December 2024

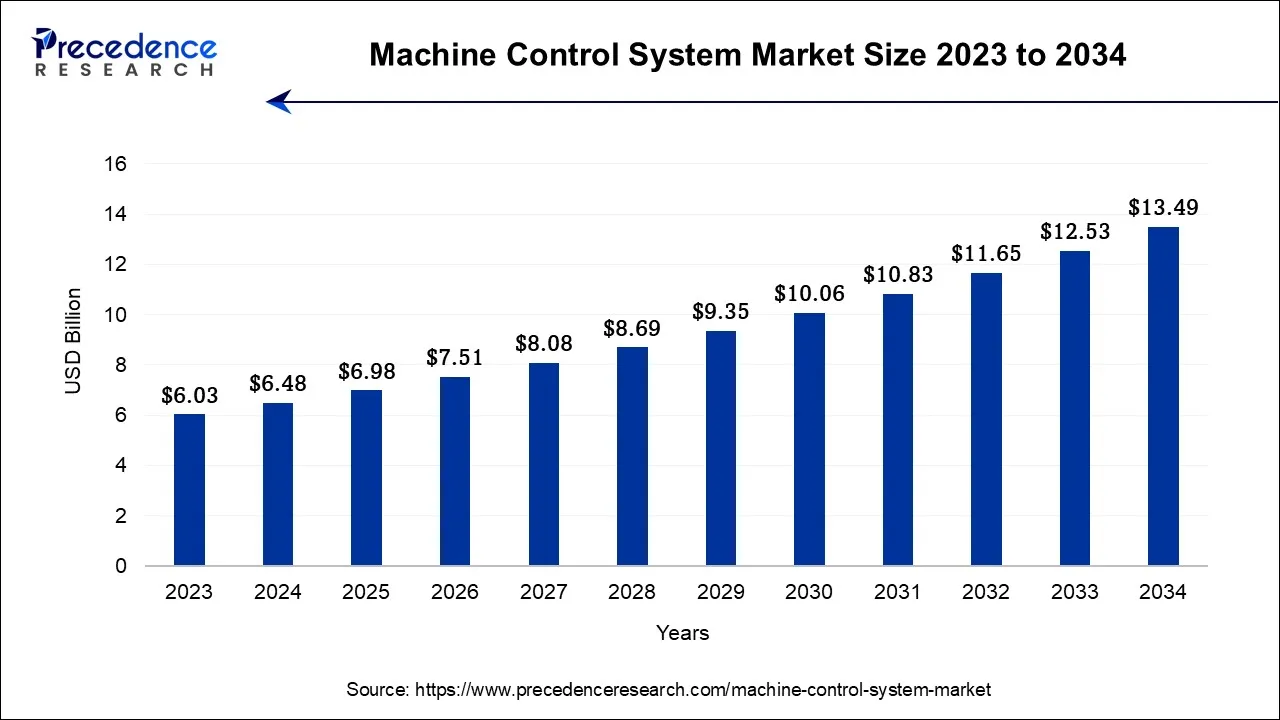

The global machine control system market size is calculated at USD 6.48 billion in 2024, grew to USD 6.98 billion in 2025, and is predicted to hit around USD 13.49 billion by 2034, poised to grow at a CAGR of 7.61% between 2024 and 2034. The North America machine control system market size accounted for USD 2.40 billion in 2024 and is anticipated to grow at the fastest CAGR of 7.75% during the forecast year.

The global machine control system market size is expected to be valued at USD 6.48 billion in 2024 and is anticipated to reach around USD 13.49 billion by 2034, expanding at a CAGR of 7.61% over the forecast period from 2024 to 2034.

