December 2024

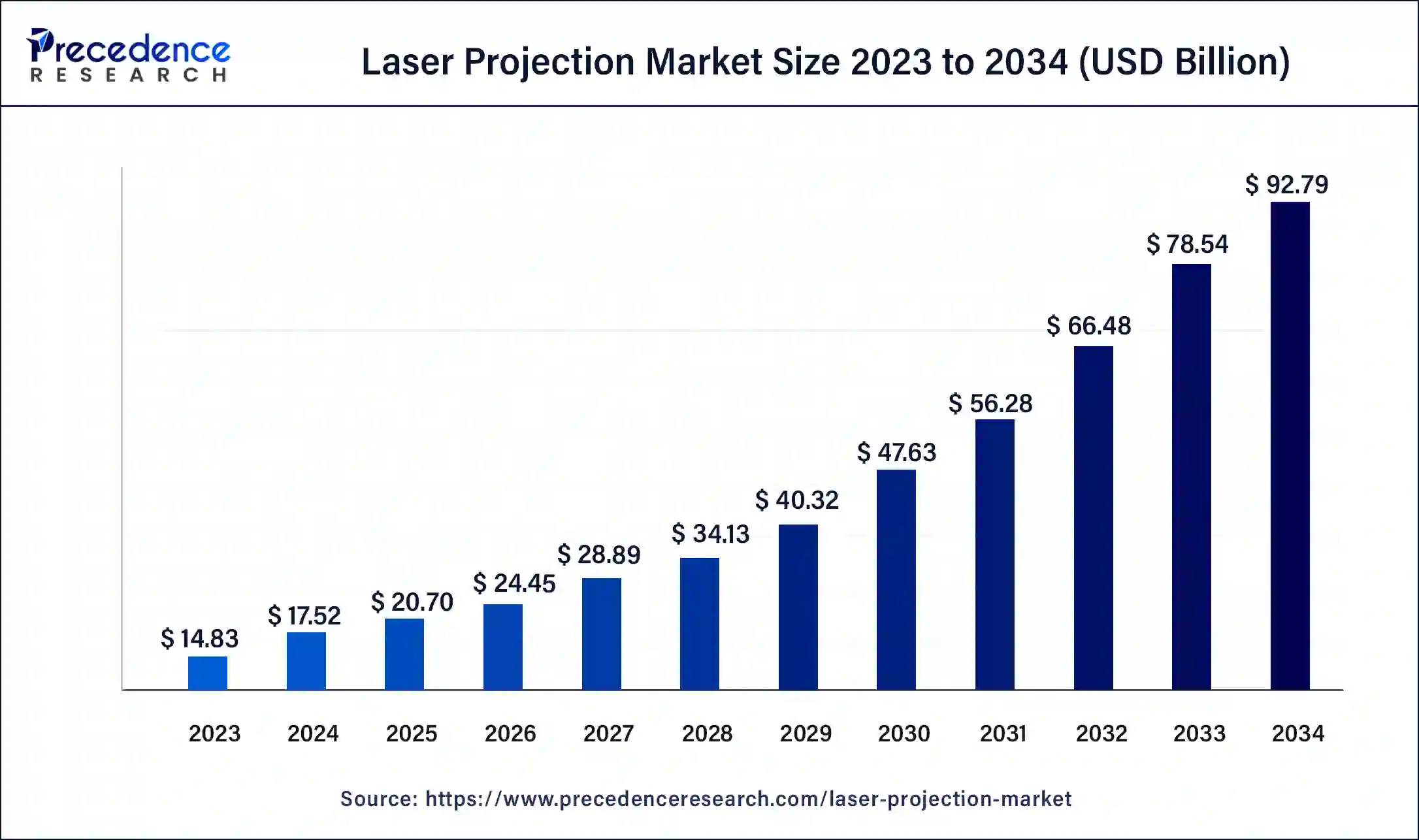

The global laser projection market size is calculated at USD 20.70 billion in 2025 and is forecasted to reach around USD 92.79 billion by 2034, accelerating at a CAGR of 18.14% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global laser projection market size was estimated at USD 17.52 billion in 2024 and is predicted to increase from USD 20.70 billion in 2025 to approximately USD 92.79 billion by 2034, expanding at a CAGR of 18.14% from 2025 to 2034.

The application of artificial intelligence (AI) is crucial for the development of the electronics industry. Currently, laser projection system companies have started integrating AI for several advantages, such as nail positioning and identifying shiners for wall panels. Moreover, AI is being used in the laser projection industry to monitor the efficacy of the laser welding process in real-time and evaluate around three thousand images every second. Thus, the integration of AI in laser projection systems has positively changed the landscape of the laser projection market.

The laser projection market is an important industry in the electronics sector. This market deals in developing and distributing laser projection systems for numerous applications. This industry manufactures several types of products, including laser projectors and CAD laser projection systems. Several types of illumination are used in these projectors, such as laser phosphor, hybrid, RGB laser, and laser diode.

