January 2025

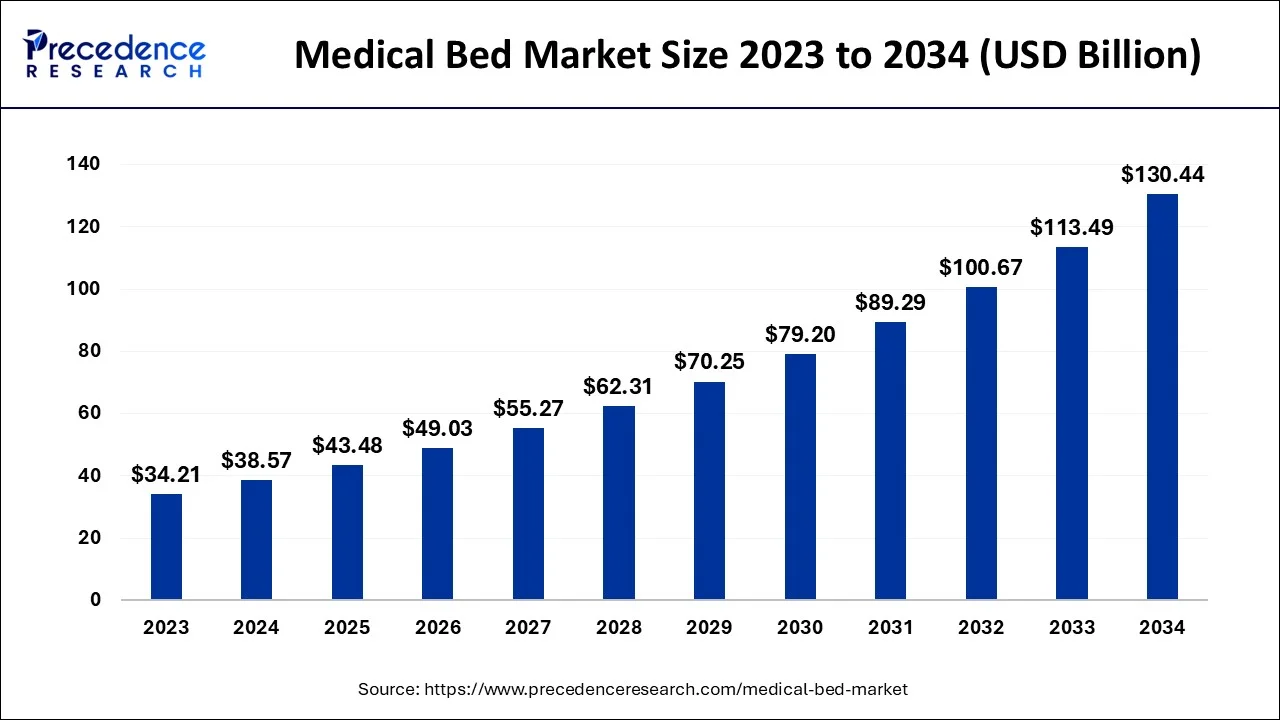

The global medical bed market size accounted for USD 4.95 billion in 2024, grew to USD 5.29 billion in 2025 and is predicted to surpass around USD 9.50 billion by 2034, representing a healthy CAGR of 6.73% between 2024 and 2034. The North America medical bed market size is calculated at USD 2.43 billion in 2024 and is expected to grow at a fastest CAGR of 6.92% during the forecast year.

The global medical bed market size is estimated at USD 4.95 billion in 2024 and is anticipated to reach around USD 9.50 billion by 2034, expanding at a CAGR of 6.73% from 2024 to 2034.

