June 2024

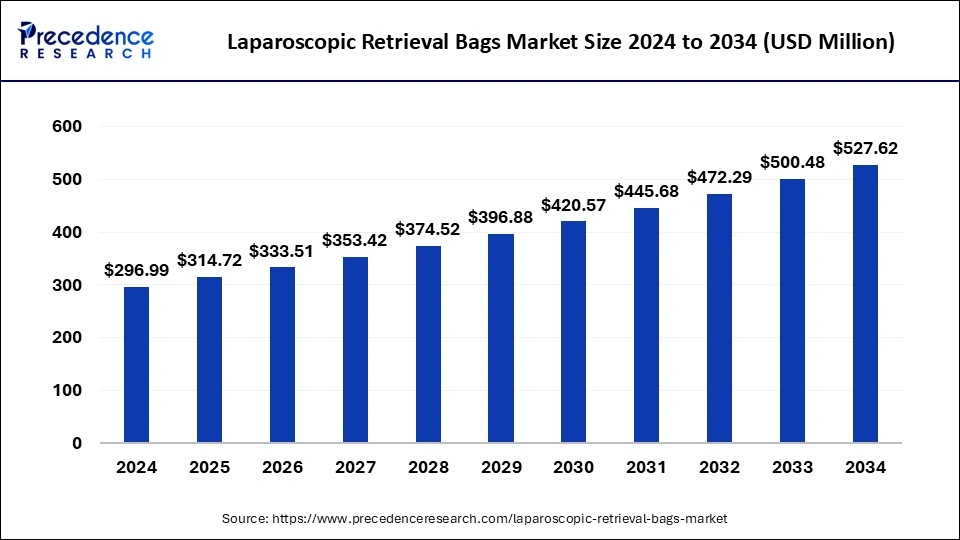

The global laparoscopic retrieval bags market size is accounted at USD 314.72 million in 2025 and is forecasted to hit around USD 527.62 million by 2034, representing a CAGR of 5.92% from 2025 to 2034. The North America market size was estimated at USD 127.71 million in 2024 and is expanding at a CAGR of 5.91% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global laparoscopic retrieval bags market size was calculated at USD 296.99 million in 2024 and is predicted to increase from USD 314.72 million in 2025 to approximately USD 527.62 million by 2034, expanding at a CAGR of 5.92% from 2025 to 2034. The laparoscopic retrieval bags market is driven by the increasing inclination for single-use laparoscopic retrieval packs.

The U.S. laparoscopic retrieval bags market size was exhibited at USD 89.39 million in 2024 and is projected to be worth around USD 162.59 million by 2034, growing at a CAGR of 6.16% from 2025 to 2034.

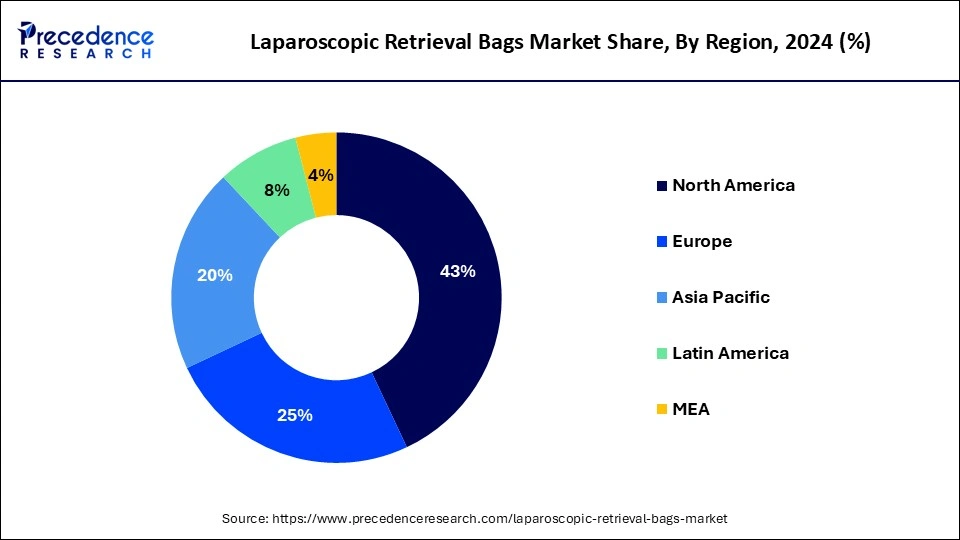

North America dominated in the laparoscopic retrieval bags market in 2024. The market for laparoscopic retrieval bags is driven by the rising prevalence of chronic conditions such as obesity, cancer, and gallbladder diseases in North America, which in turn raises the demand for laparoscopic procedures. Because of their decreased risk and faster recovery times, minimally invasive surgical procedures are chosen to treat several illnesses that frequently require surgery. Government programs and assistance with healthcare advancements are also quite important. Laparoscopic retrieval bags are among the innovative medical equipment encouraged to be used by several initiatives aimed at enhancing surgical outcomes and patient care.

