March 2025

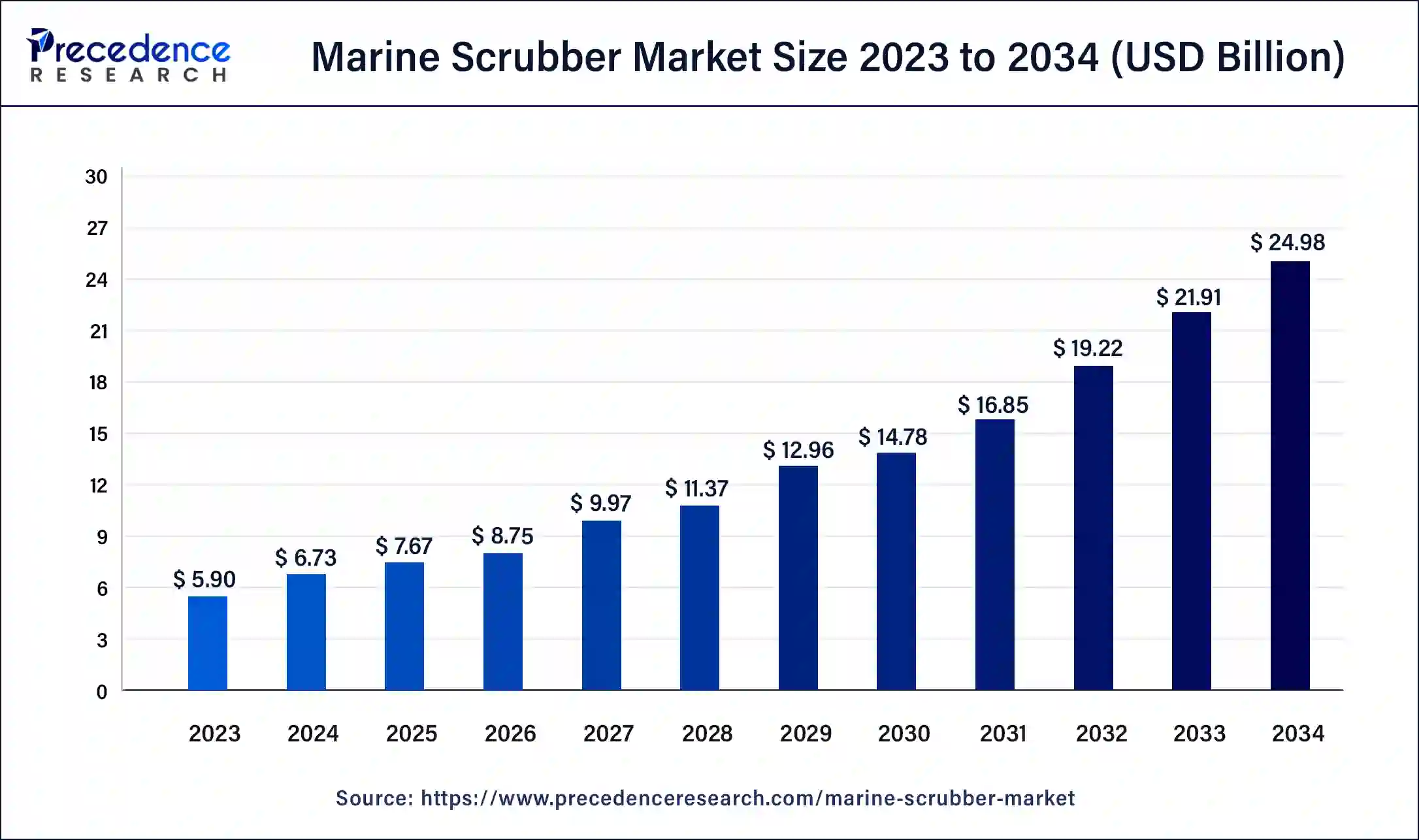

The global marine scrubber market size was USD 5.90 billion in 2023, calculated at USD 6.73 billion in 2024 and is expected to be worth around USD 24.98 billion by 2034. The market is slated to expand at 14.02% CAGR from 2024 to 2034.

The global marine scrubber market size is worth around USD 6.73 billion in 2024 and is anticipated to reach around USD 24.98 billion by 2034, growing at a solid CAGR of 14.02% over the forecast period 2024 to 2034. The marine scrubber market is driven by the implementation of stricter environmental regulations.

