emphasis of Europe on tailored medicine and sustainable chemistry aligns with international trends, positioning it as a key participant in the market.

The market for laboratory products and outsourcing services consists of external organizations that offer crucial services and products for research, development, and testing, particularly in the fields of healthcare and biotechnology. This market has grown because of the rising intricacy of research and a need for affordable options.

This market encompasses a diverse array of products and services utilized in various sectors, such as pharmaceuticals, healthcare, and academics, focused on improving efficiency, cost-effectiveness, and specialization. Market services involve delegating tasks such as clinical trials and testing to specialized firms, enabling organizations to concentrate on primary activities while leveraging external expertise.

| Report Coverage | Details |

| Market Size by 2034 | USD 85.28 Billion |

| Market Size in 2025 | USD 41.78 Billion |

| Market Size in 2024 | USD 38.6 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.25% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Need for cost-efficiency and operational adaptability

The laboratory products and outsourcing services market is propelled by cost-effectiveness and operational adaptability, enabling organizations to enhance resource utilization, minimize capital expenditures, and adjust to market fluctuations. Outsourcing tasks such as analytical testing, clinical trials, and regulatory compliance reduces operational expenses, speeds up procedures such as drug development, and enables companies to concentrate on their primary strengths.

Data breaches and the loss of intellectual property

A major restraint in the laboratory products and outsourcing services market is the potential for data breaches and the loss of intellectual property. As companies outsource, they provide sensitive information to external service providers, which raises concerns regarding cybersecurity. Sending sensitive information is frequently necessary, putting organizations at risk of cyberattacks. A report from the U.S. Department of Homeland Security showed that almost 60% of organizations experienced cybersecurity incidents connected to outsourcing in the previous year.

Adoption of personalized medicine and companion diagnostics

The laboratory products and outsourcing services market is experiencing an increase in the adoption of personalized medicine and companion diagnostics. This trend is driven by advancements in genomics and biotechnology, requiring laboratory services to facilitate the creation and application of personalized therapies, ensuring accurate treatment targeting according to the unique genetic composition of an individual.

The products segment dominated the laboratory products and outsourcing services market with the largest share in 2024, addressing various laboratory requirements that necessitate specialized equipment, consumables, reagents, and software solutions. This segmentation enables businesses to customize their products to address needs in areas such as clinical diagnostics, drug discovery, and environmental testing. The rising demand for specialized equipment in areas such as biotechnology, clinical diagnostics, and pharmaceuticals is fueling the expansion of the market.

The services segment is expected to witness the fastest rate of growth during the predicted timeframe, because of the rising intricacy of drug development procedures and rigorous regulatory standards. Pharmaceutical firms encounter difficulties in introducing new medications, as around ninety percent of drug candidates fail in clinical trials. The increased demand for specialized knowledge in bioanalytical testing services, encompassing sub-categories such as Absorption, Distribution, Metabolism and Excretion (ADME), Pharmacokinetics (PK), Pharmacodynamics (PD), bioavailability and bioequivalence testing, is fueling expansion in the service segment. The intricacies of drug development, stringent regulatory requirements, and elevated drug failure rates fuel the market, underscoring the demand for careful testing services to reduce risks linked to drug development.

The molecular diagnostics segment held a dominant presence in the market in 2024 because of its vital importance in the early detection, diagnosis, and monitoring of diseases, particularly for infectious diseases and cancers. Improvements in molecular diagnostic technologies such as PCR, DNA sequencing, and next-generation sequencing have resulted in precise and swift outcomes, crucial for effective management and treatment approaches for patients. The increasing need for personalized medicine requires accurate diagnostic tools to determine individual genetic profiles, thereby boosting the use of molecular diagnostics. The worldwide increase in infectious diseases has intensified the demand for swift and dependable diagnostic techniques, positioning molecular diagnostics as an essential component of the market.

The immunoassays category is projected to expand rapidly in the laboratory products and outsourcing services market in the coming years, because immunoassays utilize antibodies to identify specific antigens, making them essential for diagnosing diseases such as cancer, cardiovascular issues, and infections. Advancements in immunoassay technologies, including chemiluminescent immunoassays (CLIA), enzyme-linked immunosorbent assays (ELISA), and multiplex assays, have enhanced efficiency and decreased turnaround times in clinical environments. The growing incidence of chronic and infectious illnesses, improvements in laboratory automation, and partnerships among firms have enhanced the functionalities and scope of immunoassay technologies.

The medical device segment dominated the laboratory products and outsourcing services market with the highest share in 2024 due to rising demand and technological progress. These firms encounter strict regulatory demands that necessitate high-quality standards and safety measures. Outsourcing services offer specialized skills and advanced technologies without large internal expenditures, allowing businesses to effectively achieve these standards. This strategic method optimizes operations and facilitates quicker market entry for new devices, aiding in the leadership of the market in the medical device companies.

The pharmaceutical and biotech companies’ segment is projected to grow with the fastest CAGR in the market during the forecast period, as they concentrate on research and development to create and introduce new treatments to the market. The timeline for developing these products is sped up by outsourcing services, enabling companies to utilize advanced technologies and skilled experts without the significant expenses linked to sustaining internal resources. This strategic method enables them to focus on essential strengths while speeding up the process of developing new medications.

By Type

By Technology

By End-Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

January 2025