Asia-Pacific is observed to be the fastest growing in the laparoscopic retrieval bags market during the forecast period. In the Asia-Pacific area, the prevalence of chronic illnesses like cancer, obesity, and gastrointestinal problems is rising. Laparoscopic retrieval bags are crucial for the rising number of laparoscopic surgeries resulting from this. Due to their increased susceptibility to chronic diseases, the aging population is driving up demand for laparoscopic treatments and related products. The region's economic expansion has raised disposable incomes, enabling more individuals to pay for cutting-edge medical care. Greater healthcare spending, including elective operations requiring laparoscopic retrieval bags, is correlated with higher disposable incomes.

The market for specialized bags used in laparoscopic surgery to extract and contain specimens, tissues, or organs from the body cavity through tiny incisions produced during minimally invasive operations is known as the laparoscopic retrieval bags market. It is a subset of the medical equipment business. Surgeons can securely collect and remove specimens without contaminating or spilling them inside the patient by inserting and expanding these bags inside the human cavity.

Retrieval bags improve patient safety and lower the risk of complications during surgery by minimizing the possibility of bodily fluids or tissues spilling or becoming contaminated. The market for laparoscopic retrieval bags is expanding due to the growing popularity of minimally invasive operations around the world, which is driven by advantages such as shorter hospital stays and quicker recovery.

| Report Coverage | Details |

| Market Size by 2034 | USD 527.62 Million |

| Market Size in 2025 | USD 314.72 Million |

| Market Size in 2024 | USD 296.99 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.92% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technique, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for minimally invasive surgical procedures

Minimally invasive surgeries are expected to result in shorter hospital stays and less postoperative care, saving healthcare systems money. This financial benefit encourages Healthcare professionals to use and promote these methods. Quicker treatments and recuperation periods lead to higher operating room turnover rates, enhancing hospital capacity and efficiency. This drives the growth of the laparoscopic retrieval bags market.

High cost of laparoscopic instruments and accessories

Specialized tools, such as high-definition cameras, light sources, monitors, insufflators, and a variety of surgical instruments, are needed for laparoscopic procedures. These technologies require a large initial expenditure. Particularly in poorer nations, many healthcare facilities work under strict financial limits. The use of laparoscopic surgeries may be constrained by the high expense of the equipment and supplies needed for the procedure, such as retrieval bags. This limits the growth of the laparoscopic retrieval bags market.

Technological advancements in laparoscopic surgery

High-definition (HD) and 4K imaging technologies provide surgeons with more precise and more detailed views of the operative field. This increased clarity allows for more precise dissection and specimen retrieval. Techniques like near-infrared fluorescence imaging help identify critical structures and pathology, ensuring safer and more effective specimen retrieval. Three-dimensional imaging offers depth perception, enhancing the surgeon's ability to maneuver and retrieve specimens precisely. This opens an opportunity for the growth of the laparoscopic retrieval bags market.

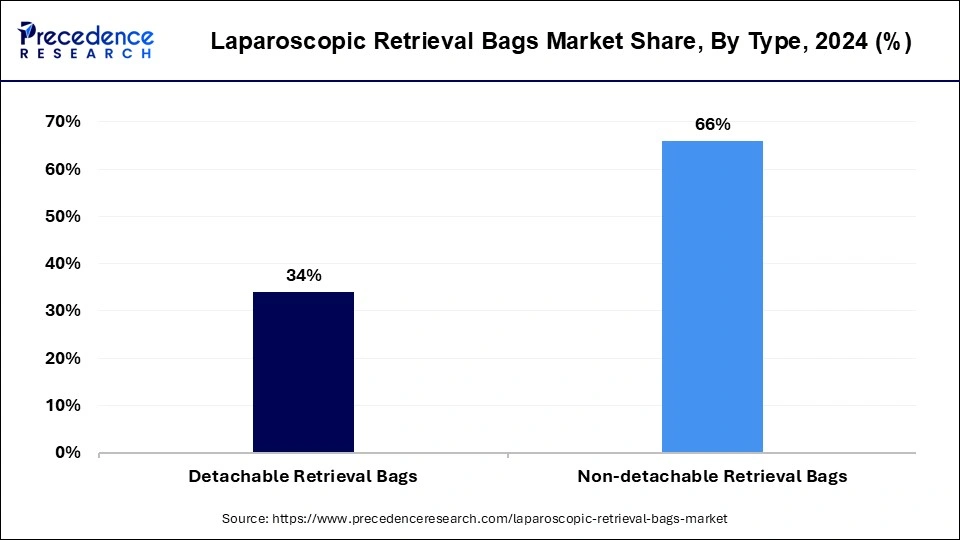

The non-detachable retrieval bags segment dominated in the laparoscopic retrieval bags market in 2023. Retrieval bags that are not detachable are made to function consistently during laparoscopic surgeries. Their one-piece construction reduces the possibility of spills or bag failures, essential to preserving a sterile surgical environment. Non-detachable bags lower the risk of contamination during surgery by removing the requirement for assembly or disassembly. They are, therefore, a safer choice for patients and aid in reducing surgical site infections. Stocking non-detachable bags allows hospitals and surgical facilities to benefit from lower inventory complexity. It is not essential to manage several components, which helps streamline logistics and lower the amount of storage needed.

