October 2024

Legal Technology Market (By Solution: Software, Services; By Type: e-Discovery, Legal Research, Practice Management, Analytics, Compliance, Document Management, Contract Lifecycle Management, Time- Tracking Billing, Other; By End-user: Law Firms, Corporate Legal Departments, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

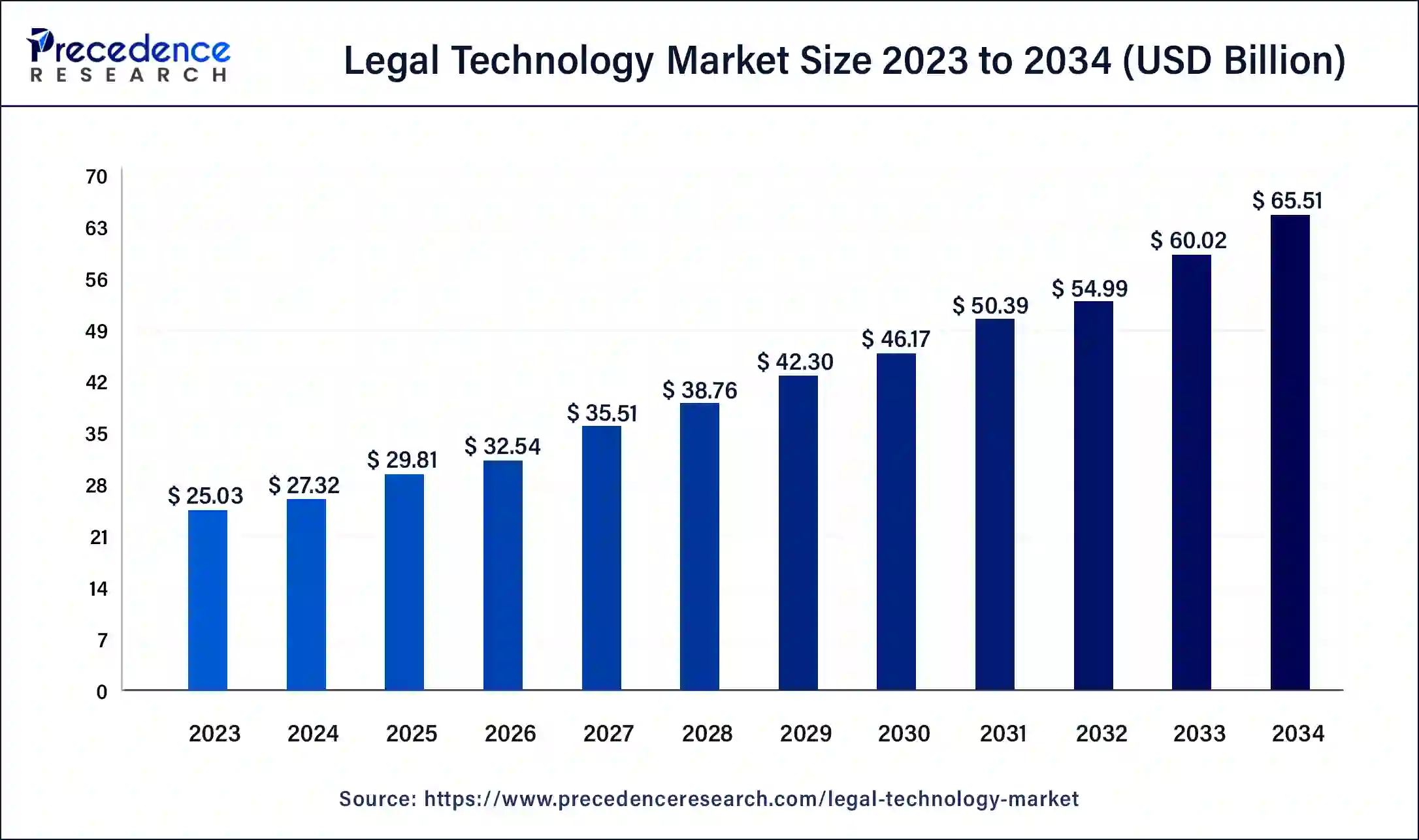

