August 2024

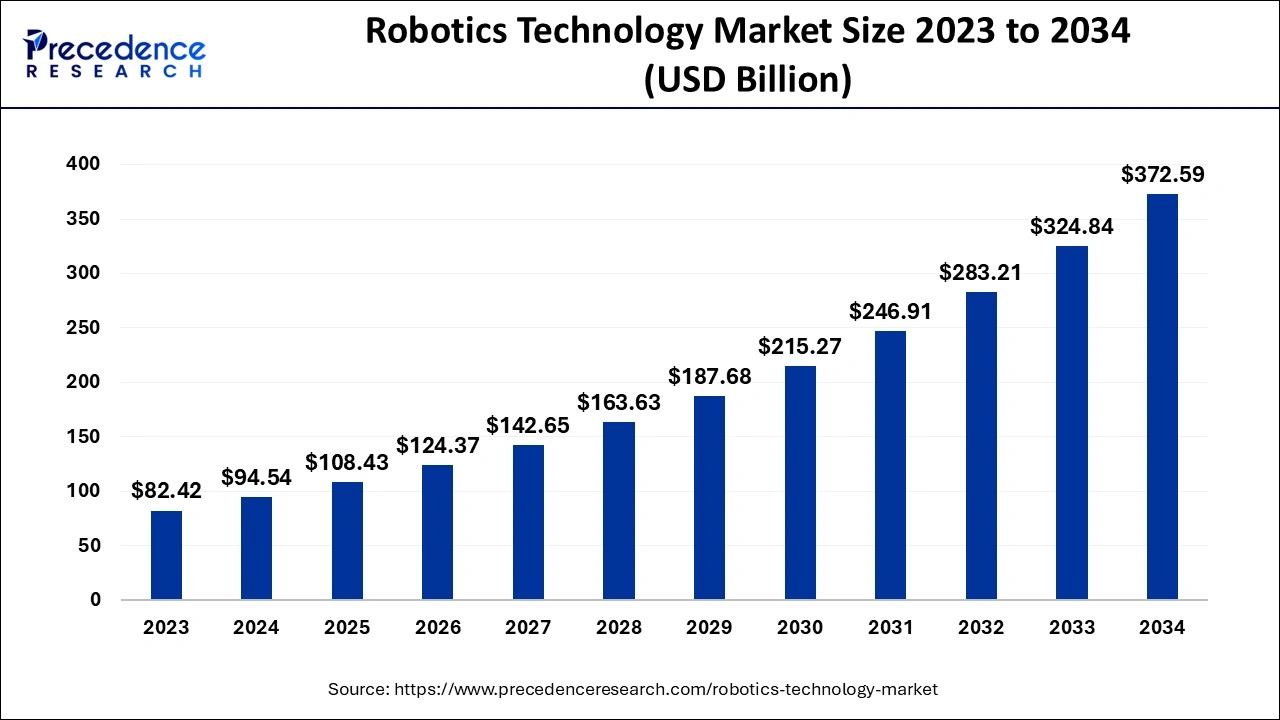

The global robotics technology market size accounted for USD 94.54 billion in 2024, grew to USD 108.43 billion in 2025 and is predicted to surpass around USD 372.59 billion by 2034, representing a healthy CAGR of 14.70% between 2024 and 2034.

The global robotics technology market size is estimated at USD 94.54 billion in 2024 and is anticipated to reach around USD 372.59 billion by 2034, expanding at a CAGR of 14.70% from 2024 to 2034.

