February 2025

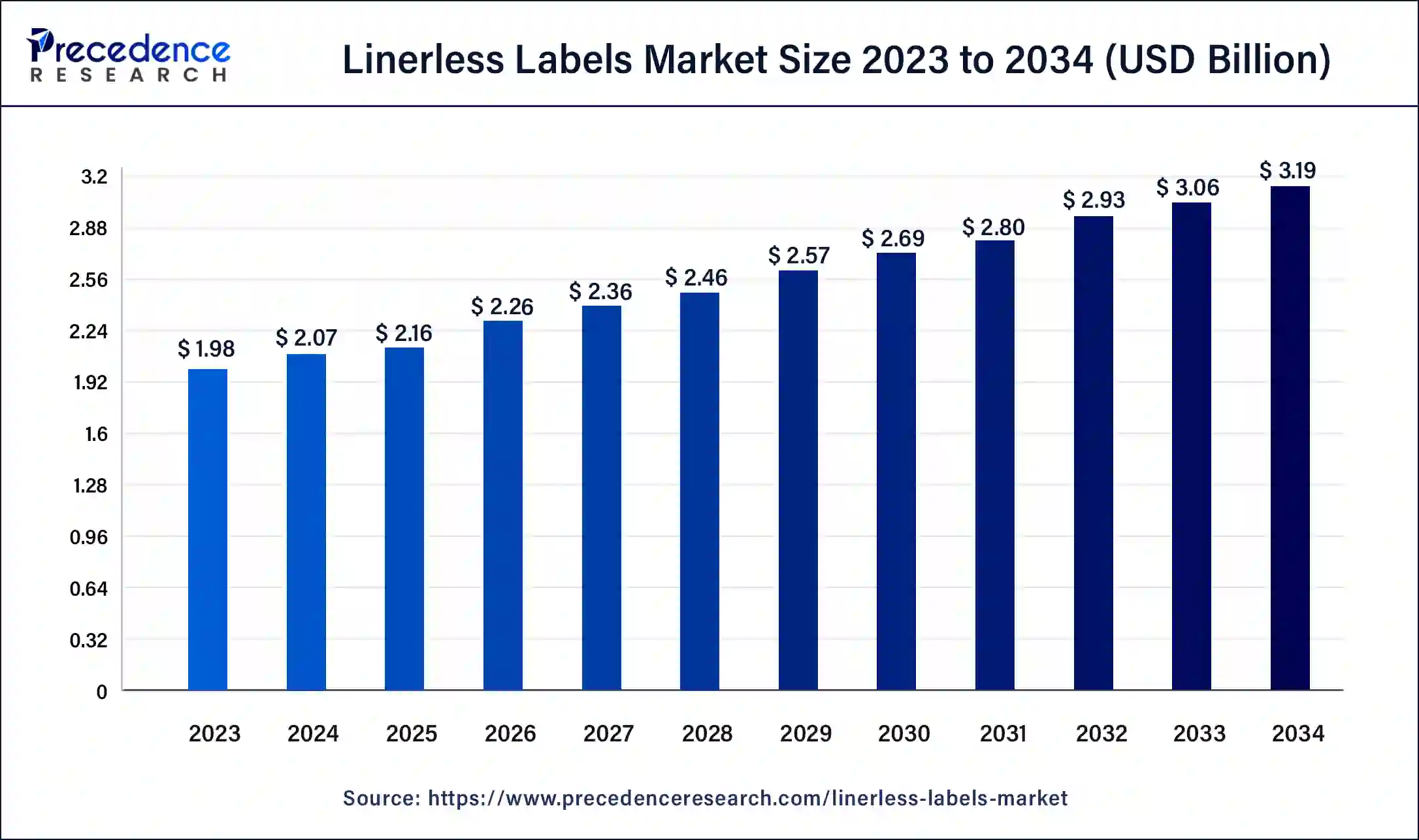

The global linerless labels market size surpassed USD 1.98 billion in 2023 and is estimated to increase from USD 2.07 billion in 2024 to approximately USD 3.19 billion by 2034. It is projected to grow at a CAGR of 4.42% from 2024 to 2034.

