January 2025

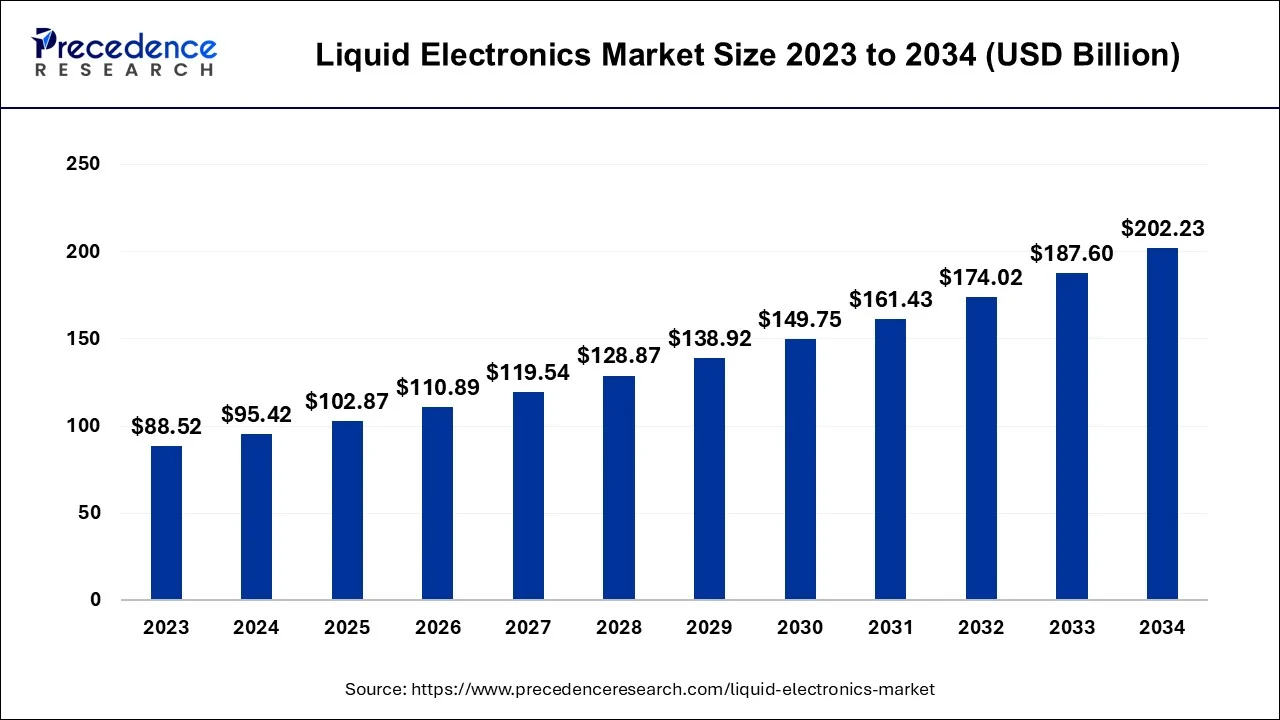

The global liquid electronics market size is estimated at USD 95.42 billion in 2024, grew to USD 102.87 billion in 2025 and is predicted to surpass around USD 202.23 billion by 2034, expanding at a CAGR of 7.80% between 2024 and 2034.

The global liquid electronics market size accounted for USD 95.42 billion in 2024, grew to USD 102.87 billion in 2025 and is anticipated to reach around USD 202.23 billion by 2034, growing at a CAGR of 7.80% between 2024 and 2034.

