What is Dietary Supplements Market Size?

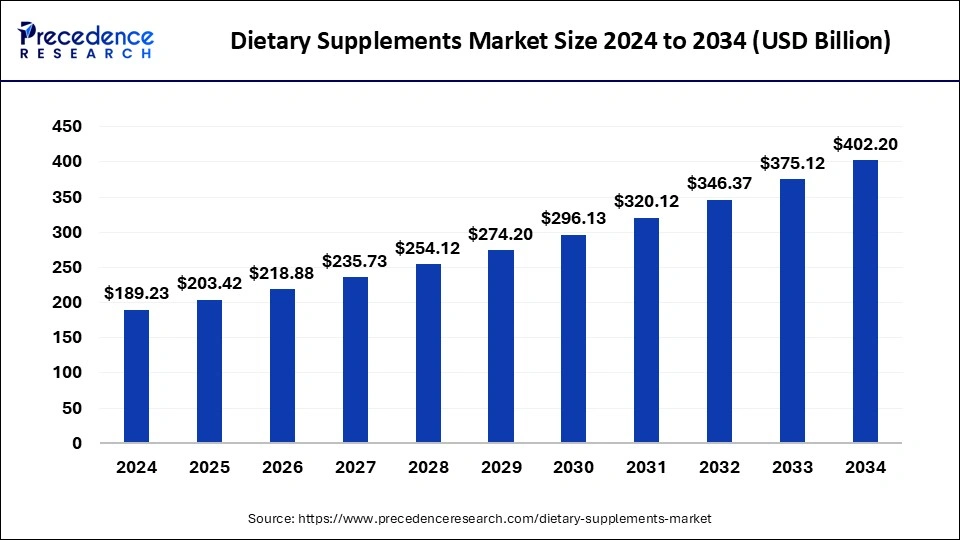

The global dietary supplements market size is valued at USD 203.42 billion in 2025 and is predicted to increase from USD 218.88 billion in 2026 to approximately USD 430.39 billion by 2034, expanding at a CAGR of 7.78% from 2026 to 2035.Dietary supplements comprise such ingredients as minerals, vitamins, amino acids, enzymes, and herbs. Thesenutritional supplementsare sold in forms such as capsules, tablets, gel caps, soft gels, liquids, and powders. Unlike drugs, nutritional supplements are not allowed to be promoted for the purpose of diagnosing, treating, curing, or preventing illnesses.

Market Highlights

- By ingredient, the vitamin segment accounted for 31.80% of the total revenue share in 2025.

- By ingredient, the botanical ingredient segment is expected to reach a CAGR of 8.95% during the forecast period.

- By ingredient, the proteins and amino acids segment is poised to hit a CAGR of 8.36% between 2026 to 2035

- By form, the tablets segment has generated 32.63% of the total revenue share in 2025.

- By form,the liquid form segment is growing at a CAGR of 9.40% between the forecast period 2026 to 2035

- By application, the immunity segment is expected to witness a CAGR of around 6.87%.

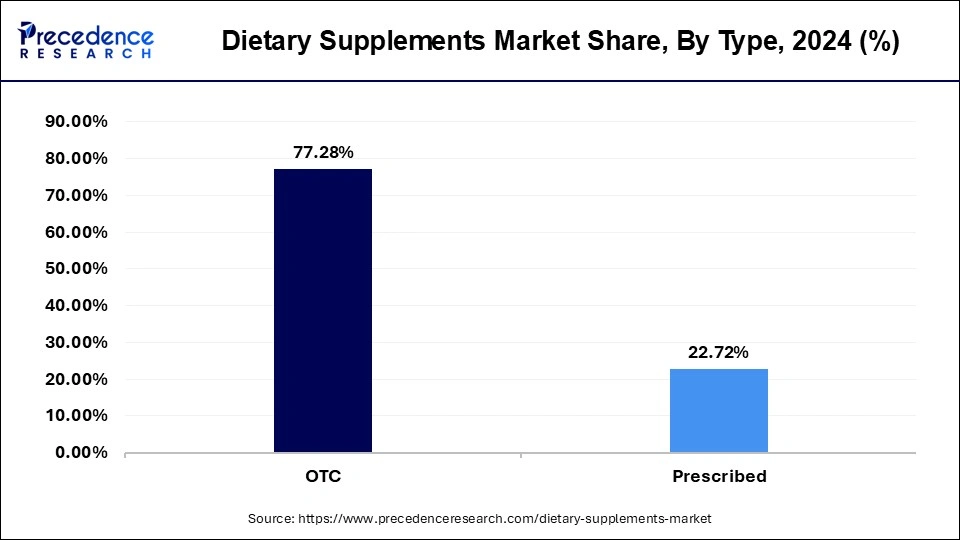

- By type, the OTC type segment accounted for 77.28% of revenue share in 2025.

