List of Contents

What is the OLED Market Size?

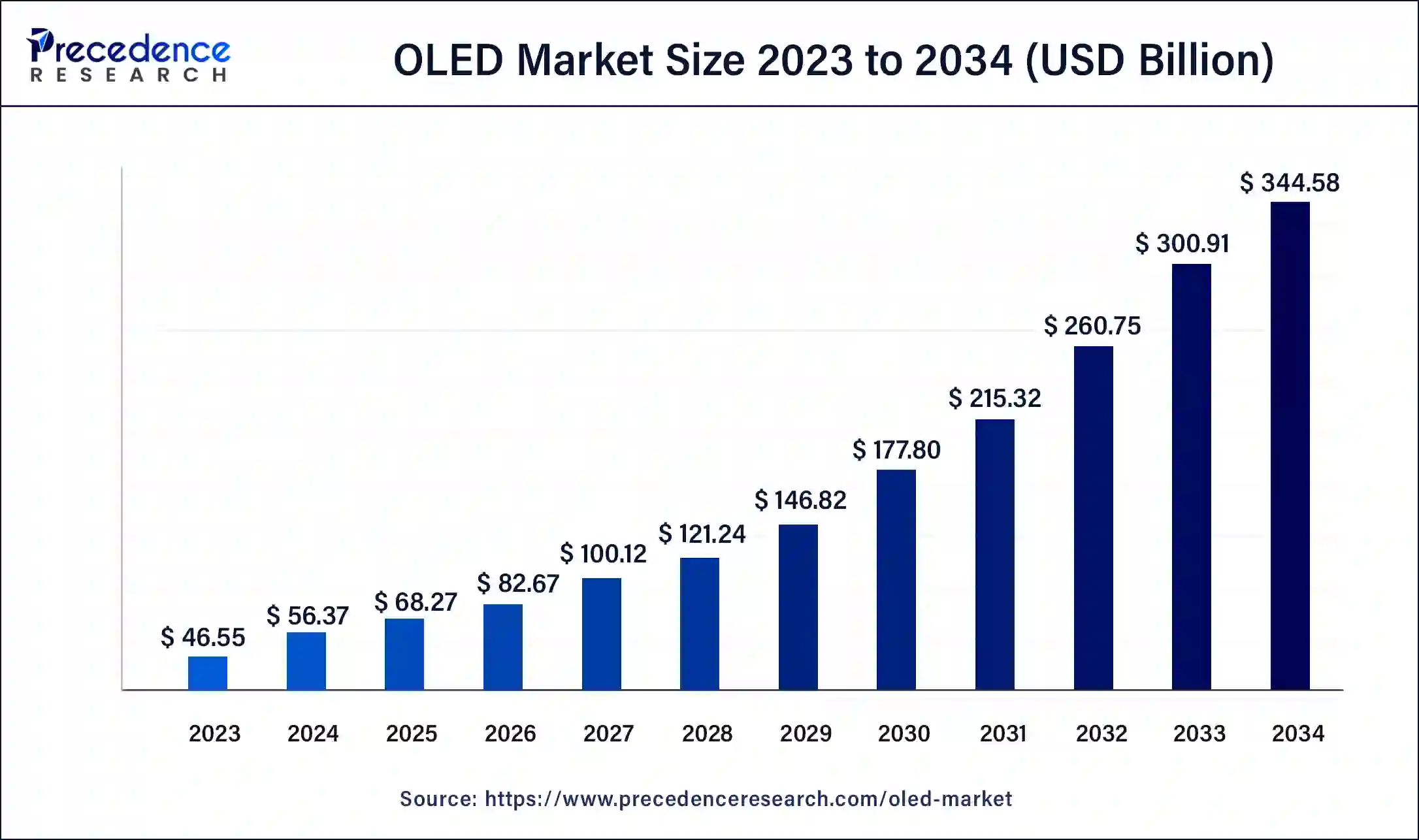

The global OLED market size is accounted at USD 68.27 billion in 2025 and predicted to increase from USD 82.67 billion in 2026 to approximately USD 344.58 billion by 2034, growing at a CAGR of 19.85% from 2024 to 2034.

