September 2024

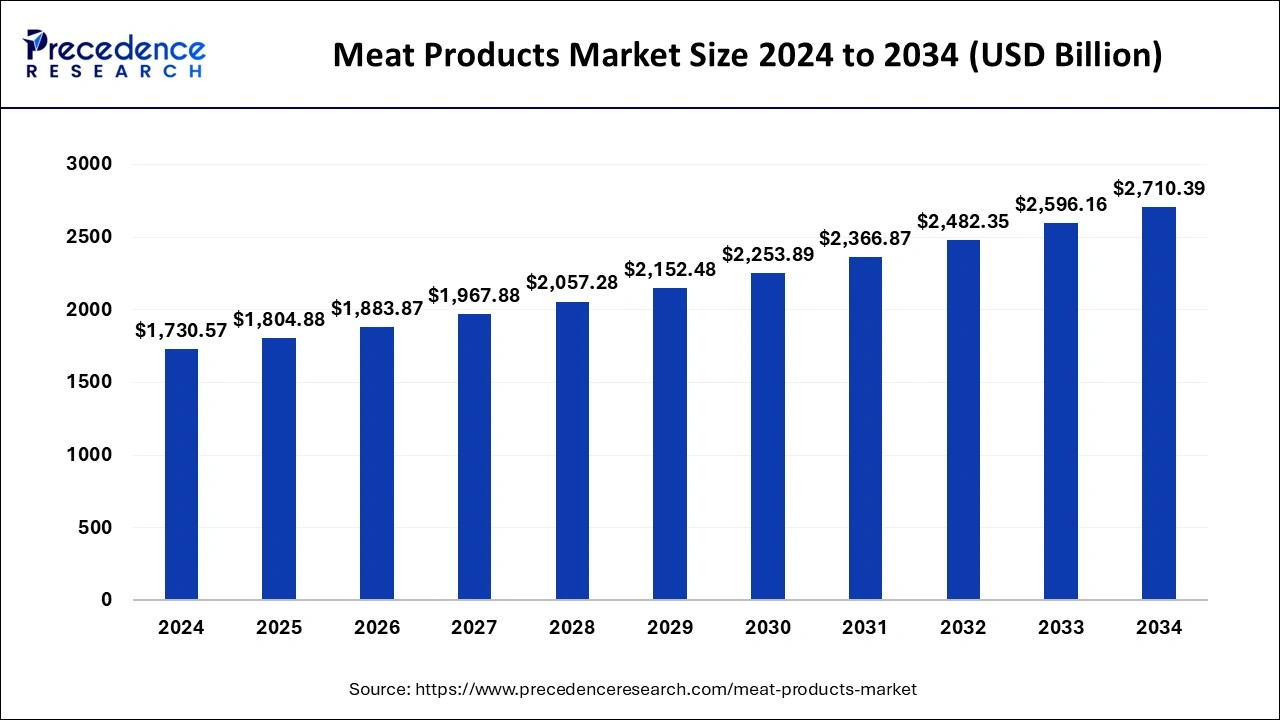

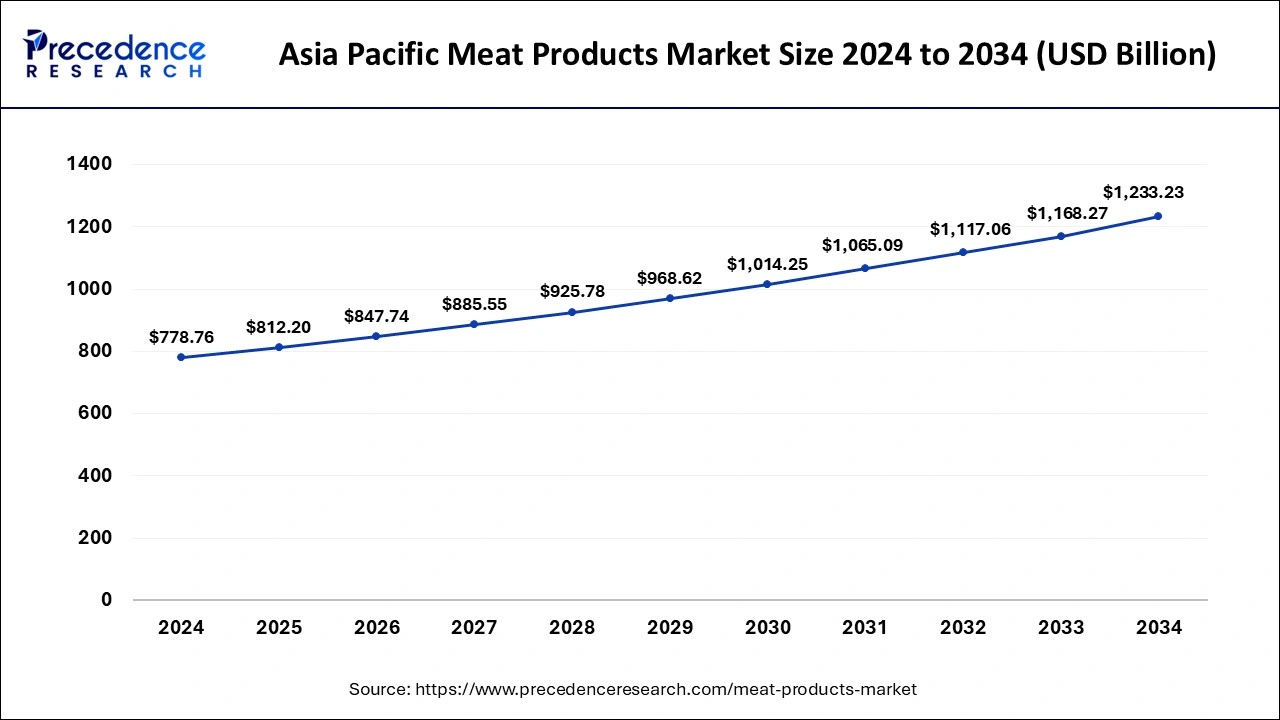

The global meat products market size is estimated at USD 1,804.88 billion in 2025 and is predicted to reach around USD 2,710.39 billion by 2034, accelerating at a CAGR of 4.59% from 2025 to 2034. The Asia Pacific meat products market size surpassed USD 812.20 billion in 2025 and is expanding at a CAGR of 4.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global meat products market size was exhibited at USD 1,730.57 billion in 2024 and is projected to hit around USD 2,710.39 billion by 2034, growing at a CAGR of 4.59% from 2025 to 2034.

The Asia Pacific meat products market size was estimated at USD 778.76 billion in 2024 and is anticipated to reach around USD 1,233.23 billion by 2034, growing at a CAGR of 4.70% from 2025 to 2034.

