June 2024

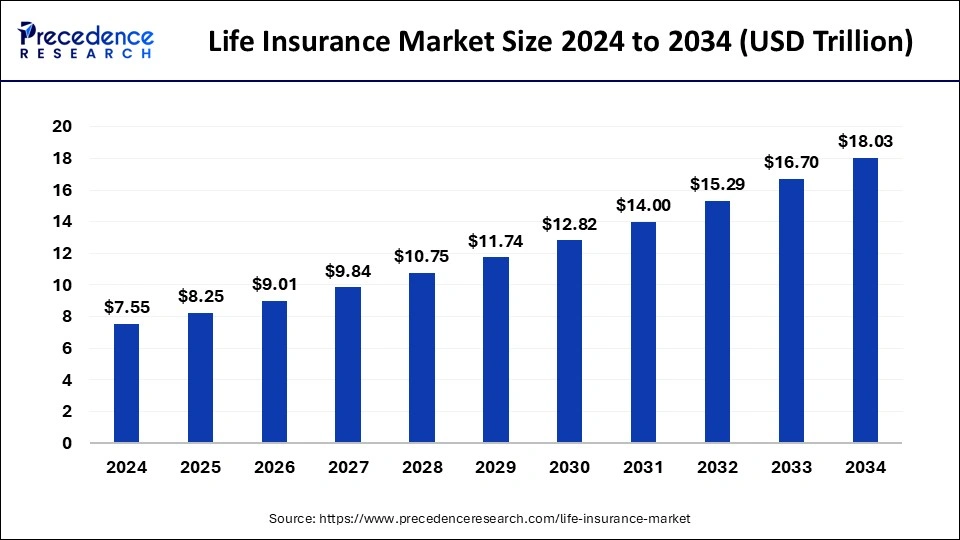

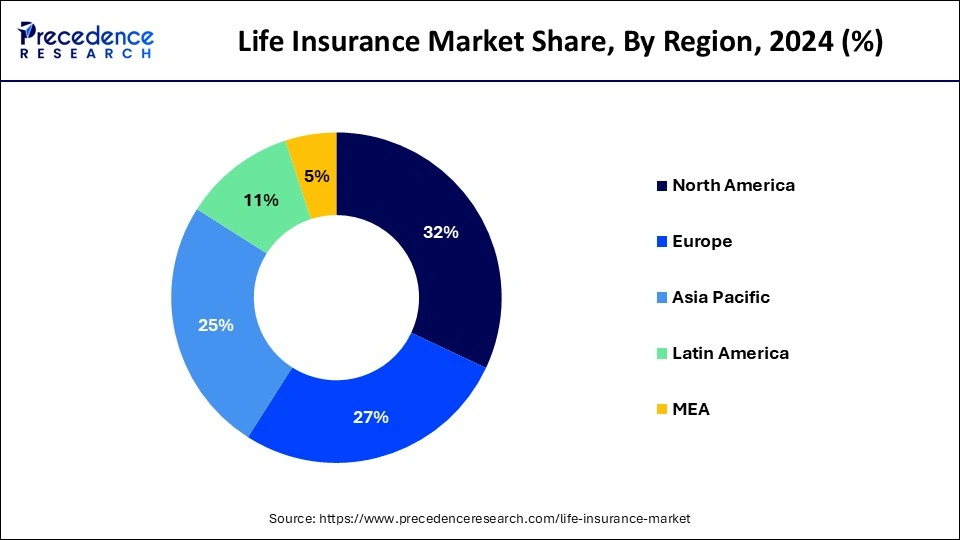

The global life insurance market size is recorded at USD 8.25 trillion in 2025 and is forecasted to reach around USD 18.03 trillion by 2034, accelerating at a CAGR of 9.10% from 2025 to 2034. The North America life insurance market size surpassed USD 2.42 trillion in 2024 and is expanding at a CAGR of 9.13% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global life insurance market size was estimated at USD 7.55 trillion in 2024 and is predicted to increase from USD 8.25 trillion in 2025 to approximately USD 18.03 trillion by 2034, expanding at a CAGR of 9.10% from 2025 to 2034. The life insurance market is driven by the expansion of the middle class in emerging markets.

