April 2024

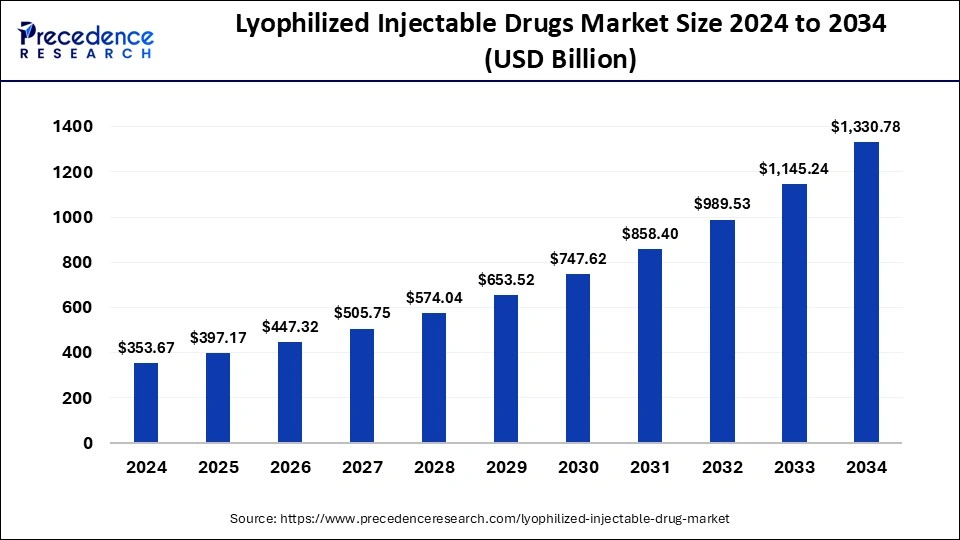

The global lyophilized injectable drug market size is calculated at USD 397.17 billion in 2025 and is forecasted to reach around USD 1,330.78 billion by 2034, accelerating at a CAGR of 14.40% from 2025 to 2034. The North America lyophilized injectable drug market size surpassed USD 166.28 billion in 2024 and is expanding at a CAGR of 14.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lyophilized injectable drug market size was estimated at USD 353.67 billion in 2024 and is predicted to increase from USD 397.17 billion in 2025 to approximately USD 1,330.78 billion by 2034, expanding at a CAGR of 14.40% from 2025 to 2034. Increased investments from the biotech, pharma, and biopharma industries have led to a rise in research and development efforts, which can fuel the growth of the lyophilized injectable drugs market

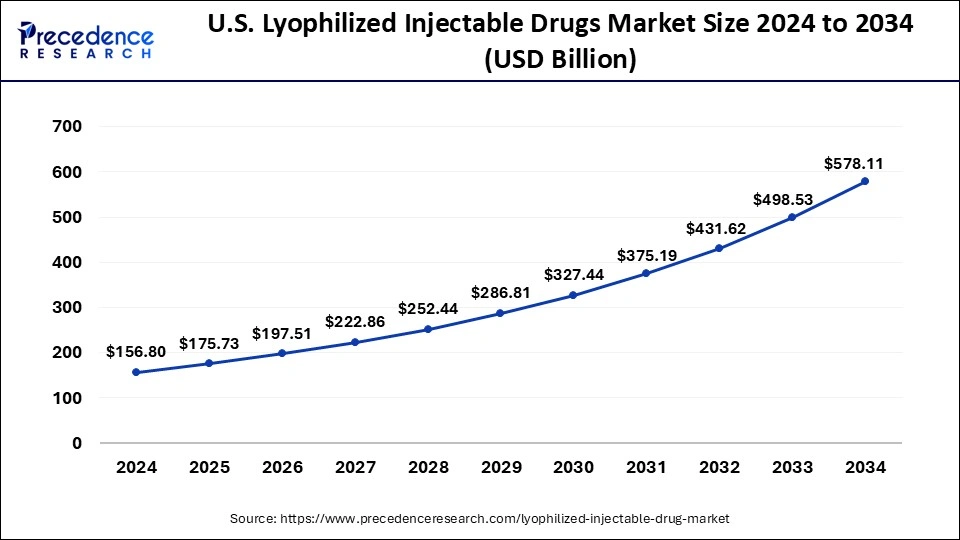

The U.S. lyophilized injectable drugs market size was estimated at USD 156.80 billion in 2024 and is predicted to be worth around USD 578.11 billion by 2034, at a CAGR of 14.10% from 2025 to 2034.

