January 2025

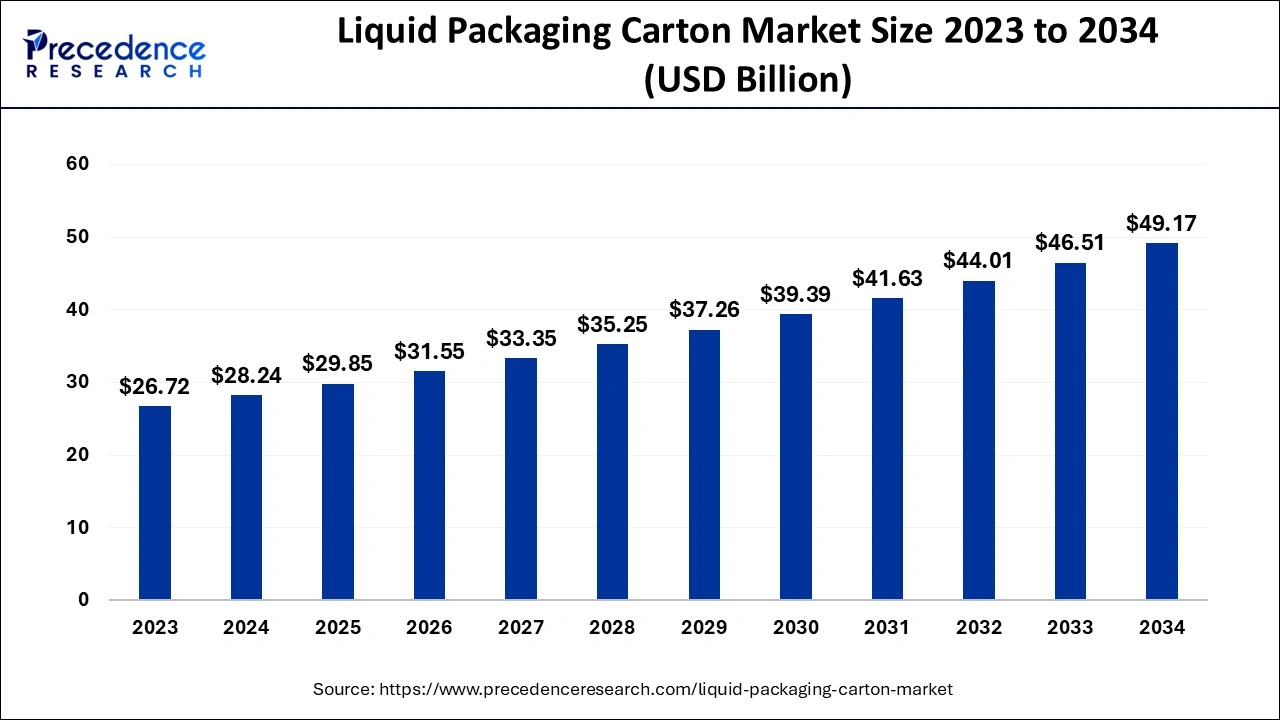

The global liquid packaging carton market size accounted for USD 28.24 billion in 2024, grew to USD 29.85 billion in 2025 and is projected to surpass around USD 49.17 billion by 2034, representing a healthy CAGR of 5.70% between 2024 and 2034.

The global liquid packaging carton market size is calculated at USD 28.24 billion in 2024 and is anticipated to reach around USD 49.17 billion by 2034, growing at a CAGR of 5.70% between 2024 and 2034. The market is attributed to the rising inclination of the population towards packaged food and beverages. The shift of customers towards ready-to-carry food also contributed to propelling the liquid packaging carton market growth.

