January 2025

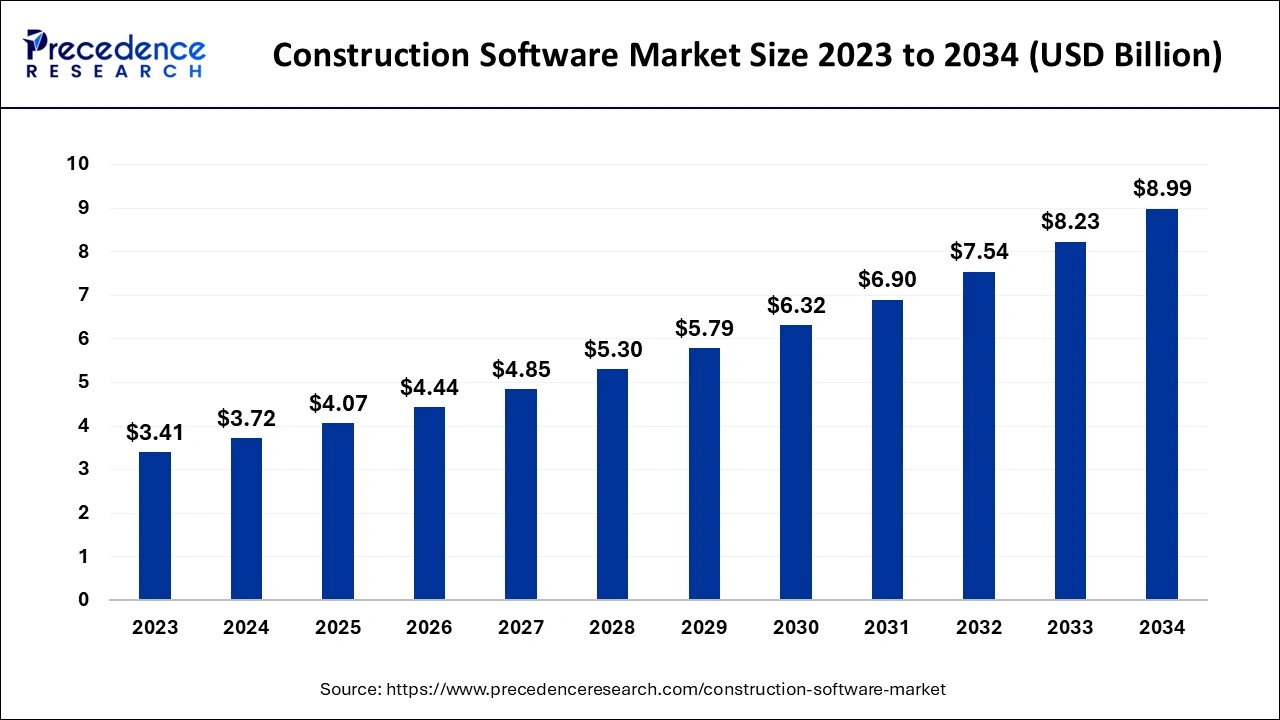

The global construction software market size accounted for USD 3.72 billion in 2024, grew to USD 4.07 billion in 2025 and is expected to be worth around USD 8.99 billion by 2034, registering a healthy CAGR of 9.21% between 2024 and 2034. The North America construction software market size is calculated at USD 1.30 billion in 2024 and is estimated to grow at a fastest CAGR of 9.37% during the forecast period.

The global construction software market size is calculated at USD 3.72 billion in 2024 and is projected to surpass around USD 8.99 billion by 2034, expanding at a solid CAGR of 9.21% from 2024 to 2034. The rising urbanization and the demand for the construction industry, along with better planning and project management, drive the growth of the construction software market.