Key Takeaways

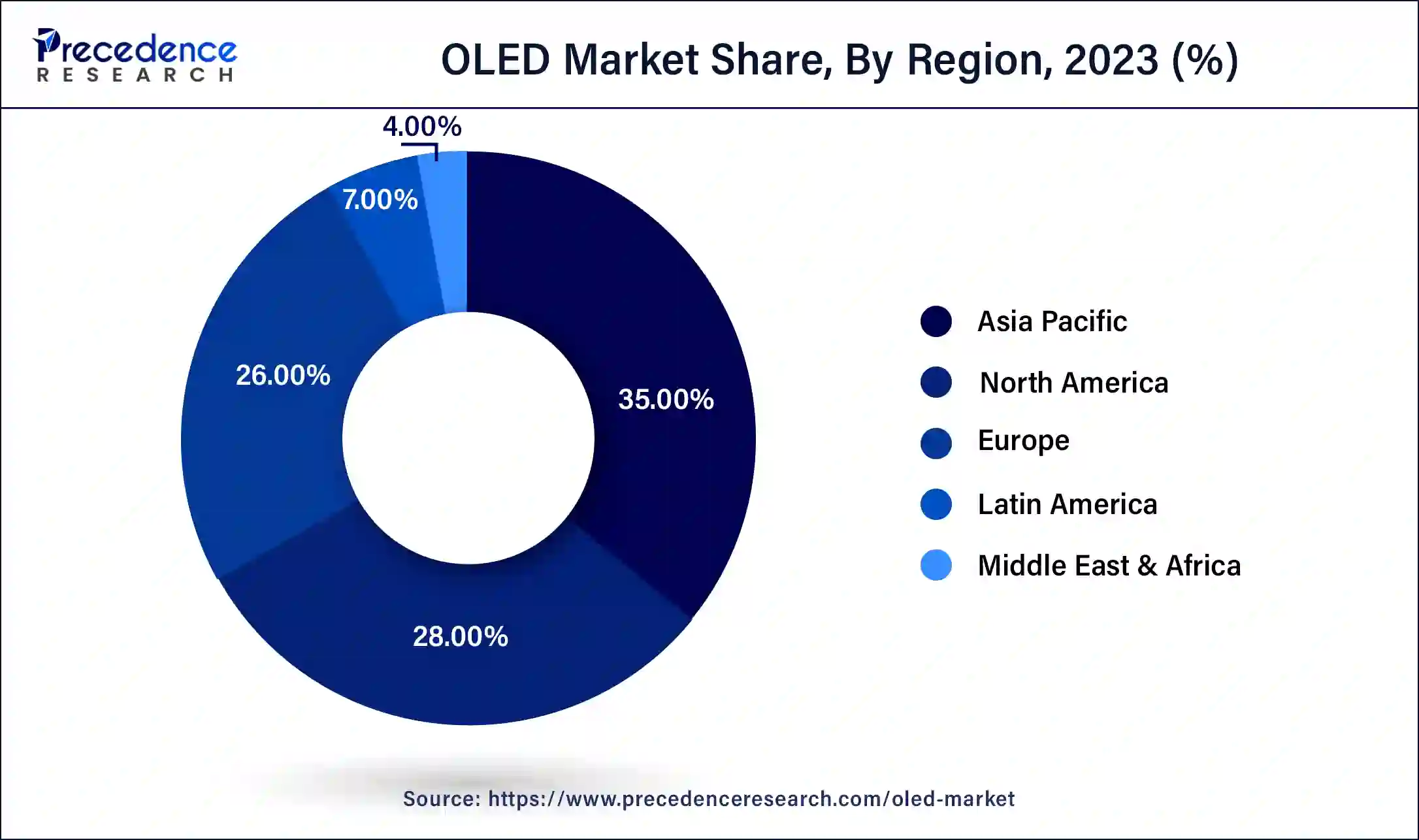

- Asia Pacific dominated the OLED market.