- By type, the prescribed dietary supplements segment is growing at a CAGR of 9.47% during the forecast period.

- By end-user, the adult segment has captured the highest revenue share of 45.96% in 2025.

- By distribution channel, the offline segment has held a revenue share of over 68.90% in 2025.

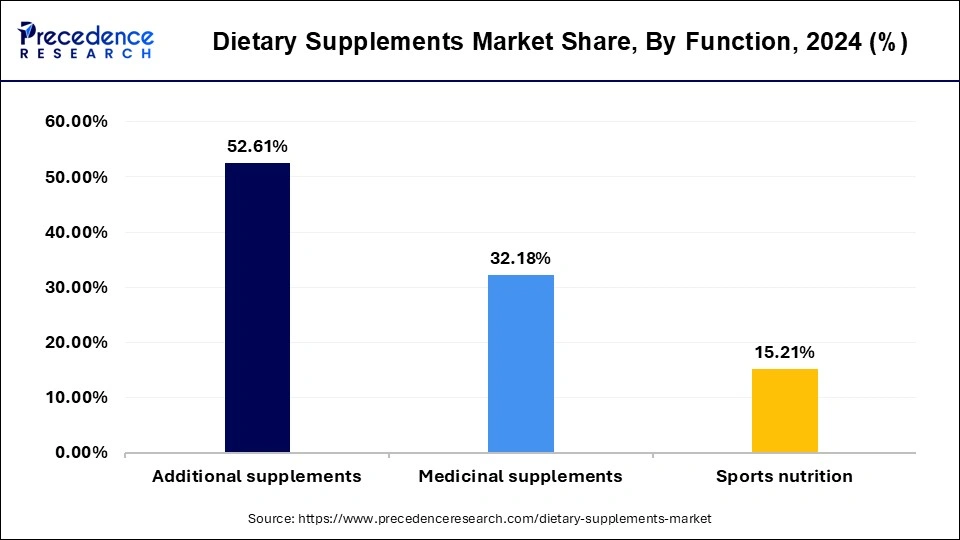

- By function, the additional supplements segment has accounted for a revenue share of around 52.61% in 2025.

AI in the Dietary Supplements Market

Artificial Intelligence is changing the dietary supplements market by making it more personal, creative, and efficient. Through data analysis, it provides personalized plans that consider the consumer's health, genetic background, and eating habits. The customer engagement is strengthened through AI-driven chatbots and virtual assistants, the ingredient discovery is sped up, and the product development provides scientific support. In the production line, AI applies smart sensors and vision systems to carry out rigorous quality control. The optimization of the supply chain leads to precise demand forecasting, diminished inventory wastage, and better delivery accuracy. This all together brings about a more intelligent and customer-centered dietary supplement ecosystem.

Market Overview

The aging population, rising interest in preventative healthcare, and rising health consciousness have all contributed to the steady rise of the global market for dietary supplements. Factors such as changes in lifestyle, urbanization, and disposable income also influence the market. A vast array of goods is included in dietary supplements, such as vitamins, minerals, enzymes, amino acids , and herbal supplements. Joint nutritional supplements include multivitamins, omega-3 fatty acids, probiotics, calcium, and vitamin D supplements.

Typically, dietary supplements are sold through various outlets, such as internet merchants, pharmacies, health food stores, and supermarkets. The convenience of online shopping and a more significant assortment of products have been the main drivers of the e-commerce segment's tremendous rise. Also, the demand for customized and targeted dietary supplements was driven by consumers' growing need for individualized nutrition solutions. Trends were influencing purchase decisions in natural ingredients and clean-label products.

Dietary Supplements Market Growth Factors

- A greater emphasis on preventative healthcare has resulted from a growing understanding of the significance of health and wellness .