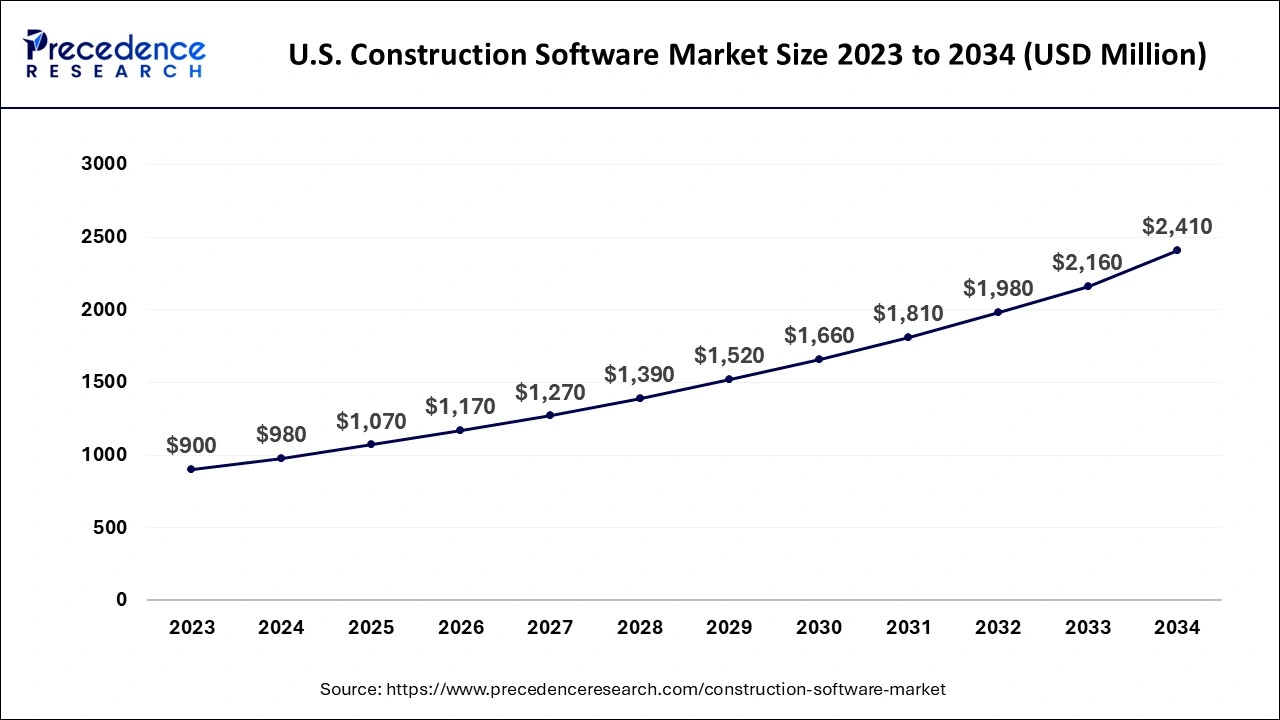

The U.S. construction software market size is exhibited at USD 0.98 billion in 2024 and is projected to be worth around USD 2.41 billion by 2034, growing at a CAGR of 9.36% from 2024 to 2034.

