January 2025

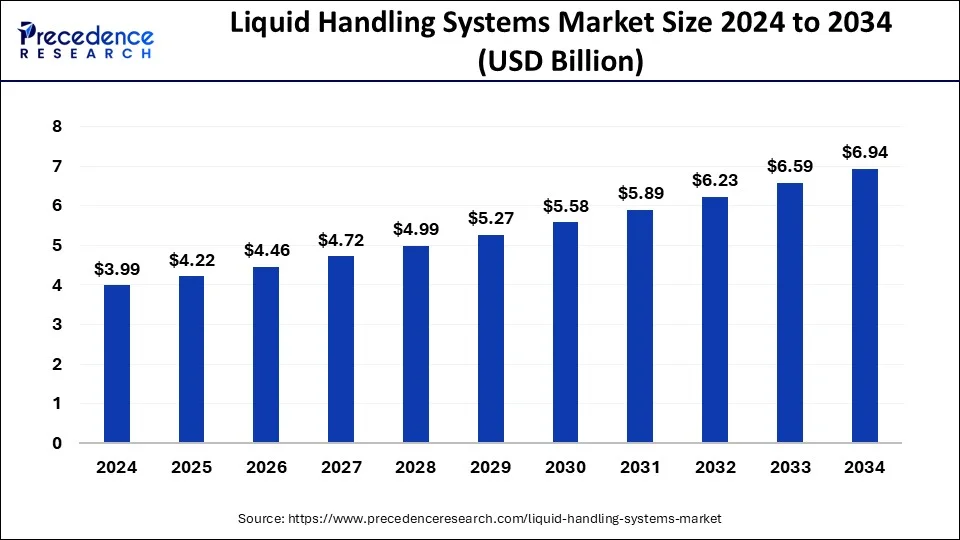

The global liquid handling systems market size is calculated at USD 4.22 billion in 2025 and is forecasted to reach around USD 6.94 billion by 2034, accelerating at a CAGR of 5.69% from 2025 to 2034. The North America liquid handling systems market size surpassed USD 1.76 billion in 2024 and is expanding at a CAGR of 6.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global liquid handling systems market size was estimated at USD 3.99 billion in 2024 and is predicted to increase from USD 4.22 billion in 2025 to approximately USD 6.94 billion by 2034, expanding at a CAGR of 5.69% from 2025 to 2034. The market is growing because of new technologies that make it easier to handle liquids, like robots, precision dispensing, and software solutions that work with other systems.

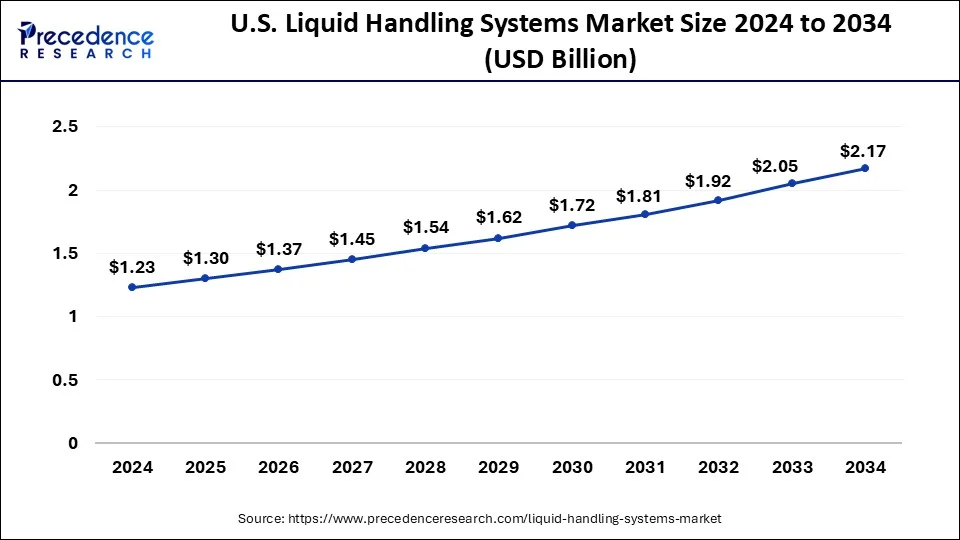

The U.S. liquid handling systems market size was estimated at USD 1.23 billion in 2024 and is predicted to be worth around USD 2.17 billion by 2034 with a CAGR of 5.84% from 2025 to 2034.

