Mass Spectrometry Market Size and Growth 2025 to 2034

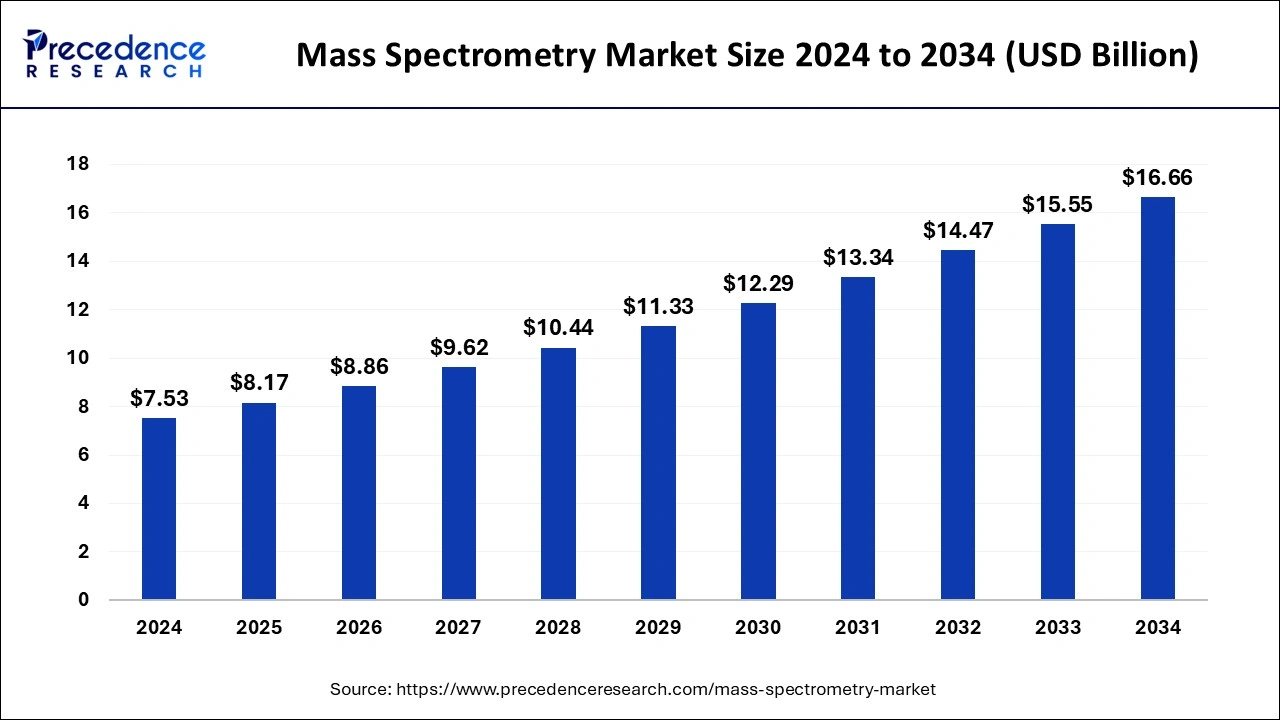

The global mass spectrometry market size was estimated at USD 7.53 billion in 2024, and it is expected to hit around USD 16.66 billion by 2034, registering a CAGR of 8.27% from 2025 to 2034.

Mass Spectrometry MarketKey Takeaways

- In terms of revenue, the market is valued at $8.17 billion in 2025.

- It is projected to reach $16.66 billion by 2034.

- The market is expected to grow at a CAGR of 8.27% from 2025 to 2034.