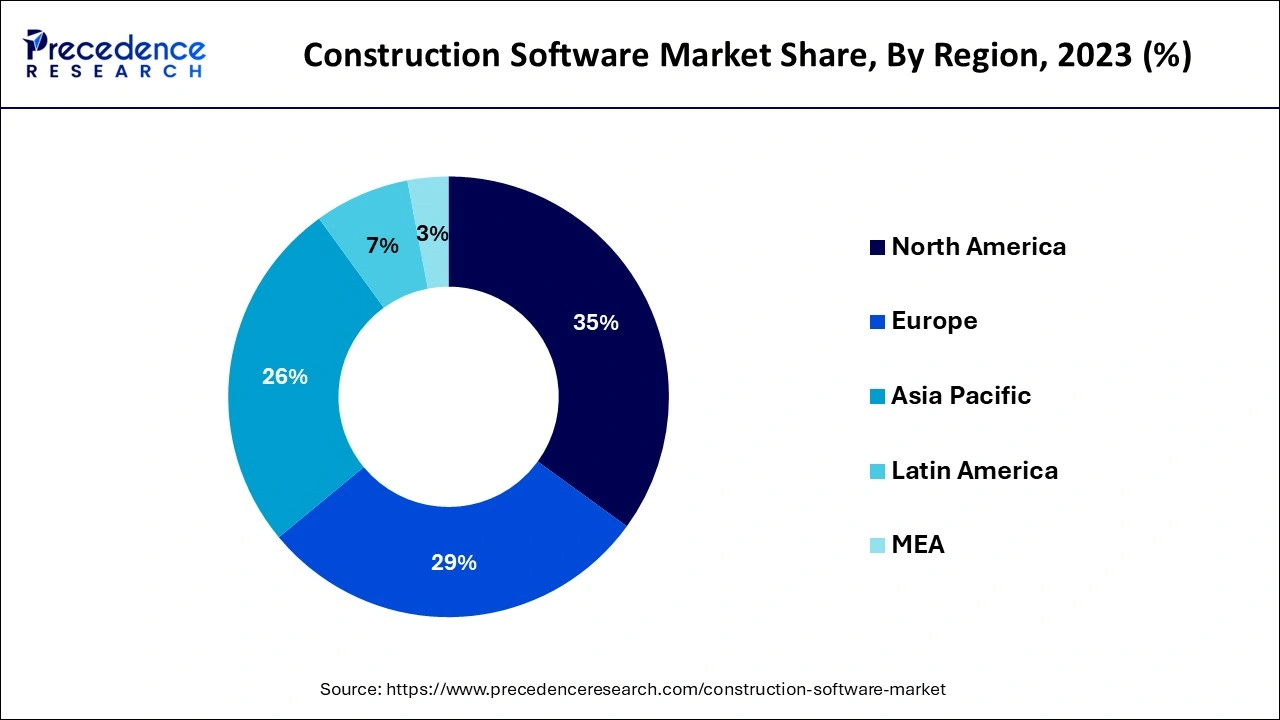

North America dominated the construction software market in 2023. The growth of the market is attributed to the rising urbanization that causes demand for the construction industry, and the United States is considered the early adopter of technologies in every field, which accelerates the demand for construction software by several builders in their construction projects. Additionally, the rising government intervention in the adoption of the technologies in the construction project for minimizing the time, and cost of the operations with the greater efficiency is fueling the growth of the construction software market in the region.

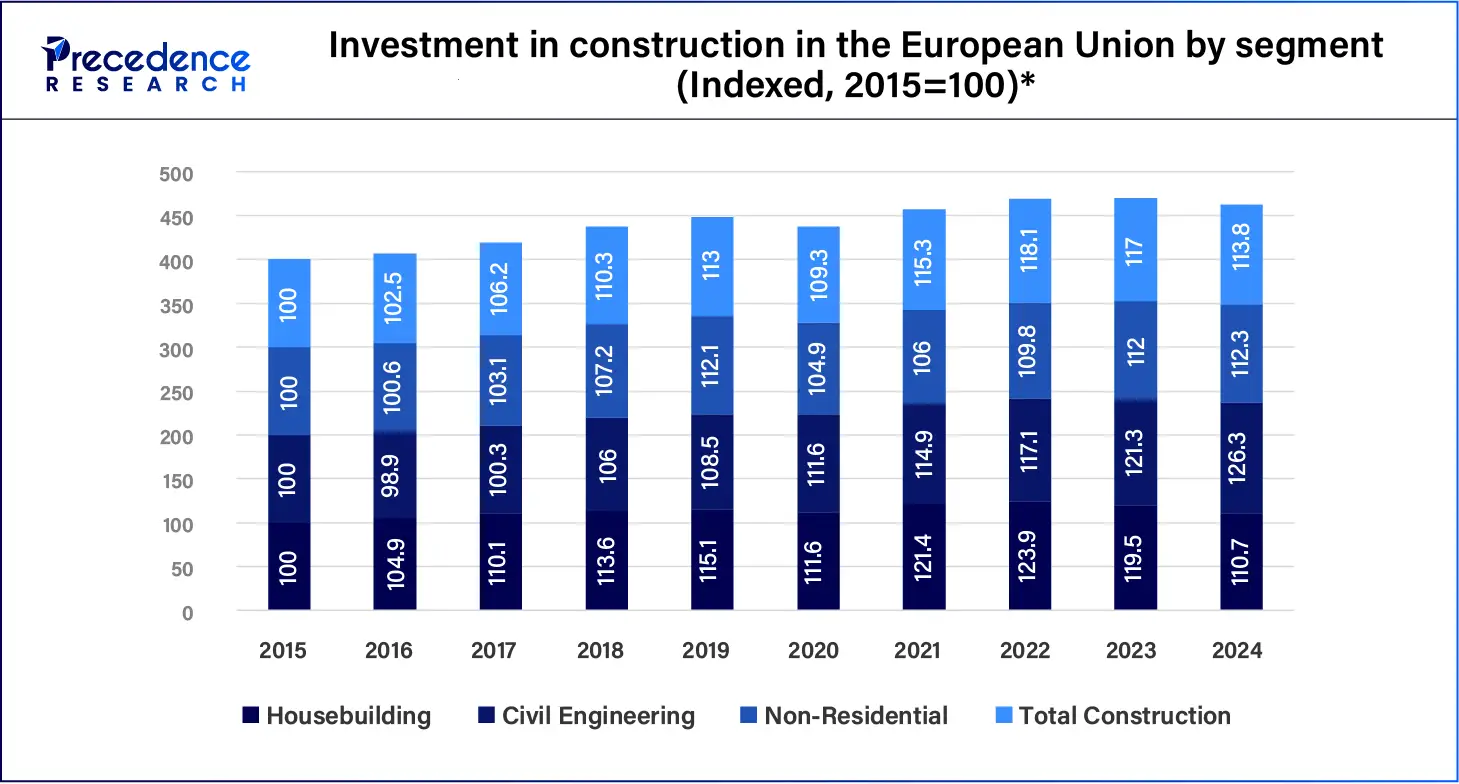

Europe is anticipated to grow at a significant growth rate during the forecast period. The rising investment in urbanization and the integration of smart construction software into the construction industry are playing a significant role in the expansion of the construction software market. Additionally, the regional government is heavily investing in smart infrastructure and technologies in construction projects, which are collectively contributing to the growth of the market across the region.