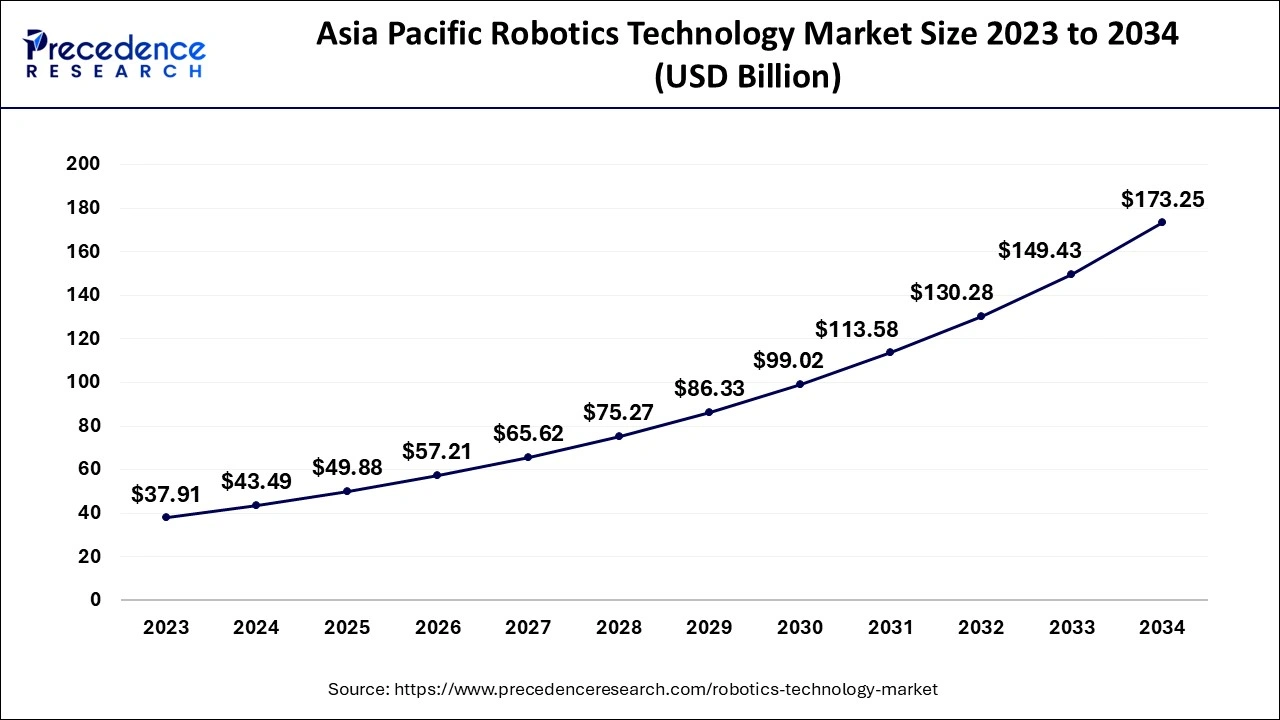

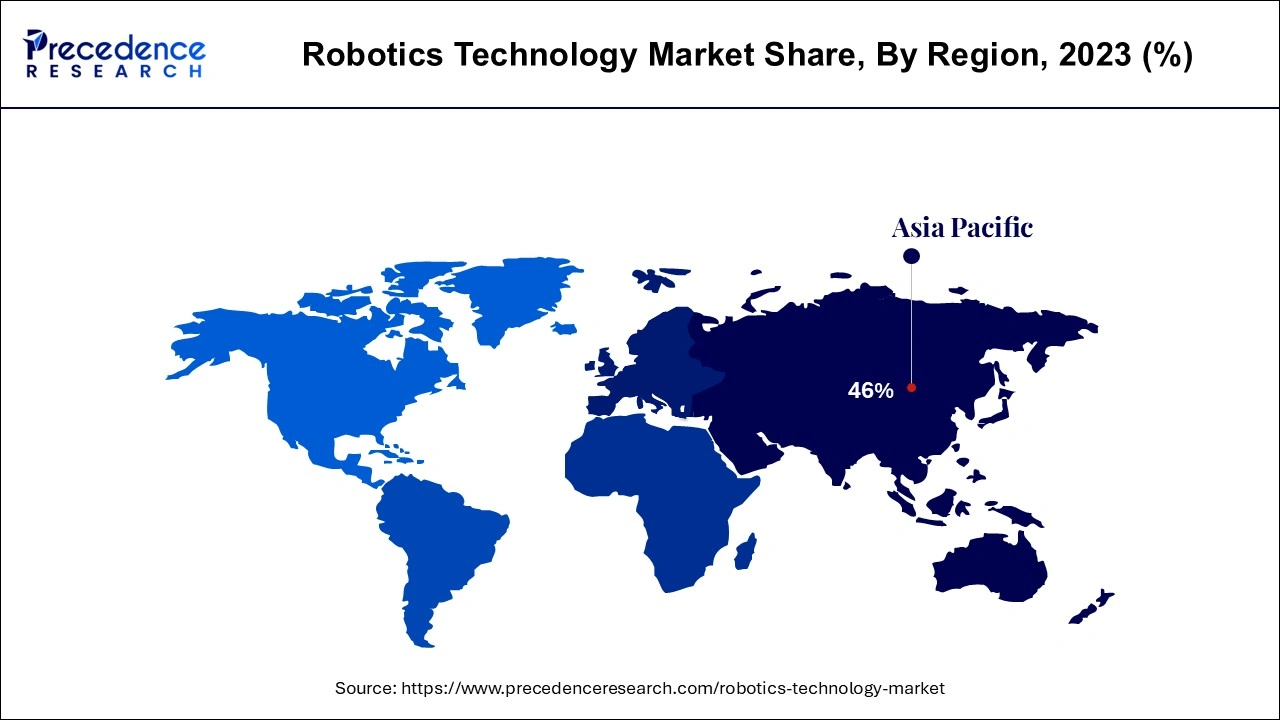

The Asia Pacific robotics technology market size is evaluated at USD 43.49 billion in 2024 and is predicted to be worth around USD 173.25 billion by 2034, rising at a CAGR of 14.81% from 2024 to 2034.