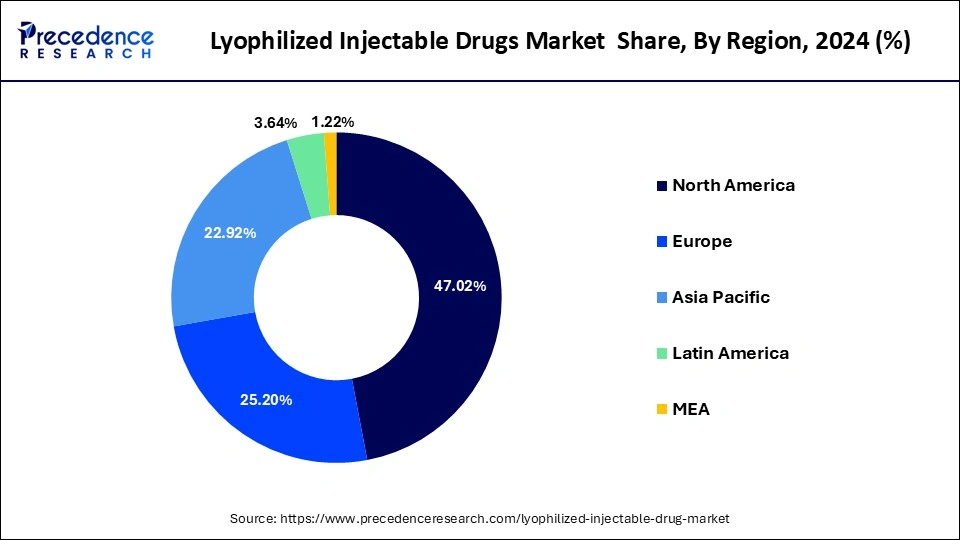

North America held the dominant share of the lyophilized injectable drugs market. Its advanced healthcare system, extensive research, and high rates of chronic diseases set it apart. The region's leading position is thanks to its strong healthcare infrastructure, significant disease rates, technological advancements, and established regulations. Research and development efforts, along with those of major pharmaceutical companies, are driving growth and innovation in the market, helping North America maintain its leadership role.

Europe is expected to gain a significant market share in the upcoming years. Countries like the UK, France, and Germany have played a significant role in driving market growth in this area. Europe's position is due to its emphasis on biopharmaceutical advancements, specialized medicine, and strict regulations for drug development. Additionally, the demand for stable and effective formulations has increased due to the growing elderly population and rising rates of chronic diseases, further boosting the market for lyophilized injectable drugs.

The lyophilized injectable drugs market refers to the industry that offers medicines that have undergone the process of freeze-drying or lyophilization. This includes a variety of drugs such as biologics, hormones, antibiotics, vaccines, and anti-inflammatory drugs. The manufacturing, packaging, and distribution of lyophilized injectable drugs involves pharmaceutical companies, contract manufacturing organizations (CMOs), and healthcare facilities.

The lyophilization process removes water from the drug by freezing it and then allowing the ice to turn directly into vapor, leaving behind a stable, solid form. These drugs offer several benefits over liquid versions, such as better stability, lower risk of degradation or contamination, longer shelf life, and easier transport. They're used to treat a wide range of medical conditions, including autoimmune disorders, infections, cancer, and heart conditions.

| Report Coverage | Details |

| Global Market Size in 2024 | USD 353.67 Billion |

| Global Market Size in 2025 | USD 397.17 Billion |

| Global Market Size by 2034 | USD 1,330.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Drug Type, By Indication, By Delivery Type, Packaging, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wide range of adoption across the globe

In recent years, there has been a significant rise in the number of businesses worldwide using lyophilization technology. This is because lyophilized medications offer better quality and longer shelf life compared to other forms. Global contract research and manufacturing firms have also seen a notable increase in the use of lyophilized injection pharmaceuticals. The main reason for this shift is to provide consumers with superior products. Opportunities in the global lyophilized injectable drugs market are being driven by factors such as the rapid growth of contract research manufacturing services (CRAMS). Compared to non-lyophilized products, lyophilized ones are gaining popularity due to their safety and ability to fulfill their intended purposes effectively.

Rising use of orphan drugs

The lyophilized injectable drugs market shows potential for growth in emerging markets, where healthcare facilities are improving and knowledge about advanced drug formulations is spreading. Entering these untapped markets strategically could lead to profitable outcomes for companies in the industry. One noticeable trend in the market is the rising use of orphan drugs for rare diseases, which often require special formulations to maintain stability and ensure effective delivery. Lyophilization provides a solution by preserving the integrity of these medications, making this trend significant in influencing market trends.