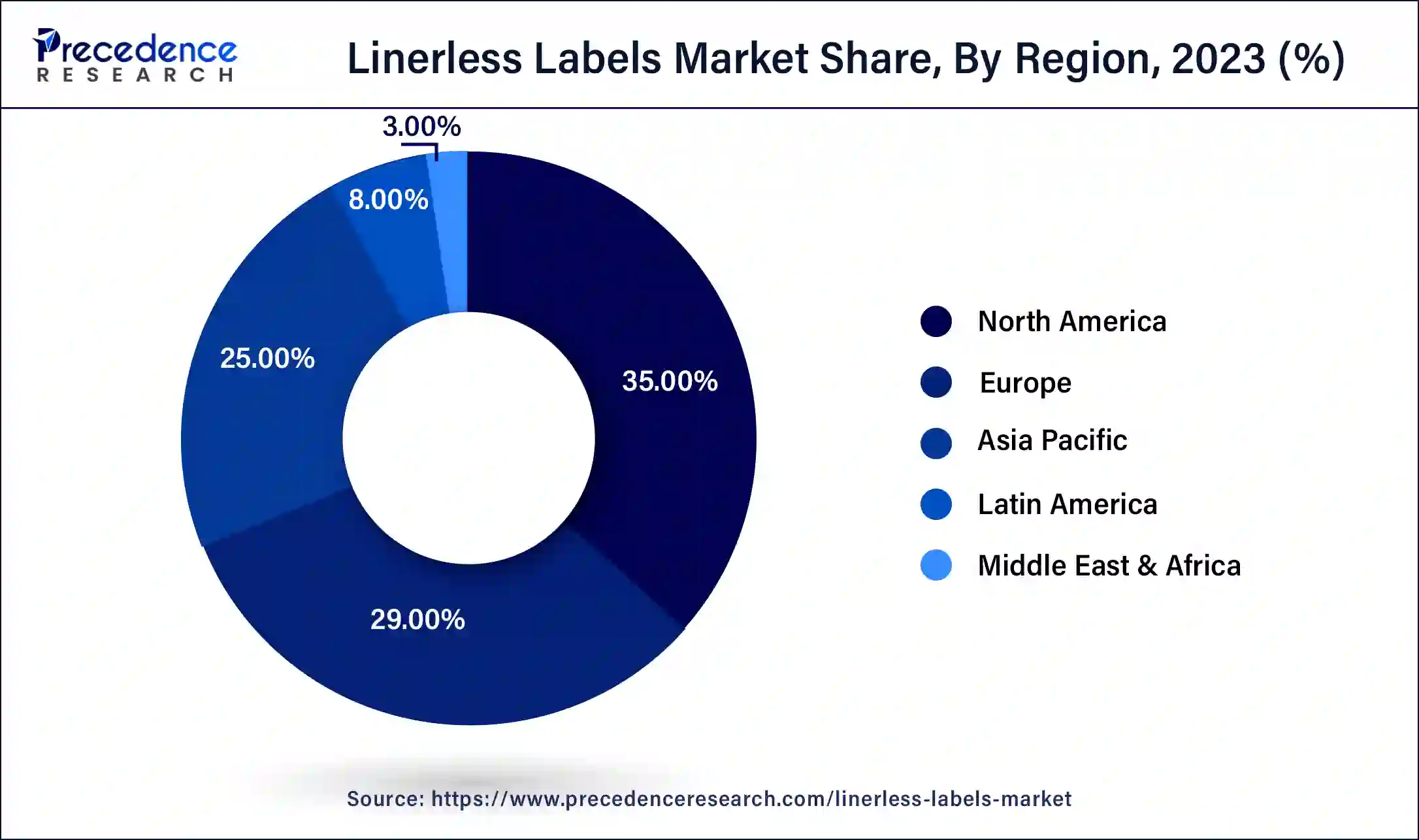

The global linerless labels market size is worth around USD 2.07 billion in 2024 and is anticipated to reach around USD 3.19 billion by 2034, growing at a CAGR of 4.42% over the forecast period 2024 to 2034. The North America linerless labels market size reached USD 690 million in 2023. The enhanced operational efficiency, advanced technologies, high customization, enhanced productivity, improved manufacturing efficiency, and linerless labels reduce the cost of liner materials etc., contributing to the growth of the market.