- By product type, the display segment has garnered a revenue share of over 82% in 2024.

- By technology, the PMOLED segment hit 28% revenue share in 2024.

- By end use, the consumer electronics segment contributed 31% market share in 2024.

What is OLED?

In comparison to conventional LED, VFD, or LCD displays, OLED (Organic Light Emitting Diode) displays offer higher contrast, are brighter, have broader viewing angles, have quicker reaction times, and use less power. OLED displays are self-illuminating due to their biological makeup; therefore, they don't need a backlight for the best visibility under all circumstances. These technologies and products have been developed by several businesses.

OLED technology, which offers effective and beautiful lighting panels, is being used in smart TVs. A digital television that is linked to the internet is known as a smart TV. It functions mostly as a regular television set with built-in internet and interactive Web 2.0 features. Users may browse the internet and see photographs while listening to music and watching movies. For these reasons, smart OLED TVs are changing how entertainment is seen and how the entertainment industry is affected. With increased disposable income brought on by global economic expansion, curved OLED TVs and other high-end items are expected to become more popular.

OLEDs have garnered a great deal of attention from the worldwide scientific and industrial sectors over the years. A wide range of OLEDs have been introduced to the market with uses in many different industries, with a concentration on passive and active-matrix solutions. Additionally, lightweight, unbreakable, bendable electronics with greater mobility have been made using flexible OLEDs. OLED displays, which do not require any of the filtering or backlighting mechanisms present in LCDs, are made from organic light-emitting materials. OLED displays' high brightness, low power requirement, and enhanced contrast are some other benefits.

What are the Growth Factors in the OLED Market?

During the projected period, the worldwide OLED displays market is anticipated to develop due to the lucrative benefits supplied by OLED technology. OLED technology has several benefits, including improved contrast ratios, quicker refresh rates, and crisper, more vibrant colours. OLED displays are smaller, thinner, and provide superior energy management since they use less electricity overall. Additionally, OLED panels' improved view angle benefits customers in other ways.

Over the projected period, expanding OLED display applications are anticipated to fuel market expansion for OLED displays worldwide. OLED-based technology has begun to be used in a number of industries throughout the world. Media players, digital cameras, mobile phones, televisions, wearable electronics, etc. all use OLED technology. A number of well-known market companies, including Sony, Samsung, and LG, have introduced a variety of items featuring OLED displays in an effort to diversify their product lines and achieve a competitive advantage.

OLED Market Outlook

- Industry Growth Overview: As demand rises for high-contrast, energy-efficient displays in smartphones, TVs, automotive panels, and as consumers choose to use premium, lightweight display technology, there will be a rapid increase in sales of OLEDs. This will be due to the growing use of flexible and transparent OLEDs being produced primarily in Asia-Pacific and North America.

- Global Expansion: Major OLED producers have expanded their manufacturing facilities into Southeast Asia, Central Europe, and Latin America to shorten shipping times and tap into the rapidly growing electronics markets in these regions. Additionally, the new fabrication lines in Vietnam, Poland, and Mexico enable manufacturers to supply the local TV, smartphone, and automotive industries more quickly and economically.

- Key Investors: Private equity and strategic investors are interested in OLED because of its high margins, large patent estate, and anticipated growth in demand from premium electronic products. Investment companies are investing in display materials and manufacturing equipment because of the expected long-term growth of OLED and the large technological barriers to entry.

