January 2025

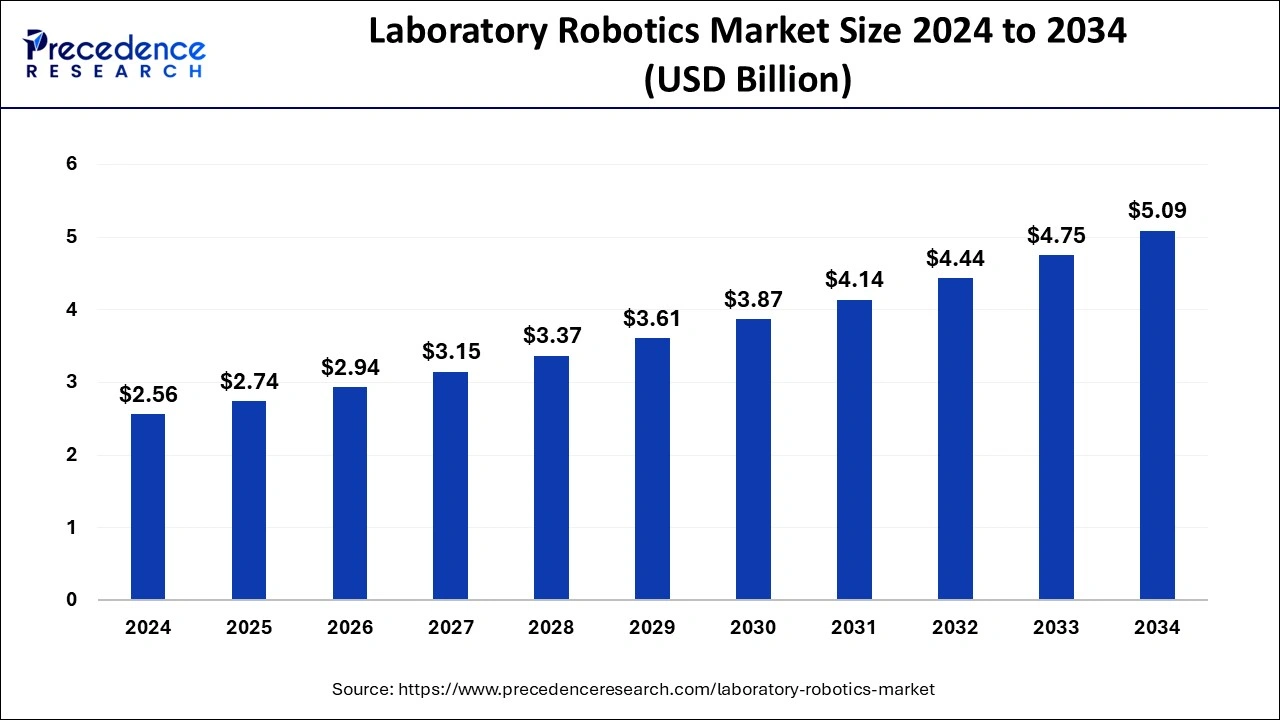

The global laboratory robotics market size is calculated at USD 2.74 billion in 2025 and is forecasted to reach around USD 5.09 billion by 2034, accelerating at a solid CAGR of 7.12% from 2025 to 2034. The North America market size surpassed USD 1.04 billion in 2024 and is expanding at a CAGR of 7.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global laboratory robotics market size accounted for USD 2.56 billion in 2024 and is expected to exceed around USD 5.09 billion by 2034, growing at a CAGR of 7.12% from 2025 to 2034. The growing demand for efficient laboratory operations is the key factor driving the laboratory robotics market growth. Also, the increasing adoption of robotic systems in the medical industry coupled with the advancements In technology can fuel market growth further.

Artificial intelligence is revolutionizing the laboratory robotics market by facilitating automation. AI algorithms can process and interpret large sets of data at a rapid pace. This ability is useful in tasks like predictive modeling, data mining, and pattern recognition. Furthermore, AI can learn each task from zero, continuously enhancing its performance over time. The capability of AI to learn and adapt makes it a powerful tool for lab automation.

In November 2024, Tata Elxsi, a global leader in design and technology services, collaborated with DENSO Robotics Europe and AAtek to inaugurate the 'Robotics and Automation Innovation Lab' at Tata Elxsi's Frankfurt office. The newly opened lab aims to transform robotics automation across multiple sectors, including medical devices, pharmaceuticals, life sciences, and food science.