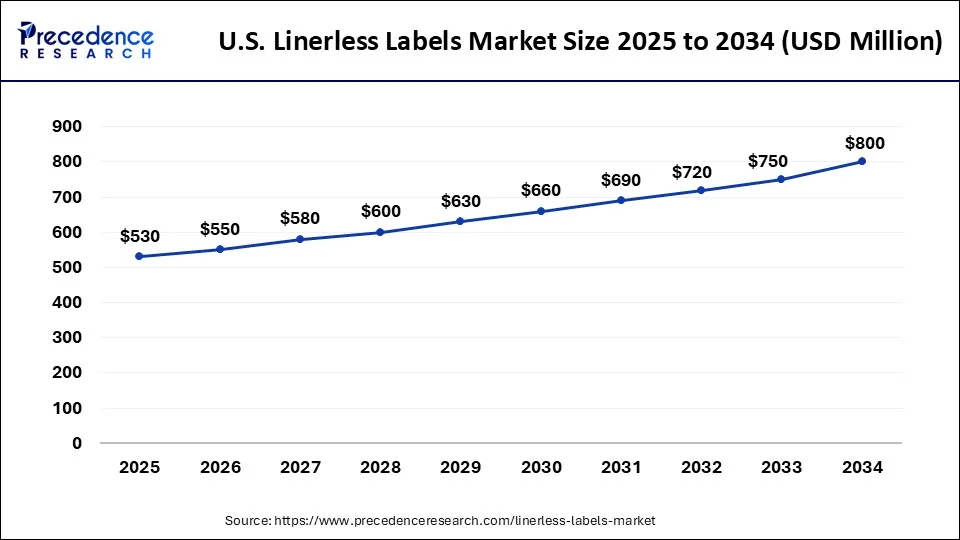

The U.S. linerless labels market size was exhibited at USD 490 million in 2023 and is projected to be worth around USD 800 million by 2034, poised to grow at a CAGR of 4.55% from 2024 to 2034.

North America dominated the linerless labels market in 2023. The demand for linerless labels is increasing because of cost efficiency and sustainability reasons. Many retail chains are adopting linerless labels for the packaging of products to minimize environmental footprint and reduce waste. The stringent government regulations help to support sustainability and implementation of many recycling programs for waste products.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. Linerless label demand is increasing in the Asia Pacific region because of the expanding e-commerce and retail sectors. Linerless labels offer efficient and cost-effective solutions for many products, including electronics and clothing. India and China are the leading countries for the growth of the linerless labels market.

The linerless labels market refers to buyers and sellers of linerless labels, also called liner-free labels, which are labels that do not have a liner or backing paper. The benefits of linerless labels include being highly customizable, being made to answer all the labeling needs, lower shipping costs for users, improved manufacturing efficiency and productivity, and more labels per roll, which can help save on transportation costs and storage. It helps reduce landfill use and waste and lowers the carbon footprint of the packaging processes. The benefits of linerless labels also include improved safety, faster processing, and reduced freight and storage footprint.

What are the benefits of AI for the Linerless Labels Market?

The use of artificial intelligence (AI) in linerless labels has many benefits, including reducing human error, facilitating instant decision-making, smoothly handling big data, automating repetitive tasks, etc. It also includes the benefits of improved cybersecurity, enhanced agriculture, improved financial services, scientific discovery, customer service excellence, advanced transportation, climate change mitigation, rising economic growth, improved healthcare, etc. These factors help to the growth of the linerless labels market.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.19 Billion |

| Market Size in 2024 | USD 2.07 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.42% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Printing Ink, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Enhanced operational efficiency

The enhanced operational efficiency contributed to the growth of the linerless labels market. Linerless labels improve speed in operations while maintaining quality. It is noted that traditional labels with liners produce waste at the time of the packaging process. Using linerless labels helps to reduce waste, making it a sustainable option that is better for the environment and landfills. Reducing waste with linerless labels helps to improve safety and may enhance compliance with standards.

