May 2025

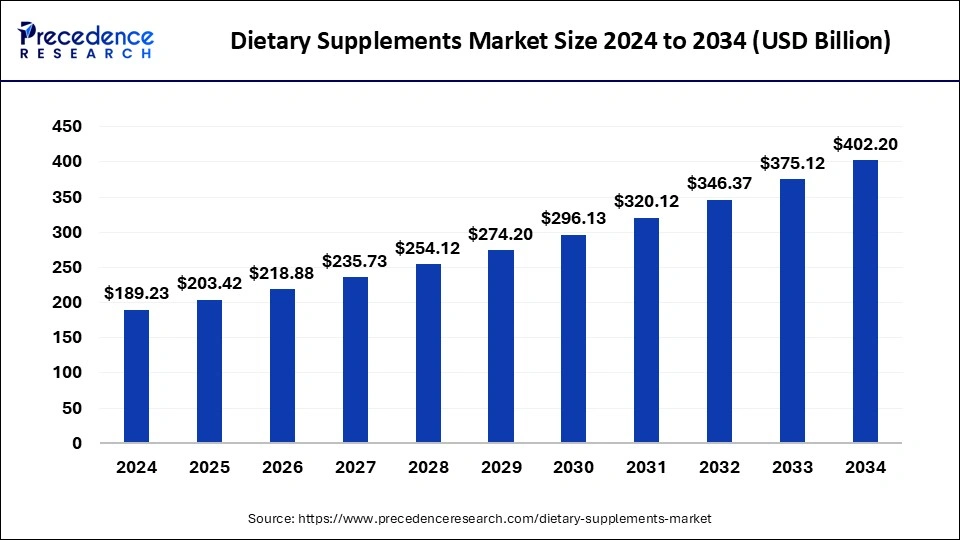

The global dietary supplements market size accounted for USD 203.42 billion in 2025 and is forecasted to hit around USD 402.20 billion by 2034, representing a CAGR of 7.87% from 2025 to 2034. The Asia Pacific market size was estimated at USD 71.64 billion in 2024 and is expanding at a CAGR of 9.44% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dietary supplements market size was calculated at USD 189.23 billion in 2024 and is predicted to increase from USD 203.42 billion in 2025 to approximately USD 402.20 billion by 2034, expanding at a CAGR of 7.87% from 2025 to 2034. Dietary supplements comprise such ingredients as minerals, vitamins, amino acids, enzymes, and herbs. These nutritional supplements are sold in forms such as capsules, tablets, gel caps, soft gels, liquids, and powders. Unlike drugs, nutritional supplements are not allowed to be promoted for the purpose of diagnosing, treating, curing, or preventing illnesses.

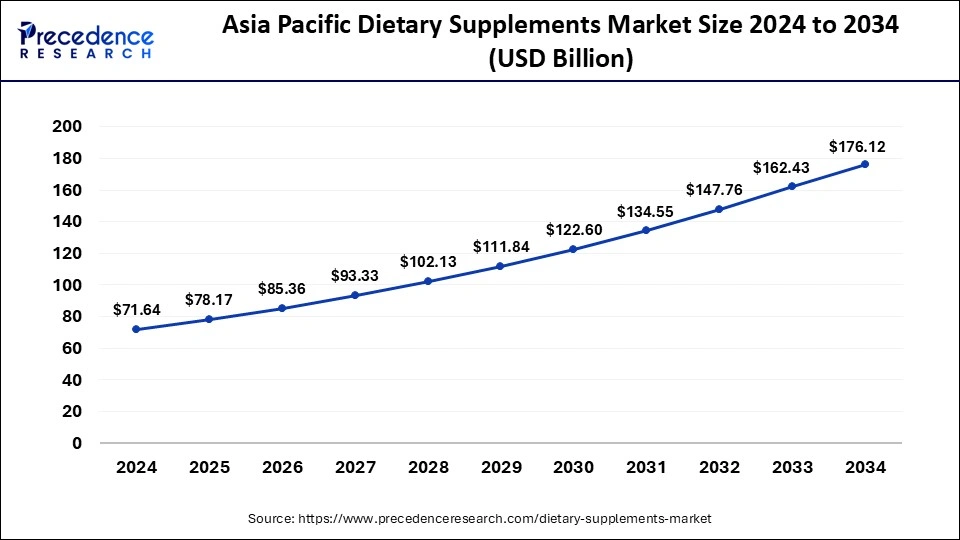

The Asia Pacific dietary supplements market size was exhibited at USD 71.64 billion in 2024 and is projected to be worth around USD 176.12 billion by 2034, growing at a CAGR of 9.44% from 2025 to 2034.

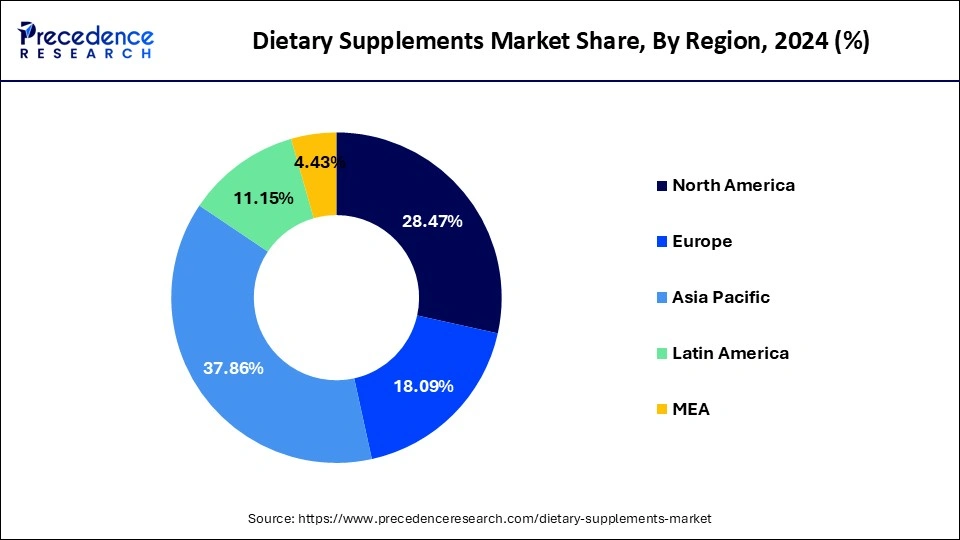

Asia Pacific dominated the dietary supplements market by holding the largest share in 2024. This is mainly due to the increased healthcare expenditure. The involvement of women has increased in sports and fitness, which further increased the demand for sports nutrition. People have become increasingly aware of the importance and benefits of dietary supplements in maintaining overall health and well-being, bolstering the region's market.

Countries like China, Japan, and India are major contributors to the Asia Pacific dietary supplements market. With the growing awareness regarding gut health, there is a high adoption of dietary supplements. The rising consumer disposable income further influences the market. As disposable income rises, healthcare spending also increases, which can propel the demand for dietary supplements. Moreover, the growing geriatric population supports regional market growth.

The aging population, rising interest in preventative healthcare, and rising health consciousness have all contributed to the steady rise of the global market for dietary supplements. Factors such as changes in lifestyle, urbanization, and disposable income also influence the market. A vast array of goods is included in dietary supplements, such as vitamins, minerals, enzymes, amino acids, and herbal supplements. Joint nutritional supplements include multivitamins, omega-3 fatty acids, probiotics, calcium, and vitamin D supplements.

Typically, dietary supplements are sold through various outlets, such as internet merchants, pharmacies, health food stores, and supermarkets. The convenience of online shopping and a more significant assortment of products have been the main drivers of the e-commerce segment's tremendous rise. Also, the demand for customized and targeted dietary supplements was driven by consumers' growing need for individualized nutrition solutions. Trends were influencing purchase decisions in natural ingredients and clean-label products.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.87% |

| Market Size in 2025 | USD 203.42 Billion |

| Market Size by 2034 | USD 402.20 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Ingredient, Form, Application, End User, Type, Distribution Channel and Function |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Drivers

Growing emphasis on organics products

Organic products are subject to strict regulations and certifications that ensure their safety, authenticity, and quality. Consumers are willing to pay a premium for organic supplements because they trust that these products have undergone rigorous testing and adhere to organic standards. Consumers are becoming more health-conscious and are actively seeking products that promote overall well-being. They are actively seeking transparency in product ingredients and sourcing, further fueling the demand for organic alternatives. Many governments around the world are promoting organic agriculture and incentivizing the production and consumption of organic products. This support has contributed to increased availability and variety of organic dietary supplements in the market. Thus, the rising emphasis on organics products fuels the growth of the market.

For instance, in November 2022, Jollywell announced the launch of a new range of plant-based and clean products in its dietary supplement line. The newly launched supplements are scientifically formed with good and natural ingredients to make it safer for consumption without any risk of side effects.

Regulatory hurdles

Dietary supplements must stick to specific labeling and regulatory requirements to provide accurate and transparent information to consumers. Claims made about the supplements’ health benefits must be supported by scientific evidence, which can limit how companies market their products. Regulatory agencies may require dietary supplement manufacturers to follow Good Manufacturing Practices (GMPs) to ensure product quality and safety. Meeting these standards can be challenging for smaller companies or those operating in developing regions. Companies are often required to report any adverse events associated with their products. This reporting process can be burdensome and may lead to increased scrutiny from regulatory authorities. Different countries have varying regulations for dietary supplements, making it challenging for companies to navigate global markets. Compliance with multiple regulatory frameworks can add complexity to exporting and importing dietary supplements. Thus, such regulatory hurdles are observed to create a restraint for the market.

Booming e-commerce market

E-commerce platforms allow dietary supplement companies to reach consumers worldwide. This expanded reach opens up markets that were previously difficult to access through traditional retail channels. Companies can target customers in various regions and countries without the need for establishing physical stores or distribution networks in each location. Online stores operate 24/7, providing customers with the flexibility to shop at any time. This accessibility removes the limitations of physical store hours and enables consumers to make purchases at their convenience, even in different time zones. Thus, the booming e-commerce market across the globe is observed to open opportunities for the market.

Misinformation and false claims

Health professionals may become wary of recommending dietary supplements to their patients due to the prevalence of false claims. This reluctance can prevent people who could benefit from certain supplements from receiving appropriate guidance. Companies that make false claims about their products may face legal consequences from regulatory authorities, such as the U.S. Food and Drug Administration (FDA) or the Federal Trade Commission (FTC), resulting in fines and reputational damage. False claims can lead consumers to believe that certain dietary supplements are effective and safe when they may not be. This can lead to individuals taking supplements that could potentially be harmful or interact negatively with other medications they are taking. Thus, the misinformation about the product and false claims creates a challenge for the market’s growth.

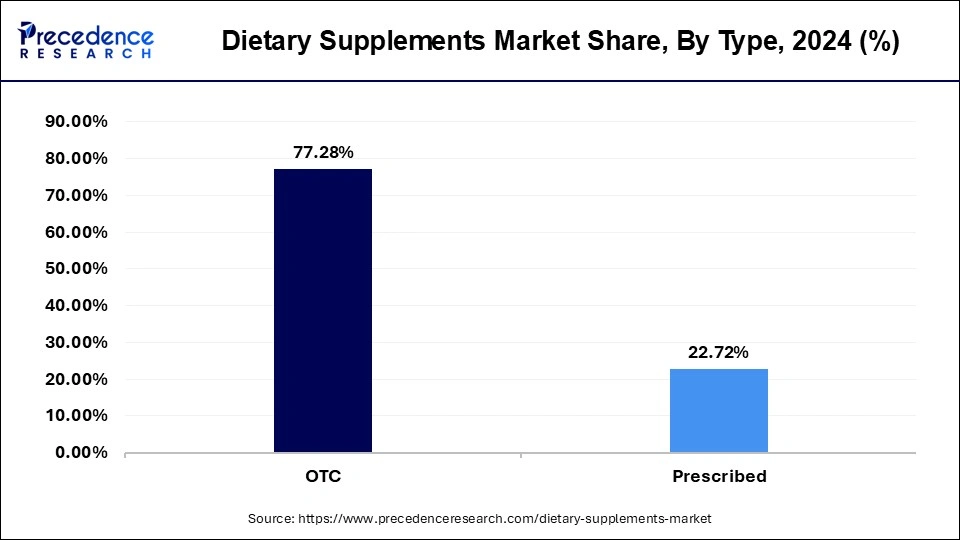

The OTC segment accounted for the largest market share in 2024. The increased awareness about self-medication is a major factor that boosted the adoption of OTC dietary supplements. These supplements are readily available, making them accessible to a broader consumer base. Moreover, OTC supplements are more cost-effective compared to prescription supplements. Since these supplements do not require a prescription, they help reduce hospital visits and healthcare costs.

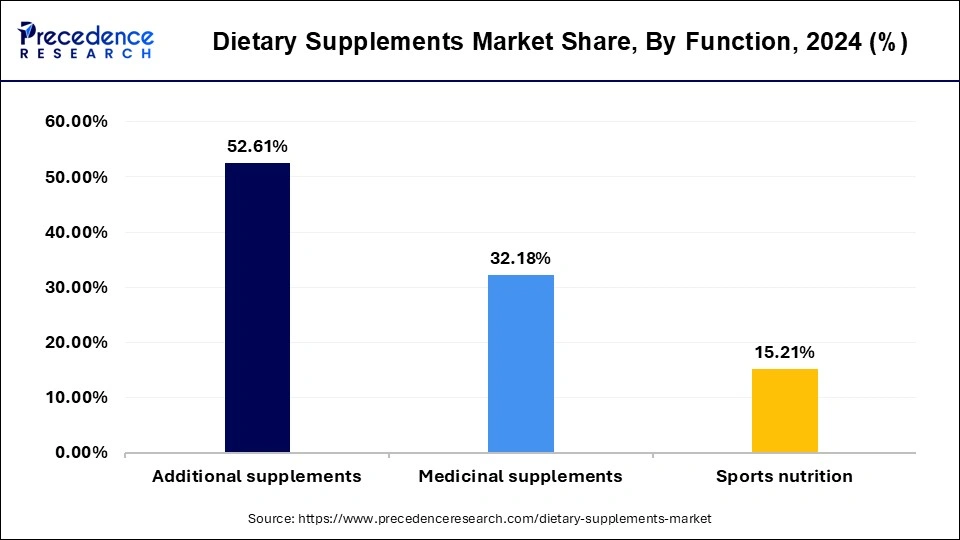

The additional supplements segment dominated the dietary supplements market with the largest share in 2024. This is mainly due to the increased demand for functional foods. Additional supplements like vitamins, minerals, and essential amino acids play a crucial role in improving digestion and overall health. These supplements can be incorporated into regular diets as a part of wellness routines. The rise in focus on preventive health further contributes to segmental growth.

Vitamins hold the largest share in the dietary supplements market. An ageing population, growing interest in preventative healthcare, and increased awareness of health and well-being have all contributed to the steady rise of the global market for dietary supplements. The market size as a whole is frequently significantly influenced by the vitamin category. Vitamins C, D, E, and many B vitamins are commonly found in dietary supplements. Consumers select supplements depending on their unique health demands, as different vitamins are linked to different health advantages. An emphasis on natural and organic ingredients, clean labelling, and individualized nutrition has all impacted consumer preferences for dietary supplements.

The belief that specific vitamins could enhance immune system performance, promote healthy bones, or offer antioxidant advantages has sparked consumer curiosity in Vitamin supplements. Countries have different laws governing dietary supplements, and market participants must adhere to strict quality and safety requirements. For instance, the Dietary Supplement Health and Education Act regulates the U.S. market and lays out precise guidelines for product claims, safety, and labelling. To satisfy customer requests, companies in the dietary supplement industry always develop novel vitamin combinations, delivery systems, and formulations. The utilization of innovative substances, such as plant-based sources and bioavailable versions of vitamins, may be one of the emerging terms.

Dietary Supplements Market Revenue, By Ingredient, 2022-2024 (USD Billion)

| Ingradient | 2022 | 2023 | 2024 |

| Vitamins | 52.6 | 56.2 | 60.2 |

| Minerals |

23.9 | 25.7 | 27.7 |

| Fibers & Specialty Carbohydrates | 17.6 | 18.6 | 19.7 |

| Omega Fatty Acids | 20.3 | 21.9 | 23.7 |

| Botanicals | 16.3 | 17.7 | 19.2 |

| Proteins & Amino Acids | 18.7 | 20.2 | 21.8 |

| Others | 14.7 | 15.8 | 16.9 |

Among different form insights, the tablet segment holds the largest share of the dietary supplement market. They frequently have a neutral flavor, are portable, and are simple to consume. Manufacturing dietary supplement tablets with different combinations of vitamins, minerals, amino acids, plant extracts, and other bioactive substances is possible. Tablets can be made up of one or more components. They can treat various medical conditions, including immune system support, joint health, and vitamin and mineral shortages. Certain tablets, known as extended-release or sustained-released tablets, are made to release their components gradually, giving a more prolonged lasting impact and lowering the frequency of doses required.

A broad spectrum of consumers can benefit from tablets, including those who struggle to swallow capsules or prefer a more recognizable supplement form. The market for nutritional supplements, including tablets, is governed by national regulatory frameworks. Regulations frequently govern ingredient safety, health claims, and labelling. Dietary supplement sales, particularly those of tablets, are dynamic and subject to change in response to customer preferences and new health issues. As of my latest report, a growing number of people were interested in individualized nutrition, natural and plant-based supplements, and general health and well-being.

Dietary Supplements Market Revenue, By Form, 2022-2024 (USD Billion)

| Form | 2022 | 2023 | 2024 |

| Capsules | 35.4 | 37.7 | 40.3 |

| Tablets | 53.2 | 57.3 | 61.7 |

| Gummies | 17.8 | 19.5 | 21.3 |

| Soft gels | 21.3 | 22.9 | 24.8 |

| Liquids | 5.7 | 6.2 | 6.7 |

| Powders | 19.8 | 21.1 | 22.4 |

| Others | 11.1 | 11.5 | 12.0 |

The energy and weight management segment is observed to lead the market in the upcoming years. Rising global obesity rates have heightened awareness about weight management. Individuals seeking to lose or control weight often turn to dietary supplements as part of their wellness journey. Growing awareness of the importance of a healthy lifestyle has driven the popularity of weight management supplements. Consumers are proactively seeking products that support overall well-being, including weight control.

By Ingredient

By Form

By Application

By End User

By Type

By Distribution Channel

By Function

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

March 2025

November 2024

August 2024