May 2025

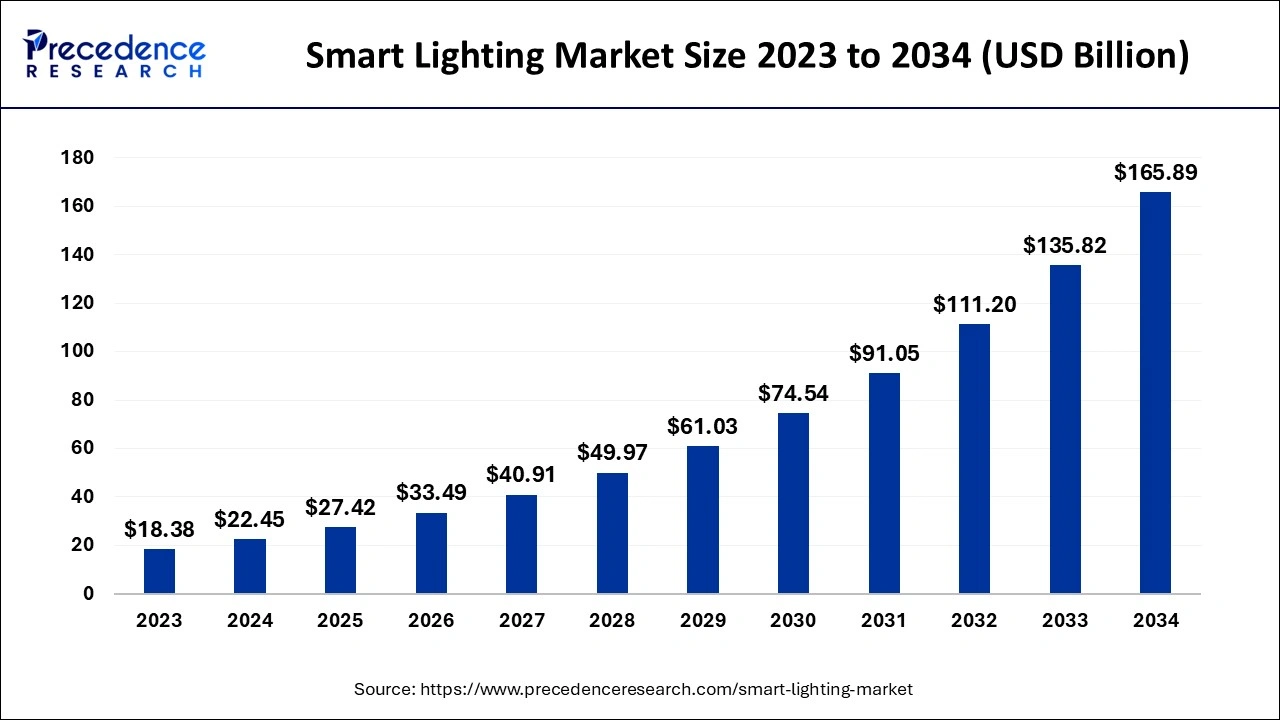

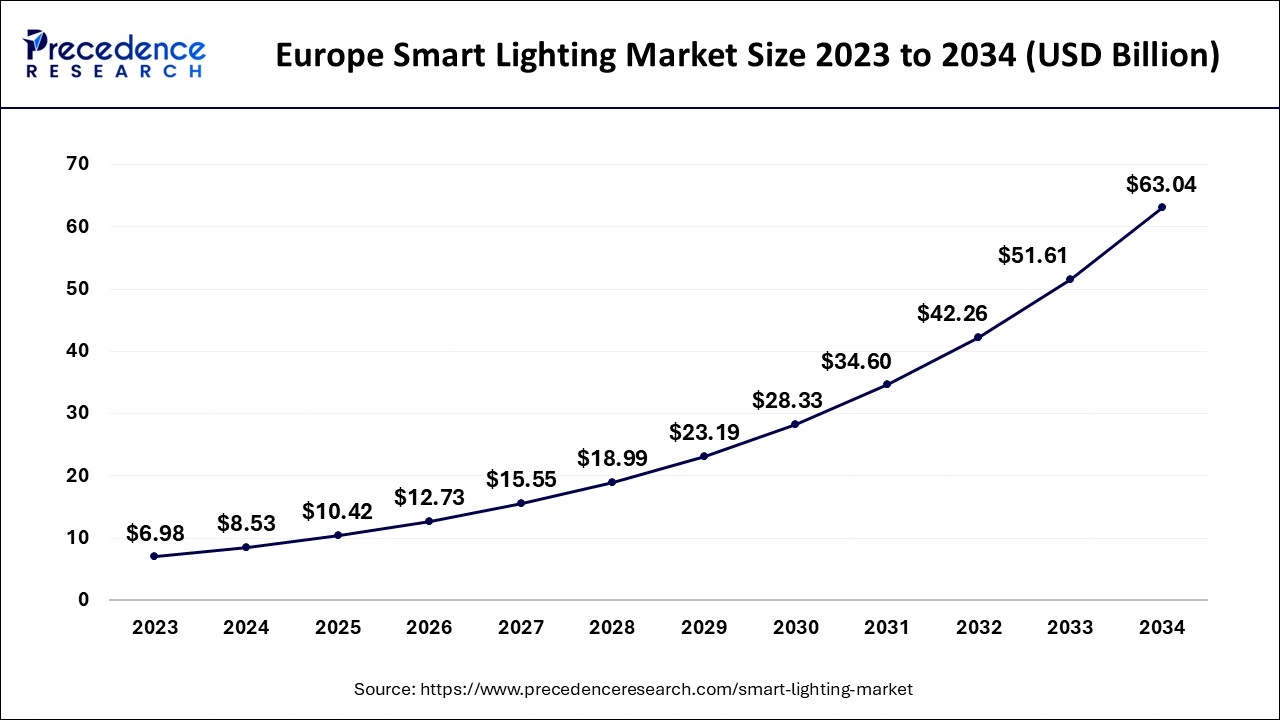

The global smart lighting market size accounted for USD 27.42 billion in 2025 and is projected to surpass around USD 165.89 billion by 2034, representing a CAGR of 22.14% between 2025 and 2034. The Europe smart lighting market size accounted for USD10.42 billion in 2024 and is expected to grow at a CAGR of 22.15% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global smart lighting market size was calculated at USD 22.45 billion in 2024 and is predicted to reach around USD 165.89 billion by 2034, expanding at a CAGR of 22.14% from 2025 to 2034. The smart lighting market is driven by the growing need for solutions that use less energy.

Artificial intelligence systems examine lighting usage trends to maximize energy efficiency. AI can automatically adjust brightness and turn off lights in unused areas by learning when and where lights are needed, which reduces waste and electricity costs. AI-powered technologies enable smart lights to anticipate possible malfunctions or issues before they arise.

By alerting operators when repairs or bulb replacements are necessary, this proactive strategy lowers maintenance expenses and downtime. Lighting data gathering and analysis are made possible by AI. This enables companies and local governments to monitor energy consumption, manage lighting for public areas, and make data-driven decisions to upgrade infrastructure.

The Europe smart lighting market size was exhibited at USD 8.53 billion in 2024 and is projected to be worth around USD 63.04 billion by 2034, growing at a CAGR of 22.15% from 2025 to 2034.