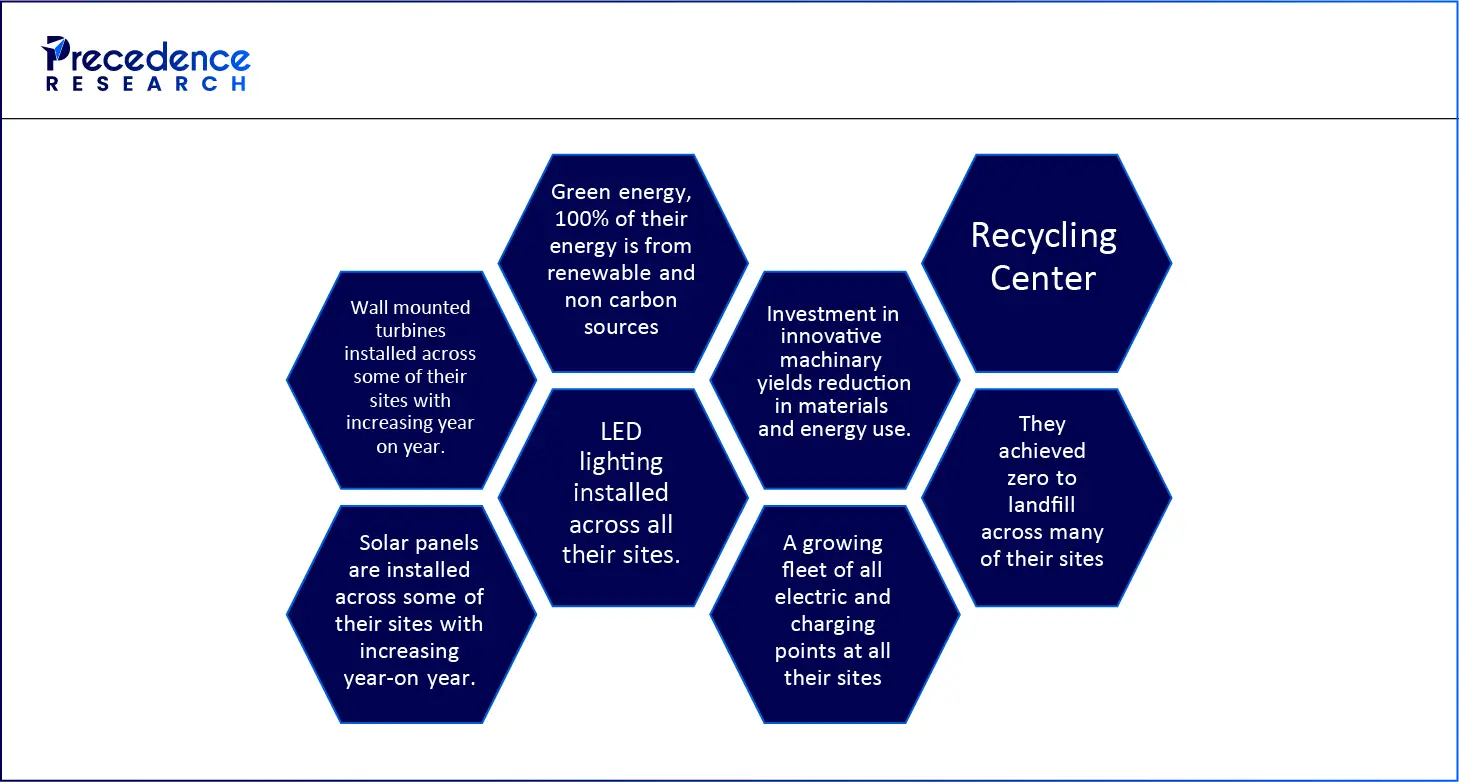

Reflex Labels Ltd. reduces its carbon footprint or achieves sustainability by the following methods:

Downsides of linerless labels

The downsides of linerless labels include their cost, which is as much as peel-and-stick labels, if not more. Special printers are needed to roll linerless labels smoothly over silicone rollers. May have to spend many thousands of dollars to purchase one-linerless labels. Linerless labels with limited shapes can be considered a drawback to end users' prospects. Linerless labels eliminate the felling of mature trees and eliminate the consumption of energy, fresh water, etc., which can hamper the growth of the linerless labels market.

Increasing the use of linerless labels in industrial and retail applications

From eliminating the environmental impact and waste to streamlining the process of labeling, linerless labels are reshaping the landscape of labeling and packaging. Mobile linerless printers are used by developing retailers to allow shop floor staff to take label printers with them to products or shelves that require label or pricing updates. These factors will help the growth of the lineless labels market in the future.