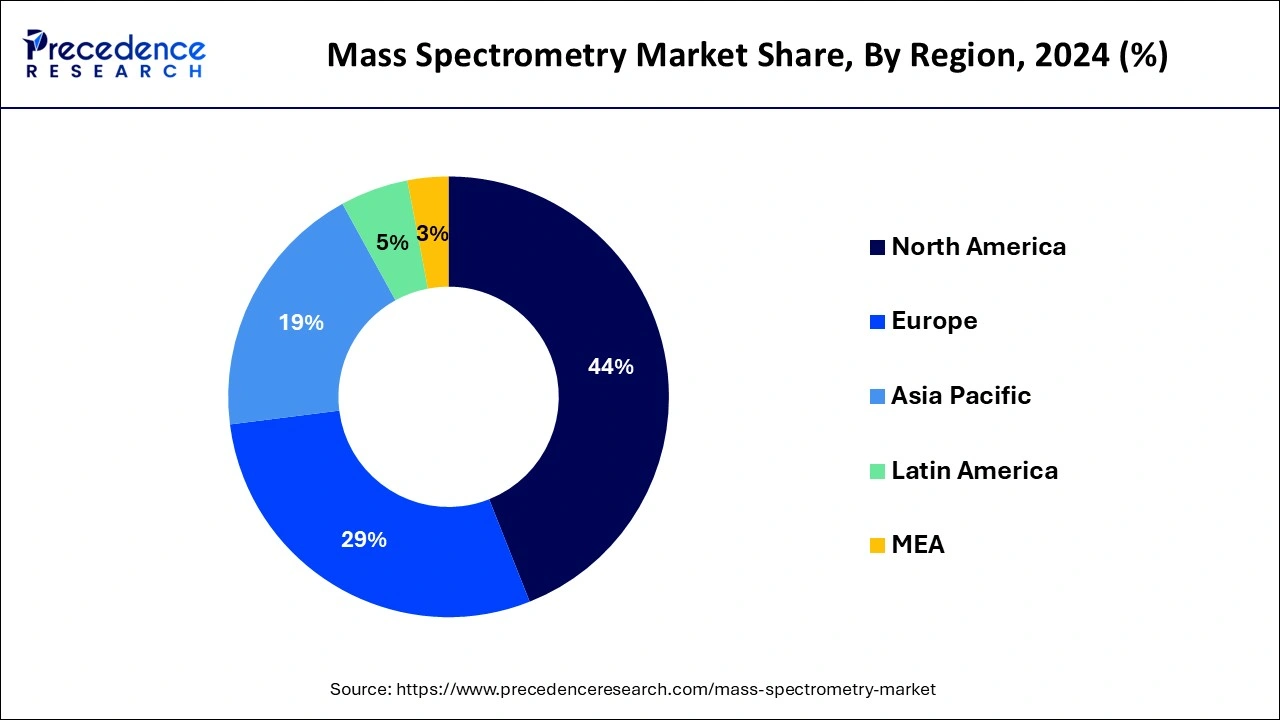

- North America dominated the global market with the largest market share of44% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR from 2025 to 2034.

- By technology, the quadrupole mass spectrometry segment dominated the market with a 28.60% share in 2024.

- By technology, the Orbitrap MS segment is expected to grow at the highest CAGR of 9.70% in 2024.

- By application, the pharmaceutical & biotechnology segment leads the market in terms of market share, holding

- the largest market share of 36.20% in 2024.

- By application, the clinical diagnostics is expected to grow at the highest CAGR of 9.90% in 2024.

- By end user, the pharmaceutical & biotech companies segment held a 33.70% market share in 2024.

- By end user, the hospitals & clinical labs segment is expected to grow at the highest CAGR of 9.80% in 2024.

- By component, the instrument segment dominated the market with a 47.30% share in 2024.

- By component, the services segment is expected to grow at the highest CAGR of 10.10% in 2024.