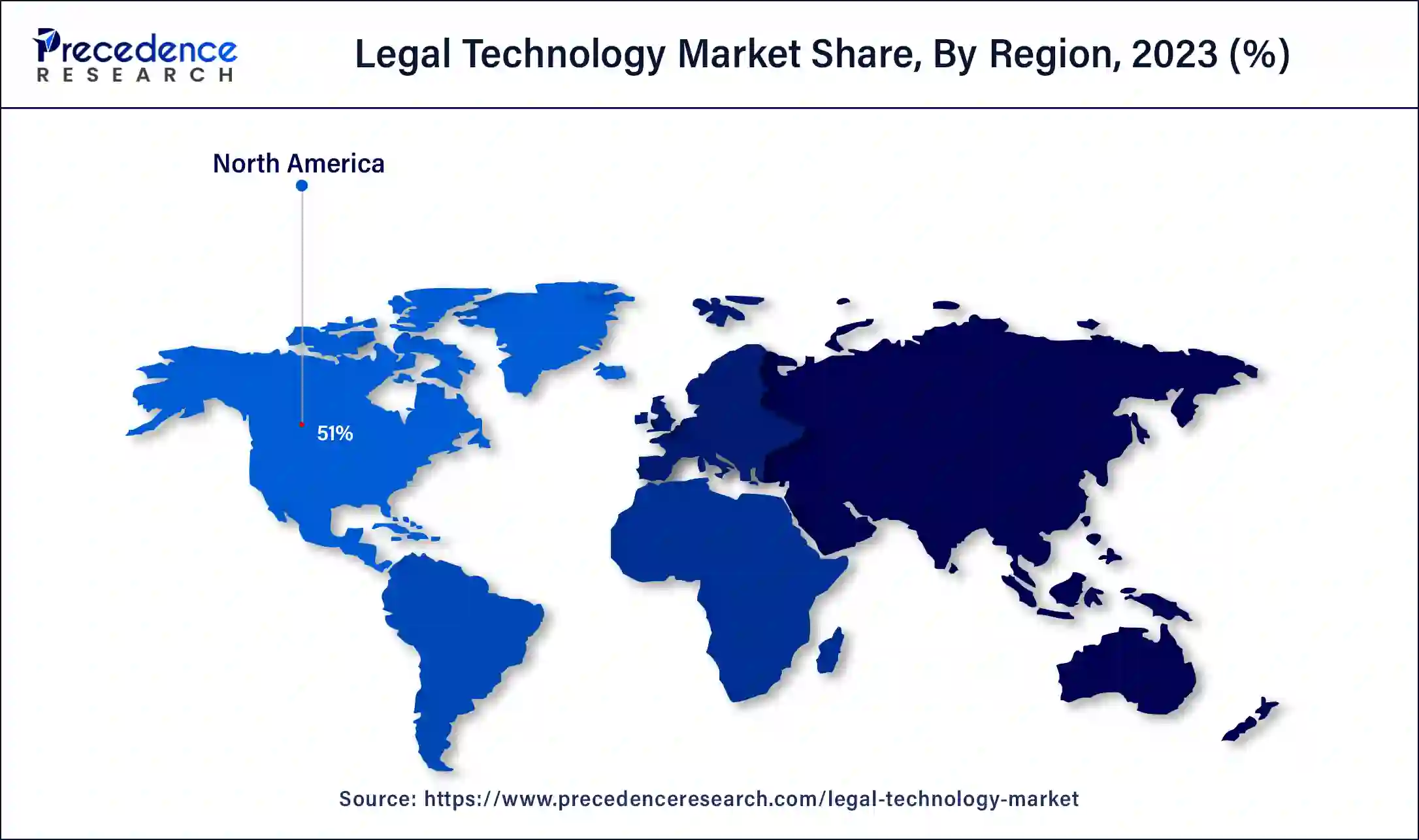

The global legal technology market size was USD 25.03 billion in 2023, calculated at USD 27.32 billion in 2024 and is expected to reach around USD 65.51 billion by 2034. The market is expanding at a solid CAGR of 9.14% over the forecast period 2024 to 2034. The North America legal technology market size reached USD 12.77 billion in 2023.