- Startup Ecosystem: As OLED has evolved, new startup companies have emerged that are focused on innovative materials development, micro-OLED technology for augmented reality and virtual reality applications, and cost-effective printing-based production techniques. Companies like Kyulux (Japan) and OTI Lumionics (Canada) have secured significant venture capitalist funding for the development of next-generation emitter technology and have incorporated sustainably sourced materials into their designs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 344.58 Billion |

| Market Size in 2025 | USD 68.27 Billion |

| Market Size in 2026 | USD 82.67 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 19.85% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Product Type, Display Panel Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

High-demand for cost-effective and energy-saving OLED Lighting

Approximately 15% of the world's total energy consumption is used for lighting. Additionally, around 5% of the world's carbon emissions come from lighting. In order to lower carbon emissions, the United Nations Environment Programme (UNEP) has published some advice on energy-efficient lighting options. With Europe and the Middle East experiencing fast urbanisation and economic expansion, it is anticipated that over the next two decades, the demand for OLED-based lighting would increase significantly. Thus, the need for more LED-based lighting to achieve efficient cost and energy savings is anticipated to propel the worldwide OLED lighting market's expansion in the upcoming years.

Rising Demand for Superior Display in Wearable Devices and Smartphones

As OLED devices are used in a range of end-use scenarios. The increased use of smartphones and the soaring demand for better cellphones are driving the industry's expansion. Smartphones and tablets are using active-matrix OLED (AMOLED) screens more frequently because of their great activation speed. Additionally, they use far less power than LCD, which is why they are recommended for widespread usage in smartphones. The popularity of different wearable gadgets like smartwatches and fitness bands is also boosting the industry's expansion. Increased demand for automated and bright-screen displays is fueling the market's expansion.

Key Market Challenges

- High cost of the technology - OLEDs are regarded as expensive since they have a higher initial capital cost than traditional lighting technologies. Cost also includes any necessary electronics and power supply. However, this is only taking into account the initial investment; the overall cost (taking into account the OLED's lifetime) would be less than that of traditional technologies. OLEDs have a reduced total cost of ownership than LED and LCD sources, which includes maintenance and energy costs. Additionally, OLEDs' early appeal is constrained by their expensive initial expenditure levels. Additionally, because OLED requires a lot of materials, it is expensive to produce OLED displays or lights. In addition, establishing new industrial facilities requires a substantial investment and government clearance. Setting up brand-new manufacturing facilities requires a significant amount of cash due to the technology's relative youth and high expertise need. This is anticipated to limit the OLED market's expansion to some extent.

- OLED technology use is not very widespread: Over the projected period, the growth of the worldwide OLED displays market is anticipated to be constrained by the low penetration rate of OLED technology. When compared to other modern technologies, OLED screens have a very low adoption rate due to their large cost. The client frequently views OLED technology as highly sophisticated and pricey in comparison to LCD technology because of the initial success of the latter. Such a barrier to the technology's rapid adoption is causing a void in the volume manufacturing required to compete with other leading technologies.

Market Opportunities

Increase in government initiatives towards OLED adoption

- To reduce costs and pollution, governments from several nations have concentrated on implementing lighting systems based on OLED technology. The global market is expanding due to different nations' favourable attitudes regarding the use of OLED lighting technology. For example the government of Germany provides grants to towns so they may install modern OLED lighting in publicly held assets like outdated street lighting. The Middle East Lighting Association (MELA), an international nonprofit organisation founded by a collaboration between Gulf Advanced Lighting, Osram, Philips Lighting, and Tridonic, is also present in the Middle Eastern nations. In order to assist lawmakers in the Middle East in developing and enforcing policies, standards, and regulations for lighting-related goods and services, MELA also works to represent the interests of the top lighting product manufacturers in the area.

- The group is also committed to promoting energy-efficient lighting practises for the protection of the environment, human comfort, and consumer health and safety. As a result, the growing number of government requirements and efforts encouraging the use of OLED lighting systems has a substantial positive impact on the worldwide OLED market's expansion.

