August 2024

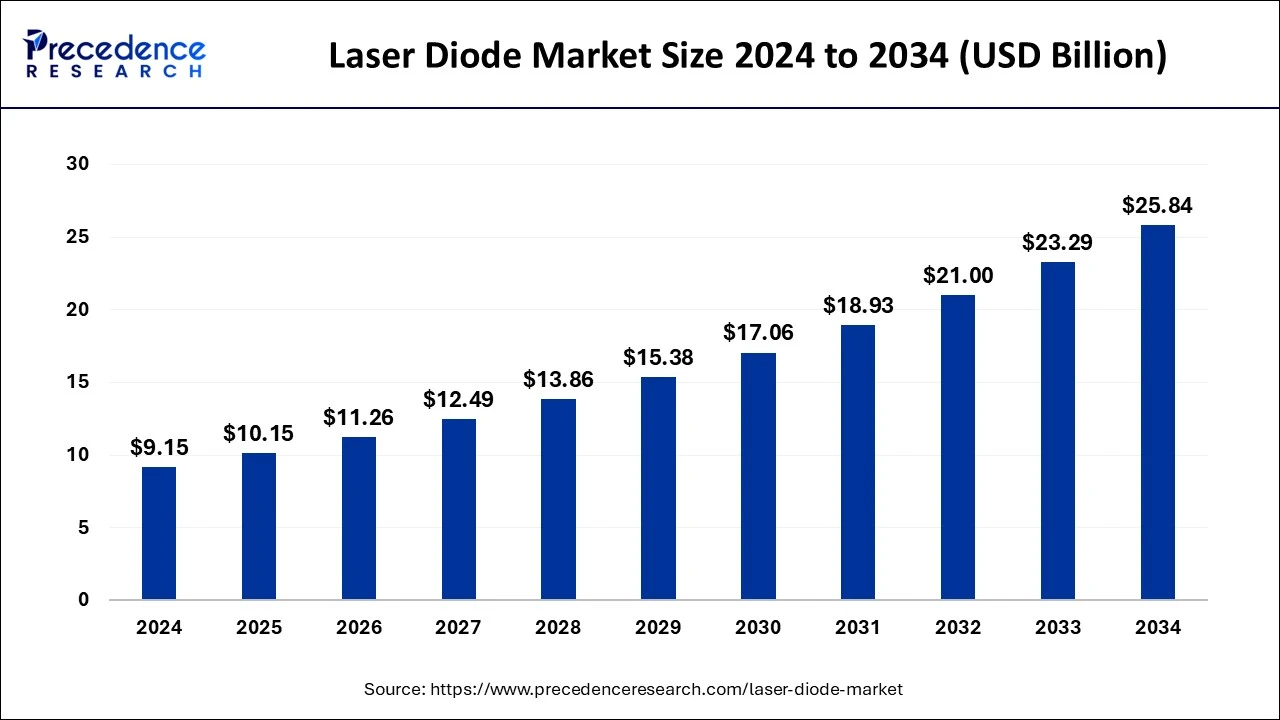

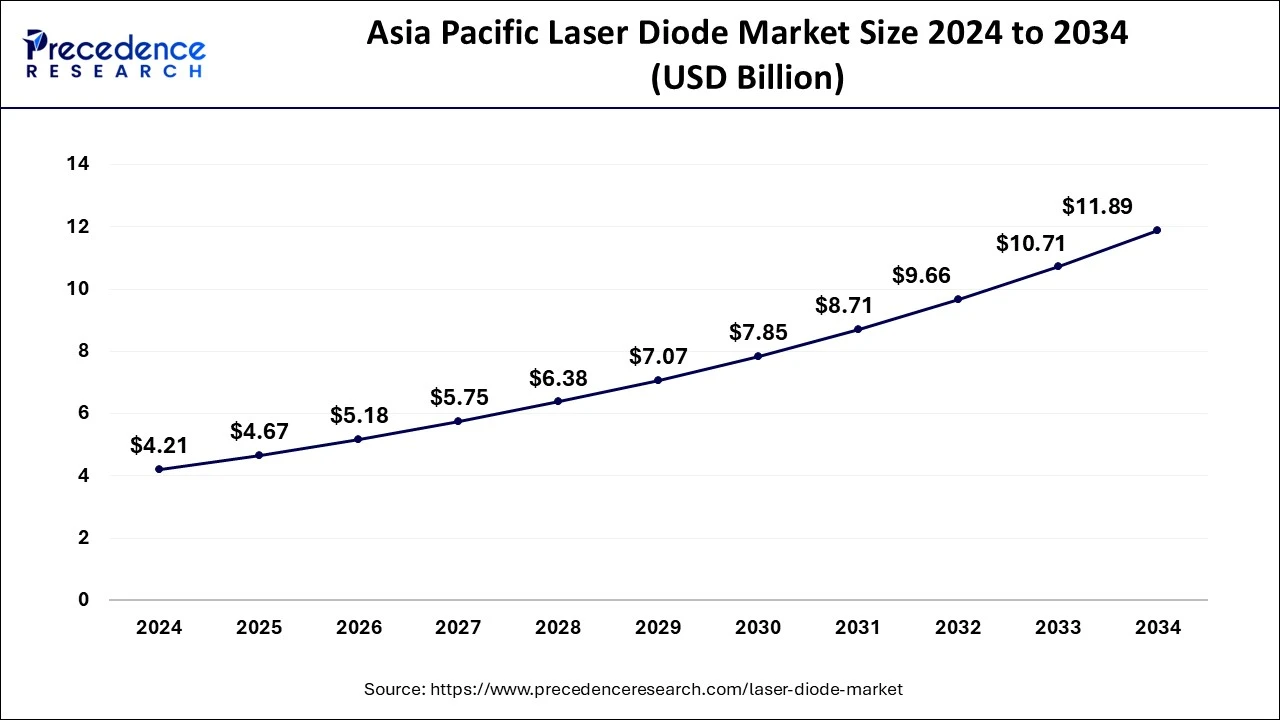

The global laser diode market size was calculated at USD 9.15 billion in 2024, grew to USD 10.15 billion in 2025 and is predicted to hit around USD 25.84 billion by 2034, expanding at a CAGR of 10.94% between 2025 and 2034. The Asia Pacific laser diode market size is evaluated at USD 4.21 billion in 2024 and is expected to grow at a CAGR of 11.05% during the forecast year.

The global laser diode market size was accounted for USD 9.15 billion in 2024 and is expected to exceed around USD 25.84 billion by 2034, growing at a CAGR of 10.94% from 2025 to 2034. The laser diode market is growing rapidly because of higher applications in communication systems, medical practices, automobiles, and industrial uses.

The laser diode market is being revolutionized due to significant transformations in AI and automation. AI-driven advancements are offering better laser diodes design, manufacturing, and testing procedures for laser diodes, resulting in improved performance and reduced production costs. Automation solution technologies result in proper management of the production process in laser diodes with better precision. Investment in AI in predictive maintenance and quality assurance enhances operational efficiency, thereby driving the market. The advancement in these technologies is driving the growth and use of laser diode bars and chips across various industries.

The Asia Pacific laser diode market size was exhibited at USD 4.21 billion in 2024 and is projected to be worth around USD 11.89 billion by 2034, growing at a CAGR of 11.05% from 2025 to 2034.