The U.S. legal technology market size was exhibited at USD 10.21 billion in 2023 and is projected to be worth around USD 27.16 billion by 2034, poised to grow at a CAGR of 9.30% from 2024 to 2034.

North America held the largest share of the legal technology market in 2023. The region is expected to experience significant growth because of its increased automation by using machine learning and artificial intelligence coupled with the growing acceptance of cloud-based solutions, which offer high levels of scalability, cost reduction, and flexibility, offering a variety of growth opportunities. The United States and Canada are anticipated to provide promising growth opportunities due to investment in artificial intelligence. In the USA, legal technology providers are focusing on offering advanced solutions for case management, lead management, document management, contract lifecycle management, billing & accounting, and others.

The growth in the region can also be attributed to established key players offering legal technology software solutions and services. Moreover, the USA is the most rapidly changing and competitive global market. Besides, the region is anticipated to adopt new technologies at a faster pace as compared to other countries in the world.

Asia Pacific is observed to witness the fastest rate of growth in the legal technology market. Governments in the region are supporting the adoption of technology in the legal sector through various initiatives and policies. These efforts aim to modernize the judiciary and improve access to justice, thereby fostering the growth of the legal technology market. There is a growing number of legal tech startups in the Asia Pacific region, attracting significant investment. These startups are developing innovative solutions such as AI-powered legal research tools, contract management systems, and e-discovery platforms, which are gaining traction in the market.

Legal technologies include a wide range of instruments and software applications that aim to eliminate or simplify any aspect of the field of law. These include the case management system, Electronic Discovery Software, Contract Management platforms, Legal Research tools, Document automation software, and Virtual law firms. The benefit of legal technology is to increase efficiency, cost reduction, and improve accuracy. The global market for legal technology is expected to grow at an encouraging rate over the coming years, due to which there will be increasing productivity among administrative staff and increased efficiency within law agencies.

The emerging concept in the legal technology market is smart contracts, blockchain technology, and Artificial intelligence (AI), which has enabled law firms and legal departments to store records safely. Furthermore, the legal industry is undergoing rapid changes as Artificial Intelligence speeds up, and law technology companies are developing a broad range of AI-powered solutions.

Additionally, Legal tech solutions to help lawyers with a wide range of tasks, such as legal research, document review, and contract analysis, can be provided by artificial intelligence or machine learning technologies. The adoption of cloud platforms is increasing the development of the global legal technology market, which allows lawyers to access legal software and data from anywhere and make it easier for lawyers to collaborate with their clients.

| Report Coverage | Details |

| Market Size by 2034 | USD 65.51 Billion |

| Market Size in 2023 | USD 25.03 Billion |

| Market Size in 2024 | USD 27.32 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.14% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Solution, Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Adoption of Cloud-based Technologies

Cloud technologies are becoming more widespread, and they have a significant influence on the law technology market. There are a variety of benefits to cloud-based legal technology, such as scalability, flexibility, and cost-effectiveness compared with existing Premises solutions.

Cloud technology enables a large amount of data to be stored safely in the cloud for law firms and lawyers. This means that the need for physical servers is no longer necessary, providing users with a simple and accessible way to access court records, case files, contracts, or other pertinent information via Internet-connected devices at any time. It makes it easier for users to find specific documents and ensures the proper management of their document lifecycle by grouping files, using metadata, applying version controls, or performing advanced searches. By using cloud technology, legal firms can focus on their core competencies, reduce administrative burdens, and enhance their overall productivity and client service.

Additionally, cloud technology has been widely adopted in the legal technology market, which has changed the way law firms and legal professionals operate. Moreover, Cloud-based solutions offer several benefits, which include greater flexibility, scale, and cost-effectiveness. Furthermore, law firms can securely store and access a wide range of data and collaborate with clients and colleagues in ways that facilitate their business processes by using cloud technology.

