January 2025

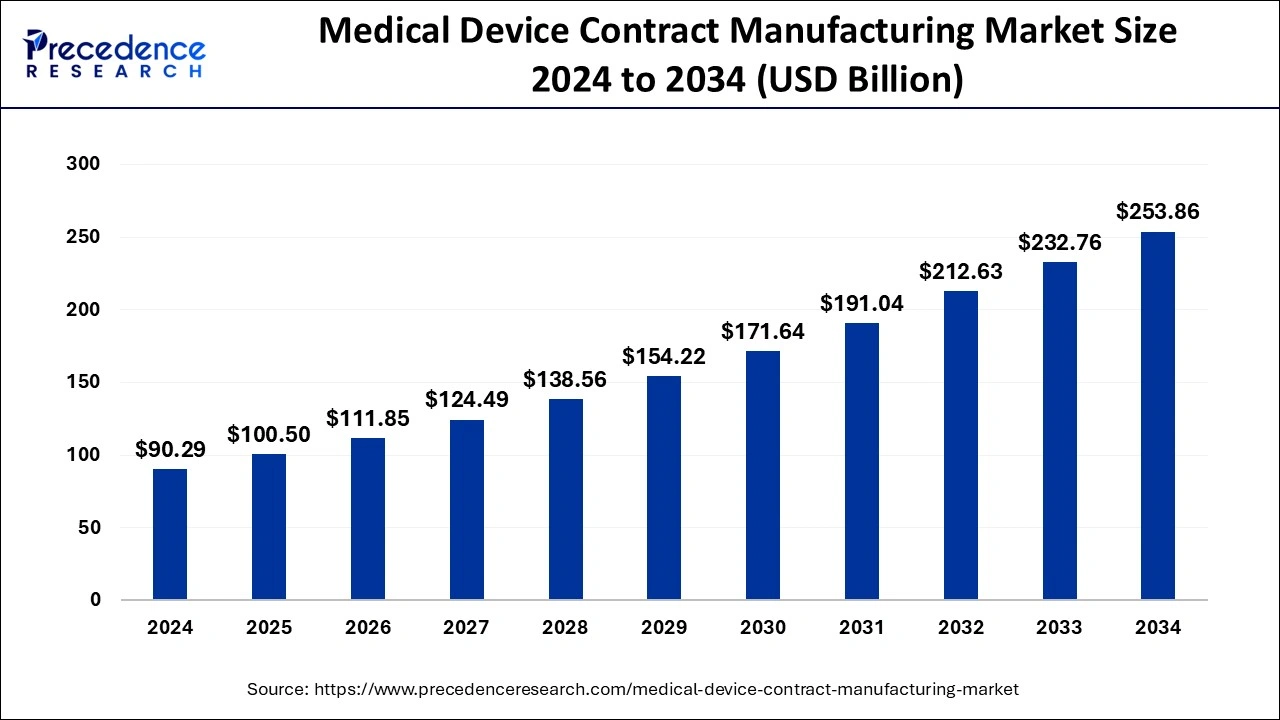

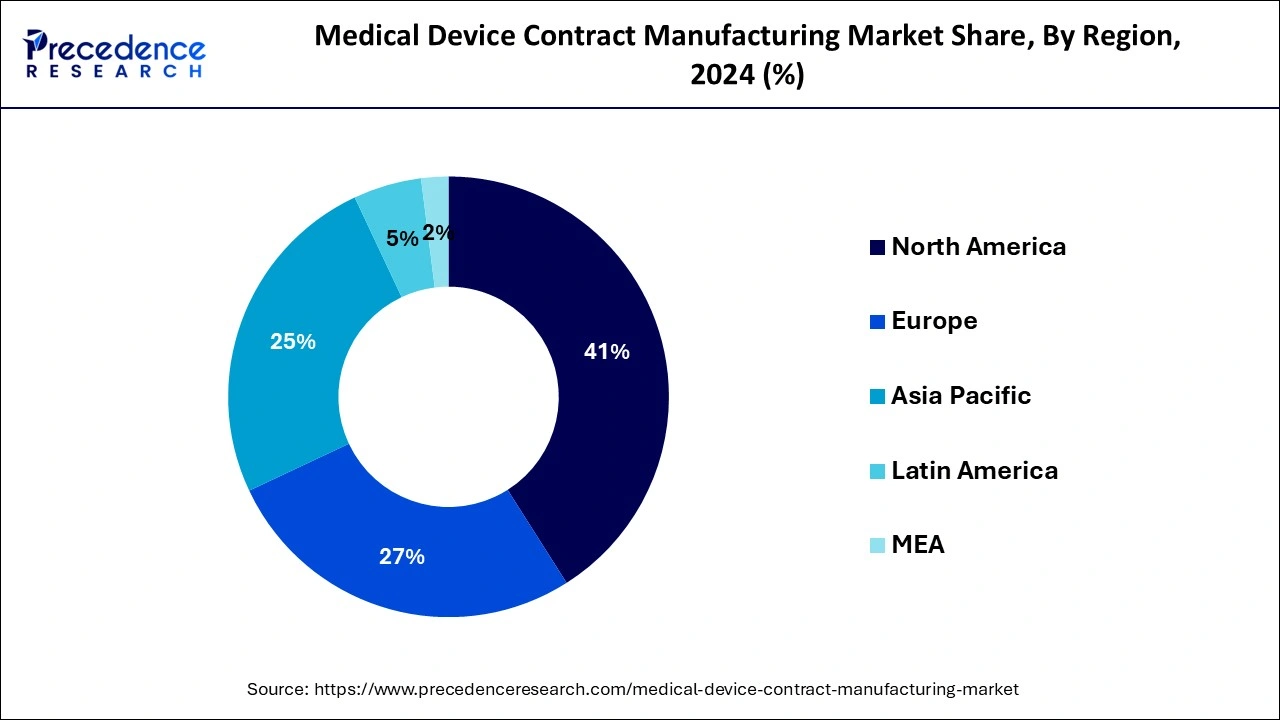

The global medical device contract manufacturing market size is estimated at USD 100.50 billion in 2025 and is anticipated to reach around USD 253.86 billion by 2034. The North America medical device contract manufacturing market size accounted for USD 41.21 billion in 2025 and is expanding at a CAGR of 10.92% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year. expanding at a CAGR of 10.89% from 2024 to 2034.

The global medical device contract manufacturing market size accounted for USD 90.29 billion in 2024 and is predicted to reach around USD 253.86 billion by 2034, growing at a CAGR of 10.89% from 2025 to 2034. Rising prevalence of non-invasive surgical procedure are propelling the demand for medical devices and medical device contract manufacturing market across the world.

Integration of artificial intelligence (AI) in medical device contract manufacturing is changing the landscape of the industry. With AI and Internet of Things (IoT) technology combination is helping real-time data tracking and analysis with improved connectivity is possible. There is a rise in demand for personalized and customized medicine, which is easily doable with AI. An AI based program can help manufacture customized and personalized needs specifically tailored for individual patients. This caters to patients that have a requirement of personalized devices. Combining AI and machine learning (ML) will boost the efficiency in manufacturing and improve performance of the medical device, It helps in reducing downtime, aids in quality control and identifies any defects during manufacturing process itself. AI can enhance productivity and efficiency that will help the growth of medical device contract manufacturing market.

