March 2025

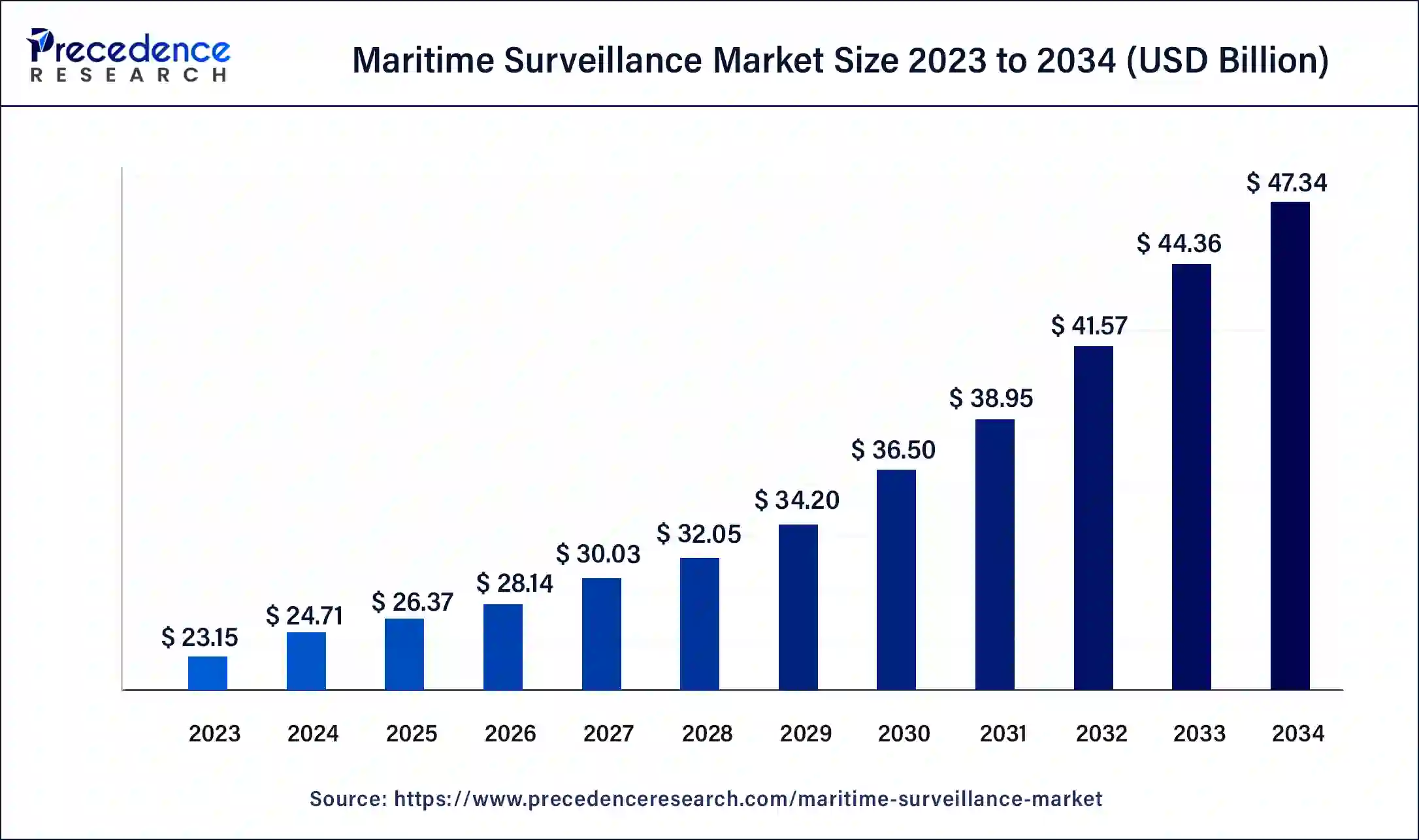

The global maritime surveillance market size surpassed USD 23.15 billion in 2023 and is estimated to increase from USD 24.71 billion in 2024 to approximately USD 47.34 billion by 2034. It is projected to grow at a CAGR of 6.72% from 2024 to 2034.

