December 2024

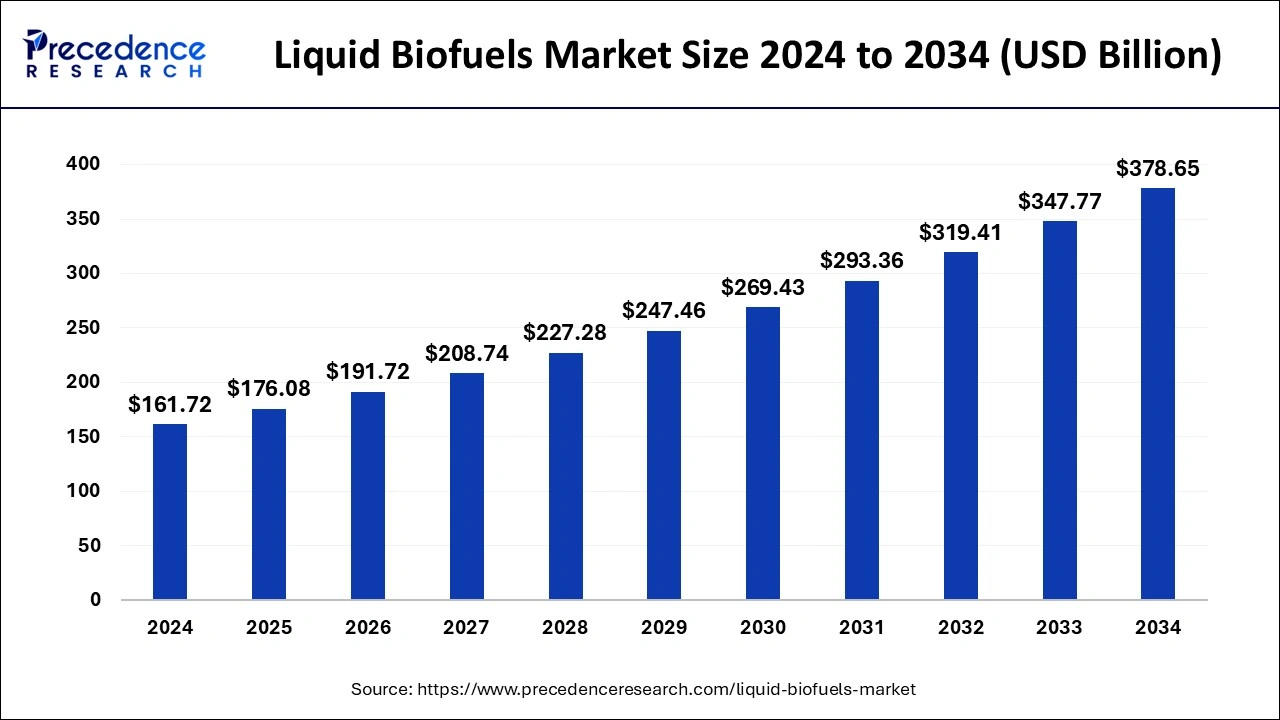

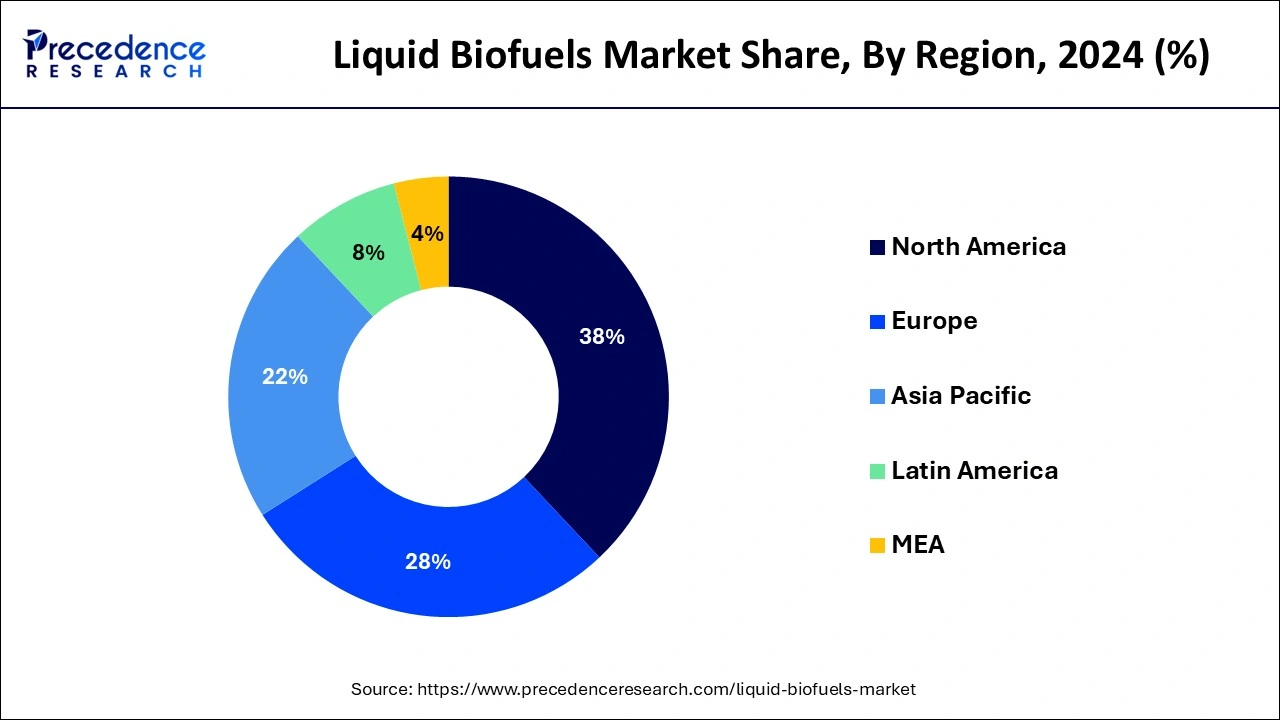

The global liquid biofuels market size is calculated at USD 176.08 billion in 2025 and is forecasted to reach around USD 378.65 billion by 2034, accelerating at a CAGR of 8.88% from 2025 to 2034. The North America market size surpassed USD 61.45 billion in 2024 and is expanding at a CAGR of 9.02% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global liquid biofuels market size accounted for USD 161.72 billion in 2024 and is expected to exceed around USD 378.65 billion by 2034, growing at a CAGR of 8.88% from 2025 to 2034. Factors such as rising preference for sustainable energy solutions, government-supported policies, rising focus on reducing greenhouse gas emissions, and increasing prices of fossil fuels are expected to drive the growth of the liquid biofuels market during the forecast period.

As artificial intelligence technology advances, the integration of Artificial intelligence (AI) is rapidly transforming sustainable energy sources. Artificial intelligence (AI)'s role in liquid biofuels provides an emerging force of advanced technology to produce energy from renewable sources. Artificial intelligence (AI) technologies are extensively utilized to optimize liquid biofuel production processes, predict productivity, and improve efficiency. The increasing usage of AI in liquid biofuels is majorly used for enhancing biofuel production such as adjusting irrigation and fertilizers usage to optimize yield. Artificial Intelligence (AI)is also widely used in liquid biofuel to improve operational efficiency and minimize costs. Machine learning (ML) algorithms and AI-powered analytics optimize feedstock processing and refining techniques, resulting in higher yield and better quality of liquid biofuels.