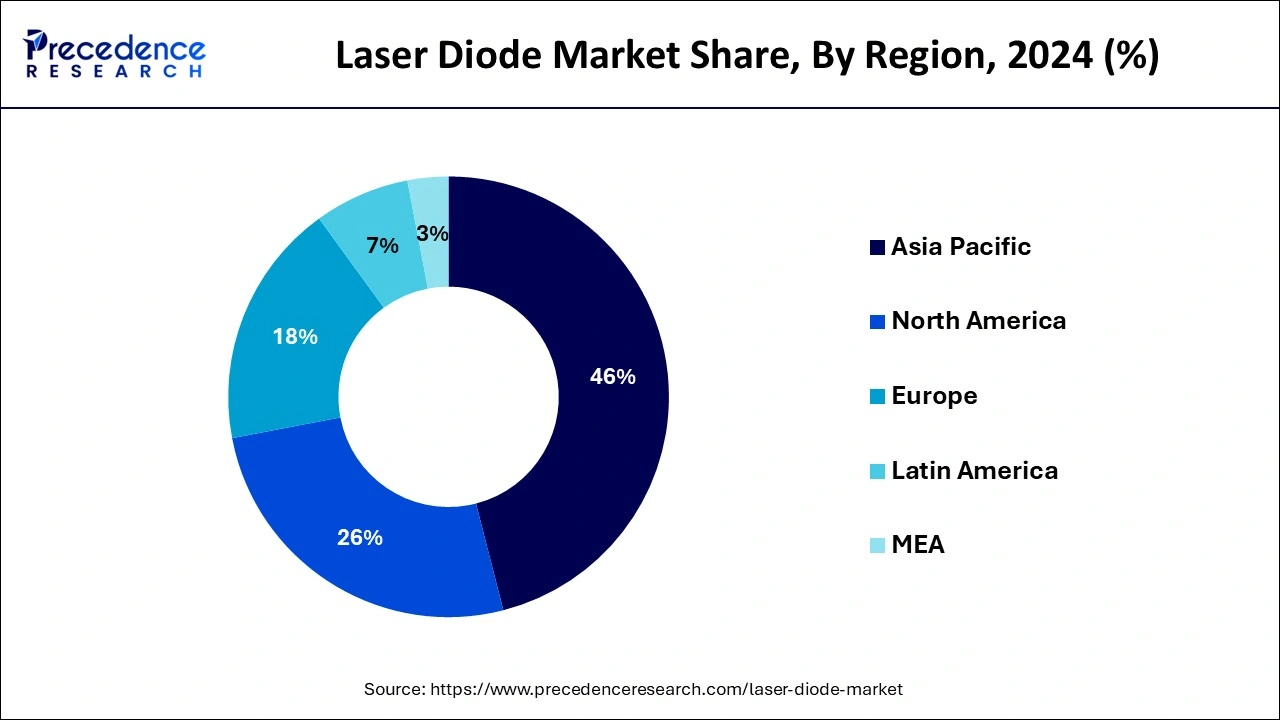

Asia Pacific accounted for the largest share of the laser diode market in 2023 due to the higher demand for material processing in several applications. Laser diodes are used in the automotive industry as is common with other industries, industries that deal with more heavy equipment, and industrial production within a certain region. Asia Pacific is the most dominant market for laser diodes, with China, Japan, India, and South Korea dominating the market. Laser diodes are required in the automotive industry for use in laser cutting, welding, and surface treatment, and they are available in the heavy industries. These industries rely on laser diodes because of their accuracy, flexibility, and ability to work with several materials.

North America is anticipated to witness the fastest growth in the laser diode market during the forecasted years. Increased investment in research and development, especially in military and defense, has led to a higher demand for laser diodes in the region. Besides, the rising deployment of applications of semiconductor laser diodes in the healthcare industry is considered one of the main growth stimulants for the market. Laser diode finds application in cosmetic applications such as liposuction, body contouring, eye surgery, OCT, skin rejuvenation, tattoo removal, wrinkle reduction, pigmentation reduction, and many more medical applications.

The laser diode is a compact semiconductor device that releases light through amplification by stimulated emission. It consists of a p-n junction typically of the alloy gallium arsenide (GaAs) or other semiconductor material. Laser diodes are used broadly in many areas such as in telecommunication, laser printing, barcode reader, optical storage, and laser pointers, etc. Laser diodes have transformed industries and technologies by offering reliable cheap and versatile sources of coherent light for purposes.

The factors driving the growth of the global laser diode market are driving the demand for laser diodes in the medical services industry due to higher precision and minimum harm, control, and the developing acknowledgment of using laser diode in the current segment and expanding usage in automobile production headlight assembly. Several factors create growth in the market share, which includes continuous innovations proposing more prominent productivity and accuracy and developing military applications.

| Report Coverage | Details |

| Market Size by 2034 | USD 25.84 Billion |

| Market Size in 2025 | USD 10.15 Billion |

| Market Size in 2024 | USD 9.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.94% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mode of Operation, Wavelength, Doping Material, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for high-speed data transmission

The laser diode market is experiencing substantial growth, driven by several factors across various industries. In the telecommunications industry, there is an increasing demand for laser diodes that provide the effective and reliable performance needed for high-speed data transmission. Laser-based communication systems are a wireless connection approach. In communication, laser beams are used as transmission media to send data from one node to the other. Laser communication systems can enhance data transfer, helping to speed up communication, which makes communication safer and more effective and helps to minimize signal interferences.