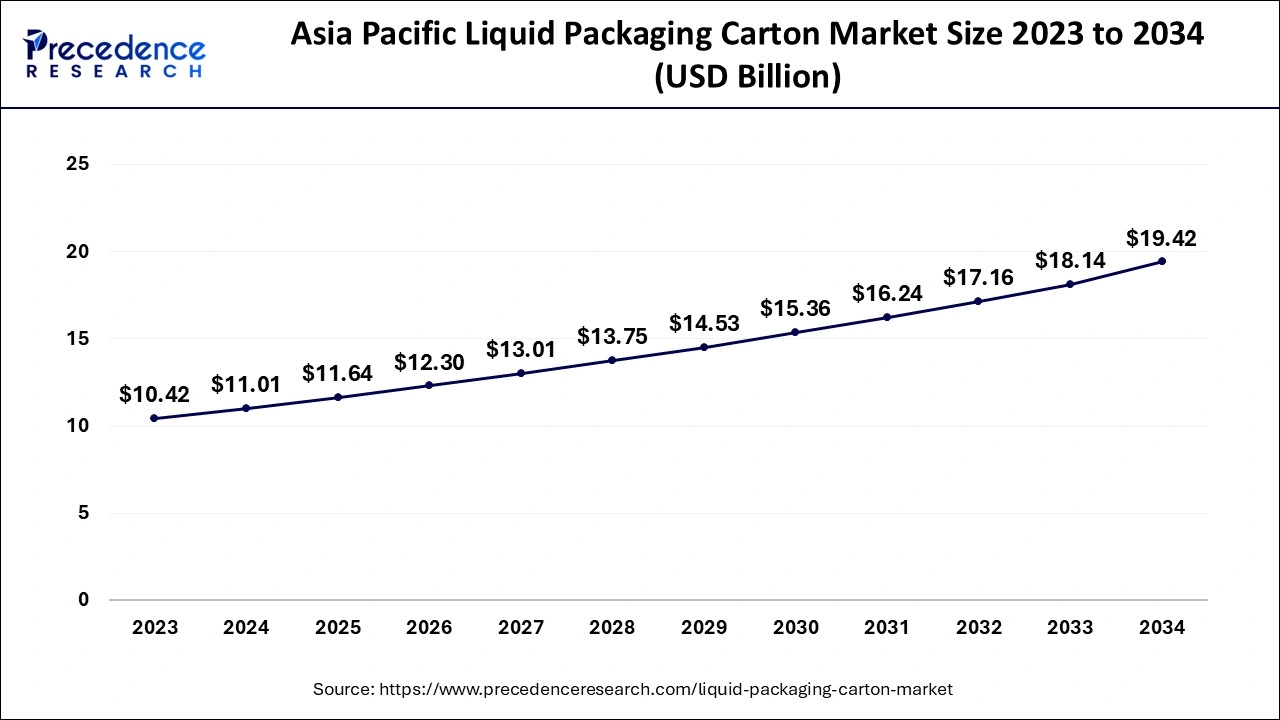

The Asia Pacific liquid packaging carton market size is estimated at USD 11.01 billion in 2024 and is predicted to be worth around USD 19.42 billion by 2034, growing at a CAGR of 5.82% between 2024 and 2034.