High Cost of Legal Technology

The high cost of legal technology is a major restraint in the legal technology market. The high costs of legal technology can be attributed to several factors. This is because of the cost of development, limited market size, and lack of standardization. As a result of the growing market, and as more companies learn how to use these technologies, the cost of legal technology is likely to decrease. However, for some time to come, the high costs of law enforcement technology will continue to be an obstacle on the market.

Cyberattacks on legal technology

Cyberattacks on legal technology, such as data breaches, unauthorized access to client information, and disruption of judicial proceedings, pose a serious risk. Due to the sensitive and valuable data they possess, law firms and legal organizations are attractive targets for hackers. To gain unauthorized access to sensitive information, cybercriminals use a range of techniques, such as phishing, ransomware attacks, and data breaches.

Nevertheless, these attacks not only affect the client data but also have an impact on operations, which leads to a loss of revenue and reputational damage. For Instance, the law firm Campbell Conroy & O'Neil P.C. was subject to a data breach on February 27, 2021. The ransomware attack prevented Campbell Conroy & O'Neil P.C. from accessing critical files in its system.

Artificial intelligence (AI) segment in legal technology Market

The AI segment in the legal technology market is growing rapidly as lawyers and legal professionals look for ways to use artificial intelligence to improve their efficiency and productivity. AI solutions for legal technology are being used in various areas, including contract review and analysis. Legal research. E-discovery. Fraud detection. In addition, artificial intelligence can automagically perform some of the everyday tasks, freeing up legal professionals' time for more important work. Artificial intelligence is transforming the legal landscape by increasing productivity, simplifying processes and workflows, and providing more efficient services through its capacity to handle complicated and data-heavy tasks.

The legal sector can be transformed into a more efficient and productive one by artificial intelligence. The development of law firms is being positively impacted by the application of artificial intelligence in the legal technology market. This growth can be expected to continue in the future as AI technology develops.