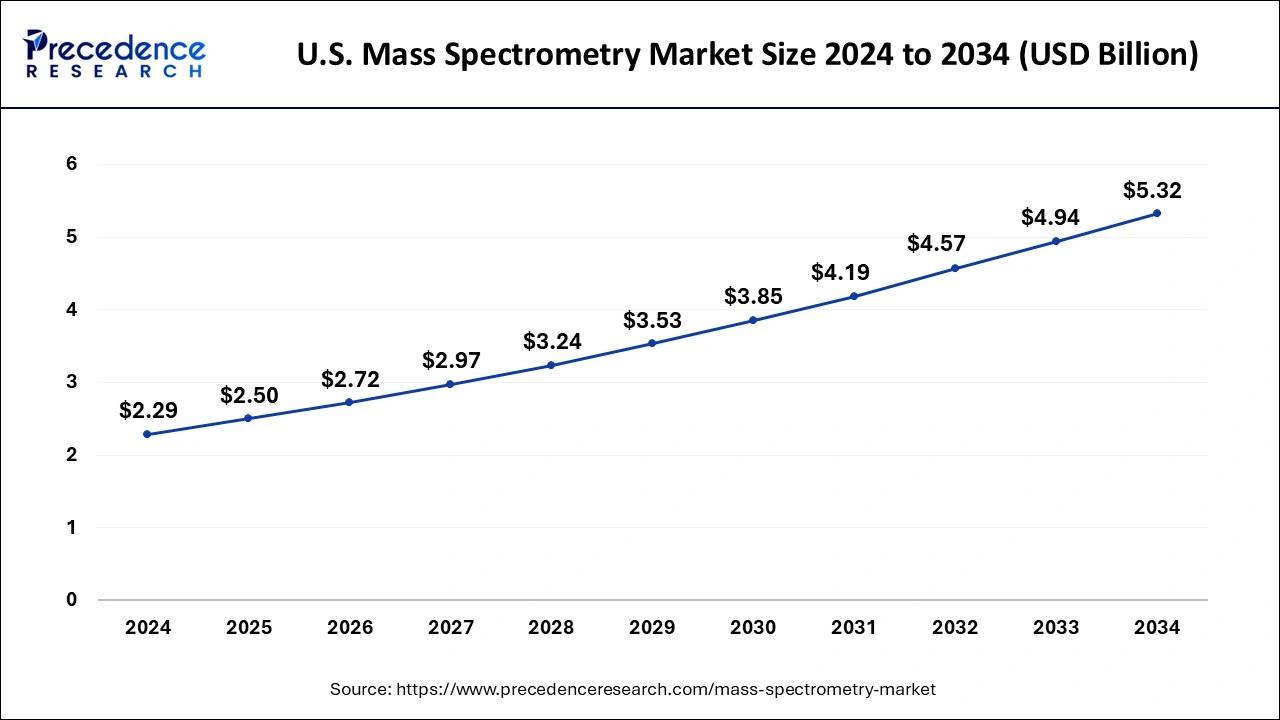

U.S. Mass Spectrometry Market Size and Growth 2025 To 2034

The U.S. mass spectrometry market size reached USD 2.29 billion in 2024 and is anticipated to reach around USD 5.32 billion by 2034, poised to grow at a CAGR of 8.79% from 2025 to 2034.

North America dominated the global mass spectrometry market in 2024.North America has stringent regulations and standards for environmental monitoring and food safety. Mass spectrometry is widely used for the detection and quantification of contaminants, pollutants, pesticides, and toxins in environmental samples and food matrices. The need for reliable and accurate analysis to ensure environmental sustainability and public health drives the demand for mass spectrometry in these sectors. The pharmaceutical and biotechnology sectors in North America are major end-users of mass spectrometry instruments and services. Mass spectrometry is widely used in drug discovery, drug development, and quality control processes.

The pharmaceutical and biotechnology sectors in North America are major end-users of mass spectrometry instruments and services. Mass spectrometry is widely used in drug discovery, drug development, and quality control processes.

Asia Pacific will witness the fastest rate of growth during the predicted timeframe.Asia Pacific is experiencing significant growth in the mass spectrometry market. Factors such as increasing investments in healthcare infrastructure, rising research and development activities, growing pharmaceutical and biotechnology sectors, and expanding applications of mass spectrometry are driving market growth. The region's large population and increasing healthcare expenditures contribute to the expanding market size.

Countries like China and India are emerging as major players in the mass spectrometry market. These countries have a rapidly growing healthcare industry, increasing investments in research and development, and a rising focus on precision medicine and personalized healthcare. The demand for advanced analytical technologies like mass spectrometry is increasing in these economies.

Market Overview

Mass spectrometry is widely used in life sciences research for proteomics, metabolomics, lipidomic, and other omics-based studies. The ability to analyze complex biological samples and identify and quantify molecules of interest has led to the increased adoption of mass spectrometry in academic research institutions, pharmaceutical companies, and biotechnology firms.