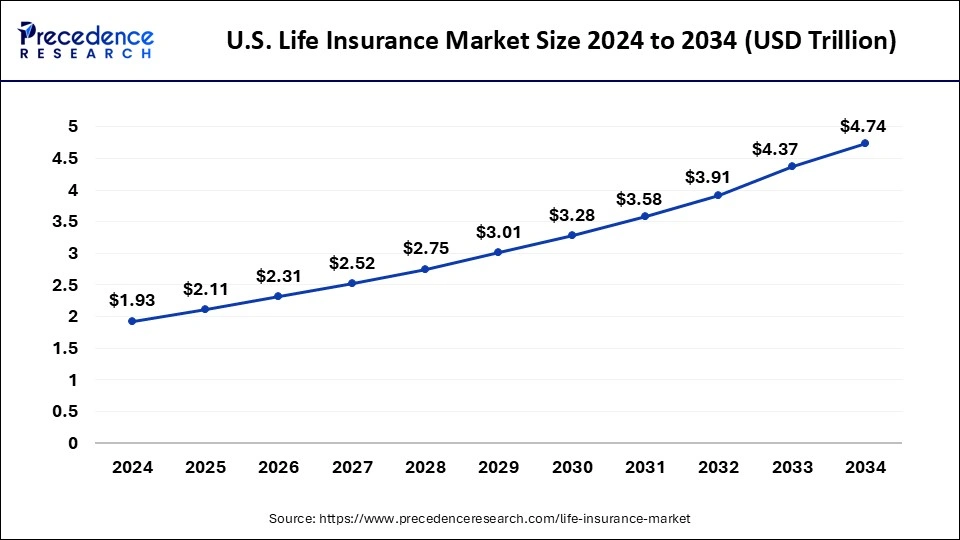

The U.S. life insurance market size was estimated at USD 1.93 trillion in 2024 and is predicted to be worth around USD 4.74 trillion by 2034 with a CAGR of 9.40% from 2025 to 2034.

North America has its largest market share in 2024 in the life insurance market. More people can purchase life insurance plans due to the region's high per capita income. The acquisition of both necessary and supplementary financial goods, such as life insurance, is made possible by this disposable money. It is deeply engrained in culture to view life insurance as a vital financial tool for safeguarding families and guaranteeing financial stability in the event of an insured person's passing. This cultural acceptance bolsters the continuous demand for life insurance products.

According to the American Council of Life Insurers (ACLI), there were 134,193,000 individual life insurance policies in force in 2023. There were over 118,000,000 people with group life insurance.

Because many high-yielding investment options are available, life insurance firms in North America enjoy robust investment returns. Because of their financial stability, insurers can provide customers with competitive and appealing products.

Asia- Pacific is the fastest growing market during the forecast period. The growing middle class in nations like China, India, and Indonesia fueled demand for products and services, which in turn drove demand in the retail, automobile, and technology industries. The area is rapidly becoming more urbanized, which increases demand for housing, infrastructure, and urban services. As a result, related businesses, including utilities, real estate, and construction, are growing.

The cloud, artificial intelligence, Internet of Things, and 5G technologies have enormous growth potential, and the digital economy is growing quickly. Businesses in the area are making significant investments in digital capabilities and infrastructure.

The life insurance market is a collection of companies and endeavors engaged in purchasing, selling, and managing life insurance policies. These policies are agreements between an insurance company and a policyholder. The insurance company agrees to pay premiums in exchange for the policyholder's beneficiary designation upon the covered person's death. Various plans on the market address distinct financial needs and objectives, including whole life, variable life, universal life, and term life insurance.

In the case of the policyholder's passing, life insurance offers beneficiaries, typically family members, financial security. To ensure that the insured's dependents are financially responsible, this can cover living expenses, debts, school tuition, and other financial commitments. Loans can be secured by life insurance policies, improving a borrower's or business's creditworthiness. This makes credit more accessible and encourages saving and investment.

The life insurance industry is a major employer, with positions in underwriting, sales, claims processing, actuarial science, and other areas. Its operations support related businesses like healthcare, finance, and legal services.

Life Insurance Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2025 | USD 8.25 Trillion |

| Market Size by 2034 | USD 18.03 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 9.10% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Greater private sector participation and an improvement in distribution capabilities

Pressure from competition causes private insurers to function more effectively. They improve service delivery, cut expenses, and streamline procedures, improving the general customer experience. The involvement of the private sector facilitates the adoption of cutting-edge technology like digital platforms, artificial intelligence, and big data analytics. With these technologies, insurers may provide more individualized products, expedite the underwriting process, and better analyze risk.

