April 2025

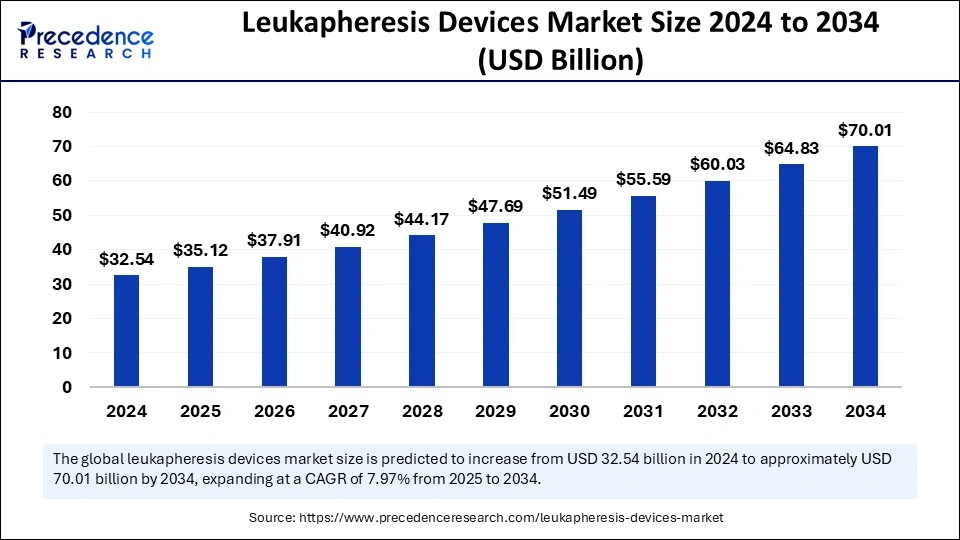

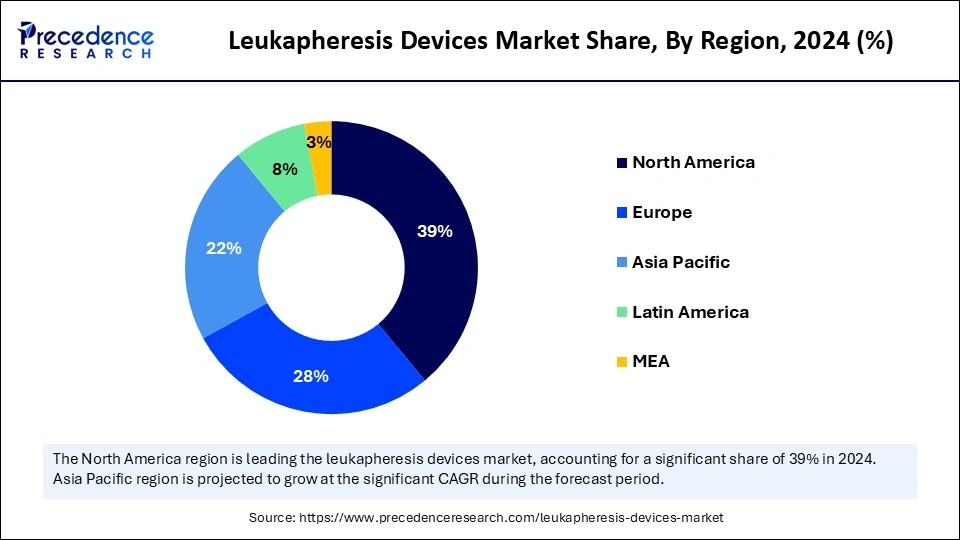

The global leukapheresis devices market size is calculated at USD 35.12 billion in 2025 and is forecasted to reach around USD 70.01 billion by 2034, accelerating at a CAGR of 7.97% from 2025 to 2034. The North America market size surpassed USD 12.69 billion in 2024 and is expanding at a CAGR of 8.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global leukapheresis devices market size accounted for USD 32.54 billion in 2024 and is predicted to increase from USD 35.12 billion in 2025 to approximately USD 70.01 billion by 2034, expanding at a CAGR of 7.97% from 2025 to 2034. The growing prevalence of leukemia is the key factor driving market growth. Also, technological innovations in leukapheresis procedures, coupled with the rising demand for personalized medicine, can fuel market growth further.