The mass spectrometry market refers to the global industry that encompasses the development, production, distribution, and utilization of mass spectrometry instruments, software, and related services. Mass spectrometry is an analytical technique used to measure the mass-to-charge ratio of ions, providing information about the chemical composition, structure, and quantity of molecules present in a sample. Mass spectrometry plays a vital role in drug discovery and development processes. It is used for drug metabolism studies, pharmacokinetics analysis, and identification of drug metabolites. Mass spectrometry enables researchers to understand the absorption, distribution, metabolism, and excretion of drugs, contributing to efficient drug development and safety assessments.

Mass Spectrometry MarketGrowth Factors

- Advancements in Drug Discovery- The need for accurate and efficient analytical techniques in pharmaceutical R&D has led to a growing demand for mass spectrometry since it provides better molecular specificity and better time to drug development as well as biomarker identification.

- Rise in Clinical Diagnostics- Increasing applications of mass spectrometry in clinical labs to detect diseases such as cancer and metabolic disorders are fueling growth in the market as mass spectrometry has the ability to analyze complex biological samples with superior sensitivity and specificity.

- Expansion of Proteomics and Genomics- The incorporation of mass spectrometry into the field of omics sciences provides greater insight into cellular processes. As mass spectrometry is better able to assess proteins and DNA, it is a critical technology for personalized medicines and biomarker investigations.

- Technology Advancements- Technology advances such as hybrid mass spectrometers, better resolution, and faster processing times improve performance from the stand point of educational and commercial laboratories. These advances have improved mass spectrometry for research and routine work. They provide a better platform for trends and Improve capability in many laboratory settings.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.17 Billion |

| Market Size by 2034 | USD 16.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.27% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Supportive funding from governments

Supportive government funding plays a crucial role in driving the growth of the mass spectrometry market. Governments often allocate funds to support research and development activities in the healthcare, life sciences, and environmental sectors. Mass spectrometry is a technology that is widely used in these fields for various applications such as proteomics, metabolomics, clinical diagnostics, and environmental testing. Government funding helps researchers and scientists access the necessary resources, equipment, and expertise to advance the capabilities of mass spectrometry and develop innovative applications. Government funding often supports translational research efforts, which aim to bridge the gap between research discoveries and practical applications.

Restraints

Lack of qualified professionals

The mass spectrometry market is having trouble because there aren't enough qualified workers. Mass spectrometry is an intricate and precise analytical technique that necessitates the expertise of professionals with many years of experience. The lack of qualified professionals is a major obstacle to the market's growth. The need for qualified individuals who can comprehend and operate the complex equipment used in mass spectrometry is growing. To solve this problem, mass spectrometry equipment producers and vendors should focus on developing training programs for staff members. Producers should also consider offering workshops and training sessions to aid users in understanding the nuances of the instruments and their applications.

High-end product cost

The high cost of the products is one of the main factors preventing the mass spectrometry market from growing. Many prospective buyers may not be able to afford the high costs associated with high-end mass spectrometry equipment. Additionally, consumables like sample preparation kits cost a lot of money. The costs associated with hiring and retaining the qualified personnel needed to operate and maintain these systems are a significant barrier as well. These factors limit the market's growth by preventing the widespread use of mass spectrometry systems and services.

Opportunities

The growing importance of drug development and discovery

Spending on end-user R&D has increased as a result of the acceleration of disease rates caused by the most prevalent chronic diseases. The mass spectrometer is very useful in the search for new drugs because it provides distinctive and significant information on molecular interactions and protein functions. The increased understanding of the disease process at the molecular level has led to the use of MS in medication discovery and development. The sensitivity and resolution of MS are anticipated to produce greater quality and increase the likelihood of its use in large protein targets due to the rapid development of mass spectrometer methodology.

Component Insights

The instrument segment dominated the market with a 47.30% share in 2024. This segment includes various types of mass spectrometry instruments used for analytical purposes. It encompasses different configurations such as quadrupole mass spectrometers, time-of-flight (TOF) mass spectrometers, ion trap mass spectrometers, magnetic sector mass spectrometers, and hybrid mass spectrometers.