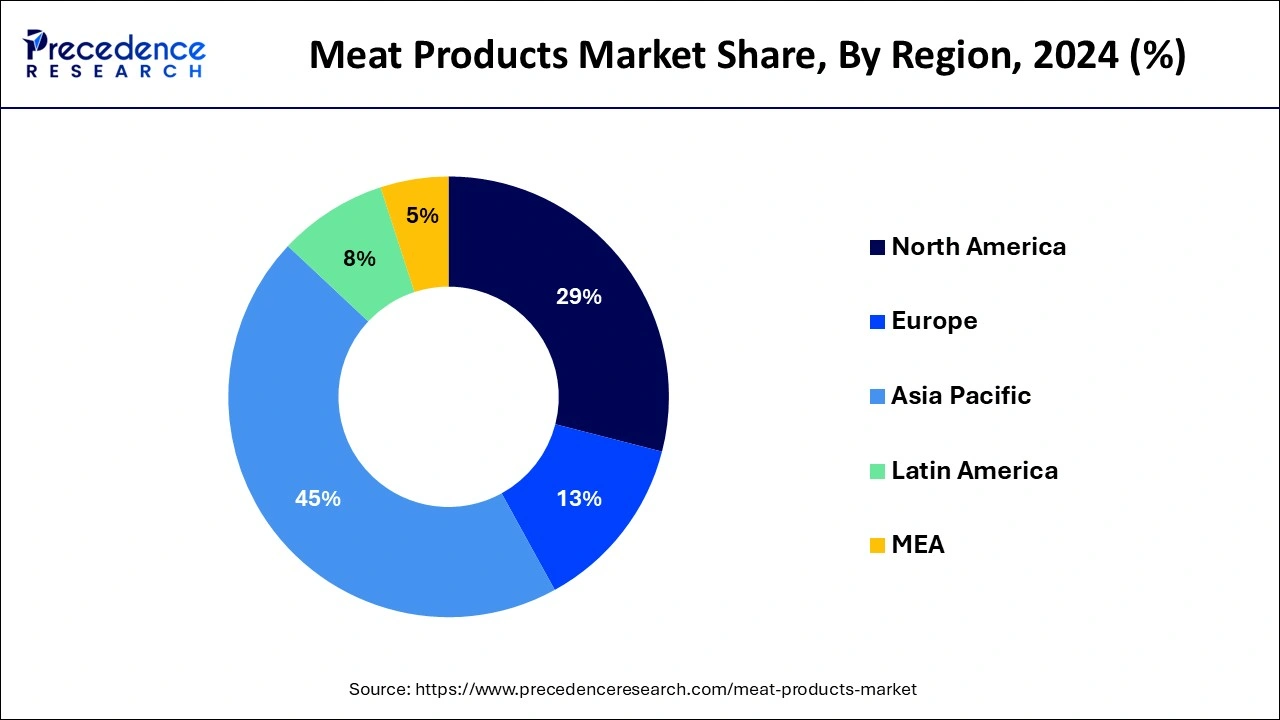

Asia Pacific held the dominating share of the meat products market in 2024. The rising popularity for meat food products across the region is observed to act as a growth factor for the market in the upcoming period. Governments and private stakeholders in the region have made significant investments in meat production, processing facilities, and distribution networks to meet growing demand. This infrastructure development supports efficient supply chains and ensures adequate availability of meat products in the market. Rapid urbanization in Asia Pacific has led to a rise in convenience-oriented lifestyles, with busy urban dwellers preferring ready-to-eat or easy-to-prepare meat products. This has spurred demand for processed and packaged meat items, such as sausages, deli meats, and pre-marinated cuts.

Meat products are fresh or cooked meat manufactured entirely or partially from any meat or other piece of the carcass of any cattle, sheep, pigs, goats, or other animals. Meat products are primarily accessible in the form of processed meat or fresh meat. Cultured meat and plant-based meat are further types of meat products. Cultured meat, often known as clean meat, is grown in a bioreactor under controlled circumstances. Cultured meat is created from cells extracted directly from animal tissues to match the sensory and nutritional qualities of traditional meat.

Meat is termed processed when it is preserved by smoking, salting, fermenting, or adding any chemical to increase its shelf-life and improve its flavor. Meats including beef, hog, turkey, chicken, and lamb are frequently used to make processed meat. Pepperoni, jerky, hot dogs, and sausages are all types of processed meat items. Meat is treated with preservatives to keep it from rotting owing to germs and other organisms.

Deli meat is the most prevalent sort of processed meat. Pre-cooked or ready-to-eat meat items supplied fresh in a restaurant or deli food service are referred to as deli meat. Deli meat is made from beef, pork, chicken, turkey, veal, and ovine. Deli meat is offered in hypermarkets/supermarkets, specialty stores, and other retail channels as cold cuts or vacuum-packed sliced meats. Deli meat is offered on sandwiches and charcuterie plates at the deli food service. There are two varieties of deli meats: cured deli meats and uncured deli meats. To give deli meats a particular flavor and taste, they are infused with spices, salt, and flavorings.

The significant factors which are leading to the growth of the meat products market are the increase in demand for ready-to-eat/ready-to-cook food products, a surge in demand for animal protein, and others. These significant factors are driving the growth of the meat products market.

| Report Coverage | Details |

| Market Size in 2025 | USD 1,660.64 Billion |

| Market Size by 2034 | USD 2,596.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Source, By Product Type, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rapid urbanization and migration to urban areas - An increase in urbanization drives the demand for processed meat globally. The fast-food chains, cafes, and popular hotels are limited to major cities and towns. These fast-food chains and cafes play a significant role in the sales of meat products. According to the United Nations, 60% of the global population is expected to live in urban areas by 2030, increasing from 55% in 2018. This provides a lucrative opportunity for processed meat vendors to boost their revenue due to a rise in the prospected customer base.