Artificial Intelligence is revolutionizing the leukapheresis devices market by improving accuracy, enhancing monitoring, and streamlining procedures and patient outcomes, which can lead to more efficient and sophisticated devices. Furthermore, AI can monitor the performance of the leukapheresis device and the vital signs of patients, alerting medical professionals to any potential deviations or problems from the expected parameters. This can facilitate early detection and intervention, enhancing patient safety and outcomes.

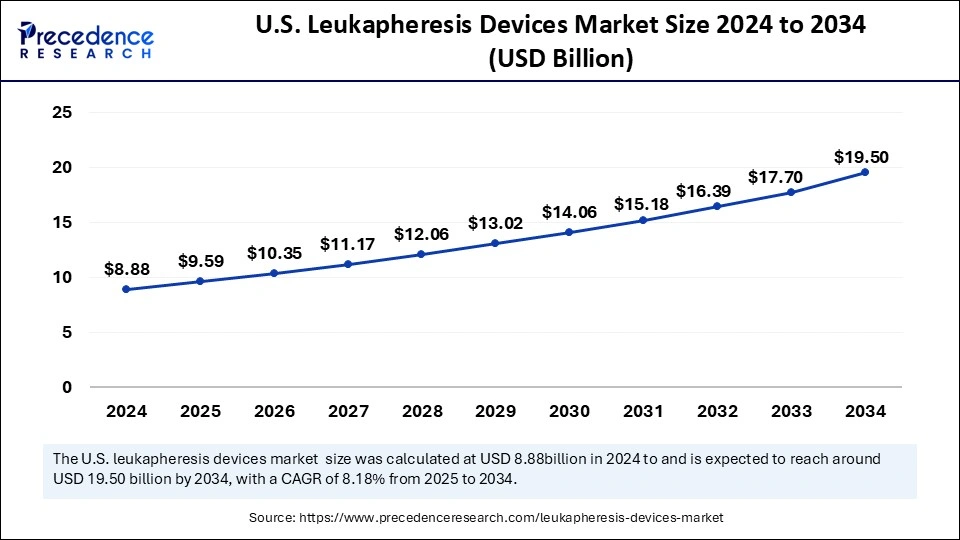

The U.S. leukapheresis devices market size was exhibited at USD 8.88 billion in 2024 and is projected to be worth around USD 19.50 billion by 2034, growing at a CAGR of 8.18% from 2025 to 2034.

North America dominated the leukapheresis devices market in 2024. The dominance of the region can be attributed to the innovative healthcare infrastructure, coupled with the increasing adoption of advanced medical technologies. Moreover, the region also benefits from the strong presence of major market players, research centers, and academic institutions emphasizing the latest leukapheresis procedures.

In North America, the U.S. led the market owing to the supportive regulatory environment, well-established healthcare system, and growing incidence of hematologic disorders. Also, innovations in cell therapies and the growing demand for leukoplakia can impact market growth positively.

Asia Pacific is expected to grow at the fastest rate over the period studied. The growth of the region can be credited to the growing healthcare expenditure, rapid urbanization, and an increasing patient population with autoimmune diseases and hematologic disorders. Furthermore, countries such as China, India, and Japan are heavily investing in medical infrastructure development.

In Asia Pacific, China dominated the leukapheresis devices market by holding the largest market share. The dominance of the country is due to the rapidly evolving healthcare sector in China and the government's initiatives to enhance healthcare affordability and access. The region is also witnessing a rising incidence of blood cancers and autoimmune disorders.