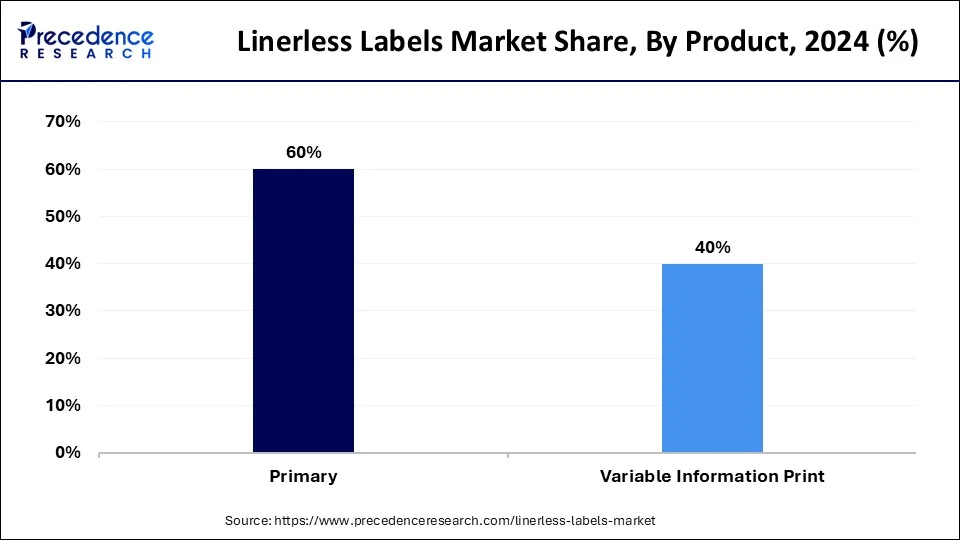

The primary segment dominated the linerless labels market in 2023. In the primary products, linerless labels contribute to improving safety and sustainability by eliminating carbon emissions at the time of production of liners and reducing liner waste, which promotes workplace safety and a greener environment.

The variable information print segment is expected to be the fastest-growing during the forecast period. The benefit of linerless labels is that there are 40% more labels per roll because of the absence of backing paper. More labels per roll means less downtime on production lines. Rising space allows for larger labels and a 40% reduction of storage space required. There is high-speed application and coding of variable information. Beontag’s VIP (Variable Information Printing) linerless labels have demonstrated a 33% water consumption reduction and 35% lower carbon footprint as compared to products with liner in the same application with advantages of every single stage of the life cycle, which help to the growth of the linerless labels market. The benefits of variable data printing include making tracking easier, personalizing label art and design, and increasing engagement. Variable data printing enables consistently targeted advertising.