The detachable retrieval bags segment is observed to be the fastest growing in the laparoscopic retrieval bags market during the forecast period. Significant technological advancements have increased the efficiency and usability of detachable retrieval bags. Some of these developments include stronger material strength, stronger closing systems, and improved deployment techniques. These more recent models are becoming increasingly popular among surgeons because of their dependability and ease of use. Clinical research and empirical data prove the benefits and effectiveness of removable retrieval bags. Positive clinical outcomes, such as shorter operating times and lower incidence of complications, reinforce their use in laparoscopic procedures.

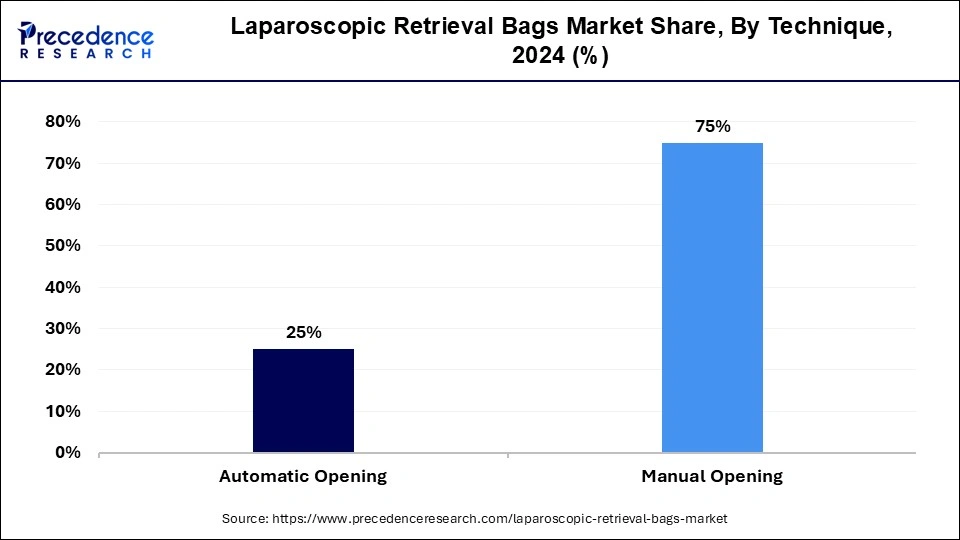

The automatic opening segment shows significant growth in the laparoscopic retrieval bags market in 2023. The retrieval of specimens during laparoscopic procedures has been made easier with the introduction of automatic-opening retrieval bags. Compared to manually handled retrieval bags, these bags automatically open when deployed, allowing surgeons to work more swiftly and efficiently.

Many difficult procedures are being done laparoscopically, increasing demand for accurate and effective specimen retrieval techniques. This need is satisfied by automatic-opening retrieval bags, which offer a simple and effective way to remove more significant or more specimens.

The gynecology segment dominated in the laparoscopic retrieval bags market in 2023. Numerous conditions can be diagnosed and treated by laparoscopy, such as ovarian cysts, endometriosis, fibroid tumors, infertility, and persistent pelvic pain. Nowadays, a lot of surgeries that were previously carried out through more extensive abdominal incisions are done laparoscopically. Recovery from laparoscopic surgery is quick since it does not require substantial abdominal incisions. In a matter of weeks, most women resume their regular activities following a hysterectomy. The diameter and opening/deployment method of specimen retrieval bags currently on the market vary.

The hospitals segment had dominated in the laparoscopic retrieval bags market in 2023. In contrast to outpatient surgery centers or specialist clinics, hospitals execute more laparoscopic procedures. These procedures include appendectomy, cholecystectomy, hernia repair, and gynecological procedures; to securely retrieve resected tissues and organs, laparoscopic retrieval bags are frequently used. Comparatively speaking, hospitals have more comprehensive procurement procedures and higher expenditures than smaller healthcare facilities. Because of their financial capacity, hospitals can keep a large inventory of laparoscopic retrieval bags on hand for various surgical procedures.

The ambulatory surgical centers segment is observed to be the fastest growing in the laparoscopic retrieval bags market during the forecast period. As laparoscopic procedures require fewer incisions than open procedures, they are associated with shorter recovery periods for patients, less pain following surgery, and decreased complications. ASCs are a good fit for these treatments since they provide a more effective and affordable option than hospitals. The advantages of minimally invasive procedures, including shorter hospital stays, faster recovery periods, and less scary, make patients prefer them more. This change drives the need for laparoscopic procedures and the usage of laparoscopic retrieval bags.

By Type

By Technique

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

December 2024

November 2024

July 2024