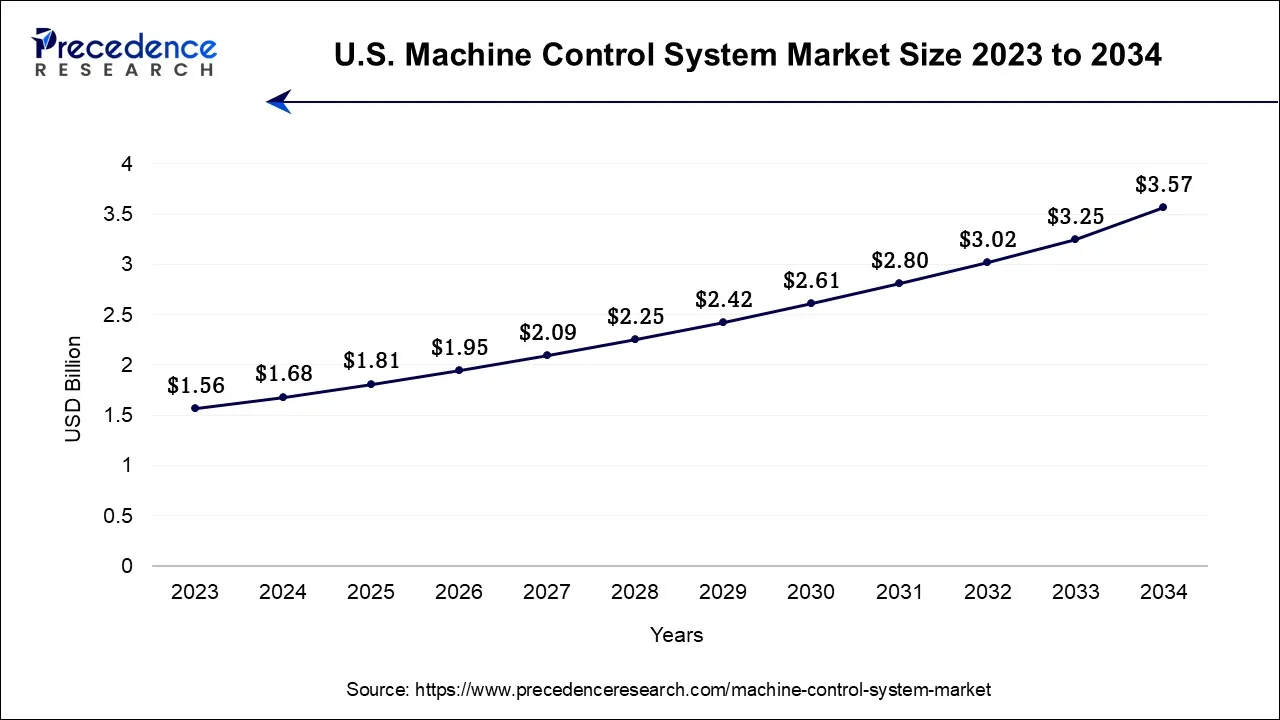

The U.S. machine control system market size is accounted for USD 1.68 billion in 2024 and is projected to be worth around USD 3.57 billion by 2034, poised to grow at a CAGR of 7.83% from 2024 to 2034.