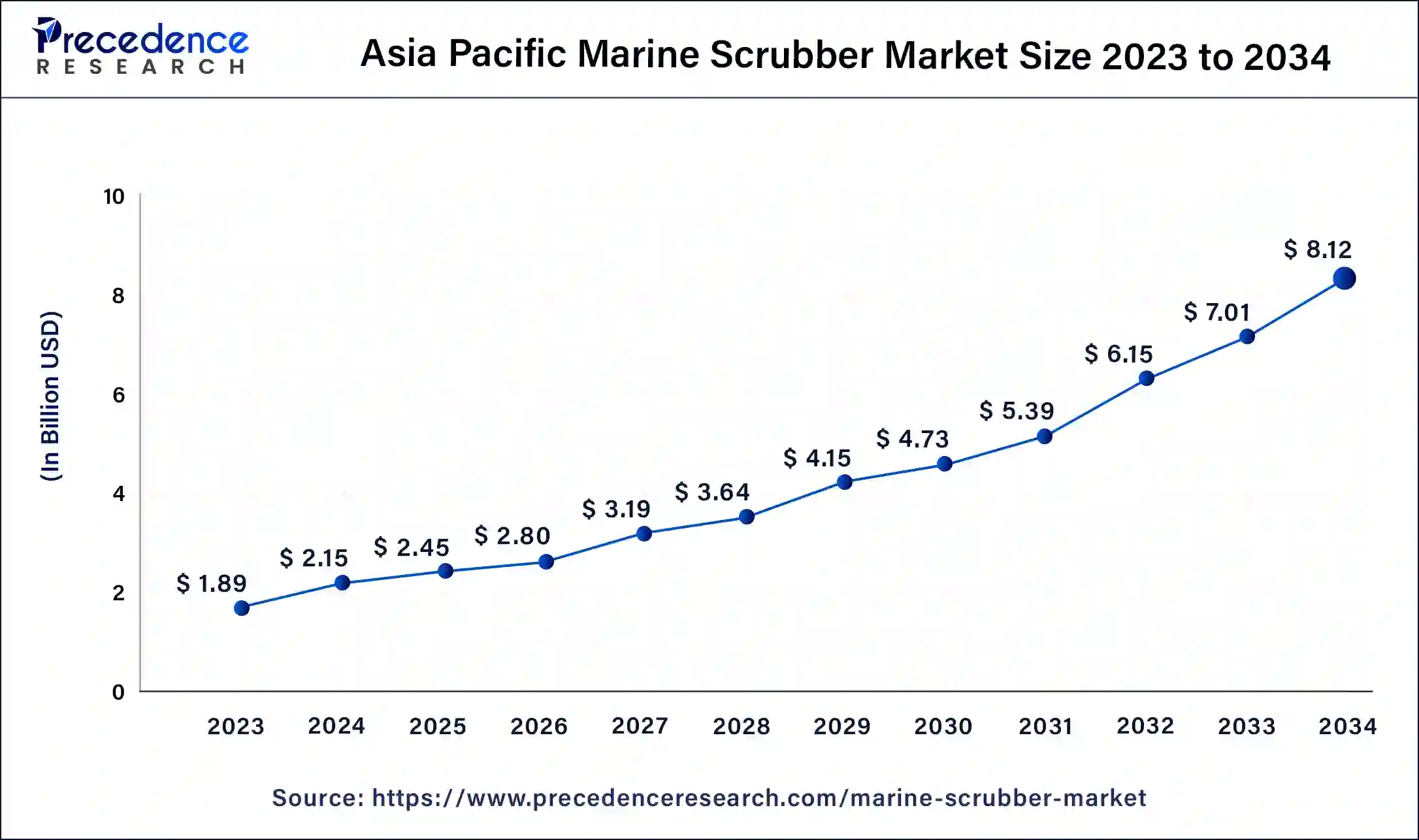

The Asia Pacific marine scrubber market size was exhibited at USD 1.89 billion in 2023 and is projected to be worth around USD 8.12 billion by 2034, poised to grow at a CAGR of 14.17% from 2024 to 2034.