OLED smart TVs are becoming increasingly popular

- Today's android TV uses OLED technology, which provides gorgeous and functional lighting panels. A smart TV is a digital television that is connected to the internet. It performs substantially the same duties as a standard television set, but with integrated internet and interactive Web 2.0 capabilities. This may be used by users to browse the internet, watch movies, listen to music, and see photos. Smart TVs may offer internet TV, on-demand streaming, interactive multimedia content (OTT), and much more in addition to the typical television functionalities.

Product Insights

Based on product, the display segment dominated the market with the highest revenue share in 2023. The lighting segment is expected to grow at a remarkable CAGR during the forecast period 2023 to 2032. And lighting segment held a market share of around 18% in 2024.

OLED displays and lighting are mostly used in the automotive industry like dashboard displays, heads up display, internal lightings, digital rear-view and internal mirrors, and other external lightings.

Technology Insights

It is anticipated that AMOLED displays in smartphones will expand quickly. The OLED screen surpasses the flat panel displays that have generally been used in smartphones since it is emissive and doesn't require any additional illumination. Additionally, mobile manufacturers are increasingly incorporating AMOLED panels into their devices due to better attributes including thinness and brightness, which is anticipated to accelerate market development.

Display Panel Insights

The introduction of foldable devices and the enthusiasm they spark will help the OLED industry grow. OLED lighting research is receiving financial backing from governments all over the globe, there is a large desire for improved viewing experiences, notably among smartphone and television users, and there is a surge in the market for AMOLED displays for usage in AR/VR headset applications.

Application Insights

OLED panels are extensively used in televisions and smartphones. A number of display panel manufacturers also claimed that new product introductions and an improved supply-demand situation for large panels had increased mobile display sales in spite of the pandemic. Therefore, the main product categories promoting consumer sector growth throughout the predicted period will be smartphone, televisions, and wearable technology, notably smartwatches and VR HMDs.

Regional Insights

Asia Pacific OLED Market Size and Growth 2025 to 2034

The Asia Pacific OLED market size is valued at 23.89 billion in 2025 and is expected to be worth around USD 120.60 billion by 2034, at a CAGR of 20% from 2025 to 2034.

Asia Pacific dominated the OLED market with the largest share in 2024 and is projected to continue its dominance throughout the forecast period. The market growth is mainly attributed to the increasing demand for OLED panels in the electronics industry. Countries such as India and China are known as manufacturing hubs for electronic devices. As the adoption and production of advanced electronic devices are increasing in these countries, the demand for innovative displays, including OLED displays, is also increasing. Moreover, renowned electronic device manufacturers in the region, such as Samsung and LG, are making efforts to boost the production of OLED displays to meet the increasing demand for these displays. For instance,

- In April 2023, Samsung Electronics announced a plan to develop advanced OLED display panels for tablets and computers by investing US$ 3.14 billion until 2026 in Asan, South Korea.

The market in North America is anticipated to expand at the fastest growth rate in the near future. The regional market growth is attributed to the increasing adoption of smart electronics, such as tablets, smart TVs, and wearable devices. Moreover, advancements in display technology led to high-performance and rollable OLED displays, contributing to market growth.

North America: U.S. OLED Market Trends

The U.S. market is witnessing robust growth driven by rising demand for high-resolution displays in smartphones, televisions, and wearable devices. OLED technology is favored for its superior color accuracy, contrast ratios, and energy efficiency compared to traditional LCDs, making it increasingly popular among premium consumer electronics. Advancements in flexible and foldable OLED panels are opening new applications in next-generation devices, including foldable smartphones and automotive displays.

Why did Europe Grow Rapidly in the OLED Market?

The OLED market in Europe has grown significantly as a result of the focus on energy efficiency, the availability of sustainable materials, and the use of progressive technology. The region has established research institutions and has manufactured many major electronics brands. The markets for OLED Technology have increased in automobiles, televisions, and lighting applications, and are creating new opportunities for companies that make flexible OLED panels for use in smart home appliances and next-generation dashboards for automobiles.