- Consumers are becoming more aware of their dietary intake and resorting to dietary supplements to cover any potential nutritional gaps.

- The demand for goods promoting general health and addressing age-related health issues is rising as the world's population ages. Vitamins and minerals are among the dietary supplements frequently used to treat and prevent age-related health problems.

- Poor eating habits and fast-paced, stressful surroundings are standard features of modern lifestyles. People with hectic schedules and convenience-driven meal choices may need more nutrients, making them look for dietary supplements to stay healthy.

- Sports nutrition supplements are in greater demand as people's interest in fitness and sports activities grows. Fitness enthusiasts and athletes use supplements to help muscle repair, improve performance, and meet dietary needs.

- Consumers now have easier access to nutritional supplements thanks to the growth of e-commerce platforms. Online shopping lets Customers easily and quickly research, evaluate, and buy various dietary supplements.

- Novel supplement formulations have been made possible by ongoing nutritional science research and development. Dietary supplements are becoming more and more appealing due to their innovative ingredients, enhanced bioavailability, and new delivery methods.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 203.42 Billion |

| Market Size in 2026 | USD 218.88 Billion |

| Market Size by 2035 | USD 430.39 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.78% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Ingredient, Form, Application, End User, Type, Distribution Channel and Function, and region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Growing emphasis on organics products

Organic products are subject to strict regulations and certifications that ensure their safety, authenticity, and quality. Consumers are willing to pay a premium for organic supplements because they trust that these products have undergone rigorous testing and adhere to organic standards. Consumers are becoming more health-conscious and are actively seeking products that promote overall well-being. They are actively seeking transparency in product ingredients and sourcing, further fueling the demand for organic alternatives. Many governments around the world are promoting organic agriculture and incentivizing the production and consumption of organic products. This support has contributed to increased availability and variety of organic dietary supplements in the market. Thus, the rising emphasis on organics products fuels the growth of the market.

- For instance, in November 2022, Jollywell announced the launch of a new range of plant-based and clean products in its dietary supplement line. The newly launched supplements are scientifically formed with good and natural ingredients to make it safer for consumption without any risk of side effects.

Restraint

Regulatory hurdles

Dietary supplements must stick to specific labeling and regulatory requirements to provide accurate and transparent information to consumers. Claims made about the supplements' health benefits must be supported by scientific evidence, which can limit how companies market their products. Regulatory agencies may require dietary supplement manufacturers to follow Good Manufacturing Practices (GMPs) to ensure product quality and safety. Meeting these standards can be challenging for smaller companies or those operating in developing regions. Companies are often required to report any adverse events associated with their products. This reporting process can be burdensome and may lead to increased scrutiny from regulatory authorities. Different countries have varying regulations for dietary supplements, making it challenging for companies to navigate global markets. Compliance with multiple regulatory frameworks can add complexity to exporting and importing dietary supplements. Thus, such regulatory hurdles are observed to create a restraint for the market.

Opportunity

Booming e-commerce market

E-commerce platforms allow dietary supplement companies to reach consumers worldwide. This expanded reach opens up markets that were previously difficult to access through traditional retail channels. Companies can target customers in various regions and countries without the need for establishing physical stores or distribution networks in each location. Online stores operate 24/7, providing customers with the flexibility to shop at any time. This accessibility removes the limitations of physical store hours and enables consumers to make purchases at their convenience, even in different time zones. Thus, the booming e-commerce market across the globe is observed to open opportunities for the market.

Challenges

Misinformation and false claims

Health professionals may become wary of recommending dietary supplements to their patients due to the prevalence of false claims. This reluctance can prevent people who could benefit from certain supplements from receiving appropriate guidance. Companies that make false claims about their products may face legal consequences from regulatory authorities, such as the U.S. Food and Drug Administration (FDA) or the Federal Trade Commission (FTC), resulting in fines and reputational damage. False claims can lead consumers to believe that certain dietary supplements are effective and safe when they may not be. This can lead to individuals taking supplements that could potentially be harmful or interact negatively with other medications they are taking. Thus, the misinformation about the product and false claims creates a challenge for the market's growth.

Dietary Supplements MarketSegment Insights

Type Insights

The OTC segment accounted for the largest market share in 2025. The increased awareness about self-medication is a major factor that boosted the adoption of OTC dietary supplements. These supplements are readily available, making them accessible to a broader consumer base. Moreover, OTC supplements are more cost-effective compared to prescription supplements. Since these supplements do not require a prescription, they help reduce hospital visits and healthcare costs.