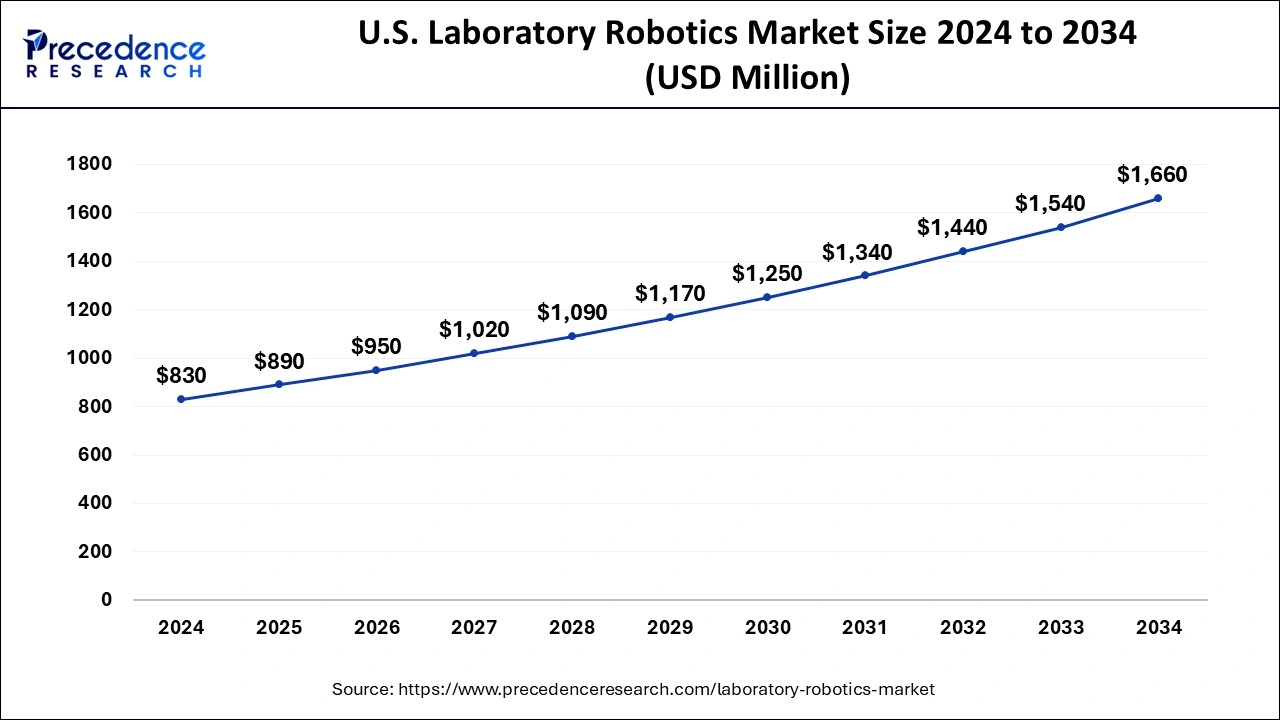

The U.S. laboratory robotics market size was exhibited at USD 830 million in 2024 and is projected to be worth around USD 1,660 million by 2034, growing at a CAGR of 7.17% from 2025 to 2034.