The laser projection industry is mainly driven by advancements in technologies associated with video enhancements along with the increasing number of cultural activities around the world. This projection system finds several applications in several end-user verticals such as enterprise, public places, cinema, education, retail, medical, industrial, and others. This industry is likely to grow significantly with the developments in the cinema industry.

| Report Coverage | Details |

| Market Size by 2034 | USD 92.79 Billion |

| Market Size in 2025 | USD 20.70 Billion |

| Market Size in 2024 | USD 17.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.14% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Illumination Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing application of laser projection systems in the industrial sector

The application of laser projection systems is very important for several industries. The demand for advanced laser projectors in the aerospace & defense sector to speed up the manufacturing process, along with the growing advancements in 3D technology-based laser projectors for metal industries, has gained prominent attraction among consumers.

Moreover, the automotive industries are using advanced projection systems for placing mounting elements, including braces, fixtures, electrical wiring, and some others, increasing the demand for laser projectors. Thus, the rising application of laser projection systems in various industries is expected to propel the growth of the laser projection market during the forecast period.

High cost and side effects on the human eye

The laser projection industry faces several problems that hamper industrial growth. The initial cost of laser projection systems is high compared to traditional projectors, which restrains the market growth. Also, the excessive use of laser projection systems can cause several problems for the human eye, which can act as a restraining factor that negatively impacts laser projection market growth

Advancements in laser diode illumination

The laser projection industry has developed significantly with the advancements in science and technology. Nowadays, laser projection companies have started investing in research and development activities associated with laser diode projectors. The emphasis on laser diode projectors has increased to provide stable brightness for longer durations and present superior image quality for numerous verticals. Thus, advancements in laser diode illumination technology are expected to create ample growth opportunities for laser projection market players in the future.

The laser phosphor segment dominated the laser projection market in 2024. The growing demand for laser phosphor projectors in government organizations has driven market growth. Also, the rising application of laser phosphor projectors in corporate offices and entertainment venues is boosting the market growth.

Moreover, the growing advancements in laser phosphorus projectors that are used in educational institutions and small auditoriums are likely to propel the market growth. Furthermore, the advantages of laser phosphorus projectors, such as enhanced brightness, instant on/off capability, flexible installation, low cost of purchase & maintenance, and some others, are expected to drive the growth of the laser projection market during the forecast period.

The RGB laser segment is estimated to exhibit a notable growth rate during the forecast period. The growing demand for RGB laser projectors from cinema halls with large screens has driven the market growth. Also, the increasing use of RGB laser projectors to provide 3D and 4D viewing experiences is likely to propel market growth. Moreover, the upsurge in demand for optical guidance systems has increased the application of RGB laser projectors for projection mapping, which in turn has fostered market growth to some extent. Furthermore, the rising application of RGB laser projectors in live event staging and theme parks to provide enhanced colors to viewers will benefit the laser projection market during the forecast period.

The enterprises segment held a dominant share of the laser projection market in 2024. The rising demand for portable projectors in business enterprises has driven the market growth. Also, the growing application of RGB laser projection systems in corporate offices to display several presentations is likely to boost the market growth. Moreover, the increase in demand for CAD laser projection systems in large enterprises to scale shapes, outlines, and templates, along with the rising use of laser projectors to minimize costs, is likely to propel industrial growth.

The cinema segment is expected to grow significantly during the forecast period. The rise in the number of cinema halls around the world has increased the demand for laser projectors. Also, the rising interest of people in visiting movie theatres for leisure is likely to propel the laser projection market growth. Moreover, the growing use of RGB laser projectors in cinema halls due to their high durability, less power-consuming capacity, less heat generation, and other benefits has boosted the market growth. Furthermore, the upsurge in demand for laser projectors to produce vivid and brighter images, along with their flexibility, is beneficial for the laser projection market.

Asia Pacific held the largest share of the laser projection market in 2024. The rising advancement in the electronic industry in countries such as China, India, Japan, South Korea, and others boost the market growth. The rising demand for MMORPG games has increased the demand for 4K laser projectors, propelling the market growth. The rising developments in the healthcare sector in Israel, India, China, and Japan have further increased the demand for laser projectors for several applications. Moreover, the growing application of laser projectors in the educational and industrial sectors in the Asia Pacific region has propelled the market growth.

This region consists of several local manufacturers of laser projection systems, such as Sony, Panasonic, Epson, LG, Hitachi, BenQ, and others. These companies are constantly developing advanced laser projection systems for numerous industries in the Asia Pacific region, which in turn is expected to drive the growth of the laser projection market.

North America is expected to be the fastest-growing region during the forecast period. The rising demand for laser projectors from government organizations such as the FDA, NASA, the White House, FBI, and others has boosted the market growth. Also, the increasing trend of companies to advertise their products and services in public places has increased the demand for laser projectors.

The rise in the number of corporate offices in Canada and the U.S. has increased the demand for advanced laser projection systems to provide superior presentations to clients. Moreover, there is a growing development in the retail sector, along with the rising trend of people visiting movie theatres. This region consists of local market players of laser projection systems such as Dell, Vava, Hutchinson Manufacturing Inc., Christie Digital System, and some others that are constantly engaged in manufacturing high-grade laser projection systems.

Famous Movie Theatres

By Application

By Illumination Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

October 2024

May 2025

April 2025