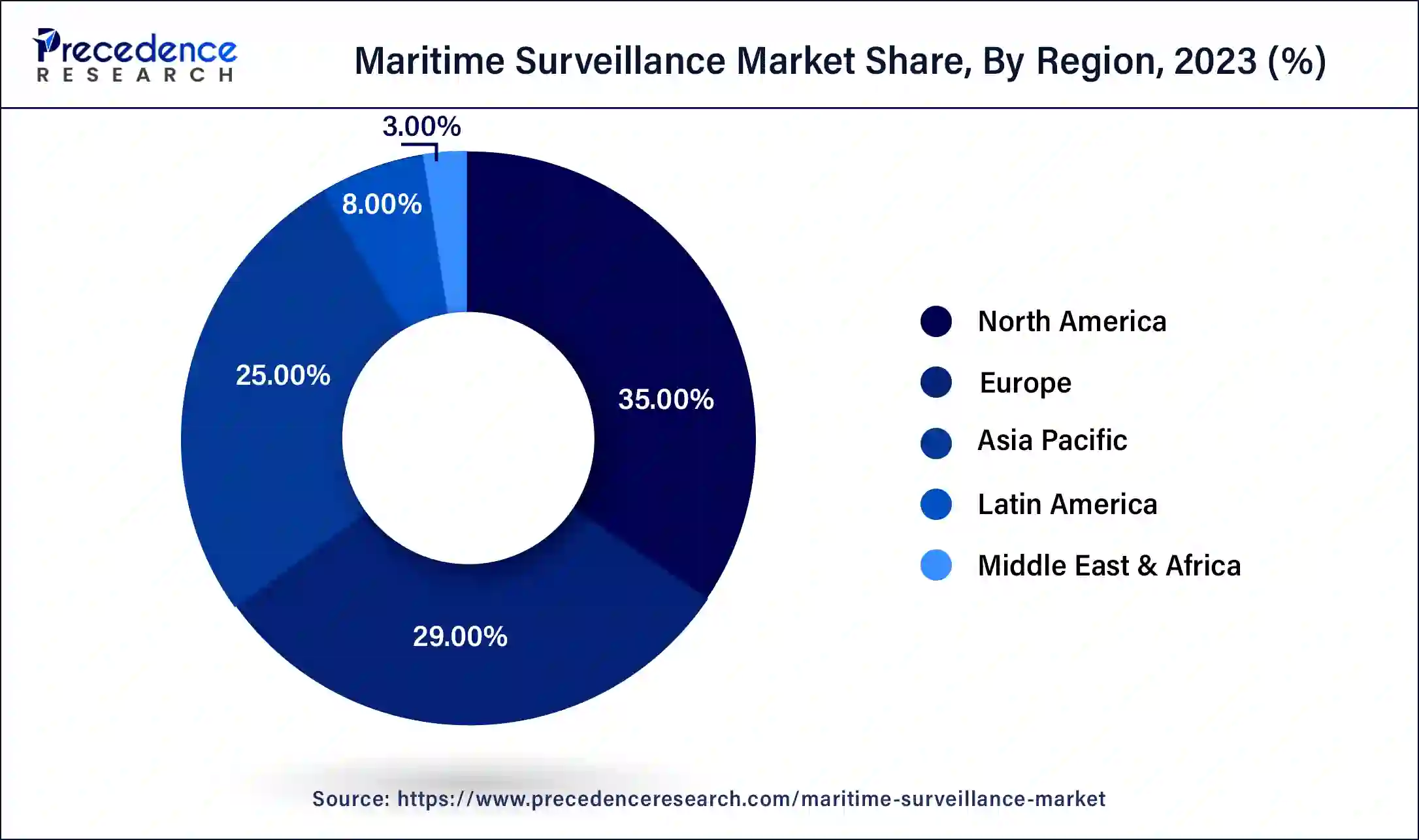

The global maritime surveillance market size is expected to be valued at USD 24.71 billion in 2024 and is anticipated to reach around USD 47.34 billion by 2034, expanding at a solid CAGR of 6.72% over the forecast period 2024 to 2034. The North America maritime surveillance market size reached USD 8.10 billion in 2023. The increasing need for national security is the key factor driving the maritime surveillance market growth.