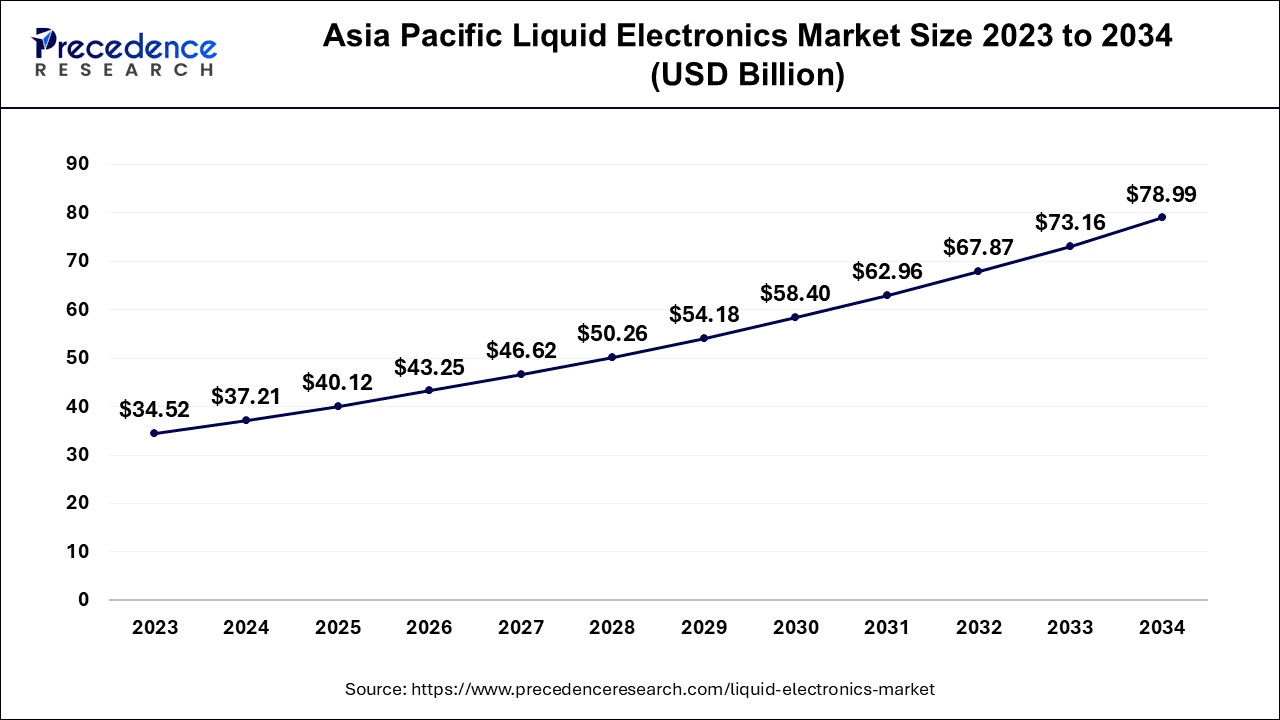

The Asia Pacific liquid electronics market size is estimated at USD 37.21billion in 2024 and is expected to be worth around USD 78.99 billion by 2034, poised to grow at a CAGR of 7.82% from 2024 to 2034.

