September 2024

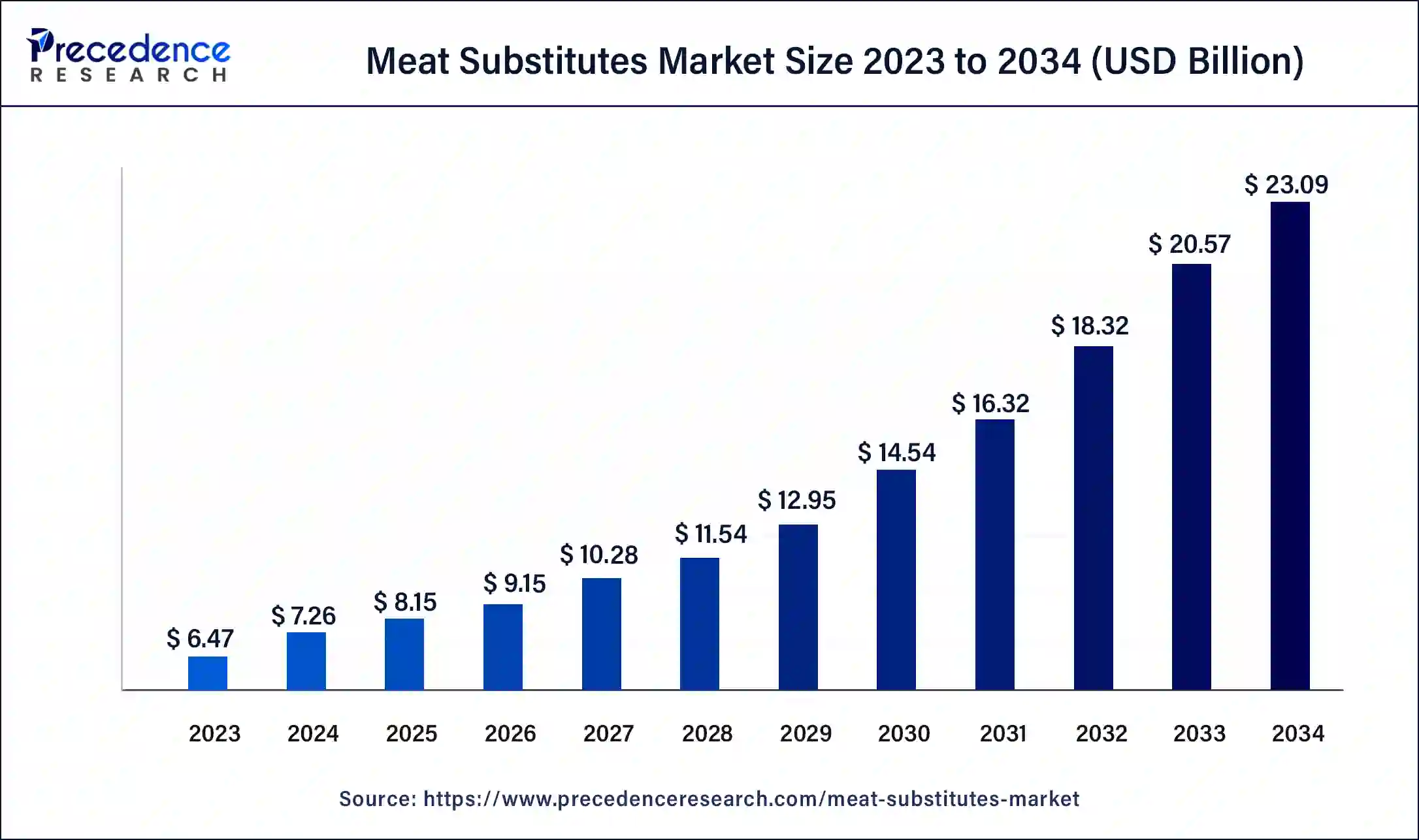

The global meat substitutes market size surpassed USD 6.47 billion in 2023 and is estimated to increase from USD 7.26 billion in 2024 to approximately USD 23.09 billion by 2034. It is projected to grow at a CAGR of 12.26% from 2024 to 2034.

The global meat substitutes market size is projected to be worth around USD 23.09 billion by 2034 from USD 7.26 billion in 2024, at a CAGR of 12.26% from 2024 to 2034. The ongoing criticisms regarding animal farming are increasing the demand for meat substitutes, fueling the market growth.