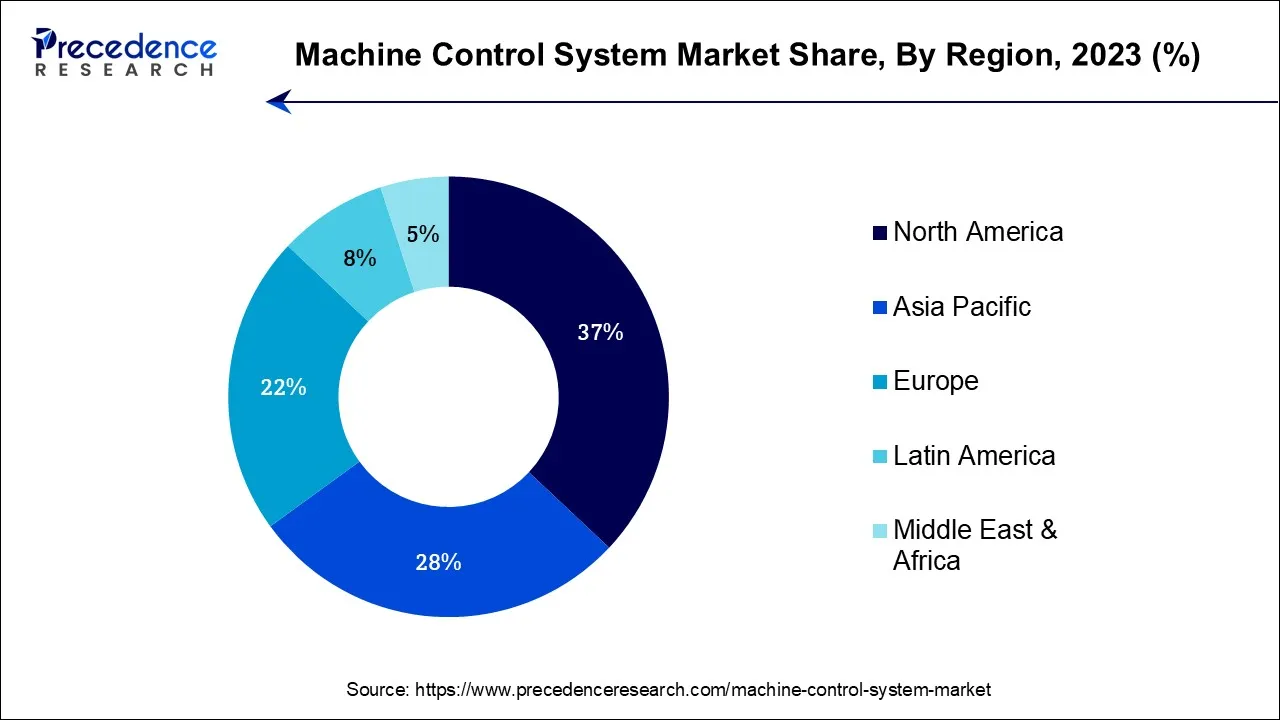

North America has held the largest revenue share 37% in 2023. In North America, the machine control system market is witnessing several trends, including the increasing adoption of advanced construction and agriculture machinery is driving demand for machine control systems to improve precision and productivity. Moreover, the incorporation of cutting-edge technologies like GPS and IoT is enhancing system capabilities. Thirdly, the emphasis on sustainable and eco-friendly practices is pushing the development of cleaner and more efficient machine control solutions. These trends reflect North America's commitment to innovation and sustainability in the market.

In Europe, the machine control system market is experiencing a surge in demand due to ongoing infrastructure projects, urbanization, and environmental regulations. There's a growing emphasis on precision and efficiency in construction and agriculture, driving the adoption of advanced machine control systems. Europe's commitment to sustainability further fuels market growth.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the machine control system market is experiencing robust growth due to rapid urbanization and infrastructure development projects. Governments are investing heavily in construction and transportation infrastructure, driving demand for precision machinery control systems. Additionally, the adoption of advanced technologies like GPS and automation is on the rise, enhancing the efficiency of construction and agriculture machinery.

The machine control system market refers to the industry involved in the development, production, and deployment of technologies and systems that enable precision control and automation of heavy machinery and equipment across various sectors. This market encompasses hardware and software solutions, including GPS, sensors, and control units. It aims to enhance the efficiency, accuracy, and safety of operations in construction, agriculture, mining, and other industries. Rapid technological advancements, increased demand for automation, and stringent accuracy requirements characterize the dynamic nature of this market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.61% |

| Market Size in 2024 | USD 6.48 Billion |

| Market Size by 2034 | USD 13.49 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Equipment Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising construction activity significantly boosts demand in the machine control system market as it necessitates precise and efficient machinery operations. Construction projects worldwide, including infrastructure development, residential, and commercial construction, require advanced control systems to achieve accurate grading, leveling, and excavation. Machine control systems improve productivity, reduce material wastage, and enhance safety on construction sites. The growing demand for these systems aligns with the construction industry's need for enhanced efficiency and cost-effectiveness, driving sustained market growth.

Moreover, remote monitoring in machine control systems enhances equipment efficiency and maintenance, reducing downtime and operational costs. It provides real-time data on machinery performance and allows timely adjustments, making these systems indispensable in industries where uptime and productivity are critical, thus surging market demand.