Dietary Supplements Market Revenue, By Type, 2022-2024 (USD Billion)

| Type | 2022 | 2023 | 2024 |

| OTC | 128.1 | 136.8 | 146.2 |

| Prescribed |

36.1 | 39.4 | 43.0 |

Function Insights

The additional supplements segment dominated the dietary supplements market with the largest share in 2025. This is mainly due to the increased demand for functional foods. Additional supplements like vitamins, minerals, and essential amino acids play a crucial role in improving digestion and overall health. These supplements can be incorporated into regular diets as a part of wellness routines. The rise in focus on preventive health further contributes to segmental growth.

Dietary Supplements Market Revenue, By Function, 2022-2024 (USD Billion)

| Function | 2022 | 2023 | 2024 |

| Additional supplements | 87.7 | 93.4 | 99.5 |

| Medicinal supplements | 52.5 | 56.5 | 60.9 |

| Sports nutrition | 24.0 | 26.3 | 28.8 |

Ingredient Insights

Vitamins hold the largest share in the dietary supplements market. An ageing population, growing interest in preventative healthcare, and increased awareness of health and well-being have all contributed to the steady rise of the global market for dietary supplements. The market size as a whole is frequently significantly influenced by the vitamin category. Vitamins C, D, E, and many B vitamins are commonly found in dietary supplements. Consumers select supplements depending on their unique health demands, as different vitamins are linked to different health advantages. An emphasis on natural and organic ingredients, clean labelling, and individualized nutrition has all impacted consumer preferences for dietary supplements.

The belief that specific vitamins could enhance immune system performance, promote healthy bones, or offer antioxidant advantages has sparked consumer curiosity in Vitamin supplements. Countries have different laws governing dietary supplements, and market participants must adhere to strict quality and safety requirements. For instance, the Dietary Supplement Health and Education Act regulates the U.S. market and lays out precise guidelines for product claims, safety, and labelling. To satisfy customer requests, companies in the dietary supplement industry always develop novel vitamin combinations, delivery systems, and formulations. The utilization of innovative substances, such as plant-based sources and bioavailable versions of vitamins, may be one of the emerging terms.

Dietary Supplements Market Revenue, By Ingredient, 2022-2024 (USD Billion)

| Ingradient | 2022 | 2023 | 2024 |

| Vitamins | 52.6 | 56.2 | 60.2 |

| Minerals |

23.9 | 25.7 | 27.7 |

| Fibers & Specialty Carbohydrates | 17.6 | 18.6 | 19.7 |

| Omega Fatty Acids | 20.3 | 21.9 | 23.7 |

| Botanicals | 16.3 | 17.7 | 19.2 |

| Proteins & Amino Acids | 18.7 | 20.2 | 21.8 |

| Others | 14.7 | 15.8 | 16.9 |

Forms Insights

Among different form insights, the tablet segment holds the largest share of the dietary supplement market. They frequently have a neutral flavor, are portable, and are simple to consume. Manufacturing dietary supplement tablets with different combinations of vitamins, minerals, amino acids, plant extracts, and other bioactive substances is possible. Tablets can be made up of one or more components. They can treat various medical conditions, including immune system support, joint health, and vitamin and mineral shortages. Certain tablets, known as extended-release or sustained-released tablets, are made to release their components gradually, giving a more prolonged lasting impact and lowering the frequency of doses required.

A broad spectrum of consumers can benefit from tablets, including those who struggle to swallow capsules or prefer a more recognizable supplement form. The market for nutritional supplements, including tablets, is governed by national regulatory frameworks. Regulations frequently govern ingredient safety, health claims, and labelling. Dietary supplement sales, particularly those of tablets, are dynamic and subject to change in response to customer preferences and new health issues. As of my latest report, a growing number of people were interested in individualized nutrition, natural and plant-based supplements, and general health and well-being.

