March 2024

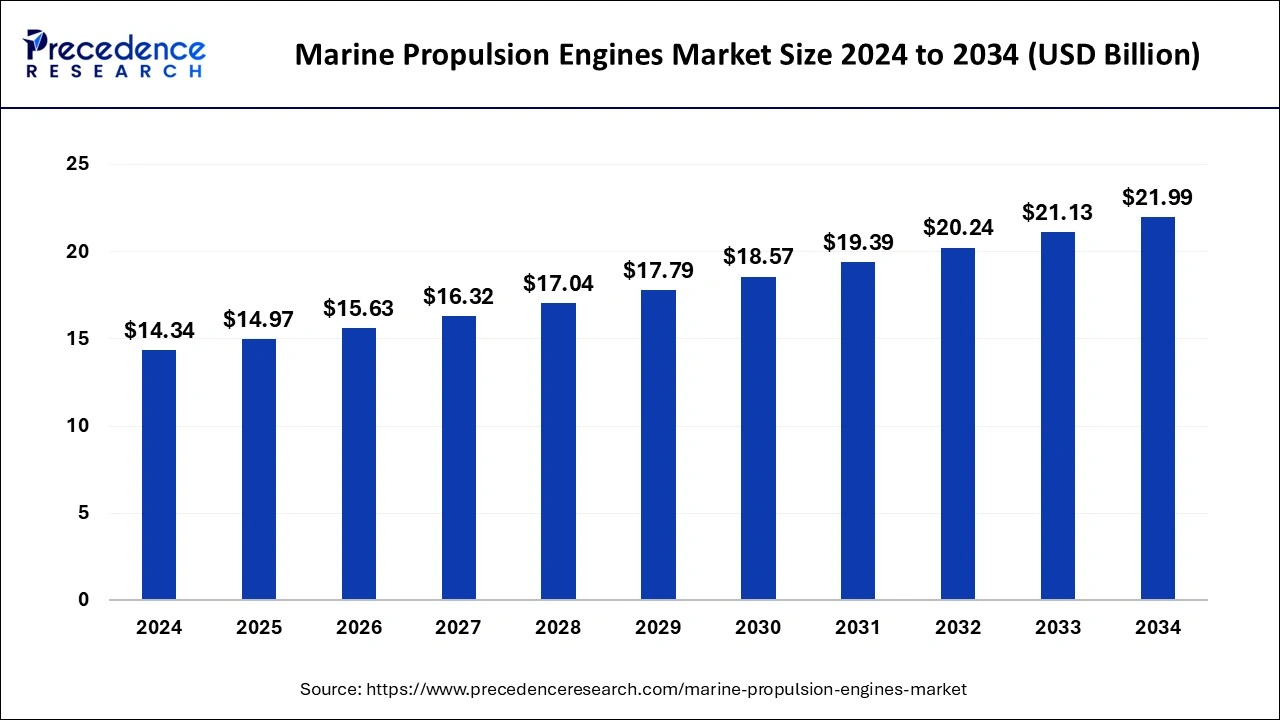

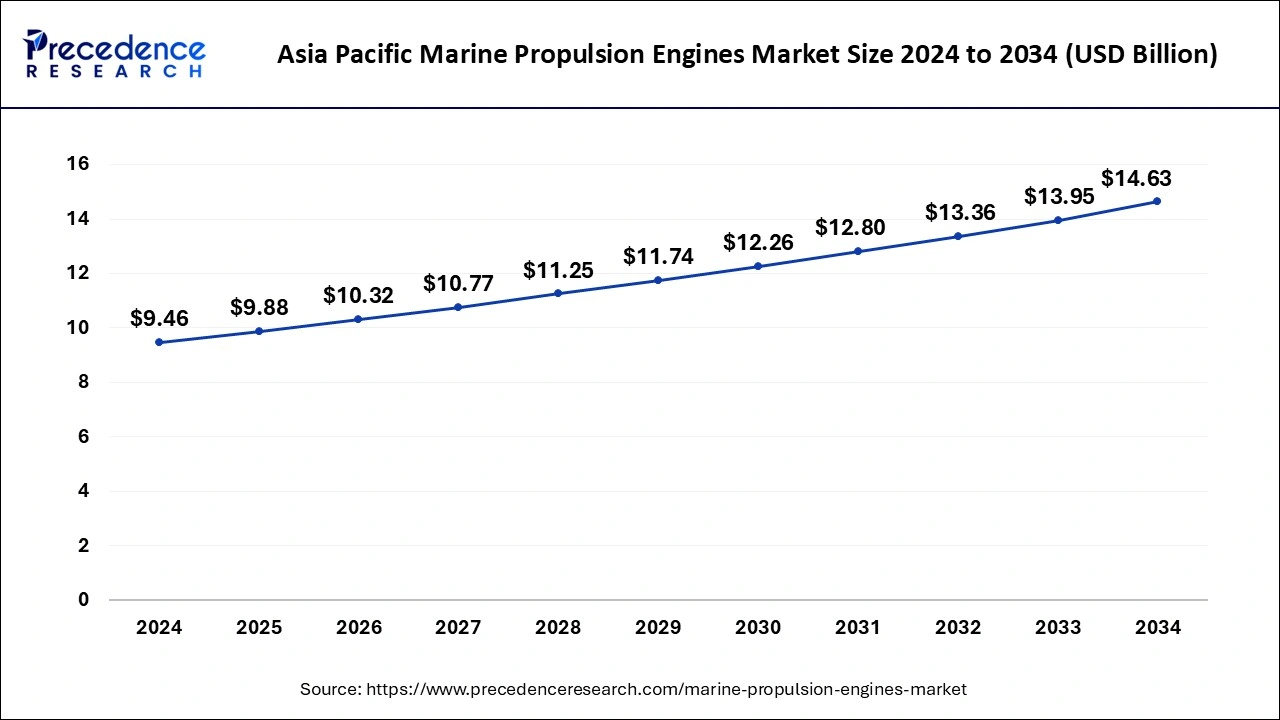

The global marine propulsion engines market size is calculated at USD 14.97 billion in 2025 and is forecasted to reach around USD 21.99 billion by 2034, accelerating at a CAGR of 4.37% from 2025 to 2034. The Asia Pacific market size surpassed USD 9.46 billion in 2024 and is expanding at a CAGR of 4.46% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global marine propulsion engines market size accounted for USD 14.34 billion in 2024 and is expected to exceed around USD 21.99 billion by 2034, growing at a CAGR of 4.37% from 2025 to 2034.

The Asia Pacific marine propulsion engines market size was evaluated at USD 9.46 billion in 2024 and is projected to be worth around USD 14.63 billion by 2034, growing at a CAGR of 4.46% from 2025 to 2034.