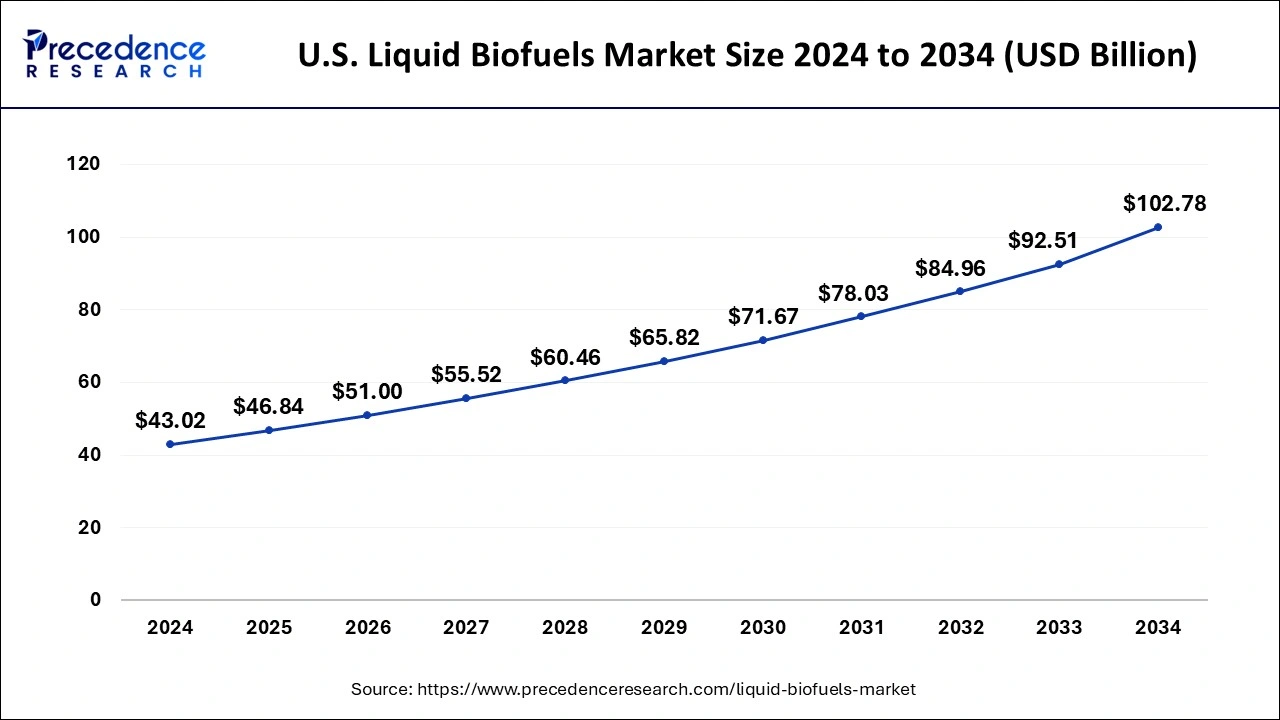

The U.S. liquid biofuels market size was evaluated at USD 43.02 billion in 2024 and is projected to be worth around USD 102.78 billion by 2034, growing at a CAGR of 9.10% from 2025 to 2034.

North America has dominated the global market over the past few years, due to the feedstock cornucopia and arable and for the production of biofuel product. Brazil, U.S., the China and European Union are foreseen to be some of the key regions boosting the demand regarding liquid biofuels. Still, other economies similar as Indonesia, Thailand, Canada, Australia, and Philippines are anticipated to produce significant opportunities for the biofuel market. In addition, concerning the biofuel potential long- term global impact, growth of the biodiesel and bioethanol markets is majorly based on the availability of agricultural land for the non-food production.

The Canadian Clean Energies Standard (CFS) has likely to apply various morals for liquid, gaseous, and solid energies burned for the production of energy coupled with the sector of transportation. Furthermore, the government of Canada has been focusing more towards the achievement of periodic reductions of Greenhouse Gas (GHG) by 30 Mt in emigrations by the year 2032, which is adding up to the country’s problems in order to attain an overall GHG emission drop of more than 30% by 2032.

The market of South and Central America has been propelled because of the rising government enterprise and adding focus towards security of energy and independence. Likewise, the high dependence on fossil energies is forcing the distinct governments in the region to find an alternatives. Also, bio-fuels give excellent solutions to the extremity of depleting fossil energies in countries similar as Venezuela, Brazil, and others.

| Report Coverage | Details |

| Market Size in 2025 | USD 176.08 Billion |

| Market Size in 2034 | USD 378.65 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.88% |

| Base Year | 2024 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Feedstock, Application, Process, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for cleaner and more sustainable energy sources

The increasing demand for cleaner and more sustainable energy sources is expected to boost the growth of the liquid biofuel market during the forecast period. Biofuels are produced from the plant-based raw materials. Liquid biofuel is an energy-efficient alternative that helps reduce energy security pollution and risk levels associated with the combustion of fossil. Liquid biofuels reduce reliance on imported fossil fuels and diversify the fuel supply. Therefore, the rising use of liquid biofuel assists in reducing dependency on imported oil and lowers the risks associated with geopolitical tensions and volatile oil prices as well as enhances resilience against supply disruptions.