Dietary Supplements Market Revenue, By Form, 2022-2024 (USD Billion)

| Form | 2022 | 2023 | 2024 |

| Capsules | 35.4 | 37.7 | 40.3 |

| Tablets | 53.2 | 57.3 | 61.7 |

| Gummies | 17.8 | 19.5 | 21.3 |

| Soft gels | 21.3 | 22.9 | 24.8 |

| Liquids | 5.7 | 6.2 | 6.7 |

| Powders | 19.8 | 21.1 | 22.4 |

| Others | 11.1 | 11.5 | 12.0 |

Application Insights

The energy and weight management segment is observed to lead the market in the upcoming years. Rising global obesity rates have heightened awareness about weight management. Individuals seeking to lose or control weight often turn to dietary supplements as part of their wellness journey. Growing awareness of the importance of a healthy lifestyle has driven the popularity of weight management supplements. Consumers are proactively seeking products that support overall well-being, including weight control.

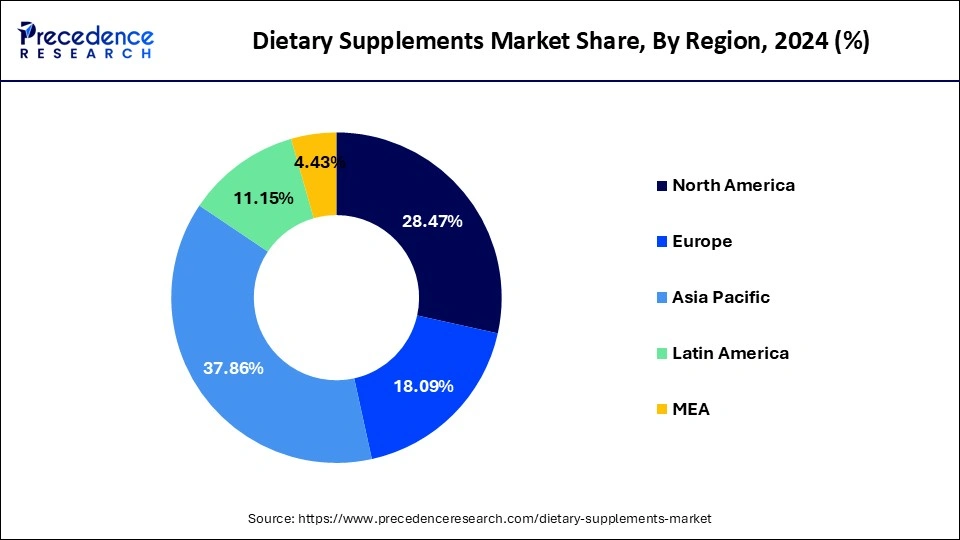

Dietary Supplements MarketRegional Insights

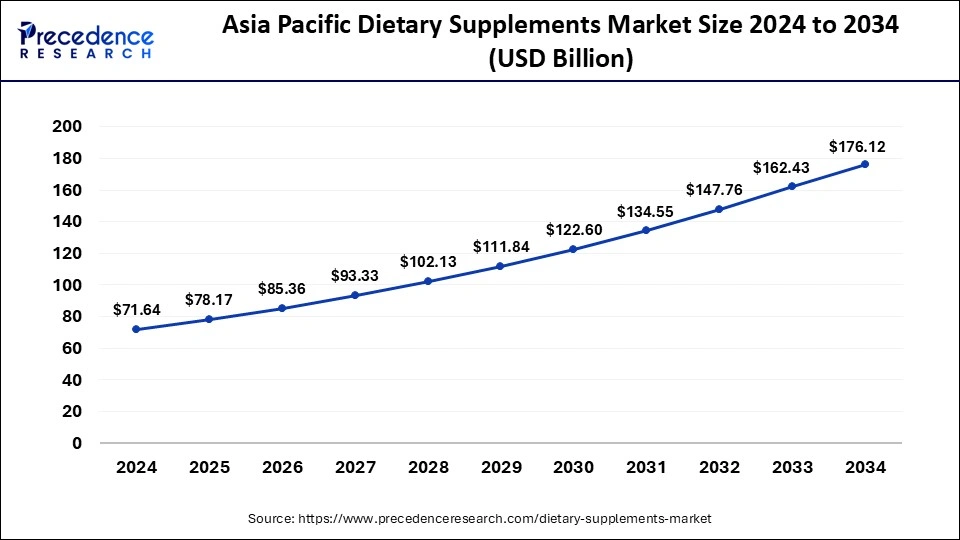

The Asia Pacific dietary supplements market size is exhibited at USD 78.17 billion in 2025 and is projected to be worth around USD 190.46 billion by 2035, growing at a CAGR of 9.31% from 2026 to 2035

Asia Pacific dominated the dietary supplements market by holding the largest share in 2024. This is mainly due to the increased healthcare expenditure. The involvement of women has increased in sports and fitness, which further increased the demand for sports nutrition. People have become increasingly aware of the importance and benefits of dietary supplements in maintaining overall health and well-being, bolstering the region's market.