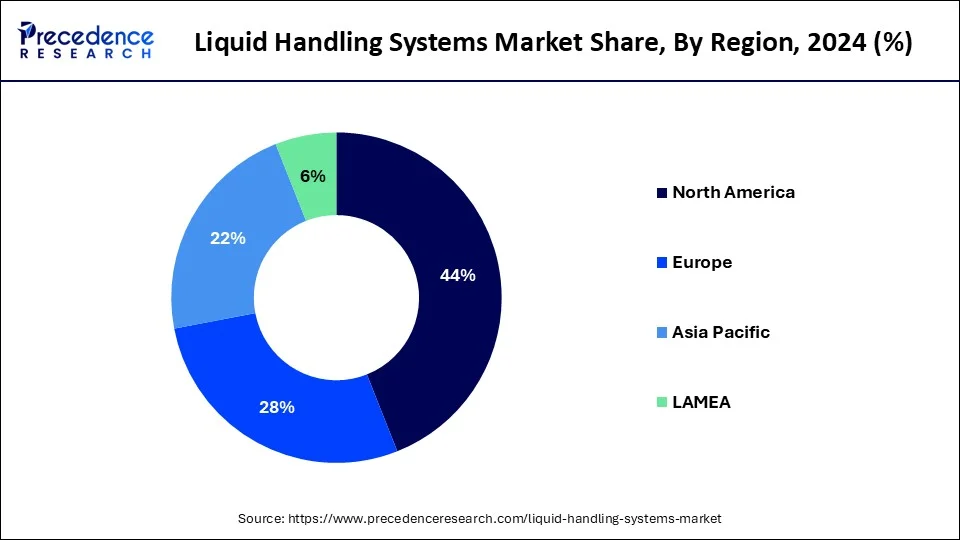

North America dominated the liquid handling systems market in 2024. The United States is a key region in research and development spending across life sciences, pharmaceuticals, and analytical chemistry. It's also a major hub for drug manufacturing, using liquid handling systems extensively in the process. Liquid handling systems are vital in drug discovery, cancer research, and clinical diagnostics, and the growth of these industries is expected to have a positive impact on the market. Furthermore, factors like investments from big companies, a rise in infectious and chronic diseases, and an increase in product launches by market players are all contributing to the market's growth.

Asia Pacific is predicted to grow rapidly over the projected period in the global liquid handling systems market. This is because the region is making big strides in improving its healthcare facilities, investing more in research and development, and embracing lab automation technologies. Countries like China, Japan, and India are seeing substantial growth in their biotech and pharmaceutical industries, driven by a growing interest in personalized medicine and genomics-based diagnostics. Hence, there's a rising demand for liquid handling systems in this region.

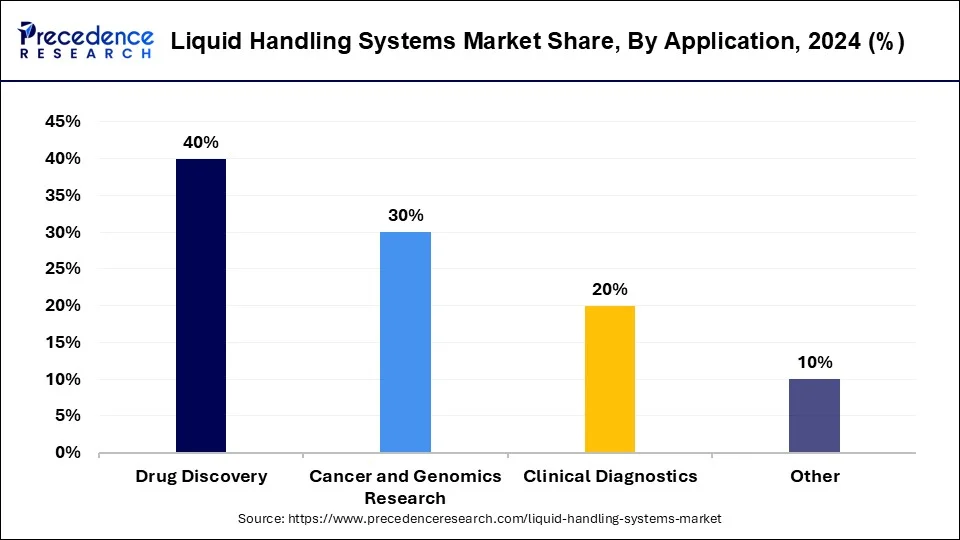

Automated liquid handling systems are becoming increasingly popular in drug discovery, with many major players in the market shifting towards these systems. This trend is fueled by the growing investment in research and drug development. The demand for high-throughput screening is also on the rise and can further drive market growth. Technological advancements in automated liquid handling systems are contributing to this growth as well.