High initial capital investment

The high initial capital investment is anticipated to hamper the growth of the market. A high initial investment is required initially for the cost of building and operating a liquid biofuel plant or biorefinery. Initial capital investment includes installation of biorefineries, procurement, maintenance, and cost of feedstock. Such factors may restrict the entry of potential companies to enter the market due to limited budget which may limit the expansion of the global liquid biofuel market during the forecast period.

Supportive government initiatives

The supportive government initiatives are projected to offer lucrative growth opportunities to the liquid biofuel market in the coming years. Several governments around the world implemented various tax incentives in different countries. The government has introduced multitudinous programs and strategies to alleviate the concerns associated with climate change. Energy security, climate change mitigation, and pastoral development are some of the crucial parameters responsible for similar policy goals. In addition, rapid technological advancements in liquid biofuel production processes have largely accelerated the expansion of the liquid biofuel market. Rising innovations in biomass conversion, feedstock cultivation, fermentation, and fuel refining have resulted in improving liquid biofuel yields, cost-effectiveness, and production efficiency. Such factors are bolstering the growth of the market.

The bioethanol & biodiesel is the dominating segment of liquid biofuels market. Significant factors impacting the growth include innovation support (for second and third generation biofuels), favorable regulatory and political support, environmental support, geopolitical support, customer support, and agricultural and economic support.

The consumption of polish bioethanol has further witnessed a growth in the base year as authorizations gradationally which have been slightly escalated, and a limited proportion had been fulfilled via the usage of biodiesels. During the same time in the Netherlands, biofuel consumption grew because of higher mandates on diesel cars and upsurge in tax. Furthermore, in Sweden, the consumption of bioethanol is dropping down substantially owing to the dip in the sales of E85 as government flex-fuel cars energy taxes foreseen hurdle for the biofuel application.

On the basis of application, transportation is the dominating segment during the forecast period. Transportation biofuel consumption is demanded to triple by 2032 and has to be on the trail with the Sustainable Development Script (SDS). This compares the one tenth of global transportation energy demand, to be compared with the current position which is around3.5%. In addition, stronger support and intention of policy which will gradually reduce the costs are needed to be balanced up with both the advanced biofuel consumption and adoption of biofuels in the numerous transportation sectors, as previsioned in the sustainable development scenario. Furthermore, as sustainable biofuels have a place in the scenario of sustainable development, more and more prevalent governance of sustainability has been paired to provide advanced biofuel production.

Brazil and India are likely to experience a growth in the product of liquid biofuel as both the countries have recorded the loftiest production all across their region. This factor is likely to boost the market further which is likely to gain sustainable development volume for 2032. In terms of bioethanol product, Brazil recorded the loftiest production across Central and South America

The sugar crops segment held a dominant presence in the market. Sugar crop-based biofuel is usually made of sugarcane or sweet potato, and produces more ethanol per acre compared to other varieties of crops, providing a higher biomass yield. Ethanol is produced from the fermentation of sugar, which is a relatively easy and thus, cost-effective.

The starch crops segment is predicted to witness significant growth in the market over the forecast period. Starch-based crops such as corn, potatoes, and wheat are also increasingly used in the production of biofuels. While fermentation in biofuel production processes using starch-based crops takes longer, the widespread availability of these crops and a shift toward sustainable farming practices, one of the many factors expected to fuel demand in the market during the coming years.

The fermentation segment accounted for a considerable market share. Fermentation is one of the most commonly used processes for biofuel production. It is widely used in the production of both sugar and starch-based biofuels. These crops are widely available, and their sugar is easier to break down through fermentation. This allows for the production of clean biofuel.

The transesterification segment is anticipated to grow with the highest CAGR in the market during the studied years. The process uses animal fats and methanol to primarily produce bio-diesel. The growing shift toward eco-friendly fuel consumption practices is expected to fuel demand for bio-diesel in the coming years. Diesel is primarily used by heavy-duty automotives such as trucks, which are still widely used to transport goods, forming the backbone of the global supply chain. A shift toward bio-diesel, as governments increasingly mandate the use of cleaner fuels, is expected to spur demand in space in the forecast period.

By Product

By Application

By Feedstock

By Process

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

January 2025