Germany OLED Market Trends

Germany has played a leading role in developing the OLED market in Europe due to its advanced automotive sector and the large investments that have been made in display technology. The majority of the OLED technology used in vehicles comes from Germany, including the dashboards, lamps, and high-end products. There is a strong partnership between German research laboratories and display manufacturers, which has allowed for new OLED material development.

Why did Latin America grow at a considerable rate in the OLED Market?

In Latin America, there was considerable growth due to an increase in purchases of smart televisions, premium mobile devices, and gaming consoles utilizing OLED display technology, along with improved internet connectivity and expanded retail distribution methods. Countries in this region are investing in enhancing the production and importation processes for electronic products and providing local assembly capabilities. The biggest opportunities are for mid-tier OLED smartphones, large-screen OLED televisions, and automotive display applications.

Brazil OLED Market Trends

Brazil was the primary market leader, having the largest number of potential customers and therefore the greatest demand for higher-end electronics. With many consumers choosing to upgrade their existing television or smartphone equipment with OLED products for improved image quality, Brazil has witnessed tremendous growth in OLED display sales. Retail outlets have responded by increasing the variety and availability of cutting-edge electronic products through both brick-and-mortar stores and online purchasing platforms.

Why did the Middle East & Africa grow at a considerable rate in the OLED Market?

The Middle East and Africa experienced modest growth from an increase in demand for OLED televisions, smartphones, and digital signage displays. Higher levels of urbanization and income supported this growth. Several countries have invested in smart city development, which has increased the use of OLED panels in public display applications. There has also been an increase in market opportunities for high-end electronics, automotive displays, and commercial signage used in shopping malls, hotels, and transportation hubs.

The UAE OLED Market Trends

The United Arab Emirates has emerged as the key market within the region as it has generated a significant amount of demand for luxury electronic products, smart cities, and digital signage products. There are many malls, hotels, and airports that utilize OLED televisions, smartphones, and advanced display systems. The United Arab Emirates has also attracted many international technology companies to invest in developing modern retail environments.

OLED Market Companies

- Acuity Brands

- OLED works

- Kopin Corporation

- Pixelligient Technologies

- BOE Technology

- LG Display

- Osram

- AU Optronics

- Tianma Microelectronics

- Samsung Electronics

- Universal Display Corporation

- Lumiotec

- Royole Corporation

- Konica Minolta Pioneer OLED

- China Star Optoelectronics Technolog

- Emagin Corporation

- JOLED

- Raystar Optronics

- Panasonic

- Truly International

- Visionox

- Winstar Display

- Wisechip Semiconductor

Recent Developments

- In November 2020, Lumenique LLC and OLEDWorks partnered. With this partnership, illuminated art manufacturer Lumenique becomes a leader in the advancement of OLED lighting. By using the latest OLED lighting panels, the business will provide stunning portable lighting.

- Samsung Electronics stated in August 2019 that it has reduced LCD output in order to be ready for a major investment in quantum dot, also known as (QD) OLED panels of hybrid displays that use both OLED as well as quantum dot technology.

- A new OLED technology license agreement and supplemental material purchasing agreement were signed between Wuhan China Star Optoelectronics Semiconductor Display Technology Co., Ltd. and Universal Display in May 2020. According to the long-term agreements, UDC will provide phosphorescent OLED components to Optoelectronics through its subsidiary UDC Limited based in Ireland for use in display goods.

Segments Covered in the Report

By Technology

- Active-matrix OLED (AMOLED)

- Passive-matrix OLED (PAMOLED)

- Foldable OLED

- White OLED

- Transparent OLED

- Others

By Product Type

- Display

- Lighting

By Display Panel Type

- Rigid

- Flexible

- Others

By Application

- Smartphone & Tablet

- Smartwatches & Wearables

- Television

- Digital Signage Systems

- PC Monitors

- Laptop

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client