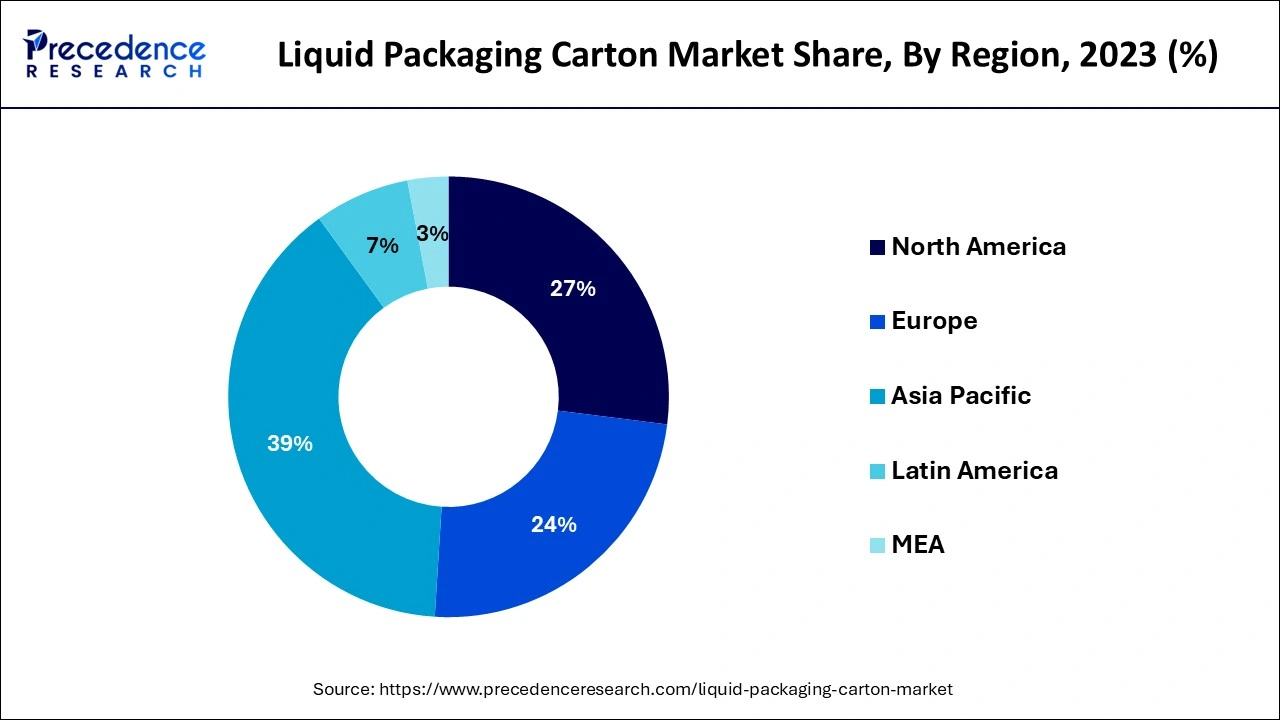

Asia Pacific dominated the liquid packaging carton market in 2023. The beverage industry and food and beverage industry in the region are still enhancing, which is boosting the market growth for liquid packaging cartons. The increased investments in the research and development sector and the population growth in emerging countries such as India, Japan, and China are driving the market growth. In addition, China and India are the major countries in the liquid packaging industry.

India is the most trusted and reputed country in the liquid packaging carton market. Hence, the milk sector is driving India's market growth. China’s rapid population has comprehensive food and beverage demands, and liquid carton packaging is helping to feed the population in China. The growing online sales of food and beverages are conducive to market growth in the country.

North America is expected to grow at the fastest rate in the liquid packaging carton market during the forecast period. The market growth in the region is attributed to the increasing presence of significant major players, the leading consumer products industry, and the flourishing dairy market.

The liquid packaging carton market deals with the packaging and distribution of products such as soups, fruit-flavored drinks, nectars, juices, milk, and other beverages. These cartons are specially made from various layers for barrier and strength properties. The material utilized to produce these layers is chosen for its capability to protect the products from external factors such as light, moisture, contaminants, and air.

Consumers appreciate the portability and convenience of liquid packaging carton markets and make them appropriate for on-the-go consumption. These cartons are usually made from renewable sources such as paper. They are considered suitable and eco-friendly packaging products due to their recyclable nature.

Why is AI Changing the Liquid Packaging Carton Market?

Artificial intelligence is an advanced technology revolutionizing the liquid packaging carton market. By enhancing operational efficiency and streamlining production processes, artificial intelligence is significantly impacting the market. AI-generated analytics are predicting maintenance needs and improving quality control. These advancements are allowing manufacturers to address the increasing demand for customized and high-quality packaging solutions effectively.

| Report Coverage | Details |

| Market Size by 2034 | USD 49.17 Billion |

| Market Size in 2024 | USD 28.24 Billion |

| Market Size in 2025 | USD 29.85 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.70% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Shelf Life,Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing use in the food and beverages sector

The growing use of liquid packaging cartons in the food and beverage (F&B) industry for assuring, conserving, and tracking the safe storage and transit of fast-moving consumer products is the major factor driving the liquid packaging carton market growth. As a result of busy schedules and growing health awareness, consumer’s shifting preferences for dietary supplements, on-the-go drinks, and healthy ready-to-eat drinks are functioning as the major driving factors. In addition, due to the rising environmental concerns, the emergence of environmentally friendly liquid packaging cartons.

Competition from substitutes, such as plastic and glass packaging

Substitute products such as plastic and glass majorly challenge liquid carton packaging. Glass bottles and flexible pouches are frequently used in countries such as Africa, India, and others, which is a vital region for the food and beverage business. In addition, the high cost of raw materials also restrains market growth. The increased preference for plastic packaging for liquid food products, as it offers cost-effective advantages and easy transportation.

The rapid technological advancement in design and manufacturing

By enabling manufacturing efficiency, design aesthetics, and enhanced functionality, technological advancements have significantly enhanced the liquid packaging carton market growth. The advancement in materials science, which has led to the improvement of cartons that offer better containment of the products, extended shelf life, and superior protection, is driving the market growth. In addition, the rapid advancements in printing technology, which provide customization capabilities and high-quality graphics.

Furthermore, automation in the manufacturing process, which has enabled consistency and precision in quality and streamlined production, is driving the liquid packaging carton market growth. In addition, these technological advancements have enabled liquid packaging cartons to become adaptable to several closure applications, sizes, and types and make them suitable for a wide range of products.

The brick liquid cartons segment held the largest liquid packaging carton market share in 2023. By type, the market is divided into shaped liquid cartons, gable top liquid cartons, and brick liquid cartons. The rectangular design of brick cartons improves space usage during store shelves, transportation, and storage. Their uniform shape enables efficient shipping and easy stacking of these cartons. They offer sufficient space for customization, product information, and branding. Manufacturers can easily print product details, graphics, and logos on these cartons. In addition, brick cartons are available in a variety of sizes to accommodate various liquid volumes. This variety makes them suitable for diverse market segments, accelerating the market demand.

The gable top segment is expected to grow at the fastest rate in the liquid packaging carton market during the forecast period. Gable top liquid cartons provide a large surface area for printing and customization, and they are also visually appealing.