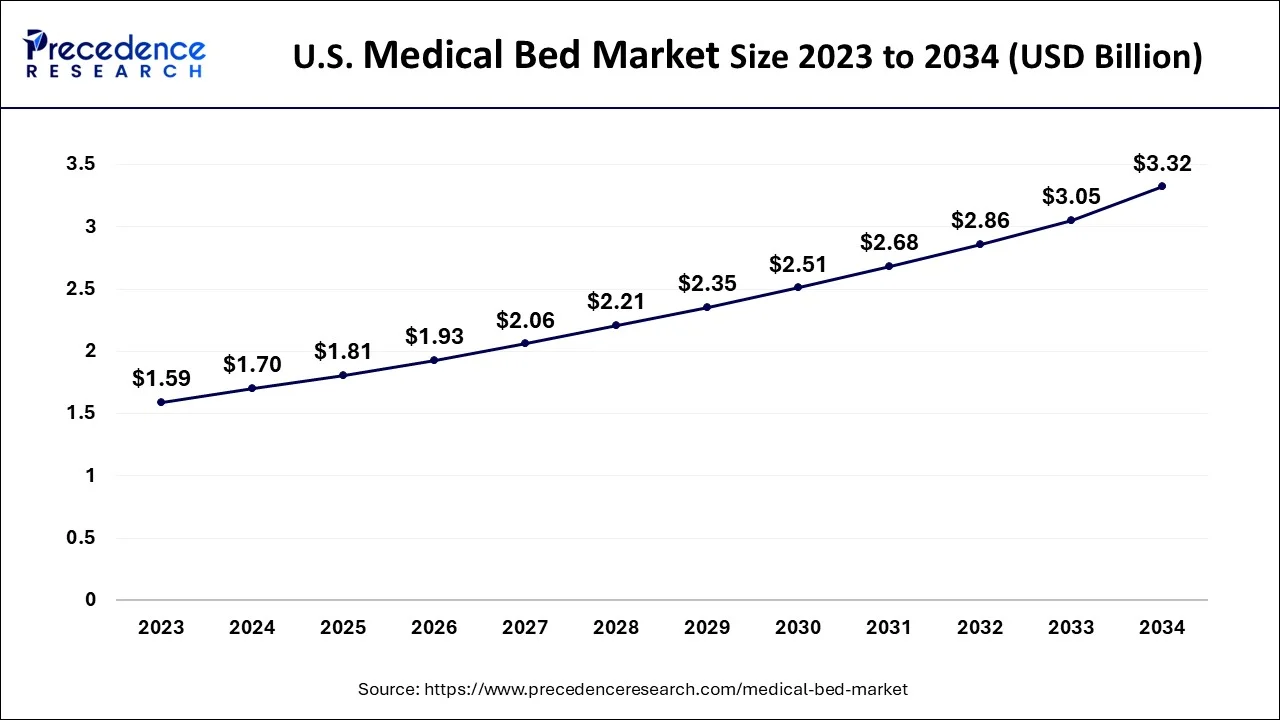

The U.S. medical bed market size is estimated at USD 1.70 billion in 2024 and is expected to be worth around USD 3.32 billion by 2034, rising at a CAGR of 6.92% from 2024 to 2034.

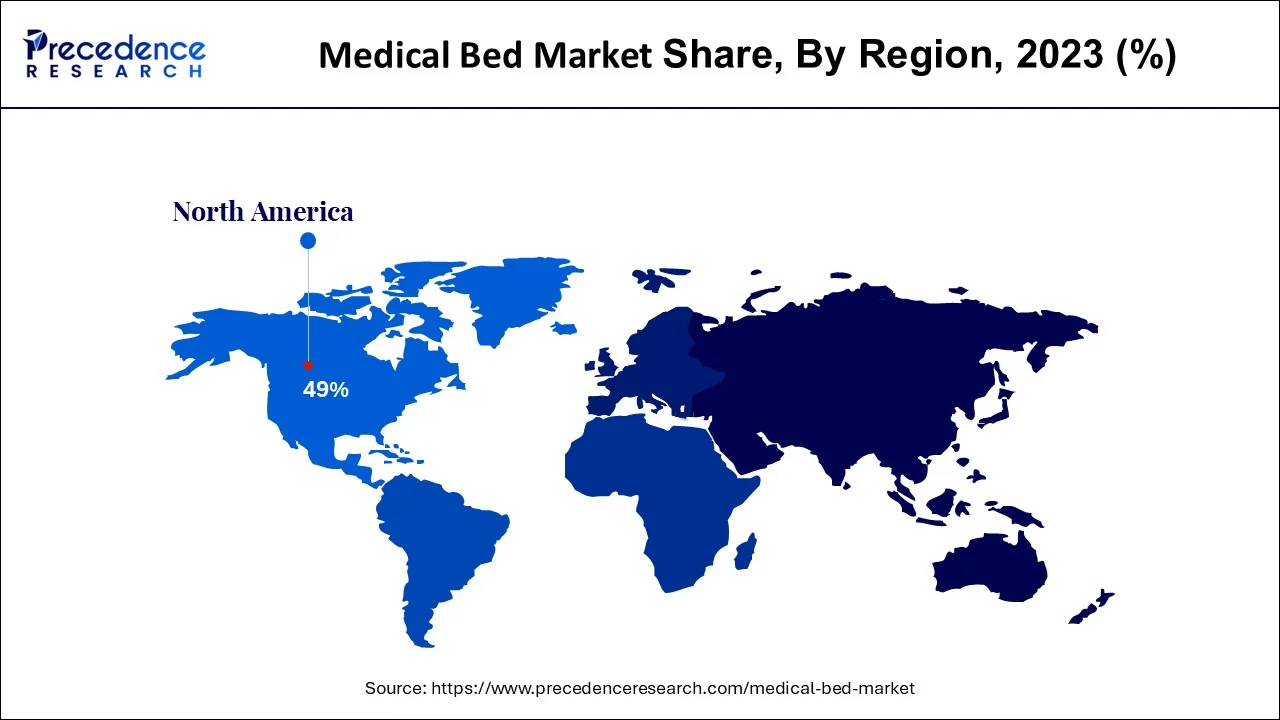

Over the course of the projection, North America is anticipated to hold a sizable portion of the market. The existence of major market participants, the rising incidence of diabetes, and the well-established healthcare infrastructure are all factors in the market expansion. In addition, it is projected that the region's rising incidence of cancer and other chronic illnesses would spur market expansion. In the United States, there were 1,762,450 new cases of cancer in 2019, according to the National Institute for Health. Because of the region's growing number of hospitals and rising healthcare infrastructure, the Asia-Pacific is expected to experience significant market expansion. Additionally, it is projected that rising hospitalization rates and the burden of sickness in developing nations would promote market expansion.