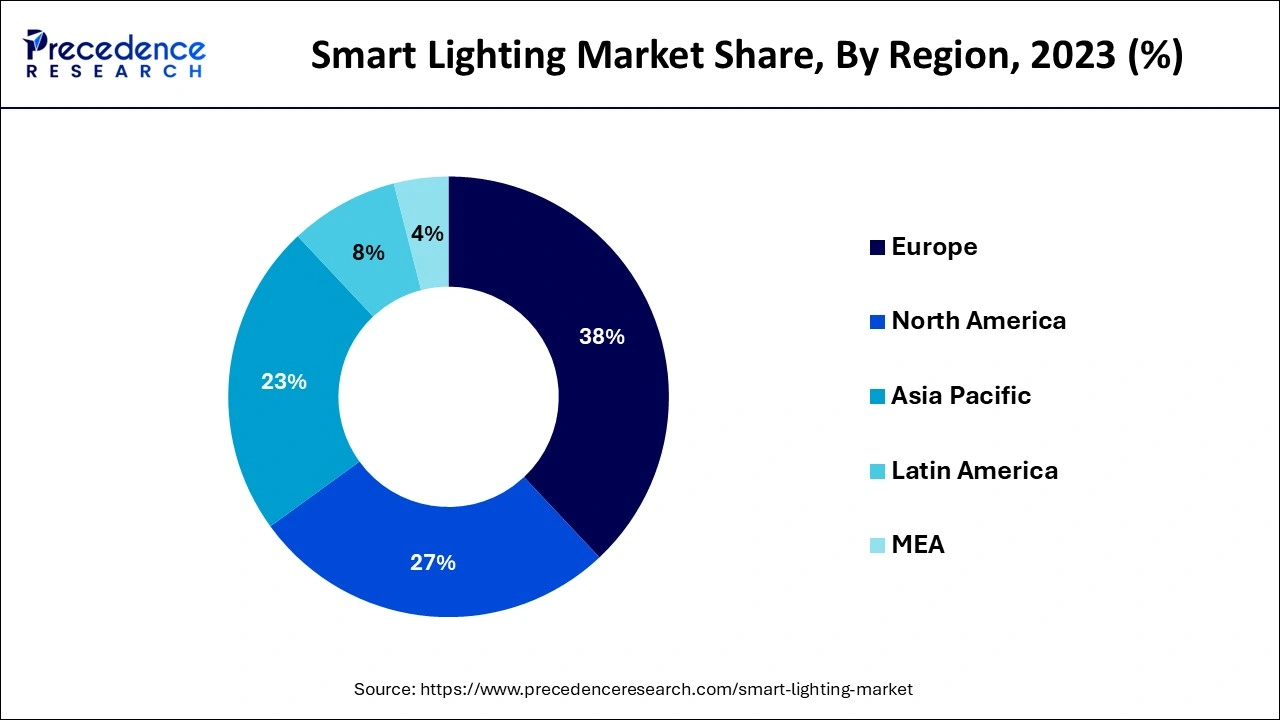

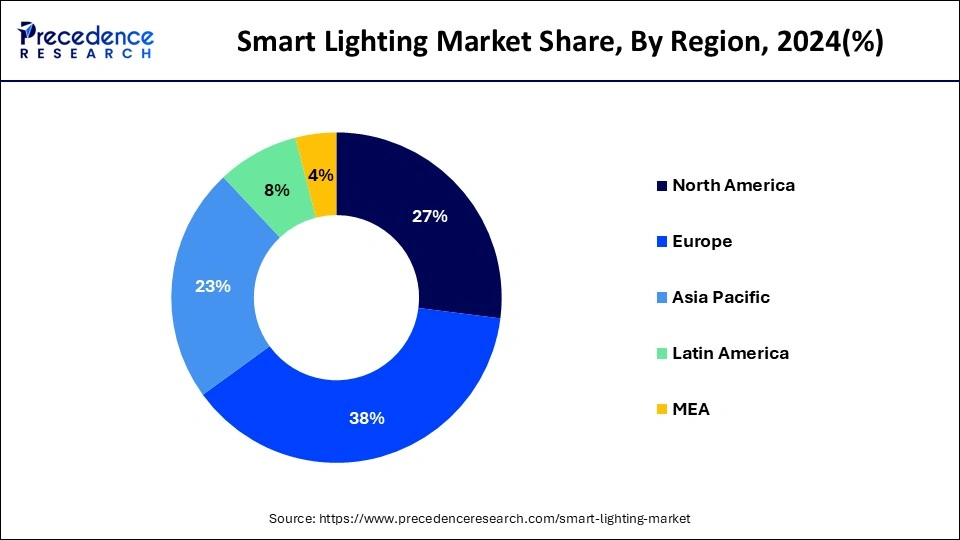

Europe dominated the smart lighting market in 2024. The integration of Internet of Things (IoT) ecosystems with smart lighting has been spearheaded by European companies. This includes capabilities like enhanced automation, app-based management, and voice control compatibility (via Google Assistant, Amazon Alexa, and others). To build sustainable and self-sufficient urban environments, European towns are progressively integrating renewable energy sources, such as solar power, with smart lighting. Because smart lighting optimizes lighting conditions and lowers energy consumption, it is widely utilized in industries and warehouses throughout Europe.

Asia-Pacific is observed to be the fastest growing in smart lighting market during the forecast period. Innovation in technology, especially in electronics and the Internet of Things, is concentrated in Asia-Pacific. Businesses in South Korea, Japan, and China are leading the way in creating sophisticated and reasonably priced smart lighting solutions. Due to the presence of regional manufacturers, these solutions are now considerably less expensive, increasing their accessibility for final consumers. Smart lighting systems with sensors and analytics are being adopted by industries to maximize energy efficiency and cut expenses. Additionally, smart lighting systems are being used more and more in public infrastructure, such as highways, train stations, and airports, to increase operational efficiency and safety.

North America shows significant growth in the smart lighting market during the forecast period. North American consumers are becoming more conscious of how smart LED lighting systems may save energy. Features like automated turn-off and dimming when rooms are empty help these systems use less electricity. To cut expenses and meet sustainability targets, companies are implementing smart lighting in warehouses, retail establishments, and office buildings. Motion, daylight, and occupancy sensors are increasingly being added to lighting systems to increase their usefulness and efficiency.