Liquid-handling instruments offer several advantages. They simplify sample preparation with consistently high accuracy, allowing laboratories to handle more samples while maintaining reproducibility. Additionally, they help laboratories address sample preparation needs for various applications, including proteins, metabolites, genomics, and NGS, thereby reducing setup times and protocol development efforts.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.99 Billion |

| Market Size in 2025 | USD 4.22 Billion |

| Market Size by 2034 | USD 6.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.69% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for high-throughput screening

High-throughput screening (HTS) is an automated process used in drug discovery to quickly identify active compounds, antibodies, or genes. It helps researchers find potential treatments for chronic conditions like cancer, HIV, and heart disease by screening large numbers of drug-like compounds. As the prevalence of these diseases increases globally, there is a growing demand for HTS products to aid in drug development. HTS technology enables rapid assessment of the biological or biochemical activity of compounds, facilitating the detection of molecules that interact with specific targets such as receptors, enzymes, or ion channels.

Cross-contamination issues

In high-throughput environments, liquid handling systems are at risk of contamination or cross-contamination between samples or reagents. To mitigate these risks, laboratories must adhere to strict protocols and implement quality control measures. Additionally, there is a need for greater awareness of career opportunities in the medical field, especially in developing countries, where many people may not be aware of the diverse career options available. These factors hinder the growth of the liquid handling systems market.

Integration of robotics with liquid handling systems

The liquid handling systems market has traditionally relied on manual, labor-intensive processes for tasks such as fluid transfer, dispensing, and pipetting. Recent advancements in robotics offer the potential to automate these repetitive tasks by integrating robots with liquid handling equipment. Robotics can enhance precision, accuracy, and output while reducing errors in high-volume dispensing and sample screening. Researchers are developing affordable robots with advanced vision capabilities to seamlessly coordinate with existing liquid handlers, creating a fully automated workflow. This integration also can significantly increase lab productivity and efficiency.

The manual liquid handling segment dominated the liquid handling systems market in 2024. The growth is linked to the low cost and deduction in time required for sample processing offered by manual liquid handling systems in research institutions, biotech firms, etc. Moreover, rising R&D investments have made various pharma companies focus on drug development.

The electronic segment is expected to show the fastest growth over the forecast period. The growth of this segment is mainly fueled by the rising investment in research and development by pharmaceutical and biotech firms. Also, there's a growing demand for dependable liquid handling systems in diagnostic labs. The COVID-19 pandemic has further boosted the need for electronic liquid handling systems. With the necessity for extensive testing and vaccine development, there's been a sharp increase in demand for automated liquid handling instruments. This segment is poised for significant growth in the foreseeable future.

The automated workstation segment dominated the liquid handling systems market in 2024 and is projected to grow significantly throughout the forecast period. In labs, automated workstations are becoming more common to improve efficiency and output. By automating tasks that scientists typically perform, like experimental procedures, labs can boost reproducibility and throughput. Robotic control ensures consistent movements, which reduces the variability that can occur with manual techniques. Modular workstations offer flexibility, allowing customization for specific applications such as sample preparation for genomics, proteomics, and cellular analysis.

The drug discovery segment dominated the liquid handling systems market in 2024. Liquid handling systems are making a big impact in drug discovery, particularly in the pharmaceutical field. They're essential in the initial phases of drug development, ensuring precise and efficient handling of various substances and samples. These systems are key in high-throughput screening, where researchers can quickly test thousands or even millions of compounds to find potential treatments. Given the growing demand for new drugs to tackle challenging diseases, the drug discovery sector is driving significant demand for liquid handling systems by pushing the market forward.

In the liquid handling systems market, the cancer and genomics research segment is predicted to grow rapidly over the projected period. Genomics research has become increasingly important, providing valuable insights into how genes work and interact, which is crucial for understanding genetic diseases and specific treatments for individuals. With the rapid progress in genomics, especially with next-generation sequencing technologies, the need for liquid handling systems in genomics research is expected to rise significantly.

By Type

By Product

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

February 2025

November 2024