The highest market share for hospital beds worldwide is held by Europe. Germany has the most hospital beds among the EU members, along with significant income and expansion. Germany has the most ICU beds, according to the most recent OECD 2020 statistics. Germany had 28,000 intensive care beds when the epidemic began, which is higher than most of its neighbors. As of April 18, 2020, 12,336 ICU beds or 41% of the country's total capacity remained unoccupied during the first SARS-CoV-2 pandemic wave. The German government prioritized primary and secondary prevention in order to deal with this health problem, and as a tertiary preventative step, more beds were added to the ICU's current capacity. As of April 27, 2020, the German government added 7,000 beds. With the increase in operations, particularly cardiac, orthopedic, and trauma surgery, the UK hospital bed market is anticipated to expand.

Medical beds, which range from manually controlled to fully electric, guarantee the patients' comfort while also having cutting-edge features. Additionally, it is projected that the market would rise as a result of healthcare providers' increasing expenditures on hospital infrastructure and patients' access to affordable treatment worldwide. The market is anticipated to increase as a result of factors like the expanding geriatric population and the prevalence of chronic illnesses worldwide. Over the projected period, the market for medical beds is expected to expand at a CAGR of almost 5.8%.

Furthermore, throughout the course of the forecast period, the market is anticipated to rise as a result of technical advancements, the adoption of medical beds, and an increase in the number of hospitals. However, it is projected that the market expansion would be hampered by the high cost of medical beds and a decline in the number of beds in public hospitals.

Medical beds are the equipment used in hospitals for patients who are bedridden or in need of care. Medical beds make it easier to transfer patients, improve patient placement, and reduce the chance that they may roll out of bed.

Patient beds known as manual medical beds are those that can be adjusted manually for the comfort of the patient. Manual medical beds are predicted to support the segment's growth throughout the forecast period because they are less likely to have a motor failure, are less expensive, and have simple operating mechanisms. Due to rising expenditures on hospital infrastructure and an increase in the number of organized hospitals throughout the world, the electric bed market is predicted to develop at a substantial rate.

According to the World Population Ageing Report, the proportion of elder people worldwide, which was about 89.3% in 2020, may rise to 16% by 2050. Furthermore, it is predicted that the market would increase during the forecast period due to the rising elderly population and lifestyle illnesses that require medical beds for better treatment and comfort.

According to the end user, the homecare sector is expected to see rapid market expansion due to the use of medical beds in homecare settings and the rising number of diabetes patients worldwide.

| Report Coverage | Details |

| Market Size in 2024 | USD 4.95 Billion |

| Market Size by 2034 | USD 9.50 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Semi-electric, electric, and manual medical beds are the three main types available on the market today. According to estimates, the electric bed market would see the greatest CAGR between 2024 and 2034. Electric beds are rapidly expanding in popularity. Additionally, these beds provide a remote-controlled therapeutic massage option for patients who are confined to their beds. This function promotes blood flow and guards against bedsores and joint discomfort. The functionality is activated by default in the mattress. Additionally, neither the patients nor the caretakers need to worry about losing support in the middle of the night or make frequent modifications. The M9 set of beds from Taranaki-based medical bed manufacturer Howard Wright was bought by Hwera Hospital in August 2022.

These beds allowed medical workers to provide patients with greater comfort without having to elevate them. The complete electric controls on the M9 beds allow for full height and position adjustment. Other electric hospital beds on the market include the Zenith9100, the Invacare Full-Electric Homecare Bed, and the DELTA 4 series.

These beds allowed medical workers to provide patients with greater comfort without having to elevate them. The complete electric controls on the M9 beds allow for full height and position adjustment. Other electric hospital beds on the market include the Zenith9100, the Invacare Full-Electric Homecare Bed, and the DELTA 4 series. The Global Cancer Observatory estimates that 19.3 million new cancer cases will be diagnosed globally in 2020, indicating an increase in the incidence of the disease worldwide. Due to its ability to improve nurse workflow efficiency and shorten total in-patient stays, smart hospital beds are predicted to continue to be in high demand.

From 2024 to 2034, the outpatient clinics market is anticipated to grow at a revenue-based CAGR of 7.3%. The expansions of primary healthcare institutions and, as a result, their predominance in rural areas throughout Asia, Africa, and South America have been directly related to improvements in healthcare standards in these nations. The primary diagnostic and first point of care for patients worldwide is provided via outpatient clinics. In addition, the incidence of acute illnesses like the flu, fevers, and bronchitis has been a major role in encouraging people all over the world to visit outpatient clinics. The World Health Organization (WHO) reports that the number of outpatient interactions per person in Europe ranged from 1.9 to 13.1 in 2011 before peaking at 2.6 to 13.5 in 2018.

By Type

By Application

By Usage

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025