Energy usage is greatly decreased by smart lighting systems that are outfitted with cutting-edge technologies like LED lights and Internet of Things-enabled sensors. Smart lighting lowers power costs for both businesses and individuals by optimizing energy use and providing features like scheduled operations and automated dimming. Smart lighting solutions are becoming more popular as a result of governments all over the world encouraging energy-efficient technologies through incentives and regulations.

| Report Coverage | Details |

| Market Size by 2034 | USD 165.89 Billion |

| Market Size in 2024 | USD 22.45 Billion |

| Market Size in 2025 | USD 27.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.14% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Connectivity, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing energy consumption awareness

Businesses and consumers are more driven than ever to find ways to lower their energy costs due to the rising cost of electricity. Because smart lighting systems are made to maximize energy use, they offer a practical answer. When lights are not needed, features like timers, motion sensors, and automated dimming allow users to consume less energy. These systems result in considerable cost savings over time. The market for smart lighting goods keeps expanding as more people realize how much money they could save by utilizing it.

Lack of consumer awareness

Many businesses in the smart lighting sector are unable to reach a large consumer base with clear and informative marketing, despite the growing interest in smart homes and linked products. Marketing campaigns frequently highlight technological characteristics above useful, everyday advantages. Companies must fund customer education initiatives, show how these systems operate, and highlight the observable advantages, like energy savings, increased convenience, and personalization, to counteract the lack of awareness.

Advancements in LED technology

LED technology advancements have made it possible to create tunable white light, which lets users change the color temperature of lights to suit their needs or tastes. Comfort, productivity, and mood can all be enhanced by this. Nowadays, smart LEDs can automatically change their illumination according to the time of day, a feature that is especially well-liked in offices and commercial settings where lighting can affect productivity and well-being. Although LEDs are renowned for having a long lifespan, new developments have increased their robustness and, over time, their cost-effectiveness.

The smart lighting market is characterized by low competition, which means there are several dominating players in the market, and it's likely fragmented. Major characteristics include ongoing growth propelled by factors such as energy efficiency and IoT integration. Furthermore, the market is also witnessing substantial growth in LED lighting, which is gaining traction rapidly.

The hardware segment dominated the smart lighting market in 2024. Unlike conventional lighting options, LEDs are much more energy-efficient, using less electricity and saving money on energy bills. By detecting presence, these sensors help automate lighting systems and ensure energy efficiency by turning lights on and off. To enable wireless communication and connectivity between lighting systems and control devices like smartphones, tablets, or centralized hubs, hardware elements like controllers and gateways are necessary. The need for cutting-edge lighting hardware to install connected lighting systems in streets, public areas, and commercial spaces has been fueled by smart city initiatives around the world.

The software segment is observed to be the fastest growing in the smart lighting market during the forecast period. Lighting systems are now sophisticated ecosystems thanks to IoT connectivity. IoT-enabled smart lighting systems rely on software as their foundation, which enables devices to interact, gather information, and carry out tasks. By employing data-driven insights, the software optimizes energy use by monitoring usage trends and dynamically modifying lighting in response to occupancy or real-time needs.

The wired segment dominated the smart lighting market in 2024. Power over Ethernet (PoE) and Ethernet-based wired systems provide consistent and reliable connectivity, removing worries about interference or dropped wireless signals. For situations where consistent lighting performance is required in commercial, industrial, or public infrastructure, this dependability is essential. Wired infrastructure is already present in a large number of existing commercial and industrial buildings. It is economical and compatible to upgrade these to smart lighting systems via wired technology.

The wireless segment shows significant growth in the smart lighting market during the forecast period. Smart home platforms such as Apple HomeKit, Google Assistant, and Amazon Alexa are compatible with wireless smart lighting solutions. Demand is increased by this interoperability, which enables consumers to manage their lighting using voice commands or smartphone applications. Energy-saving features like motion detection, remote scheduling, and adaptive dimming are frequently included in wireless smart lighting.

The indoor segment dominated the smart lighting market in 2024. Features like scheduling, dimming, and color customization are available with smart indoor lighting. With the help of these features, homeowners may design unique lighting arrangements for various times of the day or for purposes like reading, eating, or unwinding. Smart lighting systems have been implemented by businesses to increase worker happiness and productivity. For instance, in workplace settings, adjustable white light can simulate natural daylight, increasing concentration and decreasing weariness.

The outdoor segment is observed to be the fastest growing in the smart lighting market during the forecast period. In these projects, smart lighting is essential because it makes it possible for intelligent streetlights to adjust to changing environmental conditions, use less energy, and operate more efficiently. The functionality of outdoor smart lighting has been improved through the integration of wireless communication technologies, sensors, and the Internet of Things (IoT).

By enabling remote control, predictive maintenance, and real-time monitoring, these technologies lower operating costs while enhancing performance. Businesses and municipalities are especially interested in adaptive lighting systems that change brightness according to traffic patterns or meteorological conditions.

By Component

By Connectivity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

April 2025

May 2025

May 2025