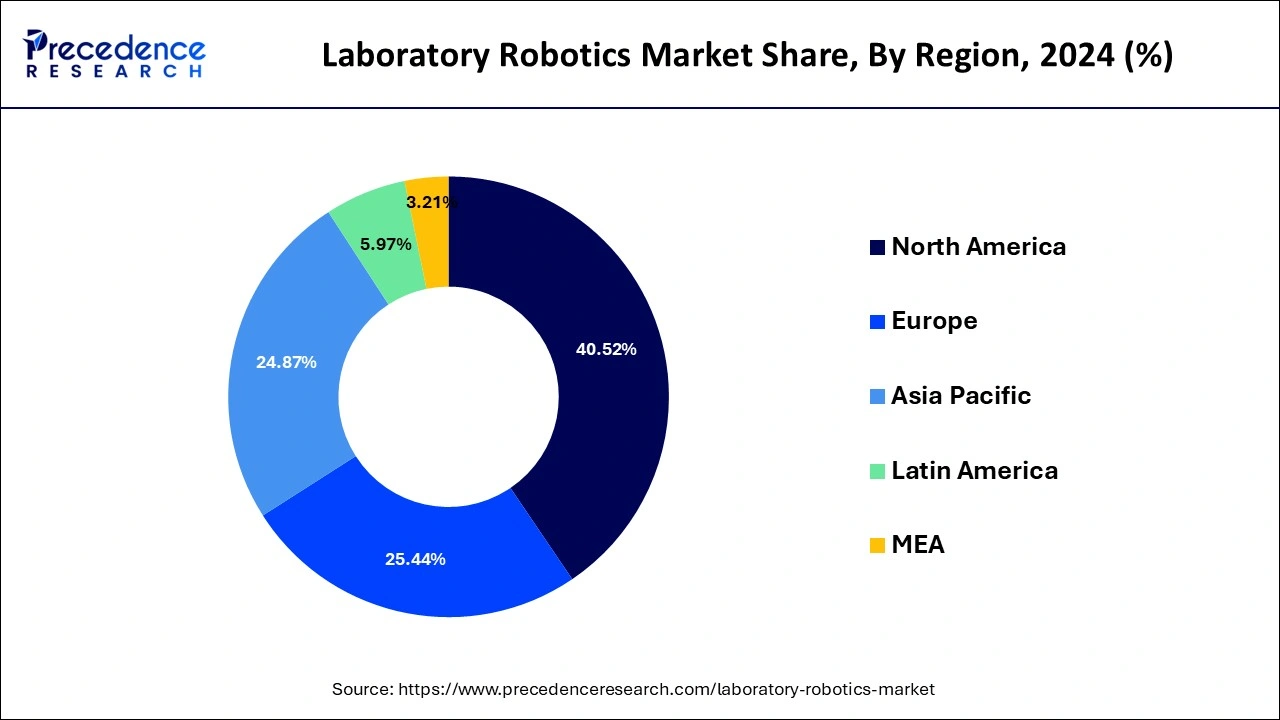

North America dominated the laboratory robotics market in 2024. The dominance of the region can be attributed to the rising need for automation in laboratories coupled with the technological advancements in the field. Moreover, the ongoing expansion of pharmaceutical, healthcare, and biotechnology companies in the region is also propelling the rapid adoption of laboratory robotics in the region. In North America, the U.S. led the market owing to the easy acceptance of innovative technologies in the country.

Asia Pacific will witness substantial growth in the laboratory robotics market during the studied period. The growth of the region can be credited to the increasing funding and investment in advanced technologies. The region is also dealing with surging demands for advanced robotic technology from a number of stakeholders, such as doctors. Furthermore, In the region, China led the market due to technological developments in robotics technology.

Laboratory robotics is an automation process in which there is greater use of instruments to perform lab processes, which limits the human input. The laboratory automation process enhances the overall precision of lab results and also improves the workflow effectively. Automation enables skilled people to place more emphasis on complex activities in the laboratory robotics market. This system consists of many parts, such as robotics, conveyor systems, hardware and software, and machine vision.

| Report Coverage | Details |

| Market Size by 2024 | USD 2.56 Billion |

| Market Size in 2025 | USD 2.74 Billion |

| Market Size in 2034 | USD 5.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for high-throughput screening process

The pharma industry across the globe is witnessing high pressure to manufacture new drugs because of an increasing number of chronic disorders that lack the proper treatment, which in turn results in a throughput screening process. Furthermore, the increasing trend for individualized therapies is also increasing the need for the laboratory robotics market for HTS.

Slow adoption of laboratory robotics among SMSL

The adoption of the laboratory robotics market is slow, particularly in small and medium-sized laboratories (SMLs). Many labs emphasize the use of total laboratory automation, which sometimes leads to failure at the primary stages. Moreover, the cost of implementing robotics in the laboratory is very high for hospitals and SMLs.

Increasing adoption of robotics in healthcare education

Educational institutes globally are focusing on launching advanced robotics systems in healthcare education to optimize the growth of the laboratory robotics market and to ensure the proper penetration of these innovations in the healthcare industry. Furthermore, many pharmaceutical, healthcare, and biotechnology organizations across the globe depend more on automation to fulfill daily tasks such as mixing, pipetting, and sorting to improve the efficient workflow in the laboratory.

The lab automation workstations segment dominated the laboratory robotics market in 2024. This dominance can be attributed to the rising demand for optimized laboratory processes due to the increasing requirement for efficiency and higher throughput. Furthermore, developments in robotics technology, including enhanced flexibility and accuracy, are expanding the abilities of automated workstations, leading to further segment growth.

The automated plate handlers segment is expected to grow at the fastest rate in the laboratory robotics market over the forecast period. The growth of the segment can be credited to the technological advancements that led to the development of versatile and efficient plate handling systems which has the ability to handle many types of plates with accuracy and speed. Also, the integration of innovative features like vision systems, robotic arms, and sophisticated software can contribute to segment expansion in the upcoming years.