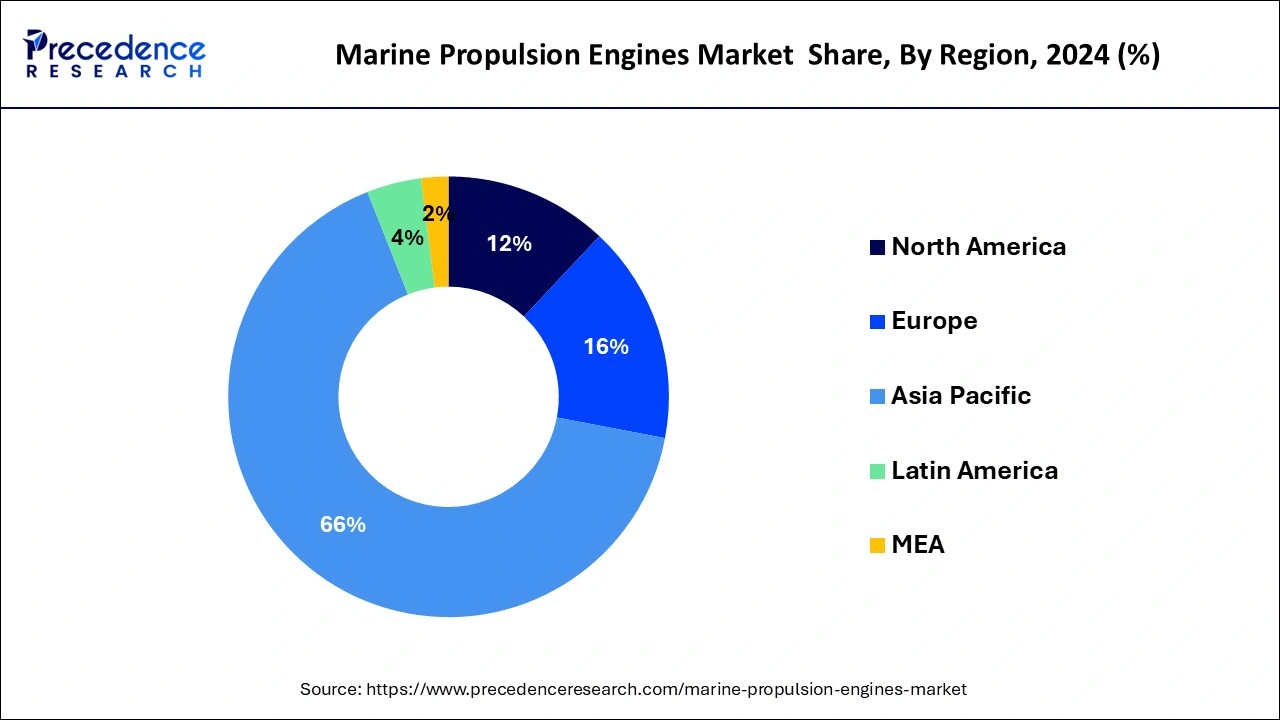

The Asia Pacific has emerged as the market leader in the global marine propulsion engines market in the year 2024. Diesel production in the region has experienced high growth in the last five years and hence the market for diesel propulsion engine. Further, diesel propelled machineries are developed in prominent amount for the marine industry owing to various benefits such as reliable and widely accepted primary propulsion engine across the shipping industry. Further, the diesel propulsion engine is also used as an auxiliary propulsion engine owing to various technology advancements and wide usage of diesel propelled engines for the demand of high range of power.

On the other hand, North America witnessed a slow growth rate in the global marine propulsion engines market during the forthcoming years. This is mainly attributed to the stringent emission regulations imposed by the government of the region in order to control the alarming rate of pollution.

Marine propulsion engines market is about to register a steady growth rate during the forthcoming years because of the rise in demand for operationally dependable and financially efficient ships. Shipping industry plays a significant role in the global trade. Cross-border trade is largely dependent on the shipping industry for importing and exporting heavy goods to various countries owing to easy and affordable cost of transportation. Some of the countries lack the abundance of natural resources, in order to fulfill the requirements, they import rest of the quantity from other countries in bulk, this also triggers the trend for shipping transportation and thus drives the growth of marine propulsion engines market.

The increasing import and export activities across the globe has put a greater emphasis on enhancing the capacity of diesel propulsion engines to prosper the growth of new-generation tankers with higher cargo holding capacity. Further, rapid depletion of conventional and shale gas reserves has prominently boosted the demand for LPG gas in marine fuel. Previously, steam turbine systems were largely preferred for marine propulsion, whereas for increasing the utilization of natural gas, the dual-fuel diesel (DFD) propulsion engines were introduced on LNG carriers.

| Report Coverage | Details |

| Market Size in 2025 | USD 14.97 Billion |