The European construction industry is gaining significant traction compared to the other industries. The new housebuilding accounted for 19.9% of the total investment in construction. At the same time, the investment in renovation accounted for 30.3% of the total investment in construction. Non-residential acquired 31.8% of the construction sector, and civil engineering accounted for a smaller portion of the construction sector investment, accounting for 17.9% of the sector.

Construction software is one of the important tools or applications in modern construction projects. The construction software is also known as the single solution that can be visited for the overall project documentation. The construction software allows project managers to manage budgets, set schedules and timelines, ensure quality and safety programs, complete quality and safety checklists, communicate and coordinate with stakeholders, and store daily reports across the field and the office. The construction software provides benefits like greater efficiency, reduced risk, better decision-making, and increased profits.

Some of the top construction software that are leading the construction software market

How Can AI Impact the Construction Software Market?

The integration of artificial intelligence and machine learning plays an important role in smart construction projects. AI and machine learning work like smart assistance that helps in assisting and analyzing the vast amount of data and alerts project managers about potential risks and damages. Artificial intelligence can be used to filter spam emails and monitor advanced safety. AI could benefit in several areas of construction, including prevention of cost overheads, better designing of buildings with generative design, project planning, risk mitigation, enhancing productivity and safety in the construction site, addressing labor shortage, off-site construction, and helping in post-construction projects.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.99 Billion |

| Market Size in 2024 | USD 3.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Deployment Mode, Organization Size, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The rising advancements in the smart cities