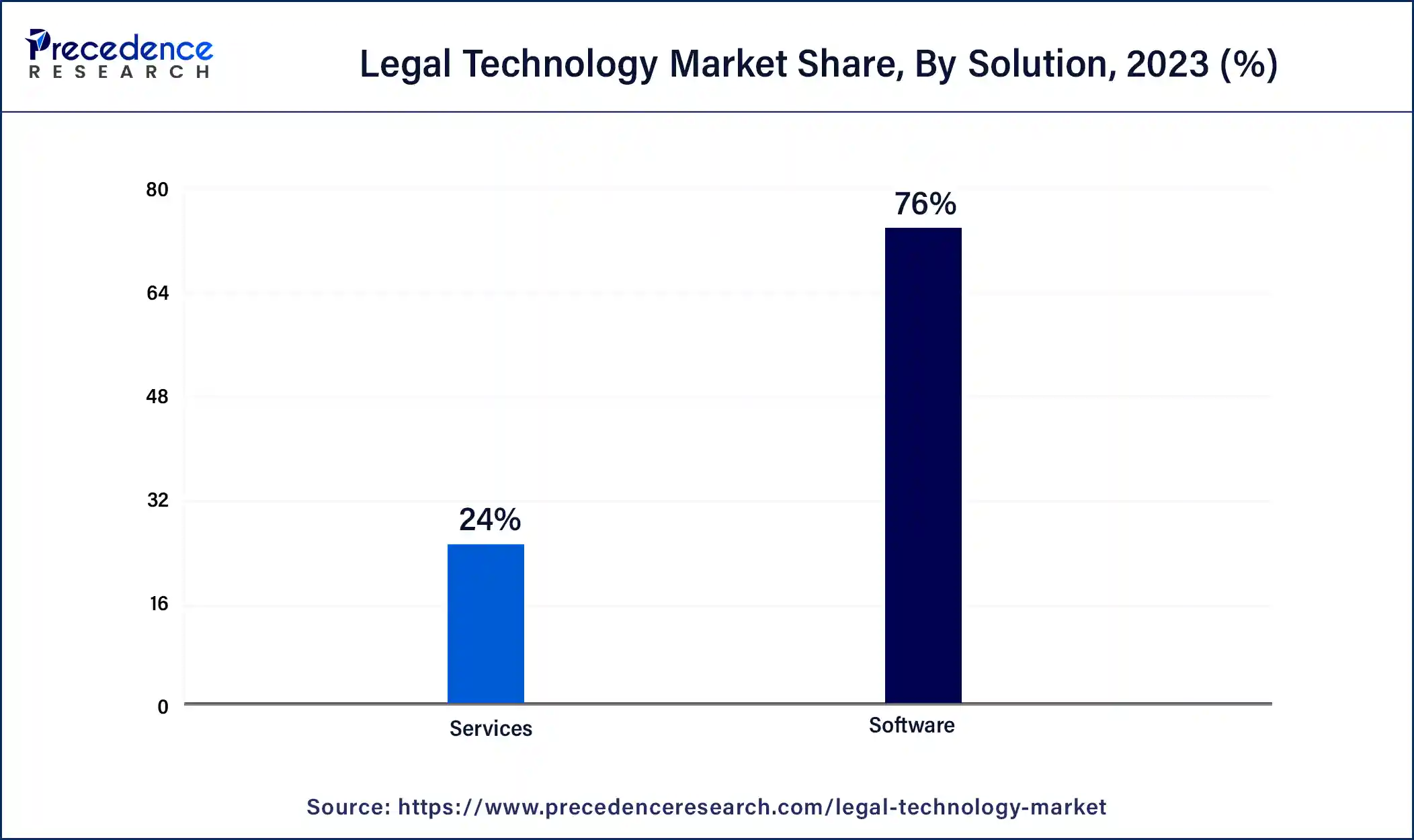

The software segment held the largest share of the legal technology market in 2023. It is because of the growing number of cloud-based legal software solutions. In comparison to traditional on-premise software, cloud-based law software is more affordable and easily used. The software segment includes a wide range of legal technology solutions, such as contract management software, legal research software, and document automation software. Over the next few years, this segment of services will also experience significant growth. This is because there is a growing demand for advisory, implementation, and training services. For law firms, these services are necessary for the most effective use of their investment in Legal Technology.

In addition, the segment is composed of cloud computing and on-premise-based software. The market is expected to generate considerable growth opportunities by incorporating the latest technological developments, such as machine learning, artificial intelligence, and blockchain.

The contract lifecycle management segment had the largest share in the legal technology market. In addition, contract lifecycle technology is used in various industries and sectors to streamline and optimize the entire contract management process. It is used in areas such as law, public procurement, sales, and human resources. Contract lifecycle management is software that involves creating contracts from the initial stage, such as drafting to negotiation to execution; it can also help to tackle compliance with contract terms. The growth of the contract lifecycle management market is due to an increase in the need for businesses to manage contracts more effectively and efficiently.

Contract lifecycle management software is becoming an essential tool for legal businesses. eDiscovery is a type of legal technology used by lawyers to manage discovery in the course of litigation. It can be used for the identification, collection, and preservation of electronic evidence. Other types of legal technology include legal chatbots, legal document automation, and legal compliance software.