Substantial improvements in operational efficiencies.

Enhancements in operational effectiveness frequently result in quicker and more precise handling of client queries, insurance claims, and policy administration. Due to automation, artificial intelligence (AI), and machine learning (ML), insurance companies may now offer more individualized services and faster response times. This increases client happiness and loyalty. Creating operational savings frees up funds that can be used for innovation and the creation of fresh insurance offerings. This enables insurance companies to meet their client's changing demands and interests by offering personalized policies, micro insurance, and digital insurance solutions.

Operational enhancements and technological breakthroughs streamline underwriting procedures. Automated underwriting systems use AI and big data to evaluate applications more rapidly and precisely, cutting down on the time it takes to issue a policy and enhancing the onboarding process for new customers. This drives the growth of the life insurance market.

Premiums for life insurance policies can be expensive

Customers frequently compare the perceived value or advantages of a life insurance coverage with the cost of the premiums. Potential clients may believe that paying large premiums is not worth the advantages, particularly if they are young and believe they have a low chance of dying. This belief may cause people to be reluctant to get life insurance, which would limit the market's expansion. Recessions and economic downturns make the problem of high premiums worse.

Families and individuals are more prone to reduce non-essential spending during these times by tightening their budgets. When finances are tight, life insurance is sometimes viewed as a non-essential expense, maybe one of the first items to go. Customers are significantly more likely to choose not to purchase life insurance due to high rates. This limits the growth of the life insurance market.

Partnering with healthcare providers to offer wellness programs

Diabetes and hypertension are two examples of chronic diseases that can be prevented and managed through wellness programs, which can lower their incidence. Promoting routine health examinations and screenings can aid in the early detection of health problems, hence lowering the severity and expense of claims.

Insurance companies and healthcare providers can collaborate to obtain full health data. This information sheds light on policyholders' ongoing medical issues, lifestyle choices, and medical histories. The data makes more accurate risk assessment possible, which improves underwriting choices and precision in insurance pricing. This opens an opportunity for the growth of the life insurance market.

The annuity premiums & deposits segment dominated the life insurance market in 2024. People are beginning to realize how vital retirement planning is. Annuity product demand is being driven by consumers seeking to secure a steady and predictable income throughout retirement. Many nations have regulatory frameworks that guarantee consumer safety and offer tax advantages, which contribute to the expansion of the annuity business. As a result, more people gain confidence and purchase annuities.

The accident & health premiums segment is the fastest growing in the life insurance market during the forecast period. Paying benefits to the insured for treating disease, injury, disability, accident, and health insurance shields policyholders from the financial strain and fallout from unforeseen medical expenses. Policies can be given to people, employers, workers, or association members. The coverage of these insurances varies considerably. Surgical and treatment-related costs, as well as hospital stays (including some room and board), are typically covered by basic medical coverage. Basic coverage often pays providers a certain sum based on "usual, reasonable, and customary" criteria.

The expansion of employer-sponsored health plans and government initiatives supporting health insurance plays a major role in the growth of the A&H premiums category. Employers are increasingly offering health insurance as a benefit, and numerous governments are putting laws into place to boost the prevalence of health insurance.

The life insurance premiums segment shows a notable growth in the life insurance market during the forecast period.

The life insurance premium is the money that fuels your policy and keeps your coverage active while protecting your beneficiaries. Paying your premiums on time is essential to keeping your policy in effect, regardless of whether you choose a permanent plan that offers lifelong protection or a term policy with a set period. Although many insurers offer quarterly, semi-annual, or annual payment choices to accommodate varying preferences, these payments are often paid monthly. Insurance companies constantly innovate and broaden the range of products they offer to meet the needs of a wider spectrum of customers.

Products such as endowment policies, whole life, term insurance, and unit-linked insurance plans (ULIPs) offer investment possibilities and a range of advantages. The availability of such a wide range of goods draws in more clients, which increases the demand for premium collections. The growth of the life insurance business is encouraged by favorable regulatory frameworks and government incentives in several countries. A rise in policy uptake and premium payments results from advantageous policies that encourage insurance penetration and tax benefits on life insurance premiums.

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

January 2025

September 2024

October 2024