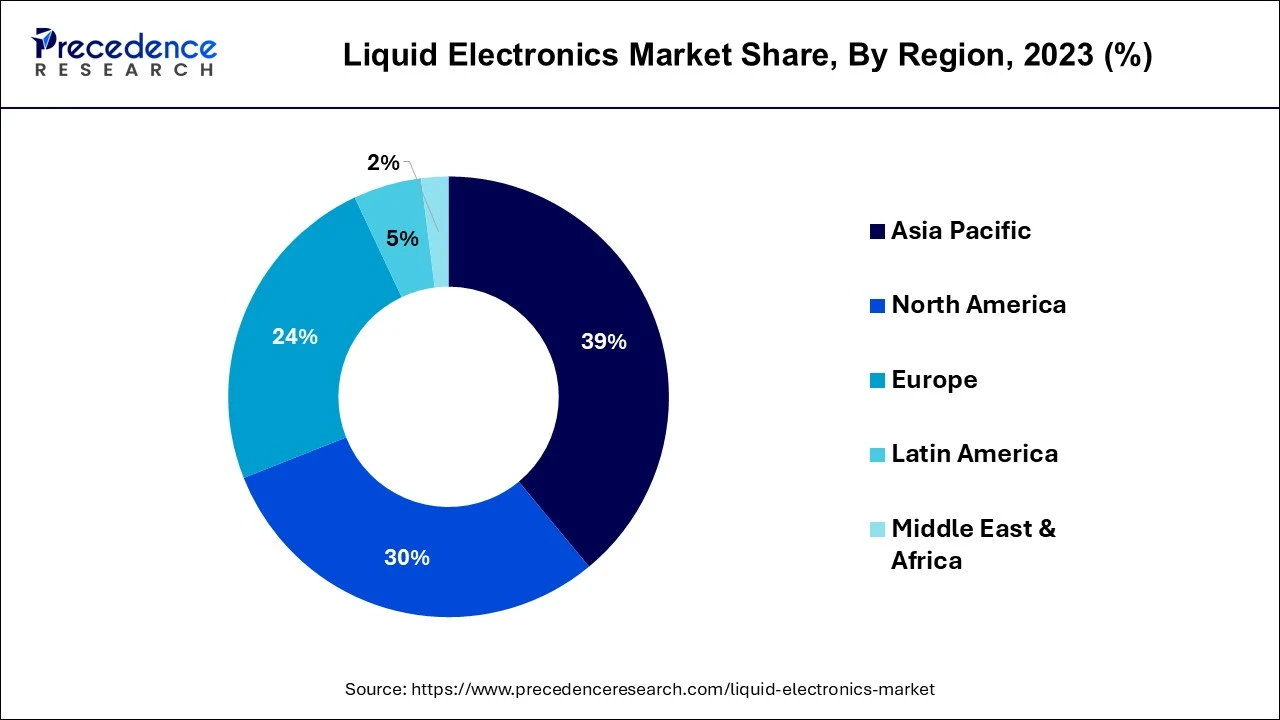

Asia Pacific has held the largest revenue share at 39% in 2023. Asia Pacific is a burgeoning powerhouse in the liquid electronics market, driven by a thriving consumer electronics industry. The adoption of liquid-based sensors, flexible displays, and wearable devices is on the rise. Asia Pacific leads in manufacturing, offering cost-effective solutions and mass production capabilities. With a growing emphasis on miniaturization, IoT integration, and sustainability, the region is at the forefront of innovation. Collaborative efforts and research and development initiatives are rapidly accelerating liquid electronics' market penetration and spurring significant growth in the region.

LAMEA is estimated to observe the fastest expansion. LAMEA, or Latin America, Middle East, and Africa, represents a diverse and emerging market for liquid electronics. In this region, various industries, including consumer electronics, healthcare, and energy, are showing increasing interest in liquid electronic solutions. While the market is still evolving, LAMEA holds immense potential due to its growing economy, expanding technological infrastructure, and a focus on adapting to innovative electronic solutions. Collaboration with global partners is also driving innovation and further establishing LAMEA as a noteworthy player in the liquid electronics industry.

In North America, the liquid electronics market is experiencing robust growth, driven by increasing investments in research and development. The region is witnessing a surge in demand for flexible and printed electronics, with applications in consumer electronics, healthcare, and automotive sectors. Moreover, a focus on sustainability and eco-friendly materials is becoming prominent, aligning with the region's environmental goals. Collaborative partnerships with research institutions and technology companies are fostering innovation and expanding market reach, solidifying North America's position as a key hub for liquid electronics development.

The liquid electronics market encompasses a diverse range of electronic components and materials in liquid form. It includes conductive, dielectric, and semiconductor liquids, each tailored for specific applications. Liquid electronics find their place in flexible and wearable electronics, printed electronics, energy storage, displays, sensors, and lighting.

The liquid electronics market serves various industries, including consumer electronics, healthcare, automotive, aerospace, industrial and manufacturing, energy, retail, telecommunications, and environmental monitoring. The demand for adaptable and flexible electronic solutions propels its growth. As technology progresses, the liquid electronics market continually evolves, ushering in fresh opportunities for the design and production of electronic devices.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.80% |

| Market Size in 2024 | USD 95.42 Billion |

| Market Size by 2034 | USD 202.23 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Printed, flexible, and wearable electronics

Printed, flexible, and wearable electronics have become prominent catalysts for the burgeoning demand in the liquid electronics market. These innovations are reshaping the industry by offering groundbreaking advantages in terms of design flexibility, portability, and adaptability. Printed electronics, driven by advancements in conductive inks and additive manufacturing techniques, have revolutionized production processes.

These approaches facilitate cost-efficient, scalable, and adaptable production of electronic components. The capability to print electronic circuits and sensors onto a wide range of substrates paves the way for their deployment in a multitude of industries. This extends from healthcare to automotive, heralding a fresh era of versatile electronic devices.

Flexible and wearable electronics, on the other hand, are meeting the rising consumer demand for adaptable and lightweight technology solutions. These innovations allow for electronics to be seamlessly integrated into clothing, and accessories, or worn directly on the body. With liquid components, these devices can be more malleable, offering consumers comfortable and unobtrusive options. This surge in demand is pushing manufacturers to explore liquid materials that can deliver both high performance and durability while conforming to various shapes and sizes. The combination of printed, flexible, and wearable electronics is therefore driving the liquid electronics market to new heights, fueling innovation, and offering consumers more convenient and versatile electronic solutions.

Material compatibility issues and lack of industry standards

Material compatibility issues pose a substantial obstacle as various liquid materials and substrates used in the manufacturing process may not interact optimally. This leads to concerns regarding the reliability and performance of electronic components. Ensuring that conductive, dielectric, and semiconductor liquids work effectively together, and with other materials, demands extensive research and development efforts. These challenges can result in longer development cycles and increased costs, ultimately deterring potential adopters of liquid electronics.

