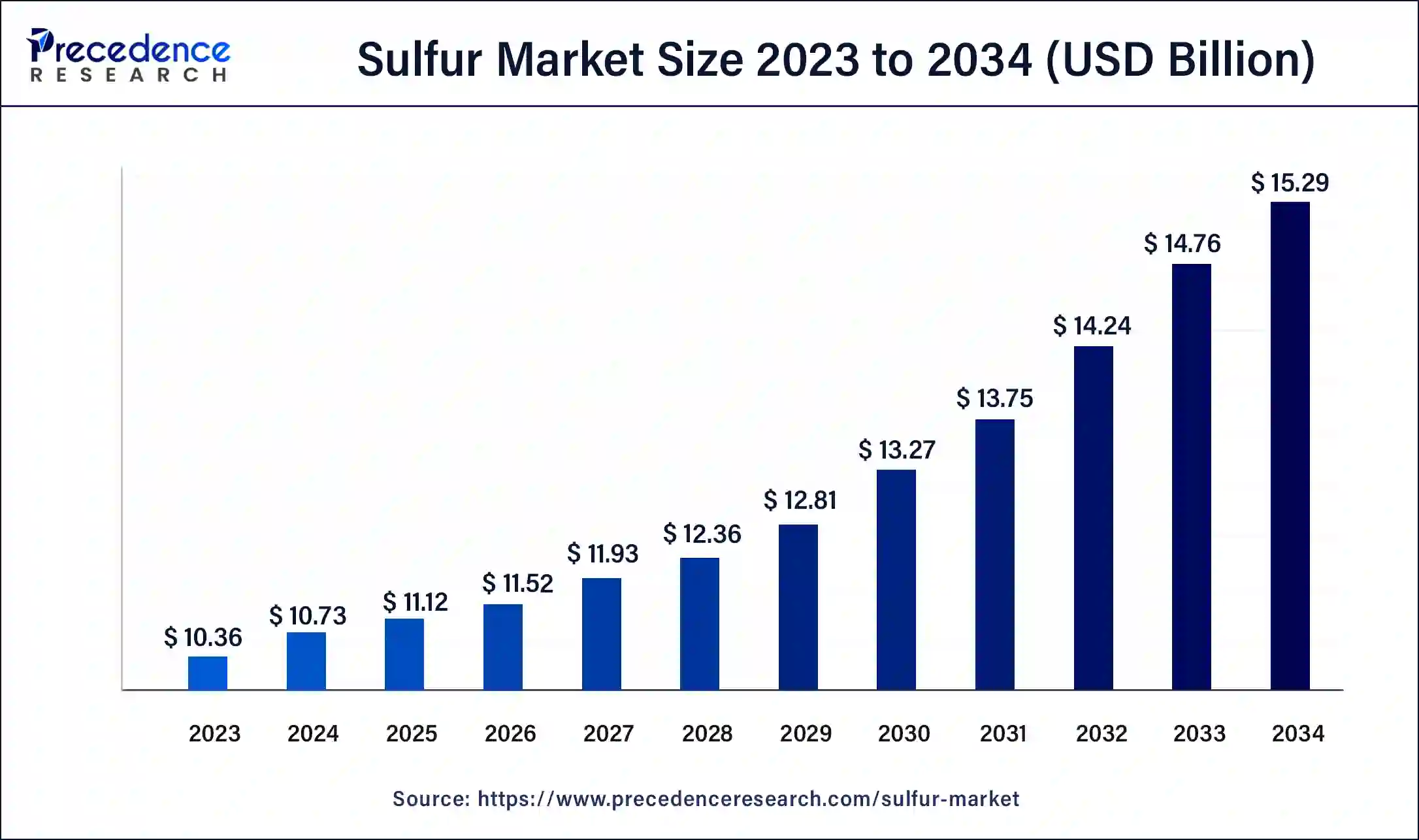

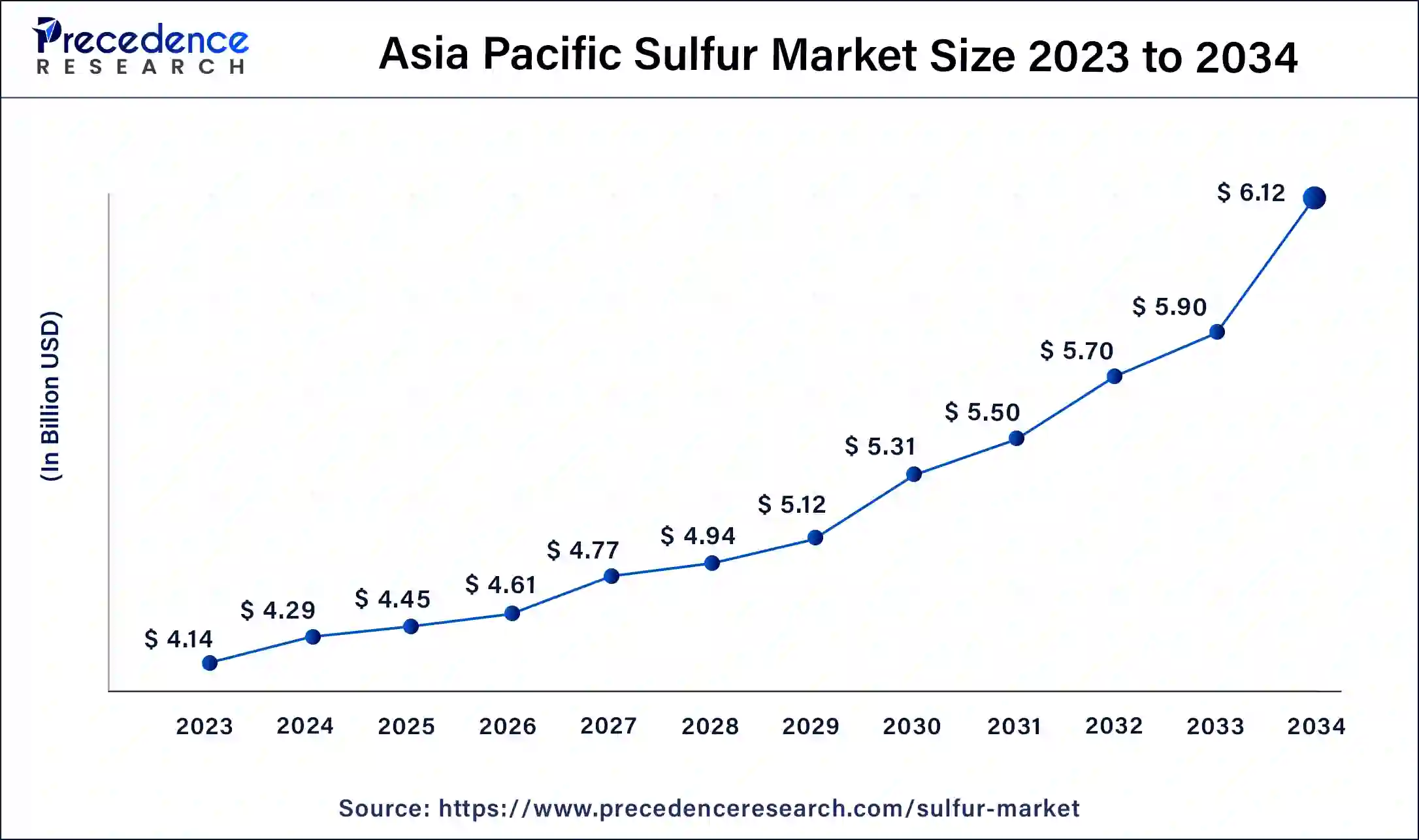

The global sulfur market size accounted for USD 11.25 billion in 2025 and is projected to surpass around USD 15.29 billion by 2034, expanding at a CAGR of 3.6% from 2025 to 2034. The Asia Pacific sulfur market size accounted for USD 4.45 billion in 2025 and is expanding at a CAGR of 3.80% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sulfur market size was calculated at USD 10.73 billion in 2024 and is expected to be worth around USD 15.29 billion by 2034, at a CAGR of 3.6% from 2025 to 2034.

The Asia Pacific sulfur market size was estimated at USD 4.29 billion in 2024 and is predicted to be worth around USD 6.12 billion by 2034, at a CAGR of 3.80% from 2025 to 2034.