The market encompasses the global industry for products and specialized equipment utilized in the process of separating and collecting leukocytes from blood for research or therapeutic purposes. The leukapheresis devices market includes an extensive range of devices, like leukapheresis columns, apheresis machines, leukoreduction filters, and cell separators. The latest trend in the is the growing use of leukopaks in CAR cell therapy.

| Report Coverage | Details |

| Market Size by 2034 | USD 70.01 Billion |

| Market Size in 2025 | USD 35.12 Billion |

| Market Size in 2024 | USD 32.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.97% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Application, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising incidence of hematologic disorders

The increasing prevalence of hematologic disorders, like lymphoma and leukemia, is a major factor driving the leukapheresis devices market. These disorders necessitate efficient treatment approaches, and hence, leukapheresis devices play an essential role in managing abnormal WBC counts. In addition, leukapheresis devices can rapidly decrease the number of leukemic cells in the blood to tackle symptoms and prepare individuals for therapies.

In September 2024, PharmaEssentia Corporation, a global biopharmaceutical innovator leveraging deep expertise and proven scientific principles to deliver new biologics in hematology and oncology, announced the availability of BESREMi® (ropeginterferon alfa-2b) in Singapore.

Regulatory hurdles

Strict regulatory requirements for efficacy, safety, and quality create a substantial hurdle to entry for market players, negatively impacting product development and market growth. Moreover, concerns about the cost-effectiveness of this treatment as compared to other therapies or conventional blood banking methods may affect the overall adoption rates of leukapheresis devices.

Increasing demand for blood and blood products

The ongoing surge in the need for blood and blood products is a major factor boosting the leukapheresis devices market. As the amount of trauma cases, surgical procedures, and chronic diseases increases, the demand for efficient blood component separation becomes crucial. Furthermore, the increasing emphasis on blood donation awareness campaigns will likely contribute to the growing volume of blood collections. Hence, healthcare settings are investing heavily in innovative leukapheresis technologies.

The apheresis devices segment dominated the leukapheresis devices market in 2024. The dominance of the segment can be attributed to the rising prevalence of leukemia across the globe and innovations in medical technology, especially in therapeutic apheresis procedures. Additionally, government initiatives and rising awareness regarding blood donation are propelling the availability of blood components, which impacts segment growth positively.

The leukapheresis columns and cell separators segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the rising incidence of autoimmune diseases along with the increasing demand for individualized medicine and research. Also, these devices optimize the separation of blood components, enabling the selective removal or collection of specific cells, such as leukocytes.

The research application segment held the largest leukapheresis devices market share in 2024. The dominance of the segment can be linked to the rise in research on blood cancer along with the innovations in leukapheresis procedures. Moreover, researchers are emphasizing developing novel therapies for many diseases, such as cancer and autoimmune disorders. Leukapheresis procedures can be utilized to separate specific cell populations, such as T cells or stem cells.

The therapeutic applications segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the growing adoption of cell-based therapies and individualized medicine. Therapeutic applications include utilizing leukapheresis to collect bone and blood marrow stem cells to help build bone marrow after chemotherapy treatment. Emergency leukapheresis also has better outcomes and lower mortality rates.

In 2024, the hospital segment dominated the leukapheresis devices market by holding the largest share. The dominance of the segment is owing to the growing emphasis on patient-centered treatments coupled with innovative therapeutic procedures. Furthermore, the hospital plays a key role in the treatment of blood disorders such as lymphoma and leukemia and in the stem cell transplantation process. Hospitals are major caregivers for patients with hematologic conditions.

The academic and research institutes segment is estimated to grow at the fastest rate during the projected period. The growth of the segment is due to interdisciplinary research, global collaboration, and government investment. Moreover, government funding and policies play a key role in funding research projects and supporting research infrastructure. Partnerships between universities and businesses are essential for translating research into practical applications.

By Device Type

By Application

By End User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

January 2025