The absence of industry standards further exacerbates these challenges. Without established norms and guidelines, manufacturers face difficulties in ensuring consistency and interoperability across different liquid electronics products. This uncertainty hampers market growth as potential customers are often hesitant to invest in solutions that may not seamlessly integrate with existing systems or adhere to industry-specific regulations. To overcome these constraints, industry players must collaborate to establish standardized testing and manufacturing practices, fostering a more conducive environment for liquid electronics adoption and market expansion.

Custom electronics solutions and collaborative partnerships

Customization in the liquid electronics market is a potent catalyst for increased market demand. As industries seek specialized solutions to address unique challenges and applications, the ability to tailor liquid electronic components becomes crucial. Customization enables businesses to provide precise electronic solutions that meet specific requirements, ensuring optimal performance and functionality.

For example, by offering customized liquid-based sensors for a range of applications, manufacturers can effectively address diverse industries, from healthcare to aerospace, further expanding their market reach. Customization also allows companies to create niche products, tapping into previously unexplored markets and fostering brand differentiation.

Collaborative partnerships in the liquid electronics sector play a pivotal role in surging market demand. Technology companies, research institutions, and manufacturers often join forces to pool resources, share knowledge, and drive innovation. By working together, these entities can leverage collective expertise and accelerate the development of new liquid electronic technologies and applications. Collaborative efforts also enable the exploration of uncharted territories, making it possible to identify and seize opportunities that may not be attainable through individual efforts. This fosters a culture of innovation, leading to the introduction of cutting-edge liquid electronic solutions, expanding market demand, and keeping the industry dynamic and responsive to evolving customer needs.

According to the type, the conductive liquids segment held 38% revenue share in 2023. Conductive liquids are materials with the ability to carry electrical current. In the liquid electronics market, these liquids, often containing metallic or conductive particles, serve as essential components in flexible circuits, printed electronics, and sensors. Recent trends show a growing demand for conductive inks and polymers, especially in applications like wearable technology, flexible displays, and smart packaging. The need for lightweight, highly flexible, and electrically conductive materials drives research and innovation in this segment, pushing for improvements in conductivity, adhesion, and environmental sustainability.

The semiconductor liquids segment is anticipated to expand at a significant CAGR of 8.1% during the projected period. Semiconductor liquids are materials that exhibit semiconductor properties when in a liquid state. They play a crucial role in various liquid electronics applications, including organic photovoltaics, organic light-emitting diodes (OLEDs), and flexible electronic devices. The liquid electronics market is witnessing trends toward developing semiconductor liquids with enhanced electrical performance and stability. These innovations aim to create more efficient and reliable electronic components, opening up opportunities for energy-efficient displays and high-performance flexible electronics in a rapidly evolving industry.

Based on the application, the flexible electronics segment is anticipated to hold the largest market share of 43% in 2023. Flexible electronics involve the use of liquid materials and technologies that allow electronic components to bend, twist, and stretch. This application segment is a key trend in the liquid electronics market, driven by consumer demand for adaptable and durable devices. Trends in flexible electronics include the development of rollable displays, foldable smartphones, and wearable sensors for healthcare and fitness applications. These advancements open new avenues for innovation in areas such as consumer electronics and medical devices, potentially revolutionizing device design and user experiences.

On the other hand, the wearable electronics segment is projected to grow at the fastest rate over the projected period. Wearable electronics are electronic devices integrated into clothing, accessories, or worn on the body. Liquid electronics are instrumental in developing flexible, comfortable, and lightweight wearable gadgets. The market trend for wearable electronics focuses on improving health monitoring, fitness tracking, and seamless connectivity. Liquid-based sensors for vital signs and biometric data are enhancing user experiences and enabling the integration of IoT capabilities. These trends reflect a growing interest in convenient, discreet technology solutions that cater to consumers' active lifestyles.

In 2023, the consumer electronics segment had the highest market share of 54% based on the end user. In the liquid electronics market, consumer electronics refers to devices designed for personal use. This segment includes smartphones, tablets, smartwatches, and other portable gadgets. A significant trend in this segment involves the integration of flexible and bendable displays and components, offering improved durability and adaptability. Moreover, the adoption of energy-efficient liquid-based technologies, like OLEDs, enhances the visual quality of consumer electronic devices, while contributing to longer battery life and thinner profiles.

The automotive segment is anticipated to expand at the fastest rate over the projected period. In the automotive sector, liquid electronics pertain to electronic components and materials used in vehicles. A notable trend is the incorporation of liquid-based sensors and displays for advanced driver-assistance systems (ADAS), infotainment, and interior lighting. This trend enhances safety, convenience, and the overall driving experience, as automotive manufacturers seek innovative ways to make vehicles more connected and intelligent.

Segments Covered in the Report

By Type

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

August 2024

September 2024