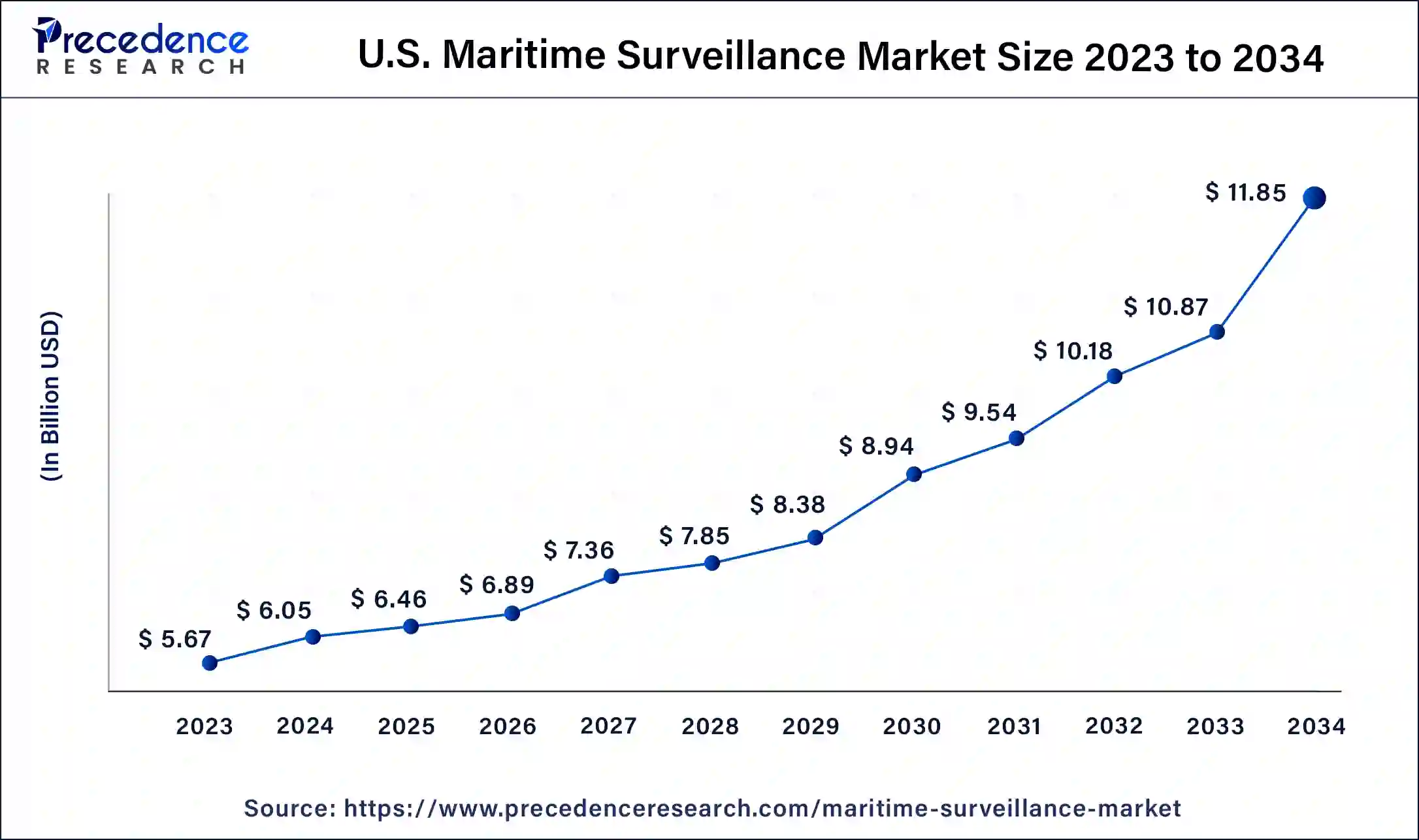

The U.S. maritime surveillance market size was exhibited at USD 5.67 billion in 2023 and is projected to be worth around USD 11.85 billion by 2034, poised to grow at a CAGR of 6.93% from 2024 to 2034.

North America dominated the maritime surveillance market in 2023. The dominance of the region can be linked to the increasing integration of surveillance systems with homeland security systems. In North America, the U.S. holds a major market share due to intuitive marine technology and the increasing demand for maritime security. Furthermore, the U.S. Coast Guard and Navy update their surveillance capabilities regularly.