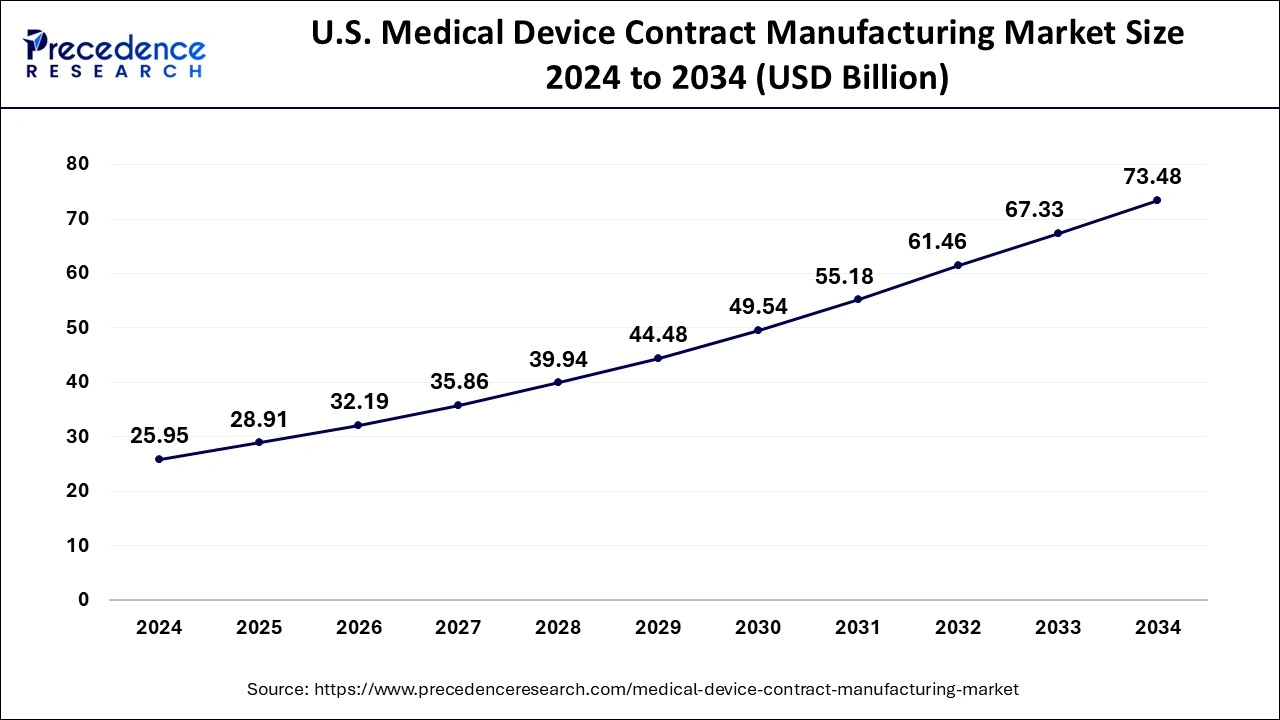

The U.S. medical device contract manufacturing market size was valued at USD 25.95 billion in 2024 and is expected to be worth around USD 73.48 billion by 2034, poised to grow at a CAGR of 11% from 2025 to 2034.

Currently North America leads the global medical device contract manufacturing market closely followed by Asia Pacific region. The growth of North America region is mainly driven by increasing in-house manufacturing costs that encourages medical device companies to adopt contract manufacturing as cost-cutting measures. Further, presence of leading medical device players is expected to drive the U.S.medical device contract manufacturing market.

Low labor cost. Increasing aging population in Japan, growing access to healthcare facilities in India is estimated to be major driving factor in Asia Pacific region. The Asia Pacific region is predicted to overtake the North America region by late of 2024

Growing investments in health care especially in Africa and improvement of health care infrastructure across MEA is expected to open up massive opportunities for market players in coming years.

Activity in the global medical device contract manufacturing market is driven by growing pressure on OEMs for medical devices to reduce manufacturing costs. In addition, macro-economic factors such as an increasing aging population across the globe paired with increasing prevalence of non-invasive surgical procedures are driving demand for medical devices and global medical device contract manufacturing market as well. In order to remain competitive in extremely specialized and increasingly segmented markets, OEMs need to rely on CMOs for everything from added manufacturing capabilities to product design and technical expertise.

Growing demand for R&D and post-market product support services for medical devices is expected to help the medical device contract manufacturing Industry to grow further. In the last few years, there has been a move towards outsourcing essential processes such as design, development, evaluation, feasibility testing, regulatory enforcement and post-market manufacturing activities such as product maintenance and upgrades.

| Report Highlights | Details |

| Market Size by 2034 | USD 253.86 Billion |

| Market Size in 2025 | USD 100.50 Billion |

| Market Size in 2024 | USD 90.29 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.89% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Service Type, Application Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

IVD devices, drug delivery devices, diagnostic imaging devices, patient monitoring devices, therapeutic patient assistive devices, minimally access surgical instruments, and others are the product type covered in the global medical device contract manufacturing market.

IVD devices accounted the considerable revenue share in product type segment of the global medical device contract manufacturing market in 2024 owing to growing adoption of point-of-care testing coupled with adoption of fully automated instruments and automation in laboratories is expected to support the growth of IVD devices in years tocome. In addition, changing lifestyle and rising chronic diseases is expected to fuel the growth of patient monitoring devices segment in near future and the segment will grow at a CAGR of 13.1%

The service segment of global medical device contract manufacturing market categorized device development and manufacturing services, quality management services and final goods assembly services. Amongst them, device development and manufacturing services held the largest share and accounted over 54% of revenue share in 2024. The growth of this segment is mainly driven by increasing demand for device engineering paired with device manufacturing services.

Growing demand for different orthopedic implants and device especially in elder population is predicted to propel orthopedic application segment massively in near future. The orthopedic application segment is estimated to grow at a CAGR of 12.9% in the analysis period.

The global medical device contract manufacturing market is highly competitive and some major players hold the considerable share. The market players operating in global medical device contract manufacturing market are working on to retain the quality of these products and acquiring the new client across different industries. Recent ongoing product research and development by manufacturers due to COVID-19 pandemic is expected to open numerous opportunities in global medical device contract manufacturing market.

This research report includes complete assessment of the market with the help of extensive qualitative and quantitative insights, and projections regarding the market. This report offers breakdown of market into prospective and niche sectors. Further, this research study calculates market revenue and its growth trend at global, regional, and country from 2025 to 2034. This report includes market segmentation and its revenue estimation by classifying it depending on device, service, application and region as follows:

By Device Type

By Service

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025