Production complexities

The lyophilized injectable drugs market shows potential for growth in emerging markets, where healthcare facilities are improving and knowledge about advanced drug formulations is spreading. Entering these untapped markets strategically could lead to profitable outcomes for companies in the industry. One noticeable trend in the market is the rising use of orphan drugs for rare diseases, which often require special formulations to maintain stability and ensure effective delivery. Lyophilization provides a solution by preserving the integrity of these medications, making this trend significant in influencing market trends.

Investments in healthcare infrastructure

Investments in healthcare infrastructure in developing regions are creating opportunities for expanding the lyophilized injectable drugs market. Better healthcare facilities and distribution networks are making these medications more accessible, addressing unmet medical needs, and boosting market growth. This reflects a growing commitment to healthcare improvement and enhanced patient care in emerging economies. Advancements in precision medicine and targeted therapies are also driving the demand for customized lyophilized formulations in personalized medicine. These formulations are specific to individual patient needs and treatment effectiveness, which offers precise dosing and delivery for better therapeutic outcomes. This trend also underscores the increasing importance of personalized approaches in modern healthcare.

Growing utilization in the pharma sector

The recent increase in demand for the lyophilized injectable drugs market is directly linked to their growing use in the pharmaceutical sector. Biologics require specialized formulation techniques like lyophilization to improve stability and prolong shelf life, which is a significant factor driving market growth. This surge in demand is fueling the expansion of the market. Additionally, a noteworthy trend in this market is the shift toward personalized medicine. With the healthcare industry increasingly adopting personalized treatment approaches, lyophilized formulations are crucial for ensuring stability and effectiveness in drug therapies. This trend is reshaping the pharmaceutical landscape and driving the adoption of these injectable products.

The anti-infective segment dominated the lyophilized injectable drugs market in 2024. The reason for this dominance is the continuous global need for antibiotics and other antimicrobial agents to fight infections. Lyophilization provides stability advantages that are especially important for preserving the effectiveness of these drugs, ensuring they remain potent, and reducing the risk of contamination during storage and transportation.

The anti-neoplastic segment is predicted to experience rapid growth in the upcoming years. This is due to the rising cases of cancer and the advancement of targeted therapies, leading to a higher demand for lyophilized injectable anti-cancer drugs. These medications often have intricate formulations and need precise dosing, making lyophilization beneficial for preserving their stability and improving their therapeutic effectiveness.

Lyophilized Injectable Drugs Market Revenue, By Drug Type 2022-2024 (USD Million)

| Drug Type | 2022 | 2023 | 2024 |

| Anti-infective | 88,674.4 | 99,448.6 | 1,11,676.4 |

| Anti-neoplastic | 1,07,403.3 | 1,20,816.4 | 1,36,079.9 |

| Anticoagulant | 10,188.5 | 11,360.2 | 12,682.7 |

| Hormones | 6,636.9 | 7,386.6 | 8,231.1 |

| Antiarrhythmic | 21,445.2 | 24,139.3 | 27,206.8 |

| Others | 46,283.8 | 51,687.1 | 57,794.8 |

The oncology segment dominated the lyophilized injectable drugs market in 2024. The rise in demand for reliable and effective formulations for cancer treatments and targeted therapies has made this segment stand out. Lyophilized drugs excel in preserving the effectiveness of complex molecules commonly found in cancer treatments, which has increased their importance in this area.

The gastrointestinal disorder segment is the fastest growing over the forecast period. Gastrointestinal diseases impact your digestive system, stretching from your mouth to your anus. These diseases come in two main types: functional and structural. Examples include colitis, food poisoning, lactose intolerance, and diarrhea.

The cartridge segment dominated the lyophilized injectable drugs market in 2023 and is expected to grow at a significant rate during the projected period. This is attributed to the increasing need for medications, particularly injectable drugs for chronic conditions, and the demand from diabetic patients is driving up the popularity of pharmaceutical cartridges. Cartridges are convenient for users and eliminate the risk of leaks or needle breakage, making them the preferred choice for medication packaging. This trend is boosting the growth of the pharmaceutical cartridge segment.

Lyophilized Injectable Drugs Market Revenue, By Packaging 2022-2024 (USD Million)

| Packaging | 2022 | 2023 | 2024 |

| Vials | 1,76,668.7 | 1,97,880.3 | 2,21,925.7 |

| Cartridges | 25,657.6 | 28,836.6 | 32,451.3 |

| Prefilled Devices | 78,305.7 | 88,121.2 | 99,294.7 |

By Drug Type

By Indication

By Delivery Type

By Packaging

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2024

December 2024

January 2025

January 2025