Asia Pacific will witness the fastest growth in the maritime surveillance market over the forecast period, driven by the region's extensive maritime boundaries and strategic importance coupled with the growing maritime trade activities. Moreover, Countries such as China, Japan, and India are investing largely in innovative surveillance technologies to protect their waters.

Maritime surveillance includes monitoring and observing maritime activities to ensure the security, effective management, and safety of seas and oceans. The maritime surveillance market encompasses a wide range of products, services, and solutions created for different stakeholders, including maritime authorities and governments. The process mainly includes tracking and detecting vessels, monitoring unethical activities such as piracy and smuggling, safeguarding navigation, and managing resources like fisheries.

Top 10 countries with the highest military expenditures in 2024

| Rank | Country | Spending (USD Billion) |

| 1. | United States | 905.5 |

| 2. | China | 407.9 |

| 3. | Russia | 294.6 |

| 4. | India | 73.6 |

| 5. | United Kingdom | 73.5 |

| 6.. | Saudi Arabia | 69.1 |

| 7. | Germany | 63.7 |

| 8. | France | 60.0 |

| 9. | Japan | 49.0 |

| 10. | South Korea | 43.8 |

Role of Artificial Intelligence in the Maritime Surveillance Market

In the maritime surveillance market, artificial intelligence (AI) plays an important role in improving naval forces’ capabilities and defending maritime borders. Hence, AI-powered security systems are creating lucrative opportunities in the industry. Furthermore, AI transformed and bolstered the ability to perform surveillance and intelligence gathering. It enables AI to track, identify, and execute actions, which can further enhance maritime capabilities.

| Report Coverage | Details |

| Market Size by 2034 | USD 47.34 Billion |

| Market Size in 2023 | USD 23.15 Billion |

| Market Size in 2024 | USD 24.71 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Application, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Expansion of maritime infrastructure

The ongoing modernization and expansion of maritime infrastructure globally is a crucial factor driving the growth of the maritime surveillance market. Additionally, there is an increasing need to protect this critical infrastructure against emerging threats. Investments in new terminals and economic zones that include advanced security technologies can help in the market expansion further along with the implementation of next-generation security solutions.

Regulatory and compliance issues

The maritime surveillance market faces constraints regarding standardization of security protocols and regulatory compliance. Moreover, the regulatory environment generates a complex landscape for market players to navigate, which can potentially hamper the rapid deployment of innovative technologies and operational practices.

Clean energy and decarbonization

Rising shifts towards low-carbon fuels and technologies in the maritime surveillance market have introduced advanced security dynamics around the use of technology and fuel supply chains. Furthermore, the growing incorporation and utilization of 5G technology is anticipated to enhance communication capabilities in maritime operations for real-time data exchange and better coordination among operators.