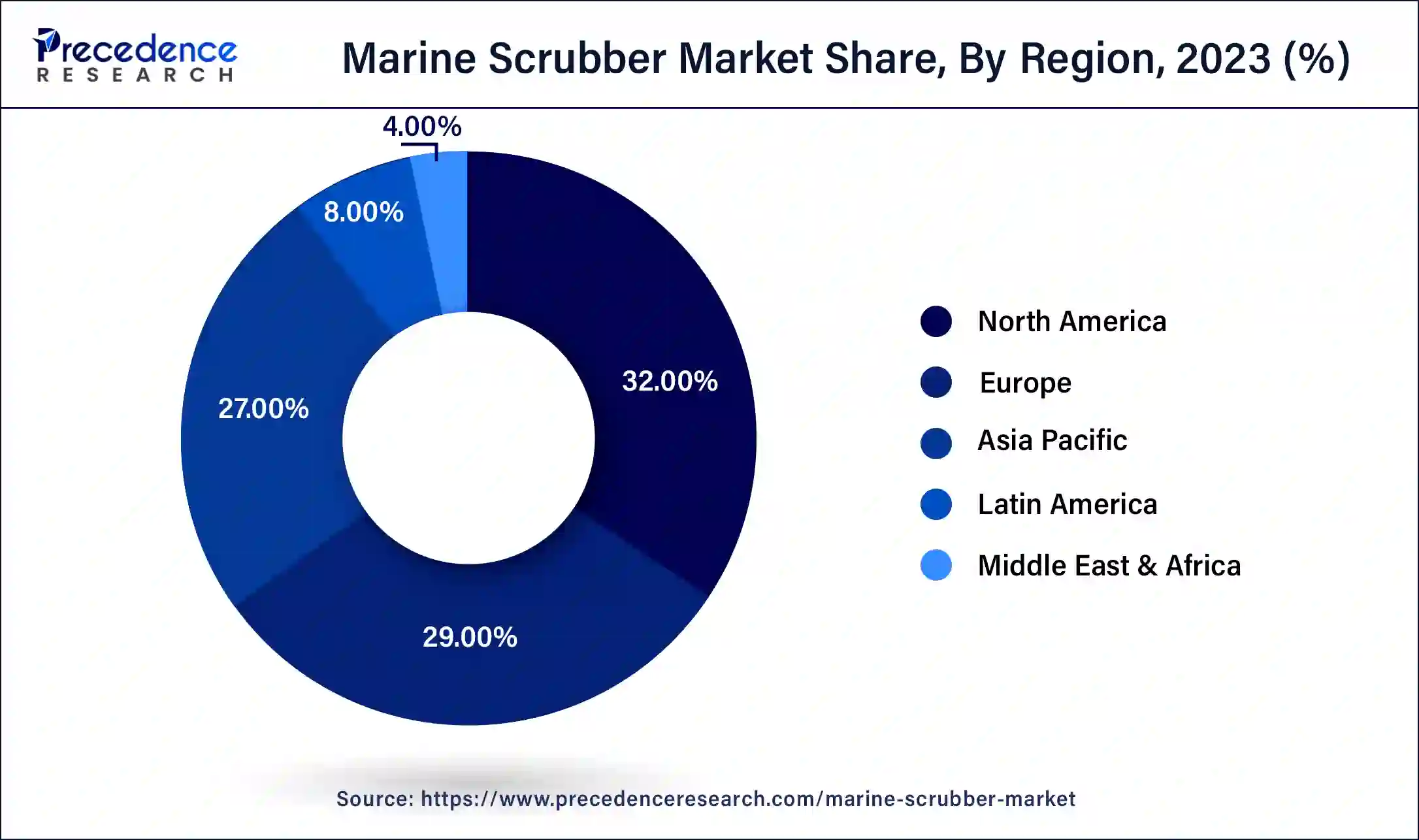

Asia- Pacific dominated the marine scrubber market in 2023. Asia-Pacific nations, especially South Korea and China, are renowned for their efficient supply chains and industries. As a result, the region has become a competitive market for manufacturing and installing marine scrubbers, lowering the overall manufacturing cost. The financial benefit of marine scrubbers over low-sulfur fuel (LSFO) is one of the main arguments in favor of their use. Because high-sulfur fuel oil (HSFO) and low-sulfur fuel oil (LSFO) are so expensive in Asia-Pacific, scrubbers are a financially viable choice for shipowners.

North America shows a significant growth in the marine scrubber market during the forecast period. It has been demonstrated that ship owners, especially those involved in long-haul transportation, can quickly recoup their investment in marine scrubbers. High-sulfur fuel is typically much less expensive than low-sulfur substitutes. Because of this financial advantage, scrubbers are becoming increasingly popular among North American shipping corporations. The region has made significant investments in studying and creating cutting-edge marine scrubber systems, especially those that lower emissions of sulfur dioxide, particulate matter, and other dangerous pollutants.