The services segment is expected to grow at the highest CAGR of 10.10% in 2024. The segment comprises accessories and consumables required for operating mass spectrometry instruments. It includes ionization sources (e.g., electrospray ionization, matrix-assisted laser desorption/ionization), sample introduction systems (e.g., autosamplers), chromatography columns (e.g., liquid chromatography columns), calibration standards, sample preparation kits, and other consumables necessary for sample analysis.

Technology Insights

The quadrupole mass spectrometry segment dominated the market with a 28.60% share in 2024. The multiple advantages offered by the technology have boosted its application in the market. Quadrupole liquid chromatography-mass spectrometry offers fast analysis times, making it suitable for high-throughput applications. The technique allows for rapid separation of compounds by liquid chromatography, combined with fast scanning and data acquisition by the mass spectrometer.

The Orbitrap MS segment is expected to grow at the highest CAGR of 9.70% in 2024. The growth of the segment can be attributed to its growing applications in metabolomics and proteomics, along with the innovations in life science technologies. Orbitrap mass spectrometry has applications in many fields, such as food safety, clinical diagnostics, etc.

Application Insights

The pharmaceutical & biotechnology segment is leading the market by holding the largest market share of 36.20% in 2024. The dominance of the segment is owing to the increasing rate of discovery, research, and development-based mass spectrometry activities in the industries. The improving infrastructure at biotechnology and pharmaceutical companies, along with the significant technological advancements, plays a crucial role in the segment's development.

The clinical diagnostics is expected to grow at the highest CAGR of 9.90% in 2024. The growth of the segment is credited to the innovations in technology and the increasing incidence of chronic diseases. Mass spectrometry plays an important role in detecting biomarkers for early disease detection and treatment, leading to further segment growth.

End Use Insights

The pharmaceutical & biotech companies segment held a 33.70% market share in 2024. The dominance of the segment can be linked to the growing demand for biopharmaceuticals, innovations in personalized medicine, and stringent regulatory requirements for drug safety. Also, Pharmaceutical and biotechnology companies are rapidly expanding their R&D spending, driving segment growth soon.

The hospitals & clinical labs segment is expected to grow at the highest CAGR of 9.80% in 2024. The dominance of the segment can be driven by a surge in personalized medicine, growing demand for rapid and accurate diagnostics, and technological advancements. Hospitals are rapidly combining clinical laboratories into their infrastructure, which leads to a greater demand for mass spectrometry equipment.

Mass Spectrometry Market Companies

- BrU.K.er Corporation

- Danaher Corporation

- JEOL Ltd.

- Rigaku Corporation

- Thermo Fisher Scientific, Inc.

- Shimadzu Corporation

- LECO Corporation

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Waters Corporation

- Shimadzu Corporation

Recent Development

- In April 2025, Bruker Announces majority acquisition of RECIPE, a leading provider of mass spectrometry-based diagnostic assay kits for therapeutic drug monitoring. This strategic collaboration immediately enhances Bruker's capabilities in small molecule clinical diagnostic assays with RECIPE's ClinMASS kits for Bruker's EVOQ liquid chromatography triple-quadrupole mass spectrometers, as well as for LC-TQ-MS systems by other vendors.

- In June 2024, Thermo Fisher Scientific announced the release of a new mass spectrometry platform, in addition to several updates to existing products at the American Society for Mass Spectrometry (ASMS) conference in Anaheim.

- In December 2024, Roche announced that it has received CE mark approval for its cobas Mass Spec solution including the cobas i 601 analyser and the first Ionify reagent pack of four assays for steroid hormones2. Matt Sause, CEO of Roche Diagnostics stated “The cobas Mass Spec solution will fundamentally change the field of clinical diagnostics”.

- In December 2024, Roche announced has launched the cobas Mass Spec solution from Roche, a fully automated liquid chromatography-mass spectrometry (LC-MS) system.

- In March 2022, a tabletop tandem mass spectrometer that is extremely sensitive and small was introduced by Waters Corporation as the Xevo TQ Absolute instrument. According to the manufacturer, its most recent mass spectrometer is 45% smaller and uses up to 50% less gas and electricity than its predecessor while being up to 15X more sensitive for assessing negatively ionizing chemicals.