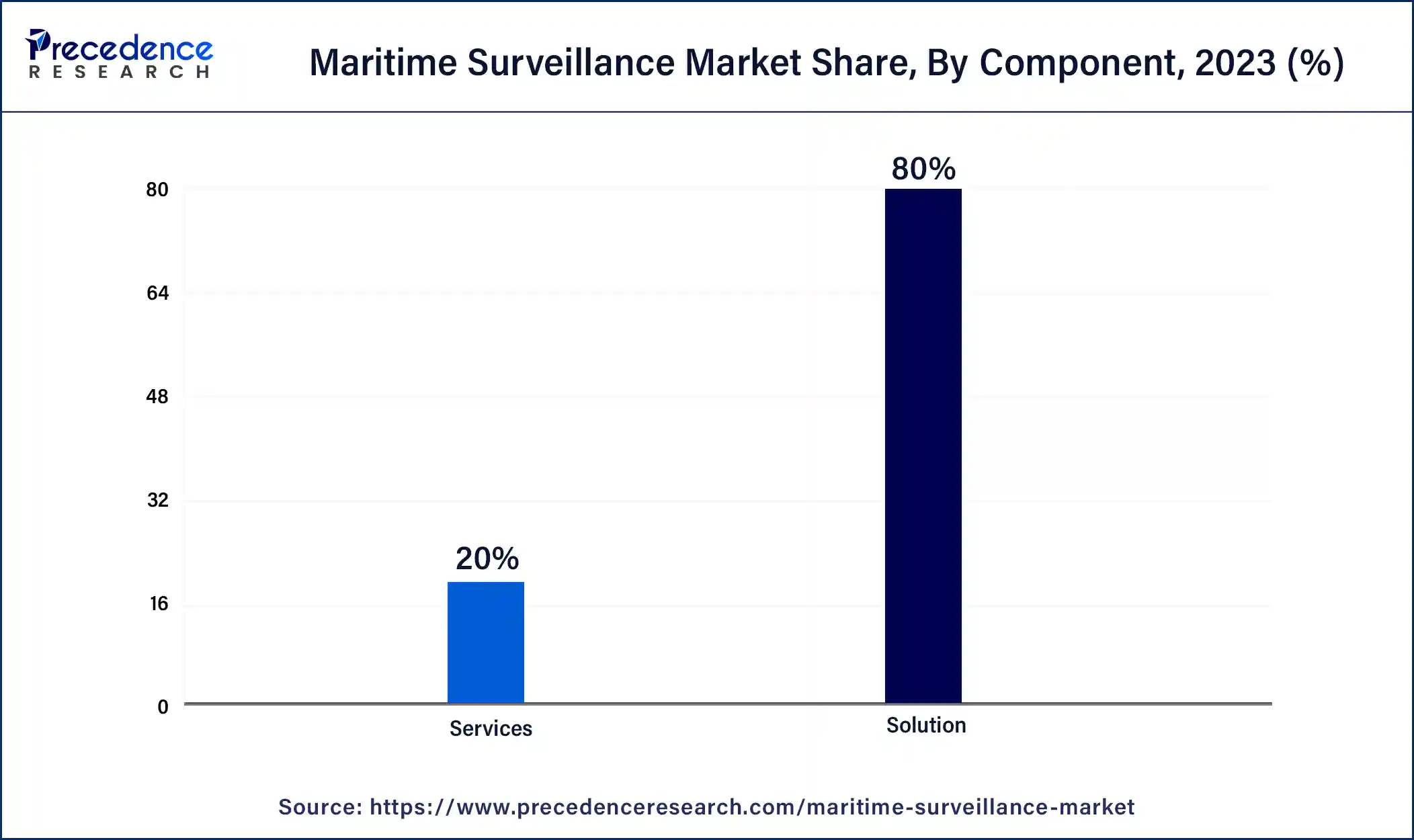

The solution segment dominated the maritime surveillance market in 2023. The dominance of the segment can be attributed to the rising demand for integrated systems, including sensors, cameras, radars, and central control rooms. These comprehensive solutions also improve maritime security and situational awareness. As maritime activities continue to grow across the globe, the solution segment's dominance is anticipated to stay fueled by the increasing complexity of maritime threats and technological advancements.

The services segment is expected to show the fastest growth in the maritime surveillance market over the forecast period. The growth of the segment can be linked to the increasing need for system integration, maintenance, and data analysis. As maritime surveillance systems become more tedious, the requirement for skilled professionals to optimize and manage these systems is expected to propel substantially.

The surveillance & tracking segment led the global maritime surveillance market in 2023. This is due to the increasing need for continuous monitoring and safeguarding of maritime borders along with the growing incidence of maritime threats such as piracy, smuggling, etc. Furthermore, these systems enable real-time monitoring of suspicious activities and vessel movements, which can sustain the dominance of the segment throughout the projected period.

The search & rescue segment is expected to show the fastest growth in the maritime surveillance market over the studied period. This is because of the increasing volume of maritime traffic coupled with the increasing incidence of natural disasters and maritime disasters. Moreover, Innovations such as real-time tracking, automated distress signals, and AI-driven decision support systems are improving the efficiency and speed of search, boosting segment growth.