| Market Size by 2034 | USD 21.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.37% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on product, the marine propulsion engines market is classified into the wind & solar propulsion engine, diesel propulsion engine, fuel cell propulsion engine, gas turbine propulsion engine, natural gas propulsion engine, steam turbine propulsion engine, and others. In the past decade, diesel propulsion engine has emerged as the prominent source of propulsion in the shipping industry. With the rising advancements in the technology and increasing preference for sustainable propulsion system alternate energy sources for example renewable energy that has minimal emission rate has garnered significant penetration in the shipping industry. This in turn accelerates the market growth for wind and solar marine propulsion engine.

Although solar and wind marine propulsion engine has gained importance as the auxiliary propulsion engine, they are insufficient to meet the power requirement for primary marine propulsion purpose. Wind propulsion systems are limited for propulsion augmentation applications if full sail propulsion method is adopted that gives rise to adverse commercial and financial implications in terms of voyage time taken and number of ships required. In addition, wind-based propulsion is dependent on the speed of wind that should be uniform and effective to sail a ship coupled with the installation of suitable control system technology in the ship. Hence, wind and solar propulsion engines witness magnificent growth as the auxiliary system as they are environment friendly and do not emit harmful substance in the environment.

Apart from the shift for renewable energy in marine propulsion system, developments in fuel injection technology, firing pressure, brake mean effective pressure, and turbo-charging efficiency have drastically reduced the fuel consumption in marine industry. This has significantly triggered the adoption of natural gas and diesel propulsion engines in the marine industry.

Key Companies & Market Share Insights

The global marine propulsion engines market is moving towards consolation owing to increasing number of merger & acquisition activities between market players. For instance, on 8th March 2019, Hyundai Heavy Industries acquired its local rival company Daewoo Shipbuilding and Marine Engineering that benefited it in increasing its stake in the global marine market by 21%. As per the acquisition deal, Hyundai Heavy Industries was likely to create a holding company under which it manages the ship building unit along with the Daewoo’s Shipbuilding.

Segments Covered in the Report

By Product Outlook

Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

July 2024