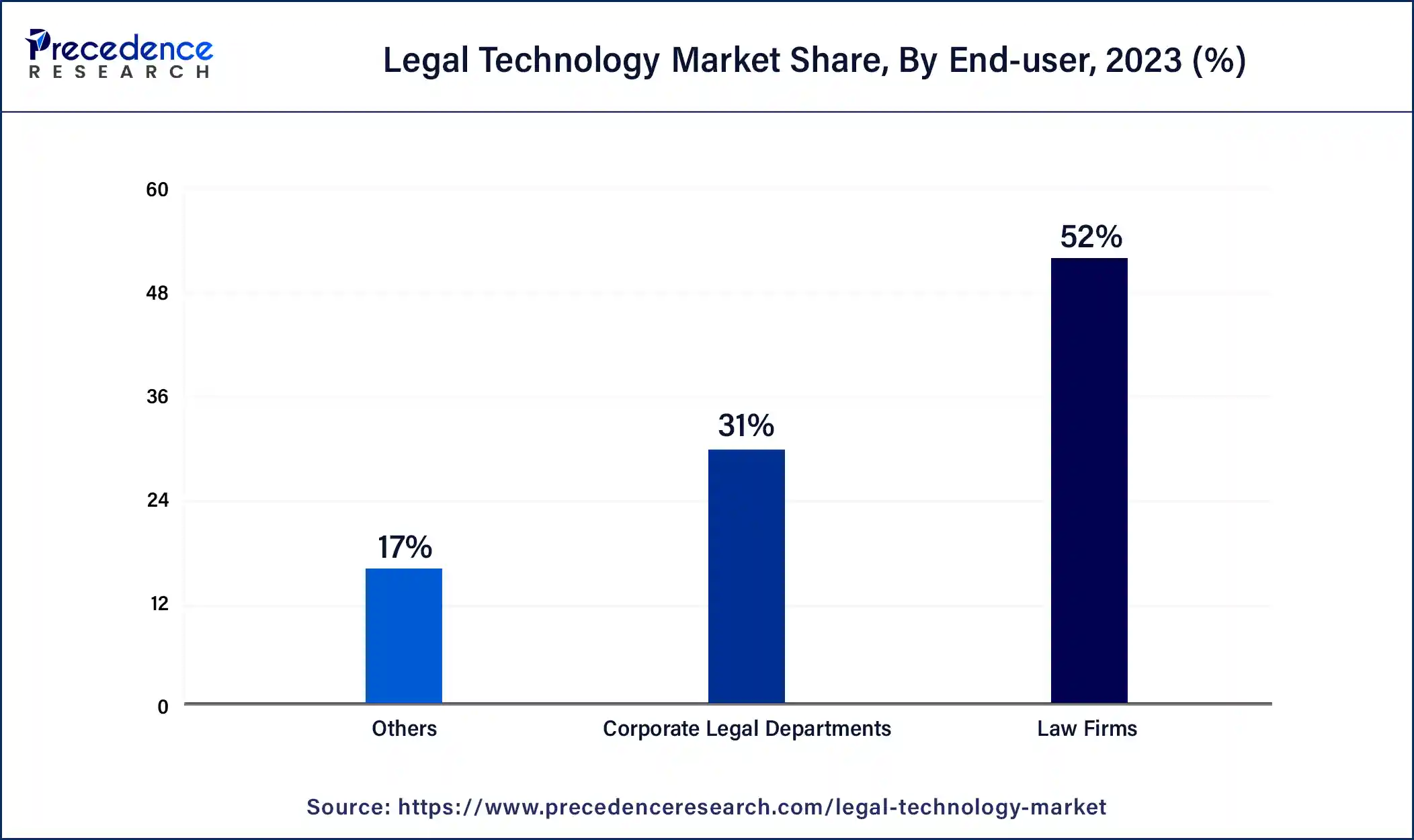

The legal technology market is dominated by the law firms segment. The segment is observed to sustain the position in the predicted period. Law firms need legal technology which can assist them with their workload management and time tracking. These solutions may include case management systems, document management software, time tracking tools, billing and invoicing platforms, and legal research platforms.

Increasing demand for automation and efficiency in law firms is driving the growth of this segment. Legal departments are the second largest user segment in the legal technology market. Additionally, this segment has been driven by increasing regulatory compliance requirements and the need to manage a large volume of data.

The corporate legal departments segment is observed to grow at a notable rate in the legal technology market. Legal technology solutions help corporate legal departments reduce costs associated with manual processes and external legal services. Tools such as contract management systems, e-discovery platforms, and legal analytics enable in-house teams to handle more work internally, reducing reliance on costly external counsel. Technologies such as AI and machine learning can automate routine tasks, allowing legal professionals to focus on higher-value activities. Document automation, AI-powered legal research, and predictive analytics improve efficiency and decision-making within legal departments.

Segment Covered in the Report

By Solution

By Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

March 2025

February 2025