Asia-Pacificdominated the robotics technology market in 2022. China, South Korea, and India dominated the robotics technology market in Asia-Pacific region. The growth of robotics technology market in Asia-Pacific region is being driven by growing constant efforts by government towards the technological developments. Furthermore, the Housing Development Board at Singapore, plans to use autonomous drones or robots to identify which areas of public housing blocks need to be cleaned. The main goal is to save water by cleaning only the dirty areas. In addition, market players are adopting various strategies, which is boosting the growth of Asia-Pacific robotics technology market. The Adibot robotic disinfection system combines Ubtech's robotics and artificial intelligence with UV-C technology to disinfect specific surfaces and air by destroying the DNA and RNA of hazardous microorganisms.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the robotics technology market in Europe region. Educational robots, industrial robots, interactive entertainment robots, and service robots have all seen increased demand in recent years in Europe. Denmark, Germany, Sweden, and Italy are the top European countries where industrial robots are widely used. The European regional market is growing as a result of the rising usage of robots in both the industrial and domestic sectors. The region's regional market is being driven by advanced expansion and the development of cutting-edge robotics technology.

One of the key factors driving the growth of global robotics technology market is the growing number of investments and fundings in the field of technology. As per the International Federation of Robotics' World Robotics report, demand for robots has been fueled by investments in new vehicle production capabilities and modernization of industrial areas. In addition, the surge in demand for industrial robots is driving the growth of the global robotic technology market. BMW AG, for example, signed an agreement with KUKA in 2020 to deliver roughly 5,000 robots for new manufacturing lines and factories around the world. These industrial robots will be deployed globally at BMW Group's foreign manufacturing locations to manufacture current and future vehicle models, according to KUKA.

Another significant factor boosting the growth of the global robotic technology market is the growing utilization of service robots all around the world. There are 2,384,600 building janitors and cleaners, according to the Bureau of Labor Statistics. Annually, businesses spend around USD 60 billion. This does not include the rising cost of insurance, as the cleaning business has one of the highest rates of workplace injuries. As a result, this factor is driving demand for cleaning robots, which is supporting the growth of the global robotic technology market over the forecast period.

The market for robotic technology is very fragmented. The robotic technology industry offers attractive potential because of Industry 4.0 and regional digitalization initiatives. Given the number of robotic trade exhibitions that occur across different areas on a regular basis, the level of transparency is considerable. Overall, there is fierce competition among existing players. The huge organizations are expected to make collaboration and business expansions with new entrants that are focused on modernization.

| Report Coverage | Details |

| Market Size in 2024 | USD 94.54 Billion |

| Market Size by 2034 | USD 372.59 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.70% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Robot Type, Application, and Geography |

The traditional industrial robots segment dominated the robotics technology market in 2022. The introduction of various types of production control techniques, as well as the implementation of automation solutions, are significant components of current production improvement plans. Furthermore, as industrial robots become more popular, they are being used in a variety of industries, including manufacturing and healthcare. Industrial robotics is a rapidly growing sector with applications in a wide range of industries.

The cobots segment is the fastest-growing segment of the robotics technology market in 2022. Collaborative robots, or cobots, are designed to assist humans in doing certain activities that are both sophisticated and precise. Humans and robots collaborate closely. The robots are capable of detecting odd activity in their environment and collaborating with humans without being physically separated. Cobots are more appealing to employ in factories and industries because of their smarter, smaller, more flexible, and user-friendly qualities. The need for Cobots is being driven by increased rivalry in numerous industries, as well as a greater focus on automation.

The healthcare segment dominated the robotics technology market in 2022. The robots in the healthcare sector assist with minimally invasive treatments, personalized and frequent monitoring for patients with chronic conditions, intelligent therapies, and social interaction for the elderly.

The logistics segment is the fastest growing segment of the robotics technology market in 2022. The robots in the logistics sector manage the storage and movement of items as they move through the supply chain. They're frequently used to arrange and transfer things in warehouses and storage facilities, a procedure known as intralogistics, but they can also be employed in other locations. Logistics robots have considerably higher uptime than manual labor, resulting in significant productivity and economic increases for businesses who use them.

By Component

By Robot Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

February 2025

October 2024