An exhaust gas cleaning system, a scrubber, removes particulate matter and dangerous compounds from ship exhaust gas streams, including nitrogen oxide (NOx) and sulfur oxide (SOx). Before the shipping industry implemented exhaust gas cleaning systems, all exhaust was released into the atmosphere, seriously endangering human health and the environment. Scrubbers, on the other hand, may remove up to 98% of the SOx emissions. China, Greece, India, Japan, Singapore, South Korea, Norway, and the United Kingdom are the top nations for maritime travel.

The new IQ Series exhaust gas treatment system from Wärtsilä was created by its Moss, Norway-based Exhaust Treatment business unit. The most recent development in maritime exhaust gas treatment technology is the IQ Series. It has several enhancements that make it particularly suitable for container ships and meet the growing demand for scrubbers as a compliance alternative from the container market segment.

How is AI helping the marine scrubber market growth?

Artificial intelligence contributes to scrubber system optimization through real-time operation adjustments, increased fuel economy, and reduced energy usage. AI-powered algorithms ensure the scrubber runs as efficiently as possible while generating the least waste by monitoring and adjusting parameters like temperature, chemical usage, and water flow rates. AI makes it possible to remotely monitor and manage scrubber systems. Fleet managers may now oversee numerous boats from one place, which enhances operational management. Faster reaction times to anomalies or inefficiencies are also made possible by real-time data and AI-driven analysis.

| Report Coverage | Details |

| Market Size by 2034 | USD 24.98 Billion |

| Market Size in 2024 | USD 6.73 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.02% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Application, Installation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing maritime trade

The construction and development of critical commercial routes, such as the Suez Canal, Panama Canal, and Arctic shipping lanes, also influence the growth of marine trade. Because these routes are essential to international supply networks, more ships are operating in these areas due to the increased use of these routes. Aside from following the law, increasing pressure from stakeholders, the public, and environmental organizations has led many shipping businesses to switch to more environmentally friendly operations. In the interim, marine scrubbers are thought to help reduce emissions; longer-term options, such as alternative fuels (like LNG and hydrogen), are still being developed.

High installation costs

Scrubber retrofitting is a costly and technically difficult process for already-built boats. The ship's construction frequently needs to be altered to install the scrubber system. This may entail rearranging the engine room, cutting and rewelding portions of the ship, and strengthening other locations. These adjustments must be made precisely to guarantee that the scrubber interfaces with the vessel's current systems without generating operational concerns. Because of this, ship owners must pay more for labor, engineering, and occasionally dry-docking the vessel, which drives up the installation's entire cost.

Growth of green shipping initiatives

Scrubber technology innovation is growing along with green shipping initiatives. The marine scrubber industry is seeing a rise in the development of more adaptable and efficient systems that can handle a range of ship sizes and kinds while maintaining compatibility with varied exhaust systems. This versatility further accelerates scrubber adoption, providing shipowners with tailored solutions that meet their unique operational requirements. In the context of green shipping aims, technological advancements also improve scrubber operational efficiency, lowering maintenance costs, extending their lifespan, and increasing ship operators' return on investment (ROI).