Countries like China, Japan, and India are major contributors to the Asia Pacific dietary supplements market. With the growing awareness regarding gut health, there is a high adoption of dietary supplements. The rising consumer disposable income further influences the market. As disposable income rises, healthcare spending also increases, which can propel the demand for dietary supplements. Moreover, the growing geriatric population supports regional market growth.

North America is fastest fastest-growing market because of the very good consumer awareness, the high priority of preventive healthcare, and the great popularity of dietary supplements. Moreover, the region takes advantage of cutting-edge product innovation, a well-established retail network, and the regulatory pressure on product safety. In addition, the growing demand for clean-label, plant-based, and functional nutrition supplements is likely to continue supporting the market expansion to be done through various consumer demographics.

North America remains one of the most mature and influential regions in the global dietary supplements market, primarily led by the United States. High consumer awareness about preventive healthcare, rising incidences of lifestyle-related diseases, and growing interest in personalized nutrition continue to drive strong demand. The region benefits from a well-established distribution network, including supermarkets, pharmacies, and a rapidly growing e-commerce sector that makes supplements more accessible. Additionally, the regulatory oversight from bodies like the FDA promotes product safety and labelling transparency, which strengthens consumer confidence. Popular segments include multivitamins, omega-3 fatty acids, and probiotics, particularly among adults and seniors. Functional and clean label supplements are gaining traction as more consumers seek natural, non-GMO, and organic formulations. Canada also shows promising growth, supported by an aging population and a strong preference for plant-based and holistic health solutions. The integration of AI in product development and recommendation platforms further supports market expansion in the region.

Europe represents a significant portion of the global dietary supplements market, with countries like Germany, the United Kingdom, France, and Italy at the forefront. The region's market is shaped by stringent regulatory frameworks such as EFSA (European Food Safety Authority) guidelines, which assure high-quality standards for supplement ingredients and health claims. This regulatory structure increases consumer trust and supports consistent product development. The market is fuelled by a growing aging population, a shift toward preventive health measures, and increasing interest in immunity boosting, heart health, and digestive wellness products. Supplements such as vitamin D, magnesium, and herbal extracts are in high demand. Europe also shows a strong preference for clean label, vegan, and sustainably sourced ingredients, which reflects evolving consumer values. The expansion of online channels and subscription-based supplement models has further boosted accessibility and consumption. Innovation is also a key growth driver, with companies investing in personalized nutrition and AI-based product customization to cater to diverse consumer needs.

The U.S. market is the largest in the world, mainly because of a fitness-loving population and preventive healthcare that people are opting for more and more. Steady demand is driven by a large variety of supplements that support wellness, immunity, and performance. The consumer is gaining more trust through digital health integration and transparent labeling, while regulatory supervision maintains product quality and market stability across the different distribution channels, including the strong growth of e-commerce.

The Asia-Pacific region dominated the market, aided by a rising middle class and health consciousness. The mixing of traditional herbal practices with modern supplement formulations is a major driver. The rise of e-commerce and the ability to get global brands are the factors that are changing consumer preferences, while urbanization and better healthcare awareness bring about continued market growth in major economies such as China, India, Japan, and South Korea, which are, of course, the largest in the region.

China Dietary Supplements Market Trends

China's market is developing at a fast pace because of urbanization, health consciousness, and people's preference for traditional medicine used alongside modern nutrition. The middle class is getting bigger and their incomes are rising; thus, domestic consumption of products is being supported strongly. The growth of online shopping platforms and government programs encouraging health and wellness are two factors that further enhance China's position as the leading market for innovative and functional dietary supplements.

Europe is an already developed and stable market where high consumer demand for botanical, organic, and vegan supplements is the major driving force. The regulators establish rules that guarantee quality, safety, and transparency, and, accordingly, consumers decide where to buy. The German, French, and Italian markets are characterized by consumers who are highly interested in sustainable products made with natural ingredients. The market is still developing towards the eco-friendly production and responsible sourcing practices needed to meet the modern wellness standards.