High initial investment

The laser diode industry is impacted strongly by initial costs in production and research and development efforts. The new generation laser diodes include sophisticated manufacturing processes and the incorporation of expensive semiconductor materials such as gallium arsenide and indium phosphide that raise the costs of manufacturing. These high production costs result in expensive products, which reduce the laser diode market penetration, especially in cost-sensitive industries. Smaller companies and startups find it mainly stimulating to enter the market due to the extensive initial investment required for R&D and manufacturing infrastructure. Laser Diode reveals that price volatility discourages investment in this technology because potential customers delay purchases in anticipation of future price drops.

Development of the energy and power sector

The electronics industry, especially the energy and power sector, is playing a significant role in the market development of laser diodes. Laser diodes have seen growing use in applications related to energy production, such as a collection of solar energy, and contributing to developing more efficient and sustainable energy solutions. In solar energy, laser diodes are implemented in photovoltaic systems, which are used in solar cell fabrication and evaluation. Semiconductor lasers are used in cutting, scribing, and structuring thin films in solar cell devices to enhance their properties. The increased usage of laser diodes for the energy and power sectors, including renewable energy sources and efficient power management, is a key factor in the increased demand for laser diodes. As the sector endures to raise and invest in advanced energy technologies, the demand for laser diodes is anticipated to rise.

The multi-mode laser diode segment noted the largest share of the laser diode market in 2023. A multimode laser diode defines an optical source that yields high output power of tens of watts at its maximum. The multimode laser diodes provide high power from laser diodes since they have a larger emitter than the single-mode laser diodes. The emerging application of multi-mode laser diodes in the medical sector, especially in therapeutic and diagnostic equipment, has opened up a wide market. Since multi-mode laser diodes are cheaper and have the ability to communicate through various modes of light, fiber optics use them in short-reach transmission.

The blue laser diode segment has contributed the largest share of the laser diode market in 2023. The blue laser diode represents a vibrant area within the larger semiconductor and photonics industry, distinguished by its diverse applications, including consumer electronics, industrial, and medical fields. In addition, the increasing need for internet bandwidth, growing proportions of internet traffic, and opt electronic technologies foster the segment expansion. Additionally, the increasing use of digitized video images and inspections in the industrial sector has boosted the sales of blue semiconductor diodes.

The Gallium Arsenide segment dominated the global laser diode market in 2023. Growing market demand for higher bandwidth in telecommunications applications and the escalating global rollout of 5G networks have further enhanced the use of GaAs-based devices. It has been found that the automotive application of ADAS and LiDAR has opened up new application areas for GaAs laser diodes. Also, the increasing energy demand from the power industry for electricity generation is increasing due to its high electron mobility and performance at low light in solar cells, which is anticipated to drive the segment growth over the forecast period. Besides, GaAs are also penetrating the medical, automotive, aerospace & defense industries because of their features, such as non-susceptibility to moisture, radiation, and ultraviolet light.

The quantum well laser diodes segment noted the largest share of the laser diode market in 2023. The quantum-well laser diode, which is a laser diode with the least active layer thickness, possesses a quantum-well structure. This leads to several aids compared to typical laser diodes for thin-film amorphous silicon solar cell applications. In quantum applications, such devices help to make progress in computing, cryptography, and sensors by offering the degree of accuracy and coherence for atom cooling and manipulation in quantum systems as precise and accurate as possible.

The automotive industry segment led the global laser diode market in 2023. Laser diodes are adopted in the automotive industry because of factors such as high accuracy, energy use, and flexibility. The increased production of electric vehicles probably fuels the laser diode worldwide. Furthermore, the rising disposable income level of people, middle-income earners, and their need to spend heavily on self-driving cars have dictated market progression. A fast-growing market of electric cars as well as hybrids, plug-in hybrids, and hydrogen fuel cell vehicles in both developed and developing countries. Also, laser diodes are required for LIDAR and radar systems owing to the emergent trend of self-driving automated cars.

By Mode of Operation

By Wavelength

By Doping Material

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

October 2024

May 2025

April 2025