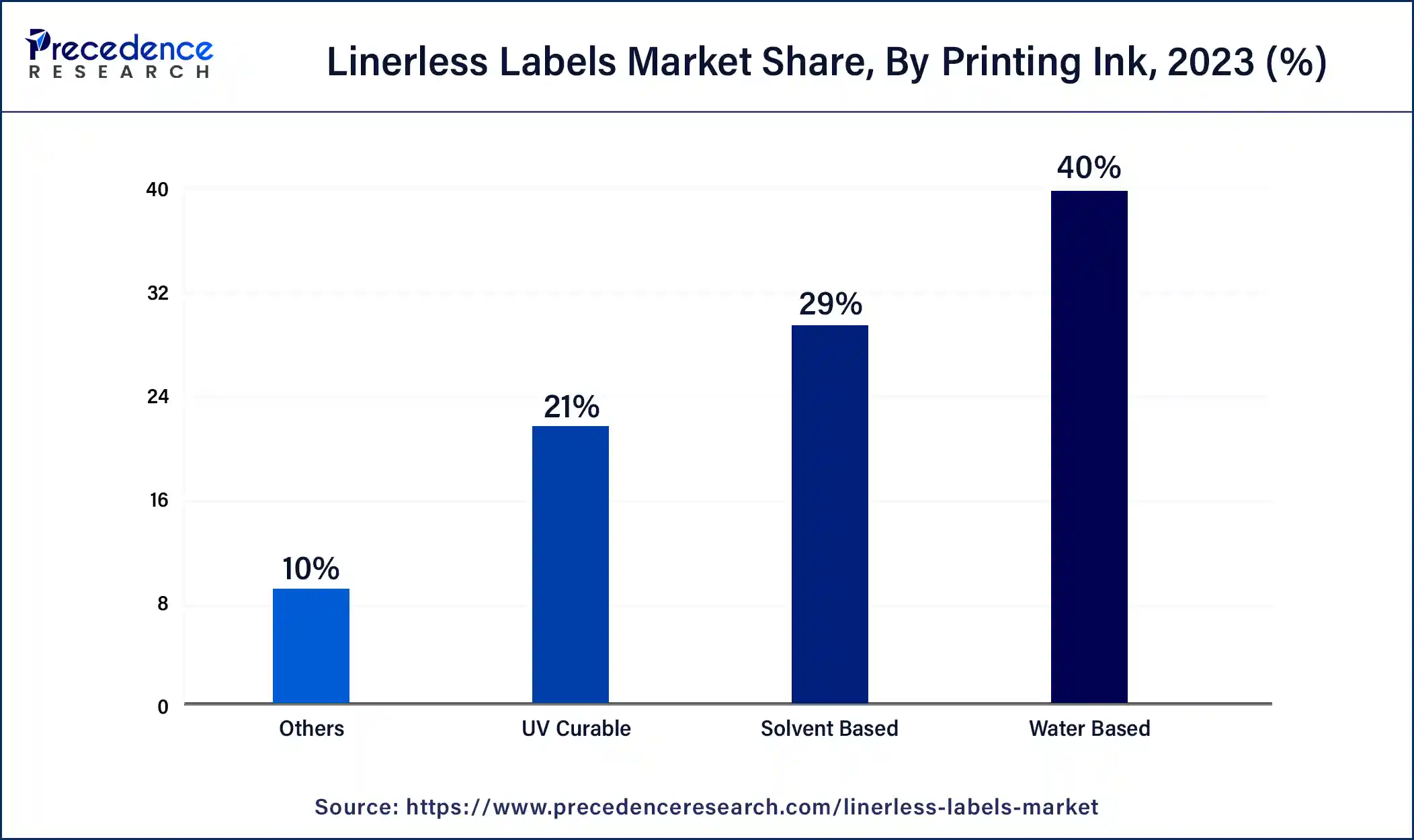

The water-based segment dominated the linerless labels market in 2023. The water-based printing ink is environmentally friendly. It is made with less volatile and toxic chemicals, which produces less waste and less carbon footprint; water-based printing inks are long-lasting, feel better, allow greater detail, are breathable, don’t sacrifice quality or color, etc. Water-based printing inks are mainly useful for printing onto many substrates in a range of industries. In cardboard packaging, water-based printing inks reduce the risks of toxic compounds, which is essential for food packaging.

The solvent-based segment is expected to grow significantly during the forecast period. Solvent-based printing inks are generally pigment inks. It contains pigments rather than dyes, and solvent inks contain alcohol or oil instead, which edge their way into media and produce a more permanent image. Solvent ink offers resistance to high temperatures and scratches and high durability at maximum environmental conditions, which makes it ideal for various types of packaging, outdoor signage, and products. The beneficial properties of solvent-based printing inks include allowing for crisp and clear printing and the ability to dissolve pigments, which help the growth of the linerless labels market.

The food segment dominated the linerless labels market in 2023. Linerless labels are used in the food sector because these are attractive labels that do not have a paper backing. Linerless labels help to improve food production. It can help to improve the efficiencies of production lines, which results in less downtime, higher production, and a tray pack with a higher return on investment (ROI). It also helps to reduce waste, reduces costs, and can operate in an environmentally friendly way. Eliminating waste also helps to increase efficiency and productivity, build sustainability, comply with regulations, and reduce disposal costs, which helps the market flow.

The beverage segment is anticipated to be the fastest-growing during the forecast period. Linerless labels can also be used in the beverage sector, which helps to the growth of the linerless labels market. It helps to improve the efficiency and accuracy of the ordering process, enhances customer experience, and improves business performance and brand reputation.

Segments Covered in the Report

By Product

By Printing Ink

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025