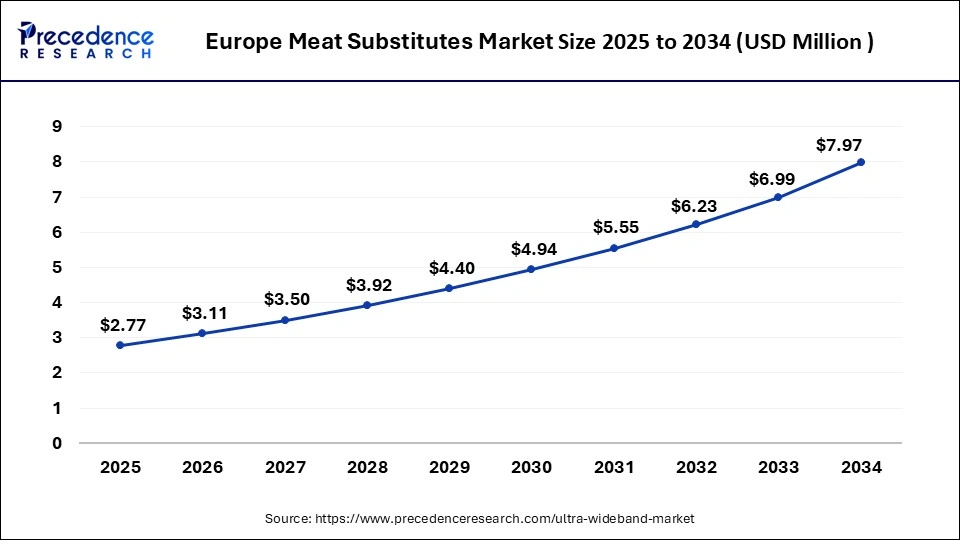

Europe Meat Substitutes Market Size and Growth 2024 to 2034

The Europe meat substitutes market size was exhibited at USD 2.20 billion in 2023 and is projected to be worth around USD 7.97 billion by 2034, poised to grow at a CAGR of 12.41% from 2024 to 2034.