Germany Dietary Supplements Market Trends

Besides Europe's dietary supplements market, demand for natural, organic, and plant-based products is mainly coming from Germany. People are considering sustainability, ingredient transparency, and ethical sourcing to be the most important factors. Strict regulations are the basis of product safety and authenticity, thus creating a trustworthy market. The continuing concern over immunity, digestion, and cognitive health is the main factor behind product innovation and consumer buying habits in these major markets.

Dietary supplements are products that are meant for ingestion, and are not sold as part of a meal, and have one or more ingredients in them, like minerals, vitamins, amino acids, and herbs or other botanicals. Dietary substances are utilized to supplement the complete diet by developing the total dietary intake. They are the focused source of nutrients such as minerals, vitamins, and enzymes, which are completely available in forms of capsules, tablets, liquids, and powders.

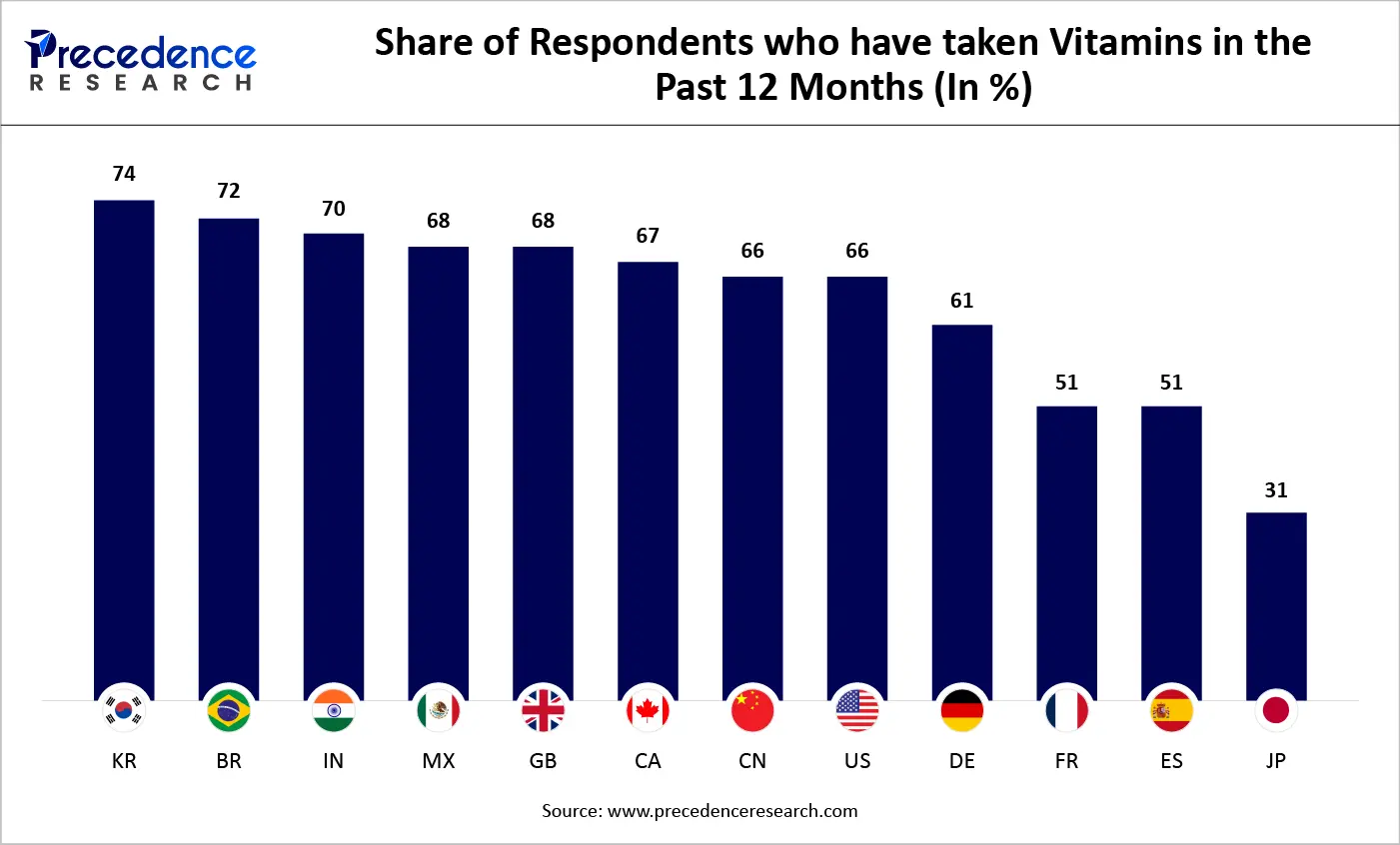

As shown in the above graph, around 8 in 10 people, which is approximately 79%, in the United States consume food supplements, as per the survey which occurred between the period October 2024 and September 2025. Among these, vitamins are the most famous, that has 66% of feedback saying that they had taken all of them in the last 12 months. Apart from this, vitamins and minerals are the next most famous creations of food supplements, with over 33% and 24% consumers who have consumed them, respectively.

Recent Developments

- In July 2025, Nestle has launched a strategic review of its vitamins, miracles, minerals, and supplements brands such as Nature's Bounty and Puritan's Pride, with as possible divestiture under consideration. The company is refocusing on premium nutrition brands like Garden of Life and Solgar to align with consumer demand and drive profitability.

- In June 2025, A bipartisan congressional Dietary Supplement Caucus has been re-established to facilitate dialogue between legislators, industry stakeholders, and researchers. The imitative aims to modernize regulatory frameworks, enhance supplement education, and explore expanding coverage of dietary supplements under health savings accounts.

Value Chain Analysis

- Raw Material Procurement (Farms, Fisheries, etc.): The process of sourcing and managing raw plant, animal, or mineral ingredients that are to be used in the manufacturing of dietary supplements.