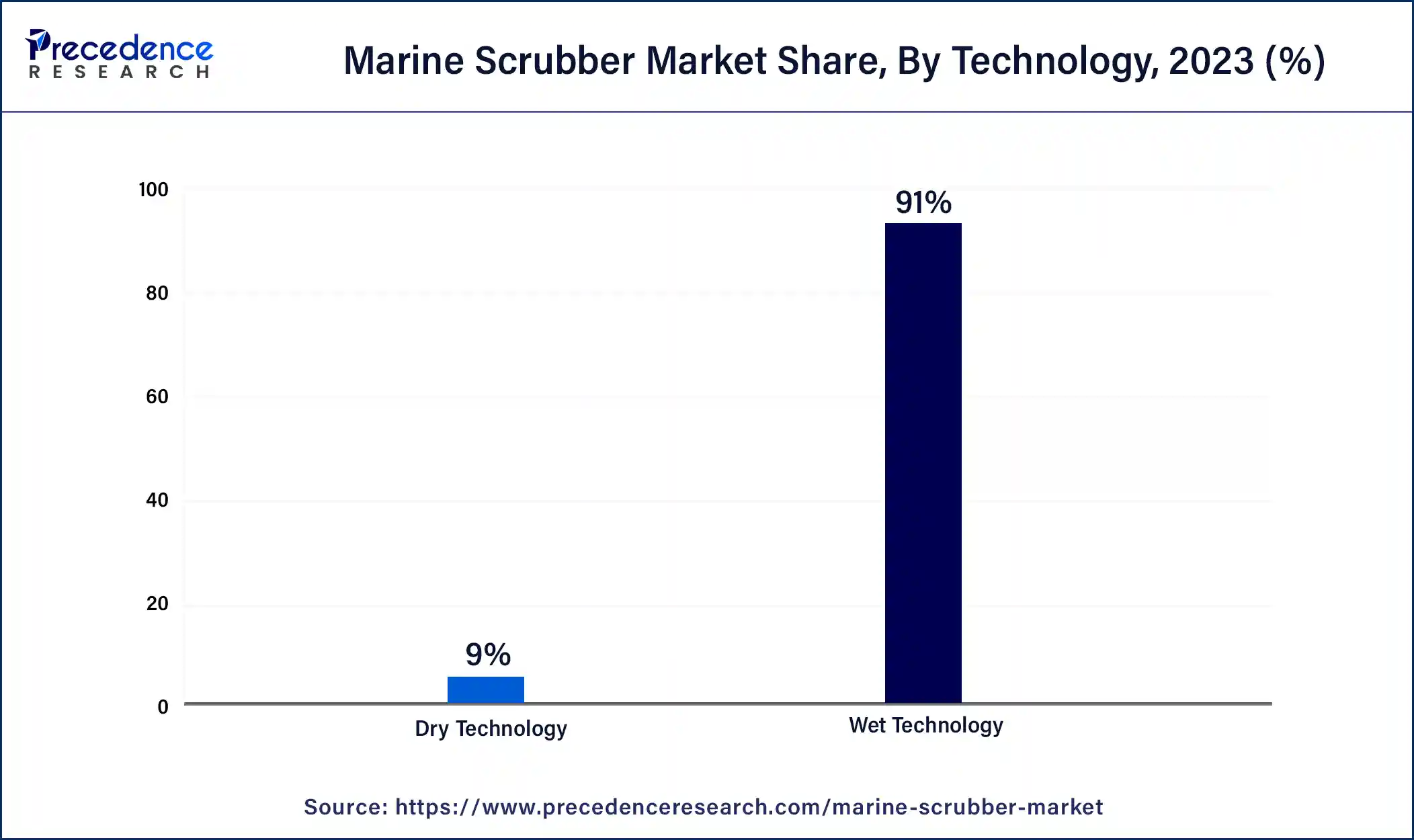

The wet technology segment dominated the marine scrubber market in 2023. One of the most well-known and tested methods for cleaning exhaust gases in various industrial settings, including maritime ones, is wet scrubbers. Historically, the shipping sector has chosen established technologies that have undergone considerable testing and shown to be reliable over an extended period. Because of their operational efficacy, wet scrubber systems have gained widespread adoption and are the preferred option for maritime firms.

The dry technology segment shows a significant growth in the marine scrubber market during the forecast period. Dry scrubbers use solid absorbent materials like lime or sodium bicarbonate to remove sulfur and other contaminants from exhaust gases. Dry scrubbers use fewer resources than wet scrubbers, which need sophisticated wastewater treatment facilities and water. Lower operational costs, including lower energy use and maintenance expenditures, result from this. Dry scrubbers simplify operation and minimize maintenance downtime because they do not require handling significant volumes of water, eliminating the need for complex pumps or wastewater management systems. Dry scrubbers are becoming increasingly popular in the market. They save shipping firms money by eliminating the need to manage tainted water systems.

The bulk carriers segment dominated the marine scrubber market in 2023. Large ships make up bulk carriers, some of which are among the most significant ship classes in the world (such as Panamax and Capesize vessels). The larger the ship, the more fuel it consumes. Larger ships with scrubbers may burn HSFO for less money, which accelerates the return on investment (ROI) for installing scrubbers when compared to smaller vessels with lower fuel use. The segment's dominance in the marine scrubber industry has been further cemented in recent years with the inclusion of scrubbers in the design of many new bulk carrier purchases.