Technical expertise acts as a significant restraint on the machine control system market by limiting accessibility and adoption. To fully leverage these systems, operators and technicians require specialized training, which may not be readily available in all regions. The shortage of skilled personnel hinders potential users from implementing these systems effectively, resulting in reduced market demand, particularly in areas where access to trained professionals is limited.

Moreover, integration challenges restrain market demand for machine control systems by complicating the adoption process. The complexities associated with integrating these systems with existing machinery and infrastructure can lead to prolonged implementation timelines and operational disruptions. This can deter potential buyers who are reluctant to face technical and logistical hurdles, limiting the broader adoption of machine control systems in various industries.

Agricultural modernization drives demand for machine control systems by promoting precision farming practices. These systems enable accurate control of machinery for planting, harvesting, and land management tasks, enhancing crop yield and resource efficiency. Farmers benefit from reduced input costs and increased productivity, which encourages adoption. Additionally, the demand for sustainable farming practices aligns with the capabilities of machine control systems, further surging their market demand in the agriculture sector.

Moreover, Technological advancement drives market demand for machine control systems by continually enhancing their capabilities, precision, and functionality. Innovations in GPS, sensors, and automation solutions make these systems more accurate and versatile, appealing to industries seeking higher efficiency, productivity, and safety in their machinery operations, thus fueling adoption.

According to the component, the GNSS segment has held 52% revenue share in 2023. GNSS (Global Navigation Satellite System) is a crucial component in machine control systems, providing accurate positioning and location data through a network of satellites. In the machine control system market, the trend is a growing reliance on multi-constellation GNSS receivers, offering improved accuracy and reliability. Additionally, integration with other sensor technologies, such as LiDAR and inertial sensors, enhances precision and enables complex tasks like autonomous operation in industries like construction and agriculture.

The total station is anticipated to expand at a significant CAGR of 9.2% during the projected period. A total station is a key component of machine control systems, consisting of an electronic theodolite and an electronic distance measuring (EDM) device. It precisely measures angles and distances for mapping, surveying, and construction applications. Total stations are increasingly integrated into machine control systems, providing real-time data for accurate positioning and control. This trend enhances the efficiency and precision of heavy machinery in construction, mining, and agriculture, contributing to the market's growth.

Based on the equipment, the excavators is anticipated to hold the largest market share of 35% in 2023. Excavators are heavy construction equipment used for digging, trenching, and earthmoving tasks. In the machine control system market, excavators are increasingly integrated with advanced control systems like GPS and sensors. This trend enhances precision in excavation and land grading operations, increasing efficiency and reducing errors. Machine control technology allows operators to achieve precise digging depths and slopes, aligning with the demand for more accurate and productive construction practices.

On the other hand, the graders segment is projected to grow at the fastest rate over the projected period. Graders, essential in road construction and maintenance, are equipped with machine control systems to ensure precise leveling and grading. In the machine control system market, the trend is towards greater automation and integration of GPS and laser-guided systems in graders. This results in improved accuracy, reduced operator fatigue, and enhanced productivity, meeting the increasing demand for efficient and precise road construction and maintenance.

In 2023, the infrastructure sector had the highest market share of 42% on the basis of the industrial vertical. Infrastructure in the machine control system market refers to the construction and maintenance of critical public works such as roads, bridges, and utilities. In this sector, machine control systems are essential for precision and efficiency. Recent trends include the integration of building information modeling (BIM) with machine control, enhancing project planning and execution. Additionally, the adoption of 5G technology enables faster data transfer and remote monitoring, further optimizing infrastructure development processes.

The commercial is anticipated to expand at the fastest rate over the projected period. The machine control system market in the commercial sector involves the integration of precision technology into heavy machinery for construction, agriculture, and logistics applications. Key trends include the increasing adoption of automation for efficiency and accuracy, enhanced connectivity through IoT and telematics, and the pursuit of eco-friendly solutions to align with sustainability goals. These trends drive the demand for machine control systems in commercial operations.

Segments Covered in the Report

By Component

By Equipment Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

October 2024

October 2023

February 2025