The liquid cartons segment dominated the global liquid packaging carton market in 2023. Based on the shelf life, the market is divided into long-term shelf life and short-term shelf life. The long-term shelf life dominated the market growth. They are designed to protect the contents from external factors, such as oxygen and light, for an extended period, which can degrade the freshness and quality of the liquid product. These cartons are suitable for a broad range of liquid products. These products provide high consumer convenience via the preservation of liquid products for a long period and save frequent stocking of products. Liquid cartons offering long shelf life are expected to continue dominating the market as consumer preferences evolve and sustainability remains a major focus in the liquid packaging industry.

The short-term shelf life segment is expected to grow rapidly in the liquid packaging carton market during the forecast period. Liquid cartons providing short term shelf life are appropriate for products such as dairy products and fruit juices. The short-term shelf life is gaining traction in the market due to consumer preference and low costs of freshness in these products.

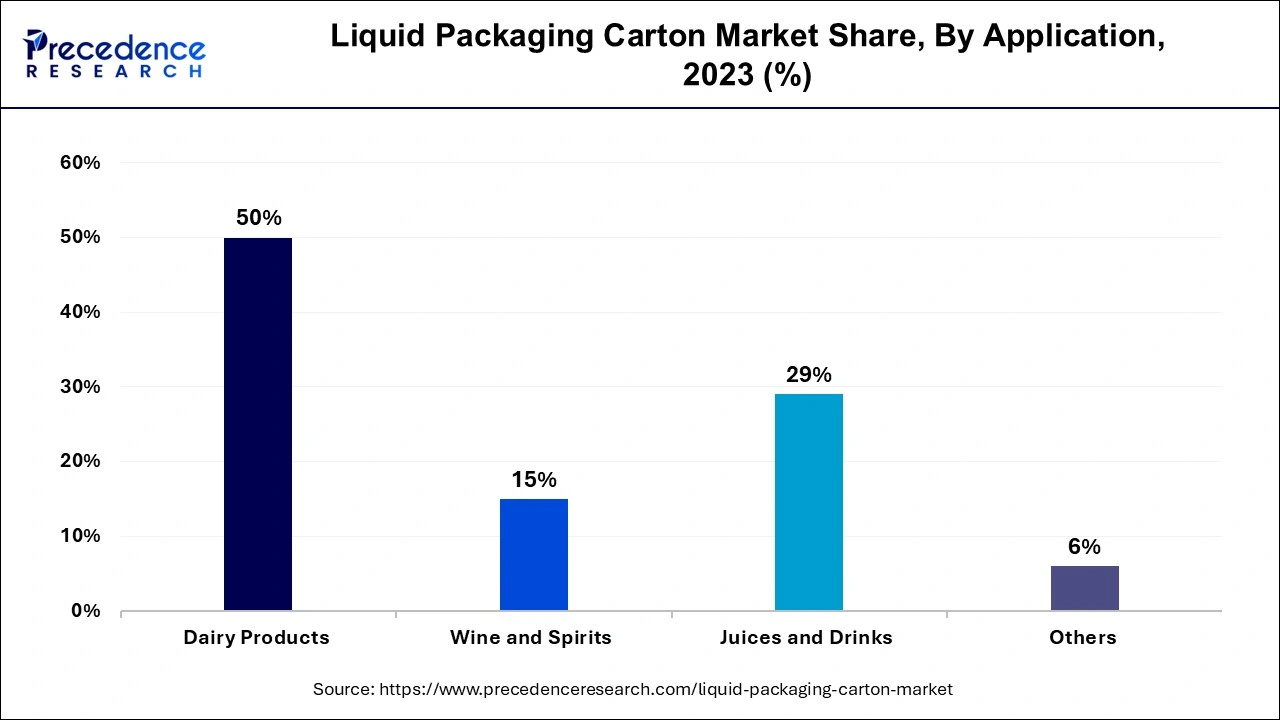

The dairy products segment dominated the liquid packaging carton market in 2023. Based on the application, the market is segmented into juices and drinks, wine and spirits, dairy products, and others. Dairy products such as cream, yogurt, and milk are sensitive to external factors such as oxygen, temperature, moisture, and light. Liquid cartons ensure the taste and quality of these products and provide an excellent barrier against these factors. Dairy brands can maintain competitive pricing in the market without worrying about sustainability due to the low cost of liquid cartons. Liquid cartons are designed to ensure the integrity and safety of dairy products and address strict food safety regulations. These factors are expected to drive the market segment during the forecast period.

The juice & drinks segment is expected to grow significantly in the liquid packaging carton market during the forecast period. Liquid packaging cartons are gaining popularity for juices and drinks due to market growth. The increasing demand for beverage packaging is appealing to customers globally.

Segments Covered in the Report

By Type

By Shelf Life

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

June 2024

January 2025

January 2025