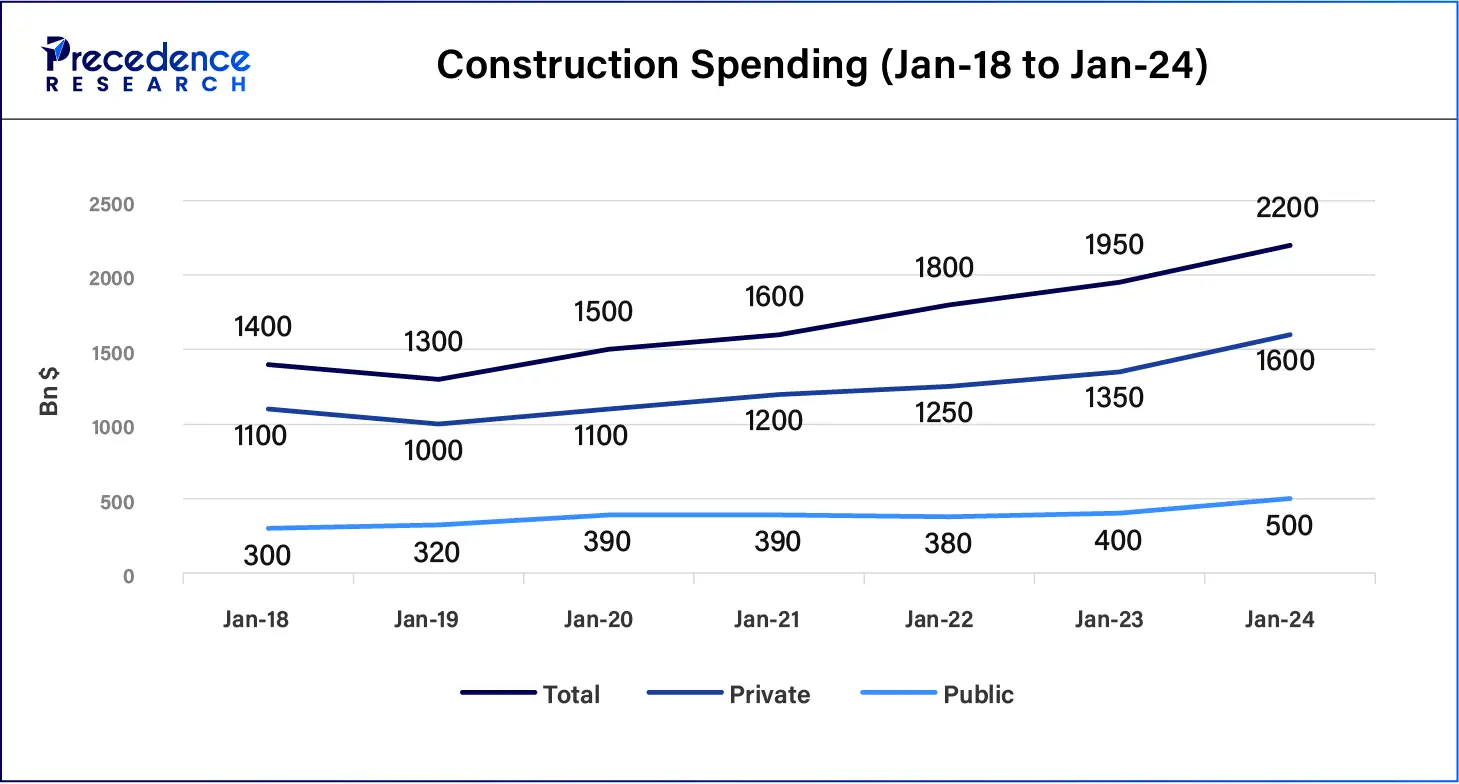

The rising demand for smart infrastructural development in economically developing and developed countries due to the rising per capita income in the population and the surging interest towards the higher lifestyle and spending on the lifestyle is driving the demand for smart building infrastructure. Thus, the rising investment in smart building or smart home infrastructural development by digitization is contributing to the expansion of the construction software market. Digitization in smart cities helps in the utilization of eco-friendly resources and better relational capital while assuring high quality and performance. These are also redefining the decision-making process in the construction industry. Also, the increasing preference for the renovation of houses and integration of smart technologies in the home is further contributing to the growth.

High cost and time

The increased cost of deployment and the time for the operation are some of the limitations of the construction software, and the fluctuating accuracy in project management is restraining the growth of the construction software market.

Emerging technologies in the construction industry

The technological transformation of the construction industry has revolutionized overall operations, quality, and productivity. The technologies in the construction industry, such as virtual reality and augmented reality, blockchain technology, drones, digital twins, 4D simulation, 3D laser scanners, BIM (building information model), and 3D printing, are enhancing efficiency with enhanced quality and productivity. Additionally, the continuous investment in the infrastructural development, energy, and utility sectors significantly driving the enhancements in construction production is also emerging as a potential opportunity in the construction software market’s growth.

The project management segment held a dominant presence in the construction software market in 2023. The increasing digitization across industries and in the construction industry is also driving the adaptation of software tools that can enhance efficiency and operations. Project management software in construction or construction project management helps enhance the coordination between personnel and material resources, increasing the life cycle of the building to be more efficient and streamlined.

It is the software that can streamline and maintain the top-to-bottom operations from coordinating and communication to the pre-construction and the completion of the project. The project management software works under the regulation of engineering, architecture, and city planning. Project management is used throughout the project’s lifecycle; it involves the management of the resources and people to control the cost, scope, quality, and time of construction.

The cloud segment registered its dominance over the construction software market in 2023. The increasing adoption of cloud deployment in construction projects is due to its higher efficiency and real-time monitoring of the projects. The cloud deployment allows project managers to connect and coordinate with several teams on the project sites in real-time. Various large-scale enterprises are using cloud-based construction software owing to its properties, such as cost efficiency, which helps streamline and increase productivity in operations.

The large enterprise segment dominated the construction software market globally in 2023. The rising global population and the demand for large-scale construction businesses for the development of residential and commercial buildings address the demand from the population. The rising evaluation of the construction industry in the last decades due to the rising demand for residential and commercial buildings and rising urbanization is driving the demand for automation and digitization across the industry for better project management. Several large enterprises and builders are accepting construction software for project perspective, like building planning, scheduling, development, and building parameters. The construction software helps project managers with greater efficiency and productivity.

The general contractors segment dominated the construction software market in 2023. The rising awareness about technologies and digitization across industries, including the construction industry, is the driving force behind the higher acceptance of construction software by general contractors. There are a number of benefits associated with the adoption of the construction software by the general contractor, such as improved project planning and scheduling, seamless government reporting, tackling the project delay on the head, streamlined subcontractor tracking, increased safety, enhanced quality control, increased collaboration between team members, manage the procurement process, attract clients with seamless reporting, and smart cost management.

Segments Covered in the Report

By Type

By Deployment Mode

By Organization Size

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

February 2025

March 2025