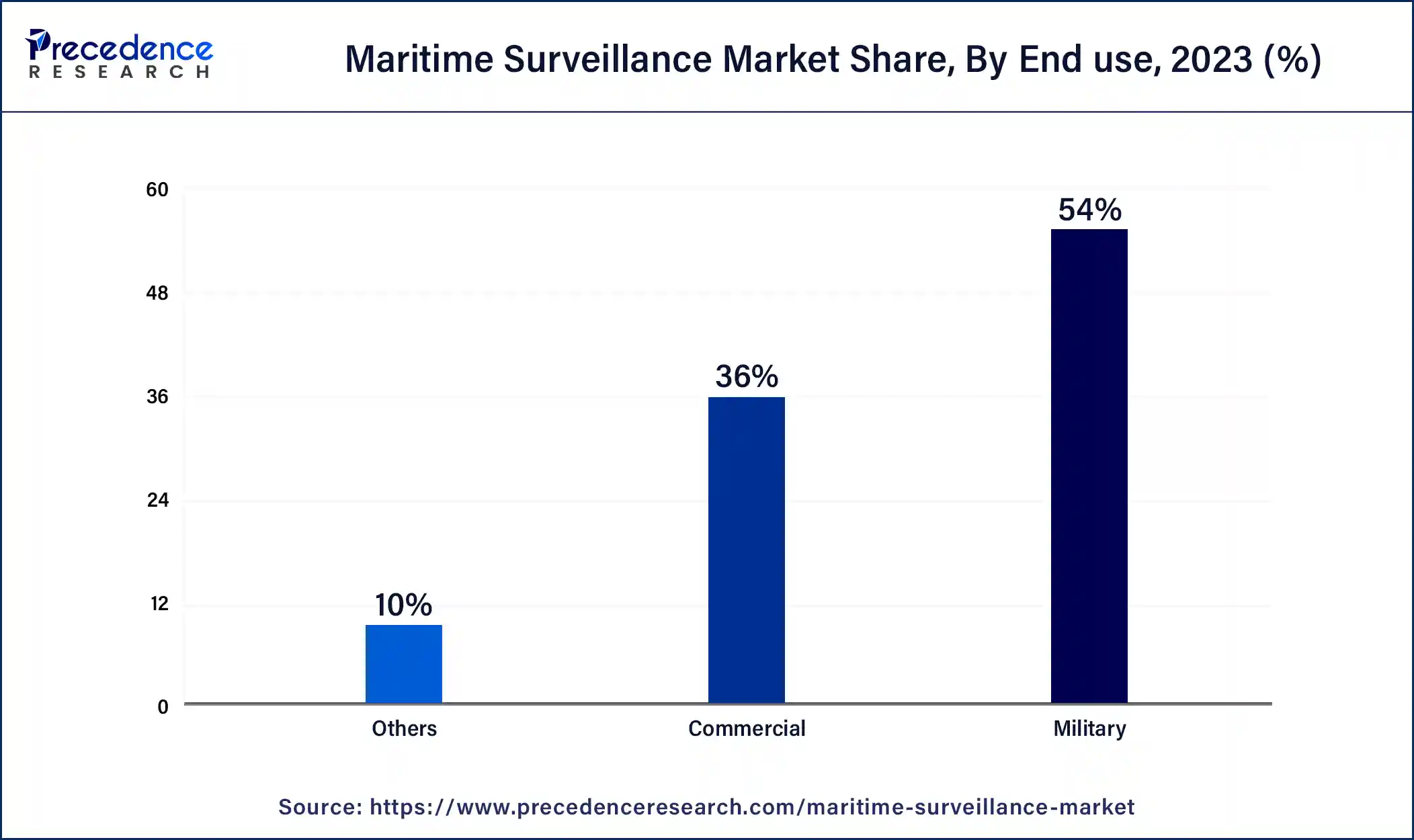

The military segment dominated the global maritime surveillance market in 2023. The dominance of the segment can be credited to the increasing reliance of Military organizations on advanced surveillance technologies to secure strategic assets and monitor maritime borders. Additionally, The segment uses a wide range of sophisticated systems involving sonar, satellite imaging, and advanced radar systems.

The commercial segment is projected to grow significantly in the maritime surveillance market during the forecast period. This is because of key market players like port authorities, shipping companies, and offshore energy operators. They are increasingly adopting advanced surveillance technologies to protect their assets and ensure safe navigation. Rising maritime trade is also driving commercial players to adopt maritime surveillance solutions.

Segments Covered in the Reports

By Component

By Application

By End use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

July 2024

October 2023