Key Players: DSM-Firmenich, Archer Daniels Midland (ADM), BASF SE - Processing and Preservation: Materials are processed through extraction, encapsulation, and preservation to keep the nutrients intact and the product stable for a longer period.

Key players: Nestle Health Science, Herbalife Nutrition, Sirio Pharma - Quality Testing and Certification: The process of conducting exhaustive laboratory tests and third-party verifications to establish the purity, potency, and compliance of the supplement with regulations.

Key players: Eurofins Scientific, SGS, Intertek Group - Packaging and Branding: The creation of protective packages having clear signs with the specific purpose of improving product recognition, consumer trust, and brand value.

Key Players: Amcor plc, Berry Global Group, Sealed Air Corporation - Cold Chain Logistics and Storage: The transportation and storage of sensitive products in controlled temperature conditions are being done to maintain their efficacy and quality.

Key Players: Americold Logistics, Lineage Logistics, Maersk - Waste Management and Recycling: The company is disposing of waste materials responsibly through recycling and disposal during the production and packaging cycle.

Key Players: Daniels Sharpsmart, Saahas Zero Waste, Hahn Plastics

Dietary Supplements Market Companies

- Bayer

- NBTY Inc

- Bionova Lifesciences

- Nu Skin Enterprises

- Carlyle Group

- Pfizer

- Arkopharma Laboratoires Pharmaceutiques

- Glanbia

- Herbalife International

- Abbott Laboratories

- GlaxoSmithKline

- Nature's Sunshine Forms

- Amway

- Archer Daniels Midland

Dietary Supplements MarketSegments Covered in the Report

By Ingredient

- Vitamins

- Minerals

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Botanicals

- Proteins & Amino Acids

- Others

By Form

- Capsules

- Tablets

- Gummies

- Soft gels

- Liquids

- Powders

- Others

By Application

- Energy & Weight Management

- Bone & Joint Health

- Diabetes

- General Health

- Immunity

- Cardiac Health

- Gastrointestinal Health

- Anti-cancer

- Lungs Detox/Cleanse

- Sexual Health

- Brain/Mental Health

- Skin/Hair/Nails

- Insomnia

- Anti-aging

- Menopause

- Prenatal Health

- Others

By End User

- Adults

- Geriatric

- Pregnant Women

- Children

- Infants

By Type

- OTC

- Prescribed

By Distribution ChannelÂ

- Offline

- Hypermarkets/Supermarkets

- Pharmacies

- Specialty Stores

- Practioner

- Others

- Online

By Function

- Additional supplements

- Medicinal supplements

- Sports nutrition

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting