November 2024

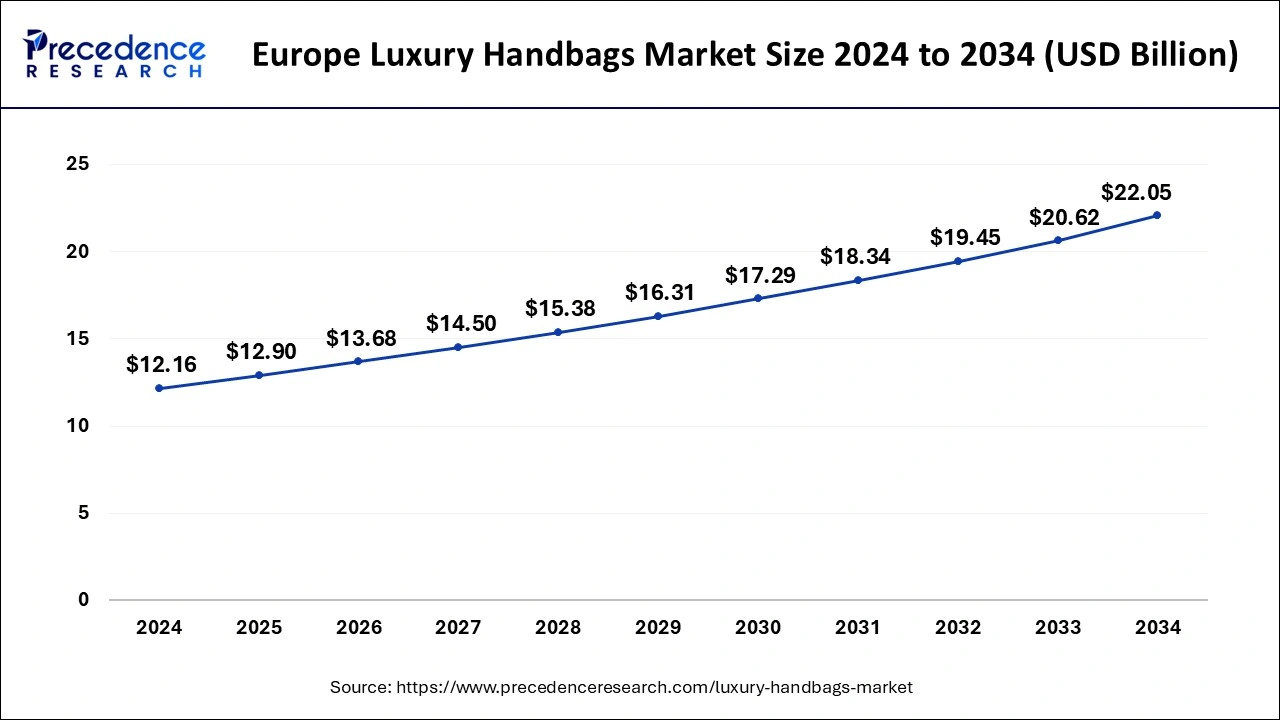

The global luxury handbags market size is calculated at USD 35.83 billion in 2025 and is forecasted to reach around USD 60.42 billion by 2034, accelerating at a CAGR of 5.98% from 2025 to 2034. The Europe luxury handbags market size accounted for USD 12.90 billion in 2025 and is expanding at a CAGR of 6.13% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global luxury handbags market size accounted for USD 33.79 billion in 2024, grew to USD 35.83 billion in 2025 and is projected to surpass around USD 60.42 billion by 2034, representing a healthy CAGR of 5.98% between 2024 and 2034. The luxury handbags market is driven by the growth of digital marketing and premium experiences offered online.

The Europe luxury handbags market size was valued at USD 12.16 billion in 2024 and is predicted to be worth around USD 22.05 billion by 2033, poised to grow at a CAGR of 6.13% from 2025 to 2034.

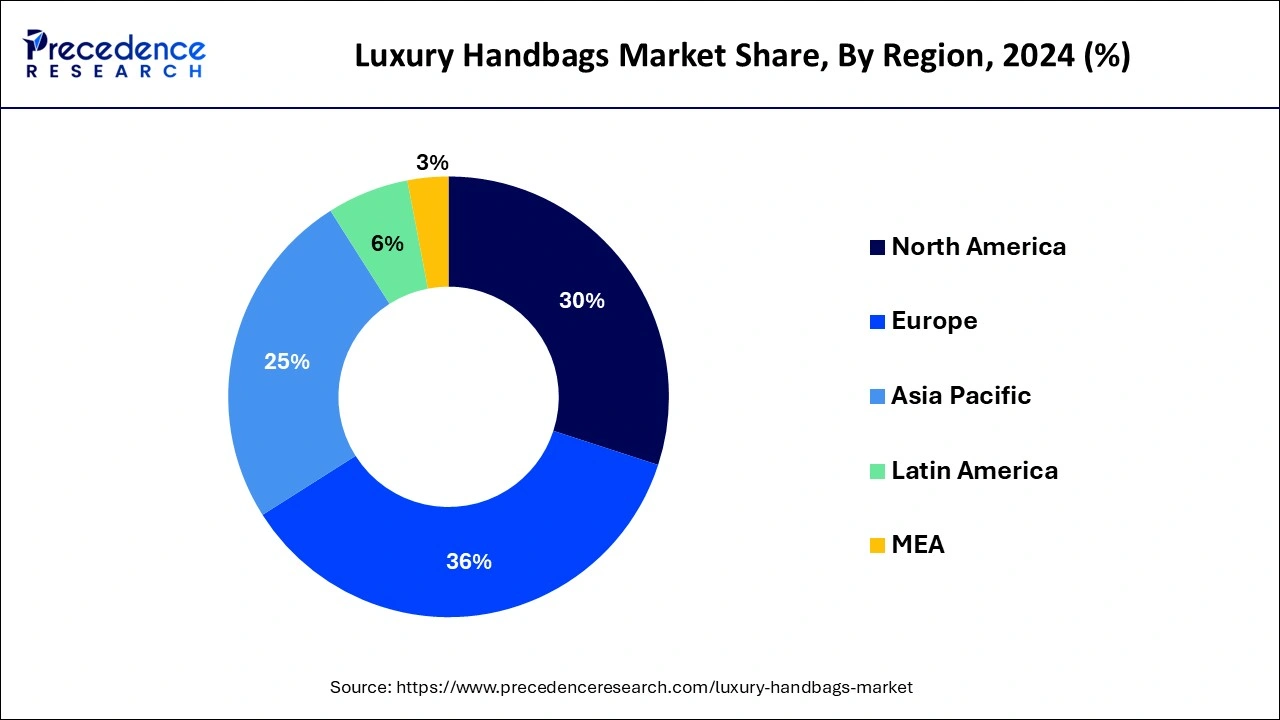

Europe has the largest market share of 36% in 2024 in the luxury handbags market. With renowned labels, including Louis Vuitton, Chanel, Gucci, and Hermès, derived from nations like France, Italy, and Spain, Europe boasts a long tradition of exquisite artistry and fashion. European luxury brands are well known for their meticulous attention to detail, superb craftsmanship, and inventive ideas. They constantly set trends in the international fashion business by introducing new styles, materials, and technologies. Every year, millions of tourists flock here, many looking for upscale shopping experiences. Luxury handbag sales in the region are heavily influenced by tourists, particularly those from developing nations such as China and India.

Asia-Pacific is the fastest-growing in the luxury handbags market during the forecast period. Due to the region's growing middle class and rising affluence, more people can purchase luxury products due to increased disposable income. As status symbols and fashion statements, luxury handbags are in higher demand due to shifting lifestyles and fashion preferences.

Furthermore, the emergence of e-commerce platforms has increased the accessibility of luxury handbags for customers in the Asia-Pacific region, including those residing in remote places. The demand has grown, and the market has expanded due to this greater accessibility.

There is a rising demand for handbags made of ethical production methods and sustainable materials. Clever features like integrated charging outlets or RFID chips for tracking and authentication are being investigated to improve usefulness and appeal to tech-savvy consumers. To accommodate different preferences and provide distinctive ownership experiences, the luxury handbags market provides individualized elements like initials, monograms, and custom designs. Due to the metaverse and virtual reality, there might be more chances to showcase and market luxury handbags in the future. Social media sites like Instagram, which highlight trends, influencer partnerships, and user-generated content, are essential marketing tools to increase brand awareness and demand.

Luxury Handbags Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.98% |

| Market Size in 2025 | USD 35.83 Billion |

| Market Size by 2034 | USD 57.28 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Material, By End-user, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increase in working women population

More women are joining the workforce, which leads to an increase in dual-income households and increased discretionary money, which makes it possible to spend more on upscale goods like handbags. Working women are likelier to keep up with current fashion trends and invest in classic, fine accessories like luxury purses to complete their appearance.

Demand for high-end brands is driven by working women's desire for luxury handbags as status symbols or to accessorize their professional outfits. Working women are more likely to treat themselves to luxury goods, such as handbags, as empowerment or self-reward when they have more financial independence.

Surge in usage of various social networking platforms

Social media sites are now considered influencer marketing's fertile field. Influencers frequently feature expensive handbags in their posts, setting an example for their followers and generating demand. Users may find and share trends more rapidly because of it. Because of this, when a high-end handbag becomes popular on social media due to celebrity or influencer endorsements, it may become viral and increase demand and sales. Thereby, the surge in usage of various social media platforms is observed to act as a driver for the luxury handbags market.

Social media is a valuable tool for luxury handbag businesses to collect client feedback and do market research. Social media interactions give brands insights into consumer preferences, enabling them to customize their services accordingly.

Fake and replicas are major risks to the luxury handbag market

Products that are counterfeit damage the exclusivity and prestige attached to luxury brands. The brand's perceived value is diminished, and its image is diluted when counterfeit versions increase the market. It must commit significant resources to using the legal system to stop counterfeiting. This includes taking counterfeiters to court, which entails expensive and time-consuming legal procedures.

High-end brands suffer significant financial losses due to counterfeiters who offer phony products at reduced costs. This lowers overall profitability and affects sales of authentic products. Compared to authentic luxury items, lower-quality materials, and craftsmanship are frequently used when comparing replica handbags to authentic luxury items. Customers may become disappointed and link the brand to subpar products, harming its reputation.

Collaborations with artists and designers

Luxury handbag companies can produce distinctive, limited-edition pieces that stand out by collaborating with artists and designers. These partnerships provide new viewpoints and creative components to classic designs, drawing customers looking for uniqueness and creativity, while opening lucrative opportunities for the luxury handbags market. Limited-edition partnerships instill in customers a sense of urgency and exclusivity, which fuels demand and cultivates a collector's mindset. The limited quantity of these collaboration pieces raises their perceived worth, luring collectors of luxury handbags to buy and possibly even invest in these one-of-a-kind pieces.

Investing in e-commerce platforms

With the help of e-commerce platforms, luxury handbag companies may expand into new areas and reach a worldwide audience, overcoming regional constraints. Through features like virtual try-ons, product recommendations, and customized promos, it helps firms to offer a personalized shopping experience and build consumer loyalty. Running an online store is frequently less expensive than keeping physical locations open, which frees up funds for firms to invest in marketing campaigns and new product development.

The handbags segment dominated the luxury handbags market in 2024. Luxurious handbag labels such as Gucci, Chanel, and Louis Vuitton have built significant brand awareness and brand loyalty among consumers across the globe, making their handbags extremely sought-after. Numerous luxury handbag companies have enduring designs that have come to represent refinement and status over time. Customers looking for investment and fashion pieces are drawn to these classic styles. Celebrities and influencers routinely promote luxury handbag manufacturers, who show off their products to millions of followers and increase their desirability and status.

The backpack segment is the fastest growing in the luxury handbags market during the forecast period. Consumer tastes have shifted in favor of more valuable and adaptable accessories. In today's world, where people want style and practicality, backpacks provide comfort and functionality. When making purchases, younger generations give priority to authenticity and ease. Luxury backpacks align with their principles, providing millennial and Gen Z customers with a functional and luxurious combination.

Backpacks are multipurpose accessories that can be used for daily use, travel, and work. Customers searching for multipurpose backpacks adaptable to various environments will find this adaptability appealing.

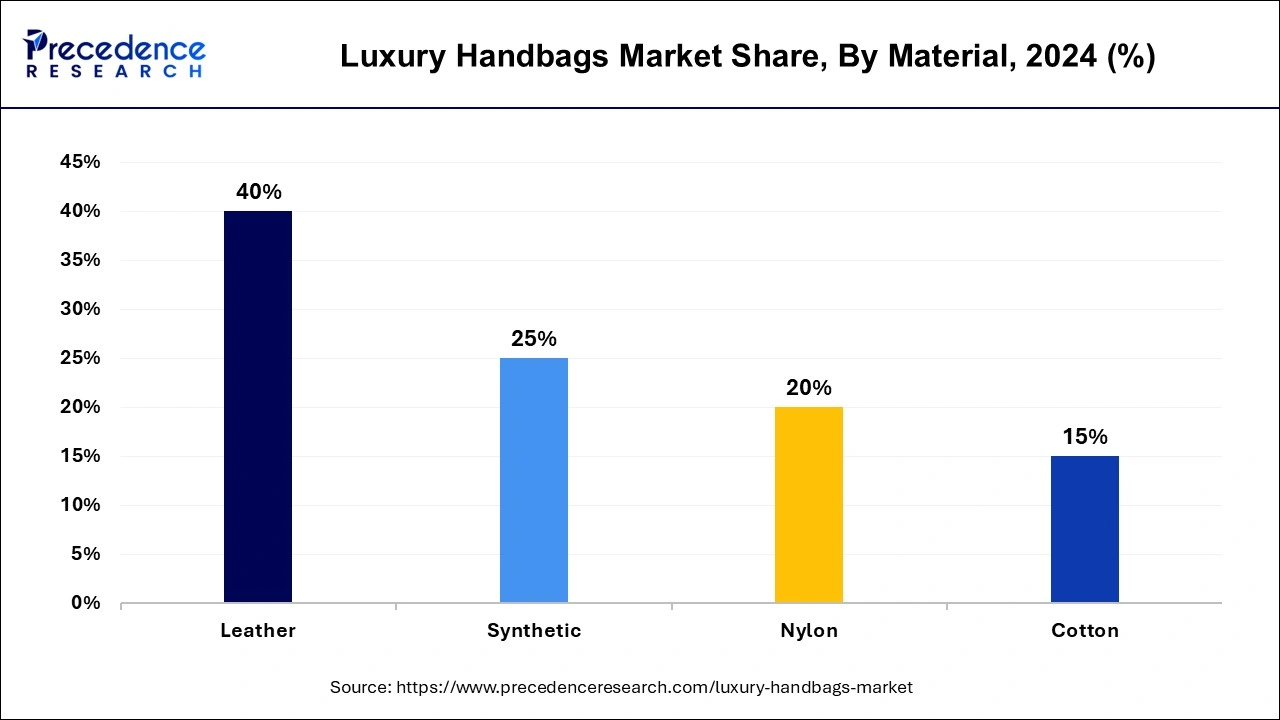

The leather segment is recorded more than 40% of revenue share in 2024. Leather is frequently thought of as being superior, enduring, and wealthy. High-end leather purses are luxurious and sophisticated, tempting buyers looking for status symbols. Handbags made of leather are known for their strength and longevity. Leather handbags are a worthy investment for customers since they are more resistant to wear and tear than purses made of other materials, including fabric or synthetic substitutes.

Numerous high-end companies offer leather handbag designs that have become timeless classics. The appeal and desirability of leather handbags among consumers are attributed to these designs and premium companies' rich legacy and reputation.

The synthetic segment is observed to be the fastest growing in the luxury handbags market during the forecast period. The development of high-quality, long-lasting, and aesthetically pleasing fabrics that closely resemble the look and feel of classic luxury materials like leather results from considerable developments in synthetic materials. Luxury handbags made of synthetic materials are frequently less expensive than those crafted from real leather or exotic skins. A broader spectrum of buyers who may be budget-conscious but still want to acquire luxury goods are drawn in by this accessibility.

The women segment dominated the luxury handbags market in 2024. Handbags and other accessories are vital to a woman's outfit and are frequently featured in women's fashion trends. Women who wish to show off their sense of style and stay up-to-date drive demand for luxury handbags, which are viewed as status symbols and fashion statements.

The men segment is observed to witness the fastest growth rate in the luxury handbags market during the forecast period. Gender conventions are changing, and men are adopting and accepting expensive handbags at a higher rate. Gender-neutral fashion is embracing items that were once thought to be feminine, even for males. Men are investing more in luxury fashion items, such as handbags, due to rising disposable incomes and a growing emphasis on appearance and personal style. This tendency is especially apparent in younger generations that value fashion highly and individual expression. Luxurious brands are actively broadening their range of products to accommodate the changing tastes of men's consumers. This entails creating handbags with a more macho aesthetic, adding useful features, and providing a wider selection of sizes and styles to suit various preferences and ways of life.

The offline segment dominated the luxury handbags market in 2024. Purchasing luxury handbags frequently entails a tailored, high-touch experience exclusive to physical stores. Consumers like talking with informed salespeople, touching the bags, and getting a close-up look at the craftsmanship. Physical flagship stores and boutiques are physical manifestations of the exclusivity and distinction of premium businesses. The luxurious retail spaces and excellent customer service add to the brand's and the product's appeal.

The online segment is the fastest growing in the luxury handbags market during the forecast period. Utilizing online channels, luxury firms may reach a wider audience than just those visiting their physical stores. Customers may explore and buy luxury handbags from the comfort of their homes or while on the road using mobile devices, providing convenience and flexibility. The demand for luxury handbags through online channels is driven by millennial and Gen Z consumers, who are increasingly shaping trends in the luxury sector. They are also more acclimated to online purchasing and digital interactions. Social media platforms are effective marketing tools for luxury businesses because they increase web traffic and revenue through influencer collaborations, relevant content, and well-targeted ads.

By Product

By Material

By End-user

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024