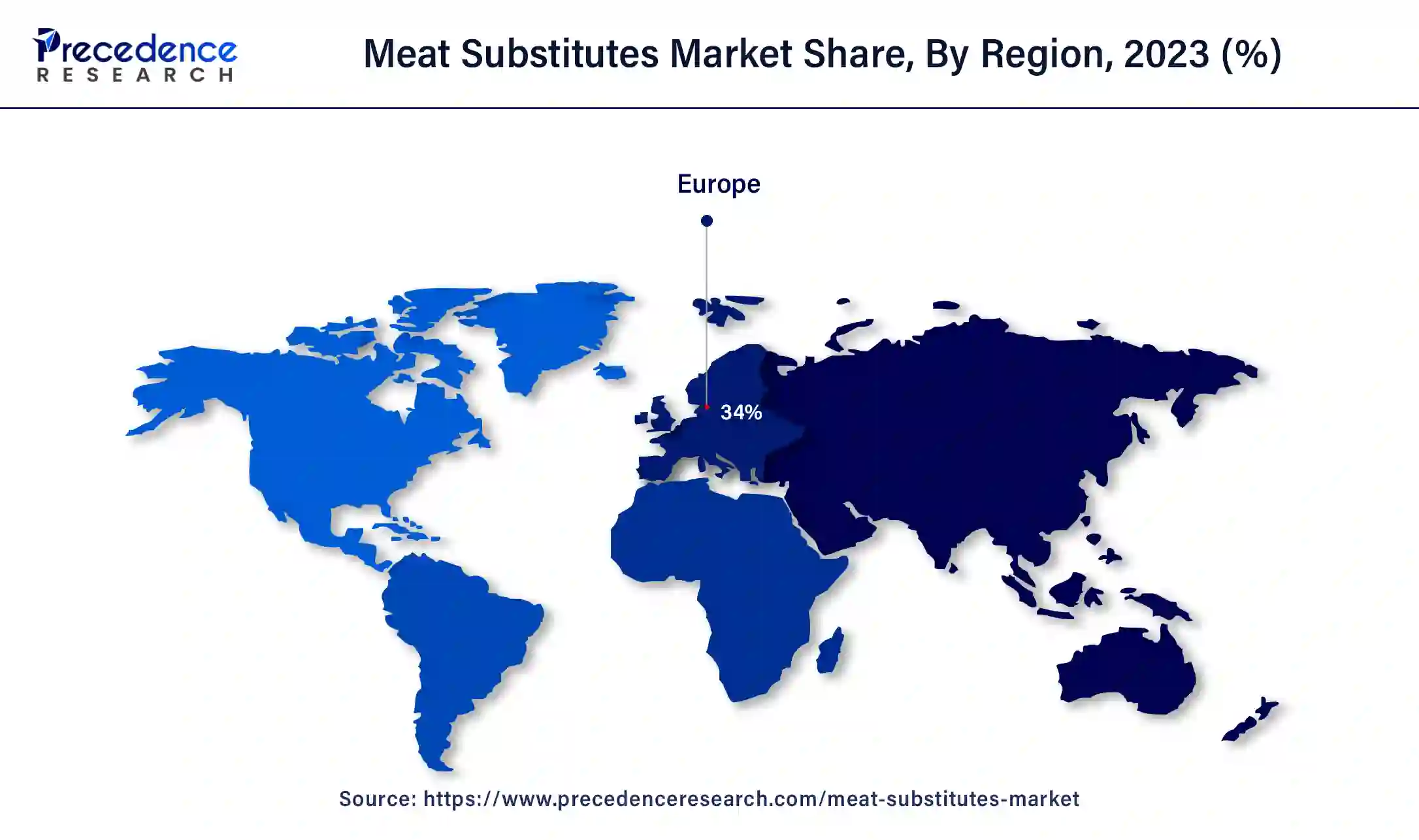

Europe dominated the global meat substitutes market in 2023. The growth of the region is attributed to increasing consumer preferences, especially among the youth and adults. This population is widely adopting sustainable options due to increasing awareness through campaigns and educational programs. The governments are also encouraging the use of meat alternatives which can help in reducing the GHG effect. This opens many opportunities for companies to target countries like Germany to mark their significance in the market.

North America holds a significant share of the global meat substitutes market. The population in countries like the United States and Canada are becoming health conscious regarding the consumption of meat. The region has access to advanced technologies like machines, which help in the production of these products. This increases the availability of meat substitutes in the region, which also increases the trade opportunity for other regions. This increasing connectivity is driving the growth of the region's market.

Asia Pacific is expected to register the fastest growth in the meat substitutes market during the forecast period. The increasing product diversification in countries like China and Japan is one of the major growth factors for the region. An increasing number of social media users are also adopting the vegan trend which can reduce the environmental impact and animal farming. The government in countries like India are also bound to promote sustainability which increases the opportunities in the region.

Meat substitutes, also known as plant-based meat, are an alternative to meat made using vegan or vegetarian ingredients. They are called replicas of meat because they use the same texture, taste, and appearance, providing the same nutritional value as meats. Some commonly used substitutes for meats are plant-based meats like tofu, which are normally added to meals with burgers and sausages.

There are meat substitutes made from white gluten, like seitan, which are used in vegetarian dishes. Mushroom-based meats like portobello and others are also known for their meat-like structure. The meat substitutes market is witnessing rapid growth due to multiple factors like increasing concerns regarding meat consumption, which is affecting the environment due to the release of greenhouse gases, which also leads to climate change.

What is the Role of AI in the Meat Substitutes Market?

The emergence of technologies like artificial intelligence (AI) is playing a vital role in the development of many sectors, including food technology. The main benefit of AI is that it can analyze multiple datasets, which helps enhance the overall production of meat alternatives. AI plays a vital role in optimizing plant-based ingredients, which can help maintain the supply of materials. It can also help formulate food products that maintain the balance between taste, texture, and nutritional values. Many companies, knowing its worth, are using AI to make significant progress in the meat substitutes market.

| Report Coverage | Details |

| Market Size by 2034 | USD 23.09 Billion |

| Market Size in 2023 | USD 6.47 Billion |

| Market Size in 2024 | USD 7.26 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 23.09% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Source, Distribution, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising environmental concerns

The rapid increase in overall lifestyles, especially in urbanization and industrialization, has raised many concerns related to the environment, which include animal farming. The increasing meat consumption can lead to many issues like climate change, deforestation, and many more, which tend to affect quality of life. Many reports also stated that the impact of meat production could also affect the water bodies due to the waste emitted from the production. The increasing awareness regarding these issues educates people, and they tend to prefer sustainable and environment-friendly options. As a result, many companies are trying to produce an alternative that won't affect the taste and nutritional value of the food.

Nutritional benefits of meat substitutes

The meat substitutes especially tend to offer more nutritional benefits while protecting the environment. The increasing market competition is leading towards the launching of premium food products that can provide additional benefits compared to meats like low saturated fat, rich in fiber, low in cholesterol, and many more. However, many people not only look towards the nutritional benefits, but some people also try to consider the environmental factor. Plant-based proteins are considered to help the growth of the meat substitutes market.