- September 2021, the first net-zero mass spectrometer in the entire globe has been officially launched, according to Thermo Fisher. This product is the first spectrometer created as part of the revolutionary ISOFootprint program to reduce CO2 emissions for more environmentally friendly science.

Segments Covered in the Report

By Technology Type

- Quadrupole Mass Spectrometry

- Single Quadrupole Mass Spectrometry (SQMS)

- Triple Quadrupole Mass Spectrometry (TQMS)

- Time-of-Flight (TOF) MS

- Reflectron TOF

- Orthogonal Acceleration TOF

- Ion Trap MS

- 3D Quadrupole Ion Trap

- Linear Ion Trap

- Orbitrap MS

- Standalone Orbitrap

- Hybrid Orbitrap (e.g., Q Exactive)

- Fourier Transform Ion Cyclotron Resonance Mass Spectrometry (FT-ICR MS)

- 7 Tesla

- 9.4 Tesla

- 12 Tesla

- Hybrid MS Systems

- Quadrupole-TOF (Q-TOF)

- Triple Quadrupole-Linear Ion Trap (QTrap)

- Orbitrap-FTICR

- Others

- Sector Field MS

- Magnetic Sector

By Application

- Pharmaceutical & Biotechnology

- Drug Discovery

- Drug Metabolism & Pharmacokinetics (DMPK)

- Proteomics

- Metabolomics

- Quality Control & Validation

- Clinical Diagnostics

- Newborn Screening

- Therapeutic Drug Monitoring

- Disease Biomarker Discovery

- Toxicology Testing

- Environmental Testing

- Water Quality Testing

- Air Pollution Monitoring

- Soil Contamination Analysis

- Waste Management

- Food & Beverage Testing

- Pesticide Residue Detection

- Nutritional Profiling

- Food Adulteration Testing

- Allergen Detection

- Chemical & Petrochemical

- Polymer Analysis

- Crude Oil Characterization

- Catalyst Efficiency Evaluation

- Additive Detection

- Academic & Research Institutes

- Omics Studies

- Structural Biology

- Bioanalytical Chemistry

- Material Science

- Forensic Science

- Drug Abuse Testing

- Forensic Toxicology

- Explosive Residue Analysis

- Fire Debris Examination

- Material Science & Semiconductors

- Thin Film Analysis

- Surface Contaminant Testing

- Isotope Ratio Analysis

By End User:

- Pharmaceutical & Biotech Companies

- In-house R&D Labs

- Pilot Plants

- GMP Manufacturing Facilities

- Hospitals & Clinical Labs

- Large Multi-specialty Hospitals

- Reference Labs

- Public Health Labs

- Government & Academic Institutions

- National Labs

- University Research Centers

- Defense Research Orgs

- Environmental Agencies

- Pollution Control Boards

- EPA Regional Labs

- Water Testing Facilities

- Food Testing Laboratories

- Private Testing Firms

- Government Food Safety Labs

- ISO-Certified Labs

- Contract Research Organizations (CROs)

- Preclinical Testing CROs

- Analytical Services CROs

- Bioanalytical CROs

- Forensic Laboratories

- Crime Scene Investigation Labs

- Toxicology Labs

- Anti-Doping Centers

- Industrial & Petrochemical

- Refinery QC Labs

- Petrochemical R&D Centers

- Specialty Chemicals Facilities

By Component:

- Instruments

- LC-MS (Liquid Chromatography-MS)

- GC-MS (Gas Chromatography-MS)

- ICP-MS (Inductively Coupled Plasma-MS)

- MALDI-TOF MS

- CE-MS (Capillary Electrophoresis-MS)

- Software

- Instrument Control Software

- Data Analysis Software

- Cloud Integration Platforms

- AI/ML-Based Interpretation Tools

- Consumables & Accessories

- Ion Sources

- Sample Prep Kits

- MS Columns

- Calibration Standards

- Services

- Installation & Validation

- Preventive Maintenance

- Remote Monitoring

- Application Training & Consulting

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344