According to United Nations, North America was the most urbanized market in 2020, with around 82% of its population residing in urban cities. North America was followed by Latin America and the Caribbean (81%) and Europe (74%). Africa and Asia have the lowest level of urbanization with 43% and 50% of the population living in urban areas respectively. Africa and Asia, therefore are expected to provide significant development opportunities for the growth of the meat products market in the upcoming years.

The surge in demand for animal protein - Protein is a source of amino acids, and adequate protein intake is critical for maintaining the health and development of muscles. Animal proteins are complete proteins as they contain all the essential amino acids required in a complete meal. Animal protein is linked with nutritional benefits and assists in lowering the risk of type 2 diabetes, lowering the risk of heart diseases and maintaining body weight. Awareness regarding the nutritional benefits of animal proteins is increasing among the global population and especially health-conscious consumers, therefore increasing the consumption of animal protein.

The higher availability of animal protein in the market due to increased livestock farming complemented by cost-effective pricing by manufacturers is encouraging them to opt for animal protein products. Moreover, the surge in the need for animal protein is boosting meat product manufacturers, as they are capitalizing on the opportunity by creating specialized meat products with added nutrients to meet market demand.

Presence of nitrates and nitrites in processed meat - Cooked processed meat is a ready-to-eat poultry product. The majority of processed meats are cured meats with added chemical additives to extend the shelf life and inhibit the growth of microorganisms. A single serving of cured meat contains 500 mcg of nitrates. Potassium nitrate and sodium nitrite are the most commonly used curing agents, and they assist in maintaining the redness and colour of the meat. Nitrates in the meat change into nitric oxide in the body. Nitric oxide dilates the blood vessel and lowers blood pressure.

According to the American Journal of Clinical Nutrition, nitrate is a potential producer of carcinogenic nitrosamines; nitrosamines are produced when cured meat products are heated to high temperatures over 266°F or 130°C, such as frying or grilling the meat. Nitrosamines are linked to oesophageal cancer, gastric cancer, colorectal cancer, and cardiac issues.

Owing to the potential health risks associated with deli meat, its consumption has reduced drastically. As a result, customers have shifted their preference from cured meat products to fresh cuts of meat that are devoid of curing agents and additives. Thus, all these factors have restrained the growth of the global market.

The meat industry is vulnerable to infectious diseases - There are various diseases associated with meat that is well recognized among meat industry players and the general public or consumers. Several diseases include E. Coli from beef, bovine spongiform encephalitis (BSV) from cattle/beef, salmonella from poultry, trichinosis from pork, and scrapie from mutton or lamb. Recently African swine fever has spread into East Asia which has impacted adversely pork meat production.

The decline in pork meat resulted in an increased demand for other meat resulting in a price hike of other meats. China was the most impacted market due to African swine fever, and it tried to meet the demand for pork meat by importing pork. Therefore, the sales and production both ridiculously deteriorate causing a temporary but huge impact on the meat market, with the outbreak of these meat-associated viruses and infectious diseases. Hence, the vulnerability of meat to infectious diseases hinders the growth of the meat products market.

To make the most of the opportunity vendors are advised to focus on growth prospects in the fastest-growing segments, while being rigid in the slow-growing segment.

On the basis of source, meat products are segmented into poultry, beef, pork, mutton, sheep, goats, birds, and others. The pork segment has gained a major share of the global market. Pork has a unique taste with a crisp texture and contains nutritional benefits. This is attributed to the fact that consumers are attracted to the taste and prefer to consume pork meat more than other alternatives available in the market.

On the basis of product type, meat products are segmented into processed meat, cultured meat, plant-based meat, chilled, frozen, and canned/preserved. The processed meat segment has gained a major share of the global market. Processed meat has a longer shelf life and is consumed on the move. In addition, processed meat is gaining popularity due to the convenience offered, as they save time and cooked processed meat does not require any additional heating before consumption.

On the basis of distribution channels, it is divided into business-to-business and business-to-consumer. Business-to-consumer is the fastest growing segment as the popularity of specialty stores is increasing due to their unique offering to the consumer based on their need.

By Source

By Product Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

February 2025

August 2024

August 2024