An article published by CBS News stated that Canadian researchers find that plant-based meat alternatives are healthier than traditional meat, which helps improve heart disease risk factors like cholesterol, blood pressure, and body weight.

Higher costs of meat substitutes

The meat substitutes market has seen significant growth over the past few years, but there are still some concerns that tend to restrict the market growth. The production process of meat substitutes requires special ingredients, which are slightly higher in cost; this also affects the overall costs of the products. Many companies are using extra ingredients like flavors to enhance the overall taste of these food products; this also increases the overall prices. These products cannot be affordable for people with low incomes. Therefore, to tackle this issue, many companies are trying to increase production in many setups, which may help in tackling the issue and increase the growth rate of the meat substitutes market.

Increasing research and development (R&D)

The rapid shift towards the adoption of meat substitutes brings many challenges and opportunities for the market players due to the competitive business environment. These companies are primarily investing heavily in coming up with solutions like improving the texture and taste of the food product. These companies study consumer patterns and try to replicate the product to meats. Increasing the R&D enables the company to make innovations that could potentially benefit them. The increasing competition in the market also leads to R&D, which takes effort to minimize product costs so that it could be more significant in the meat substitutes market.

Increasing emphasis on sustainability

The world is facing many environmental issues like climate change, global warming, and many more. This has forced many changes in multiple industries, including food and technology. Governments and organizations are constantly promoting sustainability, which includes the production of meat substitutes. These initiatives are leading towards the adoption of these products, which will help reduce the greenhouse gas effect and increase the quality of life. Governments are also promoting the use of meat alternatives that have sustainable production procedures and it also provides nutritional benefits. This is one of the hot trending topics that is attracting multiple investments and can boost the growth of the meat substitutes market.

The plant-based protein segment held the largest share of the meat substitutes market in 2023. These are derived from sources like peas, soy, chickpeas, and many more, which are widely used in protein products and meat alternatives. The existence of these products in meals has been widely increasing in the past few years due to the global trend of ‘veganism.’ This trend has been influencing many individuals to adopt a vegan lifestyle, which eliminates all the food sources derived from animals.

This trend has played a vital role in the development of multiple food options as meat alternatives. Plant-based proteins are known for their nutritional benefits. Although they are derived from plants, they also offer additional benefits like vitamins, essential amino acids, etc. Many reports also stated that women's use of plant-based proteins can help increase their life expectancy. The growth of this segment is attributed to these unique factors, which also help the market grow.

The mycoprotein segment is expected to grow at the fastest CAGR in the meat substitutes market from 2024 to 2033. These proteins are derived from fungi, which are produced through a process called fermentation. The mycoprotein segment is gaining significant popularity due to its richness in providing nutritional benefits. It also has a meat-like texture, which is the reason it is getting popular among meat consumers. The production process of mycoprotein is highly sustainable, which drives more investments and initiatives to scale its production.

The retail segment accounted for the largest share of the meat substitutes market in 2023. The growth of this segment is attributed to the established customer base of retail channels like hypermarkets, supermarkets, grocery stores, and others. These stores are well-known for selling homemade groceries, and they have also gained their attraction towards these products.

Additionally, the increasing shift towards sustainability leads to increasing promotion and advertisement of these products among consumers. As a result of increasing demand, many other companies are focusing on developing meat alternatives while reducing overall costs. Additionally, the emergence of online grocery platforms like Zepto, Blinkit, and many others is contributing to the growth of the market as they have tie-ups with local grocery stores, which leads to increasing sales of these products.

The European supermarkets are being urged to adopt targets for 60% plant-based protein. The region aims to reduce its environmental impact and align with global health recommendations.

The food service segment is expected to register the fastest growth in the meat substitutes market during the forecast period 2024 to 2034. It includes distribution through restaurants, cafes, and food chains that provide readymade food in offline and online formats. The increasing tourism, especially in North American and European countries, plays a key role in the growth of meat substitutes in the region.

The consumer preference for dine-out has increased, especially after 2021. Studying the market demand, food chains and restaurants are focusing on providing unique menus to the people, which include taste and nutrition in them. Additionally, the increasing partnerships between restaurants and online food delivery platforms increase the demand for meat alternative dishes in the market. These constant technological adoptions are driving the growth of the market.

Segments Covered in the Report

By Source

By Distribution

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

February 2025

August 2024