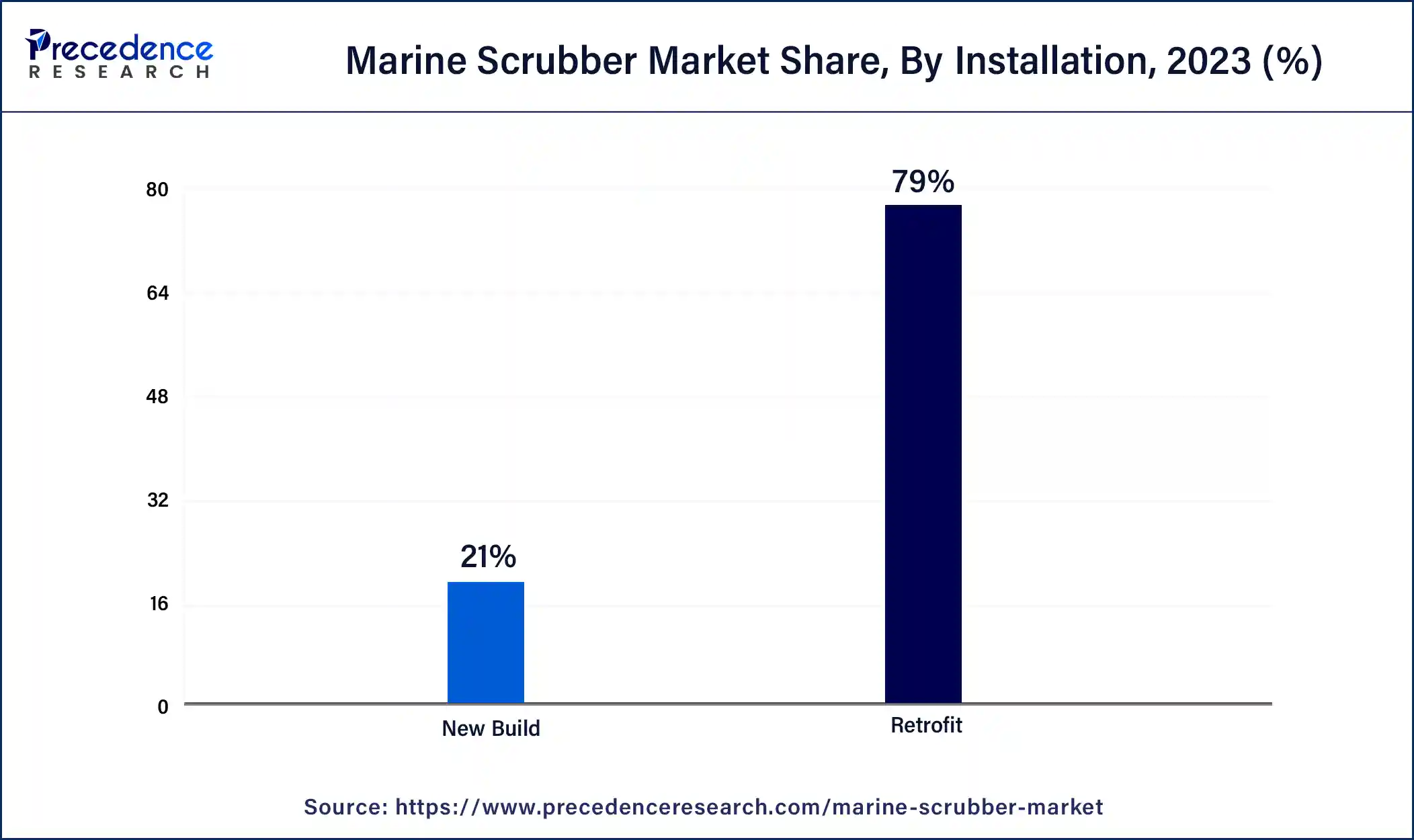

The retrofit segment dominated the marine scrubber market in 2023. Due to shipyard backlogs, building new vessels might take many years, particularly if demand spikes suddenly following IMO regulations. Refitting already-built ships offered ship owners a quicker way to comply with laws and avoid fines for fuel-related delays or outages. Retrofitting makes sense for older ships with a good amount of operating life left. It allows ship owners to keep making money from aging ships without buying new tonnage or decommissioning them early.

The new build segment shows a significant growth in the marine scrubber market during the forecast period. Pressure from shipping companies to use greener technologies to cut emissions is growing. Scrubber integration into new constructions guarantees adherence to both present and future laws. Additionally, it increases the vessels' appeal to operators and charterers who value sustainability highly. Scrubber-equipped vessels are in high demand as a result of this. The need for additional ships is rising as the world's shipping sector develops. Additionally, more contemporary, energy-efficient ships are replacing outdated fleets. Scrubbers installed during the building phase ensure that these new ships, frequently intended to meet the highest environmental compliance standards, are future proof against growing legislation.

Segments Covered in the Report

By Technology

By Application

By Installation

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

October 2024

July 2024