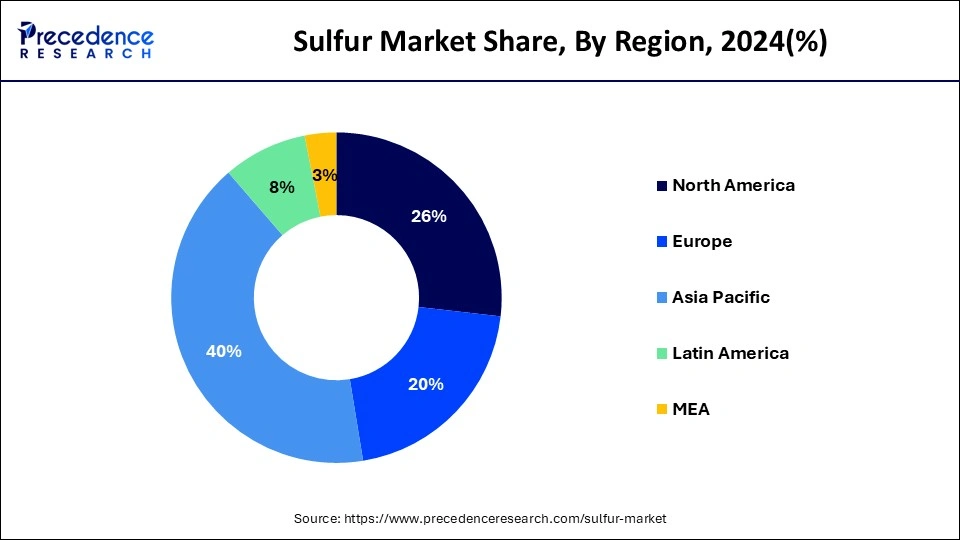

The research report covers key trends and prospects of sulfur products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. Geographically, sulfur market is conquered by Asia Pacific owing to increasing energy production, along with the favorable government policies for the sulfur production in the countries of this region, especially in China, India, Japan, and in emerging countries of the Asia Pacific region. North America is expected to register the fast growth rate, on account of increasing research and development investment by key market players and growing adoption of the sulfurs in the various end use applications such as phosphate fertilizers. Also, increasing investments in agricultural activities, coupled with rising production of vulcanized rubber are another factors anticipated to propel growth of the target industry in the countries of North America region.

Emerging applications of sulfur are estimated to create gainful growth prospects for the major companies functioning in the global sulfur market. Sulfur are multifunctional in nature and used in its elemental form the production of range of end-use products like match sticks, fungicides, insecticides, detergents, batteries, and black gunpowder in both developed as well as emerging economies. Sulfur possesses great resistance to the heat and electricity along with ideal chemical properties. Commercial sectors including fertilizer, rubber, and pharmaceutical are widely ad optioning sulfur to get competitive edge in the global market. Also, emerging countries across the globe are focusing on increasing sulfur production in order to cater the increasing global demand of the sulfur. This trend is expected to continue and will enhance growth of the global industry in the near future.

Agricultural Practices: The increased use of sulfur, including ammonium sulfate and sulfur-coated ureas, as fertilizers for agricultural practices to promote healthiness and enhance crop yield is supporting the market growth.

Pharmaceutical and Personal Care Products: The demand for sulfur in pharmaceutical and personal care products has increased, contributing to market growth.

Mining Industry: The use of sulfur is high in mining explosives, driving influence on the innovation and development of sulfur elements.

Technological Advancements: The Adoption of advanced liquid fertilizer technologies like nanoparticle formulations has increased to enhance crop yields and reduce carbon footprints.

| Report Highlights | Details |

| Market Size in 2024 | USD 10.73 Billion |

| Market Size in 2025 | USD 11.12 Billion |

| Market Size by 2034 | USD 15.29 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 3.60% |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-use Industry, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

On the basis of end-use industry segment the global market is segregated into chemical processing, metal manufacturing, rubber processing, and others. The chemical processing end-use industry segment is expected to dominate in terms of revenue over the forecast time frame. The growth is attributed to the growing demand for sulfur form the chemical processing industries across the globe for various end-use applications. These factors are primarily responsible for the greater market share of chemical processing in the end-use industry segment of the sulfur Market. Fertilizer segment will expand at a significant CAGR during the forecast time-frame. Increasing adoption of sulfur based fertilizers from the Asian countries is expected to fuel growth of the segment in the near future. Further growth increasing production of the fertilizers in order to cater the agricultural demand of the end users worldwide is expected drive growth of the segment in the next 10 years.

By End-use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client