The drug discovery segment led the global laboratory robotics market in 2024. The dominance of the segment can be linked to the rising demand for advanced drugs to treat many diseases, propelling wide R&D efforts in biotechnology & pharmaceutical companies. However, innovations in technology, including machine learning and artificial intelligence, are transforming drug discovery by enabling virtual screening and predictive modeling.

The clinical diagnosis segment is anticipated to grow at the fastest rate in the laboratory robotics market during the forecast period. This growth can be driven by a rising focus on personalized healthcare and precision medicine. Also, there is an increasing need for precise and effective diagnostic solutions. Laboratory robotics plays an essential role in automating many diagnostic processes, such as sampling, testing, and assessment, enhancing the overall operational efficiency of the process.

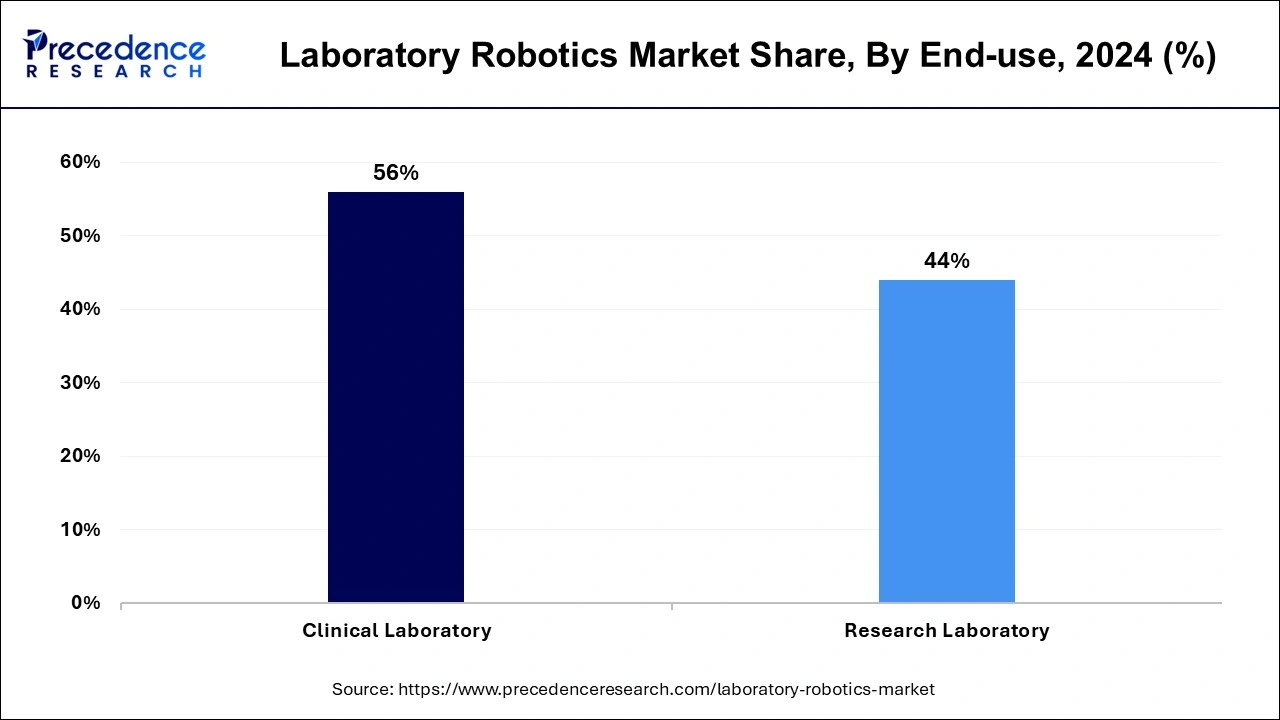

In 2024, the clinical laboratory segment dominated the laboratory robotics market by holding the largest market share. The dominance of the segment can be driven by developments in clinical research along with government support. Rising funding for medical infrastructure and new research initiatives are boosting the growth of laboratory robotic systems. Furthermore, these systems improve precision, automate repetitive tasks, and enhance workflow efficiency in laboratories.

The research laboratory segment is estimated to grow at the fastest pace in the laboratory robotics market during the projected period. The growth of the segment is due to technological advancements and raised investments in research and development. In addition, research laboratories are investing largely in automation to improve accuracy, productivity, and high throughout the process. The increasing demand for reproducibility in experiments is enabling labs to include innovative robotic systems.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

January 2025